As filed with the Securities and Exchange Commission

on May 31, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

NeuroOne Medical Technologies Corporation

(Exact name of registrant as specified in its

charter)

| Delaware |

|

27-0863354 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

7599 Anagram Dr., Eden Prairie, MN 55344

952-426-1383

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

David Rosa

7599 Anagram Dr., Eden Prairie, MN 55344

952-426-1383

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Phillip D. Torrence

Emily J. Johns

Honigman LLP

650 Trade Centre Way,

Suite 200

Kalamazoo, MI 49002

Tel: (269) 337-7700

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection

with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under

the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐ |

Accelerated filer ☐ |

| |

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933

or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is

not complete and may be changed. We may not sell these securities or accept an offer to buy these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not

soliciting offers to buy these securities in any state or other jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED MAY 31, 2024

PROSPECTUS

$150,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Offered, from time to time,

by NeuroOne Medical Technologies Corporation

From time to time, we may offer and sell an aggregate

amount of up to $150,000,000 of any combination of the securities described in this prospectus, either individually or in combination,

at prices and on terms described in one or more supplements to this prospectus. We may also offer common stock or preferred stock upon

conversion of debt securities, or common stock upon conversion of preferred stock, or common stock, preferred stock or debt securities

upon exercise of warrants.

This prospectus describes some of the general

terms that may apply to an offering of our securities by us. Each time we offer securities, we will provide specific terms of the securities

in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection

with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained

in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus,

as well as any documents incorporated by reference, before you invest in any of the securities being offered.

This prospectus may not be used to consummate

a sale of securities unless accompanied by a prospectus supplement.

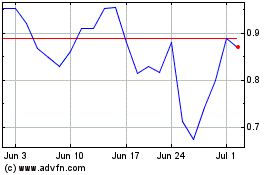

Our common stock is listed on The Nasdaq

Capital Market LLC (“Nasdaq”) under the symbol “NMTC.” On May 30, 2024, the last reported sale price of our

common stock was $0.9451 per share. The applicable prospectus supplement will contain information, where applicable, as to any

other listing on Nasdaq or any securities market or other exchange of the securities, if any, covered by the applicable prospectus

supplement. Our principal executive offices are located at 7599 Anagram Drive, Eden Prairie, MN 55344 and our telephone number is

(952) 426-1383.

We are a “smaller reporting

company” under the federal securities laws and, as such, are subject to reduced public company reporting requirements. As of

May 30, 2024, the aggregate market value of our outstanding common stock held by non-affiliates, or public float, was approximately

$32.6 million, based on 25,695,792 shares held by non-affiliates and a price of $1.27 per share, which was the price at which our

common stock was last sold on Nasdaq on April 9, 2024. We have sold $11,222,334.30 of securities pursuant to General Instruction

I.B.6. of Form S-3 during the prior 12-calendar-month period that ends on or includes the date of this prospectus. Pursuant to General Instruction I.B.6. of Form S-3, in no event will we sell securities registered on

this registration statement in a public offering with a value exceeding more than one-third of our public float in any 12-month

period so long as our public float remains below $75 million (the “Baby Shelf Limitation”). See “Summary –

Implications of Being a Smaller Reporting Company”.

We may sell these securities directly to investors,

through agents designated from time to time or to or through underwriters or dealers, on a continuous or delayed basis. For additional

information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus on

page 24 and in the applicable prospectus supplement. If any agents or underwriters are involved in the sale of any securities with respect

to which this prospectus is being delivered, the names of such agents or underwriters and any applicable fees, commissions, discounts

or over-allotment options will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds

we expect to receive from such sale will also be set forth in a prospectus supplement.

Investing in our securities involves a high

degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained

in this prospectus on page 8, in our most recent Annual Report on Form 10-K incorporated by reference into this prospectus, in the

applicable prospectus supplement and in any free writing prospectuses we have authorized for use in connection with a specific offering,

and under similar headings in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

You should rely only on the

information contained in, or incorporated by reference into, this prospectus and the applicable prospectus supplement, along with the

information contained in any free writing prospectuses we have authorized for use in connection with a specific offering. We have not

authorized anyone to provide you with different information. We are not making an offer to sell or seeking an offer to buy securities

under this prospectus or the applicable prospectus supplement and any related free writing prospectus in any jurisdiction where the offer

or sale is not permitted. The information contained in this prospectus, the applicable prospectus supplement or any related free writing

prospectus, and the documents incorporated by reference herein and therein, are accurate only as of their respective dates, regardless

of the time of delivery of this prospectus, the applicable prospectus supplement or any related free writing prospectus, or any sale

of a security.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”), using a “shelf” registration

process under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf registration statement, we

may sell from time to time in one or more offerings up to a total dollar amount of $150,000,000 of common stock and preferred stock,

various series of debt securities and/or warrants to purchase any of such securities, either individually or in combination with other

securities as described in this prospectus, subject to the Baby Shelf Limitation. This prospectus provides you with a general description

of the securities we may offer.

Each time we offer any type or series of securities

under this prospectus, we will provide a prospectus supplement that will contain more specific information about the terms of that offering.

We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these

offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add,

update or change any of the information contained in this prospectus or in the documents that we have incorporated by reference into

this prospectus. This prospectus, together with the applicable prospectus supplement, any related free writing prospectus and the documents

incorporated by reference into this prospectus and the applicable prospectus supplement, will include all material information relating

to the applicable offering. You should carefully read both this prospectus and the applicable prospectus supplement and any related free

writing prospectus, together with the additional information described under “Where You Can Find More Information”, before

buying any of the securities being offered.

THIS PROSPECTUS MAY NOT BE USED TO CONSUMMATE

A SALE OF SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

You should rely only

on the information contained in, or incorporated by reference into, this prospectus and any applicable prospectus supplement, along with

the information contained in any free writing prospectuses we have authorized for use in connection with a specific offering. Neither

we, nor any agent, underwriter or dealer has authorized anyone to provide you with any information other than contained in, or incorporated

by reference into, this for use in connection with a specific offering. We take no responsibility for, and can provide no assurance as

to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered

hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

The information appearing

in this prospectus, any applicable prospectus supplement and any related free writing prospectus is accurate only as of the date on the

front of the document and any information we have incorporated by reference is accurate only as of the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing

prospectus, or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since

those dates.

This prospectus contains

and incorporates by reference market data and industry statistics and forecasts that are based on independent industry publications and

other publicly available information. Although we believe that these sources are reliable, we do not guarantee the accuracy or completeness

of this information and we have not independently verified this information. Although we are not aware of any misstatements regarding

the market and industry data presented in this prospectus and the documents incorporated herein by reference, these estimates involve

risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors”

contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents

that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

This prospectus contains

summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for

complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred

to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this

prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can

Find More Information.”

No action is being taken

in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus

in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to

inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that

jurisdiction.

Except as otherwise indicated

herein or as the context otherwise requires, references in this prospectus to “NeuroOne,” “the company,” “we,”

“us,” and similar references refer to NeuroOne Medical Technologies Corporation, a corporation incorporated under the laws

of the State of Delaware.

This prospectus and the

information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks,

service marks and trade names included or incorporated by reference into this prospectus, any applicable prospectus supplement or any

related free writing prospectus are the property of their respective owners.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere

in this prospectus or incorporated by reference herein and does not contain all of the information that you need to consider in making

your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement and any related free

writing prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained

in this prospectus, the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other

documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference

into this prospectus, including our financial statements and related notes, and the exhibits to the registration statement of which this

prospectus is a part, before making your investment decision.

Business Overview

We are a medical technology company focused on

the development and commercialization of thin film electrode technology for continuous electroencephalogram (“cEEG”) and

stereoelectrocencephalography (“sEEG”), spinal cord stimulation, brain stimulation, drug delivery and ablation solutions

for patients suffering from epilepsy, Parkinson’s disease, dystonia, essential tremors, chronic pain due to failed back surgeries

and other related neurological disorders. We are also developing the capability to use our sEEG electrode technology to deliver drugs

or gene therapy while being able to record brain activity before, during, and after delivery. Additionally, we are investigating the

potential applications of our technology associated with artificial intelligence. Members of our management team have held senior leadership

positions at a number of medical technology and biopharmaceutical companies, including Boston Scientific, St. Jude Medical, Stryker Instruments,

C.R. Bard, A-Med Systems, Nuwellis, Inc., formerly known as Sunshine Heart, Empi, Don-Joy and PMT.

We are developing our cortical strip, grid and

depth electrode technology to provide solutions for diagnosis through cEEG recording and sEEG recording and treatment through spinal

cord stimulation, brain stimulation and ablation, all in one product. A cEEG is a continuous recording of the electrical activity of

the brain that identifies the location of irregular brain activity, which information is required for proper treatment. cEEG recording

involves an invasive surgical procedure, referred to as a craniotomy. sEEG involves a less invasive procedure whereby doctors place electrodes

in targeted brain areas by drilling small holes through the skull. Both methods of seizure diagnosis are used to identify areas of the

brain where epileptic seizures originate in order to precisely locate the seizure source for therapeutic treatment if possible.

Deep brain stimulation (“DBS”) therapies

involve activating or inhibiting the brain with electricity that can be given directly by electrodes on the surface or implanted deeper

in the brain via depth electrodes. Introduced in 1987, this procedure involves implanting a power source referred to as a neurostimulator,

which sends electrical impulses through implanted depth electrodes, to specific targets in the brain for the treatment of disorders such

as Parkinson’s disease, essential tremor, dystonia, and chronic pain. Alzheimer’s is another indication evaluating the effects

of DBS. Unlike ablative technologies, the effects of DBS are reversible.

Radio Frequency (“RF”) ablation is

a procedure that uses radiofrequency under the electrode contacts that is directed to the site of the brain tissue that is targeted for

removal. The process involves delivering energy to the contacts, thereby heating them and destroying the brain tissue. The ablation does

not remove the tissue. Rather, it is left in place and typically scar tissue forms in the place where the ablation occurs. This procedure

is also known as brain lesioning as it causes irreversible lesions. In August 2021, the Company announced a strategic partnership with

RBC Medical Innovations to develop a RF ablation generator. The following month, our OneRF ablation system was tested by representatives

from Emory University in Atlanta Georgia in an animal study. During the second fiscal quarter of 2023, we successfully completed summative

usability testing for OneRF with 15 neurosurgeons, and completed execution of internal device verification/validation protocols for the

final OneRF ablation system.

Failed back surgery syndrome

(“FBSS”) is a condition that produces chronic lower back/leg pain due to one or more failed back surgeries. Typically,

it is related to patients that suffer with pain after surgery of the lumbar spine for degenerative disc disease. Re-operations are

usually not recommended for these patients due to low success rates. These patients experience greater levels of pain, a lower

quality of life, varying levels of disability and higher rate of unemployment. Spinal cord stimulation works by placing one or more

electrodes in a targeted area of the spine and then connecting to an implantable pulse generator that sends electrical stimulation

to the electrode to block the pain signals from reaching the brain. During the second fiscal quarter of 2023, we completed an

initial animal implant of novel thin film paddle leads for spinal cord stimulation (“SCS”). The devices are intended for

the treatment of patients with chronic back pain due to multiple failed back surgery syndrome, intractable low back, and leg pain. A

percutaneous (through a needle) delivery system for paddle leads is also under development and has been successfully bench-tested.

According to a 2020 Market Insights report, the total global addressable market for spinal cord stimulation is estimated to be

greater than $3 billion.

Our cortical strip and grid electrode and depth

electrode technology have been tested over the years by both WARF, the owners of our licensed patents, and Mayo Clinic located in Rochester,

Minnesota, in both pre-clinical models as well as through an institutional review board (“IRB”) approval at Mayo Clinic for

clinical research. In December 2020, we announced the first human commercial use of our Evo cortical electrode in a procedure performed

at the Mayo Clinic. Regarding our ablation electrode, the Cleveland Clinic and representatives from Emory University have performed testing

in bench top models and pre-clinical (or animal testing) models. These pre-clinical tests have demonstrated that the technology is capable

of recording, ablation and acute stimulation.

We received 510(k) U.S. Food and Drug Administration

(“FDA”) clearance for our Evo cortical technology in November 2019, in September 2021 we received FDA clearance to market

our Evo® sEEG electrode technology for temporary (less than 24 hours) use with recording, monitoring, and stimulation equipment for

the recording, monitoring, and stimulation of electrical signals at the subsurface level of the brain, and in October 2022 we received

FDA clearance to market our Evo® sEEG electrode technology for temporary (less than 30 days) use with recording, monitoring, and

stimulation equipment for the recording, monitoring, and stimulation of electrical signals at the subsurface level of the brain.

We submitted a 510(k) application to the FDA for

the OneRF ablation system in June 2023 and responded to FDA comments on November 6, 2023. On December 6, 2023, we received 510(k) FDA

clearance to market the OneRF ablation system for creation of radiofrequency lesion in nervous tissue for functional neurosurgical procedures.

In March 2024, we announced a limited commercial launch of our OneRF ablation system. We do not have a distribution partner for the OneRF

ablation system at this time, and are continuing to pursue potential strategic partnerships for this product.

We intend to develop our Evo sEEG electrode technology

for drug delivery applications in the next 12 months. This device is intended to deliver neurological drugs or gene therapy that are

FDA approved or that are currently planned for clinical trials or in development to allow for monitoring, recording and stimulation and

drug delivery for less than 30 days. In addition to having the capability of delivering a drug through the center lumen, it will also

be able to record brain activity before, during, and after drug delivery.

Strategy

| |

● |

Introduce cortical strip and grid electrodes for the diagnosis of epilepsy in United States:

In December 2019, we announced that we received FDA 510(k) clearance to market our thin film cortical electrode technology for temporary

(less than 30 days) recording, monitoring, and stimulation on the surface of the brain. Our initial product offering has initially

been and will be placed through traditional surgical means involving a craniotomy until such time, if any, that we launch our minimally

invasive procedure. In July 2020, we entered into a development relationship with Zimmer, pursuant to which we granted Zimmer exclusive

global rights to distribute the cortical strip and grid electrodes, and Zimmer will use commercially reasonable efforts to promote,

market and sell the strip and grid electrodes. We believe, due to physician feedback, that our technology represents a major improvement

over existing cortical electrodes for the recording of brain activity. We are initially targeting epilepsy as we believe this is

a clinical area of great need and a market that is underserved with a quick path to commercialization. We believe the largest and

quickest-to-market geography for our cortical strip and grid technology under development is the United States for a number of reasons,

including the following: (i) many industry sources believe there is a large underserved U.S. market, (ii) healthy procedural reimbursement

for centers and physicians, (iii) average selling prices are robust, and (iv) there is substantial physician enthusiasm for our technology

under development. To date, several institutions around the country have successfully tried and adopted our cortical electrode technology

for diagnostic procedures. |

| |

|

|

| |

● |

Launch depth electrodes for sEEG recording: In September 2021, we announced that we received

FDA 510(k) clearance to market our Evo sEEG electrode technology for temporary (less than 24 hours) use with recording, monitoring,

and stimulation equipment for recording, monitoring, and stimulation of electrical signals at the subsurface level of the brain.

We filed for 510(k) clearance to expand the duration of use up to less than 30 days in November 2021. On October 20, 2022, the Company

received an FDA clearance to market its Evo sEEG electrode technology for temporary (less than 30 days) use with recording, monitoring,

and stimulation equipment for the recording, monitoring, and stimulation of electrical signals at the subsurface level of the brain.

Given the reluctance of patients to undergo epilepsy surgery due to its invasiveness, a number of epilepsy centers have adopted the

use of depth electrodes, which are placed by drilling small holes into the patient’s cranium, thereby avoiding a craniotomy.

We believe our technology offers advantages compared to current depth electrode technology in the market and will also enable us

to offer a therapeutic solution using this same technology in the future. As we continue to develop our technology, we plan to release

further information about the expected advantages of our technology over currently available therapies. |

| |

|

|

| |

● |

Utilize these core technologies to develop all-in-one diagnostic and therapeutic solutions

with the initial focus on a combination diagnostic and ablation electrode: For many patients who currently undergo one surgical procedure

for diagnosis, a second and different procedure or surgery is then required to treat the patient. There is strong physician/surgeon

interest to be able to perform both the diagnostic and therapeutic procedure with the same implanted devices. We are developing our

technology with the goal of being able to offer this benefit although there can be no assurance that we will be able to do so. We

are pursuing cortical grid, strip and depth electrode technology that can record brain activity (diagnose), ablate brain tissue and

also provide both acute and long-term stimulation as well as depth electrode technology that can ablate brain tissue. The technology

has demonstrated these functions in acute and short-term animal models; however, additional development is required to offer a device

that has long-term therapeutic application. These therapeutic technologies are expected to require more robust regulatory approvals

for the United States, ranging from a 510(k) to potential for pre-market approvals with human clinical data. We will engage the FDA

at the proper time to determine the most efficient regulatory path. |

| |

● |

Develop percutaneous placed electrodes for spinal cord stimulation with scalable contact configurations:

Given that many surgically placed technologies have become less invasive due to patient and physician demands, we believe that our

flexible thin film technology will allow for percutaneous placement of “paddle” shaped electrodes, thus potentially eliminating

the need to make a more invasive surgical procedure. Spinal cord clinical literature over the years has shown that “paddle”

electrodes (flat shaped) require less energy for stimulation (thus saving neurostimulator battery life) and may be associated with

lower revision rates over time. Even then, “paddle” shaped electrodes are used less often due to the more invasive surgical

procedure that is required for placement. But we hope to change that paradigm by creating “paddle” electrodes that can

be implanted percutaneously (less invasively) through a “needle hole incision”. By leveraging our existing FDA cleared

cortical electrode and sEEG technology, we may also be able to offer the ability to improve precision of where the stimulation is

delivered. NeuroOne’s platform thin film technology has the capability to increase the number of contacts in a similar footprint

that has fewer contacts. |

| |

|

|

| |

● |

Gain approval for other brain or motor related disorders such as Parkinson’s with the

therapeutic technologies developed for epilepsy: While we are developing our technology for the diagnosis and treatment of epilepsy,

we believe that our technology has strong application and utilization for other brain or motor related disorders such as Parkinson’s

disease, dystonia, essential tremors and facial pain as these diseases are currently treated with DBS if medications are not effective.

As previously mentioned, we are actively evaluating the potential to offer electrodes that can be implanted for long-term stimulation

applications, but such use will require that we pursue additional approvals from the FDA and any international regulatory bodies

where we seek to commercialize our technology. |

| |

|

|

| |

● |

Explore partnerships with other companies that leverage our core technology: Given that

our technology enables, complements and/or competes with a number of companies that are in the market or attempting to enter the

market with diagnostic or therapeutic technologies to treat brain related disorders, we believe there may be opportunities to establish

mutually beneficial relationships. In addition, our technology may have application in cardiovascular, orthopedic and pain related

indications that could benefit from a high fidelity thin film electrode product that can provide stimulation and/or ablation therapies. |

| |

|

|

| |

● |

Investigate the potential applications associated with Artificial Intelligence: We have

been informed by some of our corporate advisors that the ability to offer scale-able electrode technology that can provide thousands

of electrodes in the brain may be helpful in treating medical conditions that may benefit from using artificial intelligence. The

Company has formed an advisory board that will provide guidance to the Company as we continue to explore the opportunities in this

exciting field. |

Corporate Information

We were originally incorporated as Original

Source Entertainment, Inc. under the laws of the State of Nevada on August 20, 2009. Prior to the closing of the Acquisition, as defined

below, we completed a series of steps contemplated by a Plan of Conversion pursuant to which we, among other things, changed our name

to NeuroOne Medical Technologies Corporation, increased our authorized number of shares of Common Stock from 45,000,000 to 100,000,000,

increased our authorized number of shares of preferred stock from 5,000,000 to 10,000,000 and reincorporated in Delaware. On July 20,

2017, we acquired NeuroOne, Inc. (the “Acquisition”). Immediately following the closing of the Acquisition, the business

of NeuroOne, Inc. became our sole focus. On December 30, 2019, NeuroOne, Inc. merged with and into NeuroOne Medical Technologies Corporation.

Our principal executive offices are located

at 7599 Anagram Drive, Eden Prairie, Minnesota 55344, and our telephone number is 952-426-1383. Our website address is www.nmtc1.com.

Information contained in, or accessible through, our website does not constitute a part of this prospectus.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company”,

as defined in Rule 12b-2 of the Exchange Act of 1934, as amended (the “Exchange Act”), meaning that the market value of our

shares held by non-affiliates is less than $700 million and our annual revenue was less than $100 million during the most recently completed

fiscal year. We may continue to be a smaller reporting company if either (i) the market value of our shares held by non-affiliates is

less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market

value of our shares held by non-affiliates is less than $700 million. As a smaller reporting company, we may continue to rely on exemptions

from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company,

we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and,

similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

Additionally, as a smaller reporting company, we may continue to take advantage of the exception from compliance with the auditor attestation

requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended. If investors consider our common shares less attractive as

a result of our election to use the scaled-back disclosure permitted for smaller reporting companies, there may be a less active trading

market for our common shares and our share price may be more volatile.

Securities Exchange Listing

Our common stock is listed on Nasdaq since

May 26, 2021, under the symbol “NMTC.” The applicable prospectus supplement will contain information, where applicable, as

to other listings, if any, on Nasdaq or any other securities market or other exchange of the securities covered by the applicable prospectus

supplement.

The Securities We May Offer

We may offer shares of our common stock and

preferred stock, various series of debt securities and/or warrants to purchase any of such securities, either individually or in combination

with other securities, up to a total aggregate offering price of $150,000,000 from time to time in one or more offerings under this prospectus,

together with the applicable prospectus supplement and any related free writing prospectus, at prices and on terms to be determined at

the time of any offering. This prospectus provides you with a general description of the securities we may offer. Each time we offer

a type or series of securities under this prospectus, we will provide a prospectus supplement that will describe the specific amounts,

prices and other important terms of the securities, including, to the extent applicable:

| |

● |

designation or classification; |

| |

● |

aggregate principal amount or aggregate offering price; |

| |

● |

maturity, if applicable; |

| |

● |

original issue discount, if any; |

| |

● |

rates and times of payment of interest or dividends, if any; |

| |

● |

redemption, conversion, exchange or sinking fund terms, if any; |

| |

● |

ranking, if applicable; |

| |

● |

restrictive covenants, if any; |

| |

● |

voting or other rights, if any; |

| |

● |

conversion or exchange prices or rates, if any, and, if applicable, any provisions for changes

to or adjustments in the conversion or exchange prices or rates and in the securities or other property receivable upon conversion

or exchange; and |

| |

● |

important U.S. federal income tax considerations, if any. |

The applicable prospectus supplement and any

related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the information contained

in this prospectus or in the documents we have incorporated by reference. However, no prospectus supplement or free writing prospectus

will offer a security that is not registered and described in this prospectus at the time of the effectiveness of the registration statement

of which this prospectus is a part.

We may sell the securities directly to investors

or to or through agents, underwriters or dealers. We, and our or their agents, underwriters or dealers reserve the right to accept or

reject all or part of any proposed purchase of securities. If we do offer securities to or through agents, underwriters or dealers, we

will include in the applicable prospectus supplement:

| |

● |

the names of those underwriters or agents; |

| |

● |

applicable fees, discounts and commissions to be paid to them; |

| |

● |

details regarding over-allotment options, if any; and |

| |

● |

the estimated net proceeds to us. |

This prospectus may not be used to consummate

a sale of securities unless it is accompanied by a prospectus supplement.

Common Stock.

We may offer shares of our common stock from time to time. Holders of our common stock are entitled to one vote per share for the election

of directors and on all other matters that require stockholder approval, as further set forth herein under the heading “Description

of Common Stock.” Subject to any preferential rights of any then outstanding preferred stock, in the event of our liquidation,

dissolution or winding up, holders of our common stock are entitled to share ratably in the assets remaining after payment of liabilities

and the liquidation preferences of any then outstanding preferred stock. Our common stock does not carry any preemptive rights enabling

a holder to subscribe for, or receive shares of, any class of our common stock or any other securities convertible into shares of any

class of our common stock, or any redemption rights. We urge you, however, to read the applicable prospectus supplement (and any related

free writing prospectus) related to any common stock being offered.

Preferred Stock.

We may issue shares of our preferred stock from time to time, in one or more series. Our board of directors will determine the designations,

voting powers, preferences and rights of the preferred stock, as well as the qualifications, limitations or restrictions thereof, including

dividend rights, conversion rights, preemptive rights, terms of redemption or repurchase, liquidation preferences, sinking fund terms

and the number of shares constituting any series or the designation of any series, any or all which may be greater than the rights of

our common stock. Convertible preferred stock will be convertible into our common stock or exchangeable for other securities. Conversion

may be mandatory or at your option and would be at prescribed conversion rates.

We will fix the rights,

preferences, privileges, qualifications and restrictions of the preferred stock of each series that we sell under this prospectus and

applicable prospectus supplements in a certificate of designation relating to that series. We will file as an exhibit to, or incorporate

by reference into, the registration statement of which this prospectus is a part the form of any certificate of designation that describes

the terms of the series of preferred stock we are offering before the issuance of the related series of preferred stock. We urge you

to read the prospectus supplement (and any related free writing prospectus) related to the series of preferred stock being offered, as

well as the complete certificate of designation that contains the terms of the applicable series of preferred stock.

Debt Securities.

We may issue debt securities from time to time, in one or more series, as either senior or subordinated debt or as senior or subordinated

convertible debt. The senior debt securities will rank equally with any other unsecured and unsubordinated debt. The subordinated debt

securities will be subordinate and junior in right of payment, to the extent and in the manner described in the instrument governing

the debt, to all of our senior indebtedness. Convertible or exchangeable debt securities will be convertible into or exchangeable for

our common stock or our other securities. Conversion or exchange may be mandatory or optional (at our option or the holders’ option)

and would be at prescribed conversion or exchange rates.

Any debt securities

issued under this prospectus will be issued under one or more documents called indentures, which are contracts between us and a national

banking association or other eligible party, as trustee. In this prospectus, we have summarized certain general features of the debt

securities under “Description of Debt Securities.” We urge you, however, to read the applicable prospectus supplement (and

any free writing prospectus that we may authorize to be provided to you) related to the series of debt securities being offered, as well

as the complete indenture and any supplemental indentures that contain the terms of the debt securities. A form of indenture has been

filed as an exhibit to the registration statement of which this prospectus is a part, and supplemental indentures and forms of debt securities

containing the terms of the debt securities being offered will be filed as exhibits to the registration statement of which this prospectus

is a part or will be incorporated by reference from reports that we file with the SEC.

Warrants.

We may issue warrants for the purchase of common stock, preferred stock and/or debt securities, in one or more series. We may issue warrants

independently or in combination with common stock, preferred stock and/or debt securities offered by any prospectus supplement. In this

prospectus, we have summarized certain general features of the warrants under “Description of Warrants.” We urge you, however,

to read the applicable prospectus supplement (and any related free writing prospectus that we may authorize to be provided to you) related

to the particular series of warrants being offered, as well as any warrant agreements and warrant certificates, as applicable, that contain

the terms of the warrants. We have filed forms of the warrant agreements and forms of warrant certificates containing the terms of the

warrants that may be offered as exhibits to the registration statement of which this prospectus is a part. We will file as exhibits to

the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC,

the form of warrant and/or the warrant agreement and warrant certificate, as applicable, that contain the terms of the particular series

of warrants we are offering, and any supplemental agreements, before the issuance of such warrants.

Any warrants issued

under this prospectus may be evidenced by warrant certificates. Warrants also may be issued under an applicable warrant agreement that

we enter into with a warrant agent. We will indicate the name and address of the warrant agent, if applicable, in the prospectus supplement

relating to the particular series of warrants being offered.

Use of Proceeds.

Except as described in any prospectus supplement or any related free writing prospectus that we may authorize to be provided to you,

we currently intend to use the net proceeds from the sale of the securities offered hereby for general corporate purposes, which may

include research and development, capital expenditures, working capital and general and administrative expenses. See “Use of Proceeds”

in this prospectus.

RISK FACTORS

Investing in our securities involves a high degree

of risk. Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in

the applicable prospectus supplement, together with all of the other information under similar headings appearing in this prospectus

or incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular investment objectives

and financial circumstances. Our business, financial condition or results of operations could be materially adversely affected by any

of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

This prospectus and the incorporated documents also contain forward-looking statements that involve risks and uncertainties. Our actual

results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including

the risks mentioned elsewhere in this prospectus. Such factors, if they were to occur, could materially adversely affect our financial

condition or future results. Although we are not aware of any other factors that we currently anticipate will cause our forward-looking

statements to differ materially from our future actual results, or materially affect the Company’s financial condition or future

results, additional risks and uncertainties not currently known to us or that we currently deem to be immaterial might materially adversely

affect our actual business, financial condition and/or operating results. You should also consider the risks, uncertainties and assumptions

discussed under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K and any subsequent Quarterly

Reports on Form 10-Q or Current Reports on Form 8-K, which is on file with the SEC and incorporated herein by reference, and which may

be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. See “Where You Can

Find More Information” and “Incorporation of Certain Information by Reference”.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including

the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities

Act, and Section 21E of the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events

or performance are not historical facts and may be forward-looking uncertainties. In some cases, you can identify forward-looking statements

by the use of words or phrases such as “anticipates,” “could,” “would,” “should,” “will,”

“would,” “may,” “might,” “potential,” “contemplates,” “estimates,”

“plans,” “seeks,” “projects,” “predicts,” “targets,” “objectives,”

“continuing,” “ongoing,” “expects,” “management believes,” “we believe,”

“we intend,” or the negative of these terms, or other comparable terminology intended to identify statements about the future.

Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus, and

in particular those factors included in the sections entitled “Risk Factors” in this prospectus and in our most recent Annual

Report on Form 10-K and our most recent Quarterly Report on Form 10-Q, which are on file with the SEC and incorporated herein by reference.

Forward-looking statements

are based on management’s current expectations, estimates, forecasts and projections about our business and the industry in which

we operate, and management’s beliefs and assumptions are not guarantees of future performance or development and involve known

and unknown risks, uncertainties and other factors that are in some cases beyond our control. You should refer to the “Risk Factors”

sections of our Annual Report on Form 10-K and our Quarterly Report on Form 10-Q for a discussion of important factors that may cause

our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors,

we cannot assure you that the forward-looking statements in this Report will prove to be accurate. Furthermore, if our forward-looking

statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking

statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our

objectives and plans in any specified time frame, or at all.

You should carefully

read this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated

herein or therein by reference as described under the section titled “Incorporation of Certain Information by Reference,”

and with the understanding that our actual future results may materially differ from what we expect.

Except as required by

law, forward-looking statements speak only as of the date of this prospectus, and we assume no obligation to update or revise any forward-looking

statements for any reason, even if new information becomes available in the future. You should, however, review the factors and risks

and other information we describe in the reports we will file from time to time with the SEC after the date of this prospectus.

USE OF PROCEEDS

We intend to use the net proceeds from the sale

of any securities offered under this prospectus for general corporate purposes unless otherwise indicated in the applicable prospectus

supplement. General corporate purposes may include funding research and development expenses for our clinical and preclinical pipeline,

in-licensing or acquiring other products or technologies, working capital and capital expenditures. We have not determined the amount

of net proceeds to be used specifically for such purposes. As a result, management will retain broad discretion over the allocation of

net proceeds. We will set forth in the applicable prospectus supplement or free writing prospectus our intended use for the net proceeds

received from the sale of any securities sold pursuant to the prospectus supplement or free writing prospectus.

SECURITIES WE MAY OFFER

This prospectus contains summary descriptions

of the securities we may offer from time to time. These summary descriptions are not meant to be complete descriptions of each security.

The particular terms of any securities will be described in the applicable prospectus supplement.

DESCRIPTION OF COMMON STOCK

The following summary description of our common

stock is based on the provisions of our certificate of incorporation, as amended, and bylaws and the applicable provisions of the Delaware

General Corporation Law, as amended (the “DGCL”). This information is qualified entirely by reference to the applicable provisions

of our certificate of incorporation, as amended, our bylaws and the Delaware General Corporation Law. For information on how to obtain

copies of our certificate of incorporation, as amended, and our bylaws, which are exhibits to the registration statement of which this

prospectus is a part, see “Where You Can Find More Information.” We refer in this section to certificate of incorporation,

as amended, and our bylaws as our “certificate of incorporation” and our “bylaws”, respectively.

Our authorized capital

stock consists of 100,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value

$0.001 per share.

As of May 30, 2024, 27,842,103 shares of common stock

were outstanding. All outstanding shares of common stock are duly authorized, validly issued, fully paid, and nonassessable. All authorized

but unissued shares of our common stock are available for issuance by our board of directors without any further stockholder action,

except as required by the listing standards of Nasdaq.

Holders of the Company’s common stock are

entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting

rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors.

Holders of the Company’s common stock representing a majority of the voting power of the Company’s capital stock issued,

outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of stockholders.

A vote by the holders of a majority of the Company’s outstanding common stock is required to effectuate certain fundamental corporate

changes such as liquidation, merger or an amendment to the Company’s certificate of incorporation.

Holders of the Company’s common stock are

entitled to share in all dividends that the Company’s board of directors, in its discretion, declares from legally available funds.

In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets

that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock.

The Company’s common stock has no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to

the Company’s common stock.

The Company’s certificate of

incorporation authorizes the issuance of 10,000,000 shares of “blank check” preferred stock, par value $0.001 per share,

in one or more series, subject to any limitations prescribed by law, without further vote or action by the stockholders. Each such

series of preferred stock shall have such number of shares, designations, preferences, voting powers, qualifications, and special or

relative rights or privileges as shall be determined by our board of directors, which may include, among others, dividend rights,

voting rights, liquidation preferences, conversion rights and preemptive rights.

Options and Restricted Stock

As of March 31, 2024, (i) 183,130 shares of

common stock remain available for issuance under our 2017 Equity Incentive Plan and 2021 Inducement Plan, (ii) stock options to

purchase an aggregate of 2,879,096 shares of common stock were outstanding under our 2017 Equity Incentive Plan and 2021 Inducement

Plan, and (iii) 1,329,881 unvested shares of restricted stock units were outstanding under our 2017 Equity Incentive Plan and 2021

Inducement Plan.

Warrants

As of March 31, 2024, 4,863,566 shares of common

stock were issuable for outstanding warrants.

Registration Rights

On January 12, 2021, we entered into a Common

Stock and Warrant Purchase Agreement (the “2021 Purchase Agreement”) with certain accredited investors, pursuant to which

the Company, in a private placement, agreed to issue and sell an aggregate of 12,500,000 shares of common stock and warrants to purchase

an aggregate of 12,500,000 shares of common stock, at an aggregate purchase price of $1.00 per share of common stock and corresponding

warrant, resulting in total gross proceeds of $12.5 million before deducting placement agent fees and estimated offering expenses. The

private placement closed on January 14, 2021.

In connection with the private placement, we

agreed to file, within 30 days of the closing of the private placement, a registration statement on Form S-1 with the SEC covering

the resale of the shares of common stock and warrants sold in the private placement and the shares of common stock underlying the

warrants. Such registration statement was filed with the SEC on February 10, 2021 and declared effective by the SEC on March 8,

2021. We have agreed to use our best efforts to keep the registration statement continuously effective until the earlier of (i) the

date that all registrable securities have been sold, pursuant to such registration statement or pursuant to Rule 144, or (ii) the

date that all registrable securities may be sold without volume or manner-of-sale restrictions pursuant to Rule 144 and without the

requirement that we are in compliance with the current public information requirement under Rule 144.

Anti-Takeover Effects

We are subject to Section 203 of the Delaware

General Corporation Law (“Section 203”). Section 203 generally prohibits a public Delaware corporation from engaging in a

“business combination” with an “interested stockholder” for a period of three years after the date of the transaction

in which the person became an interested stockholder, unless:

| |

● |

prior to the date of the transaction, the board of directors of the corporation approved either

the business combination or the transaction which resulted in the stockholder becoming an interested stockholder; |

| |

|

|

| |

● |

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding

upon consummation of the transaction, excluding for purposes of determining the number of shares outstanding (a) shares owned by

persons who are directors and also officers and (b) shares owned by employee stock plans in which employee participants do not have

the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| |

|

|

| |

● |

on or subsequent to the consummation of the transaction, the business combination is approved by

the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative

vote of at least 66 2/3% of the outstanding voting stock which is not owned by the interested stockholder. |

Section 203 defines a business combination to

include:

| |

● |

any merger or consolidation involving the corporation and the interested stockholder; any sale,

transfer, pledge or other disposition involving the interested stockholder of 10% or more of the assets of the corporation; |

| |

|

|

| |

● |

subject to exceptions, any transaction involving the corporation that has the effect of increasing

the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; |

| |

|

|

| |

● |

subject to exceptions, any transaction that results in the issuance or transfer by the corporation

of any stock of the corporation to the interested stockholder; and |

| |

|

|

| |

● |

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges

or other financial benefits provided by or through the corporation. |

In general, Section 203 defines an interested

stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity

or person that is an affiliate or associate of such entity or person.

Securities Exchange Listing

Our common stock is listed on the Nasdaq Capital

Market under the symbol “NMTC.”

Transfer Agent and Registrar

The transfer agent and registrar for our common

stock is Equiniti Trust Company LLC.

DESCRIPTION OF PREFERRED STOCK

We have authority to

issue up to 10,000,000 shares of preferred stock, par value $0.001 per share. All of our authorized preferred stock is undesignated.

As of May 31, 2024, no shares of preferred stock were outstanding.

We may issue any class

of preferred stock in any series. Our board of directors has the authority to establish and designate series, and to fix the number of

shares included in each such series and to determine or alter for each such series, such voting powers, designation, preferences, and

relative participating, optional, or other rights and such qualifications, limitations or restrictions thereof. Our board of directors

is not restricted in repurchasing or redeeming such stock while there is any arrearage in the payment of dividends or sinking fund installments.

Our board of directors is authorized to increase or decrease the number of shares of any series subsequent to the issuance of shares

of that series, but not below the number of shares of such series then outstanding. The number of authorized shares of preferred stock

may be increased or decreased, but not below the number of shares thereof then outstanding, by the affirmative vote of the holders of

a majority of the common stock, without a vote of the holders of the preferred stock, or of any series thereof, unless a vote of any

such holders is required pursuant to the terms of any certificate of designation filed with respect to any series of preferred stock.

Prior to issuance of

shares of any series of preferred stock, our board of directors is required by Delaware law to adopt resolutions and file a

certificate of designation with the Secretary of State of the State of Delaware. The certificate of designation fixes for each class

or series the terms, preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends or other

distributions, qualifications and terms or conditions of redemption for each class or series. Any shares of preferred stock will,

when issued, be fully paid and non-assessable.

For any series of preferred

stock that we may issue, our board of directors will determine and the prospectus supplement relating to such series will describe:

| |

● |

the purchase price, title and stated value of the preferred stock; |

| |

● |

the number of shares of the preferred stock offered, the liquidation preference per share and the

offering price of the preferred stock; |

| |

● |

the dividend rate(s), period(s) or payment date(s) or method(s) of calculation applicable to the

preferred stock; |

| |

● |

whether dividends are cumulative or non-cumulative and, if cumulative, the date from which dividends

on the preferred stock will accumulate; |

| |

● |

our right, if any, to defer payment of dividends and the maximum length of any such deferral period; |

| |

● |

the procedures for auction and remarketing, if any, for the preferred stock; |

| |

● |

the provisions for a sinking fund, if any, for the preferred stock; |

| |

● |

the provision for redemption, if applicable, of the preferred stock; |

| |

● |

any listing of the preferred stock on any securities exchange; |

| |

● |

the terms and conditions, if applicable, upon which the preferred stock will be convertible into

common stock, including the conversion price or manner of calculation and conversion period; |

| |

● |

voting rights, if any, of the preferred stock; |

| |

● |

preemptive rights, if any, of the preferred stock; |

| |

|

|

| |

● |

restrictions on transfer, sale or other assignment, if any, of the preferred stock; |

| |

|

|

| |

● |

whether interests in the preferred stock will be represented by depositary shares; |

| |

● |

a discussion of any material or special U.S. federal income tax considerations applicable to the

preferred stock; |

| |

● |

the relative ranking and preferences of the preferred stock as to dividend rights and rights upon

the liquidation, dissolution or winding up of our affairs; |

| |

● |

any limitations on issuance of any class or series of preferred stock ranking senior to or on a

parity with the class or series of preferred stock as to dividend rights and rights upon the liquidation, dissolution or winding

up of our affairs; and |

| |

● |

any other specific terms, preferences, rights, limitations or restrictions of the preferred stock. |

Delaware law provides

that the holders of preferred stock will have the right to vote separately as a class (or, in some cases, as a series) on an amendment

to our certificate of incorporation if the amendment would change the par value or, unless the certificate of incorporation then in effect

provides otherwise, the number of authorized shares of such class or change the powers, preferences or special rights of such class or

series so as to adversely affect the class or series, as the case may be. This right is in addition to any voting rights that may be

provided for in the applicable certificate of designation.

DESCRIPTION OF DEBT SECURITIES

We may issue debt securities from time to time,

in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. While the terms we have summarized

below will apply generally to any debt securities that we may offer under this prospectus, we will describe the particular terms of any

debt securities that we may offer in more detail in the applicable prospectus supplement. The terms of any debt securities offered under

a prospectus supplement may differ from the terms described below. Unless the context requires otherwise, whenever we refer to the indenture,

we are referring to the base indenture, as well as any supplemental indentures that specify the terms of a particular series of debt

securities.

We will issue the debt securities under the indenture

that we will enter into with the trustee named in the indenture. The indenture will be qualified under the Trust Indenture Act of 1939,

as amended (the “Trust Indenture Act”). We have filed the form of base indenture as an exhibit to the registration statement

of which this prospectus is a part, and any supplemental indentures and forms of debt securities containing the terms of the debt securities

being offered will be filed as exhibits to the registration statement of which this prospectus is a part, or will be incorporated by

reference from, reports that we file with the SEC.

The following summary of material provisions of

the debt securities and the indenture is subject to, and qualified in its entirety by reference to, all of the provisions of the indenture

applicable to a particular series of debt securities. We urge you to read the applicable prospectus supplements and any related free

writing prospectuses related to the debt securities that we may offer under this prospectus, as well as the complete indenture that contains

the terms of the debt securities.

General

The indenture does not limit the amount of debt

securities that we may issue. It provides that we may issue debt securities up to the principal amount that we may authorize and may

be in any currency or currency unit that we may designate. Except for the limitations on consolidation, merger and sale of all or substantially

all of our assets contained in the indenture, the terms of the indenture do not contain any covenants or other provisions designed to

give holders of any debt securities protection against changes in our operations, financial condition or transactions involving us.

We may issue the debt securities issued under

the indenture as “discount securities,” which means they may be sold at a discount below their stated principal amount. These

debt securities, as well as other debt securities that are not issued at a discount, may be issued with “original issue discount,”

or OID, for U.S. federal income tax purposes because of interest payment and other characteristics or terms of the debt securities. Material

U.S. federal income tax considerations applicable to debt securities issued with OID will be described in more detail in any applicable

prospectus supplement.

We will describe in the applicable prospectus

supplement the terms of the series of debt securities being offered, including:

| |

● |

the title of the series of debt securities; |

| |

● |

any limit upon the aggregate principal amount that may be issued; |

| |

● |

the maturity date or dates on which the principal of the debt securities of the series is payable; |

| |

● |

the form of the debt securities of the series; |

| |

● |

the applicability of any guarantees; |

| |

● |

whether or not the debt securities will be secured or unsecured, and the terms of any secured debt; |

| |

● |

whether the debt securities rank as senior debt, senior subordinated debt, subordinated debt or

any combination thereof, and the terms of any subordination; |

| |

● |

if the price (expressed as a percentage of the aggregate principal amount thereof) at which such

debt securities will be issued is a price other than the principal amount thereof, the portion of the principal amount thereof payable

upon declaration of acceleration of the maturity thereof, or if applicable, the portion of the principal amount of such debt securities

that is convertible into another security or the method by which any such portion shall be determined; |

| |

● |

the interest rate or rates, which may be fixed or variable, or the method for determining the rate

and the date interest will begin to accrue, the dates interest will be payable and the regular record dates for interest payment

dates or the method for determining such dates; |

| |

● |

our right, if any, to defer payment of interest and the maximum length of any such deferral period; |

| |

● |

if applicable, the date or dates after which, or the period or periods during which, and the price

or prices at which, we may, at our option, redeem the series of debt securities pursuant to any optional or provisional redemption

provisions and the terms of those redemption provisions; |

| |

● |

the date or dates, if any, on which, and the price or prices at which we are obligated, pursuant

to any mandatory sinking fund or analogous fund provisions or otherwise, to redeem, or at the holder’s option to purchase,

the series of debt securities and the currency or currency unit in which the debt securities are payable; |

| |

● |

the denominations in which we will issue the series of debt securities, if other than denominations

of $1,000 and any integral multiple thereof; |

| |

● |

any and all terms, if applicable, relating to any auction or remarketing of the debt securities

of that series and any security for our obligations with respect to such debt securities and any other terms which may be advisable

in connection with the marketing of debt securities of that series; |

| |

● |

whether the debt securities of the series shall be issued in whole or in part in the form of a

global security or securities; |

| |

● |

the terms and conditions, if any, upon which such global security or securities may be exchanged

in whole or in part for other individual securities; and the depositary for such global security or securities; |

| |

● |

if applicable, the provisions relating to conversion or exchange of any debt securities of the

series and the terms and conditions upon which such debt securities will be so convertible or exchangeable, including the conversion

or exchange price, as applicable, or how it will be calculated and may be adjusted, any mandatory or optional (at our option or the

holders’ option) conversion or exchange features, the applicable conversion or exchange period and the manner of settlement

for any conversion or exchange; |

| |

● |

if other than the full principal amount thereof, the portion of the principal amount of debt securities

of the series which shall be payable upon declaration of acceleration of the maturity thereof; |

| |

● |

additions to or changes in the covenants applicable to the particular debt securities being issued,

including, among others, the consolidation, merger or sale covenant; |

| |

● |

additions to or changes in the events of default with respect to the securities and any change

in the right of the trustee or the holders to declare the principal, premium, if any, and interest, if any, with respect to such

securities to be due and payable; |

| |

● |

additions to or changes in or deletions of the provisions relating to covenant defeasance and legal

defeasance; |

| |

● |

additions to or changes in the provisions relating to satisfaction and discharge of the indenture; |

| |

● |

additions to or changes in the provisions relating to the modification of the indenture both with

and without the consent of holders of debt securities issued under the indenture; |

| |

● |

the currency of payment of debt securities if other than U.S. dollars and the manner of determining

the equivalent amount in U.S. dollars; |

| |

● |

whether interest will be payable in cash or additional debt securities at our or the holders’

option and the terms and conditions upon which the election may be made; |

| |

● |

the terms and conditions, if any, upon which we will pay amounts in addition to the stated interest,

premium, if any and principal amounts of the debt securities of the series to any holder that is not a “United States person”

for federal tax purposes; |

| |

● |

any restrictions on transfer, sale or assignment of the debt securities of the series; and |

| |

● |

any other specific terms, preferences, rights or limitations of, or restrictions on, the debt securities,

any other additions or changes in the provisions of the indenture, and any terms that may be required by us or advisable under applicable

laws or regulations. |

Conversion or Exchange Rights

We will set forth in the applicable prospectus

supplement the terms on which a series of debt securities may be convertible into or exchangeable for our common stock or our other securities.

We will include provisions as to settlement upon conversion or exchange and whether conversion or exchange is mandatory, at the option

of the holder or at our option. We may include provisions pursuant to which the number of shares of our common stock or our other securities

that the holders of the series of debt securities receive would be subject to adjustment.

Consolidation, Merger or Sale

Unless we provide otherwise in the prospectus