Luther Burbank Corp.0001475348false00014753482023-07-252023-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 25, 2023

Luther Burbank Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

California (State or other jurisdiction of incorporation or organization) | 001-38317 (Commission file number) | 68-0270948 (I.R.S. employer identification number) |

| | |

520 Third St, Fourth Floor, Santa Rosa, California (Address of principal executive offices) | | 95401 (Zip code) |

|

Registrant's telephone number, including area code: (844) 446-8201 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities Registered Pursuant to Section 12(b) of the Act |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common stock, no par value | | LBC | | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On July 25, 2023, Luther Burbank Corporation (the "Company") issued a press release, a copy of which is attached as Exhibit 99.1 to this Current Report on Form 8-K ("Current Report") and is incorporated herein by reference.

The information furnished under Item 2.02 and Item 9.01 of this Current Report, including Exhibit 99.1 to this Current Report, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to liabilities under that Section, nor shall it be deemed incorporated by reference in any registration statement or other filings of the Company under the Securities Act of 1933, as amended, except as shall be set forth by specific reference in such filing.

Item 5.08 Shareholder Director Nominations.

To the extent applicable, the information in Item 8.01 of this Current Report is incorporated by reference into this Item 5.08.

Item 8.01 Other Events.

On July 25, 2023, the Board of Directors of the Company (the "Board") determined that the Company’s 2023 annual meeting of shareholders (the “Annual Meeting”) will be held on October 24, 2023, which is more than 30 days after the anniversary of the Company's 2022 annual meeting of shareholders. The Annual Meeting does not relate to the pending merger transaction with Washington Federal, Inc. (“WAFD”). The Company will not hold the Annual Meeting if the WAFD merger transaction is completed prior to the date of the Annual Meeting. The time and location for the Annual Meeting will be set forth in the Company’s proxy statement for the Annual Meeting, which will be made available to shareholders prior to the Annual Meeting. Pursuant to Rule 14a-5(f) of the Exchange Act, the Company is hereby providing notice of the revised deadlines for shareholder proposals by means of this Form 8-K.

Due to the fact that the date of the Annual Meeting has been changed by more than 30 days from the anniversary date of the Company's 2022 annual meeting of shareholders, the Company is providing the due date for submission of any qualified shareholder proposal or qualified shareholder nominations. In order for a shareholder proposal for the Annual Meeting to be eligible for inclusion in the Company’s proxy statement pursuant to Securities and Exchange Commission (“SEC”) Rule 14a-8, the Company must have received the proposal and supporting statements at its principal executive offices no later than the close of business on August 4, 2023, which the Board has determined is a reasonable time before the Company begins to print and send its proxy materials. A shareholder must provide its proposal to the Company in writing, and it must comply with the requirements of Rule 14a-8 under the Exchange Act. Any such proposals should be sent to the attention of the corporate secretary of the Company at Luther Burbank Corporation, 520 Third St, 4th Floor, Santa Rosa, California 95401.

In addition, in accordance with the advanced notice requirements set forth in the Company's Bylaws, any shareholder wishing to nominate a candidate for director or propose other business at the Annual Meeting must send written notice to the Company’s corporate secretary at the address specified above no later than the close of business on August 4, 2023. Any such proposal must meet the requirements set forth in the Company’s Bylaws in order to be brought before the Annual Meeting.

In addition to the notice and information requirements contained in the Company’s Bylaws, to comply with the SEC universal proxy rules, shareholders who, in connection with the Annual Meeting, intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice to the Company that sets forth the information required by Rule 14a-19 under the Exchange Act no later than August 25, 2023.

Shareholder proposals that do not satisfy these requirements may, but need not (other than matters properly brought under Rule 14a-8 under the Exchange Act and included in the Company's notice of meeting), be considered and discussed but not acted upon at the Annual Meeting.

If the WAFD merger transaction is completed before we hold the Annual Meeting, such Annual Meeting will not occur and any director candidates or proposals submitted, even in accordance with applicable SEC rules or our Bylaws, will not be considered by our shareholders.

Item 9.01. Financial Statements and Exhibits

| | | | | |

| Exhibit Number | Description |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | LUTHER BURBANK CORPORATION |

| | |

| DATED: July 25, 2023 | | By: /s/ Laura Tarantino |

| | Laura Tarantino |

| | Executive Vice President and Chief Financial Officer |

LUTHER BURBANK CORPORATION REPORTS EARNINGS

FOR THE QUARTER AND SIX MONTHS ENDED JUNE 30, 2023

| | |

Second Quarter 2023 Highlights |

•Net income of $6.9 million, or $0.14 per diluted share

•Net interest margin of 1.27%

•Return on average assets and equity of 0.33% and 3.94%, respectively

•Noninterest expense to average assets of 0.76%

•Deposits increased 3% to $5.8 billion

•Estimated uninsured deposits of $997.8 million, or 17.1% of total deposits

•On-balance sheet liquidity plus borrowing capacity of more than 3 times uninsured deposits

•Nonperforming assets to total assets of 0.06%

•Book value per share of $13.71

•Tangible book value per share of $13.64 (1)

| | | | | | | | | | | | | |

| | |

| As of or For the Three Months Ended (2) | |

| (Dollars in thousands, except per share amounts) | June 30,

2023 | March 31,

2023 | June 30,

2022 | | |

| Performance Ratios | | | | | |

| Return on average assets | 0.33% | 0.67% | 1.23% | | |

| Return on average equity | 3.94% | 7.78% | 13.41% | | |

| Net interest margin | 1.27% | 1.72% | 2.62% | | |

Efficiency ratio (1) | 59.18% | 48.08% | 27.86% | | |

| Income Statement | | | | | |

| Net interest income | $26,320 | $33,986 | $47,472 | | |

| Net income | $6,917 | $13,442 | $22,567 | | |

Pre-tax, pre-provision net earnings (1) | $11,107 | $18,287 | $34,509 | | |

| Diluted earnings per share | $0.14 | $0.26 | $0.44 | | |

| | | | | |

| Balance Sheet | | | | | |

| Total loans | $6,920,994 | $7,023,479 | $6,637,829 | | |

| Total deposits | $5,840,439 | $5,649,494 | $5,668,759 | | |

| Net charge-off ratio | —% | —% | —% | | |

| Nonperforming assets to total assets | 0.06% | 0.06% | 0.07% | | |

| Capital | | | | | |

| Tier 1 leverage ratio | 9.40% | 9.73% | 10.20% | | |

| Book value per share | $13.71 | $13.64 | $13.15 | | |

Tangible book value per share (1) | $13.64 | $13.58 | $13.09 | | |

| Growth in tangible book value per share | 0.47% | 2.09% | 1.22% | | |

| Dividend declared per share | $— | $— | $0.12 | | |

| | | | | |

(1) See "Non-GAAP Reconciliation" table | | |

(2) Unaudited | | |

SANTA ROSA, Calif. (July 25, 2023) – Luther Burbank Corporation (NASDAQ: LBC) (the “Company”), the holding company for Luther Burbank Savings (the “Bank”), today reported net income of $6.9 million and $20.4 million, or $0.14 and $0.40 diluted earnings per common share (“EPS”), for the quarter and six months ended June 30, 2023, respectively.

| | | | | | | | |

| | |

| 520 Third Street, Fourth Floor, Santa Rosa, CA 95401 | Contact: | Bradley Satenberg |

| | Investor Relations |

| | (844) 446-8201 |

| | investorrelations@lbsavings.com |

Simone Lagomarsino, President and Chief Executive Officer, stated, “Our financial results for the second quarter are reflective of our liability sensitive balance sheet and the impact from the unprecedented rise in interest rates over the past 16 months. As a result of the increase in our cost of funds, our net interest margin and earnings have continued to compress. Although market competition is fierce and the price of attracting deposits is high, I am encouraged that our customer deposit activity seems to have returned to a more normalized level as concerns regarding instability within the industry appear to have dissipated. As compared to the prior quarter, deposits increased by $190.9 million, or 3%, to $5.8 billion at June 30, 2023 and uninsured deposits declined to $997.8 million, or 17.1% of our total deposits. At the same time, loans declined by $102 million, or 1%, which included loan production totaling $69.8 million. Slowing loan volume was anticipated and represents both a moderation in customer demand due to rising interest rates and our desire to obtain a reasonable spread over current elevated funding costs."

Ms. Lagomarsino continued, "My expectation is that both our margin and earnings will not improve until short-term interest rates begin to decline, and/or a significant amount of our loans reprice. As I mentioned last quarter, future changes in our cost of funds are extremely difficult to forecast and will likely be driven by competitive market conditions. We continued to maintain strong on-balance sheet liquidity with a liquid assets to total assets ratio of 15.24%. Our credit quality remains exceptionally strong, with our ratio of nonperforming assets to total assets of 0.06%, at quarter end. Our board of directors and our senior leadership remain vigilant in prudently navigating our organization through these significant, prolonged headwinds and continuing to deliver long-term value to our shareholders.”

| | |

| Liquidity and Borrowing Capacity |

As a result of the bank failures this year, we continue to closely monitor our liquidity levels to ensure that we are well-positioned for any deposit volatility. At June 30, 2023, our on-balance sheet liquidity was $161.8 million greater as compared to the prior quarter, primarily through an increase in deposits. We have pledged substantially all of our loans and investment portfolio to the Federal Home Loan Bank of San Francisco ("FHLB") and Federal Reserve Bank of San Francisco ("FRB") for liquidity contingency planning. Although the Bank has access to an aggregate borrowing capacity of $1.2 billion under FRB's Bank Term Funding Program and discount window, we have not utilized either line during the current year. At the end of the quarter, our total on-balance sheet liquidity and borrowing capacity, as shown below, represented 337% of our uninsured deposit balances. As of June 30, 2023, we maintained the following liquidity position:

| | | | | | | | | | | | | | |

| (Dollars in thousands) | | June 30, 2023 | | % of Assets |

| Unrestricted cash & cash equivalents | | $ | 699,366 | | 8.37% |

| Unpledged liquid securities | | 32,765 | | 0.39% |

Unutilized brokered deposit capacity(1) | | 298,785 | | 3.57% |

Unutilized FHLB borrowing capacity(2)(3) | | 1,123,450 | | 13.44% |

Unutilized FRB borrowing capacity(2) | | 1,162,693 | | 13.91% |

| Commercial lines of credit | | 50,000 | | 0.60% |

| Total liquidity | | $ | 3,367,059 | | 40.28% |

(1) Capacity based on internal guidelines.

(2) Capacity based on pledged collateral specific to the FHLB or FRB, as applicable.

(3) Availability to borrow from the FHLB is permitted up to 40% of the Bank assets or $3.3 billion, subject to collateral capacity. At June 30, 2023, we had $1.6 billion and $62.6 million in outstanding advances and letters of credit with the FHLB, respectively.

The Company reported net income of $6.9 million, or $0.14 EPS, for the three months ended June 30, 2023 compared to net income of $13.4 million, or $0.26 EPS, for the linked quarter. Pre-tax, pre-provision net earnings totaled $11.1 million for the three months ended June 30, 2023 compared to $18.3 million for the linked quarter.

Net Interest Income

Net interest income in the second quarter of 2023 was $26.3 million, a decrease of $7.7 million from the first quarter, primarily due to higher interest expense on our deposit portfolio and FHLB advances, partially offset by higher interest income on cash and cash equivalents and loans. The increase in interest expense on deposits was due to an increase in the interest rate paid on deposits, while the increase in interest expense on FHLB advances was due to both an

increase in the average balance of, and interest rate on, FHLB advances. As compared to the linked quarter, the cost of interest bearing deposits increased by 65 basis points and the average balance and cost of FHLB advances increased by $313.1 million and 50 basis points, respectively. The improvement in interest income on cash and cash equivalents was primarily due to an increase in average balances and, to a lesser extent, the average yield, while the increase in loan interest income was due to an increase in the average interest rate of loans. The average balance and yield of cash and cash equivalents increased $391.7 million and 47 basis points, respectively, and the yield on our loan portfolio increased 9 basis points during the second quarter.

As of June 30, 2023, the Company held swaps with an aggregate notional amount of $1.5 billion, carrying a weighted average fixed payment rate of 3.57%, while receiving a federal funds weighted average rate of 5.08%. The Company's swaps provide a hedge against the interest rate risk associated with hybrid adjustable loans in their fixed period, as well as a pool of fixed rate single family loans. The net hedging impact associated with our swaps is reported in interest income on loans. During the quarters ended June 30 and March 31, 2023, interest income earned on these swaps totaled $8.0 million and $8.2 million, respectively.

Net interest margin for the second quarter of 2023 was 1.27% compared to 1.72% for the previous quarter. The decrease in our net interest margin reflects the net impact of an increase in the cost of interest bearing liabilities, partially offset by an increase in the yield on interest earning assets. During the second quarter, the cost of our interest bearing liabilities increased by 61 basis points due to an increase in the cost of our deposits and FHLB advances, while the yield on our interest earning assets increased by 14 basis points primarily due to an increase in our yields on cash and cash equivalents and loans. Our net interest spread in the second quarter was 0.98%, a decrease of 47 basis points as compared to the linked quarter.

Noninterest Income

Noninterest income for the second quarter of 2023 was $891 thousand, a decrease of $344 thousand compared to the first quarter. The decrease was primarily attributable to a decrease in the fair value of equity securities during the current quarter compared to the prior quarter. Changes in fair value are primarily attributable to changes in market interest rates.

Noninterest income primarily consists of FHLB stock dividends, fair value adjustments on equity securities and fee income.

Noninterest Expense

Noninterest expense for the second quarter of 2023 was $16.1 million, a decrease of $830 thousand compared to the linked quarter. The decrease was predominantly due to a $553 thousand decrease in compensation costs primarily due to a decline in the required accrual for post-retirement benefits due to rising long-term interest rates during the period, partially offset by a decline in capitalized loan origination costs due to lower loan origination volume. During the current quarter, the Company further reduced its workforce by approximately 10%, predominantly impacting our loan production team. The financial benefit of this reduction will be reflected in future quarters. Noninterest expense was also positively impacted by a $512 thousand decline in costs incurred in connection with our previously announced merger with Washington Federal, Inc. ("Washington Federal") compared to the prior quarter. Our efficiency ratio was 59.2% for the quarter ended June 30, 2023 compared to 48.1% for the previous quarter and was impacted by the decline in net interest income and noninterest income, partially offset by the decrease in noninterest expense.

Noninterest expense primarily consists of compensation costs, as well as expenses incurred related to occupancy, depreciation and amortization, data processing, marketing, professional services and merger related costs.

Total assets at June 30, 2023 were $8.4 billion, an increase of $385.4 million, or 4.8%, from December 31, 2022. The increase was primarily due to a $513.5 million increase in cash and cash equivalents as compared to the prior year end, partially offset by a $89.5 million decline in loans. Total liabilities were $7.7 billion at quarter end, an increase of $368.6 million, or 5.1%, from December 31, 2022. The increase in total liabilities was primarily attributable to a $368.5 million increase in FHLB advances.

Loans

Total loans at June 30, 2023 were $6.9 billion, a decrease of 1.3% compared to the prior year end. The change in loans

during the six months ended June 30, 2023 was primarily attributable to loan prepayments exceeding loan originations. Loan production has slowed substantially during the first half of 2023. During the year to date period, loan prepayments totaled $253.3 million while loan origination volume totaled $160.1 million. Our loan portfolio generally consists of income property loans ("IPL") and single family residential ("SFR") mortgage loans, which represent 66.3% and 33.4%, respectively, of our total loan portfolio. Our IPL portfolio primarily consists of hybrid-adjustable rate multifamily residential and nonresidential commercial real estate loans and totaled $4.6 billion and $4.7 billion at June 30, 2023 and December 31, 2022, respectively. Our SFR loan portfolio totaled $2.3 billion, as of both the same dates, and consisted primarily of hybrid-adjustable rate loans representing 86.5% and 85.9% of the total as of June 30, 2023 and December 31, 2022, respectively. The remaining portion of our SFR loan portfolio primarily consisted of 30-year fixed rate loans.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Selected Loan Data (1) | | As of or For the Three Months Ended | | As of or For the Six Months Ended |

| (Dollars in thousands) | | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Loan Yield |

| IPL Portfolio | | 4.56% | | 4.36% | | 3.74% | | 4.46% | | 3.75% |

| SFR Loan Portfolio | | 3.84% | | 4.03% | | 2.94% | | 3.93% | | 2.76% |

| Loan Originations | | | | | | | |

| IPL Portfolio | | $18,994 | | $23,380 | | $501,584 | | $42,374 | | $813,131 |

| SFR Loan Portfolio | | $50,825 | | $66,927 | | $231,383 | | $117,752 | | $483,347 |

Weighted Average Coupon on Loan Originations |

| IPL Portfolio | | 6.02% | | 6.11% | | 3.39% | | 6.07% | | 3.35% |

| SFR Loan Portfolio | | 7.06% | | 6.53% | | 3.90% | | 6.76% | | 3.39% |

| Prepayment Speeds |

| IPL Portfolio | | 6.49% | | 2.97% | | 24.01% | | 4.74% | | 22.90% |

| SFR Loan Portfolio | | 5.61% | | 6.79% | | 25.57% | | 6.20% | | 32.40% |

| Weighted Average Months to Repricing |

| IPL Portfolio | | 30.7 | | 32.6 | | 36.8 | | 30.7 | | 36.8 |

| SFR Loan Portfolio | | 78.4 | | 81.2 | | 91.4 | | 78.4 | | 91.4 |

| | | | | | | | | | |

(1) This table excludes loan data related to construction loans, which are an insignificant component of our loan portfolio. |

During the three months ended June 30, 2023, the Company's internal production of new loans was $69.8 million, a decrease of $20.5 million, or 22.7%, as compared to the linked quarter. Declining loan originations are primarily attributable to slowing demand resulting from the general rise in interest rates, coupled with our desire to achieve a risk adjusted return on new loan volume in light of the high cost of new funding. During the quarter, the weighted average coupon on SFR loan originations increased 53 basis points compared to the linked quarter due to the recent rises in interest rates, while the weighted average coupon on IPL loan originations decreased by 9 basis points. This decline was primarily due to the composition of loans originated during the current quarter, which generally consisted of shorter fixed term hybrid loans as compared to the linked quarter.

During the current quarter, IPL yields increased 20 basis points compared to the prior quarter primarily due to a $1.6 million increase in income earned on IPL related interest rate swaps. IPL prepayment speeds remained low during the current quarter as higher interest rates have slowed purchase and refinance activity. The weighted average interest rate on the prepayment and other principal reduction of IPL loans was 5.20% and 4.55% for the quarters ended June 30, 2023 and March 31, 2023, respectively.

During the three months ended June 30, 2023, SFR portfolio yields decreased by 19 basis points compared to the linked quarter due to a $1.8 million decline in income earned on related interest rate swaps, partially offset by the origination of new loans at higher rates throughout the current year and the last half of the prior year. The decline in swap income was attributable to the maturity of a SFR designated swap in February 2023. Consistent with the IPL discussion above, SFR loan portfolio prepayment speeds remained low during the current quarter due to high market interest rates. The weighted average interest rate on the prepayment and other principal reduction of SFR loans was 4.35% and 4.28% for the quarters ended June 30, 2023 and March 31, 2023, respectively.

At June 30, 2023, our entire loan portfolio was secured by real estate collateral and 97% of our loan balances financed multifamily residential ("MFR") or SFR loans having a weighted average loan-to-value ("LTV") of 58.8%. Our MFR portfolio primarily supports workforce housing and, at the end of the current quarter, had an average loan balance of $1.6 million, with a weighted average debt service coverage ratio of 1.6 times and supporting collateral averaging 13.6 housing units. At June 30, 2023, the SFR portfolio had an average loan balance of $907 thousand and a weighted average borrower credit score at origination/refresh of 759. Our exposure to nonresidential commercial real estate is limited and, at June 30, 2023, had an average loan balance of $2.2 million and a weighted average debt service coverage ratio of 1.7 times. Additional detail is provided within the table below as of June 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | Count | | Balance | | Weighted Average LTV | | % of Total Loans |

| Multifamily Real Estate | | 2,709 | | $ | 4,428,226 | | 56.2% | | 64.0% |

| Single Family Real Estate | | 2,550 | | 2,308,912 | | 64.0% | | 33.4% |

| Commercial Real Estate Type: | | | | | | | | |

| Mid Rise Office | | 7 | | 37,445 | | 62.1% | | 0.5% |

| Strip Retail | | 13 | | 23,081 | | 50.1% | | 0.3% |

| Medical Office | | 5 | | 18,389 | | 58.8% | | 0.3% |

| Shopping Center | | 5 | | 17,837 | | 56.3% | | 0.3% |

| Unanchored Retail | | 8 | | 14,469 | | 44.1% | | 0.2% |

| Anchored Retail | | 3 | | 11,420 | | 50.4% | | 0.2% |

| Low rise office | | 7 | | 11,324 | | 51.6% | | 0.2% |

| More than 50% commercial | | 10 | | 10,798 | | 47.3% | | 0.2% |

| Multi-Tenant Industrial | | 5 | | 6,925 | | 41.2% | | 0.1% |

| Shadow Retail | | 3 | | 3,897 | | 61.1% | | 0.1% |

| Flex Industrial | | 2 | | 2,354 | | 60.7% | | 0.0% |

| Warehouse | | 3 | | 2,336 | | 43.9% | | 0.0% |

| Restaurant | | 2 | | 1,242 | | 25.8% | | 0.0% |

| Other | | 1 | | 71 | | 13.6% | | 0.0% |

| Commercial Real Estate | | 74 | | 161,588 | | 53.7% | | 2.3% |

Construction (1) | | 7 | | 22,268 | | 55.4% | | 0.3% |

| Total | | 5,340 | | $ | 6,920,994 | | 58.7% | | 100.0% |

(1) Construction LTV is calculated based on an "as-completed" property value. Undisbursed commitments for construction loans totaled $11.1 million at June 30, 2023.

Asset Quality

Nonperforming assets totaled $5.0 million, or 0.06% of total assets, at June 30, 2023, compared to $6.5 million, or 0.08% of total assets, at December 31, 2022. The decrease in nonperforming assets was primarily due to two SFR loans returning to performing status during the first quarter. Classified loans, which includes loans graded Substandard and of greater risk, totaled $18.3 million and $18.9 million at June 30, 2023 and December 31, 2022, respectively. Criticized loans, which includes loans graded Special Mention and classified loans, were $21.3 million at June 30, 2023 compared to $22.3 million at December 31, 2022. As of June 30, 2023 and December 31, 2022, we had no real estate owned and we have not foreclosed on any collateral since 2015.

The Company adopted the Current Expected Credit Losses ("CECL") methodology on January 1, 2023 using the modified retrospective method. Results for reporting periods beginning January 1, 2023 are reported under the CECL methodology, while prior period results continue to be reported under previously applicable U.S. generally accepted accounting principles ("GAAP"). During the three months ended June 30, 2023, the Company recorded loan loss provisions of $1.3 million, compared to recaptured loan loss provisions of $679 thousand during the three months ended March 31, 2023. The provision recorded during the current quarter was primarily related to forecasted declines in multifamily property values. The reversal during the prior quarter was predominantly due to the reversal of a specific reserve previously established on a collateral dependent loan. Our allowance for credit losses on loans to total loans was 0.54% at June 30, 2023 compared to 0.51% and 0.52% at March 31, 2023 and December 31, 2022, respectively.

Investments

Investments totaled $577.7 million and $620.8 million at June 30, 2023 and December 31, 2022, respectively. Our investment portfolio is generally comprised of U.S. government agency securities, with over 97.9% classified as available for sale ("AFS"). The unrealized losses in the Company's AFS and held to maturity portfolios were $52.8 million and $232 thousand, respectively, and represented 8.38% and 0.04%, respectively, of the total amortized cost of our investment portfolio at June 30, 2023. Unrealized losses in our AFS portfolio are reported in our stockholders' equity, net of any tax impact. Over 62% of our AFS securities portfolio consisted of floating rate securities with an average repricing period of approximately 14 months. The following table summarizes the amortized cost and the estimated fair value of our investment portfolio as of June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value |

| Available for sale: | | | | | | | |

| Government and Government Sponsored Entities: | | | | | | | |

| Commercial MBS and CMOs | $ | 344,433 | | | $ | 187 | | | $ | (28,714) | | | $ | 315,906 | |

| Residential MBS and CMOs | 210,898 | | | 10 | | | (23,618) | | | 187,290 | |

| Agency bonds | 38,698 | | | 91 | | | (136) | | | 38,653 | |

| Other ABS | 23,066 | | | — | | | (641) | | | 22,425 | |

| Total available for sale | 617,095 | | | 288 | | | (53,109) | | | 564,274 | |

| Held to maturity: | | | | | | | |

| Government Sponsored Entities: | | | | | | | |

| Residential MBS | 2,996 | | | — | | | (232) | | | 2,764 | |

| Other investments | 57 | | | — | | | — | | | 57 | |

| Total held to maturity | 3,053 | | | — | | | (232) | | | 2,821 | |

| Equity securities | 10,340 | | | — | | | — | | | 10,340 | |

| Total investment securities | $ | 630,488 | | | $ | 288 | | | $ | (53,341) | | | $ | 577,435 | |

Prepaid Expenses and Other Assets

Prepaid expenses and other assets totaled $140.9 million at June 30, 2023 compared to $147.8 million at December 31, 2022, a decrease of $6.9 million, or 4.7%.

Prepaid expenses and other assets primarily consist of bank-owned life insurance, other investments, prepaid expenses, accrued interest receivable, lease right-of-use assets, fair value adjustments on derivatives and tax related items.

Deposits

Deposits totaled $5.8 billion at both June 30, 2023 and December 31, 2022. Retail deposits decreased $120.3 million, while brokered deposits increased $121.4 million from December 31, 2022. The decline in retail deposits during the year to date period was primarily in money market savings accounts, partially offset by increases in time deposits. Consequently, the proportion of non-maturity deposits within the portfolio decreased to 35.9% at June 30, 2023 compared to 46.3% at December 31, 2022, while our portfolio of time deposits increased to 64.1% at June 30, 2023 from 53.7% at December 31, 2022. Retail deposit declines began after the events of mid-March and resulted in large first quarter outflows which were partially offset by increases during the second quarter as retail deposit activity normalized. The increase in brokered deposits was utilized to offset the decline in our retail deposits and further supplement our liquidity position. Our cost of interest bearing deposits was 3.30% during the quarter ended June 30, 2023 compared to 2.65% during the linked quarter. The increase in our cost of interest bearing deposits compared to the prior quarter was predominantly due to interest rate increases in both retail and brokered deposits.

Estimated uninsured deposits represented 17.1% and 22.5% of total deposits as of June 30, 2023 and December 31, 2022, respectively. The following table summarizes our deposit composition by source and segregates balances between estimated insured and uninsured for each deposit category as of the same dates.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| (Dollars in thousands) | | Insured | | Uninsured | | Insured | | Uninsured |

| Consumer | | $ | 3,359,071 | | $ | 828,474 | | $ | 3,090,797 | | $ | 931,454 |

| Business | | 906,244 | | 169,369 | | 981,692 | | 379,560 |

| Brokered | | 577,281 | | — | | 455,837 | | — |

| Total deposits | | $ | 4,842,596 | | $ | 997,843 | | $ | 4,528,326 | | $ | 1,311,014 |

FHLB Advances

FHLB advances totaled $1.6 billion and $1.2 billion at June 30, 2023 and December 31, 2022, respectively. The increase in FHLB advances was primarily utilized to supplement our liquidity in response to the unexpected bank closures in March 2023 and offset the declines in retail deposits, discussed above. At June 30, 2023, the weighted average interest rate and weighted average remaining maturity of FHLB advances outstanding was 3.34% and 1.5 years, respectively, compared to 2.64% and 1.7 years, respectively, at December 31, 2022. The increase in the weighted average interest rate was due to the general rise in interest rates.

Other Liabilities

Other liabilities totaled $86.9 million at June 30, 2023 compared to $88.0 million at December 31, 2022, a decrease of $1.0 million, or 1.2%.

Other liabilities primarily consist of accrued employee benefits, loan escrow balances, checks outstanding, lease liabilities, low income housing tax credit investment commitments, fair value adjustments for derivatives, accrued interest payable and the allowance for credit losses on unfunded commitments and other off-balance sheet exposures.

Capital

As of June 30, 2023, the Company was in compliance with all applicable regulatory capital requirements and the Bank qualified as ‘‘well-capitalized’’ for purposes of the FDIC’s prompt corrective action regulations, as summarized in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2023 | | March 31,

2023 | | June 30,

2022 | | Minimum Required For Capital Adequacy Purposes | | Minimum Required For Well- Capitalized Institution |

| (Dollars in thousands, unaudited) | | Capital

Ratio | Excess Capital (2) | | Capital

Ratio | | Capital

Ratio | | Capital

Ratio | | Capital

Ratio |

| Luther Burbank Corporation | | | | | |

| Tier 1 Leverage Ratio | | 9.40 | % | $456,768 | | | 9.73 | % | | 10.20 | % | | 4.00% | | N/A |

| Common Equity Tier 1 Risk-Based Ratio | | 17.95 | % | 447,545 | | | 17.18 | % | | 16.74 | % | | 7.00 | % | | N/A |

| Tier 1 Risk-Based Capital Ratio | | 19.47 | % | 448,121 | | | 18.64 | % | | 18.24 | % | | 8.50 | % | | N/A |

| Total Risk-Based Capital Ratio | | 20.39 | % | 404,219 | | | 19.50 | % | | 19.12 | % | | 10.50 | % | | N/A |

| Total Equity to Total Assets | | 8.37 | % | N/A | | 8.38 | % | | 8.92 | % | | N/A | | N/A |

Tangible Stockholders' Equity to Tangible Assets (1) | | 8.33 | % | N/A | | 8.35 | % | | 8.88 | % | | N/A | | N/A |

| Luther Burbank Savings | | | | | |

| Tier 1 Leverage Ratio | | 10.33 | % | $450,914 | | | 10.73 | % | | 11.31 | % | | 4.00% | | 5.00 | % |

| Common Equity Tier 1 Risk-Based Ratio | | 21.41 | % | 588,270 | | | 20.56 | % | | 20.23 | % | | 7.00 | % | | 6.50 | % |

| Tier 1 Risk-Based Capital Ratio | | 21.41 | % | 527,033 | | | 20.56 | % | | 20.23 | % | | 8.50 | % | | 8.00 | % |

| Total Risk-Based Capital Ratio | | 22.34 | % | 483,190 | | | 21.42 | % | | 21.10 | % | | 10.50 | % | | 10.00 | % |

| | | | | | | | | | | |

(1) See "Non-GAAP Reconciliation" table |

(2) Excess capital is based on the Basel III capital minimums including the capital conservation buffer, with the exception of Tier 1 Leverage Ratios, which are based on the regulatory requirements of 4.00% and 5.00% for the Company and the Bank, respectively. |

|

The Company's stockholders’ equity totaled $699.3 million at June 30, 2023, an increase of $16.8 million, or 2.5%, compared to December 31, 2022. The increase in stockholders' equity was primarily due to net income of $20.4 million, partially offset by unrealized losses on securities of $3.3 million during the six months ended June 30, 2023.

Given the pending merger with Washington Federal, and the desire to preserve capital in the current economic environment, the Company’s Board of Directors is continuing to suspend quarterly cash dividends.

About Luther Burbank Corporation

Luther Burbank Corporation is a publicly owned company traded on the NASDAQ Capital Market under the symbol “LBC.” The Company is headquartered in Santa Rosa, California with total assets of $8.4 billion, total loans of $6.9 billion and total deposits of $5.8 billion as of June 30, 2023. It operates primarily through its wholly-owned subsidiary, Luther Burbank Savings, an FDIC insured, California-chartered bank. Luther Burbank Savings executes on its mission to improve the financial future of customers, employees and shareholders by providing personal banking and business banking services. It offers consumers a host of competitive depository and mortgage products coupled with personalized attention. Business customers benefit from boutique-quality service along with access to products which meet their unique financial needs from the convenience of online and mobile banking, robust cash management solutions, and high-yield liquidity management products to multifamily and commercial real estate lending. Currently operating in the western United States, from ten branches in California, one branch in Washington and lending offices located throughout the market area, Luther Burbank Savings is an equal housing lender. For additional information, please visit lutherburbanksavings.com.

Cautionary Statements Regarding Forward-Looking Information

This communication and the related management commentary contain, and responses to investor questions may contain, forward-looking statements. These forward-looking statements are based on current expectations, estimates and projections about our industry, management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control and involve a number of risks and uncertainties. Accordingly, we caution you that any such forward-looking statement is not a guarantee of future performance and that actual results may prove to be materially different from the results expressed or implied by the forward-looking statements due to a number of factors, including, but not limited to, the following: interest rate, liquidity, economic, market, credit, operational, inflation risks associated with our business or industry, including the speed and predictability of changes in these risks; our ability to retain deposits and attract new deposits and loans and the composition and terms of such deposits and loans; our access to adequate sources of liquidity; business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic markets, including the tight labor market, ineffective management of the U.S. Federal budget or debt, bank failures or turbulence or uncertainty in domestic or foreign financial markets; any failure to adequately manage the transition from LIBOR as a reference rate; changes in the level of our nonperforming assets and charge-offs; the adequacy of our allowance for credit losses; our management of risks inherent in our real estate loan portfolio, including the seasoning of the portfolio, the level of non-conforming loans, the number of large borrowers, and the risk of a prolonged downturn in the real estate market; significant market concentrations in California and Washington; the occurrence of significant natural or man-made disasters (including fires, earthquakes and terrorist acts), severe weather events, health crises and other catastrophic events; climate change, including any enhanced regulatory, compliance, credit and reputational risks and costs; political instability or the effects of war or other conflicts, including, but not limited to, the current conflict between Russia and Ukraine, as well as civil unrest in Sudan; the announced merger with Washington Federal, including delays in the consummation of the merger or litigation or other conditions that may cause the parties to abandon the merger or make the merger more expensive or less beneficial; the impact that the announced merger may have on our ability to attract and retain customers and key personnel, the value of our shares, our expenses, and/or our ability to conduct our business in the ordinary course and execute on our strategies; the performance of our third-party vendors; fraud, financial crimes and fund transfer errors; failures, interruptions, cybersecurity incidents and data breaches involving the our data, technology and systems and those of our customers and third-party providers; rapid technological changes in the financial services industry; any inadequacy in our risk management framework or use of data and/or models; the laws and regulations applicable to our business, and the impact of recent and future legislative and regulatory changes; changing bank regulatory conditions, policies or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks generally, or our subsidiary bank in particular, more restrictive regulatory capital requirements, increased costs, including deposit insurance premiums, regulation or prohibition of certain income producing activities or changes in the secondary market for loans and other products; our involvement from time to time in legal proceedings and examinations and remedial actions by regulators; increased competition in the financial services industry; and changes in our reputation. Other factors include, without

limitation, those listed in our annual report on Form 10-K for the year ended December 31, 2022, including under the caption “Risk Factors” in Item 1A of Part I, subsequent Quarterly Reports on Form 10-Q and other reports or filings we file or make with the SEC. You should not place undue reliance on any of these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Non-GAAP Financial Measures

This news release and related management commentary contain financial measures that are not measures recognized under GAAP, and, therefore, are considered non-GAAP financial measures, including pre-tax, pre-provision net earnings, efficiency ratio, liquidity ratio, tangible assets, tangible stockholders’ equity, tangible book value per share and tangible stockholders’ equity to tangible assets. Our management uses these non-GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations. We believe that these non-GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods and other companies, as well as demonstrate the effects of significant changes in the current period. We also believe that investors find these non-GAAP financial measures useful as they assist investors in understanding our underlying operating performance and the analysis of ongoing operating trends. However, we acknowledge that our non-GAAP financial measures have a number of limitations. You should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other banking companies use. Other banking companies may use names similar to those we use for the non-GAAP financial measures we disclose, but may calculate them differently. You should understand how we and other companies each calculate non-GAAP financial measures when making comparisons. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are provided in the tables below.

Investor Relations

(844) 446-8201

investorrelations@lbsavings.com

###

| | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS | | |

| | | | | |

| (Dollars in thousands) | June 30,

2023 (unaudited) | | December 31,

2022 | | |

| ASSETS | | | | | |

| | | | | |

| | | | | |

| Cash and cash equivalents | $ | 699,366 | | | $ | 185,895 | | | |

| Available for sale debt securities, at fair value | 564,274 | | | 607,348 | | | |

| Held to maturity debt securities, at amortized cost | 3,053 | | | 3,108 | | | |

| Equity securities, at fair value | 10,340 | | | 10,340 | | | |

| | | | | |

| Loans | 6,920,994 | | | 7,010,445 | | | |

| | | | | |

| Allowance for credit losses on loans | (37,214) | | | (36,685) | | | |

| Total loans, net | 6,883,780 | | | 6,973,760 | | | |

| FHLB stock | 45,146 | | | 32,694 | | | |

| Premises and equipment, net | 13,199 | | | 13,661 | | | |

| | | | | |

| | | | | |

| | | | | |

| Prepaid expenses and other assets | 140,912 | | | 147,826 | | | |

| Total assets | $ | 8,360,070 | | | $ | 7,974,632 | | | |

| | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

| Liabilities: | | | | | |

| Deposits | $ | 5,840,439 | | | $ | 5,839,340 | | | |

| FHLB advances | 1,576,647 | | | 1,208,147 | | | |

| Junior subordinated deferrable interest debentures | 61,857 | | | 61,857 | | | |

| Senior debt | 94,846 | | | 94,785 | | | |

| | | | | |

| | | | | |

| Other liabilities | 86,934 | | | 87,967 | | | |

| Total liabilities | 7,660,723 | | | 7,292,096 | | | |

| Total stockholders' equity | 699,347 | | | 682,536 | | | |

| Total liabilities and stockholders' equity | $ | 8,360,070 | | | $ | 7,974,632 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED INCOME STATEMENTS (UNAUDITED) | | | | |

| | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| (Dollars in thousands except per share data) | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Interest and fee income: | | | | | | | | | |

| Loans | $ | 76,014 | | | $ | 74,604 | | | $ | 56,912 | | | $ | 150,618 | | | $ | 110,545 | |

| Investment securities | 5,613 | | | 5,488 | | | 2,863 | | | 11,101 | | | 5,163 | |

| Cash and cash equivalents | 8,623 | | | 3,303 | | | 198 | | | 11,926 | | | 265 | |

| Total interest income | 90,250 | | | 83,395 | | | 59,973 | | | 173,645 | | | 115,973 | |

| Interest expense: | | | | | | | | | |

| Deposits | 47,717 | | | 37,607 | | | 6,913 | | | 85,324 | | | 12,933 | |

| FHLB advances | 13,630 | | | 9,262 | | | 3,628 | | | 22,892 | | | 6,725 | |

| Junior subordinated deferrable interest debentures | 1,008 | | | 966 | | | 385 | | | 1,974 | | | 660 | |

| Senior debt | 1,575 | | | 1,574 | | | 1,575 | | | 3,149 | | | 3,149 | |

| Total interest expense | 63,930 | | | 49,409 | | | 12,501 | | | 113,339 | | | 23,467 | |

| Net interest income before provision for credit losses | 26,320 | | | 33,986 | | | 47,472 | | | 60,306 | | | 92,506 | |

| Provision for (reversal of) credit losses | 1,212 | | | (795) | | | 2,500 | | | 417 | | | — | |

| Net interest income after provision for credit losses | 25,108 | | | 34,781 | | | 44,972 | | | 59,889 | | | 92,506 | |

| Noninterest income | 891 | | | 1,235 | | | 362 | | | 2,126 | | | 420 | |

| Noninterest expense | 16,104 | | | 16,934 | | | 13,325 | | | 33,038 | | | 28,837 | |

| Income before provision for income taxes | 9,895 | | | 19,082 | | | 32,009 | | | 28,977 | | | 64,089 | |

| Provision for income taxes | 2,978 | | | 5,640 | | | 9,442 | | | 8,618 | | | 18,582 | |

| Net income | $ | 6,917 | | | $ | 13,442 | | | $ | 22,567 | | | $ | 20,359 | | | $ | 45,507 | |

| Basic earnings per common share | $ | 0.14 | | | $ | 0.26 | | | $ | 0.44 | | | $ | 0.40 | | | $ | 0.89 | |

| Diluted earnings per common share | $ | 0.14 | | | $ | 0.26 | | | $ | 0.44 | | | $ | 0.40 | | | $ | 0.89 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (UNAUDITED) | | | | |

| | | |

| As of or For the Three Months Ended | | For the Six Months Ended |

| (Dollars in thousands except per share data) | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| PERFORMANCE RATIOS | | | | | | | | | |

| Return on average: | | | | | | | | | |

| Assets | 0.33 | % | | 0.67 | % | | 1.23 | % | | 0.49 | % | | 1.25 | % |

| Stockholders' equity | 3.94 | % | | 7.78 | % | | 13.41 | % | | 5.85 | % | | 13.50 | % |

Efficiency ratio (1) | 59.18 | % | | 48.08 | % | | 27.86 | % | | 52.92 | % | | 31.03 | % |

| Noninterest expense to average assets | 0.76 | % | | 0.84 | % | | 0.72 | % | | 0.80 | % | | 0.79 | % |

| Loan to deposit ratio | 118.50 | % | | 124.32 | % | | 117.09 | % | | 118.50 | % | | 117.09 | % |

| Average stockholders' equity to average assets | 8.33 | % | | 8.59 | % | | 9.15 | % | | 8.45 | % | | 9.27 | % |

| Dividend payout ratio | — | % | | — | % | | 27.15 | % | | — | % | | 27.14 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| YIELDS/RATES | | | | | | | | | |

| Yield on loans | 4.35 | % | | 4.26 | % | | 3.50 | % | | 4.31 | % | | 3.46 | % |

| Yield on investments | 3.77 | % | | 3.57 | % | | 1.76 | % | | 3.67 | % | | 1.59 | % |

| Yield on interest earning assets | 4.36 | % | | 4.22 | % | | 3.31 | % | | 4.29 | % | | 3.23 | % |

| Cost of interest bearing deposits | 3.30 | % | | 2.65 | % | | 0.50 | % | | 2.98 | % | | 0.48 | % |

| Cost of borrowings | 3.62 | % | | 3.22 | % | | 2.19 | % | | 3.44 | % | | 2.19 | % |

| Cost of interest bearing liabilities | 3.38 | % | | 2.77 | % | | 0.77 | % | | 3.08 | % | | 0.74 | % |

| Net interest spread | 0.98 | % | | 1.45 | % | | 2.54 | % | | 1.21 | % | | 2.49 | % |

| Net interest margin | 1.27 | % | | 1.72 | % | | 2.62 | % | | 1.49 | % | | 2.58 | % |

| CAPITAL | | | | | | | | | |

| Total equity to total assets | 8.37 | % | | 8.38 | % | | 8.92 | % | | | | |

Tangible stockholders' equity to tangible assets (1) | 8.33 | % | | 8.35 | % | | 8.88 | % | | | | |

| Book value per share | $ | 13.71 | | | $ | 13.64 | | | $ | 13.15 | | | | | |

Tangible book value per share (1) | $ | 13.64 | | | $ | 13.58 | | | $ | 13.09 | | | | | |

| | | | | | | | | |

| ASSET QUALITY | | | | | | | | | |

| Net charge-offs | $ | — | | | $ | — | | | $ | — | | | | | |

| Net charge-off ratio | — | % | | — | % | | — | % | | | | |

| Nonperforming loans to total loans | 0.07 | % | | 0.07 | % | | 0.08 | % | | | | |

| Nonperforming assets to total assets | 0.06 | % | | 0.06 | % | | 0.07 | % | | | | |

| Allowance for credit losses on loans to loans held-for-investment | 0.54 | % | | 0.51 | % | | 0.54 | % | | | | |

| Allowance for credit losses on loans to nonperforming loans | 751.04 | % | | 722.62 | % | | 706.46 | % | | | | |

| Criticized loans | $ | 21,269 | | | $ | 21,030 | | | $ | 27,513 | | | | | |

| Classified loans | $ | 18,266 | | | $ | 18,351 | | | $ | 22,492 | | | | | |

| LOAN COMPOSITION | | | | | | | | | |

| Multifamily residential | $ | 4,428,226 | | | $ | 4,522,072 | | | $ | 4,414,725 | | | | | |

| Single family residential | $ | 2,308,912 | | | $ | 2,308,485 | | | $ | 2,011,374 | | | | | |

| Commercial real estate | $ | 161,588 | | | $ | 168,049 | | | $ | 184,708 | | | | | |

| Construction and land | $ | 22,268 | | | $ | 24,873 | | | $ | 27,022 | | | | | |

| DEPOSIT COMPOSITION | | | | | | | | | |

| Noninterest bearing transaction accounts | $ | 72,347 | | | $ | 74,756 | | | $ | 173,317 | | | | | |

| Interest bearing transaction accounts | $ | 127,638 | | | $ | 143,870 | | | $ | 230,587 | | | | | |

| Money market deposit accounts | $ | 1,894,183 | | | $ | 2,025,227 | | | $ | 3,024,460 | | | | | |

| Time deposits | $ | 3,746,271 | | | $ | 3,405,641 | | | $ | 2,240,395 | | | | | |

| | | | | | | | | |

(1) See "Non-GAAP Reconciliation" table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NON-GAAP RECONCILIATION (UNAUDITED) | | | | | |

| | | | | | | | | |

| For the Three Months Ended | | For the Six Months Ended |

| (Dollars in thousands) | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Pre-tax, Pre-provision Net Earnings | | | | | | | | | |

| Income before provision for income taxes | $ | 9,895 | | | $ | 19,082 | | | $ | 32,009 | | | $ | 28,977 | | | $ | 64,089 | |

| Plus: Provision for (reversal of) credit losses | 1,212 | | | (795) | | | 2,500 | | | 417 | | | — | |

| Pre-tax, pre-provision net earnings | $ | 11,107 | | | $ | 18,287 | | | $ | 34,509 | | | $ | 29,394 | | | $ | 64,089 | |

| Efficiency Ratio | | | | | | | | | |

| Noninterest expense (numerator) | $ | 16,104 | | | $ | 16,934 | | | $ | 13,325 | | | $ | 33,038 | | | $ | 28,837 | |

| Net interest income | 26,320 | | | 33,986 | | | 47,472 | | | 60,306 | | | 92,506 | |

| Noninterest income | 891 | | | 1,235 | | | 362 | | | 2,126 | | | 420 | |

| Operating revenue (denominator) | $ | 27,211 | | | $ | 35,221 | | | $ | 47,834 | | | $ | 62,432 | | | $ | 92,926 | |

| Efficiency ratio | 59.18 | % | | 48.08 | % | | 27.86 | % | | 52.92 | % | | 31.03 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands except per share data) | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | | | | |

| Tangible Book Value Per Share | | | | | | | | | |

| Total assets | $ | 8,360,070 | | | $ | 8,302,457 | | | $ | 7,530,516 | | | | | |

| Less: Goodwill | (3,297) | | | (3,297) | | | (3,297) | | | | | |

| Tangible assets | 8,356,773 | | | 8,299,160 | | | 7,527,219 | | | | | |

| Less: Total liabilities | (7,660,723) | | | (7,606,296) | | | (6,858,894) | | | | | |

| Tangible stockholders' equity (numerator) | $ | 696,050 | | | $ | 692,864 | | | $ | 668,325 | | | | | |

| Period end shares outstanding (denominator) | 51,027,878 | | | 51,030,877 | | | 51,063,498 | | | | | |

| Tangible book value per share | $ | 13.64 | | | $ | 13.58 | | | $ | 13.09 | | | | | |

| Tangible Stockholders' Equity to Tangible Assets | | | | | | | | | |

| Tangible stockholders' equity (numerator) | $ | 696,050 | | | $ | 692,864 | | | $ | 668,325 | | | | | |

| Tangible assets (denominator) | $ | 8,356,773 | | | $ | 8,299,160 | | | $ | 7,527,219 | | | | | |

| Tangible stockholders' equity to tangible assets | 8.33 | % | | 8.35 | % | | 8.88 | % | | | | |

| Liquidity Ratio | | | | | | | | | |

| Unrestricted cash & cash equivalents | $ | 699,366 | | | $ | 508,233 | | | $ | 86,548 | | | | | |

| Available for sale debt securities, at fair value | 564,274 | | | 593,427 | | | 661,432 | | | | | |

| Equity securities, at fair value | 10,340 | | | 10,506 | | | 10,772 | | | | | |

| Total liquid assets (numerator) | $ | 1,273,980 | | | $ | 1,112,166 | | | $ | 758,752 | | | | | |

| Total assets (denominator) | $ | 8,360,070 | | | $ | 8,302,457 | | | $ | 7,530,516 | | | | | |

| Liquidity ratio | 15.24 | % | | 13.40 | % | | 10.08 | % | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

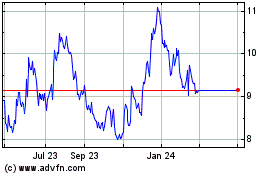

Luther Burbank (NASDAQ:LBC)

Historical Stock Chart

From Apr 2024 to May 2024

Luther Burbank (NASDAQ:LBC)

Historical Stock Chart

From May 2023 to May 2024