false

0000883975

0000883975

2024-01-26

2024-01-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 26, 2024

MICROBOT

MEDICAL INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-19871 |

|

94-3078125 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

288

Grove Street, Suite 388

Braintree,

MA 02184

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (781) 875-3605

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value |

|

MBOT |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 |

Entry

into a Material Definitive Agreement |

As

of January 26, 2024 (the “Effective Date”), Microbot Medical Inc. (the “Company”) entered into a Settlement Agreement

and Release (the “Settlement Agreement”) with Empery Asset Master Ltd., Empery Tax Efficient, LP, Empery Tax Efficient III,

LP and Hudson Bay Master Fund Ltd. (collectively, “Plaintiffs”), which resolved and settled the below referenced litigation

between the Company and Plaintiffs. The Company previously announced that it was a defendant in a lawsuit captioned Empery Asset Master

Ltd., Empery Tax Efficient, LP, Empery Tax Efficient II, LP, Hudson Bay Master Fund Ltd., Plaintiffs, against Microbot Medical Inc.,

Defendant, in the Supreme Court of the State of New York, County of New York (Index No. 651182/2020) (the “Lawsuit”),

pursuant to which the Plaintiffs alleged, among other things, that the Company breached multiple representations and warranties contained

in the Securities Purchase Agreement (the “SPA”) related to the Company’s June 8, 2017 equity financing (the “Financing”),

of which the Plaintiffs participated, and fraudulently induced Plaintiffs into signing the SPA. The complaint sought rescission of the

SPA and return of the Plaintiffs’ $6.75 million purchase price with respect to the Financing.

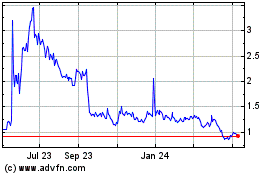

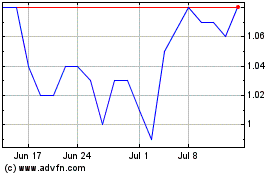

Pursuant

to the Settlement Agreement, the Company agreed to pay Plaintiffs $2,154,000 (the “Total Settlement Amount”), consisting

of a cash payment covered by the Company’s insurance carrier of $1,100,000 and 1,005,965 shares of restricted Company common stock

(the “Shares”), which Shares represent the whole number of restricted shares of Company common stock calculated pursuant

to the following formula: $1,054,000/[closing price of Company common stock on the Effective Date * 0.825]. Additionally, the Plaintiffs

and the Company each agreed to fully release the other from all claims arising out of the Financing, the SPA and/or the allegations and

claims asserted in the Lawsuit, subject to customary carve-outs.

The

Company also agreed, pursuant to a Registration Rights Agreement (the “Registration Rights Agreement”), to file a registration

statement on Form S-1 or Form S-3 covering the resale of the Shares (the “Resale Registration Statement”), within 30 calendar

days following the Effective Date, and to use reasonable best efforts to have such Resale Registration Statement declared effective by

the SEC within 60 days (or, in the event of a “full review” by the Securities and Exchange Commission, within 90 days) following

the Effective Date. The Company shall be required to make cash payments to the Plaintiffs in the event the Company fails to register

the Shares and keep the registration statement effective pursuant to the terms of the Registration Rights Agreement, and if the Company

fails to remove the restrictions on the Shares pursuant to the terms of the Settlement Agreement.

Within

three business days of Plaintiffs’ receipt of the Total Settlement Amount, Plaintiffs will file a stipulation discontinuing the

Lawsuit with prejudice.

The

Settlement Agreement and Registration Rights Agreement are attached as Exhibits 10.1 and 10.2, respectively, to this Current Report on

Form 8-K. The description of the terms of the Settlement Agreement and the Registration Rights Agreement is not intended to be complete

and is qualified in its entirety by reference to such exhibits.

| Item

3.02 |

Unregistered

Sales of Equity Securities |

The

Company issued the Shares pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended (the

“Securities Act”), available under Section 4(a)(2) as a transaction by an issuer not involving any public offering. The issuance

of the Shares has not been registered under the Securities Act and such securities may not be offered or sold in the United States absent

registration or an exemption from registration under the Securities Act and any applicable state securities laws.

| Item

7.01 |

Regulation

FD Disclosure |

On

January 30, 2024, the Company issued a press release announcing that it had entered into the Settlement Agreement.

The

press release, which is furnished as Exhibit 99.1 to this Current Report on Form 8-K, is incorporated herein by reference. The information

in this Item 7.01 and Exhibit 99.1 is being furnished and shall not be deemed to be “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This report will not be

deemed an admission as to the materiality of any information in this Item 7.01 or Exhibit 99.1.

On

January 29, 2024, the Company submitted an Investigational Device Exemption (IDE) application with the U.S. Food and Drug Administration,

in order to commence its pivotal clinical trial in humans.

| Item

9.01 |

Financial

Statetments and Exhibits |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

MICROBOT

MEDICAL INC. |

| |

|

|

| |

By: |

/s/

Harel Gadot |

| |

Name: |

Harel

Gadot |

| |

Title: |

Chief

Executive Officer, President and Chairman |

| |

|

|

| Date:

January 30, 2024 |

|

|

Exhibit 10.1

SETTLEMENT

AGREEMENT AND RELEASE

This

Settlement Agreement and Release (the “Agreement”) is made and entered into this 26th day of January, 2024 (the “Effective

Date”), by and between Empery Asset Master Ltd., Empery Tax Efficient, LP, Empery Tax Efficient III, LP (“Empery”)

and Hudson Bay Master Fund Ltd. (“Hudson Bay” together with Empery, “Plaintiffs”) on the one hand

and Microbot Medical Inc. (“Microbot” or the “Company”) on the other hand. Empery, Hudson Bay,

and Microbot are referred to herein collectively as the “Parties” and individually as a “Party.”

WHEREAS,

the Parties entered into a Securities Purchase Agreement dated June 5, 2017 (the SPA) whereby Empery and Hudson Bay each purchased

1,250,000 shares of Microbot stock for a purchase price of $3,375,000 (the “Offering”);

WHEREAS,

as part of the Offering, Plaintiffs received a Disclosure Schedule that contained a footnote in a “MBOT CAP TABLE” stating

that “Alpha Capital Anstalt, an affiliate of the Company,” was the holder of “‘toothless’ preferred stock

that converts into 11,916,000 shares of common stock subject to conversion limitations”;

WHEREAS,

Plaintiffs allege that Alpha Capital Anstalt (“Alpha”) was not an affiliate of Microbot at the time of the Offering

and that Microbot’s alleged representation that Alpha was an affiliate was a material misrepresentation upon which Plaintiffs relied;

WHEREAS,

after initially entering into a tolling and standstill agreement which thereafter expired, Plaintiffs filed a lawsuit on February 21,

2020 in the Supreme Court of the State of New York, New York County (the “Lawsuit”) alleging that Microbot materially

breached the SPA and sought, among other relief, rescission of the SPA;

WHEREAS,

Microbot denies the allegations in the Lawsuit and denies any liability to Plaintiffs with respect to the Lawsuit, the Offering,

and/or the SPA;

WHEREAS,

to avoid the uncertainty, expense, and burden of litigation, the Parties desire to resolve the dispute between them upon the terms and

in the manner provided in this Agreement, with no Party admitting nor acknowledging any fault or liability to any other Party.

NOW,

THEREFORE, in consideration of the covenants and agreements set forth in this Agreement and the RRA (as defined below) and for other

good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1.

Settlement Amount. Microbot agrees to pay Plaintiffs

two million one hundred fifty four thousand dollars ($2,154,000) (the Total Settlement Amount), consisting of a cash payment of

one million one hundred thousand dollars ($1,100,000) (the “Cash Settlement Portion”) and the whole number of restricted

shares of Microbot common stock calculated pursuant to the following formula: $1,054,000/[closing price of Microbot common stock on the

Effective Date * 0.825] (the “Stock Settlement Portion”). For the avoidance of doubt, the Parties agree that the Stock Settlement

Portion equals one million five thousand nine hundred sixty-five (1,005,965) shares of restricted Microbot common stock (the “Shares”).

2.

Registration Rights Agreement. Contemporaneously with

the execution of this Agreement, each of the Parties will execute and delivery to the other Parties a registration rights agreement in

form and substance attached hereto as Exhibit A (the “RRA”) which governs the Company’s obligations to file

a registration statement covering the Shares and cause such registration statement to be declared effective and be maintained.

3.

Settlement Payment.

(a)

Within fifteen (15) business days from the Effective

Date, Microbot shall pay the Cash Settlement Portion to Plaintiffs as set forth on Schedule A attached hereto, all in accordance with

the wiring instructions set forth on Schedule A.

(b)

Within five (5) business days from the Effective Date,

Microbot shall issue the Stock Settlement Portion to Plaintiffs as set forth on Schedule A attached hereto. The Shares representing the

Stock Settlement Portion shall be delivered to Plaintiffs via delivery of a book entry statement issued by Microbot’s transfer

agent (the “Transfer Agent”). Microbot will pay all fees and expenses of its Transfer Agent in connection with the

delivery of the Stock Settlement Portion.

4.

Legends and Legend Removal.

(a)

The Plaintiffs agree to the imprinting, so long as is

required by this Section 4(a), of a legend on any of the Shares in substantially the following form:

THIS

SECURITY HAS NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON

AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY

NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION

FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE

SECURITIES LAWS. THIS SECURITY MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT WITH A REGISTERED BROKER-DEALER OR OTHER

LOAN WITH A FINANCIAL INSTITUTION THAT IS AN “ACCREDITED INVESTOR” AS DEFINED IN RULE 501(a) UNDER THE SECURITIES ACT OR

OTHER LOAN SECURED BY SUCH SECURITIES.

(b)

Subject to applicable law, the Company acknowledges

and agrees that a Plaintiff may from time to time pledge pursuant to a bona fide margin agreement with a registered broker-dealer or

grant a security interest in some or all of the Shares to a financial institution that is an “accredited investor” as defined

in Rule 501(a) under the Securities Act and, if required under the terms of such arrangement, such Plaintiff may transfer pledged or

secured Shares to the pledgees or secured parties. Such a pledge or transfer would not be subject to approval of the Company and no legal

opinion of legal counsel of the pledgee, secured party or pledgor shall be required in connection therewith. Further, no notice shall

be required of such pledge. At the appropriate Plaintiff’s expense, and subject to applicable law, the Company will execute and

deliver such reasonable documentation as a pledgee or secured party of Shares may reasonably request in connection with a pledge or transfer

of the Shares, including, if the Shares are subject to registration pursuant to the Registration Rights Agreement, the preparation and

filing of any required prospectus supplement under Rule 424(b)(3) under the Securities Act or other applicable provision of the Securities

Act to appropriately amend the list of Selling Stockholders (as defined in the Registration Rights Agreement) thereunder.

(c)

Provided that the Plaintiffs are not affiliates of the

Company under applicable law, the Shares shall not contain any legend (including the legend set forth in Section 4(a) hereof), (i) while

a registration statement (including the Registration Statement (as defined in the RRA)) covering the resale of such security is effective

under the Securities Act, (ii) following any sale of such Shares pursuant to Rule 144 and the Company is then in compliance with the

current public information required under Rule 144, (iii) if such Shares are eligible for sale or may be sold under Rule 144, without

volume or manner-of-sale restrictions, or (iv) if such legend is not required under applicable requirements of the Securities Act (including

judicial interpretations and pronouncements issued by the staff of the Securities and Exchange Commission (the “Commission”))

(the earliest of such dates, the “Release Date”). The Company shall cause its counsel to issue a legal opinion to

the Transfer Agent or the Plaintiff promptly after the Release Date if required by the Transfer Agent to effect the removal of the legend

hereunder under applicable law, or if requested by a Plaintiff, respectively. In furtherance of the foregoing, the Company agrees that

following the earliest Release Date (for purposes of this Section 4(c), as to some or all Shares) or such time as such legend is no longer

required under this Section 4(c), it will, no later than the earlier of (i) two (2) Trading Days (as defined below) and (ii) the number

of Trading Days comprising the Standard Settlement Period (as defined below) following the delivery by a Plaintiff to the Company or

the Transfer Agent of instructions to cancel the Shares issued with a restrictive legend for de-legending (such date, the “Legend

Removal Date”), deliver or cause to be delivered to such Plaintiff such Shares that are free from all restrictive and other

legends. The Company may not make any notation on its records or give instructions to the Transfer Agent that enlarge the restrictions

on transfer set forth in this Section 4. Shares subject to legend removal hereunder shall be transmitted by the Transfer Agent to the

Plaintiff by crediting the account of the Plaintiff’s prime broker with the Depository Trust Company System as directed by such

Plaintiff. As used herein, (i) “Standard Settlement Period” means the standard settlement period, expressed in a number

of Trading Days, on the Company’s primary Trading Market with respect to the Shares as in effect on the date of delivery of a certificate

representing Shares issued with a restrictive legend, (ii) “Trading Day” means a day on which the principal Trading

Market is open for trading, and (ii) “Trading Market” means any of the following markets or exchanges on which the

Shares are listed or quoted for trading on the date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market,

the Nasdaq Global Select Market, the New York Stock Exchange, the OTCQB, OTCQX, Pink Open Market (or any successors to any of the foregoing)

The Company will pay all fees and expenses of its Transfer Agent in connection with the removal of legends from the Shares under this

Section 4, including without limitation fees and expenses in connection with expedited actions by the Transfer Agent.

(d)

In addition to such Plaintiff’s other available

remedies, the Company shall pay to a Plaintiff, in cash, if the Company fails to (a) issue and deliver (or cause to be delivered) to

a Plaintiff by the Legend Removal Date the Shares (so delivered or instructed to be delivered to the Company or Transfer Agent by such

Plaintiff) that is free from all restrictive and other legends and (b) if after the Legend Removal Date such Plaintiff purchases (in

an open market transaction or otherwise) shares of Microbot common stock to deliver in satisfaction of a sale by such Plaintiff of all

or any portion of the number of shares of Microbot common stock, or a sale of a number of shares of Microbot common stock equal to all

or any portion of the number of shares of Microbot common stock that such Plaintiff anticipated receiving from the Company without any

restrictive legend, then, an amount equal to the excess of such Plaintiff’s total purchase price (including brokerage commissions

and other out-of-pocket expenses, if any) for the shares of Microbot common stock so purchased (including brokerage commissions and other

out-of-pocket expenses, if any) (the “Buy-In Price”) over the product of (A) such number of Shares that the Company

was required to deliver to such Plaintiff by the Legend Removal Date multiplied by (B) the lowest closing sale price of Microbot common

stock on any Trading Day during the period commencing on the date of the delivery by such Plaintiff to the Company of the applicable

Shares and ending on the date of such delivery and payment under this section. For the avoidance of doubt, no amounts shall be payable

by the Company under this Section 4(d) that relate to sales by a Plaintiff of Microbot common stock occurring prior to the earlier of

the date that (i) the Registration Statement (as defined in the RRA) is declared effective under the Securities Act, or (ii) the Shares

are eligible for resale pursuant to Rule 144.

(e)

The Company shall (a) by 9:00 am on January 30, 2024,

issue a press release disclosing the settlement, and (b) file a Current Report on Form 8-K, including this Agreement and the RRA as exhibits

thereto, with the Securities and Exchange Commission within the time required by the Securities Exchange Act of 1934, as amended. From

and after the issuance of such press release, the Company represents to the Plaintiffs that it shall have publicly disclosed all material,

non-public information delivered to any of the Plaintiffs by the Company or any of its subsidiaries, or any of their respective officers,

directors, employees, affiliates or agents in connection with the transactions contemplated hereby. In addition, effective upon the issuance

of such press release, the Company acknowledges and agrees that any and all confidentiality or similar obligations under any agreement,

whether written or oral, between the Company, any of its subsidiaries or any of their respective officers, directors, agents, employees

or affiliates, on the one hand, and any of the Plaintiffs or any of their affiliates on the other hand, shall terminate and be of no

further force or effect. The Company understands and confirms that each Plaintiff shall be relying on the foregoing covenant in effecting

transactions in securities of the Company. The Company further covenants and agrees that neither it, nor any other Person acting on its

behalf will provide any Plaintiff or its agents or counsel with any information that constitutes, or the Company reasonably believes

constitutes, material non-public information, unless prior thereto such Plaintiff shall have consented in writing to the receipt of such

information and agreed in writing with the Company to keep such information confidential.

5.

Mutual Releases.

(a)

Plaintiffs’ Releases of Microbot. Upon

receipt of an executed copy of this Agreement, the RRA and the Total Settlement Amount from Microbot, Plaintiffs on behalf of (i) themselves

and their current and former principals, members, shareholders, directors, managers, officers, employees, agents, representatives, partners,

joint venturers, consultants, beneficiaries, heirs, assigns, executors, administrators, trustees, attorneys and advisors, and (ii) each

of their predecessors, successors, parents, subsidiaries, affiliates, and each of their respective current and former principals, members,

shareholders, directors, managers, officers, employees, agents, representatives, partners, joint venturers, consultants, beneficiaries,

heirs, assigns, executors, administrators, trustees, attorneys and advisors (the “Plaintiff Releasing Parties”), fully

and irrevocably releases, settles, acquits and forever discharges (i) Microbot and its current and former principals, members, shareholders,

directors, managers, officers, employees, agents, representatives, partners, joint venturers, consultants, beneficiaries, heirs, assigns,

executors, administrators, trustees, attorneys and advisors, and (ii) each of their predecessors, successors, parents, subsidiaries,

affiliates and divisions, and each of their respective current and former principals, members, shareholders, directors, managers, officers,

employees, agents, representatives, partners, joint venturers, consultants, beneficiaries, heirs, assigns, executors, administrators,

trustees, attorneys and advisors (the “Microbot Released Parties”) to the fullest extent permitted by applicable law

from any and all claims, counterclaims, complaints, causes of action, suits, losses of every kind, demands, debts or expenses (including,

but not limited to, attorneys’ fees and costs actually incurred), liens, contractual obligations, undertakings, warranties, liabilities

or damages of whatever nature, at law, in equity, or otherwise, whether known or unknown, suspected or unsuspected, asserted or unasserted,

whether for equitable, declaratory, monetary, injunctive or any other type of relief whatsoever that the Plaintiff Releasing Parties

have, had or may have against the Microbot Released Parties, arising out of or relating to the Offering, the SPA, and/or the allegations

and claims asserted in the Lawsuit, from the beginning of the world through the date of signing this Agreement; provided that nothing

in this Section 5(a) releases Microbot from the obligations contained in this Agreement or the RRA nor are the Plaintiff Releasing Parties

releasing any claims or causes of action against Microbot for enforcement of this Agreement or the RRA.

(b)

Microbot Releases of Plaintiffs. Upon receipt

of an executed copy of this Agreement from Plaintiffs and payment of the Total Settlement Amount, Microbot, on behalf of (i) itself and

its current and former principals, members, shareholders, directors, managers, officers, employees, agents, representatives, partners,

joint venturers, consultants, beneficiaries, heirs, assigns, executors, administrators, trustees, attorneys and advisors, and (ii) each

of their predecessors, successors, parents, subsidiaries, affiliates and divisions, and each of their respective current and former principals,

members, shareholders, directors, managers, officers, employees, agents, representatives, partners, joint venturers, consultants, beneficiaries,

heirs, assigns, executors, administrators, trustees, attorneys and advisors (the “Microbot Releasing Parties”), fully

and irrevocably releases, settles, acquits and forever discharges (i) Plaintiffs and their current and former principals, members, shareholders,

directors, managers, officers, employees, agents, representatives, partners, joint venturers, consultants, beneficiaries, heirs, assigns,

attorneys and advisors, and (ii) each of Plaintiffs’ predecessors, successors, parents, subsidiaries, affiliates and divisions,

and each of their respective current and former principals, members, shareholders, directors, managers, officers, employees, agents,

representatives, partners, joint venturers, consultants, beneficiaries, heirs, assigns, executors, administrators, trustees, attorneys

and advisors (the “Plaintiff Released Parties”) to the fullest extent permitted by applicable law from any and all

claims, counterclaims, complaints, causes of action, suits, losses of every kind, demands, debts or expenses (including, but not limited

to, attorneys’ fees and costs actually incurred), liens, contractual obligations, undertakings, warranties, liabilities or damages

of whatever nature, at law, in equity, or otherwise, whether known or unknown, suspected or unsuspected, asserted or unasserted, whether

for equitable, declaratory, monetary, injunctive or any other type of relief whatsoever that the Microbot Releasing Parties have, had

or may have against the Plaintiff Released Parties, arising out of or relating to the Offering, the SPA, and/or the allegations and claims

asserted in the Lawsuit, from the beginning of the world through the date of signing this Agreement; provided that nothing in this Section

5(b) releases Plaintiffs from the obligations contained in this Agreement or the RRA nor are the Microbot Releasing Parties releasing

any claims or causes of action against the Plaintiffs for enforcement of this Agreement or the RRA.

(c)

The Plaintiff Releasing Parties and the Microbot Releasing

Parties each understand and agree that the Parties’ agreement to provide these general releases is a material condition of this

Agreement and to providing the Settlement Amount identified in this Agreement.

(d)

The Plaintiff Releasing Parties represent that they

have no other suits, claims, complaints or demands of any kind whatsoever currently pending against the Microbot Released Parties with

any local, state, or federal court or other tribunal, nor are they aware of any facts that would serve as the basis for any civil or

administrative proceeding against the Microbot Released Parties.

(e)

The Microbot Releasing Parties represent that they have

no other suits, claims, complaints or demands of any kind whatsoever currently pending against the Plaintiff Released Parties with any

local, state, or federal court or other tribunal, nor are they aware of any facts that would serve as the basis for any civil or administrative

proceeding against the Plaintiff Released Parties.

(f)

The Plaintiff Releasing Parties and Microbot Releasing

Parties hereby acknowledge and waive any and all rights and protections under California Civil Code Section 1542, or any similar provision

of state or federal law. The Parties each acknowledge that they have been advised by their attorneys of the contents and effects of Section

1542, which section has been duly explained and reads as follows:

A

GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR

AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE

DEBTOR OR RELEASED PARTY.

6.

No Release for Breach of this Agreement or the RRA.

Notwithstanding anything to the contrary in this Agreement or the RRA, the releases contained in this Agreement do not and are not intended

to release any claims that either Party may have against the other Party for a breach of this Agreement or the RRA.

7.

Covenant Not to Sue. Each Party covenants never

to institute, participate in, assist or encourage, either directly or indirectly, any suit, action, arbitration or proceeding, at law

or in equity, against the Microbot Released Parties or the Plaintiff Released Parties, as applicable, arising from or related to the

claims, counterclaims, complaints, causes of action, suits, losses, demands, debts or expenses (including, but not limited to, attorneys’

fees and costs actually incurred), liens, liabilities or damages that are released in this Agreement.

8.

Dismissal of the Action. Within three (3) business

days of Plaintiffs’ receipt of the Total Settlement Amount, Plaintiffs will file a stipulation discontinuing the Action with prejudice

that shall be executed by counsel for Plaintiffs and Microbot substantially in the same form attached to this Agreement as Exhibit

B.

9.

No Admission of Liability. The Parties have entered

into this Agreement and the RRA solely for the purposes of avoiding the expense and inconvenience of litigation. Neither the execution

of this Agreement and the RRA, nor the effectuation of the settlement as set forth herein and therein, shall constitute or be construed

in any manner whatsoever as an admission or concession of liability or wrongdoing, or lack of merit of any claims or defenses, on the

part of either Party. This Agreement, the RRA, and any other evidence of the terms of this settlement, shall not be offered or received

in evidence in any action or other proceeding as an admission or concession of liability or wrongdoing, or lack of merit of any claims

or defenses, on the part of either Party.

10.

Ownership of Claims. Each Party warrants and

represents that it is the sole and lawful owner of all rights, title and interests in and to any claims, counterclaims, complaints, causes

of action, suits, losses, demands, debts or expenses (including, but not limited to, attorneys’ fees and costs actually incurred),

liens, liabilities or damages that are the subject of this Agreement, including without limitation the releases set forth in this Agreement,

and that it has not sold, assigned, granted, transferred or hypothecated any right, title or interest in any such claims, counterclaims,

complaints, causes of action, suits, losses, demands, debts or expenses (including, but not limited to, attorneys’ fees and costs

actually incurred), liens, liabilities or damages to any other person or entity.

11.

Governing Law and Venue. This Agreement shall

be construed under and governed by the laws of the State of New York, without regard to choice-of-law principles. Any suit, action, or

proceeding between the Parties arising out of or related to this Agreement must be brought exclusively in the federal or state courts

located in New York, New York, and the Parties each hereby submit to the personal jurisdiction thereof and agree to such courts as the

appropriate venue, and expressly waive any objection to such jurisdiction or venue based on the doctrine of forum non conveniens.

Process in any action or proceeding referenced in this paragraph 13 may be served in accordance with the notice provisions set forth

in paragraph 22 of this Agreement.

12.

No Waiver. Any failure by a Party to pursue any

breach of any provision of this Agreement shall not constitute a waiver of that provision, or any other provision, of this Agreement.

The failure of a Party to insist upon the strict performance of any term or condition in this Agreement shall not be considered a waiver

or relinquishment of further compliance therewith.

13.

Entire Agreement; Amendments. This Agreement

and the RRA contains the entire agreement between the Parties concerning the subject matter hereof and supersedes all prior agreements,

understandings, discussions, negotiations and undertakings, whether written or oral, between the Parties with respect thereto. In entering

this Agreement and the RRA, no Party has relied upon any representation or warranty of the other Party that is not included in this Agreement

or the RRA.

14.

No Oral Modification. This Agreement may not

be amended, modified or terminated, except by a written instrument signed by each of the Parties hereto.

15.

Saving Clause and Severability. If any provision

of this Agreement is held to be invalid or unenforceable by any judicial or other competent authority, all other provisions of this Agreement

will remain in full force and effect and will not in any way be impaired, provided that no Party is deprived of the material benefits

of this Agreement. If owing to the invalidity or unenforceability of any provision of this Agreement any Party is deprived of the material

benefits of this Agreement, the Parties shall substitute for the invalid or unenforceable provision, a provision that will allow such

Party or Parties to enjoy such material benefits.

16.

Binding Effect. This Agreement shall inure to

the benefit of the Parties and shall be binding upon each of the Parties and their permitted assigns, successors, heirs, and representatives.

17.

Authority to Enter Into and Understanding of Agreement.

Each Party hereto represents and warrants as respects itself that: (i) the individual executing this Agreement on its behalf is duly

authorized to do so; (ii) such Party is entering this Agreement of its own free will, free of any duress, undue influence or compulsion

by any person or entity, and has the full authority and capacity necessary to do so; (iii) such Party is represented by counsel of its

own choosing in connection with this Agreement; and (iv) such Party has read this Agreement and understands all of the terms hereof.

18.

Agreement Jointly Drafted. The Parties agree

that each and every provision of this Agreement and the RRA shall be deemed to have been simultaneously drafted by each of the Parties,

and no laws or rules relating to the interpretation of contracts against the drafter of any particular clause should be applied to the

interpretation or enforcement of this Agreement or the RRA.

19.

Non-Inducement. The Parties warrant that no promise

or inducement has been made or offered, except as set forth herein, and that this Agreement is executed voluntarily to dispose of all

claims identified in this Agreement, without reliance upon any statement or representation by any attorney, agent or other representative

acting on behalf of any of the Parties.

20.

Attorneys’ Fees and Costs. Each Party to

this Agreement shall bear its own attorneys’ fees and costs arising out of or related to the dispute between the Parties, this

Agreement and the claims released herein, and no further claim shall be made therefore.

21.

No Third-Party Beneficiaries. The provisions

of this Agreement are for the sole benefit of the Parties and their successors and permitted assigns,

and they will not be construed as conferring any rights (including, without limitation, any third-party beneficiary rights) to any other

person.

22.

Notice. All notices, requests, and demands to

or upon a Party shall be in writing and sent by email and overnight courier as follows (or to such other address or email as either Party

may from time to time direct):

| If

to Empery: |

c/o

Empery Asset Management, LP

1

Rockefeller Plaza, Suite 1205

New

York, New York 10020

Attention:

Brett Director

E-mail:

notices@emperyam.com

With

a copy (which shall not constitute notice) to:

Schulte

Roth & Zabel, LLP

919

Third Avenue

New

York, New York 10022

Attention:

Andrew D. Gladstein

Email:

andrew.gladstein@srz.com |

| |

|

| If

to Hudson Bay: |

c/o

Hudson Bay Capital Management, LP

28

Havemeyer Place, 2nd Floor

Greenwich,

Connecticut 06830

Attention:

DITeam

Email:

diteam@hudsonbaycapital.com

With

a copy (which shall not constitute notice) to:

Schulte

Roth & Zabel LLP

919

Third Avenue

New

York, New York 10022

Attention:

Andrew D. Gladstein

Email:

andrew.gladstein@srz.com |

| |

|

| If

to Microbot |

Microbot

Medical Inc.

288

Grove Street, Suite 388

Braintree,

MA 02184

Attention:

Harel Gadot

Email:

info@microbotmedical.com

With

a copy (which shall not constitute notice) to:

Mintz

Levin Cohn Ferris

Glovsky

and Popeo, P.C.

One

Financial Center

Boston,

MA 02111

Attention:

John F. Sylvia

Email:

jfsylvia@mintz.com |

23.

No Assignment. This Agreement may not be assigned,

conveyed or otherwise transferred, in whole or in part, by either Party (other than by the operation of law in connection with a merger

or sale) without express written consent of the non-assigning Party.

24.

Counterparts. This Agreement may be executed

in counterparts, and each counterpart, when executed, shall have the efficacy of a signed original. Photographic, emailed, imaged and

facsimiled copies of such signed counterparts may be used in lieu of the originals for any purpose.

25.

Headings. The headings of the paragraphs of this

Agreement have been inserted for reference only and are not part of this Agreement and are not to be used in any way in the construction

or interpretation hereof.

IN

WITNESS WHEREOF, intending to be legally bound hereby, the undersigned have executed this Agreement as of the Effective Date.

[Signatures

on next page]

| |

EMPERY

ASSET MASTER LTD. |

| |

By:

|

Empery

Asset Management, LP, its authorized agent |

| |

|

|

| |

/s/

Brett Director |

| |

Name:

|

Brett

Director |

| |

Title: |

General

Counsel |

| |

|

|

| |

EMPERY

TAX EFFICIENT, LP |

| |

By:

|

Empery

Asset Management, LP, its authorized agent |

| |

|

|

| |

/s/

Brett Director |

| |

Name:

|

Brett

Director |

| |

Title: |

General

Counsel |

| |

|

|

| |

EMPERY

TAX EFFICIENT III, LP |

| |

By:

|

Empery

Asset Management, LP, its authorized agent |

| |

|

|

| |

/s/

Brett Director |

| |

Name:

|

Brett

Director |

| |

Title: |

General

Counsel |

| |

|

|

| |

HUDSON

BAY MASTER FUND LTD. |

| |

By: |

Hudson

Bay Capital Management, LP |

| |

|

|

| |

/s/

Richard Allison |

| |

Name: |

Richard

Allison |

| |

Title of Authorized Signatory: Authorized Signatory, Hudson Bay Capital Management LP not individually, but solely as Investment Advisor to Hudson Bay Master Fund Ltd. |

| |

|

|

| |

MICROBOT

MEDICAL INC. |

| |

|

|

| |

/s/

Harel Gadot |

| |

By: |

Harel

Gadot |

| |

Title of Authorized Signatory: CEO & President |

Schedule

A

| Name | |

Cash

Settlement Amount | | |

#

of Shares | |

| | |

| | |

| |

Empery

Asset Master, Ltd. | |

$ | 290,608.97 | | |

| 280,574 | |

| Wire Instructions: | |

| | | |

| | |

| | |

| | | |

| | |

Empery

Tax Efficient, LP | |

$ | 146,042.56 | | |

| 140,999 | |

| Wire Instructions: | |

| | | |

| | |

| | |

| | | |

| | |

Empery

Tax Efficient III, LP | |

$ | 188,515.67 | | |

| 182,006 | |

| Wire Instructions: | |

| | | |

| | |

| | |

| | | |

| | |

Hudson

Bay Master Fund Ltd. | |

$ | 474,832.80 | | |

| 402,386 | |

| Wire Instructions: | |

| | | |

| | |

| | |

| | | |

| | |

TOTAL

| |

$ | 1,100,000.00 | | |

| 1,005,965 | |

Exhibit

10.2

REGISTRATION

RIGHTS AGREEMENT

This

Registration Rights Agreement (this “Agreement”) is made and entered into as of January 26, 2024, between Microbot

Medical Inc., a Delaware corporation (the “Company”), and each of the several entities signatory hereto (each such

entity, a “Plaintiff” and, collectively, the “Plaintiffs”).

This

Agreement is made pursuant to the Settlement Agreement and Release, dated as of the date hereof, between the Company and each Plaintiff

(the “Settlement Agreement”).

The

Company and each Plaintiff hereby agree as follows:

1.

Definitions. Capitalized terms used and not otherwise defined herein that are defined in the Settlement Agreement shall have the

meanings given such terms in the Settlement Agreement. As used in this Agreement, the following terms shall have the following meanings:

“Advice”

shall have the meaning set forth in Section 6(b).

“Effectiveness

Date” means, with respect to the Registration Statement required to be filed hereunder, the 60th calendar day following

the date hereof (or, in the event of a “full review” by the Commission, the 90th calendar day following the date

hereof), provided, if such Effectiveness Date falls on a day that is not a Trading Day, then the Effectiveness Date shall be the

next succeeding Trading Day.

“Effectiveness

Period” shall have the meaning set forth in Section 2(a).

“Filing

Date” means the 30th calendar day following the date hereof.

“Holder”

or “Holders” means the holder or holders, as the case may be, from time to time of Registrable Securities.

“Indemnified

Party” shall have the meaning set forth in Section 5(c).

“Indemnifying

Party” shall have the meaning set forth in Section 5(c).

“Losses”

shall have the meaning set forth in Section 5(a).

“Prospectus”

means the prospectus included in a Registration Statement (including, without limitation, a prospectus that includes any information

previously omitted from a prospectus filed as part of an effective registration statement in reliance upon Rule 430A promulgated by the

Commission pursuant to the Securities Act), as amended or supplemented by any prospectus supplement, with respect to the terms of the

offering of any portion of the Registrable Securities covered by a Registration Statement, and all other amendments and supplements to

the Prospectus, including post-effective amendments, and all material incorporated by reference or deemed to be incorporated by reference

in such Prospectus.

“Registrable

Securities” means, as of any date of determination, (a) all shares issued as the Stock Settlement Portion and (b) any securities

issued or then issuable upon any stock split, dividend or other distribution, recapitalization or similar event with respect to the foregoing;

provided, however, that any such Registrable Securities shall cease to be Registrable Securities (and the Company shall

not be required to maintain the effectiveness of any, or file another, Registration Statement hereunder with respect thereto) for so

long as (a) a Registration Statement with respect to the sale of such Registrable Securities is declared effective by the Commission

under the Securities Act and such Registrable Securities have been disposed of by the Holder in accordance with such effective Registration

Statement, (b) such Registrable Securities have been previously sold in accordance with Rule 144, or (c) such securities become eligible

for resale without volume or manner-of-sale restrictions and without current public information pursuant to Rule 144 as set forth in

a written opinion letter to such effect, addressed, delivered and acceptable to the Transfer Agent and the affected Holders (assuming

that such securities and any securities issuable upon exercise, conversion or exchange of which, or as a dividend upon which, such securities

were issued or are issuable, were at no time held by any Affiliate of the Company, as reasonably determined by the Company, upon the

advice of counsel to the Company.

“Registration

Statement” means any registration statement required to be filed hereunder pursuant to Section 2(a), including the Prospectus,

amendments and supplements to any such registration statement or Prospectus, including pre- and post-effective amendments, all exhibits

thereto, and all material incorporated by reference or deemed to be incorporated by reference in any such registration statement.

“Rule

415” means Rule 415 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted

from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect

as such Rule.

“Rule

424” means Rule 424 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted

from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect

as such Rule.

“Selling

Stockholder Questionnaire” shall have the meaning set forth in Section 3(a).

“SEC

Guidance” means (i) any publicly-available written or oral guidance of the Commission staff, or any comments, requirements

or requests of the Commission staff and (ii) the Securities Act.

2.

Shelf Registration.

(a)

On or prior to the Filing Date, the Company shall prepare and file with the Commission a Registration Statement covering the resale of

all of the Registrable Securities that are not then registered on an effective Registration Statement for an offering to be made on a

continuous basis pursuant to Rule 415. The Registration Statement filed hereunder shall be on Form S-3 or Form S-1 and shall contain

(unless otherwise directed by at least a majority in interest of the Holders) substantially the “Plan of Distribution”

attached hereto as Annex A and substantially the “Selling Stockholder” section attached hereto as Annex B;

provided, however, that no Holder shall be required to be named as an “underwriter” without such Holder’s

express prior written consent. Subject to the terms of this Agreement, the Company shall use its reasonable best efforts to cause a Registration

Statement filed under this Agreement to be declared effective under the Securities Act as promptly as possible after the filing thereof,

but in any event no later than the applicable Effectiveness Date, and shall use its reasonable best efforts to keep such Registration

Statement continuously effective under the Securities Act until the date that all Registrable Securities covered by such Registration

Statement (i) have been sold, thereunder or pursuant to Rule 144, or (ii) may be sold without volume or manner-of-sale restrictions pursuant

to Rule 144 and without the requirement for the Company to be in compliance with the current public information requirement under Rule

144, as determined by the counsel to the Company pursuant to a written opinion letter to such effect, addressed and acceptable to the

Transfer Agent and the affected Holders (the “Effectiveness Period”). The Company shall telephonically request effectiveness

of a Registration Statement as of 5:00 p.m. (New York City time) on a Trading Day. The Company shall promptly notify the Holders via

e-mail of the effectiveness of a Registration Statement on the same Trading Day that the Company telephonically confirms effectiveness

with the Commission, which shall be the date requested for effectiveness of such Registration Statement. The Company shall, by 9:30 a.m.

(New York City time) on the Trading Day after the effective date of such Registration Statement, file a final Prospectus with the Commission

as required by Rule 424. Failure to so notify the Holder within one (1) Trading Day of such notification of effectiveness or failure

to file a final Prospectus as aforesaid shall be deemed an Event under Section 2(c).

(b)

Notwithstanding the registration obligations set forth in Section 2(a), if the Commission informs the Company that all of the Registrable

Securities cannot, as a result of the application of Rule 415, be registered for resale as a secondary offering on a single registration

statement, the Company agrees to promptly inform each of the Holders thereof and use its reasonable best efforts to file amendments to

the Registration Statement as required by the Commission, covering the maximum number of Registrable Securities permitted to be registered

by the Commission, on Form S-3 or Form S-1 or such other form available to register for resale the Registrable Securities as a secondary

offering; provided, however, that prior to filing such amendment, the Company shall be obligated to use diligent efforts

to advocate with the Commission for the registration of all of the Registrable Securities in accordance with the SEC Guidance, including

without limitation, Compliance and Disclosure Interpretation 612.09.

(c)

If: (i) the Registration Statement is not filed on or prior to the Filing Date (if the Company files the Registration Statement without

affording the Holders the opportunity to review and comment on the same as required by Section 3(a) herein, the Company shall be deemed

to have not satisfied this clause (i)), or (ii) the Company fails to file with the Commission a request for acceleration of a Registration

Statement in accordance with Rule 461 promulgated by the Commission pursuant to the Securities Act, within five (5) Trading Days of the

date that the Company is notified (orally or in writing, whichever is earlier) by the Commission that such Registration Statement will

not be “reviewed” or will not be subject to further review, or (iii) prior to the effective date of a Registration Statement,

the Company fails to file a pre-effective amendment and otherwise respond in writing to comments made by the Commission in respect of

such Registration Statement within fifteen (15) calendar days after the receipt of comments by or notice from the Commission that such

amendment is required in order for such Registration Statement to be declared effective, or (iv) a Registration Statement registering

for resale all of the Registrable Securities is not declared effective by the Commission by the Effectiveness Date of the Registration

Statement, or (v) after the effective date of a Registration Statement, such Registration Statement ceases for any reason to remain continuously

effective as to all Registrable Securities included in such Registration Statement, or the Holders are otherwise not permitted to utilize

the Prospectus therein to resell such Registrable Securities, for more than twenty (20) consecutive calendar days or more than an aggregate

of thirty (30) calendar days (which need not be consecutive calendar days) during any 12-month period (any such failure or breach being

referred to as an “Event”, and for purposes of clauses (i) and (iv), the date on which such Event occurs, and for

purpose of clause (ii) the date on which such five (5) Trading Day period is exceeded, and for purpose of clause (iii) the date which

such fifteen (15) calendar day period is exceeded, and for purpose of clause (v) the date on which such twenty (20) or thirty (30) calendar

day period, as applicable, is exceeded being referred to as “Event Date”), then, in addition to any other rights the

Holders may have hereunder or under applicable law, on each such Event Date and on each monthly anniversary of each such Event Date (if

the applicable Event shall not have been cured by such date) until the applicable Event is cured, the Company shall pay to each Holder

an amount in cash, as partial liquidated damages and not as a penalty, equal to the product of 1.0% multiplied by the aggregate value

of such Holder’s pro-rata Stock Settlement Portion of the Total Settlement Amount attributable to such Holder pursuant to the Settlement

Agreement. If the Company fails to pay any partial liquidated damages pursuant to this Section in full within seven (7) days after the

date payable, the Company will pay interest thereon at a rate of 12% per annum (or such lesser maximum amount that is permitted to be

paid by applicable law) to the Holder, accruing daily from the date such partial liquidated damages are due until such amounts, plus

all such interest thereon, are paid in full. The partial liquidated damages pursuant to the terms hereof shall apply on a daily pro rata

basis for any portion of a month prior to the cure of an Event.

(d)

Notwithstanding anything to the contrary contained herein, in no event shall the Company be permitted to name any Holder or affiliate

of a Holder as any Underwriter without the prior written consent of such Holder.

3.

Registration Procedures. In connection with the Company’s registration obligations hereunder, the Company shall:

(a)

Not less than three (3) Trading Days prior to the filing of each Registration Statement and not less than one (1) Trading Day prior to

the filing of any related Prospectus or any amendment or supplement thereto (including any document that would be incorporated or deemed

to be incorporated therein by reference), the Company shall (i) furnish to each Holder copies of all such documents proposed to be filed,

which documents (other than those incorporated or deemed to be incorporated by reference) will be subject to the review of such Holders,

and (ii) cause its officers and directors, counsel and independent registered public accountants to respond to such inquiries as shall

be necessary, in the reasonable opinion of respective counsel to each Holder, to conduct a reasonable investigation within the meaning

of the Securities Act. Each Holder agrees to furnish to the Company a completed questionnaire in customary form (a “Selling

Stockholder Questionnaire”) on a date that is not less than one (1) Trading Day prior to the Filing Date.

(b)

(i) Prepare and file with the Commission such amendments, including post-effective amendments, to a Registration Statement and the Prospectus

used in connection therewith as may be necessary to keep a Registration Statement continuously effective as to the applicable Registrable

Securities for the Effectiveness Period and prepare and file with the Commission such additional Registration Statements in order to

register for resale under the Securities Act all of the Registrable Securities, (ii) cause the related Prospectus to be amended or supplemented

by any required Prospectus supplement (subject to the terms of this Agreement), and, as so supplemented or amended, to be filed pursuant

to Rule 424, (iii) respond as promptly as reasonably possible to any comments received from the Commission with respect to a Registration

Statement or any amendment thereto and provide as promptly as reasonably possible to the Holders true and complete copies of all correspondence

from and to the Commission relating to a Registration Statement (provided that, the Company shall excise any information contained therein

which would constitute material non-public information regarding the Company or any of its Subsidiaries), and (iv) comply in all material

respects with the applicable provisions of the Securities Act and the Exchange Act with respect to the disposition of all Registrable

Securities covered by a Registration Statement during the applicable period in accordance (subject to the terms of this Agreement) with

the intended methods of disposition by the Holders thereof set forth in such Registration Statement as so amended or in such Prospectus

as so supplemented.

(c)

Notify the Holders of Registrable Securities to be sold (which notice shall, pursuant to clauses (iii) through (vi) hereof, be accompanied

by an instruction to suspend the use of the Prospectus until the requisite changes have been made) as promptly as reasonably possible

(and, in the case of (i)(A) below, not less than one (1) Trading Day prior to such filing) and (if requested by any such Person) confirm

such notice in writing no later than one (1) Trading Day following the day (i)(A) when a Prospectus or any Prospectus supplement or post-effective

amendment to a Registration Statement is proposed to be filed, (B) when the Commission notifies the Company whether there will be a “review”

of such Registration Statement and whenever the Commission comments in writing on such Registration Statement, and (C) with respect to

a Registration Statement or any post-effective amendment, when the same has become effective, (ii) of any request by the Commission or

any other federal or state governmental authority for amendments or supplements to a Registration Statement or Prospectus or for additional

information, (iii) of the issuance by the Commission or any other federal or state governmental authority of any stop order suspending

the effectiveness of a Registration Statement covering any or all of the Registrable Securities or the initiation of any Proceedings

for that purpose, (iv) of the receipt by the Company of any notification with respect to the suspension of the qualification or exemption

from qualification of any of the Registrable Securities for sale in any jurisdiction, or the initiation or threatening of any Proceeding

for such purpose, (v) of the occurrence of any event or passage of time that makes the financial statements included in a Registration

Statement ineligible for inclusion therein or any statement made in a Registration Statement or Prospectus or any document incorporated

or deemed to be incorporated therein by reference untrue in any material respect or that requires any revisions to a Registration Statement,

Prospectus or other documents so that, in the case of a Registration Statement or the Prospectus, as the case may be, it will not contain

any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements

therein, in light of the circumstances under which they were made, not misleading, and (vi) of the occurrence or existence of any pending

corporate development with respect to the Company that the Company believes may be material and that, in the determination of the Company,

makes it not in the best interest of the Company to allow continued availability of a Registration Statement or Prospectus; provided,

however, that in no event shall any such notice contain any information which would constitute material, non-public information

regarding the Company or any of its Subsidiaries, and the Company agrees that the Holders shall not have any duty of confidentiality

to the Company or any of its Subsidiaries and shall not have any duty to the Company or any of its Subsidiaries not to trade on the basis

of such information.

(d)

Use its reasonable best efforts to avoid the issuance of, or, if issued, obtain the withdrawal of (i) any order stopping or suspending

the effectiveness of a Registration Statement, or (ii) any suspension of the qualification (or exemption from qualification) of any of

the Registrable Securities for sale in any jurisdiction, at the earliest practicable moment.

(e)

Furnish to each Holder, without charge, at least one conformed copy of each such Registration Statement and each amendment thereto, including

financial statements and schedules, all documents incorporated or deemed to be incorporated therein by reference to the extent requested

by such Person, and all exhibits to the extent requested by such Person (including those previously furnished or incorporated by reference)

promptly after the filing of such documents with the Commission, provided that any such item which is available on the EDGAR system (or

successor thereto) need not be furnished in physical form.

(f)

Subject to the terms of this Agreement, the Company hereby consents to the use of such Prospectus and each amendment or supplement thereto

by each of the selling Holders in connection with the offering and sale of the Registrable Securities covered by such Prospectus and

any amendment or supplement thereto, except after the giving of any notice pursuant to Section 3(c).

(g)

Prior to any resale of Registrable Securities by a Holder, use its commercially reasonable efforts to register or qualify or cooperate

with the selling Holders in connection with the registration or qualification (or exemption from the registration or qualification) of

such Registrable Securities for the resale by the Holder under the securities or Blue Sky laws of such jurisdictions within the United

States as any Holder reasonably requests in writing, to keep each registration or qualification (or exemption therefrom) effective during

the Effectiveness Period and to do any and all other acts or things reasonably necessary to enable the disposition in such jurisdictions

of the Registrable Securities covered by each Registration Statement, provided that the Company shall not be required to qualify generally

to do business in any jurisdiction where it is not then so qualified, subject the Company to any material tax in any such jurisdiction

where it is not then so subject or file a general consent to service of process in any such jurisdiction.

(h)

If requested by a Holder, cooperate with such Holder to facilitate the timely preparation and delivery of certificates representing Registrable

Securities to be delivered to a transferee pursuant to a Registration Statement, which certificates shall be free, to the extent permitted

by the Settlement Agreement, of all restrictive legends, and to enable such Registrable Securities to be in such denominations and registered

in such names as any such Holder may request.

(i)

Upon the occurrence of any event contemplated by Section 3(c), as promptly as reasonably possible under the circumstances taking into

account the Company’s good faith assessment of any adverse consequences to the Company and its stockholders of the premature disclosure

of such event, prepare a supplement or amendment, including a post-effective amendment, to a Registration Statement or a supplement to

the related Prospectus or any document incorporated or deemed to be incorporated therein by reference, and file any other required document

so that, as thereafter delivered, neither a Registration Statement nor such Prospectus will contain an untrue statement of a material

fact or omit to state a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances

under which they were made, not misleading. If the Company notifies the Holders in accordance with

clauses (iii) through (vi) of Section 3(c) above to suspend the use of any Prospectus until the requisite changes to such Prospectus

have been made, then the Holders shall suspend use of such Prospectus. The Company will use its reasonable best efforts to ensure that

the use of the Prospectus may be resumed as promptly as is practicable. The Company shall

be entitled to exercise its right under this Section 3(i) to suspend the availability of a Registration Statement and Prospectus, subject

to the payment of partial liquidated damages otherwise required pursuant to Section 2(c), for a period not to exceed 60 calendar days

(which need not be consecutive days) in any 12-month period.

(j)

Otherwise use commercially reasonable efforts to comply with all applicable rules and regulations of the Commission under the Securities

Act and the Exchange Act, including, without limitation, Rule 172 under the Securities Act, file any final Prospectus, including any

supplement or amendment thereof, with the Commission pursuant to Rule 424 under the Securities Act, promptly inform the Holders in writing

if, at any time during the Effectiveness Period, the Company does not satisfy the conditions specified in Rule 172 and, as a result thereof,

the Holders are required to deliver a Prospectus in connection with any disposition of Registrable Securities and take such other actions

as may be reasonably necessary to facilitate the registration of the Registrable Securities hereunder.

(k)

The Company may require each selling Holder to furnish to the Company a certified statement as to the number of shares of Common Stock

beneficially owned by such Holder and, if required by the Commission, the natural persons thereof that have voting and dispositive control

over the shares. During any periods that the Company is unable to meet its obligations hereunder with respect to the registration of

the Registrable Securities solely because any Holder fails to furnish such information within three Trading Days of the Company’s

request, any liquidated damages that are accruing at such time as to such Holder only shall be tolled and any Event that may otherwise

occur solely because of such delay shall be suspended as to such Holder only, until such information is delivered to the Company.

4.

Registration Expenses. All fees and expenses incident to the performance of or compliance with, this Agreement by the Company

shall be borne by the Company whether or not any Registrable Securities are sold pursuant to a Registration Statement. The fees and expenses

referred to in the foregoing sentence shall include, without limitation, (i) all registration and filing fees (including, without limitation,

fees and expenses of the Company’s counsel and independent registered public accountants) (A) with respect to filings made with

the Commission, (B) with respect to filings required to be made with any Trading Market on which the Common Stock is then listed for

trading, and (C) in compliance with applicable state securities or Blue Sky laws reasonably agreed to by the Company in writing (including,

without limitation, fees and disbursements of counsel for the Company in connection with Blue Sky qualifications or exemptions of the

Registrable Securities), (ii) printing expenses (including, without limitation, expenses of printing certificates for Registrable Securities),

(iii) messenger, telephone and delivery expenses, (iv) fees and disbursements of counsel for the Company, (v) Securities Act liability

insurance, if the Company so desires such insurance, and (vi) fees and expenses of all other Persons retained by the Company in connection

with the consummation of the transactions contemplated by this Agreement. In addition, the Company shall be responsible for all of its

internal expenses incurred in connection with the consummation of the transactions contemplated by this Agreement (including, without

limitation, all salaries and expenses of its officers and employees performing legal or accounting duties), the expense of any annual

audit and the fees and expenses incurred in connection with the listing of the Registrable Securities on any securities exchange as required

hereunder. In no event shall the Company be responsible for any broker or similar commissions of any Holder or any legal fees or other

costs of the Holders.

5.

Indemnification.

(a)

Indemnification by the Company. The Company shall, notwithstanding any termination of this Agreement, indemnify and hold harmless

each Holder, the officers, directors, members, partners, agents, brokers (including brokers who offer and sell Registrable Securities

as principal as a result of a pledge or any failure to perform under a margin call of Common Stock), investment advisors and employees

(and any other Persons with a functionally equivalent role of a Person holding such titles, notwithstanding a lack of such title or any

other title) of each of them, each Person who controls any such Holder (within the meaning of Section 15 of the Securities Act or Section

20 of the Exchange Act) and the officers, directors, members, stockholders, partners, agents and employees (and any other Persons with

a functionally equivalent role of a Person holding such titles, notwithstanding a lack of such title or any other title) of each such

controlling Person, to the fullest extent permitted by applicable law, from and against any and all losses, claims, damages, liabilities,

costs (including, without limitation, reasonable attorneys’ fees) and expenses (collectively, “Losses”), as

incurred, arising out of or relating to (1) any untrue or alleged untrue statement of a material fact contained in a Registration Statement,

any Prospectus or any form of prospectus or in any amendment or supplement thereto or in any preliminary prospectus, or arising out of

or relating to any omission or alleged omission of a material fact required to be stated therein or necessary to make the statements

therein (in the case of any Prospectus or supplement thereto, in light of the circumstances under which they were made) not misleading

or (2) any violation or alleged violation by the Company of the Securities Act, the Exchange Act or any state securities law, or any

rule or regulation thereunder, in connection with the performance of its obligations under this Agreement, except to the extent, but

only to the extent, that (i) such untrue statements or omissions are based solely upon information regarding such Holder furnished in

writing to the Company by such Holder expressly for use therein, or to the extent that such information relates to such Holder or such

Holder’s proposed method of distribution of Registrable Securities and was reviewed and expressly approved in writing by such Holder

expressly for use in a Registration Statement, such Prospectus or in any amendment or supplement thereto (it being understood that the

Holder has approved Annex A hereto for this purpose) or (ii) in the case of an occurrence of an event of the type specified in Section

3(c)(iii)-(vi), the use by such Holder of an outdated, defective or otherwise unavailable Prospectus after the Company has notified such

Holder in writing (or otherwise in accordance with the notice provisions in the Settlement Agreement) that the Prospectus is outdated,

defective or otherwise unavailable for use by such Holder and prior to the receipt by such Holder of the Advice contemplated in Section

6(b). The Company shall notify the Holders promptly of the institution, threat or assertion of any Proceeding arising from or in connection

with the transactions contemplated by this Agreement of which the Company is aware. Such indemnity shall remain in full force and effect

regardless of any investigation made by or on behalf of such indemnified person and shall survive the transfer of any Registrable Securities

by any of the Holders in accordance with Section 6(f).

(b)

Indemnification by Holders. Each Holder shall, severally and not jointly, indemnify and hold harmless the Company, its directors,

officers, agents and employees, each Person who controls the Company (within the meaning of Section 15 of the Securities Act and Section

20 of the Exchange Act), and the directors, officers, agents or employees of such controlling Persons, to the fullest extent permitted

by applicable law, from and against all Losses, as incurred, to the extent arising out of or based solely upon: any untrue or alleged

untrue statement of a material fact contained in any Registration Statement, any Prospectus, or in any amendment or supplement thereto

or in any preliminary prospectus, or arising out of or relating to any omission or alleged omission of a material fact required to be

stated therein or necessary to make the statements therein (in the case of any Prospectus or supplement thereto, in light of the circumstances

under which they were made) not misleading (i) to the extent, but only to the extent, that such untrue statement or omission is contained

in any information so furnished in writing by such Holder to the Company expressly for inclusion in such Registration Statement or such

Prospectus or (ii) to the extent, but only to the extent, that such information relates to such Holder’s information provided in

the Selling Stockholder Questionnaire or the proposed method of distribution of Registrable Securities and was reviewed and expressly

approved in writing by such Holder expressly for use in a Registration Statement (it being understood that the Holder has approved Annex

A hereto for this purpose), such Prospectus or in any amendment or supplement thereto. In no event shall the liability of a selling Holder

be greater in amount than the dollar amount of the proceeds (net of all expenses paid by such Holder in connection with any claim relating

to this Section 5 and the amount of any damages such Holder has otherwise been required to pay by reason of such untrue statement or

omission) received by such Holder upon the sale of the Registrable Securities included in the Registration Statement giving rise to such

indemnification obligation.

(c)

Conduct of Indemnification Proceedings. If any Proceeding shall be brought or asserted against any Person entitled to indemnity

hereunder (an “Indemnified Party”), such Indemnified Party shall promptly notify the Person from whom indemnity is

sought (the “Indemnifying Party”) in writing, and the Indemnifying Party shall have the right to assume the defense

thereof, including the employment of counsel reasonably satisfactory to the Indemnified Party and the payment of all fees and expenses

incurred in connection with defense thereof, provided that the failure of any Indemnified Party to give such notice shall not relieve

the Indemnifying Party of its obligations or liabilities pursuant to this Agreement, except (and only) to the extent that it shall be

finally determined by a court of competent jurisdiction (which determination is not subject to appeal or further review) that such failure

shall have materially and adversely prejudiced the Indemnifying Party.

An

Indemnified Party shall have the right to employ separate counsel in any such Proceeding and to participate in the defense thereof, but

the fees and expenses of such counsel shall be at the expense of such Indemnified Party or Parties unless: (1) the Indemnifying Party

has agreed in writing to pay such fees and expenses, (2) the Indemnifying Party shall have failed promptly to assume the defense of such