false

0001659617

0001659617

2024-10-24

2024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(D) of

The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 24, 2024

MOLECULIN BIOTECH, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-37758

|

47-4671997

|

|

(State or Other Jurisdiction of Incorporation

or Organization)

|

(Commission File No.)

|

(I.R.S. Employer Identification No.)

|

5300 Memorial Drive, Suite 950, Houston, TX 77007

(Address of principal executive offices and zip code)

(713) 300-5160

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

MBRX

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As reported below under Item 5.07 of this Current Report, Moleculin Biotech, Inc., (the “Company”) held its 2024 Annual Meeting of Stockholders (the "Annual Meeting") at which the Company’s stockholders approved the Moleculin Biotech, Inc. 2024 Stock Plan (the “2024 Plan”). For more information about the 2024 Plan, see the Company’s definitive proxy statement filed with the U.S. Securities and Exchange Commission on September 13, 2024 (the “Proxy Statement”), the relevant portions of which are incorporated herein by reference.

The foregoing description of the 2024 Plan does not purport to be complete and is qualified in its entirety by reference to the complete text of the 2024 Plan, a copy of which is filed as Exhibit 10.1 to this Current Report and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

The Annual Meeting was held on October 24, 2024. As of August 26, 2024, the record date for the Annual Meeting, there were 2,844,527 shares of common stock issued and outstanding and entitled to vote on the proposals presented at the Annual Meeting, of which 1,545,043 shares, or 54.3%, were present in person or represented by proxy, which constituted a quorum. The holders of shares of our common stock are entitled to one vote for each share held.

Set forth below are the final voting results for each of the proposals submitted to a vote of the Company's stockholders at the Annual Meeting. Each of these proposals is described in greater detail in the Proxy Statement.

Proposal 1. Election of Directors - The Company's stockholders elected Walter V. Klemp, Robert E. George, Michael D. Cannon, John Climaco, Elizabeth A. Cermak, and Joy Yan to serve until the 2025 Annual Meeting of Stockholders, or until such person's successor is qualified and elected.

|

Director Name

|

|

Votes For

|

|

Votes Withheld

|

|

Broker Non-Votes

|

|

Walter V. Klemp

|

|

626,761

|

|

|

165,796

|

|

|

752,486

|

|

|

Robert E. George

|

|

649,746

|

|

|

142,811

|

|

|

752,486

|

|

|

Michael D. Cannon

|

|

619,570

|

|

|

172,987

|

|

|

752,486

|

|

|

John Climaco

|

|

629,445

|

|

|

163,112

|

|

|

752,486

|

|

|

Elizabeth A. Cermak

|

|

630,154

|

|

|

162,403

|

|

|

752,486

|

|

|

Joy Yan

|

|

631,199

|

|

|

161,358

|

|

|

752,486

|

|

Proposal 2. Ratify Grant Thornton LLP as Independent Registered Public Accountant - The Company's stockholders ratified the appointment of Grant Thornton, LLP as the Company's independent registered public accounting firm for the year ending December 31, 2024, by the following vote:

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

1,188,732

|

|

349,405

|

|

6,906

|

Proposal 3. Vote to Approve the 2024 Stock Plan - The Company's stockholders approved the Moleculin Biotech, Inc. 2024 Stock Plan, by the following vote:

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

559,463

|

|

230,943

|

|

2,151

|

|

752,486

|

Proposal 4. Vote on a Non-binding, Advisory Resolution to Approve Executive Compensation - The Company's stockholders approved a non-binding, advisory resolution to approve executive compensation, by the following vote:

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

538,730

|

|

246,066

|

|

7,761

|

|

752,486

|

Proposal 5. The Nasdaq Proposal - The Company's stockholders approved, for purposes of complying with Nasdaq Listing Rule 5635(d), (i) the issuance of up to 5,056,054 shares of Company common stock upon the exercise of certain warrants issued on August 19, 2024; and (ii) the repricing of warrants to purchase up to 895,834 shares of Company common stock originally issued on December 26, 2023, from $9.60 per share to $2.23 per share and to extend the termination date of such warrants to five years from the date the Company’s stockholders approve such amendment. The votes on the matter were :

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

574,012

|

|

215,240

|

|

3,305

|

|

752,486

|

Proposal 6. Vote to Approve an Amendment to the Company’s Amended and Restated Certificate of Incorporation to Eliminate Supermajority Voting Requirements - An amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate supermajority voting requirements was not approved. Pursuant to the Company’s Amended and Restated Certificate of Incorporation, the affirmative vote of two-thirds of the Company's outstanding shares of common stock is required. The votes on the matter were:

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

620,396

|

|

169,514

|

|

2,647

|

|

752,486

|

Proposal 7. Vote to Authorize the adjournment of the Annual Meeting - The authorization to allow for the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting or adjournment or postponement thereof to approve Proposal 3 or Proposal 5 was approved. The votes on the matter were:

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

605,393

|

|

183,194

|

|

3,970

|

|

752,486

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 25, 2024

|

MOLECULIN BIOTECH, INC.

|

|

|

|

|

|

|

By:

|

/s/ Jonathan P. Foster |

|

|

Jonathan P. Foster

|

|

|

Chief Financial Officer

|

Exhibit 10.1

MOLECULIN BIOTECH, INC.

2024 STOCK PLAN

Section 1. Establishment and Purpose.

1.1 The Board of Directors of Moleculin Biotech, Inc. (the “Company”) established the Moleculin Biotech, Inc. 2024 Stock Plan (the “Plan”), subject to approval by the Company’s stockholders at the Company’s annual meeting on October 24, 2024.

1.2 The purpose of the Plan is to attract and retain outstanding individuals as Key Employees, Directors and Consultants of the Company and its Subsidiaries, to recognize the contributions made to the Company and its Subsidiaries by Key Employees, Directors and Consultants, and to provide such Key Employees, Directors and Consultants with additional incentive to expand and improve the profits and achieve the objectives of the Company and its Subsidiaries, by providing such Key Employees, Directors and Consultants with the opportunity to acquire or increase their proprietary interest in the Company through receipt of Awards.

Section 2. Definitions.

As used in the Plan, the following terms shall have the meanings set forth below:

2.1 “Award” means any award or benefit granted under the Plan, which shall be a Stock Option, a Stock Award, a Stock Unit Award or an SAR.

2.2 “Award Agreement” means, as applicable, a Stock Option Agreement, Stock Award Agreement, Stock Unit Award Agreement or SAR Agreement evidencing an Award granted under the Plan.

2.3 “Board” means the Board of Directors of the Company.

2.4 “Change in Control” has the meaning set forth in Section 8.2 of the Plan.

2.5 “Cause” means that the Participant: (A) pleads “guilty” or “no contest” to, or is convicted of an act which is defined as a felony under federal or state law, or is indicted or formally charged with acts involving criminal fraud or embezzlement; (B) in carrying out his or her duties, engages in conduct that constitutes gross negligence or willful misconduct; (C) engages in substantiated fraud, misappropriation or embezzlement against the Company; (D) engages in any inappropriate or improper conduct that causes material harm to the reputation of the Company; or (E) materially breaches the terms of any agreement between the Participant and the Company.

2.6 “Code” means the Internal Revenue Code of 1986, as amended from time to time.

2.7 “Committee” means the Compensation Committee of the Board or such other committee as may be designated by the Board from time to time to administer the Plan, or, if no such committee has been designated at the time of any grants, it shall mean the Board.

2.8 “Common Stock” means the Common Stock, par value $0.001 per share, of the Company.

2.9 “Company” means Moleculin Biotech, Inc., a Delaware corporation.

2.10 “Consultant” means any person, including an advisor, who is engaged by the Company or an affiliate to render consulting or advisory services and is compensated for such services. However, service solely as a Director, or payment of a fee for such service, will not cause a Director to be considered a “Consultant” for purposes of the Plan. Notwithstanding the foregoing, a person is treated as a Consultant under this Plan only if a Form S-8 Registration Statement under the Securities Act is available to register either the offer or the sale of the Company’s securities to such person.

Table of Contents

2.11 “Director” means a director of the Company who is not an employee of the Company or a Subsidiary.

2.12 “Exchange Act” means the Securities Exchange Act of 1934, as amended from time to time.

2.13 “Fair Market Value” means as of any date, the closing price of a share of Common Stock on the national securities exchange on which the Common Stock is listed, or, if the Common Stock is not listed on a national securities exchange, the over-the-counter market on which the Common Stock trades, or, if the Common Stock is not listed on a national securities exchange or an over-the-counter market, as determined by the Board as of such date, or, if no trading occurred on such date, as of the trading day immediately preceding such date.

2.14 “Incentive Stock Option” or “ISO” means a Stock Option granted under Section 5 of the Plan that meets the requirements of Section 422(b) of the Code or any successor provision.

2.15 “Key Employee” means an employee of the Company or any Subsidiary selected to participate in the Plan in accordance with Section 3. A Key Employee may also include a person who is granted an Award (other than an Incentive Stock Option) in connection with the hiring of the person prior to the date the person becomes an employee of the Company or any Subsidiary, provided that such Award shall not vest prior to the commencement of employment.

2.16 “Non-Qualified Stock Option” or “NSO” means a Stock Option granted under Section 5 of the Plan that is not an Incentive Stock Option.

2.17 “Participant” means a Key Employee, Director or Consultant selected to receive an Award under the Plan.

2.18 “Plan” means the Moleculin Biotech, Inc. 2024 Stock Plan.

2.19 “Stock Appreciation Right” or “SAR” means a grant of a right to receive shares of Common Stock or cash under Section 8 of the Plan.

2.20 “Stock Award” means a grant of shares of Common Stock under Section 6 of the Plan.

2.21 “Stock Option” means an Incentive Stock Option or a Non-Qualified Stock Option granted under Section 5 of the Plan.

2.22 “Stock Unit Award” means a grant of a right to receive shares of Common Stock or cash under Section 7 of the Plan.

2.23 “Subsidiary” means an entity of which the Company is the direct or indirect beneficial owner of not less than 50% of all issued and outstanding equity interest of such entity.

Section 3. Administration.

3.1 The Committee.

The Plan shall be administered by the Committee, which shall be comprised of at least two members of the Board who satisfy the “non-employee director” definition set forth in Rule 16b-3 under the Exchange Act, unless the Board otherwise determines.

3.2 Authority of the Committee.

(a) The Committee, in its sole discretion, shall determine the Key Employees, Consultants and Directors to whom, and the time or times at which Awards will be granted, the form and amount of each Award, the expiration date of each Award, the time or times within which the Awards may be exercised, the cancellation of the Awards and the other limitations, restrictions, terms and conditions applicable to the grant of the Awards. The terms and conditions of the Awards need not be the same with respect to each Participant or with respect to each Award.

Table of Contents

(b) To the extent permitted by applicable law, regulation, and rules of a stock exchange on which the Common Stock is listed or traded, the Committee may delegate its authority to grant Awards to Key Employees and to determine the terms and conditions thereof to such officer of the Company as it may determine in its discretion, on such terms and conditions as it may impose, except with respect to Awards to officers subject to Section 16 of the Exchange Act.

(c) The Committee may, subject to the provisions of the Plan, establish such rules and regulations as it deems necessary or advisable for the proper administration of the Plan, and may make determinations and may take such other action in connection with or in relation to the Plan as it deems necessary or advisable. Each determination or other action made or taken pursuant to the Plan, including interpretation of the Plan and the specific terms and conditions of the Awards granted hereunder, shall be final and conclusive for all purposes and upon all persons.

(d) No member of the Board or the Committee shall be liable for any action taken or determination made hereunder in good faith. Service on the Committee shall constitute service as a Director so that the members of the Committee shall be entitled to indemnification and reimbursement as Directors of the Company pursuant to the Company’s Certificate of Incorporation and By-Laws.

3.3 Award Agreements.

(a) Each Award shall be evidenced by a written Award Agreement specifying the terms and conditions of the Award. In the sole discretion of the Committee, the Award Agreement may condition the grant of an Award upon the Participant’s entering into one or more of the following agreements with the Company: (i) an agreement not to compete with the Company and its Subsidiaries which shall become effective as of the date of the grant of the Award and remain in effect for a specified period of time following termination of the Participant’s employment with the Company; (ii) an agreement to cancel, to the extent permitted under Section 409A of the Code, any employment agreement, fringe benefit or compensation arrangement in effect between the any employment agreement, fringe benefit or compensation arrangement in effect between the Company and the Participant; and (iii) an agreement to retain the confidentiality of certain information. Such agreements may contain such other terms and conditions as the Committee shall determine. If the Participant shall fail to enter into any such agreement at the request of the Committee, then the Award granted or to be granted to such Participant shall be forfeited and cancelled.

(b) Performance-Based Awards.

(i) The Committee may, in its discretion, provide that any Award granted under the Plan shall be subject to the attainment of performance goals.

(ii) Performance goals may be based on one or more business criteria, including, but not limited to: earnings, earnings per share or earnings per share growth; earnings before interest and taxes, or earnings before interest, taxes, depreciation and/or amortization; Share price; total stockholder return, return on assets; net asset turnover; inventory turnover; return on capital or return on invested capital; return on equity; cash flow; net or pre-tax income; profit margin; working capital turns; market share; expense management; revenue; revenue growth; stockholder equity; leverage ratio; investment rating; debt coverage; the achievement of clinical milestones; and the achievement of technological milestones. Performance goals may be absolute in their terms or measured against or in relationship to the performance of other companies or indices selected by the Committee, and may be particular to one or more lines of business or Subsidiaries or may be based on the performance of the Company and its Subsidiaries as a whole. In addition, the Committee may adjust performance goals for any events that occur during a performance period, including significant acquisitions or dispositions of businesses or assets by the Company; litigation, judgments or settlements; changes in tax laws, accounting principles, or other laws or provisions affecting reported results; any reorganization and restructuring programs; unusual and/or non-recurring items; and fluctuations in foreign exchange rates.

Table of Contents

(iii) With respect to each performance period established by the Committee, the Committee shall establish such performance goals relating to one or more of the business criteria identified above, and shall establish targets for Participants for achievement of performance goals. The performance goals and performance targets established by the Committee may be identical for all Participants for a given performance period or, at the discretion of the Committee, may differ among Participants. Following the completion of each performance period, the Committee shall determine the extent to which performance goals for that performance period have been achieved, and the related performance-based restrictions shall lapse in accordance with the terms of the applicable Award Agreement.

Section 4. Shares of Common Stock Subject to Plan.

4.1 Total Number of Shares.

(a) The total number of shares of Common Stock that may be issued under the Plan shall be 1,000,000. Such shares may be either authorized but unissued shares or treasury shares, and shall be adjusted in accordance with the provisions of Section 4.3 of the Plan.

(b) The number of shares of Common Stock delivered by a Participant or withheld by the Company on behalf of any such Participant as full or partial payment of an Award, including the exercise price of a Stock Option or of any required withholding taxes, shall not again be available for issuance pursuant to subsequent Awards, and shall count towards the aggregate number of shares of Common Stock that may be issued under the Plan. Any shares of Common Stock purchased by the Company with proceeds from a Stock Option exercise shall not again be available for issuance pursuant to subsequent Awards, shall count against the aggregate number of shares that may be issued under the Plan and shall not increase the number of shares available under the Plan.

(c) If there is a lapse, forfeiture, expiration, termination or cancellation of any Award for any reason (including for reasons described in Section 3.3), or if shares of Common Stock are issued under such Award and thereafter are reacquired by the Company pursuant to rights reserved by the Company upon issuance thereof, the shares of Common Stock subject to such Award or reacquired by the Company shall again be available for issuance pursuant to subsequent Awards, and shall not count towards the aggregate number of shares of Common Stock that may be issued under the Plan.

4.2 Shares Under Awards.

Of the shares of Common Stock authorized for issuance under the Plan pursuant to Section 4.1:

(a) The maximum number of shares of Common Stock as to which a Key Employee or Consultant may receive Stock Options or SARs in any calendar year will not exceed $1,000,000 in total value (calculating the value of any such Stock Options or SARs based on the grant date fair value of such Stock Options or SARs for financial reporting purposes). For the avoidance of doubt, shares of Common Stock that may be used for Stock Awards and/or Stock Unit Awards pursuant to Section 4.2(c) shall not be included in the foregoing calculation.

(b) The maximum number of shares of Common Stock that may be subject to Stock Options (ISOs and/or NSOs) is the full number of shares of Common Stock that may be issued under Section 4.1 of the Plan.

(c) The maximum number of shares of Common Stock that may be used for Stock Awards and/or Stock Unit Awards that may be granted to any Key Employee or Consultant in any calendar year will not exceed $1,000,000 in total value (calculating the value of any such Stock Awards and/or Stock Unit Awards based on the grant date fair value of such Stock Awards and/or Stock Unit Awards for financial reporting purposes). For the avoidance of doubt, shares of Common Stock that may be used for Stock Options and/or SARs pursuant to Section 4.2(a) shall not be included in the foregoing calculation.

(d) The maximum number of shares of Common Stock subject to Awards granted under the Plan or otherwise during any one calendar year to any Director, taken together with any cash fees paid by the Company to such Director during such calendar year for service on the Board, will not exceed $500,000 in total value (calculating the value of any such Awards based on the grant date fair value of such Awards for financial reporting purposes).

Table of Contents

The numbers of shares described herein shall be as adjusted in accordance with Section 4.3 of the Plan.

4.3 Adjustment.

In the event of any reorganization, recapitalization, stock split, stock distribution, merger, consolidation, split-up, spin-off, combination, subdivision, consolidation or exchange of shares, any change in the capital structure of the Company or any similar corporate transaction, the Committee shall make such adjustments as it deems appropriate, in its sole discretion, to preserve the benefits or intended benefits of the Plan and Awards granted under the Plan. Such adjustments may include: (a) adjustment in the number and kind of shares reserved for issuance under the Plan; (b) adjustment in the number and kind of shares covered by outstanding Awards; (c) adjustment in the exercise price of outstanding Stock Options or SARs or the price of Stock Awards or Stock Unit Awards under the Plan; (d) adjustments to any of the shares limitations set forth in Section 4.1 or 4.2 of the Plan; and (e) any other changes that the Committee determines to be equitable under the circumstances.

Section 5. Grants of Stock Options.

5.1 Grant.

Subject to the terms of the Plan, the Committee may from time to time grant Stock Options to Participants. Unless otherwise expressly provided at the time of the grant, Stock Options granted under the Plan to Key Employees will be NSOs. Stock Options granted under the Plan to Directors or Consultants who, in each case are not employees of the Company or any Subsidiary will be NSOs. Only Key Employees of the Company, any “parent corporation” (as defined in Section 424(e) of the Code or any Subsidiary that is a “subsidiary company” (as defined in Section 424(f) and (g) of the Code) are eligible to be granted ISOs.

5.2 Stock Option Agreement.

The grant of each Stock Option shall be evidenced by a written Stock Option Agreement specifying the type of Stock Option granted, the exercise period, the exercise price, the terms for payment of the exercise price, the expiration date of the Stock Option, the number of shares of Common Stock to be subject to each Stock Option and such other terms and conditions established by the Committee, in its sole discretion, not inconsistent with the Plan.

5.3 Exercise Price and Exercise Period.

With respect to each Stock Option granted to a Participant:

(a) The per share exercise price of each Stock Option shall not be less than the Fair Market Value of the Common Stock subject to the Stock Option on the date on which the Stock Option is granted.

(b) Each Stock Option shall vest and become exercisable as provided in the Stock Option Agreement and subject to such terms and conditions as determined by the Committee; provided that the Committee shall have the discretion to accelerate the date as of which any Stock Option shall become exercisable in the event of the Participant’s termination of employment with the Company, or service on the Board or as a Consultant, for any reason other than Cause.

(c) Each Stock Option shall expire, and all rights to purchase shares of Common Stock thereunder shall expire, on the date ten years after the date of grant.

5.4 Required Terms and Conditions of ISOs.

In addition to the foregoing, each ISO granted to a Key Employee shall be subject to the following specific rules:

Table of Contents

(a) The aggregate Fair Market Value (determined with respect to each ISO at the time such Option is granted) of the shares of Common Stock with respect to which ISOs are exercisable for the first time by a Key Employee during any calendar year (under all incentive stock option plans of the Company and its Subsidiaries) shall not exceed $100,000. If the aggregate Fair Market Value (determined at the time of grant) of the Common Stock subject to an ISO which first becomes exercisable in any calendar year exceeds the limitation of this Section 5.4(a), so much of the ISO that does not exceed the applicable dollar limit shall be an ISO and the remainder shall be a NSO; but in all other respects, the original Stock Option Agreement shall remain in full force and effect.

(b) Notwithstanding anything herein to the contrary, if an ISO is granted to a Key Employee who owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company (or its parent or subsidiaries within the meaning of Section 422(b)(6) of the Code): (i) the purchase price of each share of Common Stock subject to the ISO shall be not less than 110% of the Fair Market Value of the Common Stock on the date the ISO is granted; and (ii) the ISO shall expire, and all rights to purchase shares of Common Stock thereunder shall expire, no later than the fifth anniversary of the date the ISO was granted.

(c) No ISOs shall be granted under the Plan after ten years from the earlier of the date the Plan is adopted or approved by shareholders of the Company.

5.5 Exercise of Stock Options.

(a) A Participant entitled to exercise a Stock Option may do so by delivering written notice to that effect specifying the number of shares of Common Stock with respect to which the Stock Option is being exercised and any other information the Committee may prescribe. Such notice will be accompanied by payment in full of the purchase price. All notices or requests provided for herein shall be delivered to the Chief Financial Officer of the Company.

(b) The Committee in its sole discretion may make available one or more of the following alternatives for the payment of the Stock Option exercise price: (i) in cash or by certified or bank check; (ii) in cash received from a broker-dealer to whom the Participant has submitted an exercise notice together with irrevocable instructions to deliver promptly to the Company the amount of sales proceeds from the sale of the shares subject to the Stock Option to pay the exercise price; (iii) by directing the Company to withhold such number of shares of Common Stock otherwise issuable in connection with the exercise of the Stock Option having an aggregate Fair Market Value equal to the exercise price; (iv) by delivering previously acquired shares of Common Stock that are acceptable to the Committee and that have an aggregate Fair Market Value on the date of exercise equal to the Stock Option exercise price; (v) by certifying to ownership by attestation of such previously acquired shares of Common Stock; or (vi) by combination of any of the foregoing methods.

The Committee shall have the sole discretion to establish the terms and conditions applicable to any alternative made available for payment of the Stock Option exercise price.

Section 6. Stock Awards.

6.1 Grant.

The Committee may, in its discretion, (a) grant shares of Common Stock under the Plan to any Participant without consideration from such Participant or (b) sell shares of Common Stock under the Plan to any Participant for such amount of cash, Common Stock or other consideration as the Committee deems appropriate.

6.2 Stock Award Agreement.

Each share of Common Stock granted or sold hereunder shall be subject to such restrictions, conditions and other terms as the Board may determine at the time of grant or sale, the general provisions of the Plan, the restrictions, terms and conditions of the related Stock Award Agreement, and the following specific rules:

Table of Contents

(a) The Award Agreement shall specify whether the shares of Common Stock are granted or sold to the Participant and such other provisions, not inconsistent with the terms and conditions of the Plan, as the Committee shall determine.

(b) The restrictions to which the shares of Common Stock awarded hereunder are subject shall lapse as provided in Stock Award Agreement; provided that the Committee shall have the discretion to accelerate the date as of which the restrictions lapse with respect to any Award held by a Participant in the event of the Participant’s termination of employment with the Company, or service on the Board or as a Consultant, for any reason other than Cause.

(c) Except as provided in this subsection (c) and unless otherwise set forth in the related Stock Award Agreement, the Participant receiving a grant of or purchasing Common Stock pursuant to an Award Agreement shall thereupon be a stockholder with respect to such shares and shall have the rights of a stockholder with respect to such shares, including the right to vote such shares and to receive dividends and other distributions paid with respect to such shares; provided that any dividends or other distributions payable with respect to the Stock Award shall be accumulated and held by the Company and paid to the Participant only upon, and to the extent, the restrictions lapse in accordance with the terms of the applicable Stock Award Agreement. Any such dividends or other distributions held by the Company attributable to the portion of a Stock Award that is forfeited shall also be forfeited.

Section 7. Stock Unit Awards.

7.1 Grant.

The Committee may, in its discretion, grant Stock Unit Awards to any Participant. Each Stock Unit subject to the Award shall entitle the Participant to receive, on the date or the occurrence of an event (including the attainment of performance goals) as described in the Stock Unit Award Agreement, a share of Common Stock or cash equal to the Fair Market Value of a share of Common Stock on such date or the date of such event as provided in the Stock Unit Award Agreement.

7.2 Stock Unit Agreement.

Each Stock Unit Award shall be subject to such restrictions, conditions and other terms as the Committee may determine at the time of grant, the general provisions of the Plan, the restrictions, terms and conditions of the related Stock Unit Award Agreement and the following specific rules:

(a) The Stock Unit Agreement shall specify such provisions, not inconsistent with the terms and conditions of the Plan, as the Committee shall determine.

(b) The restrictions to which the shares of Stock Units awarded hereunder are subject shall lapse as provided in Stock Unit Agreement; provided that the Committee shall have the discretion to accelerate the date as of which the restrictions lapse with respect to any Award held by a Participant in the event of the Participant’s termination of employment with the Company, or service on the Board or as a Consultant, for any reason other than Cause.

(c) Except as provided in this subsection (c) and unless otherwise set forth in the Stock Unit Agreement, the Participant receiving a Stock Unit Award shall have no rights of a stockholder, including voting or dividends or other distributions rights, with respect to any Stock Units prior to the date they are settled in shares of Common Stock; provided that a Stock Unit Award Agreement may provide that until the Stock Units are settled in shares or cash, the Participant shall be entitled to receive on each dividend or distribution payment date applicable to the Common Stock an amount equal to the dividends or other distributions that the Participant would have received had the Stock Units held by the Participant as of the related record date been actual shares of Common Stock. Such amounts shall be accumulated and held by the Company and paid to the Participant only upon, and to the extent, the restrictions lapse in accordance with the terms of the applicable Stock Unit Award Agreement. Such amounts held by the Company attributable to the portion of the Stock Unit Award that is forfeited shall also be forfeited.

Table of Contents

Section 8. SARs.

8.1 Grant.

The Committee may grant SARs to Participants. Upon exercise, an SAR entitles the Participant to receive from the Company the number of shares of Common Stock having an aggregate Fair Market Value equal to the excess of the Fair Market Value of one share as of the date on which the SAR is exercised over the exercise price, multiplied by the number of shares with respect to which the SAR is being exercised. The Committee, in its discretion, shall be entitled to cause the Company to elect to settle any part or all of its obligations arising out of the exercise of an SAR by the payment of cash in lieu of all or part of the shares it would otherwise be obligated to deliver in an amount equal to the Fair Market Value of such shares on the date of exercise. Cash shall be delivered in lieu of any fractional shares. The terms and conditions of any such Award shall be determined at the time of grant.

8.2 SAR Agreement.

(a) Each SAR shall be evidenced by a written SAR Agreement specifying the terms and conditions of the SAR as the Committee may determine, including the SAR exercise price, expiration date of the SAR, the number of shares of Common Stock to which the SAR pertains, the form of settlement and such other terms and conditions established by the Committee, in its sole discretion, not inconsistent with the Plan.

(b) The per Share exercise price of each SAR shall not be less than 100% of the Fair Market Value of a Share on the date the SAR is granted.

(c) Each SAR shall expire and all rights thereunder shall cease on the date fixed by the Committee in the related SAR Agreement, which shall not be later than the ten years after the date of grant; provided however, to the extent permitted under Section 409A of the Code and regulations thereunder, if a Participant is unable to exercise an SAR because trading in the Common Stock is prohibited by law or the Company’s insider-trading policy, the SAR exercise date shall be extended to the date that is 30 days after the expiration of the trading prohibition.

(d) Each SAR shall become exercisable as provided in the related SAR Agreement; provided that notwithstanding any other Plan provision, the Committee shall have the discretion to accelerate the date as of which any SAR shall become exercisable in the event of the Participant’s termination of employment, or service on the Board or as a Consultant, for any reason other than Cause.

(e) No dividends or dividend equivalents shall be paid with respect to any SAR prior to the exercise of the SAR.

(f) A person entitled to exercise an SAR may do so by delivery of a written notice in accordance with procedures established by the Committee specifying the number of shares of Common Stock with respect to which the SAR is being exercised and any other information the Committee may prescribe. As soon as reasonably practicable after the exercise of an SAR, the Company shall (i) issue the total number of full shares of Common Stock to which the Participant is entitled and cash in an amount equal to the Fair Market Value, as of the date of exercise, of any resulting fractional share, and (ii) if the Committee causes the Company to elect to settle all or part of its obligations arising out of the exercise of the SAR in cash, deliver to the Participant an amount in cash equal to the Fair Market Value, as of the date of exercise, of the shares it would otherwise be obligated to deliver.

Section 9. Change in Control.

9.1 Effect of a Change in Control.

Table of Contents

(a) Notwithstanding any of the provisions of the Plan or any outstanding Award Agreement, upon a Change in Control of the Company (as defined in Section 9.2), the Committee is authorized and has sole discretion to provide that (i) all outstanding Awards shall become fully exercisable, (ii) all restrictions applicable to all Awards shall terminate or lapse and (iii) performance goals applicable to any Awards shall be deemed satisfied at the highest level, as applicable, in order that Participants may realize the benefits thereunder.

(b) In addition to the Committee’s authority set forth in Section 3 and except as set forth in any written employment agreement between the Company and the Participant, upon such Change in Control of the Company, the Board is authorized and has sole discretion as to any Award, either at the time such Award is granted hereunder or any time in anticipation of or thereafter, as applicable, to take any one or more of the following actions: (i) cause any outstanding Stock Option or SAR to become fully vested and immediately exercisable for a reasonable period in advance of the Change in Control and, to the extent exercised prior to the Change in Control, cancel that Stock Option or SAR upon the Change in Control; (ii) cancel any Award in exchange for a substitute award; (iii) redeem any shares subject to an outstanding Stock Award or Stock Unit Award for cash and/or other substitute consideration with value equal to the Fair Market Value of an unrestricted share of Common Stock on the date of the Change in Control; (iv) provide for the purchase of any outstanding Stock Option or SAR, for an amount of cash equal to the difference between the exercise price and the then Fair Market Value of the Common Stock covered thereby had such Stock Option been currently exercisable, provided that, if the Fair Market Value per share of Common Stock on the date of the Change in Control does not exceed the exercise price of the Stock Option or SAR, can the Stock Option or SAR without any consideration; (v) make such adjustment to any such Award then outstanding as the Board deems appropriate to reflect such Change in Control; and (vi) cause any such Award then outstanding to be assumed by the acquiring or surviving corporation after such Change in Control or (viii) take such other action as the Committee shall determine to be reasonable under the circumstances.

(c) In the discretion of the Committee, any cash or substitute consideration payable upon cancellation of an Award may be subjected to (i) vesting terms substantially identical to those that applied to the cancelled Award immediately prior to the Change in Control, or (ii) earn-out, escrow, holdback or similar arrangements, to the extent such arrangements are applicable to any consideration paid to stockholders in connection with the Change in Control.

(d) Notwithstanding any provision of this Section 9.1, in the case of any Award subject to Section 409A of the Code, the Committee shall only be permitted to take actions under this Section 9.1 to the extent that such actions would be consistent with the intended treatment of such Award under Section 409A of the Code.

9.2 Definition of Change in Control.

“Change in Control” of the Company shall be deemed to have occurred if at any time during the term of an Award granted under the Plan any of the following events occurs:

(a) any Person (other than the Company, a trustee or other fiduciary holding securities under an employee benefit plan of the Company, or a corporation owned directly or indirectly by the shareholders of the Company in substantially the same proportions as their ownership of shares of Common Stock of the Company) is or becomes the Beneficial Owner, directly or indirectly, of securities of the Company representing 50% or more of the combined voting power of the Company’s then outstanding securities entitled to vote generally in the election of directors (“Person” and “Beneficial Owner” being defined in Rule 13d-3 of the General Rules and Regulations of the Exchange Act);

(b) the Company is party to a merger, consolidation, reorganization or other similar transaction with another corporation or other Person unless, following such transaction, more than 50% of the combined voting power of the outstanding securities of the surviving, resulting or acquiring corporation or Person or its parent entity entitled to vote generally in the election of directors (or Persons performing similar functions) is then beneficially owned, directly or indirectly, by all or substantially all of the individuals and entities who were the beneficial owners of the Company’s outstanding securities entitled to vote generally in the election of directors immediately prior to such transaction, in substantially the same proportions as their ownership, immediately prior to such transaction, of the Company’s outstanding securities entitled to vote generally in the election of directors;

Table of Contents

(c) the election to the Board, without the recommendation or approval of two-thirds of the incumbent Board, of the lesser of: (i) three Directors; or (ii) Directors constituting a majority of the number of Directors of the Company then in office; provided, however, that Directors whose initial assumption of office is in connection with an actual or threatened election contest, including but not limited to a consent solicitation, relating to the election of Directors of the Company will not be considered as incumbent members of the Board for purposes of this Section; or

(d) there is a complete liquidation or dissolution of the Company, or the Company sells all or substantially all of its business and/or assets to another corporation or other Person unless, following such sale, more than 50% of the combined voting power of the outstanding securities of the acquiring corporation or Person or its parent entity entitled to vote generally in the election of directors (or Persons performing similar functions) is then beneficially owned, directly or indirectly, by all or substantially all of the individuals and entities who were the beneficial owners of the Company’s outstanding securities entitled to vote generally in the election of directors immediately prior to such sale, in substantially the same proportions as their ownership, immediately prior to such sale, of the Company’s outstanding securities entitled to vote generally in the election of directors.

In no event, however, shall a Change in Control be deemed to have occurred, with respect to a Participant, if that Participant is part of a purchasing group which consummates the Change in Control transaction. A Participant shall be deemed “part of a purchasing group” for purposes of the preceding sentence if the Participant is an equity participant or has agreed to become an equity participant in the purchasing company or group (except for (a) passive ownership of less than 3% of the shares of the purchasing company; or (b) ownership of equity participation in the purchasing company or group which is otherwise not deemed to be significant, as determined prior to the Change in Control by a majority of the disinterested Directors).

Section 10. Payment of Taxes.

(a) In connection with any Award, and as a condition to the issuance or delivery of any shares of Common Stock to the Participant in connection therewith, the Company shall require the Participant to pay the Company the minimum amount of federal, state, local or foreign taxes required to be withheld, and in the Company’s sole discretion, the Company may permit the Participant to pay the Company up to the maximum individual statutory rate of applicable withholding.

(b) The Company in its sole discretion may make available one or more of the following alternatives for the payment of such taxes: (i) in cash; (ii) in cash received from a broker-dealer to whom the Participant has submitted notice together with irrevocable instructions to deliver promptly to the Company the amount of sales proceeds from the sale of the shares subject to the Award to pay the withholding taxes; (iii) by directing the Company to withhold such number of shares of Common Stock otherwise issuable in connection with the Award having an aggregate Fair Market Value equal to the minimum amount of tax required to be withheld; (iv) by delivering previously acquired shares of Common Stock of the Company that are acceptable to the Board that have an aggregate Fair Market Value equal to the amount required to be withheld; or (v) by certifying to ownership by attestation of such previously acquired shares of Common Stock.

The Committee shall have the sole discretion to establish the terms and conditions applicable to any alternative made available for payment of the required withholding taxes.

Section 11. Postponement.

The Committee may postpone any grant or settlement of an Award or exercise of a Stock Option or SAR for such time as the Board in its sole discretion may deem necessary in order to permit the Company:

Table of Contents

(a) to effect, amend or maintain any necessary registration of the Plan or the shares of Common Stock issuable pursuant to an Award, including upon the exercise of a Stock Option or SAR, under the Securities Act of 1933, as amended, or the securities laws of any applicable jurisdiction;

(b) to permit any action to be taken in order to (i) list such shares of Common Stock on a stock exchange if shares of Common Stock are then listed on such exchange or (ii) comply with restrictions or regulations incident to the maintenance of a public market for its shares of Common Stock, including any rules or regulations of any stock exchange on which the shares of Common Stock are listed; or

(c) to determine that such shares of Common Stock and the Plan are exempt from such registration or that no action of the kind referred to in (b)(ii) above needs to be taken; and the Company shall not be obligated by virtue of any terms and conditions of any Award or any provision of the Plan to sell or issue shares of Common Stock in violation of the Securities Act of 1933 or the law of any government having jurisdiction thereof.

Any such postponement shall not extend the term of an Award and neither the Company nor its Directors or officers shall have any obligation or liability to a Participant, the Participant’s successor or any other person with respect to any shares of Common Stock as to which the Award shall lapse because of such postponement.

Section 12. Nontransferability.

Awards granted under the Plan, and any rights and privileges pertaining thereto, may not be transferred, assigned, pledged or hypothecated in any manner, or be subject to execution, attachment or similar process, by operation of law or otherwise, other than by will or by the laws of descent and distribution.

Section 13. Delivery of Shares.

Shares of Common Stock issued pursuant to a Stock Award, the exercise of a Stock or SAR or the settlement of a Stock Unit Award shall be represented by stock certificates or on a non-certificated basis, with the ownership of such shares by the Participant evidenced solely by book entry in the records of the Company’s transfer agent; provided, however, that upon the written request of the Participant, the Company shall issue, in the name of the Participant, stock certificates representing such shares of Common Stock. Notwithstanding the foregoing, shares granted pursuant to a Stock Award shall be held by the Secretary of the Company until such time as the shares are forfeited or settled.

Section 14. Termination or Amendment of Plan and Award Agreements.

14.1 Termination or Amendment of Plan.

(a) Except as described in Section 14.3 below, the Board may terminate, suspend, or amend the Plan, in whole or in part, from time to time, without the approval of the stockholders of the Company, unless such approval is required by applicable law, regulation or rule of any stock exchange on which the shares of Common Stock are listed. No amendment or termination of the Plan shall adversely affect the right of any Participant under any outstanding Award in any material way without the written consent of the Participant, unless such amendment or termination is required by applicable law, regulation or rule of any stock exchange on which the shares of Common Stock are listed. Subject to the foregoing, the Committee may correct any defect or supply an omission or reconcile any inconsistency in the Plan or in any Award granted hereunder in the manner and to the extent it shall deem desirable, in its sole discretion, to effectuate the Plan.

(b) The Board shall have the authority to amend the Plan to the extent necessary or appropriate to comply with applicable law, regulation or accounting rules in order to permit Participants who are located outside of the United States to participate in the Plan.

14.2 Amendment of Award Agreements.

The Committee shall have the authority to amend any Award Agreement at any time; provided however, that no such amendment shall adversely affect the right of any Participant under any outstanding Award Agreement in any material way without the written consent of the Participant, unless such amendment is required by applicable law, regulation or rule of any stock exchange on which the shares of Common Stock are listed.

Table of Contents

14.3 No Repricing of Stock Options.

Notwithstanding the foregoing, and except as described in Section 4.3, there shall be no amendment to the Plan or any outstanding Stock Option Agreement or SAR Agreement that results in the repricing of Stock Options or SARs without stockholder approval. For this purpose, repricing includes (i) a reduction in the exercise price of the Stock Option or SARs or (ii) the cancellation of a Stock Option in exchange for cash, Stock Options or SARs with an exercise price less than the exercise price of the cancelled Options or SARs, other Awards or any other consideration provided by the Company, but does not include any adjustment described in Section 4.3.

Section 15. No Contract of Employment.

Neither the adoption of the Plan nor the grant of any Award under the Plan shall be deemed to obligate the Company or any Subsidiary to continue the employment or service of any Participant for any particular period, nor shall the granting of an Award constitute a request or consent to postpone the retirement date of any Participant.

Section 16. Applicable Law.

All questions pertaining to the validity, construction and administration of the Plan and all Awards granted under the Plan shall be determined in conformity with the laws of Delaware, without regard to the conflict of law provisions of any state, and, in the case of Incentive Stock Options, Section 422 of the Code and regulations issued thereunder.

Section 17. Effective Date and Term of Plan.

17.1 Effective Date.

The Plan as amended and restated has been adopted by the Board and stockholders of the Company, and is effective, as of October 24, 2024.

17.2 Term of Plan.

Notwithstanding anything to the contrary contained herein, no Awards shall be granted on or after October 24, 2034.

v3.24.3

Document And Entity Information

|

Oct. 24, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MOLECULIN BIOTECH, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 24, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-37758

|

| Entity, Tax Identification Number |

47-4671997

|

| Entity, Address, Address Line One |

5300 Memorial Drive

|

| Entity, Address, Address Line Two |

Suite 950

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77007

|

| City Area Code |

713

|

| Local Phone Number |

300-5160

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MBRX

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001659617

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

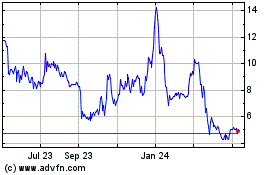

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

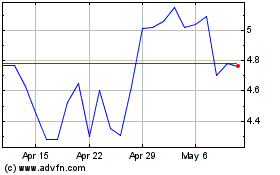

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Dec 2023 to Dec 2024