Montauk Renewables, Inc. (“Montauk” or “the Company”) (NASDAQ:

MNTK), a renewable energy company specializing in the management,

recovery, and conversion of biogas into renewable natural gas

(“RNG”), today announced financial results for the first quarter

ended March 31, 2024.

First Quarter Financial Highlights:

- Revenues of $38.8 million, increased 102.5% compared to the

first quarter of 2023

- Net Income of $1.9 million, increased 148.8% compared to the

first quarter of 2023

- Non-GAAP Adjusted EBITDA of $9.5 million, increased 212.7%

compared to the first quarter of 2023

- RNG production of 1.4 million MMBtu, increased 4.4% compared to

the first quarter of 2023

- RINs Sold of 7.9 million, increase of 167.5% compared to the

first quarter of 2023

Our profitability is highly dependent on the

market price of Environmental Attributes, including the market

price for RINs. As we self-market a significant portion of our

RINs, a strategic decision not to commit to transfer available RINs

during a period will impact our operating revenue and operating

profit. We made a strategic determination to not transfer all

available D3 RINs generated and available for transfer during the

first quarter of 2024. As of result of this strategic decision, we

have approximately 3,351 RINs in inventory from 2024 RNG

production. In April 2024, we signed a second feedstock supply

agreement which includes additional access to hog spaces with this

individual feedstock supplier. When added to the first feedstock

supply agreement, which was signed in the fourth quarter of 2023,

we believe we are on pace to target the 120 thousand hog spaces

which will provide sufficient feedstock under our Duke Energy REC

agreement. Additionally, in the first quarter of 2024, we

successfully commissioned the last expansion of our Pico digestion

capacity project. With the increased digestion capacity, we

produced approximately 39% more MMBtu during the first quarter of

2024 compared to the first quarter of 2023.

First Quarter Financial Results

Total revenues in the first quarter of 2024 were

$38.8 million, an increase of $19.6 million (102.5%) compared to

$19.2 million in the first quarter of 2023. The increase is

primarily related to an increase in self-monetized RINs in the

first quarter of 2024 as a result of our strategic decision in the

first quarter of 2023 to not self-market a significant amount of

RINs from 2023 RNG production due to 2023 D3 RIN index price

volatility. Additionally, an increase in realized RIN pricing of

61.7% during the first quarter of 2024 as compared to the first

quarter of 2023 contributed to the increase in revenues. Our RNG

Operating and maintenance expenses in the first quarter of 2024

were $12.1 million, an increase of $0.8 million (7.0%) compared to

$11.3 million in the first quarter of 2023. The primary driver of

this increase was related to timing of preventative maintenance

expenses at our Rumpke and Atascocita facilities. Our Renewable

Electricity Generation operating and maintenance expenses in the

first quarter of 2024 were $2.3 million, a decrease of $0.6 million

(19.9%) compared to $2.9 million in the first quarter of 2023,

primarily due to the reversal of our asset retirement obligation

liability related to the sale of our Security facility. Total

general and administrative expenses in the first quarter of 2024

were $9.4 million, flat as compared to $9.5 million in the first

quarter of 2023. Operating income in the first quarter of 2024 was

$2.4 million, an increase of $16.5 million (116.7%) compared to an

operating loss of $14.2 million in the first quarter of 2023. Net

income in the first quarter of 2024 was $1.9 million, an increase

of $5.6 million (148.8%) compared to a net loss of $3.8 million in

the first quarter of 2023.

First Quarter Operational Results

We produced approximately 1.4 million Metric

Million British Thermal Units (“MMBtu”) of RNG in the first quarter

of 2024, an increase of less than 0.1 million compared to 1.4

million in the first quarter of 2023. We want to highlight that our

Pico facility produced 9 MMBtu more in the first quarter of 2024 as

compared to the first quarter of 2023 related to the commissioning

our digestion expansion project. We produced approximately 54

thousand megawatt hours (“MWh”) in Renewable Electricity in the

first quarter of 2024, an increase of 8 thousand MWh compared to 46

thousand MWh produced in the first quarter of 2023. Our Security

facility produced approximately 3 thousand MWh more in the first

quarter of 2024 compared to the first quarter of 2023 as a result

of prior period engine maintenance. Our Bowerman facility produced

approximately 3 thousand MWh more in the first quarter of 2024

compared to the first quarter of 2023 primarily related to timing

of preventative engine maintenance.

Reaffirmed 2024 Full Year Outlook

- RNG revenues are expected to range between $195 and $215

million

- RNG production volumes are expected to range between 5.8 and

6.1 million MMBtu

- Renewable Electricity revenues are expected to range between

$18.0 and $19.0 million

- Renewable Electricity production volumes are expected to range

between 190 and 200 thousand MWh

Conference Call Information

The Company will host a conference call today at

5:00 p.m. ET to discuss results. Access for the conference call

will be available via the following link:

-

https://register.vevent.com/register/BI3c6a9f48d8c5414099325fc910abf8c7

Please register for the conference call and

webcast using the above link in advance of the call start time. The

webcast platform will register your name and organization as well

as provide dial-ins numbers and a unique access pin. The conference

call will be broadcast live and be available for replay at

https://edge.media-server.com/mmc/p/txdbnngi/ and on the Company’s

website at https://ir.montaukrenewables.com after 8:00 p.m. Eastern

time on the same day through May, 9, 2025.

Use of Non-GAAP Financial Measures

This press release and the accompanying tables

include references to EBITDA and Adjusted EBITDA, which are

Non-GAAP financial measures. We present EBITDA and Adjusted EBITDA

because we believe the measures assist investors in analyzing our

performance across reporting periods on a consistent basis by

excluding items that we do not believe are indicative of our core

operating performance.

In addition, EBITDA and Adjusted EBITDA are

financial measurements of performance that management and the board

of directors use in their financial and operational decision-making

and in the determination of certain compensation programs. EBITDA

and Adjusted EBITDA are supplemental performance measures that are

not required by or presented in accordance with GAAP. EBITDA and

Adjusted EBITDA should not be considered alternatives to net (loss)

income or any other performance measure derived in accordance with

GAAP, or as an alternative to cash flows from operating activities

or a measure of our liquidity or profitability.

About Montauk Renewables, Inc.

Montauk Renewables, Inc. (NASDAQ: MNTK) is a

renewable energy company specializing in the management, recovery

and conversion of biogas into RNG. The Company captures methane,

preventing it from being released into the atmosphere, and converts

it into either RNG or electrical power for the electrical grid

(“Renewable Electricity”). The Company, headquartered in

Pittsburgh, Pennsylvania, has more than 30 years of experience in

the development, operation and management of landfill

methane-fueled renewable energy projects. The Company has current

operations at 14 operating projects and on going development

projects located in California, Idaho, Ohio, Oklahoma,

Pennsylvania, North Carolina, South Carolina, and Texas. The

Company sells RNG and Renewable Electricity, taking advantage of

Environmental Attribute premiums available under federal and state

policies that incentivize their use. For more information, visit

https://ir.montaukrenewables.com

Company Contact: John Ciroli Chief Legal Officer

(CLO) & Secretary investor@montaukrenewables.com (412)

747-8700

Investor Relations Contact: Georg Venturatos

Gateway Investor Relations MNTK@gateway-grp.com (949) 574-3860

Safe Harbor Statement

This release contains “forward-looking statements”

within the meaning of U.S. federal securities laws that involve

substantial risks and uncertainties. All statements other than

statements of historical or current fact included in this report

are forward-looking statements. Forward-looking statements refer to

our current expectations and projections relating to our financial

condition, results of operations, plans, objectives, strategies,

future performance, and business. Forward-looking statements may

include words such as “anticipate,” “assume,” “believe,” “can

have,” “contemplate,” “continue,” “strive,” “aim,” “could,”

“design,” “due,” “estimate,” “expect,” “forecast,” “goal,”

“intend,” “likely,” “may,” “might,” “objective,” “plan,” “predict,”

“project,” “potential,” “seek,” “should,” “target,” “will,”

“would,” and other words and terms of similar meaning in connection

with any discussion of the timing or nature of future operational

performance or other events. For example, all statements we make

relating to our future results of operations, financial condition,

expectations and plans, including expected benefits of the Pico

digestion capacity increase, the Montauk Ag project in North

Carolina, the Second Apex RNG Facility, the Blue Granite RNG

Facility, the Bowerman RNG Facility, the delivery of biogenic

carbon dioxide volumes to European Energy, the resolution of gas

collection issues at the McCarty facility, the mitigation of

wellfield extraction environmental factors at the Rumpke facility,

and weather-related anomalies are forward-looking statements. All

forward-looking statements are subject to risks and uncertainties

that may cause actual results to differ materially from those that

we expect and, therefore, you should not unduly rely on such

statements. The risks and uncertainties that could cause those

actual results to differ materially from those expressed or implied

by these forward-looking statements include but are not limited to:

our ability to develop and operate new renewable energy projects,

including with livestock farms, and related challenges associated

with new projects, such as identifying suitable locations and

potential delays in acquisition financing, construction, and

development; reduction or elimination of government economic

incentives to the renewable energy market; the inability to

complete strategic development opportunities; widespread manmade,

natural and other disasters (including severe weather events),

health emergencies, dislocations, geopolitical instabilities or

events, terrorist activities, international hostilities, government

shutdowns, political elections, security breaches, cyberattacks or

other extraordinary events that impact general economic conditions,

financial markets and/or our business and operating results;

continued inflation could raise our operating costs or increase the

construction costs of our existing or new projects; rising interest

rates could increase the borrowing costs of future indebtedness;

the potential failure to attract and retain qualified personnel of

the Company or a possible increased reliance on third-party

contractors as a result, and the potential unenforecability of

non-compete clauses with our employees; the length of development

and optimization cycles for new projects, including the design and

construction processes for our renewable energy projects;

dependence on third parties for the manufacture of products and

services and our landfill operations; the quantity, quality and

consistency of our feedstock volumes from both landfill and

livestock farm operations; reliance on interconnections with and

access to electric utility distribution and transmission facilities

and gas transportation pipelines for our Renewable Natural Gas and

Renewable Electricity Generation segments; our projects not

producing expected levels of output; potential benefits associated

with the combustion-based oxygen removal condensate neutralization

technology; concentration of revenues from a small number of

customers and projects; our outstanding indebtedness and

restrictions under our credit facility; our ability to extend our

fuel supply agreements prior to expiration; our ability to meet

milestone requirements under our power purchase agreements;

existing regulations and changes to regulations and policies that

effect our operations; expected benefits from the extension of the

Production Tax Credit and other tax credit benefits under the

Inflation Reduction Act of 2022; decline in public acceptance and

support of renewable energy development and projects, or our

inability to appropriately address environmental, social and

governance targets, goals, commitments or concerns, including

climate-related disclosures; our expectations regarding

Environmental Attribute volume requirements and prices and

commodity prices; our expectations regarding the period during

which we qualify as an emerging growth company under the Jumpstart

Our Business Startups Act (“JOBS Act”); our expectations regarding

future capital expenditures, including for the maintenance of

facilities; our expectations regarding the use of net operating

losses before expiration; our expectations regarding more

attractive carbon intensity scores by regulatory agencies for our

livestock farm projects; market volatility and fluctuations in

commodity prices and the market prices of Environmental Attributes

and the impact of any related hedging activity; regulatory changes

in federal, state and international environmental attribute

programs and the need to obtain and maintain regulatory permits,

approvals, and consents; profitability of our planned livestock

farm projects; sustained demand for renewable energy; potential

liabilities from contamination and environmental conditions;

potential exposure to costs and liabilities due to extensive

environmental, health and safety laws; impacts of climate change,

changing weather patterns and conditions, and natural disasters;

failure of our information technology and data security systems;

increased competition in our markets; continuing to keep up with

technology innovations; concentrated stock ownership by a few

stockholders and related control over the outcome of all matters

subject to a stockholder vote; and other risks and uncertainties

detailed in the section titled “Risk Factors” in our latest Annual

Report on Form 10-K and as otherwise disclosed in our filings with

the SEC.

We make many of our forward-looking statements

based on our operating budgets and forecasts, which are based upon

detailed assumptions. While we believe that our assumptions are

reasonable, we caution that it is very difficult to predict the

impact of known factors, and it is impossible for us to anticipate

all factors that could affect our actual results. All

forward-looking statements attributable to us are expressly

qualified in their entirety by these cautionary statements as well

as others made in our Securities and Exchange Commission filings

and public communications. You should evaluate all forward-looking

statements made by us in the context of these risks and

uncertainties. The forward-looking statements included herein are

made only as of the date hereof. We undertake no obligation to

publicly update or revise any forward-looking statement as a result

of new information, future events, or otherwise, except as required

by law.

| MONTAUK

RENEWABLES, INC. |

|

| CONSOLIDATED

BALANCE SHEETS |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| (in

thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

as of March

31, |

|

|

as of

December 31, |

|

|

ASSETS |

|

2024 |

|

|

2023 |

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

63,277 |

|

|

$ |

73,811 |

|

|

Accounts and other receivables |

|

|

9,669 |

|

|

|

12,752 |

|

|

Current restricted cash |

|

|

8 |

|

|

|

8 |

|

|

Income tax receivable |

|

|

98 |

|

|

— |

|

|

Current portion of derivative instruments |

|

|

766 |

|

|

|

785 |

|

|

Prepaid expenses and other current assets |

|

|

2,801 |

|

|

|

2,819 |

|

|

Total current assets |

|

$ |

76,619 |

|

|

$ |

90,175 |

|

| Non-current

restricted cash |

|

$ |

443 |

|

|

$ |

423 |

|

| Property,

plant and equipment, net |

|

|

231,373 |

|

|

|

214,289 |

|

| Goodwill and

intangible assets, net |

|

|

18,178 |

|

|

|

18,421 |

|

| Deferred tax

assets |

|

|

1,827 |

|

|

|

2,076 |

|

| Non-current

portion of derivative instruments |

|

|

580 |

|

|

|

470 |

|

| Operating

lease right-of-use assets |

|

|

4,275 |

|

|

|

4,313 |

|

| Finance

lease right-of-use assets |

|

|

17 |

|

|

|

36 |

|

| Related

party receivable |

|

|

10,148 |

|

|

|

10,138 |

|

| Other

assets |

|

|

11,229 |

|

|

|

9,897 |

|

|

Total assets |

|

$ |

354,689 |

|

|

$ |

350,238 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

12,323 |

|

|

$ |

7,916 |

|

|

Accrued liabilities |

|

|

12,127 |

|

|

|

12,789 |

|

|

Income tax payable |

|

— |

|

|

|

313 |

|

|

Current portion of operating lease liability |

|

|

447 |

|

|

|

420 |

|

|

Current portion of finance lease liability |

|

|

7 |

|

|

|

26 |

|

|

Current portion of long-term debt |

|

|

8,878 |

|

|

|

7,886 |

|

|

Total current liabilities |

|

$ |

33,782 |

|

|

$ |

29,350 |

|

|

Long-term debt, less current portion |

|

|

52,651 |

|

|

|

55,614 |

|

|

Non-current portion of operating lease liability |

|

|

4,056 |

|

|

|

4,133 |

|

|

Non-current portion of finance lease liability |

|

|

9 |

|

|

|

10 |

|

|

Asset retirement obligations |

|

|

6,001 |

|

|

|

5,900 |

|

|

Other liabilities |

|

|

3,860 |

|

|

|

4,992 |

|

| |

|

|

|

|

|

|

|

Total liabilities |

|

$ |

100,359 |

|

|

$ |

99,999 |

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Common

stock, $0.01 par value, authorized 690,000,000 shares; 143,732,811

shares issued at March 31, 2024 and December 31, 2023; 141,986,189

shares outstanding at March 31, 2024 and December 31, 2023 |

|

|

1,420 |

|

|

|

1,420 |

|

| Treasury

stock, at cost, 984,762 shares March 31, 2024 and December 31,

2023 |

|

|

(11,173 |

) |

|

|

(11,173 |

) |

| Additional

paid-in capital |

|

|

216,619 |

|

|

|

214,378 |

|

| Retained

earnings |

|

|

47,464 |

|

|

|

45,614 |

|

|

Total stockholders' equity |

|

|

254,330 |

|

|

|

250,239 |

|

|

Total liabilities and stockholders' equity |

|

$ |

354,689 |

|

|

$ |

350,238 |

|

|

|

|

|

|

|

|

|

| |

|

| MONTAUK

RENEWABLES, INC. |

|

| CONSOLIDATED

STATEMENTS OF OPERATIONS |

|

|

(Unaudited) |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in

thousands, except per share data) |

|

for the three months ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

Total operating revenues |

|

$ |

38,787 |

|

|

$ |

19,154 |

|

| |

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

Operating and maintenance expenses |

|

|

14,451 |

|

|

|

14,182 |

|

|

General and administrative expenses |

|

|

9,427 |

|

|

|

9,475 |

|

|

Royalties, transportation, gathering and production fuel |

|

|

6,518 |

|

|

|

3,933 |

|

|

Depreciation, depletion and amortization |

|

|

5,434 |

|

|

|

5,196 |

|

|

Impairment loss |

|

|

528 |

|

|

|

451 |

|

|

Transaction costs |

|

|

61 |

|

|

|

83 |

|

|

Total operating expenses |

|

$ |

36,419 |

|

|

$ |

33,320 |

|

|

Operating income (loss) |

|

$ |

2,368 |

|

|

$ |

(14,166 |

) |

| |

|

|

|

|

|

|

| Other

expenses (income): |

|

|

|

|

|

|

|

Interest expense |

|

$ |

1,165 |

|

|

$ |

1,675 |

|

|

Other (income) expense |

|

|

(1,060 |

) |

|

|

7 |

|

|

Total other expenses |

|

$ |

105 |

|

|

$ |

1,682 |

|

| Income

(loss) before income taxes |

|

$ |

2,263 |

|

|

$ |

(15,848 |

) |

|

|

|

|

|

|

|

|

| Income tax

expense (benefit) |

|

|

413 |

|

|

|

(12,060 |

) |

|

Net income (loss) |

|

$ |

1,850 |

|

|

$ |

(3,788 |

) |

|

|

|

|

|

|

|

|

| Income

(loss) per share: |

|

|

|

|

|

|

|

Basic |

|

$ |

0.01 |

|

|

$ |

(0.03 |

) |

|

Diluted |

|

$ |

0.01 |

|

|

$ |

(0.03 |

) |

| |

|

|

|

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

141,986,189 |

|

|

|

141,633,417 |

|

|

Diluted |

|

|

142,369,219 |

|

|

|

141,633,417 |

|

| MONTAUK

RENEWABLES, INC. |

|

| CONSOLIDATED

STATEMENTS OF CASH FLOWS |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| (in

thousands): |

|

|

|

|

|

|

| |

|

for the

three months ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Cash

flows from operating activities: |

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

1,850 |

|

|

$ |

(3,788 |

) |

| Adjustments

to reconcile net income (loss) to net cash provided by operating

activities: |

|

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

5,434 |

|

|

|

5,196 |

|

|

Provision (benefit) for deferred income taxes |

|

|

249 |

|

|

|

(13,033 |

) |

|

Stock-based compensation |

|

|

2,241 |

|

|

|

1,770 |

|

|

Derivative mark-to-market adjustments and settlements |

|

|

(91 |

) |

|

|

396 |

|

|

Net loss on sale of assets |

|

|

22 |

|

|

|

37 |

|

|

(Decrease) increase in earn-out liability |

|

|

(849 |

) |

|

|

214 |

|

|

Accretion of asset retirement obligations |

|

|

108 |

|

|

|

100 |

|

|

Liabilities associated with properties sold |

|

|

(225 |

) |

|

|

— |

|

|

Amortization of debt issuance costs |

|

|

90 |

|

|

|

93 |

|

|

Impairment loss |

|

|

528 |

|

|

|

451 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts and other receivables and other current assets |

|

|

1,639 |

|

|

|

1,033 |

|

|

Accounts payable and other accrued expenses |

|

|

3,296 |

|

|

|

(4,307 |

) |

|

Net cash provided by (used in) operating activities |

|

$ |

14,292 |

|

|

$ |

(11,838 |

) |

| Cash

flows from investing activities: |

|

|

|

|

|

|

| Capital

expenditures |

|

$ |

(21,986 |

) |

|

$ |

(13,278 |

) |

| Asset

acquisition |

|

|

(820 |

) |

|

|

— |

|

| Cash

collateral deposits, net |

|

|

20 |

|

|

— |

|

|

Net cash used in investing activities |

|

$ |

(22,786 |

) |

|

$ |

(13,278 |

) |

| Cash

flows from financing activities: |

|

|

|

|

|

|

| Repayments

of long-term debt |

|

$ |

(2,000 |

) |

|

$ |

(2,000 |

) |

| Finance

lease payments |

|

|

(20 |

) |

|

|

(18 |

) |

|

Net cash used in financing activities |

|

$ |

(2,020 |

) |

|

$ |

(2,018 |

) |

| Net decrease

in cash and cash equivalents and restricted cash |

|

$ |

(10,514 |

) |

|

$ |

(27,134 |

) |

| Cash and

cash equivalents and restricted cash at beginning of period |

|

$ |

74,242 |

|

|

$ |

105,606 |

|

| Cash and

cash equivalents and restricted cash at end of period |

|

$ |

63,728 |

|

|

$ |

78,472 |

|

| |

|

|

|

|

|

|

|

Reconciliation of cash, cash equivalents, and restricted

cash at end of period: |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

63,277 |

|

|

$ |

78,043 |

|

| Restricted

cash and cash equivalents - current |

|

8 |

|

|

22 |

|

| Restricted

cash and cash equivalents - non-current |

|

443 |

|

|

407 |

|

| |

|

$ |

63,728 |

|

|

$ |

78,472 |

|

| |

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

| Cash paid

for interest |

|

$ |

1,237 |

|

|

$ |

1,211 |

|

| Cash paid

for income taxes |

|

|

574 |

|

|

|

63 |

|

| Accrual for

purchase of property, plant and equipment included in accounts

payable and accrued liabilities |

|

|

7,492 |

|

|

|

2,995 |

|

| MONTAUK

RENEWABLES, INC. |

|

| NON-GAAP

FINANCIAL MEASURES |

|

|

(Unaudited) |

|

| |

|

|

|

|

|

|

| (in

thousands): |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

The following table provides our EBITDA and Adjusted EBITDA, as

well as a reconciliation to net income (loss) which is the most

directly comparable GAAP measure for the three months ended March

31, 2024 and 2023, respectively: |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Three Months

Ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

Net income (loss) |

|

$ |

1,850 |

|

|

$ |

(3,788 |

) |

|

Depreciation, depletion and amortization |

|

|

5,434 |

|

|

|

5,196 |

|

| Interest

expense |

|

|

1,165 |

|

|

|

1,675 |

|

| Income tax

expense (benefit) |

|

|

413 |

|

|

|

(12,060 |

) |

|

Consolidated EBITDA |

|

|

8,862 |

|

|

|

(8,977 |

) |

| |

|

|

|

|

|

|

| Impairment

loss |

|

|

528 |

|

|

|

451 |

|

| Net loss on

sale of assets |

|

|

22 |

|

|

|

37 |

|

| Transaction

costs |

|

|

61 |

|

|

|

83 |

|

|

Adjusted EBITDA |

|

$ |

9,473 |

|

|

$ |

(8,406 |

) |

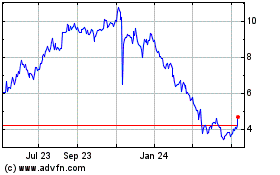

Montauk Renewables (NASDAQ:MNTK)

Historical Stock Chart

From Nov 2024 to Nov 2024

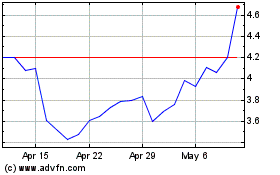

Montauk Renewables (NASDAQ:MNTK)

Historical Stock Chart

From Nov 2023 to Nov 2024