0001220754FALSE00012207542023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 2, 2023

ModivCare Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34221 | 86-0845127 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 6900 E Layton Avenue, 12th Floor, | Denver, | Colorado | 80237 |

|

| (Address of principal executive offices) | (Zip Code) |

(303) 728-7012

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock, $0.001 par value per share | MODV | The NASDAQ Global Select Market |

| | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨

|

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2023, ModivCare Inc. ("ModivCare" or the "Company") issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | |

Exhibit

Number | Description |

| |

| 99.1 | |

| |

| 101 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the iXBRL document. |

| |

| 104 | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | ModivCare Inc. |

| Date: November 2, 2023 | | | | By: | | /s/ L. Heath Sampson |

| | | | Name: | | L. Heath Sampson |

| | | | Title: | | Chief Executive Officer |

Modivcare Reports Third Quarter 2023

Financial Results; Maintains Guidance

Denver, CO – November 2, 2023 – Modivcare Inc. (the “Company” or “Modivcare”) (Nasdaq: MODV), a technology-enabled healthcare services company that provides a platform of integrated supportive care solutions focused on improving health outcomes, today reported financial results for the three and nine months ended September 30, 2023.

Third Quarter 2023 Highlights:

•Service revenue of $686.9 million, a 6.0% increase as compared to $647.8 million in the third quarter of 2022

•Net loss of $4.3 million or $0.30 per diluted common share

•Adjusted EBITDA(1) of $51.3 million, adjusted net income(1) of $20.5 million and adjusted EPS(1) of $1.44 per diluted common share

•Cash provided by operating activities during the quarter of $53.5 million and free cash flow(2) of $44.7 million

•Contract receivables increased by $9.5 million to $129.3 million and contract payables increased by $24.5 million to $133.6 million, resulting in net contract payables of $4.3 million as of September 30, 2023

•Repaid $43.5 million on the $325.0 million revolving credit facility, reducing the balance drawn to $83.0 million as of September 30, 2023

•$138.0 million of NEMT managed Medicaid total contract value (TCV) won during third quarter 2023; awarded a state Medicaid expansion in the northeast that will be implemented in mid-2024 once finalized; national MCO contract won earlier in 2023 implemented during the quarter

| | | | | |

| |

(1) Non-GAAP financial measure reconciliations and other related information about non-GAAP financial measures provided below |

(2) Free cash flow, a non-GAAP financial measure, is calculated by us as cash flow from operations less our capital expenditures during the period of $8.9 million that is included in our purchase of property and equipment line in our Statements of Cash Flows provided below. |

"We're pleased to announce strong Q3 2023 results, highlighted by adjusted EBITDA of $51 million, $54 million of cash flow from operations, and $45 million of free cash flow," said L. Heath Sampson, President and CEO. "We have addressed internal inefficiencies in our operations and are now leveraging new technologies to deliver high quality care at a lower cost. The net result can be seen in our strong profitability and cash flow this quarter, which enabled us to reduce our outstanding revolver balance by one-third and improved our leverage ratio. Since taking on the role of CEO a year ago, our transformation has been comprehensive. We've initiated foundational shifts in our operating model, transitioning to a more unified, customer-centric strategy. While making these pivotal investments, we've maintained focus on our balance sheet. By generating cash, we aim to demonstrate to the market that our platform is not only resilient in the face of short-term challenges but also well-positioned for sustainable growth and margin expansion."

Mr. Sampson continued, "In our NEMT business, we've achieved meaningful operational improvements, including a notable sequential uptick in our margins. While navigating near-term complexities like Medicaid redetermination, we've excelled in customer service level agreements, leading to significant new contract wins. Our personal care services segment, has made rapid strides in 2023, setting the stage for improved growth and margins in 2024. Our remote patient monitoring segment continues to grow with high margins and acts as a digital gateway for members to access care. When integrated with our NEMT and personal care services, we can unlock unique customer value and diversify our revenue streams. In summary, our transformation is not merely aspirational; it's a tangible reality that is driving measurable outcomes and positioning us for long-term success. I want to extend my deepest gratitude to our dedicated team, many of whom are managing multiple change-oriented roles in addition to their core responsibilities."

2023 Guidance

We maintained our revenue and adjusted EBITDA guidance ranges as follows ($ in millions):

| | | | | | | | | | | | | | |

| 2023 Guidance | |

| Low | | High | |

| Revenue | $ | 2,750 | | | $ | 2,800 | | |

| Adjusted EBITDA | $ | 200 | | | $ | 210 | | |

Guidance excludes the effects of any future merger or acquisition activity and is based on the current operating environment.

Third Quarter 2023 Results

For the third quarter of 2023, the Company reported $686.9 million in revenue, a 6.0% increase from $647.8 million in the third quarter of 2022. The revenue growth was driven by a 9.7% increase in total paid trips in our NEMT segment coupled with a 2.3% increase in hours worked and a 3.9% increase in rate per hour in our personal care services segment, partially offset by a 3.6% decrease in revenue per paid trip in our NEMT segment.

Our operating income was $12.0 million, or 1.8% of revenue, in the third quarter of 2023, compared to operating income of $12.4 million, or 1.9% of revenue, in the third quarter of 2022. Net loss in the third quarter of 2023 was $4.3 million, or $0.30 per diluted common share, compared to net loss of $28.5 million, or $2.03 per diluted common share, in the third quarter of 2022. While our operating income remained relatively flat period over period, the net loss in 2022 is higher due to our allocated percentage of a one-time impairment taken at our Matrix investment.

Adjusted EBITDA was $51.3 million, or 7.5% of revenue, in the third quarter of 2023, compared to $51.8 million, or 8.0% of revenue, in the third quarter of 2022. Our Adjusted EBITDA was largely consistent, primarily related to a $4.1 million decrease in adjusted EBITDA at our NEMT segment, offset by a $4.1 million increase in adjusted EBITDA at our corporate segment. The NEMT segment's decrease was driven by increased payroll and other expense per trip and higher than expected trip volume. Accordingly, adjusted net income in the third quarter of 2023 was $20.5 million, or $1.44 per diluted common share, compared to $22.7 million, or $1.61 per diluted common share, in the third quarter of 2022.

Cash generated from operations during the quarter was $53.5 million as compared to $5.7 million of cash used in operations during the third quarter of 2022. The primary source of cash during the quarter was a $24.5 million build in contract payables, coupled with a $21.3 million decrease in accounts receivable. We used $43.5 million of this cash to pay down our revolving credit facility and ended the quarter with $83.0 million drawn.

Third Quarter Earnings Conference Call

Modivcare will hold a conference call to discuss its financial results on Friday, November 3, 2023 at 8:30 a.m. ET. To access the call, please dial:

US toll-free: 1 (877) 407-8037

International: 1 (201) 689-8037

You may also access the conference call via webcast at investors.modivcare.com, where the call will also be archived.

About Modivcare

Modivcare Inc. ("Modivcare" or the "Company") is a technology-enabled healthcare services company that provides a suite of integrated supportive care solutions for public and private payors and their members. Our value-based solutions address the social determinants of health (SDoH) by connecting members to essential care services. By doing so, Modivcare helps health plans manage risks, reduce costs, and improve overall health outcomes. Modivcare is a provider of non-emergency medical transportation (NEMT), personal care services (PCS), and remote patient monitoring (RPM) solutions. To learn more about Modivcare, please visit www.modivcare.com.

Non-GAAP Financial Measures and Adjustments

In addition to the financial measures prepared in accordance with generally accepted accounting principles in the United States ("GAAP"), this press release includes (as applicable) EBITDA, Adjusted EBITDA and Adjusted G&A expense for the Company and its segments, Adjusted EBITDA margin for the Company's segments (other than its Corporate segment), and Adjusted Net Income and Adjusted EPS for the Company, all of which are performance measures that are not recognized under GAAP, and also free cash flow for the Company, which is a liquidity measure that is not recognized under GAAP. EBITDA is defined as net income (loss) before: (1) interest expense, net, (2) provision (benefit) for income taxes, and (3) depreciation and amortization. Adjusted EBITDA is calculated as EBITDA before (as applicable): (1) restructuring and related costs, (2) transaction and integration costs, (3) settlement related costs, (4) stock-based compensation, (5) impairment of goodwill, as applicable, (6) equity in net (income) loss of investee, net of tax, and (7) COVID-19 related costs, net of grant income. Adjusted EBITDA margin is calculated as Adjusted EBITDA, divided by service revenue, net. Adjusted Net Income is calculated as net income (loss) before: (1) restructuring and related costs, (2) transaction and integration costs, (3) settlement related costs, (4) stock-based compensation, (5) impairment of goodwill, as applicable, (6) equity in net (income) loss of investee, net of tax (7) intangible asset amortization expense, (8) COVID-19 related costs, net of grant income, and (9) the income tax impact of such adjustments. Adjusted EPS is calculated as Adjusted Net Income divided by the diluted weighted-average number of common shares outstanding as calculated for Adjusted Net Income. Adjusted G&A expense is calculated as G&A expense before (as applicable): (1) restructuring and related costs, (2) transaction and integration costs, (3) settlement related costs and (4) stock-based compensation. Free cash flow is calculated as cash flow from operations less our applicable capital expenditures included in our purchase of property and equipment line in our Statements of Cash Flows. Reconciliations of the non-GAAP financial measures to their most directly comparable GAAP financial measures that are not included in the discussion above are included below. We do not provide guidance for net income (loss) in this presentation on a basis consistent with GAAP or a reconciliation of forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures on a forward-looking basis because we are unable to predict items contained in the GAAP financial measures without unreasonable efforts. Our non-GAAP performance measures exclude expenses and amounts that are not driven by our core operating results and may be one time in nature. Excluding these expenses makes comparisons with prior periods as well as to other companies in our industry more meaningful. We believe such measures allow investors to gain a better understanding of the factors and trends affecting the ongoing operations of our business. We consider our core operations to be the ongoing activities to provide services from which we earn revenue, including direct operating costs and indirect costs to support these activities. As a result, our net income or loss in equity investee is excluded from these measures, as we do not have the ability to manage the venture, allocate resources within the venture, or directly control its operations or performance. Our non-GAAP liquidity measure is included because it reflects an additional way of viewing our liquidity that, when viewed together with our GAAP results, provides management, investors, and other users of our financial information with a more complete understanding of factors and trends affecting our cash flows. Our use of the term free cash flow is not intended to imply, and no inference should be made, however, that the reported amounts are free to be used without restriction for discretionary expenditures, as our use of these funds may be restricted by the terms of our outstanding indebtedness, including our credit facility, and otherwise earmarked for other non-discretionary expenditures.

Our non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial measures differently. In addition, there are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by other companies, and exclude expenses that may have a material impact on our reported financial results. The presentation of non-GAAP financial measures is not intended to be considered in isolation from or as a substitute for the most directly comparable financial measures prepared in accordance with GAAP. We urge you to review the reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures included below, and not to rely on any single financial measure to evaluate our business.

Forward-Looking Statements

Certain statements contained in this press release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are predictive in nature and are frequently identified by the use of terms such as “may,” “will,” “should,” “expect,” “believe,” “estimate,” “intend,” and similar words indicating possible future expectations, events or actions. The updated guidance discussed herein constitutes forward-looking statements. Such forward-looking statements are based on current expectations, assumptions, estimates and projections about our business and our industry, and are not guarantees of our future performance. These statements are subject to a number of known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control or predict, which may cause actual results to be materially different from those expressed or implied herein, including but not limited to: government or private insurance program funding reductions or limitations; implementation of alternative payment models or the transition of Medicaid and Medicare beneficiaries to Managed Care Organizations; our inability to control reimbursement rates received for our services; cost containment initiatives undertaken by private third-party payors and an inability to maintain or reduce our cost of services below rates set forth by our payors; the effects of a public health emergency; inadequacies in our information technology systems; changes in the funding, financial viability or

our relationships with our payors; pandemics and other infectious diseases; disruptions to our contact center operations caused by health epidemics or pandemics; delays in collection of our accounts receivable; any impairment of our goodwill and long-lived assets; any failure to maintain or to develop reliable, efficient and secure information technology systems; any inability to attract and retain qualified employees; any disruptions from acquisition or acquisition integration efforts; estimated income taxes being different from income taxes that we ultimately pay; our contracts not surviving until the end of their stated terms, or not being renewed or extended; our failure to compete effectively in the marketplace; our not being awarded contracts through the government’s requests for proposals process, or our awarded contracts not being profitable; any failure to satisfy our contractual obligations or to maintain existing pledged performance and payment bonds; any failure to estimate accurately the cost of performing our contracts; any misclassification of the drivers we engage as independent contractors rather than as employees; significant interruptions in our communication and data services; not successfully executing on our strategies in the face of our competition; any inability to maintain relationships with existing patient referral sources; certificates of need laws or other regulatory and licensure obligations that may adversely affect our personal care integration efforts and expansion into new markets; any failure to obtain the consent of the New York Department of Health to manage the day to day operations of our licensed in-home personal care services agency business; changes in the case-mix of our personal care patients, or changes in payor mix or payment methodologies; our loss of existing favorable managed care contracts; our experiencing labor shortages in qualified employees and management; labor disputes or disruptions, in particular in New York; becoming subject to malpractice or other similar claims; our operating in the competitive remote patient monitoring industry, and failing to develop and enhance related technology applications; any failure to innovate and provide services that are useful to customers and to achieve and maintain market acceptance; our lack of sole decision-making authority with respect to our minority investment in Matrix and any failure by Matrix to achieve positive financial position and results of operations; the cost of our compliance with laws; changes to the regulatory landscape applicable to our businesses; changes in budgetary priorities of the government entities or private insurance programs that fund our services; regulations relating to privacy and security of patient and service user information; actions for false claims or recoupment of funds; civil penalties or loss of business for failing to comply with bribery, corruption and other regulations governing business with public organizations; changes to, or violations of, licensing regulations; our contracts being subject to audit and modification by the payors with whom we contract; a loss of Medicaid coverage by a significant number of Medicaid beneficiaries following the expiration of the COVID-19 public health emergency under the Families First Coronavirus Response Act (2020); our existing debt agreements containing restrictions that limit our flexibility in operating our business; our substantial indebtedness and lease obligations; any loss of available financing alternatives; our ability to incur substantial additional indebtedness; and the results of the remediation of our identified material weaknesses in internal control over financial reporting.

The Company has provided additional information about the risks facing our business in our annual report on Form 10-K and subsequent periodic and current reports most recently filed with the Securities and Exchange Commission that could impact future performance. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made and are expressly qualified in their entirety by the cautionary statements set forth herein and in our filings with the Securities and Exchange Commission, which you should read in their entirety before making an investment decision with respect to our securities. We undertake no obligation to update or revise any forward-looking statements contained in this release, whether as a result of new information, future events or otherwise, except as required by applicable law.

Investor Relations Contact

Kevin Ellich,

Head of Investor Relations

Kevin.Ellich@modivcare.com

--financial tables to follow--

Modivcare Inc.

Page 5

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Modivcare Inc. |

| Unaudited Condensed Consolidated Statements of Operations |

| (in thousands, except share and per share data) |

| | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Service revenue, net | | $ | 686,925 | | | $ | 647,782 | | | $ | 2,048,338 | | | $ | 1,850,472 | |

| Grant income | | 551 | | | 789 | | | 4,649 | | | 4,587 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Service expense | | 579,214 | | | 534,563 | | | 1,718,735 | | | 1,498,108 | |

| General and administrative expense | | 70,142 | | | 75,889 | | | 229,095 | | | 232,108 | |

| Depreciation and amortization | | 26,077 | | | 25,672 | | | 77,679 | | | 74,376 | |

| Impairment of goodwill | | — | | | — | | | 183,100 | | | — | |

| Total operating expenses | | 675,433 | | | 636,124 | | | 2,208,609 | | | 1,804,592 | |

| | | | | | | | |

| Operating income (loss) | | 12,043 | | | 12,447 | | | (155,622) | | | 50,467 | |

| | | | | | | | |

| | | | | | | | |

| Interest expense, net | | 17,844 | | | 15,557 | | | 50,769 | | | 46,429 | |

Income (loss) before income taxes and equity method investment | | (5,801) | | | (3,110) | | | (206,391) | | | 4,038 | |

| Income tax (provision) benefit | | 1,659 | | | 1,053 | | | 4,362 | | | (877) | |

| Equity in net income (loss) of investee, net of tax | | (160) | | | (26,448) | | | 2,821 | | | (28,020) | |

Net loss | | $ | (4,302) | | | $ | (28,505) | | | $ | (199,208) | | | $ | (24,859) | |

| | | | | | | | |

Loss per common share: | | | | | | | | |

| Basic | | $ | (0.30) | | | $ | (2.03) | | | $ | (14.06) | | | $ | (1.77) | |

| Diluted | | $ | (0.30) | | | $ | (2.03) | | | $ | (14.06) | | | $ | (1.77) | |

| | | | | | | | |

| Weighted-average number of common shares outstanding: | | | | | | |

| Basic | | 14,182,839 | | | 14,051,794 | | | 14,169,537 | | | 14,041,224 | |

| Diluted | | 14,182,839 | | | 14,051,794 | | | 14,169,537 | | | 14,041,224 | |

--more--

Modivcare Inc.

Page 6

| | | | | | | | | | | | | | |

| Modivcare Inc. |

| Unaudited Condensed Consolidated Balance Sheets |

| (in thousands) |

| | | | |

| | September 30, 2023 | | December 31, 2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 8,070 | | | $ | 14,451 | |

| Accounts receivable, net | | 202,701 | | | 223,210 | |

| Contract receivables | | 129,275 | | | 71,131 | |

Other current assets(1) | | 47,895 | | | 37,362 | |

| Total current assets | | 387,941 | | | 346,154 | |

| Property and equipment, net | | 81,419 | | | 69,138 | |

| Goodwill | | 785,554 | | | 968,654 | |

| Intangible assets, net | | 380,591 | | | 439,409 | |

| Equity investment | | 45,207 | | | 41,303 | |

| Operating lease right-of-use assets | | 39,744 | | | 39,405 | |

| Other long-term assets | | 42,630 | | | 40,209 | |

| Total assets | | $ | 1,763,086 | | | $ | 1,944,272 | |

| | | | |

| Liabilities and stockholders' equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | 41,834 | | | 54,959 | |

| Accrued contract payables | | 133,576 | | | 194,287 | |

| Accrued expenses and other current liabilities | | 146,564 | | | 135,860 | |

| Accrued transportation costs | | 102,974 | | | 96,851 | |

| Current portion of operating lease liabilities | | 8,902 | | | 9,640 | |

| Short-term borrowings | | 83,000 | | | — | |

| Total current liabilities | | 516,850 | | | 491,597 | |

| Long-term debt, net of deferred financing costs | | 982,630 | | | 979,361 | |

| Operating lease liabilities, less current portion | | 33,397 | | | 32,088 | |

| | | | |

Other long-term liabilities(2) | | 71,348 | | | 86,670 | |

| Total liabilities | | 1,604,225 | | | 1,589,716 | |

| | | | |

| Stockholders' equity | | | | |

| Stockholders' equity | | 158,861 | | | 354,556 | |

Total liabilities and stockholders' equity | | $ | 1,763,086 | | | $ | 1,944,272 | |

(1) Includes other receivables, prepaid expenses and other current assets and short-term restricted cash.

(2) Includes other long-term liabilities and deferred tax liabilities.

--more--

Modivcare Inc.

Page 7

| | | | | | | | | | | | | | | | | | | | | | | |

| Modivcare Inc. |

| Unaudited Condensed Consolidated Statements of Cash Flows |

| (in thousands) |

| | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Operating activities | | | | | | | |

Net loss | $ | (4,302) | | | $ | (28,505) | | | $ | (199,208) | | | $ | (24,859) | |

| Depreciation and amortization | 26,077 | | | 25,672 | | | 77,679 | | | 74,376 | |

| Stock-based compensation | 1,743 | | | 656 | | | 4,029 | | | 5,152 | |

| Equity in net (income) loss of investee | 222 | | | 36,525 | | | (3,915) | | | 38,883 | |

| Deferred income taxes | (4,971) | | | (16,739) | | | (15,235) | | | (31,232) | |

| Impairment of goodwill | — | | | — | | | 183,100 | | | — | |

| Reduction of right-of-use asset | 2,924 | | | 2,923 | | | 9,875 | | | 8,680 | |

Other non-cash items(1) | 1,594 | | | 1,925 | | | 1,486 | | | (4,570) | |

Changes in operating assets and liabilities: | | | | | | | |

Contract receivables | (9,512) | | | (13,562) | | | (58,143) | | | (35,580) | |

Contract payables | 24,483 | | | (37,938) | | | (60,710) | | | (37,786) | |

Other working capital items(2) | 15,289 | | | 23,363 | | | 3,715 | | | 52,462 | |

| Net cash provided by (used in) operating activities | 53,547 | | | (5,680) | | | (57,327) | | | 45,526 | |

| | | | | | | |

| Investing activities | | | | | | | |

| Purchase of property and equipment | (8,878) | | | (9,619) | | | (31,143) | | | (25,518) | |

| Acquisitions, net of cash acquired | — | | | (11) | | | — | | | (78,872) | |

| Net cash used in investing activities | (8,878) | | | (9,630) | | | (31,143) | | | (104,390) | |

| | | | | | | |

| Financing activities | | | | | | | |

| Proceeds from short-term borrowings | (43,500) | | | — | | | 83,000 | | | — | |

| Debt issuance costs | — | | | — | | | (376) | | | (2,415) | |

Proceeds from common stock issued pursuant to stock option exercise | — | | | 99 | | | 31 | | | 1,237 | |

| Restricted stock surrendered for employee tax payment | (21) | | | (42) | | | (861) | | | (649) | |

| Other financing activities | — | | | — | | | 315 | | | — | |

| Net cash provided by (used in) financing activities | (43,521) | | | 57 | | | 82,109 | | | (1,827) | |

| | | | | | | |

| Net change in cash, cash equivalents and restricted cash | 1,148 | | | (15,253) | | | (6,361) | | | (60,691) | |

| Cash, cash equivalents and restricted cash at beginning of period | 7,466 | | | 87,984 | | | 14,975 | | | 133,422 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 8,614 | | | $ | 72,731 | | | $ | 8,614 | | | $ | 72,731 | |

(1) Includes amortization of deferred financing costs and debt discount and other assets.

(2) Includes accounts receivable and other receivables, prepaid expenses and other current assets, accounts payable and accrued expenses, accrued transportation costs and other long-term liabilities.

--more--

Modivcare Inc.

Page 8

Modivcare Inc.

Unaudited Reconciliation of Non-GAAP Financial Measures

Segment Information and Adjusted EBITDA

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2023 |

| NEMT | | PCS | | RPM | | Corporate and Other | | Total |

| | | | | | | | | |

| Service revenue, net | $ | 485,951 | | | $ | 179,979 | | | $ | 19,779 | | | $ | 1,216 | | | $ | 686,925 | |

| Grant income | — | | | 551 | | | — | | | — | | | 551 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Service expense | 428,021 | | | 143,078 | | | 6,934 | | | 1,181 | | | 579,214 | |

| General and administrative expense | 25,433 | | | 20,252 | | | 5,685 | | | 18,772 | | | 70,142 | |

| Depreciation and amortization | 6,814 | | | 12,850 | | | 6,174 | | | 239 | | | 26,077 | |

| | | | | | | | | |

| Total operating expenses | 460,268 | | | 176,180 | | | 18,793 | | | 20,192 | | | 675,433 | |

| | | | | | | | | |

| Operating income (loss) | 25,683 | | | 4,350 | | | 986 | | | (18,976) | | | 12,043 | |

| | | | | | | | | |

| Interest expense, net | — | | | — | | | — | | | 17,844 | | | 17,844 | |

| Income (loss) before income taxes and equity method investment | 25,683 | | | 4,350 | | | 986 | | | (36,820) | | | (5,801) | |

| Income tax (provision) benefit | (6,994) | | | (1,208) | | | (279) | | | 10,140 | | | 1,659 | |

| Equity in net income (loss) of investee, net of tax | 142 | | | — | | | — | | | (302) | | | (160) | |

| Net income (loss) | 18,831 | | | 3,142 | | | 707 | | | (26,982) | | | (4,302) | |

| | | | | | | | | |

| Interest expense, net | — | | | — | | | — | | | 17,844 | | | 17,844 | |

| Income tax provision (benefit) | 6,994 | | | 1,208 | | | 279 | | | (10,140) | | | (1,659) | |

| Depreciation and amortization | 6,814 | | | 12,850 | | | 6,174 | | | 239 | | | 26,077 | |

| EBITDA | 32,639 | | | 17,200 | | | 7,160 | | | (19,039) | | | 37,960 | |

| | | | | | | | | |

Restructuring and related costs(1) | 2,711 | | | — | | | — | | | 6,205 | | | 8,916 | |

| Transaction and integration costs | 101 | | | 431 | | | 22 | | | 605 | | | 1,159 | |

| Settlement related costs | (25) | | | — | | | — | | | 1,474 | | | 1,449 | |

| Stock-based compensation | — | | | — | | | — | | | 1,690 | | | 1,690 | |

| | | | | | | | | |

| Equity in net (income) loss of investee, net of tax | (142) | | | — | | | — | | | 302 | | | 160 | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 35,284 | | | $ | 17,631 | | | $ | 7,182 | | | $ | (8,763) | | | $ | 51,334 | |

(1) Restructuring and related costs include professional fees for strategic initiatives, organizational consolidation costs, severance and other professional fees.

--more--

Modivcare Inc.

Page 9

Modivcare Inc.

Unaudited Reconciliation of Non-GAAP Financial Measures

Segment Information and Adjusted EBITDA

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2022 |

| NEMT | | PCS | | RPM | | Corporate and Other | | Total |

| | | | | | | | | |

| Service revenue, net | $ | 459,796 | | | $ | 169,226 | | | $ | 18,760 | | | $ | — | | | $ | 647,782 | |

| Grant income | — | | | 789 | | | — | | | — | | | 789 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Service expense | 394,981 | | | 132,746 | | | 6,836 | | | — | | | 534,563 | |

| General and administrative expense | 31,815 | | | 22,057 | | | 5,816 | | | 16,201 | | | 75,889 | |

| Depreciation and amortization | 7,079 | | | 12,919 | | | 5,467 | | | 207 | | | 25,672 | |

| Total operating expenses | 433,875 | | | 167,722 | | | 18,119 | | | 16,408 | | | 636,124 | |

| | | | | | | | | |

| Operating income (loss) | 25,921 | | | 2,293 | | | 641 | | | (16,408) | | | 12,447 | |

| | | | | | | | | |

| Interest expense, net | — | | | — | | | — | | | 15,557 | | | 15,557 | |

| Income (loss) before income taxes and equity method investment | 25,921 | | | 2,293 | | | 641 | | | (31,965) | | | (3,110) | |

| Income tax (provision) benefit | (6,978) | | | (661) | | | (179) | | | 8,871 | | | 1,053 | |

| Equity in net income (loss) of investee, net of tax | 208 | | | — | | | — | | | (26,656) | | | (26,448) | |

| Net income (loss) | 19,151 | | | 1,632 | | | 462 | | | (49,750) | | | (28,505) | |

| | | | | | | | | |

| Interest expense, net | — | | | — | | | — | | | 15,557 | | | 15,557 | |

| Income tax provision (benefit) | 6,978 | | | 661 | | | 179 | | | (8,871) | | | (1,053) | |

| Depreciation and amortization | 7,079 | | | 12,919 | | | 5,467 | | | 207 | | | 25,672 | |

| EBITDA | 33,208 | | | 15,212 | | | 6,108 | | | (42,857) | | | 11,671 | |

| | | | | | | | | |

Restructuring and related costs(1) | 902 | | | 582 | | | 39 | | | 565 | | | 2,088 | |

Transaction and integration costs(2) | 6 | | | 2,231 | | | 471 | | | 2,191 | | | 4,899 | |

| Settlement related costs | 5,500 | | | — | | | — | | | 500 | | | 6,000 | |

| | | | | | | | | |

Stock-based compensation(3) | — | | | — | | | — | | | 83 | | | 83 | |

| COVID-19 related costs, net of grant income | (51) | | | 659 | | | — | | | — | | | 608 | |

| Equity in net (income) loss of investee, net of tax | (208) | | | — | | | — | | | 26,656 | | | 26,448 | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 39,357 | | | $ | 18,684 | | | $ | 6,618 | | | $ | (12,862) | | | $ | 51,797 | |

(1) Restructuring and related costs include professional fees for strategic initiatives, organizational consolidation costs, severance and other professional fees.

(2) Transaction and integration costs consist of fees incurred related to Sarbanes-Oxley Act of 2002 implementation and business integration efforts.

(3) Stock-based compensation includes cash settled equity balances.

--more--

Modivcare Inc.

Page 10

Modivcare Inc.

Unaudited Reconciliation of Non-GAAP Financial Measures

Segment Information and Adjusted EBITDA

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2023 |

| NEMT | | PCS | | RPM | | Corporate and Other | | Total |

| | | | | | | | | |

| Service revenue, net | $ | 1,452,389 | | | $ | 534,435 | | | $ | 57,702 | | | $ | 3,812 | | | $ | 2,048,338 | |

| Grant income | — | | | 4,649 | | | — | | | — | | | 4,649 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Service expense | 1,277,604 | | | 417,636 | | | 20,129 | | | 3,366 | | | 1,718,735 | |

| General and administrative expense | 87,645 | | | 63,480 | | | 16,781 | | | 61,189 | | | 229,095 | |

| Depreciation and amortization | 20,319 | | | 38,590 | | | 18,087 | | | 683 | | | 77,679 | |

| Impairment of goodwill | — | | | 137,331 | | | 45,769 | | | — | | | 183,100 | |

| Total operating expenses | 1,385,568 | | | 657,037 | | | 100,766 | | | 65,238 | | | 2,208,609 | |

| | | | | | | | | |

| Operating income (loss) | 66,821 | | | (117,953) | | | (43,064) | | | (61,426) | | | (155,622) | |

| | | | | | | | | |

| Interest expense, net | — | | | — | | | — | | | 50,769 | | | 50,769 | |

| Income (loss) before income taxes and equity method investment | 66,821 | | | (117,953) | | | (43,064) | | | (112,195) | | | (206,391) | |

| Income tax (provision) benefit | (18,014) | | | (5,452) | | | (765) | | | 28,593 | | | 4,362 | |

| Equity in net income (loss) of investee, net of tax | 984 | | | — | | | — | | | 1,837 | | | 2,821 | |

| Net income (loss) | 49,791 | | | (123,405) | | | (43,829) | | | (81,765) | | | (199,208) | |

| | | | | | | | | |

| Interest expense, net | — | | | — | | | — | | | 50,769 | | | 50,769 | |

| Income tax provision (benefit) | 18,014 | | | 5,452 | | | 765 | | | (28,593) | | | (4,362) | |

| Depreciation and amortization | 20,319 | | | 38,590 | | | 18,087 | | | 683 | | | 77,679 | |

| EBITDA | 88,124 | | | (79,363) | | | (24,977) | | | (58,906) | | | (75,122) | |

| | | | | | | | | |

Restructuring and related costs(1) | 11,865 | | | — | | | — | | | 21,606 | | | 33,471 | |

| Transaction and integration costs | 101 | | | 881 | | | 70 | | | 1,834 | | | 2,886 | |

| Settlement related costs | 250 | | | — | | | — | | | 8,683 | | | 8,933 | |

| Stock-based compensation | — | | | — | | | — | | | 3,485 | | | 3,485 | |

| Impairment of goodwill | — | | | 137,331 | | | 45,769 | | | — | | | 183,100 | |

| Equity in net (income) loss of investee, net of tax | (984) | | | — | | | — | | | (1,837) | | | (2,821) | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 99,356 | | | $ | 58,849 | | | $ | 20,862 | | | $ | (25,135) | | | $ | 153,932 | |

(1) Restructuring and related costs include professional fees for strategic initiatives, organizational consolidation costs, severance and other professional fees.

--more--

Modivcare Inc.

Page 11

Modivcare Inc.

Unaudited Reconciliation of Non-GAAP Financial Measures

Segment Information and Adjusted EBITDA

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2022 |

| NEMT | | PCS | | RPM | | Corporate and Other | | Total |

| | | | | | | | | |

| Service revenue, net | $ | 1,309,449 | | | $ | 491,661 | | | $ | 49,362 | | | $ | — | | | $ | 1,850,472 | |

| Grant income | — | | | 4,587 | | | — | | | — | | | 4,587 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Service expense | 1,100,801 | | | 379,423 | | | 17,884 | | | — | | | 1,498,108 | |

| General and administrative expense | 102,736 | | | 68,536 | | | 17,520 | | | 43,316 | | | 232,108 | |

| Depreciation and amortization | 21,576 | | | 37,976 | | | 14,201 | | | 623 | | | 74,376 | |

| Total operating expenses | 1,225,113 | | | 485,935 | | | 49,605 | | | 43,939 | | | 1,804,592 | |

| | | | | | | | | |

| Operating income (loss) | 84,336 | | | 10,313 | | | (243) | | | (43,939) | | | 50,467 | |

| | | | | | | | | |

| Interest expense, net | — | | | — | | | — | | | 46,429 | | | 46,429 | |

| Income (loss) before income taxes and equity method investment | 84,336 | | | 10,313 | | | (243) | | | (90,368) | | | 4,038 | |

| Income tax (provision) benefit | (23,116) | | | (2,902) | | | 68 | | | 25,073 | | | (877) | |

| Equity in net income (loss) of investee, net of tax | 143 | | | — | | | — | | | (28,163) | | | (28,020) | |

| Net income (loss) | 61,363 | | | 7,411 | | | (175) | | | (93,458) | | | (24,859) | |

| | | | | | | | | |

| Interest expense, net | — | | | — | | | — | | | 46,429 | | | 46,429 | |

| Income tax provision (benefit) | 23,116 | | | 2,902 | | | (68) | | | (25,073) | | | 877 | |

| Depreciation and amortization | 21,576 | | | 37,976 | | | 14,201 | | | 623 | | | 74,376 | |

| EBITDA | 106,055 | | | 48,289 | | | 13,958 | | | (71,479) | | | 96,823 | |

| | | | | | | | | |

Restructuring and related costs(1) | 11,359 | | | 763 | | | 63 | | | 950 | | | 13,135 | |

Transaction and integration costs(2) | 6 | | | 6,334 | | | 2,753 | | | 7,219 | | | 16,312 | |

| Settlement related costs | 5,500 | | | — | | | — | | | 500 | | | 6,000 | |

| | | | | | | | | |

Stock-based compensation(3) | — | | | 190 | | | 86 | | | 3,950 | | | 4,226 | |

| COVID-19 related costs, net of grant income | 105 | | | (2,370) | | | — | | | — | | | (2,265) | |

| Equity in net (income) loss of investee, net of tax | (143) | | | — | | | — | | | 28,163 | | | 28,020 | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 122,882 | | | $ | 53,206 | | | $ | 16,860 | | | $ | (30,697) | | | $ | 162,251 | |

(1) Restructuring and related costs include professional fees for strategic initiatives, organizational consolidation costs, severance and other professional fees.

(2) Transaction and integration costs consist of fees incurred related to Sarbanes-Oxley Act of 2002 implementation and business integration efforts.

(3) Stock-based compensation includes cash settled equity balances.

--more--

Modivcare Inc.

Page 12

Modivcare Inc.

Unaudited Reconciliation of Non-GAAP Financial Measures

Adjusted Net Income and Adjusted Net Income per Common Share

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net income (loss) | $ | (4,302) | | | $ | (28,505) | | | $ | (199,208) | | | $ | (24,859) | |

| | | | | | | |

Restructuring and related costs(1) | 8,916 | | | 2,088 | | | 33,471 | | | 13,135 | |

Transaction and integration costs(2) | 1,159 | | | 4,899 | | | 2,886 | | | 16,312 | |

| Settlement related costs | 1,449 | | | 6,000 | | | 8,933 | | | 6,000 | |

| | | | | | | |

Stock-based compensation(3) | 1,690 | | | 83 | | | 3,485 | | | 4,226 | |

| Impairment of goodwill | — | | | — | | | 183,100 | | | — | |

| Equity in net (income) loss of investee, net of tax | 160 | | | 26,448 | | | (2,821) | | | 28,020 | |

| Intangible asset amortization expense | 19,748 | | | 20,727 | | | 59,457 | | | 59,978 | |

COVID-19 related costs, net of grant income(4) | — | | | 608 | | | — | | | (2,265) | |

| Tax effected impact of adjustments | (8,327) | | | (9,649) | | | (27,833) | | | (26,964) | |

| | | | | | | |

| Adjusted net income | $ | 20,493 | | | $ | 22,699 | | | $ | 61,470 | | | $ | 73,583 | |

| | | | | | | |

| Adjusted EPS | $ | 1.44 | | | $ | 1.61 | | | $ | 4.33 | | | $ | 5.21 | |

| | | | | | | |

| Diluted weighted-average number of common shares outstanding | 14,218,141 | | | 14,110,928 | | | 14,209,787 | | | 14,119,598 | |

(1) Restructuring and related costs include professional fees for strategic initiatives, organizational consolidation costs, severance and other professional fees.

(2) Transaction and integration costs consist of fees incurred related to SOX implementation and business integration efforts.

(3) Stock-based compensation includes cash settled equity balances.

(4) COVID-19 related costs were added back as one-time items through 2022. As the Public Health Emergency ended in 2023 and the effects of COVID-19 have become normal course of business, COVID-19 related items are no longer added back in 2023.

--more--

Modivcare Inc.

Page 13

Modivcare Inc.

Unaudited Key Statistical and Financial Data

(in thousands, except for statistical data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Nine months ended | | | | Three months ended | | |

| September 30, 2023 | | September 30, 2022 | | % Change | | September 30, 2023 | | September 30, 2022 | | % Change | | June 30, 2023 | | QoQ % Change |

| | | | | | | | | | | | | | | |

| NEMT Segment | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Service revenue, net | $ | 485,951 | | | $ | 459,796 | | | 5.7 | % | | $ | 1,452,389 | | | $ | 1,309,449 | | | 10.9 | % | | $ | 496,975 | | | (2.2) | % |

| Purchased services expense | 363,594 | | | 340,138 | | | 6.9 | % | | 1,085,206 | | | 935,298 | | | 16.0 | % | | 377,192 | | | (3.6) | % |

| Payroll and other expense | 64,427 | | | 54,843 | | | 17.5 | % | | 192,398 | | | 165,503 | | | 16.3 | % | | 64,705 | | | (0.4) | % |

| Service expense | $ | 428,021 | | | $ | 394,981 | | | 8.4 | % | | $ | 1,277,604 | | | $ | 1,100,801 | | | 16.1 | % | | $ | 441,897 | | | (3.1) | % |

| | | | | | | | | | | | | | | |

| Gross profit | $ | 57,930 | | | $ | 64,815 | | | (10.6) | % | | $ | 174,785 | | | $ | 208,648 | | | (16.2) | % | | $ | 55,078 | | | 5.2 | % |

| Gross margin | 11.9 | % | | 14.1 | % | | | | 12.0 | % | | 15.9 | % | | | | 11.1 | % | | |

| | | | | | | | | | | | | | | |

| G&A expense | $ | 25,433 | | | $ | 31,815 | | | (20.1) | % | | $ | 87,645 | | | $ | 102,736 | | | (14.7) | % | | $ | 28,337 | | | (10.2) | % |

| G&A expense adjustments: | | | | | | | | | | | | | | | |

| Restructuring and related costs | 2,711 | | | 902 | | | 200.6 | % | | 11,865 | | | 11,359 | | | 4.5 | % | | 2,055 | | | 31.9 | % |

| Transaction and integration costs | 101 | | | 6 | | | N/M | | 101 | | | 6 | | | N/M | | — | | | N/M |

| Settlement related costs | (25) | | | 5,500 | | | N/M | | 250 | | | 5,500 | | | N/M | | — | | | N/M |

| Adjusted G&A expense | $ | 22,646 | | | $ | 25,407 | | | (10.9) | % | | $ | 75,429 | | | $ | 85,871 | | | (12.2) | % | | $ | 26,282 | | | (13.8) | % |

| Adjusted G&A expense % of revenue | 4.7 | % | | 5.5 | % | | | | 5.2 | % | | 6.6 | % | | | | 5.3 | % | | |

| | | | | | | | | | | | | | | |

| Net income | $ | 18,831 | | | $ | 19,151 | | | (1.7) | % | | $ | 49,791 | | | $ | 61,363 | | | (18.9) | % | | $ | 14,789 | | | 27.3 | % |

| Net income margin | 3.9 | % | | 4.2 | % | | | | 3.4 | % | | 4.7 | % | | | | 3.0 | % | | |

| | | | | | | | | | | | | | | |

| Adjusted EBITDA | $ | 35,284 | | | $ | 39,357 | | | (10.3) | % | | $ | 99,356 | | | $ | 122,882 | | | (19.1) | % | | $ | 28,796 | | | 22.5 | % |

| Adjusted EBITDA margin | 7.3 | % | | 8.6 | % | | | | 6.8 | % | | 9.4 | % | | | | 5.8 | % | | |

| | | | | | | | | | | | | | | |

| Total paid trips (thousands) | 8,824 | | | 8,045 | | | 9.7 | % | | 25,761 | | | 22,987 | | | 12.1 | % | | 8,735 | | | 1.0 | % |

| Average monthly members (thousands) | 33,660 | | | 36,026 | | | (6.6) | % | | 33,892 | | | 33,998 | | | (0.3) | % | | 34,312 | | | (1.9) | % |

| | | | | | | | | | | | | | | |

| Revenue per member per month | $ | 4.81 | | | $ | 4.25 | | | 13.2 | % | | $ | 4.76 | | | $ | 4.28 | | | 11.2 | % | | $ | 4.83 | | | (0.4) | % |

| Revenue per trip | $ | 55.07 | | | $ | 57.15 | | | (3.6) | % | | $ | 56.38 | | | $ | 56.96 | | | (1.0) | % | | $ | 56.89 | | | (3.2) | % |

| Monthly utilization | 8.7 | % | | 7.4 | % | | | | 8.4 | % | | 7.5 | % | | | | 8.5 | % | | |

| | | | | | | | | | | | | | | |

| Purchased services per trip | $ | 41.21 | | | $ | 42.28 | | | (2.5) | % | | $ | 42.13 | | | $ | 40.69 | | | 3.5 | % | | $ | 43.18 | | | (4.6) | % |

| Payroll and other per trip | $ | 7.30 | | | $ | 6.82 | | | 7.0 | % | | $ | 7.47 | | | $ | 7.20 | | | 3.7 | % | | $ | 7.41 | | | (1.5) | % |

| Total service expense per trip | $ | 48.51 | | | $ | 49.10 | | | (1.2) | % | | $ | 49.60 | | | $ | 47.89 | | | 3.6 | % | | $ | 50.59 | | | (4.1) | % |

N/M - Not Meaningful. Certain figures in the tables above do not provide meaningful percentage comparison, thus, the percentage has been removed.

--more--

Modivcare Inc.

Page 14

Modivcare Inc.

Unaudited Key Statistical and Financial Data

(in thousands, except for statistical data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Nine months ended | | | | Three months ended | | |

| September 30, 2023 | | September 30, 2022 | | % Change | | September 30, 2023 | | September 30, 2022 | | % Change | | June 30, 2023 | | QoQ % Change |

| | | | | | | | | | | | | | | |

| PCS Segment | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Service revenue, net | $ | 179,979 | | | $ | 169,226 | | | 6.4 | % | | $ | 534,435 | | | $ | 491,661 | | | 8.7 | % | | $ | 180,325 | | | (0.2) | % |

| Service expense | 143,078 | | | 132,746 | | | 7.8 | % | | 417,636 | | | 379,423 | | | 10.1 | % | | 138,468 | | | 3.3 | % |

| Gross profit | $ | 36,901 | | | $ | 36,480 | | | 1.2 | % | | $ | 116,799 | | | $ | 112,238 | | | 4.1 | % | | $ | 41,857 | | | (11.8) | % |

| Gross Margin | 20.5 | % | | 21.6 | % | | | | 21.9 | % | | 22.8 | % | | | | 23.2 | % | | |

| | | | | | | | | | | | | | | |

| G&A expense | $ | 20,252 | | | $ | 22,057 | | | (8.2) | % | | $ | 63,480 | | | $ | 68,536 | | | (7.4) | % | | $ | 20,565 | | | (1.5) | % |

G&A expense adjustments | | | | | | | | | | | | | | | |

| Restructuring and related costs | — | | | 582 | | | (100.0) | % | | — | | | 763 | | | (100.0) | % | | — | | | N/M |

| Transaction and integration costs | 431 | | | 2,231 | | | (80.7) | % | | 881 | | | 6,334 | | | (86.1) | % | | 173 | | | 149.1 | % |

| Stock-based compensation | — | | | — | | | N/M | | — | | | 190 | | | (100.0) | % | | — | | | N/M |

| Adjusted G&A expense | $ | 19,821 | | | $ | 19,244 | | | 3.0 | % | | $ | 62,599 | | | $ | 61,249 | | | 2.2 | % | | $ | 20,392 | | | (2.8) | % |

| Adjusted G&A expense % of revenue | 11.0 | % | | 11.4 | % | | | | 11.7 | % | | 12.5 | % | | | | 11.3 | % | | |

| | | | | | | | | | | | | | | |

| Net income | $ | 3,142 | | | $ | 1,632 | | | 92.5 | % | | $ | (123,405) | | | $ | 7,411 | | | (1765.2) | % | | $ | (129,372) | | | (102.4) | % |

| Net income margin | 1.7 | % | | 1.0 | % | | | | (23.1) | % | | 1.5 | % | | | | (71.7) | % | | |

| | | | | | | | | | | | | | | |

| Adjusted EBITDA | $ | 17,631 | | | $ | 18,684 | | | (5.6) | % | | $ | 58,849 | | | $ | 53,206 | | | 10.6 | % | | $ | 24,099 | | | (26.8) | % |

| Adjusted EBITDA margin | 9.8 | % | | 11.0 | % | | | | 11.0 | % | | 10.8 | % | | | | 13.4 | % | | |

| | | | | | | | | | | | | | | |

| Total hours (in thousands) | 6,995 | | | 6,836 | | | 2.3 | % | | 20,752 | | | 20,076 | | | 3.4 | % | | 6,933 | | | 0.9 | % |

| Revenue per hour | $ | 25.73 | | | $ | 24.76 | | | 3.9 | % | | $ | 25.75 | | | $ | 24.49 | | | 5.1 | % | | $ | 26.01 | | | (1.1) | % |

| Service expense per hour | $ | 20.45 | | | $ | 19.42 | | | 5.3 | % | | $ | 20.13 | | | $ | 18.90 | | | 6.5 | % | | $ | 19.97 | | | 2.4 | % |

N/M - Not Meaningful. Certain figures in the tables above do not provide meaningful percentage comparison, thus, the percentage has been removed.

--more--

Modivcare Inc.

Page 15

Modivcare Inc.

Unaudited Key Statistical and Financial Data

(in thousands, except for statistical data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Nine months ended | | | | Three months ended | | |

| September 30, 2023 | | September 30, 2022 | | % Change | | September 30, 2023 | | September 30, 2022 | | % Change | | June 30, 2023 | | QoQ % Change |

| | | | | | | | | | | | | | | |

| RPM Segment | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Service revenue, net | $ | 19,779 | | | $ | 18,760 | | | 5.4 | % | | $ | 57,702 | | | $ | 49,362 | | | 16.9% | | $ | 19,211 | | | 3.0 | % |

| Service expense | 6,934 | | | 6,836 | | | 1.4 | % | | 20,129 | | | 17,884 | | | 12.6% | | 6,705 | | | 3.4 | % |

| Gross profit | $ | 12,845 | | | $ | 11,924 | | | 7.7 | % | | $ | 37,573 | | | $ | 31,478 | | | 19.4% | | $ | 12,506 | | | 2.7 | % |

| Gross Margin | 64.9 | % | | 63.6 | % | | | | 65.1 | % | | 63.8 | % | | | | 65.1 | % | | |

| | | | | | | | | | | | | | | |

| G&A expense | $ | 5,685 | | | $ | 5,816 | | | (2.3) | % | | $ | 16,781 | | | $ | 17,520 | | | (4.2)% | | $ | 5,327 | | | 6.7 | % |

G&A expense adjustments | | | | | | | | | | | | | | | |

| Restructuring and related costs | — | | | 39 | | | (100.0) | % | | — | | | 63 | | | (100.0)% | | — | | | N/M |

| Transaction and integration costs | 22 | | | 471 | | | (95.3) | % | | 70 | | | 2,753 | | | (97.5)% | | 16 | | | 37.5 | % |

| Stock-based compensation | — | | | — | | | N/M | | — | | | 86 | | | (100.0)% | | — | | | N/M |

| Adjusted G&A expense | $ | 5,663 | | | $ | 5,306 | | | 6.7 | % | | $ | 16,711 | | | $ | 14,618 | | | 14.3% | | $ | 5,311 | | | 6.6 | % |

| Adjusted G&A expense % of revenue | 28.6 | % | | 28.3 | % | | | | 29.0 | % | | 29.6 | % | | | | 27.6 | % | | |

| | | | | | | | | | | | | | | |

| Net income (loss) | $ | 707 | | | $ | 462 | | | 53.0 | % | | $ | (43,829) | | | $ | (175) | | | N/M | | $ | (44,965) | | | (101.6) | % |

| Net income (loss) margin | 3.6 | % | | 2.5 | % | | | | (76.0) | % | | (0.4) | % | | | | (234.1) | % | | |

| | | | | | | | | | | | | | | |

| Adjusted EBITDA | $ | 7,182 | | | $ | 6,618 | | | 8.5 | % | | $ | 20,862 | | | $ | 16,860 | | | 23.7% | | $ | 7,195 | | | (0.2) | % |

| Adjusted EBITDA margin | 36.3 | % | | 35.3 | % | | | | 36.2 | % | | 34.2 | % | | | | 37.5 | % | | |

| | | | | | | | | | | | | | | |

| Average monthly members (in thousands) | 247 | | | 230 | | | 7.4 | % | | 241 | | | 201 | | 19.9% | | 240 | | | 2.9 | % |

| Revenue per member per month | $ | 26.69 | | | $ | 27.19 | | | (1.8) | % | | $ | 26.60 | | | $ | 27.29 | | | (2.5)% | | $ | 26.68 | | | — | % |

| Service expense per member per month | $ | 9.36 | | | $ | 9.91 | | | (5.5) | % | | $ | 9.28 | | | $ | 9.89 | | | (6.2)% | | $ | 9.31 | | | 0.5 | % |

N/M - Not Meaningful. Certain figures in the tables above do not provide meaningful percentage comparison, thus, the percentage has been removed.

--more--

Modivcare Inc.

Page 16

Modivcare Inc.

Unaudited Key Statistical and Financial Data

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Nine months ended | | | | Three months ended | | |

| September 30, 2023 | | September 30, 2022 | | % Change | | September 30, 2023 | | September 30, 2022 | | % Change | | June 30, 2023 | | QoQ % Change |

| | | | | | | | | | | | | | | |

| Corporate and Other Segment | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| G&A expense | $ | 18,772 | | | $ | 16,201 | | | 15.9 | % | | $ | 61,189 | | | $ | 43,316 | | | 41.3 | % | | $ | 25,011 | | | (24.9) | % |

G&A expense adjustments | | | | | | | | | | | | | | | |

| Restructuring and related costs | 6,205 | | | 565 | | | N/M | | 21,606 | | | 950 | | | N/M | | 8,055 | | | (23.0) | % |

| Transaction and integration costs | 605 | | | 2,191 | | | (72.4) | % | | 1,834 | | | 7,219 | | | (74.6) | % | | 665 | | | (9.0) | % |

| Settlement related costs | 1,474 | | | 500 | | | 194.8 | % | | 8,683 | | | 500 | | | N/M | | 7,209 | | | (79.6) | % |

| Stock-based compensation | 1,690 | | | 83 | | | N/M | | 3,485 | | | 3,950 | | | (11.8) | % | | 947 | | | 78.5 | % |

| Adjusted G&A expense | $ | 8,798 | | | $ | 12,862 | | | (31.6) | % | | $ | 25,581 | | | $ | 30,697 | | | (16.7) | % | | $ | 8,135 | | | 8.1 | % |

| Adjusted G&A expense % of consolidated revenue | 1.3 | % | | 2.0 | % | | | | 1.2 | % | | 1.7 | % | | | | 1.2 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Nine months ended | | | | Three months ended | | |

| September 30, 2023 | | September 30, 2022 | | % Change | | September 30, 2023 | | September 30, 2022 | | % Change | | June 30, 2023 | | QoQ % Change |

| | | | | | | | | | | | | | | |

| Consolidated Modivcare Inc. | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| G&A expense | $ | 70,142 | | | $ | 75,889 | | | (7.6) | % | | $ | 229,095 | | | $ | 232,108 | | | (1.3) | % | | $ | 79,240 | | | (11.5) | % |

G&A expense adjustments | | | | | | | | | | | | | | | |

| Restructuring and related costs | 8,916 | | | 2,088 | | | 327.0 | % | | 33,471 | | | 13,135 | | | 154.8 | % | | 10,110 | | | (11.8) | % |

| Transaction and integration costs | 1,159 | | | 4,899 | | | (76.3) | % | | 2,886 | | | 16,312 | | | (82.3) | % | | 854 | | | 35.7 | % |

| Settlement related costs | 1,449 | | | 6,000 | | | (75.9) | % | | 8,933 | | | 6,000 | | | 48.9 | % | | 7,209 | | | (79.9) | % |

| Stock-based compensation | 1,690 | | | 83 | | | N/M | | 3,485 | | | 4,226 | | | (17.5) | % | | 947 | | | 78.5 | % |

| Adjusted G&A expense | $ | 56,928 | | | $ | 62,819 | | | (9.4) | % | | $ | 180,320 | | | $ | 192,435 | | | (6.3) | % | | $ | 60,120 | | | (5.3) | % |

| Adjusted G&A expense % of revenue | 8.3 | % | | 9.7 | % | | | | 8.8 | % | | 10.4 | % | | | | 8.6 | % | | |

N/M - Not Meaningful. Certain figures in the tables above do not provide meaningful percentage comparison, thus, the percentage has been removed.

--end--

v3.23.3

Cover

|

Aug. 03, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 02, 2023

|

| Entity Registrant Name |

ModivCare Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34221

|

| Entity Tax Identification Number |

86-0845127

|

| Entity Address, Address Line One |

6900 E Layton Avenue, 12th Floor,

|

| Entity Address, City or Town |

Denver,

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80237

|

| City Area Code |

303

|

| Local Phone Number |

728-7012

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

MODV

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001220754

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

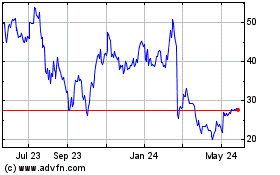

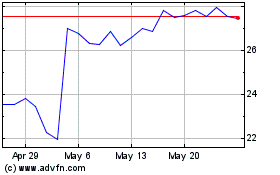

ModivCare (NASDAQ:MODV)

Historical Stock Chart

From Apr 2024 to May 2024

ModivCare (NASDAQ:MODV)

Historical Stock Chart

From May 2023 to May 2024