Anthony & Sylvan Pools Corporation Reports Third Quarter and

Nine Month Results and Announces Odd Lot Tender Offer MAYFIELD

VILLAGE, Ohio, Oct. 27 /PRNewswire-FirstCall/ -- Anthony &

Sylvan Pools Corporation today announced results for its third

quarter ended September 30, 2003. Net sales for the quarter were

$61,786,000, an increase of 31.6% compared with $46,950,000

reported a year ago. Net income from continuing operations and net

income for the third quarter ended September 30, 2003 were both

$2,828,000, or $0.53 per diluted share, compared with net income

from continuing operations of $1,407,000, or $0.26 per diluted

share, in the third quarter of 2002 and net income for the third

quarter of 2002, including discontinued operations, of $177,000, or

$0.03 per diluted share. For the nine months ended September 30,

2003, revenues of $139,265,000 increased 8.6% compared with

$128,221,000 for the same period last year. The company reported

both net income from continuing operations and net income of

$2,218,000, or $0.42 per diluted share, for the nine months ended

September 30, 2003, compared with net income from continuing

operations of $2,661,000, or $0.49 per diluted share and net income

of $310,000, or $0.06 per diluted share, for the nine months ended

September 30, 2002. In 2002, the Company exited two geographic

markets in Florida. The financial results of these businesses are

reported as discontinued operations. In accordance with generally

accepted accounting principles, earnings, assets and liabilities of

the discontinued operations are shown separately in the income

statement and balance sheet, respectively, for all periods

presented, where applicable. All information in this earnings

release, including all supplemental information, reflects

continuing operations, unless otherwise noted. The Company also

announced that it will commence a tender offer for the purchase of

all shares of its common stock held by persons owning 99 or fewer

shares as of the close of business on October 23, 2003. The Company

will pay $4.00 for each share properly tendered by an eligible

shareholder. This price per share represents a premium of 49% over

$2.68, the weighted average closing price of shares at which trades

were reported on the Nasdaq SmallCap Market for the period January

1, 2003 through October 24, 2003. It also represents a premium of

12% over the average 30 trading day closing price prior to this

announcement. Documents containing details of the offer will be

mailed to all shareholders beginning on October 28, 2003. The offer

will expire at 5:00 p.m., Eastern Standard Time, on Thursday,

December 11, 2003, unless extended. Eligible shareholders who would

like to accept the offer must tender all shares that they own.

Partial tenders will not be accepted. Questions or requests for

documents may be directed to Georgeson Shareholder, the Information

Agent for the offer, by toll-free telephone at (800) 213-0475.

Information on the tender offer may also be obtained free of charge

on the website of the Company ( http://www.anthonysylvan.com/ ) or

the Securities and Exchange Commission ("SEC") (

http://www.sec.gov/ ). Tendering shareholders will not have to pay

any processing fees or brokerage costs associated with the offer.

If, as a result of this offer, the Company has fewer than 300

shareholders of record, it intends to terminate the registration of

its common shares under the Securities Exchange Act of 1934 and

become a private, non-reporting company. This means that the

Company would no longer file periodic reports with the SEC,

including, among other things, annual reports on Form 10-K and

quarterly reports on Form 10-Q, and it would not be subject to the

SEC's proxy rules. In addition, the Company's common shares would

no longer be eligible for trading on the Nasdaq SmallCap Market.

Instead, the Company's common shares may be quoted in the "pink

sheets." This announcement is not an offer to purchase or a

solicitation of an offer to purchase the Company's shares. The

odd-lot tender offer is being made upon the terms and conditions in

the Offer to Purchase that will be mailed to all shareholders

beginning October 28, 2003. Commenting on the financial results,

Stuart D. Neidus, Anthony & Sylvan's Chairman and Chief

Executive Officer, said, "We entered our third quarter with a good

backlog of business, which helped us in our efforts to construct

swimming pools in one of our traditionally strongest quarters." As

to the outlook for the remainder of the year, Mr. Neidus noted

that, "Now that we have completed our third quarter, all

indications continue to point to an improvement over last year's

second half performance." Regarding the commencement of the tender

offer for odd lot shares, Mr. Neidus stated, "We have not realized

the benefits we had hoped would materialize from being a public

company. Our stock is very thinly traded and provides minimum real

liquidity for our shareholders. Furthermore, with increasing

compliance and other regulatory requirements, the costs to us of

continuing to be a public company are significant, given our small

size." Anthony & Sylvan operates in the leisure industry,

offering in-ground, concrete residential swimming pools, spas and

related products to its customers. The Company serves its customers

through a network of 39 sales design centers in 22 geographic

markets in 16 states. It also sells pool- related consumables,

replacement parts, equipment and supplies through retail service

centers. This press release contains statements that are

forward-looking, as that term is defined by the Private Securities

Litigation Reform Act of 1995 or by the Securities and Exchange

Commission in its rules, regulations, and releases. The Company

intends that such forward-looking statements be subject to the safe

harbors created thereby. The Company assumes no obligation to

update or revise any such statements, whether as a result of new

information or otherwise. All forward-looking statements are based

on current expectations regarding important risk factors, including

but not limited to: the seasonal nature of our business; dependence

on existing management; consumer spending; market conditions;

interest rates and weather. A number of those risks, trends and

uncertainties are discussed in the Company's SEC reports, including

the Company's annual report on Form 10-K and quarterly reports on

Form 10-Q. Accordingly, actual results may differ from those

expressed in the forward-looking statements, and the making of such

statements should not be regarded as a representation by the

Company or any other person that results expressed therein will be

achieved. ANTHONY & SYLVAN POOLS CORPORATION AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (Dollars in thousands)

September 30, December 31, 2003 2002 (unaudited) (audited) Assets

Current Assets: Cash and cash equivalents $10,010 $432 Contract

receivables, net 7,686 8,354 Inventories 6,091 5,841 Prepayments

and other 3,340 3,655 Deferred income taxes 2,510 1,936 Total

current assets 29,637 20,218 Property, plant and equipment, net

6,450 7,794 Goodwill, net 26,276 26,276 Deferred income taxes - 373

Other 2,841 2,951 Total assets $65,204 $57,612 Liabilities and

Shareholders' Equity Current Liabilities: Accounts payable $9,995

$4,310 Accrued expenses 16,155 11,149 Net liabilities of

discontinued operations 758 1,169 Accrued income taxes 1,330 14

Total current liabilities 28,238 16,642 Long-term debt - 6,300

Other long-term liabilities 3,525 3,526 Commitments and

contingencies - - Shareholders' equity 33,441 31,144 Total

liabilities and shareholders' equity $65,204 $57,612 ANTHONY &

SYLVAN POOLS CORPORATION AND SUBSIDIARIES Unaudited Condensed

Consolidated Statements of Operations For the Three Months and Nine

Months Ended September 30, 2003 and 2002 (In thousands, except per

share data) Three Months Ended Nine Months Ended September 30,

September 30, 2003 2002 2003 2002 Net Sales $61,786 $46,950

$139,265 $128,221 Cost of Sales 43,463 32,991 98,663 90,250 Gross

Profit 18,323 13,959 40,602 37,971 Operating expenses 13,777 11,653

36,834 33,513 Operating income from continuing operations 4,546

2,306 3,768 4,458 Interest and other expense 43 55 218 201 Income

before income taxes from continuing operations 4,503 2,251 3,550

4,257 Income taxes 1,675 844 1,332 1,596 Net Income from continuing

operations 2,828 1,407 2,218 2,661 Loss from discontinued

operations, net of income taxes - (1,230) - (2,351) Net income

$2,828 $177 $2,218 $310 Basic income per share: Basic income per

share from continuing operations $0.54 $0.27 $0.42 $0.49 Basic

(loss) per share from discontinued operations - (0.24) - (0.43) Net

income $0.54 $0.03 $0.42 $0.06 Diluted income per share: Diluted

income per share from continuing operations $0.53 $0.26 $0.42 $0.49

Diluted (loss) per share from discontinued operations - (0.23) -

(0.43) Net income $0.53 $0.03 $0.42 $0.06 Average shares

outstanding: Basic 5,245 5,229 5,245 5,427 Diluted 5,313 5,298

5,309 5,496 ANTHONY & SYLVAN POOLS CORPORATION AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Cash Flows For the

Nine Months Ended September 30, 2003 and 2002 (Dollars in

thousands) 2003 2002 Cash Flows from Operating Activities: Net

income $2,218 $310 Adjustments to reconcile net income to net cash

provided by operating activities: Loss from discontinued operations

- 2,351 Depreciation 1,942 1,994 Deferred income taxes and other

non-cash items (61) 79 Changes in operating assets and liabilities:

Contract receivables 668 9,847 Inventories (250) (1,246)

Prepayments and other 315 227 Accounts payable 5,685 643 Accrued

expenses and other 6,431 2,332 Net cash provided by operating

activities 16,948 16,537 Cash Flows from Investing Activities:

Additions to property, plant and equipment (659) (1,356) Net cash

used in investing activities (659) (1,356) Cash Flows from

Financing Activities: Repayments of long-term debt (6,300) (7,555)

Proceeds from stock option exercise - 34 Treasury stock purchases -

(2,513) Net cash used in financing activities (6,300) (10,034)

Increase in Cash and Cash Equivalents 9,989 5,147 Net cash used in

discontinued operations (411) (2,218) Cash and Cash Equivalents:

Beginning of period 432 351 End of period $ 10,010 $3,280

DATASOURCE: Anthony & Sylvan Pools Corporation CONTACT: William

J. Evanson, Executive Vice President & Chief Financial Officer

of Anthony & Sylvan Pools Corporation, +1-440-720-3301 Web

site: http://www.anthonysylvan.com/

Copyright

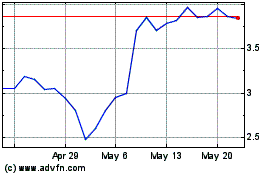

Latham (NASDAQ:SWIM)

Historical Stock Chart

From Jun 2024 to Jul 2024

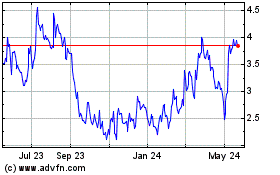

Latham (NASDAQ:SWIM)

Historical Stock Chart

From Jul 2023 to Jul 2024