Current Report Filing (8-k)

May 25 2022 - 7:01AM

Edgar (US Regulatory)

false000093313600009331362022-05-252022-05-25

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 25, 2022

Mr. Cooper Group Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-14667

|

|

91-1653725

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

8950 Cypress Waters Blvd.

Coppell, TX 75019

(Address of Principal Executive Offices, and Zip Code)

469-549-2000

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

COOP

|

The Nasdaq Stock Market

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01 Regulation FD Disclosure.

In connection with investor meetings taking place on May 26, 2022, Mr. Cooper Group Inc. (the “Company”) provided the following updated outlook for its

operational and financial performance:

|

•

|

The Company expects roughly break-even net income in the second quarter, excluding potential mark-to-market gains on its MSRs and severance

charges, reflecting pressure on volumes and margins in its Originations segment, while it continues to project strong growth in Servicing segment pretax income culminating in a quarterly run-rate of $100-$120 million by fourth quarter.

|

|

•

|

Due to incrementally higher mortgage rates, the Company has reduced its Originations pretax operating income guidance for the second quarter to

$40-$50 million, down from its prior guidance of $65-$85 million. Assuming no further change in market interest rates, the Company projects Originations pretax income in the third quarter of approximately $50-60 million on volumes of

$5-6 billion, with the improvement due to additional reductions in capacity and other operational enhancements.

|

|

•

|

The Company disclosed that prepayment speeds have continued to decline so far in the second quarter, with MSR CPRs now expected to average

11.8% for second quarter, compared to 15.1% for the first quarter. As a result, the Company expects Servicing operating pretax income for the second quarter of approximately $25 million, with strong growth in the third and fourth quarter

due to higher interest income and lower amortization.

|

|

•

|

So far during the second quarter through May 24, 2022, the Company has repurchased 1.7 million shares for approximately $77.5 million.

|

The information furnished pursuant to this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), nor will such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such

filing.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and

assumptions. Our actual results could differ materially from those predicted or implied. Undue reliance should not be placed on the forward-looking statements in this Current Report on Form 8-K. We assume no obligation to update such statements.

Non-GAAP Financial Measures

The Company utilizes non-GAAP financial measures as the measures provide additional information to assist investors in understanding and assessing the

Company’s and our business segments’ ongoing performance and financial results, as well as assessing our prospects for future performance. The adjusted operating financial measures facilitate a meaningful analysis and allow more accurate

comparisons of our ongoing business operations because they exclude items that may not be indicative of or are unrelated to the Company’s and our business segments’ core operating performance and are better measures for assessing trends in our

underlying businesses. These notable items are consistent with how management views our businesses. The Company is unable to provide a reconciliation of the forward-looking non-GAAP financial measures of Originations pretax operating income and

Servicing pre-tax operating income contained in this Form 8-K to their most directly comparable GAAP financial measures, because the information necessary for a quantitative reconciliation of the forward-looking non-GAAP financial measures to their

respective most directly comparable GAAP financial measure is not (and was not, when prepared) available to the Company without unreasonable efforts due to the inherent difficulty and impracticability of predicting certain amounts required by GAAP

with a reasonable degree of accuracy. Pre-tax income (loss) includes the impact of certain items, such as mark-to-market in the Servicing segment, that impact comparability between periods, which may be significant and are difficult to project with

a reasonable degree of accuracy. In addition, the Company believes such reconciliation could imply a degree of precision that might be confusing or misleading to investors. The probable significance of providing these forward-looking

non-GAAP financial measures without the directly comparable GAAP financial measures is that such GAAP financial measures may be materially different from the corresponding non-GAAP financial measures.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

Mr. Cooper Group Inc.

|

| |

|

|

| |

|

|

| |

|

|

|

Date: May 25, 2022

|

By:

|

/s/ Jaime Gow

|

| |

|

Jaime Gow

Executive Vice President & Chief Financial Officer

|

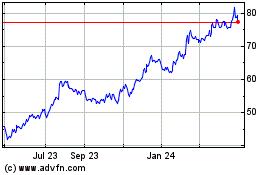

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jul 2024 to Aug 2024

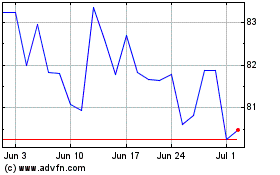

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Aug 2023 to Aug 2024