Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

December 16 2022 - 11:17AM

Edgar (US Regulatory)

| Filed Pursuant to Rule 424(b)(5) |

Registration No. 333-267921 |

AMENDMENT NO. 1 DATED DECEMBER 16, 2022

TO PROSPECTUS SUPPLEMENT DATED DECEMBER 13, 2022

(To Prospectus dated October 26, 2022)

1,247,000 Shares

Common Stock

Netcapital Inc.

This Amendment No. 1 to Prospectus Supplement (the “Amendment”)

amends the Prospectus Supplement dated December 13, 2022. This Amendment should be read in conjunction with the Prospectus Supplement

dated December 13, 2022 and the Prospectus dated October 26, 2022, each of which are to be delivered with this Amendment No. 1 to Prospectus

Supplement. This Amendment No. 1 amends only those sections of the Prospectus Supplement listed in this Amendment; all other sections

of the Prospectus Supplement remain as is.

We are offering 1,247,000 shares of our common stock, $0.001 par value

per share.

Our common stock is traded on the Nasdaq Capital Market under the symbol

“NCPL” On December 13, 2022, the last reported sale price of our common stock on the Nasdaq Capital Market was $2.20 per share.

As of December 13, 2022, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $6,024,513

based on 2,738,415 shares of common stock held by such non-affiliates, and a per share price of $2.20, the closing sale price of our common

stock on December 13, 2022. During the 12-calendar month period that ends on, and includes, the date of this prospectus supplement (but

excluding this offering), we have not offered and sold any of our securities pursuant to General Instruction I.B.6 of Form S-3.

Investing in our securities involves a high degree of risk. You should

read the ’‘Risk Factors’’ section beginning on page S-10 of this prospectus supplement and page 12 of the

accompanying prospectus and in the documents incorporated by reference in this prospectus supplement for a discussion of factors to consider

before deciding to invest in our common stock.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Share | |

Total |

| Public offering price | |

$ | 1.400 | | |

$ | 1,745,800 | |

| Underwriting discount and commissions (1) | |

$ | 0.105 | | |

$ | 130,935 | |

| Proceeds, before expenses, to us (2) | |

$ | 1.295 | | |

$ | 1,614,865 | |

| (1) |

|

We have agreed to issue the representative of the underwriters or its designees warrants to purchase a number of shares of common stock equal to 5% of the shares of common stock sold in this offering and to reimburse the underwriters for certain offering-related expenses. See “Underwriting” beginning on page S-15 of this prospectus supplement for additional information regarding underwriting discounts, commissions and estimated expenses. |

| (2) |

|

The amount of offering proceeds to us presented in this table does not give effect to any exercise of the over-allotment option described below. |

The underwriters have committed

to purchase all of the shares of common stock offered by us in this offering, other than those covered by the over-allotment option described

below. The obligations of the underwriters may be terminated upon the occurrence of certain events specified in the Underwriting Agreement.

Furthermore, pursuant to the Underwriting Agreement, the underwriters’ obligations are subject to customary conditions, representations

and warranties, such as receipt by the underwriters of officers’ certificates and legal opinions.

We have granted the underwriters

an option, exercisable for 45 days from December 13, 2022, to purchase up to additional 187,000 shares of our common stock (15% of the

shares sold in this offering) at the initial public offering price after deducting the underwriting discounts and commissions.

The underwriters expect to deliver the shares on or about December

16, 2022.

ThinkEquity

The date of this Amendment No. 1 to Prospectus Supplement

is December 16, 2022

The purpose of this Amendment is to update

the section “Underwriting—Representative’s Warrants”, to remove the language referring to the registration of

the Representative’s Warrants and underlying shares of common stock.

The following amendments to the Prospectus

Supplement are made by this Amendment:

AMENDMENTS TO THE “UNDERWRITING”

SECTION

The following sentence is deleted from

the “Representative’s Warrants” section under “Underwriting”:

“The registration statement of which

this prospectus forms a part also registers the Representative’s Warrants and underlying shares of common stock.”

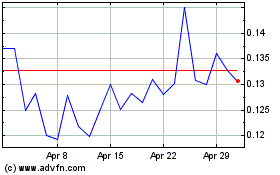

Netcapital (NASDAQ:NCPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

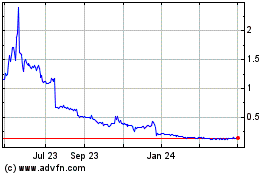

Netcapital (NASDAQ:NCPL)

Historical Stock Chart

From Apr 2023 to Apr 2024