false000182660000018266002024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 08, 2024 |

Montauk Renewables, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39919 |

85-3189583 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

5313 Campbells Run Road Suite 200 |

|

Pittsburgh, Pennsylvania |

|

15205 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (412) 747-8700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

MNTK |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, Montauk Renewables, Inc. issued a press release announcing its financial results for the second quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

No. Description

99.1 Press release, dated August 8, 2024 of Montauk Renewables, Inc.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

MONTAUK RENEWABLES, INC. |

|

|

|

|

Date: |

August 8, 2024 |

By: |

/s/ Kevin A. Van Asdalan |

|

|

Name: Title: |

Kevin A. Van Asdalan

Chief Financial Officer |

Exhibit 99.1

Montauk Renewables Announces Second Quarter 2024 Results

PITTSBURGH, PENNSYLVANIA – August 8, 2024—Montauk Renewables, Inc. (“Montauk” or “the Company”) (NASDAQ: MNTK), a renewable energy company specializing in the management, recovery, and conversion of biogas into renewable natural gas (“RNG”), today announced financial results for the second quarter ended June 30, 2024.

Second Quarter Financial Highlights:

• Unsold RINs of 4.7 million as of June 30, 2024, increased 58.7% compared to the second quarter of 2023

• In July 2024, committed for transfer all 4.7 million unsold RINs as of June 30, 2024 at average price of $3.32 compared to second quarter of 2024 average index price of $3.20

• Revenues of $43.3 million, decreased 18.6% compared to the second quarter of 2023

• Net Loss of $0.7 million compared to net income in the second quarter of 2023

• Non-GAAP Adjusted EBITDA of $7.0 million, decreased 63.7% compared to the second quarter of 2023

• RNG production of 1.4 million MMBtu, flat compared to the second quarter of 2023

• RINs Sold of 10.0 million, decrease of 42.7% compared to the second quarter of 2023

Our profitability is highly dependent on the market price of environmental attributes, including the market price for Renewable Identification Numbers ("RINs"). As we self-market a significant portion of our RINs, a decision not to commit to transfer available RINs during a period will impact our operating revenue and operating profit. We made a strategic determination to not transfer all available D3 RINs generated and available for transfer during the second quarter of 2024. As a result of this strategic decision, we had approximately 4.7 million RINs in inventory from second quarter of 2024 RNG production. We have since entered into commitments to transfer all of these RINs during the third quarter of 2024 at an average realized price of approximately $3.32. During the second quarter of 2024, we commissioned the pilot reactor for our Montauk Ag Renewables North Carolina project that we relocated from Magnolia, NC to our Turkey, NC processing facility. We have also completed the majority of the installation of collection process equipment on two farms for which we have feedstock agreements. In August 2024, we received approval from the North Carolina Utilities Commission for our New Renewables Energy Facility amendment application. We completed the initial site surveys related to locating the processing equipment and received the first site plans from EE North America for our CO2 use development opportunity. Additionally, at our Pico facility, we produced approximately 38% more Metric Million British Thermal Units (“MMBtu”) during the second quarter of 2024 compared to the second quarter of 2023.

Second Quarter Financial Results

Total revenues in the second quarter of 2024 were $43.3 million, a decrease of $10.0 million (18.6%) compared to $53.3 million in the second quarter of 2023. The decrease is primarily related to a decrease in self-monetized RINs in the second quarter of 2024 as a result of our strategic decision to not self-market a significant amount of RINs from 2024 RNG production due to second quarter 2024 D3 RIN index price volatility. An increase in realized RIN pricing of 44.4% during the second quarter of 2024 as compared to the second quarter of 2023 helped to offset the decrease in revenue caused by a decrease in RIN sales. Our RNG operating and maintenance expenses in the second quarter of 2024 were $13.9 million, an increase of $2.2 million (18.9%) compared to $11.7 million in the second quarter of 2023. The primary driver of this increase were increased utility expenses and timing of preventative maintenance expenses at our McCarty, Rumpke, Apex and Coastal facilities. Our Renewable Electricity Generation operating and maintenance expenses in the second quarter of 2024 were $4.7 million, an increase of $1.3 million (37.3%) compared to $3.4 million in the second quarter of 2023, primarily due to the timing of annual original equipment manufacturer preventative maintenance expenses at our Bowerman facility. Total general and administrative expenses in the second quarter of 2024 were $8.7 million, flat as compared to the second quarter of 2023. Operating income in the second quarter of 2024 was $0.9 million, a decrease of $12.7 million (93.6%) compared to $13.6 million in the second quarter of 2023. Net loss in the second quarter of 2024 was $0.7 million compared to a net income of $1.0 million in the second quarter of 2023.

Second Quarter Operational Results

We produced approximately 1.4 million MMMBtu of RNG in the second quarter of 2024, flat compared to 1.4 million in the second quarter of 2023. Our Texas facilities, McCarty, Atascocita, and Galveston produced 47 thousand fewer MMBtu in the second quarter of 2024 compared to the second quarter of 2023 as a result of severe weather causing widespread, multi-day power outages across the Houston, Texas area. Our Pico facility produced 13 thousand MMBtu more in the second quarter of 2024 as compared to the second quarter of 2023 due to the commissioning of our digestion expansion project. We produced approximately 45 thousand megawatt hours (“MWh”) in Renewable Electricity in the second quarter of 2024, a decrease of 4 thousand MWh compared to 49 thousand MWh produced in the second quarter of 2023. Our Security facility produced approximately 3 thousand MWh less in the second quarter of 2024 compared to the second quarter of 2023 due to the first quarter of 2024 sale of the gas rights back to the landfill host.

Unchanged 2024 Full Year Outlook

• RNG revenues are expected to range between $195 and $215 million

• RNG production volumes are expected to range between 5.8 and 6.1 million MMBtu

• Renewable Electricity revenues are expected to range between $18.0 and $19.0 million

• Renewable Electricity production volumes are expected to range between 190 and 200 thousand MWh

Conference Call Information

The Company will host a conference call today at 5:00 p.m. ET to discuss results. Access for the conference call will be available via the following link:

• https://register.vevent.com/register/BIdf7ca653968a4ea29aa2e066775e971f

Please register for the conference call and webcast using the above link in advance of the call start time. The webcast platform will register your name and organization as well as provide dial-ins numbers and a unique access pin. The conference call will be broadcast live and be available for replay at https://edge.media-server.com/mmc/p/gitdoken/ and on the Company’s website at https://ir.montaukrenewables.com after 8:00 p.m. Eastern time on the same day through August, 8, 2025.

Use of Non-GAAP Financial Measures

This press release and the accompanying tables include references to EBITDA and Adjusted EBITDA, which are Non-GAAP financial measures. We present EBITDA and Adjusted EBITDA because we believe the measures assist investors in analyzing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance.

In addition, EBITDA and Adjusted EBITDA are financial measurements of performance that management and the board of directors use in their financial and operational decision-making and in the determination of certain compensation programs. EBITDA and Adjusted EBITDA are supplemental performance measures that are not required by or presented in accordance with GAAP. EBITDA and Adjusted EBITDA should not be considered alternatives to net (loss) income or any other performance measure derived in accordance with GAAP, or as an alternative to cash flows from operating activities or a measure of our liquidity or profitability.

About Montauk Renewables, Inc.

Montauk Renewables, Inc. (NASDAQ: MNTK) is a renewable energy company specializing in the management, recovery and conversion of biogas into RNG. The Company captures methane, preventing it from being released into the atmosphere, and converts it into either RNG or electrical power for the electrical grid (“Renewable Electricity”). The Company, headquartered in Pittsburgh, Pennsylvania, has more than 30 years of experience in the development, operation and management of landfill methane-fueled renewable energy projects. The Company has current operations at 14 operating projects and on going development projects located in California, Idaho, Ohio, Oklahoma, Pennsylvania, North Carolina, South Carolina, and Texas. The Company sells RNG and Renewable Electricity, taking advantage of Environmental Attribute premiums available under federal and state policies that incentivize their use. For more information, visit https://ir.montaukrenewables.com

Company Contact:

John Ciroli

Chief Legal Officer (CLO) & Secretary

investor@montaukrenewables.com

(412) 747-8700

Investor Relations Contact:

Georg Venturatos

Gateway Investor Relations

MNTK@gateway-grp.com

(949) 574-3860

Safe Harbor Statement

This release contains “forward-looking statements” within the meaning of U.S. federal securities laws that involve substantial risks and uncertainties. All statements other than statements of historical or current fact included in this report are forward-looking statements. Forward-looking statements refer to our current expectations and projections relating to our financial condition, results of operations, plans, objectives, strategies, future performance, and business. Forward-looking statements may include words such as “anticipate,” “assume,” “believe,” “can have,” “contemplate,” “continue,” “strive,” “aim,” “could,” “design,” “due,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “likely,” “may,” “might,” “objective,” “plan,” “predict,” “project,” “potential,” “seek,” “should,” “target,” “will,” “would,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operational performance or other events. For example, all statements we make relating to our future results of operations, financial condition, expectations and plans, including expected benefits of the Pico digestion capacity increase, the Montauk Ag project in North Carolina, the Second Apex RNG Facility, the Blue Granite RNG Facility, the Bowerman RNG Facility, the delivery of biogenic carbon dioxide volumes to European Energy, the resolution of gas collection issues at the McCarty facility, the mitigation of wellfield extraction environmental factors at the Rumpke facility, and weather-related anomalies are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expect and, therefore, you should not unduly rely on such statements. The risks and uncertainties that could cause those actual results to differ materially from those expressed or implied by these forward-looking statements include but are not limited to: our ability to develop and operate new renewable energy projects, including with livestock farms, and related challenges associated with new projects, such as identifying suitable locations and potential delays in acquisition financing, construction, and development; reduction or elimination of government economic incentives to the renewable energy market; the inability to complete strategic development opportunities; widespread manmade, natural and other disasters (including severe weather events), health emergencies, dislocations, geopolitical instabilities or events, terrorist activities, international hostilities, government shutdowns, political elections, security breaches, cyberattacks or other extraordinary events that impact general economic conditions, financial markets and/or our business and operating results; continued inflation could raise our operating costs or increase the construction costs of our existing or new projects; rising interest rates could increase the borrowing costs of future indebtedness; the potential failure to attract and retain qualified personnel of the Company or a possible increased reliance on third-party contractors as a result, and the potential unenforceability of non-compete clauses with our employees; the length of development and optimization cycles for new projects, including the design and construction processes for our renewable energy projects; dependence on third parties for the manufacture of products and services and our landfill operations; the quantity, quality and consistency of our feedstock volumes from both landfill and livestock farm operations; reliance on interconnections with and access to electric utility distribution and transmission facilities and gas transportation pipelines for our Renewable Natural Gas and Renewable Electricity Generation segments; our ability to renew pathway provider sharing arrangements at historical counterparty share percentages; our projects not producing expected levels of output; potential benefits associated with the combustion-based oxygen removal condensate neutralization technology; concentration of revenues from a small number of customers and projects; our outstanding indebtedness and restrictions under our credit facility; our ability to extend our fuel supply agreements prior to expiration; our ability to meet milestone requirements under our power purchase agreements; existing regulations and changes to regulations and policies that effect our operations; expected benefits from the extension of the Production Tax Credit and other tax credit benefits under the Inflation Reduction Act of 2022; decline in public acceptance and support of renewable energy development and projects, or our inability to appropriately address environmental, social and governance targets, goals, commitments or concerns, including climate-related disclosures; our expectations regarding Environmental Attribute volume requirements and prices and commodity prices; our expectations regarding the period during which we qualify as an emerging growth company under the Jumpstart Our Business Startups Act (“JOBS Act”); our expectations regarding future capital expenditures, including for the maintenance of facilities; our expectations regarding the use of net operating losses before expiration; our expectations regarding more attractive carbon intensity scores by regulatory agencies for our livestock farm projects; market volatility and fluctuations in commodity prices and the market prices of Environmental Attributes and the impact of any related hedging activity; regulatory changes in federal, state and international environmental attribute programs and the need to obtain and maintain regulatory permits, approvals, and consents; profitability of our planned livestock farm projects; sustained demand for renewable energy; potential liabilities from contamination and environmental conditions; potential exposure to costs and liabilities due to extensive environmental, health and safety laws; impacts of climate change, changing weather patterns and conditions, and natural disasters; failure of our information technology and data security systems; increased competition in our markets; continuing to keep up with technology innovations; concentrated stock ownership by a few stockholders and related control over the outcome of all matters subject to a stockholder vote; and other risks and uncertainties detailed in the section titled “Risk Factors” in our latest Annual Report on Form 10-K and as otherwise disclosed in our filings with the SEC.

We make many of our forward-looking statements based on our operating budgets and forecasts, which are based upon detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. All forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements as well as others made in our Securities and Exchange Commission filings and public communications. You should evaluate all forward-looking statements made by us in the context of these risks and uncertainties. The forward-looking statements included herein

are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law.

|

|

|

|

|

|

|

|

|

MONTAUK RENEWABLES, INC. |

|

CONSOLIDATED BALANCE SHEETS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

(in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as of June 30, |

|

|

as of December 31, |

|

ASSETS |

|

2024 |

|

|

2023 |

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

42,285 |

|

|

$ |

73,811 |

|

Accounts and other receivables |

|

|

21,984 |

|

|

|

12,752 |

|

Current restricted cash |

|

|

8 |

|

|

|

8 |

|

Income tax receivable |

|

|

506 |

|

|

— |

|

Current portion of derivative instruments |

|

|

766 |

|

|

|

785 |

|

Prepaid expenses and other current assets |

|

|

5,598 |

|

|

|

2,819 |

|

Total current assets |

|

$ |

71,147 |

|

|

$ |

90,175 |

|

Non-current restricted cash |

|

$ |

452 |

|

|

$ |

423 |

|

Property, plant and equipment, net |

|

|

244,367 |

|

|

|

214,289 |

|

Goodwill and intangible assets, net |

|

|

17,932 |

|

|

|

18,421 |

|

Deferred tax assets |

|

|

1,908 |

|

|

|

2,076 |

|

Non-current portion of derivative instruments |

|

|

515 |

|

|

|

470 |

|

Operating lease right-of-use assets |

|

|

4,165 |

|

|

|

4,313 |

|

Finance lease right-of-use assets |

|

|

147 |

|

|

|

36 |

|

Related party receivable |

|

|

10,158 |

|

|

|

10,138 |

|

Other assets |

|

|

11,181 |

|

|

|

9,897 |

|

Total assets |

|

$ |

361,972 |

|

|

$ |

350,238 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

11,864 |

|

|

$ |

7,916 |

|

Accrued liabilities |

|

|

20,671 |

|

|

|

12,789 |

|

Income tax payable |

|

— |

|

|

|

313 |

|

Current portion of operating lease liability |

|

|

452 |

|

|

|

420 |

|

Current portion of finance lease liability |

|

|

67 |

|

|

|

26 |

|

Current portion of long-term debt |

|

|

9,874 |

|

|

|

7,886 |

|

Total current liabilities |

|

$ |

42,928 |

|

|

$ |

29,350 |

|

Long-term debt, less current portion |

|

|

49,685 |

|

|

|

55,614 |

|

Non-current portion of operating lease liability |

|

|

3,953 |

|

|

|

4,133 |

|

Non-current portion of finance lease liability |

|

|

79 |

|

|

|

10 |

|

Asset retirement obligations |

|

|

6,113 |

|

|

|

5,900 |

|

Other liabilities |

|

|

3,893 |

|

|

|

4,992 |

|

|

|

|

|

|

|

|

Total liabilities |

|

$ |

106,651 |

|

|

$ |

99,999 |

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value, authorized 690,000,000 shares; 143,732,811 shares issued at June 30, 2024 and December 31, 2023; 142,186,722 and 141,986,189 shares outstanding at June 30, 2024 and December 31, 2023, respectively |

|

|

1,422 |

|

|

|

1,420 |

|

Treasury stock, at cost, 1,069,627 and 984,762 shares June 30, 2024 and December 31, 2023, respectively |

|

|

(11,570 |

) |

|

|

(11,173 |

) |

Additional paid-in capital |

|

|

218,717 |

|

|

|

214,378 |

|

Retained earnings |

|

|

46,752 |

|

|

|

45,614 |

|

Total stockholders' equity |

|

|

255,321 |

|

|

|

250,239 |

|

Total liabilities and stockholders' equity |

|

$ |

361,972 |

|

|

$ |

350,238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTAUK RENEWABLES, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands, except per share data) |

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total operating revenues |

|

$ |

43,338 |

|

|

$ |

53,256 |

|

|

$ |

82,125 |

|

|

$ |

72,409 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating and maintenance expenses |

|

|

18,662 |

|

|

|

15,221 |

|

|

|

33,113 |

|

|

|

29,402 |

|

General and administrative expenses |

|

|

8,737 |

|

|

|

8,745 |

|

|

|

18,166 |

|

|

|

18,220 |

|

Royalties, transportation, gathering and production fuel |

|

|

9,077 |

|

|

|

10,205 |

|

|

|

15,593 |

|

|

|

14,138 |

|

Depreciation, depletion and amortization |

|

|

5,823 |

|

|

|

5,251 |

|

|

|

11,257 |

|

|

|

10,447 |

|

Impairment loss |

|

|

171 |

|

|

|

274 |

|

|

|

699 |

|

|

|

726 |

|

Transaction costs |

|

|

- |

|

|

|

3 |

|

|

|

61 |

|

|

|

86 |

|

Total operating expenses |

|

$ |

42,470 |

|

|

$ |

39,699 |

|

|

$ |

78,889 |

|

|

$ |

73,019 |

|

Operating income (loss) |

|

$ |

868 |

|

|

$ |

13,557 |

|

|

$ |

3,236 |

|

|

$ |

(610 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

$ |

1,286 |

|

|

$ |

711 |

|

|

$ |

2,451 |

|

|

$ |

2,386 |

|

Other income |

|

|

(50 |

) |

|

|

(90 |

) |

|

|

(1,110 |

) |

|

|

(84 |

) |

Total other expenses (income) |

|

$ |

1,236 |

|

|

$ |

621 |

|

|

$ |

1,341 |

|

|

$ |

2,302 |

|

(Loss) income before income taxes |

|

$ |

(368 |

) |

|

$ |

12,936 |

|

|

$ |

1,895 |

|

|

$ |

(2,912 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit) |

|

|

344 |

|

|

|

11,933 |

|

|

|

757 |

|

|

|

(127 |

) |

Net (loss) income |

|

$ |

(712 |

) |

|

$ |

1,003 |

|

|

$ |

1,138 |

|

|

$ |

(2,785 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.01 |

) |

|

$ |

0.01 |

|

|

$ |

0.01 |

|

|

$ |

(0.02 |

) |

Diluted |

|

$ |

(0.01 |

) |

|

$ |

0.01 |

|

|

$ |

0.01 |

|

|

$ |

(0.02 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

142,069,697 |

|

|

|

141,633,417 |

|

|

|

142,027,943 |

|

|

|

141,633,417 |

|

Diluted |

|

|

142,069,697 |

|

|

|

142,045,498 |

|

|

|

142,252,085 |

|

|

|

141,633,417 |

|

|

|

|

|

|

|

|

|

|

MONTAUK RENEWABLES, INC. |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

(in thousands): |

|

|

|

|

|

|

|

|

For the six months ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income (loss) |

|

$ |

1,138 |

|

|

$ |

(2,785 |

) |

Adjustments to reconcile net income (loss) to net cash provided by operating

activities: |

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

11,257 |

|

|

|

10,447 |

|

Provision (benefit) for deferred income taxes |

|

|

168 |

|

|

|

87 |

|

Stock-based compensation |

|

|

4,339 |

|

|

|

3,495 |

|

Derivative mark-to-market adjustments and settlements |

|

|

(26 |

) |

|

|

(119 |

) |

Net loss on sale of assets |

|

|

71 |

|

|

|

37 |

|

(Decrease) increase in earn-out liability |

|

|

(465 |

) |

|

|

350 |

|

Accretion of asset retirement obligations |

|

|

220 |

|

|

|

202 |

|

Liabilities associated with properties sold |

|

|

(225 |

) |

|

|

— |

|

Amortization of debt issuance costs |

|

|

180 |

|

|

|

184 |

|

Impairment loss |

|

|

699 |

|

|

|

726 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts and other receivables and other current assets |

|

|

(13,934 |

) |

|

|

(13,246 |

) |

Accounts payable and other accrued expenses |

|

|

11,063 |

|

|

|

6,699 |

|

Net cash provided by operating activities |

|

$ |

14,485 |

|

|

$ |

6,077 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

Capital expenditures |

|

$ |

(40,764 |

) |

|

$ |

(29,588 |

) |

Asset acquisition |

|

|

(820 |

) |

|

|

— |

|

Cash collateral deposits |

|

|

29 |

|

|

|

1 |

|

Net cash used in investing activities |

|

$ |

(41,555 |

) |

|

$ |

(29,587 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Repayments of long-term debt |

|

$ |

(4,000 |

) |

|

$ |

(4,000 |

) |

Common stock issuance |

|

$ |

2 |

|

|

$ |

- |

|

Treasury stock purchase |

|

$ |

(397 |

) |

|

$ |

- |

|

Finance lease payments |

|

|

(32 |

) |

|

|

(36 |

) |

Net cash used in financing activities |

|

$ |

(4,427 |

) |

|

$ |

(4,036 |

) |

Net decrease in cash and cash equivalents and restricted cash |

|

$ |

(31,497 |

) |

|

$ |

(27,546 |

) |

Cash and cash equivalents and restricted cash at beginning of period |

|

$ |

74,242 |

|

|

$ |

105,606 |

|

Cash and cash equivalents and restricted cash at end of period |

|

$ |

42,745 |

|

|

$ |

78,060 |

|

|

|

|

|

|

|

|

Reconciliation of cash, cash equivalents, and restricted cash at end of

period: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

42,285 |

|

|

$ |

77,630 |

|

Restricted cash and cash equivalents - current |

|

8 |

|

|

22 |

|

Restricted cash and cash equivalents - non-current |

|

452 |

|

|

408 |

|

|

|

$ |

42,745 |

|

|

$ |

78,060 |

|

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

Cash paid for interest |

|

$ |

2,366 |

|

|

$ |

2,460 |

|

Cash paid for income taxes |

|

|

1,407 |

|

|

|

865 |

|

Accrual for purchase of property, plant and equipment included in accounts

payable and accrued liabilities |

|

|

7,697 |

|

|

|

6,565 |

|

|

|

|

|

|

|

|

|

|

MONTAUK RENEWABLES, INC. |

|

NON-GAAP FINANCIAL MEASURES |

|

(Unaudited) |

|

|

|

|

|

|

|

|

(in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table provides our EBITDA and Adjusted EBITDA, as well as a reconciliation to net income (loss) which is the most directly comparable GAAP measure for the three and six months ended June 30, 2024 and 2023, respectively: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Net (loss) income |

|

$ |

(712 |

) |

|

$ |

1,003 |

|

Depreciation, depletion and amortization |

|

|

5,823 |

|

|

|

5,251 |

|

Interest expense |

|

|

1,286 |

|

|

|

711 |

|

Income tax expense |

|

|

344 |

|

|

|

11,933 |

|

Consolidated EBITDA |

|

|

6,741 |

|

|

|

18,898 |

|

|

|

|

|

|

|

|

Impairment loss |

|

|

171 |

|

|

|

274 |

|

Net loss on sale of assets |

|

|

49 |

|

|

|

— |

|

Transaction costs |

|

|

— |

|

|

|

3 |

|

Adjusted EBITDA |

|

$ |

6,961 |

|

|

$ |

19,175 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Net income (loss) |

|

$ |

1,138 |

|

|

$ |

(2,785 |

) |

Depreciation, depletion and amortization |

|

|

11,257 |

|

|

|

10,447 |

|

Interest expense |

|

|

2,451 |

|

|

|

2,386 |

|

Income tax expense (benefit) |

|

|

757 |

|

|

|

(127 |

) |

Consolidated EBITDA |

|

|

15,603 |

|

|

|

9,921 |

|

|

|

|

|

|

|

|

Impairment loss |

|

|

699 |

|

|

|

726 |

|

Net loss on sale of assets |

|

|

71 |

|

|

|

37 |

|

Transaction Costs |

|

|

61 |

|

|

|

86 |

|

Adjusted EBITDA |

|

$ |

16,434 |

|

|

$ |

10,770 |

|

v3.24.2.u1

Document And Entity Information

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

Montauk Renewables, Inc.

|

| Entity Central Index Key |

0001826600

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-39919

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-3189583

|

| Entity Address, Address Line One |

5313 Campbells Run Road

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Pittsburgh

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

15205

|

| City Area Code |

(412)

|

| Local Phone Number |

747-8700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

MNTK

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

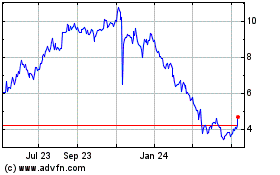

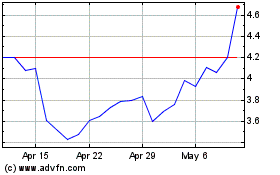

Montauk Renewables (NASDAQ:MNTK)

Historical Stock Chart

From Nov 2024 to Nov 2024

Montauk Renewables (NASDAQ:MNTK)

Historical Stock Chart

From Nov 2023 to Nov 2024