Securities Registration: Employee Benefit Plan (s-8)

November 09 2021 - 4:31PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on November 9, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MERCURY SYSTEMS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts

|

|

04-2741391

|

|

(State of Incorporation)

|

|

(I.R.S. Employer Identification Number)

|

50 Minuteman Road

Andover, Massachusetts 01810

(978) 256-1300

(Address of Principal Executive Offices)

MERCURY SYSTEMS, INC.

Amended and Restated 2018 Stock Incentive Plan

(Full Title of the Plan)

Christopher C. Cambria

Executive Vice President, General Counsel, and Secretary

Mercury Systems, Inc.

50 Minuteman Road

Andover, Massachusetts 01810

(978) 256-1300

(Name, Address and Telephone Number, Including Area Code, of Agent for Service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer [X]

|

|

Accelerated filer

|

|

|

|

|

Non-accelerated filer

|

|

Smaller reporting company

|

|

|

|

|

|

Emerging growth company

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities to be Registered

|

|

|

|

Amount

to be

Registered (1)(2)

|

|

|

|

Proposed

Maximum

Offering Price

Per Share (3)

|

|

|

|

Proposed

Maximum

Aggregate Offering

Price (3)

|

|

|

|

Amount of

Registration Fee (3)

|

|

Common Stock

|

|

|

|

28,775

|

|

|

|

$50.29

|

|

|

|

$1,447,094.75

|

|

|

|

$134.15

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers an indeterminate number of additional shares of Common Stock to be offered or sold as a result of the anti-dilution provisions of the employee benefit plan described herein, including to prevent dilution resulting from any reorganization, recapitalization, reclassification, stock dividend, stock split, or other similar change.

|

|

(2)

|

28,775 shares of the registrant’s Common Stock listed were part of the shares previously registered by the registrant on Form S-8 (File No. 333-217735 filed on May 5, 2017) in connection with the registrant’s Amended and Restated 2005 Stock Incentive Plan.

|

|

(3)

|

Calculated in accordance with Rule 457(c) and (h) under the Securities Act solely for the purpose of determining the amount of the registration fee, based on the average of the high and low prices of our Common Stock on the Nasdaq Global Select Market on November 3, 2021.

|

|

|

|

|

EXPLANATORY NOTE

This Registration Statement is being filed solely for the purpose of registering 28,775 additional shares of common stock, par value $0.01 per share (“Common Stock”), of Mercury Systems, Inc. (the “Company”) to be offered to participants under the Company’s Amended and Restated 2018 Stock Incentive Plan (the “2018 Plan”). The number of shares of Common Stock reserved for issuance under the 2018 Plan includes 6,781,597 shares which were previously registered with the Securities and Exchange Commission (the “Commission”) on Forms S-8 (File Nos. 333-228617 filed on November 30, 2018, 333-234534 filed on November 6, 2019, and 333-250039 filed on November 12, 2020) (the “Prior Registration Statements”), plus the number of shares underlying any grants previously made under the Company’s Amended and Restated 2005 Stock Incentive Plan (the “2005 Plan”) that are forfeited, canceled, or are terminated (other than by exercise) from and after the effective date of the 2018 Plan.

All 28,775 shares registered hereby have been included in the shares reserved for issuance under the 2018 Plan as a result of the forfeiture, cancellation, or termination (other than by exercise) of grants previously made under the 2005 Plan.

This Registration Statement relates to securities of the same class as that to which the Prior Registration Statements relate, and is submitted in accordance with General Instruction E to Form S-8 regarding Registration of Additional Securities. Pursuant to General Instruction E of Form S-8, the contents of the Prior Registration Statements, to the extent relating to the registration of Common Stock issuable under the 2018 Plan, are incorporated herein by reference and made part of this Registration Statement, except as amended hereby.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE.

The following documents are incorporated herein by reference:

|

|

|

|

|

|

|

|

(a)

|

The Company’s Annual Report on Form 10-K for the fiscal year ended July 2, 2021, as filed with the Commission on August 17, 2021;

|

|

(b)

|

The Company’s Definitive Proxy Statement on Schedule 14A, as filed with the Commission on September 9, 2021, as amended by the Revised Definitive Proxy Soliciting Materials on Schedule DEFR 14A filed with the Commission on September 14, 2021, to the extent specifically incorporated by reference into the Company’s Annual Report on Form 10-K for the fiscal year ended July 2, 2021;

|

|

(c)

|

The Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended October 1, 2021, as filed with the Commission on November 9, 2021;

|

|

(d)

|

The Company’s Current Reports on Form 8-K filed with the Commission on August 3, 2021 (Items 2.05 and 5.02 only) and November 1, 2021; and

|

|

(e)

|

The description of the Company’s Common Stock contained in the Company’s Registration Statement on Form 8-A dated January 7, 1998, as updated by Exhibit 4.2 to the Company’s Annual Report on Form 10-K for the fiscal year ended July 3, 2020, as filed with the Commission on August 18, 2020.

|

All documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Securities Exchange Act of 1934, as amended, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or that deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part hereof from the date of the filing of such documents.

ITEM 5. INTERESTS OF NAMED EXPERTS AND COUNSEL.

The validity of the Common Stock offered under this Registration Statement will be passed upon for the Company by Morgan, Lewis & Bockius LLP, Boston, Massachusetts. Morgan, Lewis & Bockius LLP does not have a substantial interest, direct or indirect, in the Company.

ITEM 8. EXHIBITS.

See the Exhibit Index attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the Town of Andover, the Commonwealth of Massachusetts on this 9th day of November, 2021.

MERCURY SYSTEMS, INC.

By: /s/ Michael D. Ruppert

Michael D. Ruppert

Executive Vice President, Chief Financial Officer, and Treasurer

Power of Attorney

KNOW ALL MEN BY THESE PRESENTS that each person whose signature appears below constitutes and appoints Mark Aslett, Christopher C. Cambria, and Michael D. Ruppert as his or her true and lawful attorneys-in-fact and agents, each acting alone, with full powers of substitution and resubstitution, for him or her or in his or her name, place and stead, in any and all capacities to sign any and all amendments or post-effective amendments to this Registration Statement (or any Registration Statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933), and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, each acting alone, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, each acting alone, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

Signature

|

Title

|

Date

|

|

/s/ Mark Aslett

Mark Aslett

|

President, Chief Executive Officer, and Director (Principal Executive Officer)

|

November 9, 2021

|

|

/s/ Michael D. Ruppert

Michael D. Ruppert

|

Executive Vice President, Chief Financial Officer, and Treasurer (Principal Financial Officer)

|

November 9, 2021

|

|

/s/ Michelle M. McCarthy

Michelle M. McCarthy

|

Vice President, Chief Accounting Officer (Principal Accounting Officer)

|

November 9, 2021

|

|

/s/ William K. O’Brien

William K. O’Brien

|

Chairman of the Board of Directors

|

November 9, 2021

|

|

/s/ James K. Bass

James K. Bass

|

Director

|

November 9, 2021

|

|

/s/ Orlando P. Carvalho

Orlando P. Carvalho

|

Director

|

November 9, 2021

|

|

/s/ Michael A. Daniels

Michael A. Daniels

|

Director

|

November 9, 2021

|

|

/s/ Lisa S. Disbrow

Lisa S. Disbrow

|

Director

|

November 9, 2021

|

|

/s/ Mary Louise Krakauer

Mary Louise Krakauer

|

Director

|

November 9, 2021

|

|

/s/ Barry R. Nearhos

Barry R. Nearhos

|

Director

|

November 9, 2021

|

|

/s/ Debora A. Plunkett

Debora A. Plunkett

|

Director

|

November 9, 2021

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

Exhibit

|

Description

|

|

4.1

|

|

|

4.2

|

|

|

4.3

|

|

|

4.4

|

|

|

4.5

|

|

|

4.6

|

|

|

4.7

|

|

|

5.1*

|

|

|

23.1*

|

|

|

23.2

|

Consent of Morgan, Lewis & Bockius LLP (contained in the opinion filed as Exhibit 5.1 to this Registration Statement)

|

|

24.1

|

Power of Attorney (included in signature page to this Registration Statement)

|

|

*

|

Filed herewith

|

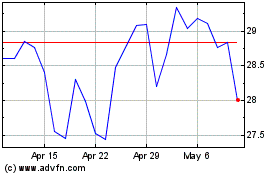

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

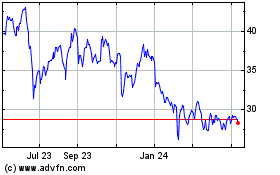

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Apr 2023 to Apr 2024