0001635984false00016359842023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported) August 08, 2023

NATIONAL WESTERN LIFE GROUP, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-55522 | | 47-3339380 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 10801 N. Mopac Expy Bldg 3 | | |

| Austin, | Texas | | 78759 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (512) 836-1010

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class to be registered: | | Trading Symbol | | Name of each exchange on which each class is to be registered: |

| Class A Common Stock, $0.01 par value | | NWLI | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of the chapter) or Rule 12-b2 of the Securities Exchange Act of 1934 (§240.12b-2 of the chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 8, 2023, National Western Life Group, Inc. ("Company") announced via press release the Company's financial results for the quarter and six months ended June 30, 2023. A copy of the Company's press release is attached hereto as Exhibit 99.1. This Form 8-K and the attached exhibit are provided under Item 9.01 of Form 8-K and are furnished to, but not filed with, the Securities and Exchange Commission.

The press release is available at the Company's website, www.nwlgi.com.

| | | | | | | | | | | |

| Item 9.01 Financial Statements and Exhibits |

|

| ( d ) Exhibits |

|

| Exhibit No. | Description |

| |

| 99.1 | Press Release dated August 8, 2023 |

|

|

|

| | | | | | | | | | | |

| SIGNATURE |

|

| Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

|

| NATIONAL WESTERN LIFE GROUP, INC. |

|

Date: August 8, 2023 | /S/Brian M. Pribyl |

| | Brian M. Pribyl |

| Senior Vice President, |

| Chief Financial Officer |

| | and Treasurer |

|

|

| | | | | | | | | | | |

| EXHIBIT INDEX |

|

| Exhibit | | Description |

| | |

| | Press Release of National Western Life Group, Inc. issued August 8, 2023 reporting financial results for the quarter and six months ended June 30, 2023. |

EXHIBIT 99.1

National Western Life Group, Inc. Announces 2023 Second Quarter Earnings

Austin, Texas, August 8, 2023 ‑ Ross R. Moody, Chairman of the Board, President, and Chief Executive Officer of National Western Life Group, Inc. (Nasdaq: NWLI), announced today second quarter 2023 consolidated net earnings of $29.6 million, or $8.38 per diluted share of Class A Common Stock, compared with restated consolidated net earnings of $96.5 million, or $27.30 per diluted share of Class A Common Stock, for the second quarter ended June 30, 2022. For the six months ended June 30, 2023, the Company reported consolidated net earnings of $41.9 million, or $11.86 per diluted share of Class A Common Stock, compared with $194.1 million, or $54.89 per diluted share of Class A Common Stock, a year ago. The Company's book value per share as of June 30, 2023 increased to $626.57.

The Company's financial statements, including the comparable periods for 2022, were prepared in accordance with the new required accounting standard, Accounting for Long-Duration Contracts, referred to as "LDTI." One of the LDTI requirements is the setting liability balances for certain contract features that have Market Risk Benefits based upon interest rates on the reporting period date. Any changes in those liabilities go through net earnings. If the interest rates change from period to period, the Market Risk Benefits liabilities also fluctuate and impact net earnings, introducing variability in reported results. In the quarters ended June 30, 2023 and 2022, the Company's pretax earnings expense/(benefit) pertaining to Market Risk Benefits were $(0.8) million and $(55.5) million, respectively. For the six months ended June 30, 2023 and 2022, the pretax earnings expense/(benefit) from Market Risk Benefits liability changes were $36.2 million and $(116.5) million.

Following the announcement on May 16, 2023 that the Company's Board of Directors was exploring strategic alternatives, the publicly traded price per share of the Company's Class A Common Stock increased significantly in the second quarter, moving from $281.00 at December 31, 2022 and $242.62 at March 31, 2023 to $415.56 at June 30, 2023. The Company's period end Class A Common Stock price is a primary input used for establishing liabilities for outstanding share-based equity awards at each date with the change in liability reported in pretax earnings. Included in the Company's Other operating expenses for the three and six months ended June 30, 2023 are pretax expenses associated with share-based equity awards of $34.6 million and $32.3 million, respectively.

Commenting on the results for the reporting period, Mr. Moody observed, "Unfortunately, these accounting conventions masked the hard work and progress we have made so far in 2023. We have released competitive new products into distribution channels that we have not previously been in, and we have managed to do this while decreasing our administrative cash expenditures compared to last year."

National Western Life Group, Inc. is the parent organization of National Western Life Insurance Company, which is the parent organization of Ozark National Life Insurance Company, both stock life insurance companies in aggregate offering a broad portfolio of individual universal life, whole life and term insurance plans, as well as annuity products. At June 30, 2023, the Company maintained consolidated total assets of $12.5 billion, consolidated stockholders' equity of $2.3 billion, and combined life insurance in force of $18.9 billion.

Caution Regarding Forward-Looking Statements:

This press release contains statements which are or may be viewed as forward-looking within the meaning of The Private Securities Litigation Reform Act of 2005. Forward-looking statements relate to future operations, strategies, financial results or other developments, and are subject to assumptions, risks, and uncertainties. These risks and uncertainties also include, (1) the timing of the strategic alternatives review, (2) the outcome of the strategic alternatives review, including whether any transaction occurs at all, (3) if a transaction does occur, the form (cash, securities or other consideration) and the amount of the consideration, if any, paid to the Company's stockholders, and (4) if a definitive agreement for a transaction is signed with another party, whether the conditions to closing are satisfied, including any necessary insurance regulatory or other approvals. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in the Company's most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q and other documents of the Company on file with the SEC. The Company does not undertake any obligation to update, correct or otherwise revise any forward-looking statements. All subsequent written and oral forward-looking statements attributable to the Company and/or any person acting on its behalf are expressly qualified in their entirety by this section.

National Western Life Group, Inc.

News Release - Page 2

Summary of Consolidated Financial Results (Unaudited)

(In thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | | |

| Revenues, excluding investment and index option gains (losses) | $ | 164,183 | | | 154,939 | | | 313,797 | | | 327,596 | |

| Realized and unrealized gains (losses) on index options | | 21,968 | | | (38,425) | | | 24,901 | | | (76,623) | |

| Realized gains on investments | | 26 | | | 1,766 | | | 93 | | | 5,560 | |

| Total revenues | | 186,177 | | | 118,280 | | | 338,791 | | | 256,533 | |

| | | | | | | | |

| Benefits and expenses: | | | | | | | | |

| Life and other policy benefits | | 32,688 | | | 26,200 | | | 56,878 | | | 59,713 | |

| Market risk benefit expense | | (788) | | | (55,492) | | | 36,172 | | | (116,498) | |

| Amortization of deferred transaction costs | | 22,000 | | | 22,500 | | | 43,274 | | | 45,936 | |

| Universal life and annuity contract interest | | 32,947 | | | (26,198) | | | 63,159 | | | (39,769) | |

| Other operating expenses | | 62,443 | | | 30,323 | | | 87,126 | | | 62,903 | |

| Total benefits and expenses | | 149,290 | | | (2,667) | | | 286,609 | | | 12,285 | |

| | | | | | | | |

| Earnings before income taxes | | 36,887 | | | 120,947 | | | 52,182 | | | 244,248 | |

| Income tax expense | | 7,253 | | | 24,420 | | | 10,244 | | | 50,159 | |

| Net earnings | $ | 29,634 | | | 96,527 | | | 41,938 | | | 194,089 | |

| | | | | | | | |

| Net earnings attributable to Class A shares | $ | 28,796 | | | 93,797 | | | 40,752 | | | 188,600 | |

| | | | | | | | |

| Diluted Earnings Per Class A Share | $ | 8.38 | | | 27.30 | | | 11.86 | | | 54.89 | |

| | | | | | | | |

| Diluted Weighted Average Class A Shares | | 3,436 | | | 3,436 | | | 3,436 | | | 3,436 | |

| | | | | | | | |

| | | | | | June 30, | | December 31, |

| | | | | | 2023 | | 2022 |

| | | | | | | | |

| Book value per share | | | | | $ | 626.57 | | | 602.56 | |

| Less: Per share impact of accumulated other comprehensive income (loss) | | | | | | (119.05) | | | (131.52) | |

| Book value per share, excluding accumulated other comprehensive income (loss) * | | | | | $ | 745.62 | | | 734.08 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Book value per share excluding accumulated other comprehensive income (loss) is a non-GAAP financial measure. Accumulated other comprehensive income (loss) totaled $(432.9) million at June 30, 2023 and $(478.2) million at December 31, 2022. Since accumulated other comprehensive income (loss) fluctuates from quarter to quarter due to unrealized changes in the fair value of investments caused primarily by changes in market interest rates, National Western Life Group, Inc. believes this financial measure provides useful supplemental information. |

Investor Relations Contact:

Brian M. Pribyl - Senior Vice President, Chief Financial Officer and Treasurer

(512) 836-1010

bpribyl@nwlic.com

www.nwlgi.com

v3.23.2

Cover Page

|

Aug. 08, 2023 |

| Cover [Abstract] |

|

| Entity Address, State or Province |

TX

|

| Document Type |

8-K

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-55522

|

| Entity Central Index Key |

0001635984

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity Registrant Name |

NATIONAL WESTERN LIFE GROUP, INC.

|

| Entity Tax Identification Number |

47-3339380

|

| Entity Address, Address Line One |

10801 N. Mopac Expy Bldg 3

|

| Entity Address, City or Town |

Austin,

|

| Entity Address, Postal Zip Code |

78759

|

| City Area Code |

(512)

|

| Local Phone Number |

836-1010

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value

|

| Trading Symbol |

NWLI

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

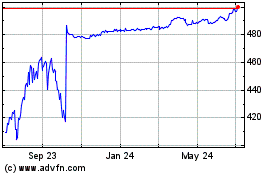

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From Apr 2024 to May 2024

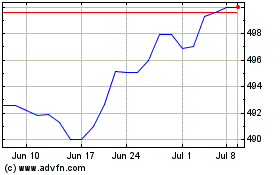

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From May 2023 to May 2024