UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13A-16

OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of September

2023

MOBILICOM LIMITED

Commission File Number 001-41427

(Translation of registrant’s name into

English)

1 Rakefet Street

Shoham, Israel 6083705

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

CONTENTS

Attached

hereto and incorporated herein is the Registrant’s (i) press release issued on

September 5, 2023, titled “Mobilicom to Trade Exclusively on Nasdaq” and (ii) Australian

Securities Exchange (“ASX”) announcement, dated September 5, 2023, which was sent to holders of the Registrant’s

ordinary shares, as required by the laws and regulations of the ASX.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

MOBILICOM LIMITED |

| |

|

| Date: September 5, 2023 |

By: |

/s/ Oren Elkayam |

| |

|

Name: |

Oren Elkayam |

| |

|

Title: |

Chairman |

3

Exhibit 99.1

Mobilicom to Trade Exclusively on Nasdaq

| · | Reflects Mobilicom’s focus on U.S. and global market |

| · | Reduction in ASX related administrative expenses to fund operations and growth |

| · | Concentrating shares on one exchange supports larger trading volume on Nasdaq |

Shoham, Israel, Sept. 05, 2023 (GLOBE

NEWSWIRE) -- Mobilicom Limited (Mobilicom or the Company, NASDAQ: MOB, MOBBW ; ASX: MOB), a

provider of cybersecurity and robust solutions for drones and robotics, today announced that its shares will trade exclusively on

the Nasdaq Capital Market following the voluntarily delisting of its ordinary shares from trading on the Australian Securities

Exchange (ASX).

“It is early days, but Mobilicom is growing

into a leading global provider of cybersecure solutions for uncrewed systems with an increased operational and customer footprint in the

U.S.,” stated Mobilicom CEO Oren Elkayam. “In addition to creating cost savings that will be invested in growth, we believe

that concentrating our shares on the Nasdaq, the world’s second largest exchange, will lead to larger volume trading, liquidity

and efficiency.”

Under Australian law and ASX rules, the delisting

of Mobilicom’s ordinary shares from trading on the ASX will take place at least 30 days after the date of this announcement, which

is expected to be on or about October 11, 2023. Mobilicom will announce the exact date of its ASX delisting when it becomes available.

Mobilicom’s American Depositary Shares,

each of which represents 275 ordinary shares, will continue to trade on the Nasdaq Capital Market under the symbol “MOB” without

interruption.

Holders of ordinary shares that currently trade

on the ASX may convert their ordinary shares into ADSs through their banks or brokers. The process to convert ordinary shares into ADSs

involves depositing ordinary shares in the Australian account of The Bank of New York Mellon, the Depositary of Mobilicom’s ADS

program. The Bank of New York Mellon will waive its conversion and issuance fees for all shareholders who convert their ordinary shares

until October 6, 2023. After October 6, 2023, each conversion will be charged $5.00 per 100 ADSs (or portion of 100 ADSs). Holders of

the Company’s ordinary shares are encouraged to contact their banks or brokers with any questions about the conversion process.

Additional information regarding the conversion process and details of The Bank of New York Mellon’s custodian bank, HSBC Bank Australia

Limited, is available at https://ir.mobilicom.com/wp-content/uploads/2023/09/Issuance-and-conversion-Guide-for-Mobilicom-Limited.pdf

About Mobilicom

Mobilicom is an end-to-end provider of cybersecurity

and robust solutions for drones and robotics focusing primarily on targeting global drone, robotics and autonomous system manufacturers.

The Company holds patented technology & unique

know-how for Mobile Mesh networking. It has a large, field proven portfolio of commercialised products used in a variety of applications.

Mobilicom is growing a global customer base with

sales to high profile customers including corporates, governments and military. Mobilicom’s competitive advantages include outstanding

security capabilities and performance in harsh environmental conditions.

Mobilicom’s large solution portfolio is

being deployed worldwide, and the Company derives revenue from hardware, software sales & licensing fees and professional support

services.

For investors, please use https://ir.mobilicom.com/

For company, please use www.mobilicom.com

Forward Looking Statements

This press release contains “forward-looking

statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained

in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by

the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,”

“expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,”

“predict,” “project,” “target,” “aim,” “should,” “will” “would,”

or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking

statements are based on Mobilicom Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions

that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove

to be accurate. These and other risks and uncertainties are described more fully in the Company’s filings with the Securities and

Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Mobilicom Limited undertakes

no duty to update such information except as required under applicable law.

For more information on Mobilicom, please contact:

Liad Gelfer

Mobilicom Ltd

liad.gelfer@mobilicom.com

Exhibit 99.2

MOBILICOM TO TRADE EXCLUSIVELY ON NASDAQ: COMPANY

TO SEEK VOLUNTARY DELISTING FROM THE ASX

Highlights

| ● | Company’s

business and operations primarily focused in the U.S. and Israel |

| | | |

| ● | Reduction

in ASX related administrative expenses |

| | | |

| ● | Concentrating

shares under single market supports larger share volume on Nasdaq |

5 September 2023

— Mobilicom Limited (Mobilicom or the Company) (Nasdaq: MOB, MOBBW, ASX: MOB) announces that the Company has

requested formal approval from ASX to be removed from the official list of ASX pursuant to ASX Listing Rule 17.11 (Delisting).

Following the Delisting, the Company’s American

Depositary Shares (ADSs), each of which represents 275 ordinary shares (Shares) will continue to trade on the Nasdaq Capital

Market under the trading symbol ‘MOB’ without interruption.

The Company informally consulted with ASX on the

Delisting prior to formally making the request for approval. Notwithstanding the prior informal consultation of the Company with ASX,

ASX is not required to act on the Delisting request and may require conditions to be satisfied before acting on the request.

Reasons for Delisting from the ASX

The Company seeks to pursue the Delisting on the

basis that it has re-domiciled its business to the United States as part of the listing on Nasdaq completed in August 2022 and accordingly

no longer views maintaining the secondary listing on the ASX to be in the interest of Mobilicom or its shareholders.

This view has been formed by the board of Mobilicom

on the basis that:

| ● | The

aggregate traded volume of Mobilicom ordinary shares on the ASX since the Nasdaq listing

(on and from 25 August 2022) has been 419,747,255, representing 32% of the issue ordinary

shares of the Company during that period. The volume of trading of Mobilicom ordinary shares

on ASX is substantially lower than the number of ADSs traded during the same period (noting

that one ADS represents 275 fully paid ordinary shares, and therefore the equivalent of 72,437,007,500

ordinary shares, representing 5460% of the issue ordinary shares of the Company have been

traded on Nasdaq during that period. Accordingly, it is not expected maintaining a secondary

listing on ASX will have any material benefit to shareholders or result in increased liquidity. |

| ● | The Delisting would result in a reduction in corporate overheads and ongoing compliance costs in connection

with the ASX listing, including ASX listing fees. The Board considers that the financial, administrative and compliance costs associated

with an ASX listing, including the higher level of regulatory compliance costs associated with a dual listing are, in light of the lack

of liquidity on the ASX, not justified and not in the interests of its shareholders. |

| ● | The operations of Mobilicom are conducted by subsidiaries incorporated in the United States and Israel,

with limited operations in Australia other than administrative and regulatory matters required in connection with maintaining the ongoing

ASX listing of the Company. Mobilicom has operated as a holding company for its Israeli subsidiary since its incorporation, however the

expansion of the Mobilicom business into the United States has resulted in Nasdaq being the preferred primary exchange. As at the date

of this submission, we are instructed that the operations of Mobilicom have limited affinity with or commercial exposure to Australia

and the ongoing listing on the ASX is not expected by the Board to result in any material positive commercial outcome for Mobilicom, its

operations or shareholders. |

| ● | The Board is of the opinion that Mobilicom is undervalued having regard to the current prevailing share

price and market capitalisation of Mobilicom on the ASX. The Board is of the view that the undervaluing of Mobilicom is due to a lack

of interest in the Australian market, which reflects the recent trading activities as described above. |

Consequences for the Company and its Shareholders

Some of the key consequences for the Company and

its shareholders if the Company is removed from the official list of the ASX include:

| ● | shareholders will no longer have the ability to sell their securities and realise their investment in

the Company via trading on the ASX (noting however that the Company will remain listed on Nasdaq); and |

| ● | the Company will no longer have to comply with the ASX Listing Rules. In particular, the following ASX

Listing Rules will no longer apply: |

| - | continuous disclosure and other periodic reporting requirements (although the Company’s reporting requirements

(including continuous disclosure - see below) will still be governed by the Corporations Act, the applicable rules of Nasdaq and its reporting

obligations under US securities laws; |

| - | disclosure of certain information under the ASX Listing Rules (including changes of capital or information

related to directors and the auditor of the Company); |

| - | restrictions on the issue of new capital (such as the inability of the Company to issue in excess of 15%

of its capital in any 12-month period without shareholder approval) and certain restrictions on transactions with related parties (although

these will still be governed by the Corporations Act and the applicable rules of Nasdaq); |

| - | requirements relating to significant changes to the Company’s activities; and |

| - | the requirement to report against the ASX Corporate Governance Principles and Recommendations. |

| ● | The Company will still be governed by the Corporations Act, including: |

| (i) | (Section 675) the Company will become an “unlisted disclosing entity” under section

111AL of the Corporations Act. As such, following its removal from the Official List and for as long as it has at least 100 members, the

Company will be subject to the continuous disclosure obligations set out in section 675 of the Corporations Act; |

| (ii) | (Chapter 6) for as long as the Company has more than 50 members, it will continue to be subject

to the “takeover” provisions in Chapter 6 of the Corporations Act (Chapter 6) and, as such, voting power in the Company

will continue to be regulated by Chapter 6 for shareholders who hold between 20% and 90% of the voting power in the Company; and |

| (iii) | (Related Party Provisions) the related party provisions of Chapter 2E of the Corporations Act will

continue to apply. |

| (iv) | (Directors Duties) directors will continue to be subject to directors’ duties under the Corporations

Act, including to act in good faith and in the best interests of the Company. |

Some shareholders may consider that the reduction

of obligations associated with the Delisting is a disadvantage, including, in particular, minority shareholders. While there will be differences

in the regulatory regimes pre and post Delisting, minority shareholders will continue to benefit from the protections in the Corporations

Act including requirements for approvals in relation to the variation of shareholder rights, financial reporting obligations and requirements

to hold annual general meetings. Shareholders will also have protections as a result of the application of Nasdaq listing rules.

In addition, for so long as the Company has 100

or more shareholders, it will be an “unlisted disclosing entity” for the purposes of the Corporations Act and will still be

required to give continuous disclosure of material matters in accordance with the Corporations Act.

Arrangements to enable conversion of Shares

The Company has established a voluntary ADS conversion

facility which will enable shareholders to convert their shares to ADS without the ADS conversion fee which will be waived. The Company

will release additional documents in relation to the ADS conversion facility and will dispatch forms relating to participation in the

facility to holders of Shares.

The Company will also provide shareholders with

further general information on the sale and/or conversion of their Shares in communications to be provided in connection with the Delisting.

Remedies that may be pursued by security holders

Part 2F.1 of the Corporations Act

In circumstances where a shareholder of the Company

considers the Delisting to be contrary to the interests of shareholders as a whole or oppressive to, unfairly prejudicial to, or discriminatory

against a shareholder or shareholders, that shareholder may apply to the court for an order under Part 2F.1 of the Corporations Act.

The court can make any order under section 233

of the Corporations Act that it considers appropriate in relation to the Company. This may include an order that the Company be wound

up or an order regulating the conduct of the Company’s affairs in the future.

Part 6.10 Division 2 Subdivision B of the

Corporations Act

In circumstances where a shareholder of the Company

considers that the Delisting involves “unacceptable circumstances”, that shareholder may apply to the Takeovers Panel to make

a declaration of unacceptable circumstances or orders under Part 6.10 Division 2 Subdivision B of the Corporations Act (see also Guidance

Note 1: Unacceptable Circumstances issued by the Takeovers Panels).

Pursuant to section 657D of the Corporations Act,

if the Takeovers Panel has declared circumstances to be unacceptable under section 657A of the Corporations Act, it may make any order

(except for an order directing a person to comply with a requirement of Chapter 6, 6A, 6B or 6C of the Corporations Act) that it thinks

appropriate to (among others) protect the rights or interests of any person or group of persons where it is satisfied that those rights

or interests have been or are being affected, or will be or are likely to be affected, by the circumstances.

Delisting Conditions

ASX’s in-principle decision to approve the Delisting

is subject to the Company’s compliance with the following conditions imposed by ASX under Listing Rule 17.11 and Guidance Note 33:

| (a) | The Company sends written or electronic communications to all shareholders whose Shares are held on the

Company’s Australian principal share register, in form and substance satisfactory to ASX (Notice), setting out: |

| (i) | the nominated time and date at which the entity will be removed from the ASX and that: |

| (A) | if they wish to sell their Shares on ASX, they will need to do so before then; and |

| (B) | if they don’t, thereafter they will only be able to sell the underlying securities on-market on Nasdaq

in the form of ADSs; and |

| (ii) | generally what they need to do if they wish to sell their securities on Nasdaq. |

| (b) | The removal shall not take place any earlier than one month after the date the information in the Notice

has been sent to shareholders. |

| (c) | The Company releases the full terms of this decision to the market upon making a formal application to

ASX to remove the Company from the official list of ASX. |

Timetable

A timetable for the Delisting is set out below:

| Event |

Date |

| Announcement of proposed Delisting |

5 September 2023 |

| Dispatch of letter to shareholders advising of Delisting and means of converting shares to ADRs |

7 September 2023 |

| Closing Date: Participation in ADS Conversion Facility |

6 October 2023 |

| Last day for trading of shares on ASX |

9 October 2023 |

| Delisting date |

11 October 2023 |

About Mobilicom

Mobilicom is an end-to-end provider of cybersecurity and robust solutions

for drones and robotics focussing primarily on targeting global drone, robotics and autonomous system manufacturers.

The Company holds patented technology & unique know-how for Mobile

Mesh networking. It has a large, field proven portfolio of commercialised products used in a variety of applications.

Mobilicom is growing a global customer base with sales to high profile

customers including corporates, governments and military. Mobilicom’s competitive advantages include outstanding security capabilities

and performance in harsh environmental conditions.

Mobilicom’s large solution portfolio is being deployed worldwide,

and the Company derives revenue from hardware, software sales & licensing fees and professional support services.

For investors, please use https://ir.mobilicom.com/

For company, please use www.mobilicom.com

This announcement has been approved for release by the Board of

Mobilicom.

Forward Looking Statements

This press release contains “forward-looking

statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained

in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by

the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,”

“expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,”

“predict,” “project,” “target,” “aim,” “should,” “will” “would,”

or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking

statements are based on Mobilicom Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions

that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove

to be accurate. These and other risks and uncertainties are described more fully in the Company’s filings with the Securities and

Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Mobilicom Limited undertakes

no duty to update such information except as required under applicable law.

6

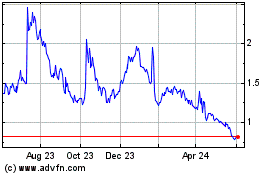

Mobilicom (NASDAQ:MOB)

Historical Stock Chart

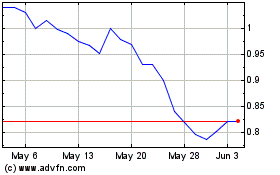

From Sep 2024 to Oct 2024

Mobilicom (NASDAQ:MOB)

Historical Stock Chart

From Oct 2023 to Oct 2024