Statement of Changes in Beneficial Ownership (4)

February 12 2021 - 8:55AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

LAWLOR AUGUSTINE |

2. Issuer Name and Ticker or Trading Symbol

LEAP THERAPEUTICS, INC.

[

LPTX

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Operating Officer |

|

(Last)

(First)

(Middle)

C/O LEAP THERAPEUTICS, INC., 47 THORNDIKE STREET SUITE B1-1 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/9/2021 |

|

(Street)

CAMBRIDGE, MA 02141

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Warrant (Right to Buy) | $1.95 | 2/9/2021 | | J (1)(2) | | | 571428 | 2/5/2019 | 2/5/2026 | Common Stock, $0.001 par value per share | 571428 | (3) | 0 | I | See footnote (2) |

| Warrant (Right to Buy) | $1.95 | 2/9/2021 | | F (1) | | 11544 | | 2/5/2019 | 2/5/2026 | Common Stock, $0.001 par value per share | 11544 | (3) | 11544 | I | See footnote (4) |

| Explanation of Responses: |

| (1) | On February 9, 2020, HealthCare Ventures IX, L.P. ("HCVIX") transferred, for no consideration, all 571,428 warrants to purchase common stock it held (the "Transfer") to the limited partners of HCVIX on a pro rata basis. The term of HCVIX expired on December 31, 2020, at which time HCVIX entered into liquidation. The process of liquidating HCVIX, including the distribution of marketable and non-marketable securities, has commenced in 2021, and HealthCare Partners IX, L.P. ("HCPIX"), the General Partner of HCVIX, as liquidator, will use its best efforts to complete the orderly liquidation of HCVIX. |

| (2) | These warrants were owned directly by HCVIX. Christopher K. Mirabelli, Douglas E. Onsi and Augustine Lawlor (collectively, the "HCVIX Directors") are the Managing Directors of HealthCare Partners IX, LLC ("HCPIX LLC"), which is the General Partner of HCPIX, which is the General Partner of HCVIX. Each of the HCVIX Directors, HCPIX LLC and HCPIX indirectly beneficially owns and shares voting and dispositive power with respect to all of the securities owned by HCVIX, and each disclaimed beneficial ownership of the warrants except to the extent of his or its proportionate pecuniary interest therein. |

| (3) | The warrants were acquired in connection with the purchase of an equal number of shares of common stock by HCVIX on February 5, 2019 for $1.75 per share. Each such purchased share of common stock was issued with a warrant to purchase one share of common stock. HCVIX will continue to hold 4,144,804 shares of common stock following the Transfer. |

| (4) | These warrants were acquired by Nine Capital Partners, LLC ("Nine Capital Partners"), a limited partner of HCVIX, in connection with the Transfer. The reporting person is a member of Nine Capital Partners and may be deemed to indirectly beneficially own and share voting and dispositive power with respect to all securities held by Nine Capital Partners. The reporting person disclaims beneficial ownership of the warrants except to the extent of his proportionate pecuniary interest therein. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

LAWLOR AUGUSTINE

C/O LEAP THERAPEUTICS, INC.

47 THORNDIKE STREET SUITE B1-1

CAMBRIDGE, MA 02141 |

| X | Chief Operating Officer |

|

Signatures

|

| /s/ Douglas E. Onsi, as Attorney-In-Fact for Augustine Lawlor | | 2/12/2021 |

| **Signature of Reporting Person | Date |

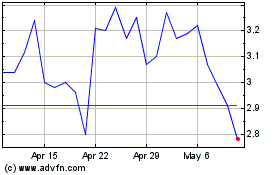

Leap Therapeutics (NASDAQ:LPTX)

Historical Stock Chart

From Aug 2024 to Sep 2024

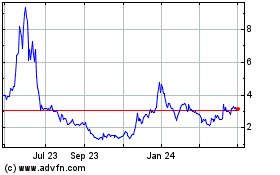

Leap Therapeutics (NASDAQ:LPTX)

Historical Stock Chart

From Sep 2023 to Sep 2024