false000081033200008103322024-10-152024-10-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 16, 2024 |

Mesa Air Group, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Nevada |

001-38626 |

85-0302351 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

410 North 44th Street, Suite 700 |

|

Phoenix, Arizona |

|

85008 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (602) 685-4000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, no par value |

|

MESA |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 16, 2024, the Company issued a press release announcing its financial and operating results for its quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information in this “Item 2.02 Results of Operations and Financial Condition” section of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Mesa Air Group, Inc. |

|

|

|

|

Date: |

October 16, 2024 |

By: |

/s/ Brian S. Gillman |

|

|

|

Brian S. Gillman

Executive Vice President and General Counsel |

Mesa Air Group Reports Third Quarter Fiscal 2024 Results

October 16, 2024

PHOENIX, October 16, 2024 – Mesa Air Group, Inc. (NASDAQ: MESA) (“Mesa” or the “Company”) today reported third quarter fiscal 2024 financial and operating results.

Third Quarter Fiscal 2024 Update:

•Total operating revenues of $110.8 million, United Express contract revenue 8.0% higher year-over-year

•Pre-tax loss of $20.7 million, net loss of $19.9 million, or $(0.48) per diluted share

•Adjusted net loss of $9.4 million, or $(0.23) per diluted share

•Adjusted EBITDAR1 of $10.6 million

•Operated at a 99.94% controllable completion factor

United CPA and Fleet Update:

•Extended increased block-hour rate on E-175 flying in current United CPA through August 31, 2025

•At United’s request, agreed to accelerate transition of fleet to all E-175s by March 1, 2025

•United to reimburse costs up to $14 million associated with transition

•United to purchase two CRJ-700s formerly leased to a third party for total proceeds of $11.0 million, $4.5 million of which will pay down the related outstanding obligations

•Mesa and United remain in discussions for an enhanced CPA to support long-term profitability

Additional Updates:

•During June quarter, entered agreements to sell 23 CF34-8C engines for total proceeds of $33.5 million, $29.0 million of which will pay down U.S. Treasury debt

•Completed all asset transactions to eliminate RASPRO finance lease obligation

•Generated $9.6 million from sale of approximately 2.3 million common shares of Archer Aviation, Inc. (“Archer”), originally acquired for $5.0 million, with Mesa still retaining up to approximately 1.17 million unvested equity warrants in Archer

“While we were pleased to experience an 8.0% increase in United Express contract revenue, our third-quarter block-hours were negatively impacted by a lag as we removed CRJ-900s from our contractual fleet and trained pilots to fly our E-175s,” said Jonathan Ornstein, Chairman and CEO. “We generated positive adjusted EBITDAR for the second straight quarter given improving fleet mix and cost control. We continue to monetize our surplus assets and will direct proceeds toward reducing the related obligations and, as a result, interest expense. We were modestly operating cash flow-positive during the third quarter.

“Importantly, we have extended the increased block-hour rate in our CPA with United into next year. United has also agreed to reimburse Mesa for expenses associated with the transition to fully flying E-175 aircraft. The updated financial terms and our ongoing planning with United is critical as we rebuild our E-175 fleet utilization and margin runway through fiscal year 2025. We currently have the pilot resources to fly increased E-175 block hours, and have started the process of recalling pilots from furlough in anticipation of improved aircraft utilization.

“While we are not yet providing a forecast for fiscal year 2025, our focus continues to be on increasing utilization and maintaining overall operational performance,” continued Ornstein. “As we transition into flying all E-175s, we will look to drive additional efficiencies from operating a single fleet type. We will also continue to consider longer-term financial and strategic opportunities to enhance the business.”

Third Quarter Fiscal 2024 Details

Total operating revenues in Q3 2024 were $110.8 million, a decrease of $3.9 million, or 3.4%, from $114.7 million for Q3 2023. Contract revenue increased $1.2 million, or 1.3%, to $95.6 million, compared to $94.4 million in Q3 2023, driven by higher E-175 block-hour rates with United Airlines despite 3.3% fewer block hours. This increase was partially offset by higher deferred revenue in Q3 2024 and the wind-down of the DHL contract.

Pass-through revenue decreased by $5.1 million, or 25.3%, driven by lower pass-through maintenance expense. Mesa’s Q3 2024 results include, per GAAP, the deferral of $2.3 million in revenue, versus the recognition of $1.8 million of previously deferred revenue in Q3 2023. The remaining deferred revenue balance of $12.4 million will be recognized as flights are completed over the remaining term of the United contract.

Total operating expenses in Q3 2024 were $119.8 million, a decrease of $35.1 million, or 22.7%, versus Q3 2023. This decrease primarily reflects a $22.6 million lower asset impairment loss. In addition, maintenance expense decreased by $6.8 million primarily due to lower labor and pass-through costs, and flight operations expense was $6.1 million lower due to decreases in pilot wages and training costs. Depreciation and amortization expense decreased $5.6 million primarily due to the retirement and sale of CRJ aircraft and engines.

Mesa’s Q3 2024 results reflect a net loss of $19.9 million, or $(0.48) per diluted share, compared to a net loss of $47.6 million, or $(1.17) per diluted share, for Q3 2023. Mesa’s Q3 2024 adjusted net loss was $9.4 million, or $(0.23) per diluted share, versus an adjusted net loss of $27.2 million, or $(0.67) per diluted share, in Q3 2023.

Mesa’s adjusted EBITDA1 for Q3 2024 was $8.9 million, compared to an adjusted EBITDA loss of $1.8 million for Q3 2023. Adjusted EBITDAR was $10.6 million for Q3 2024, compared to an adjusted EBITDAR loss of $0.9 million for Q3 2023.

Third Quarter Fiscal 2024 Operating Performance

Operationally, the Company reported a controllable completion factor of 99.94% for United during Q3 2024. This is compared to a controllable completion factor of 98.83% for United during Q3 2023. Controllable completion factor excludes cancellations due to weather and air traffic control.

For Q3 2024, approximately 98% of the Company’s total revenue was derived from its contract with United. The Company’s CPA with United provided for 73 large (70/76 seats) jets, comprising a mix of E-175s and CRJ-900s. In Q3 2024, Mesa’s fleet mix comprised 55 E-175s and 18 CRJ-900s.

Balance Sheet and Liquidity

Mesa ended the June quarter with $16.3 million in unrestricted cash and cash equivalents. As of June 30, 2024, the Company had $366.4 million in total debt, secured primarily with aircraft and engines, compared to a balance of $577.5 million as of June 30, 2023. During the quarter, the Company made $22.3 million of debt payments related to CRJ engine sale transactions, $3.9 million in scheduled debt payments, and $5.0 million in principal payments associated with the restructuring of finance leases.

As of September 30, 2024, Mesa had $15.4 million in unrestricted cash and cash equivalents. Based on the most recent appraisal value of spare parts, Mesa had $12.4 million in available credit under its United facility, subject to approval.

About Mesa Air Group, Inc.

Headquartered in Phoenix, Arizona, Mesa Air Group, Inc. is the holding company of Mesa Airlines, a regional air carrier providing scheduled passenger service to 65 cities in 33 states, the District of Columbia, Cuba, and Mexico. As of September 30, 2024, Mesa operated a fleet of 67 aircraft, with approximately 260 daily departures. The Company had approximately 1,838 employees. Mesa operates all its flights as United Express pursuant to the terms of a capacity purchase agreement entered into with United Airlines, Inc.

Important Cautions Regarding Forward-Looking Statements

This Press Release includes information that constitutes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”, “believe”, “may”, “might”, “will”, “should”, “can have”, “likely” and similar expressions are used to identify forward-looking statements. These forward-looking statements are based on the Company’s current beliefs, assumptions, and expectations regarding future events, which in turn are based on information currently available to the Company. By their nature, forward-looking statements address matters that are subject to risks and uncertainties. A variety of factors could cause actual events and results to differ materially from those expressed in or contemplated by the forward-looking statements. These factors include, without limitation, the Company’s ability to respond in a timely and satisfactory matter to the inquiries by Nasdaq, the Company’s ability to regain compliance with Listing Rule, the Company’s ability to become current with its reports with the SEC, and the risk that the completion and filing of the Form 10-Qs will take longer than expected. For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to the Company’s filings with the SEC, including the risk factors contained in its most recent Annual Report on Form 10-K and the Company’s other subsequent filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by applicable laws.

Contact:

Mesa Air Group, Inc.

Media

media@mesa-air.com

Investor Relations

investor.relations@mesa-air.com

MESA AIR GROUP, INC.

Consolidated Statements of Operations and Comprehensive (Loss) Income

(In thousands, except per share amounts) (Unaudited)

|

|

|

|

|

|

|

Three months ended June 30, |

|

Nine months ended June 30, |

|

2024 |

2023 |

|

2024 |

2023 |

Operating revenues: |

|

|

|

|

|

Contract revenue |

$ 95,596 |

$ 94,356 |

|

$ 310,516 |

$ 326,588 |

Pass-through and other revenue |

15,197 |

20,335 |

|

50,636 |

57,111 |

Total operating revenues |

110,793 |

114,691 |

|

361,152 |

383,699 |

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

Flight operations |

45,445 |

51,557 |

|

146,602 |

164,707 |

Maintenance |

44,266 |

51,072 |

|

137,165 |

145,344 |

Aircraft rent |

1,684 |

864 |

|

4,296 |

5,782 |

General and administrative |

9,715 |

11,346 |

|

32,857 |

38,872 |

Depreciation and amortization |

9,730 |

15,316 |

|

32,846 |

47,060 |

Asset impairment |

7,880 |

30,489 |

|

50,923 |

50,951 |

Loss/(Gain) on sale of assets |

— |

(6,722) |

|

150 |

(7,271) |

Other operating expenses |

1,090 |

999 |

|

5,098 |

2,358 |

Total operating expenses |

119,820 |

154,921 |

|

409,937 |

447,803 |

Operating loss |

(9,027) |

(40,230) |

|

(48,785) |

(64,104) |

|

|

|

|

|

|

Other income (expense), net: |

|

|

|

|

|

Interest expense |

(9,032) |

(12,015) |

|

(30,832) |

(36,321) |

Interest income |

17 |

8 |

|

45 |

128 |

(Loss)/Gain on investments |

(776) |

— |

|

6,454 |

— |

Unrealized (Loss)/Gain on investments, net |

(2,025) |

2,859 |

|

(6,073) |

3,275 |

Gain on extinguishment of debt |

— |

— |

|

2,954 |

— |

Gain on debt forgiveness |

— |

— |

|

10,500 |

— |

Other income (expense), net |

125 |

(946) |

|

(234) |

(540) |

Total other expense, net |

(11,691) |

(10,094) |

|

(17,186) |

(33,458) |

Loss before taxes |

(20,718) |

(50,324) |

|

(65,971) |

(97,562) |

Income tax expenses (benefit) |

(810) |

(2,764) |

|

126 |

(5,791) |

Net loss |

$ (19,908) |

$ (47,560) |

|

$ (66,097) |

$ (91,771) |

|

|

|

|

|

|

Net loss per share attributable to common shareholders |

|

|

|

|

|

Basic |

$ (0.48) |

$ (1.17) |

|

$ (1.61) |

$ (2.35) |

Diluted |

$ (0.48) |

$ (1.17) |

|

$ (1.61) |

$ (2.35) |

|

|

|

|

|

|

Weighted-average common shares outstanding |

|

|

|

|

|

Basic |

41,217 |

40,688 |

|

41,075 |

38,986 |

Diluted |

41,217 |

40,688 |

|

41,075 |

38,986 |

MESA AIR GROUP, INC.

Consolidated Balance Sheets

(In thousands, except shares) (Unaudited)

|

|

|

|

|

|

|

June 30, 2024 |

|

September 30, 2023 |

ASSETS |

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

|

$ 16,302 |

|

$ 32,940 |

Restricted cash |

|

2,983 |

|

3,132 |

Marketable securities |

|

5,442 |

|

— |

Receivables, net |

|

5,953 |

|

8,253 |

Expendable parts and supplies, net |

|

30,652 |

|

29,245 |

Assets held for sale |

|

20,151 |

|

57,722 |

Prepaid expenses and other current assets |

|

3,425 |

|

7,294 |

Total current assets |

|

84,908 |

|

138,586 |

|

|

|

|

|

Property and equipment, net |

|

497,914 |

|

698,022 |

Lease and equipment deposits |

|

1,289 |

|

1,630 |

Operating lease right-of-use assets |

|

7,247 |

|

9,709 |

Deferred heavy maintenance, net |

|

7,209 |

|

7,974 |

Assets held for sale |

|

57,229 |

|

12,000 |

Other assets |

|

8,569 |

|

30,546 |

TOTAL ASSETS |

|

$ 664,365 |

|

$ 898,467 |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Current portion of long-term debt and finance leases |

|

$ 72,769 |

|

$ 163,550 |

Current portion of deferred revenue |

|

4,443 |

|

4,880 |

Current maturities of operating leases |

|

2,212 |

|

3,510 |

Accounts payable |

|

64,409 |

|

58,957 |

Accrued compensation |

|

11,180 |

|

10,008 |

Other accrued expenses |

|

32,481 |

|

27,001 |

Total current liabilities |

|

187,494 |

|

267,906 |

|

|

|

|

|

NONCURRENT LIABILITIES: |

|

|

|

|

Long-term debt and finance leases, excluding current portion |

|

287,749 |

|

364,728 |

Noncurrent operating lease liabilities |

|

6,412 |

|

8,077 |

Deferred credits |

|

3,275 |

|

4,617 |

Deferred income taxes |

|

8,059 |

|

8,414 |

Deferred revenue, net of current portion |

|

7,963 |

|

16,167 |

Other noncurrent liabilities |

|

28,526 |

|

28,522 |

Total noncurrent liabilities |

|

341,984 |

|

430,525 |

Total liabilities |

|

529,478 |

|

698,431 |

|

|

|

|

|

STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

Common stock of no par value and additional paid-in capital, 125,000,000 shares authorized; 41,312,204 (2024) and 40,940,326 (2023) shares issued and outstanding, 4,899,497 (2024) and 4,899,497 (2023) warrants issued and outstanding |

|

272,104 |

|

271,155 |

Accumulated deficit |

|

(137,217) |

|

(71,119) |

Total stockholders' equity |

|

134,887 |

|

200,036 |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ 664,365 |

|

$ 898,467 |

MESA AIR GROUP, INC.

Operating Highlights

(Unaudited)

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

June 30, |

|

|

2024 |

|

2023 |

|

Change |

Available seat miles (thousands) |

|

962,669 |

|

1,002,945 |

|

(4.0)% |

Block hours |

|

43,813 |

|

45,301 |

|

(3.3)% |

Average stage length (miles) |

|

535 |

|

555 |

|

(3.6)% |

Departures |

|

24,144 |

|

24,555 |

|

(1.7)% |

Passengers |

|

1,513,581 |

|

1,500,634 |

|

0.9% |

Controllable completion factor* |

|

|

|

|

|

|

United |

|

99.94% |

|

98.83% |

|

1.1% |

Total completion factor** |

|

|

|

|

|

|

United |

|

96.86% |

|

96.39% |

|

0.5% |

*Controllable completion factor excludes cancellations due to weather and air traffic control

**Total completion factor includes all cancellations

Reconciliation of non-GAAP financial measures

Although these financial statements are prepared in accordance with accounting principles generally accepted in the U.S. ("GAAP"), certain non-GAAP financial measures may provide investors with useful information regarding the underlying business trends and performance of Mesa's ongoing operations and may be useful for period-over-period comparisons of such operations. The tables below reflect supplemental financial data and reconciliations to GAAP financial statements for the three and nine months ended June 30, 2024 and June 30, 2023. Readers should consider these non-GAAP measures in addition to, not a substitute for, financial reporting measures prepared in accordance with GAAP. These non-GAAP financial measures exclude some, but not all items that may affect the Company's net income or loss. Additionally, these calculations may not be comparable with similarly titled measures of other companies.

1Reconciliation of GAAP versus non-GAAP Disclosures

(In thousands, except for per diluted share) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

|

Three Months Ended June 30, 2023 |

|

Income (Loss) Before Taxes |

Income Tax (Expense) Benefit |

Net Income (Loss) |

Net Income (Loss) per Diluted Share |

|

Income (Loss) Before Taxes |

Income Tax (Expense) Benefit |

Net Income (Loss) |

Net Income (Loss) per Diluted Share |

|

|

|

|

|

|

|

|

|

|

GAAP income (loss) |

$ (20,718) |

$ 810 |

$ (19,908) |

$ (0.48) |

|

$ (50,324) |

$ 2,764 |

$ (47,560) |

$ (1.17) |

Adjustments(1)(2)(3)(4)(5)(6)(7) (8) |

10,921 |

(427) |

10,494 |

$ 0.25 |

|

21,239 |

(884) |

20,355 |

$ 0.50 |

Adjusted loss |

(9,797) |

383 |

(9,414) |

$ (0.23) |

|

(29,085) |

1,880 |

(27,205) |

$ (0.67) |

|

|

|

|

|

|

|

|

|

|

Interest expense |

9,032 |

|

|

|

12,015 |

|

|

Interest income |

(17) |

|

|

|

|

(8) |

|

|

|

Depreciation and amortization |

9,730 |

|

|

|

|

15,316 |

|

|

|

Adjusted EBITDA |

8,948 |

|

|

|

|

(1,762) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Aircraft rent |

1,684 |

|

|

|

|

864 |

|

|

|

Adjusted EBITDAR |

$ 10,632 |

|

|

|

|

$ (898) |

|

|

|

(1) $6.7 million gain from the sale of 20 engines during the three months ended June 30, 2023.

(2) $0.3 million loss on deferred financing costs related to retirement of debts during the three months ended June 30, 2023.

(3) $5.7 million and $30.5 million loss on held for sale accounting treatment during the three months ended June 30, 2024 and 2023, respectively.

(4) $2.0 million loss and $2.9 million gain resulting from changes in the fair value of the Company's investments in equity securities during the three months ended June 30, 2024 and 2023, respectively.

(5) $0.8 million loss on the transfer of investments in equity securities during the three months ended June 30, 2024.

(6) $2.2 million impairment fair value adjustment gain on 737 inventory during the three months ended June 30, 2024.

(7) $4.3 million impairment true-up loss on held for sale accounting treatment during the three months ended June 30, 2024.

(8) $0.2 million in non-recurring third party costs associated with the sale of assets during the three months ended June 30, 2024.

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended June 30, 2024 |

|

Nine Months Ended June 30, 2023 |

|

Income (Loss) Before Taxes |

Income Tax (Expense) Benefit |

Net Income (Loss) |

Net Income (Loss) per Diluted Share |

|

Income (Loss) Before Taxes |

Income Tax (Expense) Benefit |

Net Income (Loss) |

Net Income (Loss) per Diluted Share |

GAAP income (loss) |

$ (65,971) |

$ (126) |

$ (66,097) |

$ (1.61) |

|

$ (97,562) |

$5,791 |

$(91,771) |

$ (2.35) |

Adjustments(1)(2)(3)(4)(5)(6)(7) (8)(9)(10)(11) |

43,138 |

82 |

43,220 |

$ 1.05 |

|

41,398 |

(2,459) |

38,939 |

$ 1.00 |

Adjusted income loss |

(22,833) |

(44) |

(22,877) |

$ (0.56) |

|

(56,164) |

3,332 |

(52,832) |

$ (1.36) |

|

|

|

|

|

|

|

|

|

|

Interest expense |

30,832 |

|

|

|

36,321 |

|

|

Interest income |

(45) |

|

|

|

|

(128) |

|

|

|

Depreciation and amortization |

32,846 |

|

|

|

|

47,060 |

|

|

|

Adjusted EBITDA |

40,800 |

|

|

|

|

27,089 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Aircraft rent |

4,296 |

|

|

|

|

5,782 |

|

|

|

Adjusted EBITDAR |

$45,096 |

|

|

|

|

$32,871 |

|

|

|

(1) $3.7 million impairment loss on intangible asset during the nine months ended June 30, 2023.

(2) $51.3 million and $47.2 million impairment loss on held for sale accounting treatment during the nine months ended June 30, 2024 and 2023, respectively.

(3) $0.2 million loss and $7.3 million gain from the sale of assets during the nine months ended June 30, 2024 and 2023, respectively.

(4) $1.5 million and $1.0 million loss on deferred financing costs related to retirement of debts during the nine months ended June 30, 2024 and 2023, respectively.

(5) $6.1 million loss and $3.4 million gain resulting from changes in the fair value of the Company's investments in equity securities during the nine months ended June 30, 2024 and 2023, respectively.

(6) $6.5 million gain on the transfer of investments in equity securities during the nine months ended June 30, 2024.

(7) $10.5 million gain on debt forgiveness during the nine months ended June 30, 2024.

(8) $0.9 million loss for early payment fees on the retirement of debt during the nine months ended June 30, 2024.

(9) $3.2 million in non-recurring third party costs associated with the sale of assets and retirement of debt during the nine months ended June 30, 2024.

(10) $0.4 million impairment true-up gain on held for sale accounting treatment during the nine months ended June 30, 2024.

(11) $3.0 million gain on extinguishment of debt during the nine months ended June 30, 2024.

Source: Mesa Air Group, Inc.

v3.24.3

Document And Entity Information

|

Oct. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 16, 2024

|

| Entity Registrant Name |

Mesa Air Group, Inc.

|

| Entity Central Index Key |

0000810332

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38626

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Tax Identification Number |

85-0302351

|

| Entity Address, Address Line One |

410 North 44th Street

|

| Entity Address, Address Line Two |

Suite 700

|

| Entity Address, City or Town |

Phoenix

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85008

|

| City Area Code |

(602)

|

| Local Phone Number |

685-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre commencement Tender Offer |

false

|

| Pre commencement Issuer Tender Offer |

false

|

| Security 12b Title |

Common Stock, no par value

|

| Trading Symbol |

MESA

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

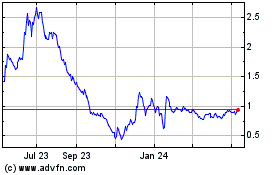

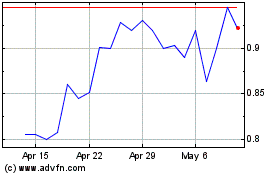

Mesa Air (NASDAQ:MESA)

Historical Stock Chart

From Nov 2024 to Nov 2024

Mesa Air (NASDAQ:MESA)

Historical Stock Chart

From Nov 2023 to Nov 2024