0001326706

false

Q2

--12-31

0001326706

2023-01-01

2023-06-30

0001326706

2023-08-11

0001326706

2023-06-30

0001326706

2022-12-31

0001326706

us-gaap:SeriesCPreferredStockMember

2023-06-30

0001326706

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001326706

us-gaap:SeriesDPreferredStockMember

2023-06-30

0001326706

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001326706

us-gaap:SeriesEPreferredStockMember

2023-06-30

0001326706

us-gaap:SeriesEPreferredStockMember

2022-12-31

0001326706

us-gaap:SeriesFPreferredStockMember

2023-06-30

0001326706

us-gaap:SeriesFPreferredStockMember

2022-12-31

0001326706

2023-04-01

2023-06-30

0001326706

2022-04-01

2022-06-30

0001326706

2022-01-01

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-03-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-03-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-03-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2022-03-31

0001326706

us-gaap:CommonStockMember

2022-03-31

0001326706

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001326706

us-gaap:RetainedEarningsMember

2022-03-31

0001326706

2022-03-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2021-12-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2021-12-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2021-12-31

0001326706

us-gaap:CommonStockMember

2021-12-31

0001326706

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001326706

us-gaap:RetainedEarningsMember

2021-12-31

0001326706

2021-12-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-03-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2023-03-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-03-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2023-03-31

0001326706

us-gaap:CommonStockMember

2023-03-31

0001326706

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001326706

us-gaap:RetainedEarningsMember

2023-03-31

0001326706

2023-03-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-12-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2022-12-31

0001326706

us-gaap:CommonStockMember

2022-12-31

0001326706

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001326706

us-gaap:RetainedEarningsMember

2022-12-31

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-04-01

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-04-01

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-04-01

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2022-04-01

2022-06-30

0001326706

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001326706

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0001326706

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-01-01

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-01-01

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2022-01-01

2022-06-30

0001326706

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001326706

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-06-30

0001326706

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-04-01

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2023-04-01

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-04-01

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2023-04-01

2023-06-30

0001326706

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001326706

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001326706

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-01-01

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2023-01-01

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-01-01

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2023-01-01

2023-06-30

0001326706

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001326706

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-06-30

0001326706

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2022-06-30

0001326706

us-gaap:CommonStockMember

2022-06-30

0001326706

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001326706

us-gaap:RetainedEarningsMember

2022-06-30

0001326706

2022-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-06-30

0001326706

us-gaap:PreferredStockMember

us-gaap:SeriesFPreferredStockMember

2023-06-30

0001326706

us-gaap:CommonStockMember

2023-06-30

0001326706

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001326706

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001326706

us-gaap:RetainedEarningsMember

2023-06-30

0001326706

srt:MinimumMember

2023-03-31

0001326706

2023-05-22

0001326706

2023-05-22

2023-05-22

0001326706

2023-02-08

2023-02-08

0001326706

2023-02-15

2023-02-16

0001326706

NAOV:EmployeeOptionsMember

2023-04-01

2023-06-30

0001326706

NAOV:EmployeeOptionsMember

2023-01-01

2023-06-30

0001326706

NAOV:EmployeeOptionsMember

2022-04-01

2022-06-30

0001326706

NAOV:EmployeeOptionsMember

2022-01-01

2022-06-30

0001326706

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001326706

us-gaap:WarrantMember

2022-01-01

2022-06-30

0001326706

NAOV:EmployeeOptionsMember

2021-12-31

0001326706

NAOV:EmployeeOptionsMember

2022-01-01

2022-03-31

0001326706

NAOV:EmployeeOptionsMember

2022-03-31

0001326706

NAOV:EmployeeOptionsMember

2022-06-30

0001326706

NAOV:EmployeeOptionsMember

2022-12-31

0001326706

NAOV:EmployeeOptionsMember

2023-01-01

2023-03-31

0001326706

NAOV:EmployeeOptionsMember

2023-03-31

0001326706

NAOV:EmployeeOptionsMember

2023-06-30

0001326706

us-gaap:ResearchAndDevelopmentExpenseMember

2023-04-01

2023-06-30

0001326706

us-gaap:ResearchAndDevelopmentExpenseMember

2022-04-01

2022-06-30

0001326706

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-06-30

0001326706

us-gaap:ResearchAndDevelopmentExpenseMember

2022-01-01

2022-06-30

0001326706

us-gaap:SellingAndMarketingExpenseMember

2023-04-01

2023-06-30

0001326706

us-gaap:SellingAndMarketingExpenseMember

2022-04-01

2022-06-30

0001326706

us-gaap:SellingAndMarketingExpenseMember

2023-01-01

2023-06-30

0001326706

us-gaap:SellingAndMarketingExpenseMember

2022-01-01

2022-06-30

0001326706

us-gaap:GeneralAndAdministrativeExpenseMember

2023-04-01

2023-06-30

0001326706

us-gaap:GeneralAndAdministrativeExpenseMember

2022-04-01

2022-06-30

0001326706

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-06-30

0001326706

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-06-30

0001326706

us-gaap:WarrantMember

NAOV:PrivateInvestorsMember

2021-12-31

0001326706

us-gaap:WarrantMember

NAOV:PrivateInvestorsMember

2022-01-01

2022-06-30

0001326706

us-gaap:WarrantMember

NAOV:PrivateInvestorsMember

2022-06-30

0001326706

us-gaap:WarrantMember

NAOV:PrivateInvestorsMember

2022-12-31

0001326706

us-gaap:WarrantMember

NAOV:PrivateInvestorsMember

2023-01-01

2023-06-30

0001326706

us-gaap:WarrantMember

NAOV:PrivateInvestorsMember

2023-06-30

0001326706

NAOV:StockOptionsEmployeeAndNonEmployeeMember

2023-01-01

2023-06-30

0001326706

NAOV:StockOptionsEmployeeAndNonEmployeeMember

2022-01-01

2022-06-30

0001326706

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001326706

us-gaap:WarrantMember

2022-01-01

2022-06-30

0001326706

country:US

2023-04-01

2023-06-30

0001326706

country:US

2022-04-01

2022-06-30

0001326706

country:US

2023-01-01

2023-06-30

0001326706

country:US

2022-01-01

2022-06-30

0001326706

srt:EuropeMember

2023-04-01

2023-06-30

0001326706

srt:EuropeMember

2022-04-01

2022-06-30

0001326706

srt:EuropeMember

2023-01-01

2023-06-30

0001326706

srt:EuropeMember

2022-01-01

2022-06-30

0001326706

country:AU

2023-04-01

2023-06-30

0001326706

country:AU

2022-04-01

2022-06-30

0001326706

country:AU

2023-01-01

2023-06-30

0001326706

country:AU

2022-01-01

2022-06-30

0001326706

srt:AsiaMember

2023-04-01

2023-06-30

0001326706

srt:AsiaMember

2022-04-01

2022-06-30

0001326706

srt:AsiaMember

2023-01-01

2023-06-30

0001326706

srt:AsiaMember

2022-01-01

2022-06-30

0001326706

NAOV:OtherCountryMember

2023-04-01

2023-06-30

0001326706

NAOV:OtherCountryMember

2022-04-01

2022-06-30

0001326706

NAOV:OtherCountryMember

2023-01-01

2023-06-30

0001326706

NAOV:OtherCountryMember

2022-01-01

2022-06-30

0001326706

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

NAOV:TwoCustomersMember

2023-04-01

2023-06-30

0001326706

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

NAOV:TwoCustomersMember

2023-01-01

2023-06-30

0001326706

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

NAOV:TwoCustomersMember

2022-04-01

2022-06-30

0001326706

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

NAOV:TwoCustomersMember

2022-01-01

2022-06-30

0001326706

srt:MinimumMember

2023-06-30

0001326706

srt:MaximumMember

2023-06-30

0001326706

NAOV:LicensingAgreementMember

NAOV:SanuwaveHealthIncMember

2020-04-09

0001326706

NAOV:PriceAtValuationMember

NAOV:SanuwaveHealthIncMember

2023-06-30

0001326706

NAOV:PriceAtValuationMember

NAOV:SanuwaveHealthIncMember

2022-06-30

0001326706

us-gaap:MeasurementInputExercisePriceMember

NAOV:SanuwaveHealthIncMember

2023-06-30

0001326706

us-gaap:MeasurementInputExercisePriceMember

NAOV:SanuwaveHealthIncMember

2022-06-30

0001326706

us-gaap:MeasurementInputRiskFreeInterestRateMember

NAOV:SanuwaveHealthIncMember

2023-06-30

0001326706

us-gaap:MeasurementInputRiskFreeInterestRateMember

NAOV:SanuwaveHealthIncMember

2022-06-30

0001326706

NAOV:SanuwaveHealthIncMember

2023-06-30

0001326706

NAOV:SanuwaveHealthIncMember

2022-06-30

0001326706

us-gaap:MeasurementInputPriceVolatilityMember

NAOV:SanuwaveHealthIncMember

2023-06-30

0001326706

us-gaap:MeasurementInputPriceVolatilityMember

NAOV:SanuwaveHealthIncMember

2022-06-30

0001326706

NAOV:DerivativeAssetMember

2021-12-31

0001326706

NAOV:DerivativeAssetMember

2022-01-01

2022-03-31

0001326706

NAOV:DerivativeAssetMember

2022-03-31

0001326706

NAOV:DerivativeAssetMember

2022-04-01

2022-06-30

0001326706

NAOV:DerivativeAssetMember

2022-06-30

0001326706

NAOV:DerivativeAssetMember

2022-12-31

0001326706

NAOV:DerivativeAssetMember

2023-01-01

2023-03-31

0001326706

NAOV:DerivativeAssetMember

2023-03-31

0001326706

NAOV:DerivativeAssetMember

2023-04-01

2023-06-30

0001326706

NAOV:DerivativeAssetMember

2023-06-30

0001326706

us-gaap:FairValueInputsLevel1Member

2023-06-30

0001326706

us-gaap:FairValueInputsLevel2Member

2023-06-30

0001326706

us-gaap:FairValueInputsLevel3Member

2023-06-30

0001326706

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001326706

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001326706

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001326706

2021-02-25

2021-02-26

0001326706

2023-03-14

2023-03-15

0001326706

NAOV:ArbitratorMember

2023-01-01

2023-06-30

0001326706

NAOV:ArbitratorMember

2022-01-01

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended June 30, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ________ to ________

Commission

File Number: 001-36445

NanoVibronix,

Inc

(Exact

name of registrant as specified in its charter)

| Delaware |

|

01-0801232 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(I.R.S.

Employer

Identification

Number) |

| |

|

|

| 525

Executive Blvd. Elmsford, New York |

|

10523 |

| (Address

of principal executive office) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (914) 233-3004

(Former

name, former address and

former

fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

NAOV |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and every Interactive Data File required to be submitted pursuant to

Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant has been required to submit

and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No ☒

The

number of shares outstanding of the registrant’s Common Stock as of August 11, 2023 was 1,662,330 shares.

NanoVibronix,

Inc.

Quarter

Ended June 30, 2023

TABLE

OF CONTENTS

PART

I - FINANCIAL INFORMATION

ITEM

1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NanoVibronix,

Inc.

Condensed

Consolidated Balance Sheets

(Amounts

in thousands except share and per share data)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(unaudited) | | |

| |

| ASSETS: | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 253 | | |

$ | 2,713 | |

| Trade receivables, net | |

| 71 | | |

| 9 | |

| Prepaid expenses and other accounts receivable | |

| 176 | | |

| 712 | |

| Inventory, net | |

| 3,114 | | |

| 2,175 | |

| Total current assets | |

| 3,614 | | |

| 5,609 | |

| | |

| | | |

| | |

| Noncurrent assets: | |

| | | |

| | |

| Fixed assets, net | |

| 7 | | |

| 7 | |

| Other assets | |

| 3 | | |

| 3 | |

| Severance pay fund | |

| 170 | | |

| 179 | |

| Operating lease right-of-use assets, net | |

| 37 | | |

| 81 | |

| Total non-current assets | |

| 217 | | |

| 270 | |

| Total assets | |

$ | 3,831 | | |

$ | 5,879 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Trade payables | |

$ | 33 | | |

$ | 66 | |

| Other accounts payable and accrued expenses | |

| 2,300 | | |

| 2,148 | |

| Deferred revenue | |

| - | | |

| 21 | |

| Operating lease liabilities | |

| 37 | | |

| 81 | |

| Total current liabilities | |

| 2,370 | | |

| 2,316 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Accrued severance pay | |

| 212 | | |

| 223 | |

| Deferred licensing income | |

| 84 | | |

| 107 | |

| Total liabilities | |

| 2,666 | | |

| 2,646 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Series C Preferred stock of $0.001 par value - Authorized: 3,000,000 shares at both June 30, 2023 and December 31, 2022; Issued and outstanding: 0 shares at both June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| | |

| | | |

| | |

| Series D Preferred stock of $0.001 par value - Authorized: 506 shares at both June 30, 2023 and December 31, 2022; Issued and outstanding: 0 shares at both June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| | |

| | | |

| | |

| Series E Preferred stock of $0.001 par value - Authorized: 1,999,494 shares at both June 30, 2023 and December 31, 2022; Issued and outstanding: 0 shares at both June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| | |

| | | |

| | |

| Series F Preferred stock of $0.01 par value - Authorized: 40,000 and 0 shares at both June 30, 2023 and December 31, 2022; Issued and outstanding: 0 shares at both June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Common stock of $0.001 par value - Authorized: 40,000,000 shares at both June 30, 2023 and December 31, 2022, respectively; Issued and outstanding: 1,662,330 and 1,641,146 shares at June 30, 2023 and December 31, 2022, respectively | |

| 2 | | |

| 2 | |

| | |

| | | |

| | |

| Additional paid in capital | |

| 65,774 | | |

| 65,634 | |

| Accumulated other comprehensive income | |

| (55 | ) | |

| (18 | ) |

| Accumulated deficit | |

| (64,556 | ) | |

| (62,385 | ) |

| Total stockholders’ equity | |

| 1,165 | | |

| 3,233 | |

| Total liabilities and stockholders’ equity | |

$ | 3,831 | | |

$ | 5,879 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements

NanoVibronix,

Inc.

Condensed

Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

(Amounts

in thousands except share and per share data)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 294 | | |

$ | 485 | | |

$ | 648 | | |

$ | 757 | |

| Cost of revenues | |

| 78 | | |

| 204 | | |

| 197 | | |

| 370 | |

| Gross profit | |

| 216 | | |

| 281 | | |

| 451 | | |

| 387 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 35 | | |

| 61 | | |

| 90 | | |

| 127 | |

| Selling and marketing | |

| 227 | | |

| 333 | | |

| 441 | | |

| 543 | |

| General and administrative | |

| 963 | | |

| 1,155 | | |

| 1,984 | | |

| 2,097 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 1,225 | | |

| 1,549 | | |

| 2,515 | | |

| 2,767 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,009 | ) | |

| (1,268 | ) | |

| (2,064 | ) | |

| (2,380 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (33 | ) | |

| - | | |

| (67 | ) | |

| - | |

| Financial expense, net | |

| (19 | ) | |

| (18 | ) | |

| (25 | ) | |

| (31 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| (13 | ) | |

| (16 | ) | |

| (15 | ) | |

| (23 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,074 | ) | |

$ | (1,302 | ) | |

$ | (2,171 | ) | |

$ | (2,434 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss available for holders of common stock | |

$ | (0.65 | ) | |

$ | (0.93 | ) | |

$ | (1.31 | ) | |

$ | (1.74 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 1,662,330 | | |

| 1,399,890 | | |

| 1,662,330 | | |

| 1,399,890 | |

| Comprehensive loss: | |

| | | |

| | | |

| | | |

| | |

Net loss available to common

stockholders | |

| (1,074 | ) | |

| (1,302 | ) | |

| (2,171 | ) | |

| (2,434 | ) |

Change in foreign currency

translation adjustments | |

| (30 | ) | |

| (46 | ) | |

| (37 | ) | |

| (51 | ) |

| Comprehensive loss available to common stockholders | |

| (1,104 | ) | |

| (1,348 | ) | |

| (2,208 | ) | |

| (2,485 | ) |

NanoVibronix,

Inc.

Condensed

Consolidated Statement of Stockholders’ Equity (Unaudited)

(Amounts

in thousands except share and per share data)

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Equity | |

| | |

Series

C Preferred Stock | | |

Series

D Preferred Stock | | |

Series

E Preferred Stock | | |

Series

F Preferred Stock | | |

Common

Stock | | |

Additional

Paid - in | | |

Accumulated

Other Comprehensive | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Equity | |

| Balance, March 31, 2022 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,399,890 | | |

$ | 1 | | |

$ | 63,248 | | |

$ | 54 | | |

$ | (58,069 | ) | |

$ | 5,261 | |

| Stock-based

compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 83 | | |

| - | | |

| - | | |

| 83 | |

| Exercise of warrants | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 137 | | |

| - | | |

| - | | |

| 137 | |

| Currency

translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (45 | ) | |

| - | | |

| (45 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,302 | ) | |

| (1,302 | ) |

| Balance, June 30, 2022 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,399,890 | | |

$ | 1 | | |

$ | 63,468 | | |

$ | 9 | | |

$ | (59,371 | ) | |

$ | 4,134 | |

| | |

Series

C Preferred Stock | | |

Series

D Preferred Stock | | |

Series

E Preferred Stock | | |

Series

F Preferred Stock | | |

Common

Stock | | |

Additional

Paid - in | | |

Accumulated

Other Comprehensive | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Equity | |

| Balance, December 31, 2021 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,399,890 | | |

$ | 1 | | |

$ | 63,162 | | |

$ | 60 | | |

$ | (56,937 | ) | |

$ | 6,313 | |

| Stock-based

compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 169 | | |

| - | | |

| - | | |

| 169 | |

| Exercise of warrants | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 137 | | |

| - | | |

| - | | |

| 137 | |

| Currency

translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (51 | ) | |

| - | | |

| (51 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,434 | ) | |

| (2,434 | ) |

| Balance, June 30, 2022 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,399,890 | | |

$ | 1 | | |

$ | 63,468 | | |

$ | 9 | | |

$ | (59,371 | ) | |

$ | 4,134 | |

| | |

Series

C Preferred Stock | | |

Series

D Preferred Stock | | |

Series

E Preferred Stock | | |

Series

F Preferred Stock | | |

Common

Stock | | |

Additional

Paid - in | | |

Accumulated

Other Comprehensive | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Equity | |

| Balance, March 31, 2023 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,662,330 | | |

$ | 2 | | |

$ | 65,708 | | |

$ | (25 | ) | |

$ | (63,482 | ) | |

$ | 2,203 | |

| Stock-based

compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 66 | | |

| - | | |

| - | | |

| 66 | |

| Currency

translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (30 | ) | |

| - | | |

| (30 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,074 | ) | |

| (1,074 | ) |

| Balance, June 30, 2023 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,662,330 | | |

$ | 2 | | |

$ | 65,774 | | |

$ | (55 | ) | |

$ | (64,556 | ) | |

$ | 1,165 | |

| | |

Series

C Preferred Stock | | |

Series

D Preferred Stock | | |

Series

E Preferred Stock | | |

Series

F Preferred Stock | | |

Common

Stock | | |

Additional

Paid - in | | |

Accumulated

Other Comprehensive | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Equity | |

| Balance, December 31, 2022 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,641,146 | | |

$ | 2 | | |

$ | 65,634 | | |

$ | (18 | ) | |

$ | (62,385 | ) | |

$ | 3,233 | |

| Beginning

balance, value | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,641,146 | | |

$ | 2 | | |

$ | 65,634 | | |

$ | (18 | ) | |

$ | (62,385 | ) | |

$ | 3,233 | |

| Stock-based

compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 133 | | |

| - | | |

| - | | |

| 133 | |

| Currency

translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (37 | ) | |

| - | | |

| (37 | ) |

| Exercise of options | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,458 | | |

| - | | |

| 7 | | |

| - | | |

| - | | |

| 7 | |

| Rounding

up of fractional shares due to stock split | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 15,726 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,171 | ) | |

| (2,171 | ) |

| Balance, June 30, 2023 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,662,330 | | |

$ | 2 | | |

$ | 65,774 | | |

$ | (55 | ) | |

$ | (64,556 | ) | |

$ | 1,165 | |

| Ending

balance, value | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 1,662,330 | | |

$ | 2 | | |

$ | 65,774 | | |

$ | (55 | ) | |

$ | (64,556 | ) | |

$ | 1,165 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

NanoVibronix,

Inc.

Condensed

Consolidated Statements of Cash Flows (Unaudited)

(Amounts

in thousands except share and per share data)

| | |

2023 | | |

2022 | |

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (2,171 | ) | |

$ | (2,434 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1 | | |

| - | |

| Stock-based compensation | |

| 133 | | |

| 306 | |

| Noncash interest expense | |

| 67 | | |

| - | |

| Change in fair value of equity investment | |

| - | | |

| 10 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Trade receivable | |

| (62 | ) | |

| (62 | ) |

| Prepaid expenses and other accounts receivable | |

| 536 | | |

| (945 | ) |

| Inventory | |

| (939 | ) | |

| (753 | ) |

| Trade payables | |

| (33 | ) | |

| 86 | |

| Other accounts payable and accrued expenses | |

| 85 | | |

| 80 | |

| Deferred revenue | |

| (44 | ) | |

| (23 | ) |

| Accrued severance pay, net | |

| (2 | ) | |

| (5 | ) |

| Net cash used in operating activities | |

| (2,429 | ) | |

| (3,740 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of equipment | |

| (1 | ) | |

| (2 | ) |

| Net cash used in investing activities | |

| (1 | ) | |

| (2 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from exercise of options | |

| 7 | | |

| - | |

| Net cash provided by financing activities | |

| 7 | | |

| - | |

| | |

| | | |

| | |

| Effects of currency translation on cash and cash equivalents | |

| (37 | ) | |

| (51 | ) |

| | |

| | | |

| | |

| Net (decrease) in cash | |

| (2,460 | ) | |

| (3,793 | ) |

| Cash at beginning of period | |

| 2,713 | | |

| 7,737 | |

| | |

| | | |

| | |

| Cash at end of period | |

$ | 253 | | |

$ | 3,944 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements

NanoVibronix,

Inc.

Notes

to Condensed Consolidated Financial Statements (Unaudited)

(Amounts

in thousands except share and per share data)

NOTE

1 – DESCRIPTION OF BUSINESS

NanoVibronix,

Inc. (the “Company”), a Delaware corporation, commenced operations on October 20, 2003 and is a medical device company focusing

on noninvasive biological response-activating devices that target wound healing and pain therapy and can be administered at home, without

the assistance of medical professionals.

The

Company’s principal research and development activities are conducted in Israel through its wholly owned subsidiary, NanoVibronix

(Israel 2003) Ltd., a company registered in Israel, which commenced operations in October 2003.

NOTE

2 – GOING CONCERN, LIQUIDITY AND OTHER UNCERTAINTIES

The

Company’s ability to continue to operate is dependent mainly on its ability to successfully market and sell its products and the

receipt of additional financing until profitability is achieved. During the three and six months ended June 30, 2023, the Company has

incurred losses as well as negative cash outflows from operating activities and expects to incur losses and negative cash outflows from

operating activities through at least fiscal year 2023. Because

the Company does not have sufficient resources to fund its operations for the next twelve months from the date of this filing and there

could be a significant arbitration payment due (see Note 9), substantial doubt exists as to the Company’s ability to continue as

a going concern.

The

Company will need to raise additional capital to finance its losses and negative cash flows from operations and may continue to be dependent

on additional capital raising as long as our products do not reach commercial profitability. If the Company is unable to obtain additional

financing, the development of its product candidates and the Company’s commercial strategy may be impacted

and there could be a material adverse effect on the Company’s business and financial condition. These financial statements do not

include any adjustments that may result from the outcome of this uncertainty.

On

May 23, 2023, we received a letter from the Listing Qualifications Department of Nasdaq indicating that we no longer comply with the

minimum stockholders’ equity requirement under Nasdaq Listing Rule 5550(b)(1) (the “Rule”) for continued listing

on Nasdaq because our stockholders’ equity of approximately $2.2

million as reported in our Quarterly Report on Form 10-Q for the period ended March 31, 2023, is below the required minimum of

$2.5

million, and as of May 22, 2023, we did not meet the alternative compliance standards relating to the market value of listed

securities of $35

million or net income from continuing operations of $500,000

in the most recently completed fiscal year or in two of the last three most recently completed fiscal years.

In

accordance with Nasdaq Listing Rules, we had 45 calendar days, or until July 7, 2023, to submit a plan to regain compliance. On July

7, 2023 we submitted our plan to regain compliance with the Nasdaq minimum stockholders’ equity standard. If our plan is accepted,

Nasdaq may grant us an extension of up to 180 calendar days from the date of the notification letter to evidence compliance. On July

19, 2023, the Staff granted the Company’s request for continued listing pursuant to an extension through November 20, 2023, to

evidence compliance with the Rule.

NOTE

3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of presentation and principles of consolidation

The

unaudited consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany accounts

and transactions have been eliminated in consolidation. The Company’s condensed consolidated financial statements have been prepared

in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for the interim

financial information and with instructions to Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, the accompanying

unaudited interim consolidated financial statements reflect all adjustments, which include only normal recurring adjustments, necessary

to state fairly the financial position and results of operations of the Company. These condensed consolidated financial statements and

notes thereto are unaudited and should be read in conjunction with the Company’s audited financial statements for the year ended

December 31, 2022, as found in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the

“SEC”) on April 17, 2023.

The

balance sheet for December 31, 2022 was derived from the Company’s audited financial statements for the year ended December 31,

2022. The results of operations for the periods presented are not necessarily indicative of results that could be expected for the entire

fiscal year due to seasonality and other factors. Certain information and footnote disclosures normally included in the consolidated

financial statements in accordance with U.S. GAAP have been omitted in accordance with the rules and regulations of the SEC for interim

reporting.

Use

of estimates

The

preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates, judgments and

assumptions. The Company believes that the estimates, judgments and assumptions used are reasonable based upon information available

at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities and disclosure

of contingent assets and liabilities at the dates of the financial statements, and the reported amounts of revenue and expenses during

the reporting period. Actual results could differ from those estimates.

Foreign

currency translation

Non-U.S.

dollar denominated transactions and balances have been re-measured to U.S. dollars. All gains and losses from re-measurement of monetary

balance sheet items denominated in non-U.S. dollar currencies are reflected in the statements of operations as other comprehensive income,

as appropriate. The cumulative translation gains for the periods ended June

30, 2023 and 2022 were $37 and $51, respectively.

Revenue

recognition

Revenues

from product sales are recognized in accordance with ASC 606 “Revenue Recognition.” Five basic steps must be followed before

revenue can be recognized; (1) Identifying the contract(s) with a customer that creates enforceable rights and obligations; (2) Identifying

the performance obligations in the contract, such as promising to transfer goods or services to a customer; (3) Determining the transaction

price, meaning the amount of consideration in a contract to which an entity expects to be entitled in exchange for transferring promised

goods or services to a customer; (4) Allocating the transaction price to the performance obligations in the contract, which requires

the company to allocate the transaction price to each performance obligation on the basis of the relative standalone selling prices of

each distinct good or services promised in the contract; and (5) Recognizing revenue when (or as) the entity satisfies a performance

obligation by transferring a promised good or service to a customer. The amount of revenue recognized is the amount allocated to the

satisfied performance obligation.

Revenue

from product sales is recorded at the net sales price, or “transaction price,” which includes estimates of variable consideration

that result from coupons, discounts and distributor fees, processing fees, as well as allowances for returns and government rebates.

The Company constrains revenue by considering factors that could otherwise lead to a probable reversal of revenue. Collectability of

revenue is reasonably assured based on historical evidence of collectability between the Company and its customers.

Revenues

from sales to distributors are recognized at the time the products are delivered to the distributors (“sell-in”). The Company does

not grant rights of return, credits, rebates, price protection, or other privileges on its products to distributors.

Recently

adopted accounting standards

In

June 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2016-13,

Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”)

and also issued subsequent amendments to the initial guidance: ASU 2018-19, ASU 2019-04, and ASU 2019-05 (collectively, “Topic

326”). Topic 326 requires measurement and recognition of expected credit losses for financial assets held. This ASU is effective

for interim and annual reporting periods beginning after December 15, 2022, including interim periods within those fiscal years. The

Company adopted ASU 2016-13 as of January 1, 2023, and there was no material impact on its condensed consolidated financial statements

upon adoption.

NOTE

4 – STOCKHOLDERS’ EQUITY

Common

stock

The

common stock confers upon the holders the right to receive notice to participate and vote in general meetings of the Company, and the

right to receive dividends, if declared, and to participate in the distribution of the surplus assets and funds of the Company in the

event of liquidation, dissolution or winding up of the Company.

Reverse

Stock Split

On

February 8, 2023, the Company effected a reverse stock split of its common stock at a ratio of 1 post-split share for every 20 pre-split

shares. The Company’s common stock begin trading on a split-adjusted basis when the market opened on February 9, 2023 (the “Reverse

Stock Split”).

At

the effective time of the Reverse Stock Split, every 20 shares of the Company’s issued and outstanding common stock were converted

automatically into one issued and outstanding share of common stock without any change in the par value per share. Stockholders holding

shares through a brokerage account had their shares automatically adjusted to reflect the 1-for-20 Reverse Stock Split. The Reverse Stock

Split affected all stockholders uniformly and did not alter any stockholder’s percentage interest in the Company’s equity,

except to the extent that the Reverse Stock Split resulted in a stockholder owning a fractional share. Any fractional share of a stockholder

resulting from the Reverse Stock Split was rounded up to the nearest whole number of shares. Proportional adjustments were made to the

number of shares of the Company’s common stock issuable upon exercise or conversion of the Company’s equity awards, warrants

and other convertible securities, as well as the applicable exercise or conversion price thereof. On February 16, 2023, the Company rounded

up fractional shares to its nearest whole number of 15,726 shares.

All

references in this Report to number of shares, price per share and weighted average number of shares of common stock outstanding prior

to the Reverse Stock Split have been adjusted to reflect the Reverse Stock Split on a retroactive basis, unless otherwise noted.

Stock-based

compensation and Options

During

the three and six-month period ended June 30, 2023, 0 and 5,459 employee options were exercised respectively. During the three and six-month

period ended June 30, 2022, no employee options were exercised. During the three and six-month period ended June 30, 2023, no employee

options were granted. During the three and six-month period ended June 30, 2022, 0 and 6,000 employee options were granted, respectively.

The

options granted to employees and board members and were recorded at a fair value and vested over three years. During the three and six-month

period ended June 30, 2023, stock-based compensation expense of $66 and $133 was recorded for options that vested, respectively. During

the three and six-month period ended June 30, 2022, stock-based compensation expense of $85 and $171 was recorded for options that vested,

respectively. During the second quarter of 2023 and 2022, no options expired.

SCHEDULE

OF OPTIONS ACTIVITY

| | |

Shares Under Options | | |

Weighted Average Exercise Price per Share | | |

Weighted Average Remaining Life (Years) | |

| Outstanding – December 31, 2021 | |

| 127,000 | | |

$ | 31.86 | | |

| 7.77 | |

| Granted | |

| 6,000 | | |

| 15.56 | | |

| 9.89 | |

| Exercised | |

| - | | |

| - | | |

| - | |

| Outstanding – March 31, 2022 | |

| 133,000 | | |

$ | 26.00 | | |

| 7.63 | |

| Granted | |

| - | | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | | |

| - | |

| Outstanding – June 30, 2022 | |

| 133,000 | | |

$ | 26.00 | | |

| 7.63 | |

| | |

| | | |

| | | |

| | |

| Outstanding – December 31, 2022 | |

| 147,619 | | |

$ | 24.42 | | |

| 7.24 | |

| Granted | |

| - | | |

| - | | |

| - | |

| Exercised | |

| (5,459 | ) | |

| 0.07 | | |

| 0.24 | |

| Outstanding – March 31, 2023 | |

| 142,160 | | |

$ | 25.31 | | |

| 7.50 | |

| Granted | |

| - | | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | | |

| - | |

| Outstanding – June 30, 2023 | |

| 142,160 | | |

$ | 25.31 | | |

| 7.50 | |

The

total stock-based expense recognized in the financial statements for services received from employees and non-employees is shown in the

following table.

SCHEDULE

OF STOCK BASED EXPENSES RECOGNIZED SERVICES FROM EMPLOYEES AND NON-EMPLOYEES

| | |

| | |

| | |

| | |

| |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Research and development | |

| 1 | | |

| 1 | | |

| 3 | | |

| 3 | |

| Selling and marketing | |

| 6 | | |

| 6 | | |

| 12 | | |

| 12 | |

| General and administrative | |

| 59 | | |

| 213 | | |

| 118 | | |

| 291 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total | |

$ | 66 | | |

$ | 220 | | |

$ | 133 | | |

$ | 306 | |

As

of June 30, 2023, the total unrecognized estimated compensation cost related to non-vested stock options granted prior to that date was

$195, which is expected to be recognized over a weighted average period of approximately 1.91 years.

Warrants

For

the six months ended June 30, 2023 and 2022, there were 0 and 12,500 warrants granted, respectively. For the six months ended June 30,

2023 and 2022, no warrants were exercised and/ or cancelled.

SCHEDULE

OF WARRANTS ACTIVITY

| | |

Warrants | |

| Outstanding – December 31, 2021 | |

| 115,467 | |

| Granted | |

| 12,500 | |

| Exercised | |

| - | |

| Canceled | |

| - | |

| Outstanding – June 30, 2022 | |

| 127,967 | |

| | |

| | |

| Outstanding – December 31, 2022 | |

| 78,252 | |

| Granted | |

| - | |

| Exercised | |

| - | |

| Canceled | |

| - | |

| Outstanding – June 30, 2023 | |

| 78,252 | |

NOTE

5 – LOSS PER SHARE APPLICABLE TO COMMON STOCKHOLDER

Basic

net loss per common share is computed by dividing net loss available to common stockholders by the weighted average number of shares

of common stock outstanding during the period. All outstanding stock options and warrants for the six months ended June 30, 2023 and

2022 have been excluded from the calculation of the diluted net loss per share because all such securities are anti-dilutive for all

periods presented.

The

following table summarizes the Company’s securities, in common stock equivalents, which have been excluded from the calculation

of dilutive loss per share as their effect would be anti-dilutive:

SUMMARY

OF COMMON SHARE EQUIVALENTS BEEN EXCLUDED FROM DILUTIVE LOSS PER SHARE AS ANTI-DILUTIVE

| | |

June 30, 2023 | | |

June 30, 2022 | |

| Stock Options – employee and non-employee | |

| 142,160 | | |

| 133,000 | |

| Warrants | |

| 78,252 | | |

| 127,967 | |

| Total | |

| 220,412 | | |

| 260,967 | |

The

diluted loss per share equals basic loss per share in the six months ended June 30, 2023 and 2022 because the Company had a net loss

and the impact of the assumed exercise of stock options and the vesting of restricted stock would have been anti-dilutive.

NOTE

6 – GEOGRAPHIC INFORMATION AND MAJOR CUSTOMER DATA

The

Company manages its business on the basis of one reportable segment and derives revenues from selling its products directly to patients

as well as through distributor agreements. The following is a summary of revenues within geographic areas: SUMMARY OF REVENUE WITHIN

GEOGRAPHIC AREAS

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| United States | |

$ | 282 | | |

$ | 476 | | |

$ | 592 | | |

$ | 723 | |

| Europe | |

| - | | |

| 1 | | |

| 19 | | |

| 12 | |

| Australia/New Zealand | |

| - | | |

| 5 | | |

| 13 | | |

| 5 | |

| Asia | |

| - | | |

| 3 | | |

| 1 | | |

| 9 | |

| Other | |

| 12 | | |

| - | | |

| 23 | | |

| 8 | |

| Total | |

$ | 294 | | |

$ | 485 | | |

$ | 648 | | |

$ | 757 | |

For

both the three and six months ended June 30, 2023, our two largest customers comprised approximately 86%

of total revenues in each of the respective periods. Customer one comprised 36% and 86% while customer two comprised 50% and

0%, respectively. During the three and six months ended June 30, 2022, our largest customer

comprised approximately 78%

and 64%

of total revenues, respectively.

NOTE

7 – LEASES

The

Company has operating lease agreements with terms up to 2-3 years, including car and office space leases.

The

Company’s weighted-average remaining lease term relating to its operating leases is 0.56 years, with a weighted-average discount

rate of 10%.

The

Company incurred $36 and $14 of lease expense for its operating leases for the six months ended June 30, 2023 and 2022, respectively.

The

following table presents information about the amount and timing of liabilities arising from the Company’s operating leases as

of June 30, 2023:

SCHEDULE

OF LIABILITIES ARISING FROM OPERATING LEASES

| | |

| | |

| 2023 | |

$ | 35 | |

| 2024 | |

| 3 | |

| Total undiscounted operating lease payments | |

| 38 | |

| Less: Imputed interest | |

| 1 | |

| Present value of operating lease liabilities | |

$ | 37 | |

NOTE

8 – OTHER ASSETS

On

April 9, 2020, pursuant to a licensing agreement entered into in March 2020, the Company received 10-year warrants to purchase 127,000

shares of Sanuwave Health, Inc. at a price of $0.19 per share. The fair value for warrants received was estimated at the date of grant

and at each reporting period using a Black-Scholes-Merton pricing model with the following underlying assumptions:

SCHEDULE

OF WARRANTS ASSUMPTIONS

| |

|

June

30, 2023 |

|

|

June

30, 2022 |

|

| Price

at valuation |

|

$ |

0.02 |

|

|

$ |

0.08 |

|

| Exercise

price |

|

$ |

0.19 |

|

|

$ |

0.19 |

|

| Risk

free interest |

|

|

3.97 |

% |

|

|

1.44 |

% |

| Expected

term (in years) |

|

|

7 |

|

|

|

8 |

|

| Volatility |

|

|

155.6 |

% |

|

|

137.7 |

% |

The

Company considers this to be Level 3 inputs and is valued at each reporting period. For the three and six months ended June 30, 2023,

changes in the fair value of these warrants amounted to $(2) and $0, respectively, leaving a balance of $3 as of June 30, 2023. For the

three and six months ended June 30, 2022, changes in the fair value of these warrants amounted to $8 and $10, respectively, leaving a

balance of $9 as of June 30, 2022.

Financial

Instruments Measured at Fair Value on a Recurring Basis

The

fair value accounting standards define fair value as the amount that would be received to sell an asset or paid to transfer a liability

in an orderly transaction between market participants. As such, fair value is determined based upon assumptions that market participants

would use in pricing an asset or liability. Fair value measurements are rated on a three-tier hierarchy as follows:

| ● |

Level

1 inputs: Quoted prices (unadjusted) for identical assets or liabilities in active markets; |

| |

|

| ● |

Level

2 inputs: Inputs, other than quoted prices included in Level 1, that are observable either directly or indirectly; and |

| |

|

| ● |

Level

3 inputs: Unobservable inputs for which there is little or no market data, which require the reporting entity to develop its own

assumptions. |

There

were no transfers between Level 3 during the three and six months ended June 30, 2023 and 2022.

The

following table presents changes in Level 3 asset and liability measured at fair value for the quarters ended June 30, 2023 and 2022:

SCHEDULE

OF CHANGES IN LEVEL 3 AND LIABILITY MEASURED AT FAIR VALUE

| | |

Asset | |

| Balance – December 31, 2021 | |

$ | 19 | |

| Fair value adjustments – Sanuwave warrants | |

| (2 | ) |

| Balance – March 31, 2022 | |

$ | 17 | |

| Fair value adjustments – Sanuwave warrants | |

| (8 | ) |

| Balance – June 30, 2022 | |

$ | 9 | |

| | |

| | |

| Balance – December 31, 2022 | |

| 3 | |

| Fair value adjustments – Sanuwave warrants | |

| 2 | |

| Balance – March 31, 2023 | |

$ | 5 | |

| Fair value adjustments – Sanuwave warrants | |

| (2 | ) |

| Balance – June 30, 2022 | |

$ | 3 | |

The

following table sets forth the Company’s assets and liabilities which are measured at fair value on a recurring basis by level

within the fair value hierarchy:

SCHEDULE

OF ASSETS AND LIABILITY MEASURED AT FAIR VALUE

| | |

Level I | | |

Level II | | |

Level III | | |

Total | |

| | |

Fair Value Measurements as of June 30, 2023 | |

| | |

Level I | | |

Level II | | |

Level III | | |

Total | |

| Asset: | |

| | | |

| | | |

| | | |

| | |

| Other assets | |

$ | - | | |

$ | - | | |

$ | 3 | | |

$ | 3 | |

| | |

Level I | | |

Level II | | |

Level III | | |

Total | |

| | |

Fair Value Measurements as of December 31, 2022 | |

| | |

Level I | | |

Level II | | |

Level III | | |

Total | |

| Asset: | |

| | | |

| | | |

| | | |

| | |

| Other assets | |

$ | - | | |

$ | - | | |

$ | 3 | | |

$ | 3 | |

NOTE

9 – COMMITMENTS AND CONTINGENCIES

Pending

litigation

On

February 26, 2021, Protrade Systems, Inc. (“Protrade”) filed a Request for Arbitration (the “Request”) with the

International Court of Arbitration (the “ICA”) of the International Chamber of Commerce alleging the Company is in breach

of an Exclusive Distribution Agreement dated March 7, 2019 (the “Exclusive Distribution Agreement”) between Protrade and

the Company. Protrade alleges, in part, that the Company has breached the Exclusive Distribution Agreement by discontinuing the manufacture

of the DV0057 Painshield MD device in favor of an updated 10-100-001 Painshield MD device. Protrade claims damages estimated at $3 million.

On

March 15, 2022, the arbitrator issued a final award, which, determined that (i) the Company had the right to terminate the Exclusive

Distribution Agreement; (ii) the Company did not breach the duty of good faith and fair dealing with regard to the Exclusive Distribution

Agreement; and (iii) the Company did not breach any confidentiality obligations to Protrade.

Nevertheless the arbitrator determined that the Company did not comply with the obligation to supply Protrade with a year’s supply

of patches, and awarded Protrade $1,500,250, which consists of $1,432,000 for “lost profits” and $68,250 as reimbursement

of arbitration costs, on the grounds that the Company allegedly failed to supply Protrade with certain patches utilized by users of DV0057

Painshield MD device. The arbitrator based the decision on the testimony of Protrade’s president who asserted that a user would

use in excess of 33 patches per each device. The Company believes that the number of patches per device alleged by Protrade is grossly

inflated, and that these claims were not properly raised before the arbitrator. Accordingly, on

April 13, 2022, the Company submitted an application for the correction of the award which the arbitrator denied on June 22, 2022.

On

April 5, 2022, Protrade filed a Petition with the Supreme Court of New York Nassau County seeking to confirm the Award. On April 13,

2022, the Company submitted an application to the ICA seeking to correct an error in the award based on the evidence that the Company

only sold 2-3 reusable patches per device contrary to the 33 reusable patches claimed by Protrade. The same arbitrator who issued the

award, denied the application.

On

July 22, 2022, the Company filed a cross-motion seeking to vacate arbitration award on the grounds that the arbitrator exceeded her authority,

that the award was procured by fraud, and that the arbitrator failed to follow procedures established by New York law. In particular,

the Company averred in its motion that Protrade’s witness made false statements in arbitration, and that the arbitrator resolved

a claim that was never raised by Protrade and that has no factual basis.

On

October 3, 2022, the court issued a decision granting Protrade its petition to confirm the award and

denying the cross-motion.

On

November 9, 2022, the Company filed a motion to re-argue and renew its cross-motion to vacate the arbitration decision based on newer

information that was not available during the initial hearing. On the same day, the Company also filed a notice of appeal with the Appellate

Division, Second Department. On March 21, 2023, the Court denied the motion to re-argue and renew.

On

July 10, 2023, we filed its appeal with the Appellate Division, Second Department. The Company intends to continue to

vigorously pursue its opposition to the award in all appropriate fora.

As

of June 30, 2023 and December 31, 2022, the Company accrued the amount of the award to Protrade amounting to approximately $1.9 million,

with the $0.4 million of interest accrued as part of “Interest expense” and “Other accounts payable and accrued expenses”

on both periods.

NOTE

10 – RELATED PARTY TRANSACTION

The

firm of FisherBroyles LLP is handling the Company’s Protrade litigation and appeals. For the three and six months ended June 30,

2023, the Company have been billed and paid legal fees from FisherBroyles amounting to $23 and $89, respectively, and it has been recorded

as part of “General and administrative expenses” in the condensed consolidated statements of operations. As has been previously

disclosed, one of the Company’s board members, Aurora Cassirer, is a partner at FisherBroyles. Ms. Cassirer does not provide any

legal services or legal advice to the Company.

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion and analysis of the results of operations and financial condition of NanoVibronix, Inc. (the “Company”)

as of June 30, 2023 and for the six months ended June 30, 2023 and 2022 should be read in conjunction with our financial statements and

the notes to those financial statements that are included elsewhere in this Quarterly Report on Form 10-Q. This discussion and analysis

should be read in conjunction with the Company’s audited financial statements and related disclosures as of December 31, 2022 and

for the year then ended December 31, 2022, which are included in the Form 10-K filed with the Securities and Exchange Commission (“SEC”)

on April 17, 2023. References in this Management’s Discussion and Analysis of Financial Condition and Results of Operations to

“us”, “we”, “our” and similar terms refer to the Company.

Cautionary

Note Regarding Forward-Looking Statements

This

Quarterly Report on Form 10-Q contains “forward-looking statements,” which include information relating to future events,

future financial performance, financial projections, strategies, expectations, competitive environment and regulation. Words such as

“may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates,” and similar expressions, as well as statements in future tense, identify forward-looking statements. Forward-looking

statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance

or results will be achieved. Forward-looking statements are based on information we have when those statements are made or management’s

good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance

or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could

cause such differences include, but are not limited to:

| |

● |

Our

history of losses and expectation of continued losses; |

| |

● |

Global

economic and political instability and conflicts, such as the conflict between Russia and Ukraine, could adversely affect our business,

financial condition or results of operations; |

| |

● |

Increasing

inflation could adversely affect our business, financial condition, results of operations or cash flows; |

| |

●

|

The

geographic, social and economic impact of COVID-19 on the Company’s business operations; |

| |

●

|

Our

ability to raise funding for, and the timing of, clinical studies and eventual U.S. Food and Drug Administration approval of our

product candidates; |

| |

●

|

Regulatory

actions that could adversely affect the price of or demand for our approved products; |

| |

●

|

Market

acceptance of existing and new products; |

| |

●

|

Favorable

or unfavorable decisions about our products from government regulators, insurance companies or other third-party payers (including

the U.S. Centers for Medicare and Medicaid Services, or “CMS”); |

| |

●

|

Risks

of product liability claims and the availability of insurance; |

| |

●

|

Our

ability to successfully develop and commercialize our products; |

| |

●

|

Our

ability to generate internal growth; |

| |

●

|

Risks

related to computer system failures and cyber-attacks; |

| |

●

|

Our

ability to obtain regulatory approval in foreign jurisdictions; |

| |

●

|

Uncertainty

regarding the success of our clinical trials for our products in development; |

| |

●

|

Risks

related to our operations in Israel, including political, economic and military instability; |

| |

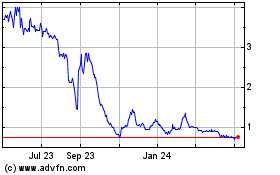

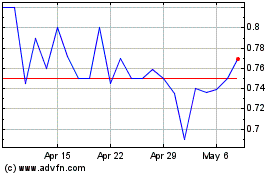

●

|

The

price of our securities is volatile with limited trading volume; |

| |

●

|

Our

ability to regain compliance with the continued listing requirements of the NASDAQ capital market; |

| |

●

|

Our

ability to maintain effective internal control over financial reporting and to remedy identified material weaknesses; |

| |

●

|

We

are a “smaller reporting company” and have reduced disclosure obligations that may make our stock less attractive to

investors; |

| |

●

|

Our

intellectual property portfolio and our ability to protect our intellectual property rights; |

| |

●

|

Our

ability to recruit and retain qualified regulatory and research and development personnel; |

| |

●

|

Unforeseen

changes in healthcare reimbursement for any of our approved products; |

| |

●

|

The

adoption of health policy changes and health care reform; |

| |

●

|

Lack

of financial resources to adequately support our operations; |

| |

●

|

Difficulties

in maintaining commercial scale manufacturing capacity and capability; |

| |

●

|

Our

ability to generate internal growth; |

| |

●

|

Changes

in our relationship with key collaborators; |

| |

●

|

Changes

in the market valuation or earnings of our competitors or companies viewed as similar to us; |

| |

●

|

Our

failure to comply with regulatory guidelines; |

| |

●

|

Uncertainty

in industry demand and patient wellness behavior; |

| |

●

|

General

economic conditions and market conditions in the medical device industry; |

| |

●

|

Future