0001772177false00017721772025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2025

KURA SUSHI USA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-39012 |

26-3808434 |

(State or other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

17461 Derian Avenue, Suite 200 Irvine, California |

|

92614 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (657) 333-4100

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Class A Common Stock, par value $0.001 per share |

KRUS |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

The 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Kura Sushi USA, Inc. (the “Company”) was held at the offices of the Company at 17461 Derian Avenue, Suite 200, Irvine, CA 92614 on January 23, 2025, at 10:00 a.m. Pacific Time. Stockholders considered four proposals at the meeting, which are described in more detail in the Company’s Definitive Proxy Statement on Schedule 14A (the “Proxy Statement”) filed with the Securities and Exchange Commission on December 11, 2024.

At the beginning of the Annual Meeting, there were 10,106,384 shares of Class A common stock and 1,000,050 shares of Class B common stock present at the Annual Meeting in person or by proxy, which represented 95.5% of the combined voting power of the shares of Class A common stock and Class B common stock entitled to vote at the Annual Meeting (voting together as a single class), and which constituted a quorum for the transaction of business. Holders of the Company’s Class A common stock were entitled to one vote for each share held as of the close of business on November 26, 2024 (the “Record Date”), and holders of the Company’s Class B common stock were entitled to ten votes for each share held as of the Record Date.

The final voting results are reported below.

Proposal One: Election of five directors, including Shintaro Asako, Treasa Bowers, Kim Ellis, Carin L. Stutz and Hajime Uba to serve for a term until the 2026 annual meeting of stockholders.

The Company’s stockholders elected each of the five nominees for director, and the voting results are set forth below:

|

|

|

|

|

|

|

|

|

Name |

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

Shintaro Asako |

|

17,911,132 |

|

1,684,771 |

|

13,471 |

|

497,510 |

Treasa Bowers |

|

19,294,926 |

|

300,910 |

|

13,538 |

|

497,510 |

Kim Ellis |

|

19,575,473 |

|

20,352 |

|

13,549 |

|

497,510 |

Carin L. Stutz |

|

17,565,219 |

|

2,030,601 |

|

13,554 |

|

497,510 |

Hajime Uba |

|

19,531,203 |

|

64,699 |

|

13,472 |

|

497,510 |

Proposal Two: Ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending on August 31, 2025.

The Company’s stockholders ratified the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending on August 31, 2025, and the voting results are set forth below:

|

|

|

|

|

For |

|

Against |

|

Abstain |

20,100,647 |

|

1,332 |

|

4,905 |

Proposal Three: Approval, on an advisory basis, of named executive officer compensation.

The Company’s stockholders gave advisory approval of the compensation of the Company’s named executive officers, and the voting results are set forth below:

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

19,386,397 |

|

217,187 |

|

5,790 |

|

497,510 |

Proposal Four: Recommendation, on a non-binding basis, of the voting frequency of non-binding approval of named executive officer compensation.

The Company’s stockholders gave advisory approval of setting the frequency of future advisory votes on named executive compensation at one year, and the voting results are set forth below:

|

|

|

|

|

|

|

One Year |

|

Two Years |

|

Three Years |

|

Abstain |

19,590,754 |

|

208 |

|

15,194 |

|

3,218 |

Item 8.01 Other Events.

On January 23, 2025, the board of directors of the Company adopted a form of performance restricted stock unit award notice and award agreement for performance restricted stock unit awards to be granted under the Company’s 2018 Incentive Compensation Plan. A copy of the agreement is filed with this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

KURA SUSHI USA, INC. |

|

|

|

|

|

|

|

|

|

|

Date |

January 24, 2025 |

|

By: |

/s/ Jeffrey Uttz |

|

|

|

Name: |

Jeffrey Uttz |

|

|

|

Title: |

Chief Financial Officer |

KURA SUSHI USA, INC.

2018 Incentive Compensation Plan

Performance Restricted Stock Unit Award Notice and Award Agreement (“Award Agreement”)

PART I

[Mr.][Ms.] "First" "Middle" "Last"

Effective _________ (“Award Date”), you have been granted a Performance Restricted Stock Unit Award of ____ units (“Awarded Performance RSUs”) of KURA SUSHI USA, INC., a Delaware corporation (the “Company”) under the Kura Sushi USA, Inc. 2018 Incentive Compensation Plan, as amended and restated as of January 29, 2021 (the “Plan”), as further specified in Appendix A of this Award Agreement (including upward and downward adjustments to the amount of Awarded Performance RSUs). These Awarded Performance RSUs are not vested, and not settled in Shares, until both the Service Condition and the Performance Condition are satisfied.

The Service Condition and the Performance Condition will be determined as of the date below with respect to the Awarded Performance RSUs:

|

|

Number of Awarded Performance RSUs |

Vesting Date |

|

|

|

|

|

|

By your signature and the Company’s signature below, you and the Company agree that this Award is granted under and governed by the terms and conditions of the Plan and the Award Agreement (including PART I and PART II), all of which are made a part of this document.

KURA SUSHI USA, INC.

Signature: ________________________________________ Date: ________________________

Print Name:

Title:

PARTICIPANT

Signature: ________________________________________ Date: ______________________________

Print Name: "First" "Middle" "Last"

RSU-Performance and Service Vesting Page 1 of 6

PART II

General Terms and Conditions

(a)Size and Type of Award. The Awarded Performance RSUs are listed in Part I of this Award Agreement (“Award Notice”) and are subject to all the terms and conditions of the Kura Sushi USA, Inc. 2018 Incentive Compensation Plan, as amended and restated as of January 29, 2021 (the “Plan”).

(b)Form and Time of Payment. Awarded Performance RSUs that vest will be paid in the form of Shares, on the basis of one (1) Share for each vested Awarded Performance RSU, as soon as administratively practicable after the Vesting Date but in no event later than thirty (30) days after the Vesting Date.

(c)Service Your Continuous Service constitutes adequate consideration for the issuance of the Awarded Performance RSUs to you, but the vesting conditions described below will nevertheless determine your right to payment of vested Awarded Performance RSUs.

(a)Vesting Date. The vesting date (the “Vesting Date”) for your Awarded Performance RSUs is specified in the Award Notice. On the Vesting Date, subject to the provisions of this Award Agreement (including Section 1(b) above and Section 2(b) below), you will be entitled to the Shares to be issued upon settlement of your Awarded Performance RSUs.

(b)Vesting Conditions. There are two conditions you must satisfy before your Awarded Performance RSUs will vest:

(i) You must, except as otherwise provided in Section 2(d) below, remain in Continuous Service from the Award Date through the Vesting Date (the “Service Condition”); and

(ii) The performance goals specified in Appendix A of this Award Agreement (the “Performance Goals”) must be met as of the end of the Performance Period as determined by the Committee in accordance with the terms of the Plan (the “Performance Condition”).

(c)Forfeitures. Except as otherwise provided herein, if you terminate Continuous Service prior to the Vesting Date, you will forfeit any Awarded Performance RSUs that are scheduled to vest on or after such termination of Continuous Service date. When you forfeit Awarded Performance RSUs, all of your interest in the unvested Awarded Performance RSUs will be automatically canceled.

(d)Death or Disability; Termination without Cause. If your Continuous Service ends due to death or Disability or termination by the Company without Cause, your Service Condition will be deemed satisfied and all of the Awarded Performance RSUs will remain in effect subject to the Performance Condition.

Section 3.Dividend Equivalents. Any Dividend Equivalents relating to the Awarded Performance RSUs will be accounted for and paid to you, at the time specified in Section 1(b) above, in whole Shares, if, as, and when the related Awarded Performance RSUs become vested (with any amounts that would result in fractional Shares being paid to you in cash).

RSU-Performance and Service Vesting Page 2 of 6

Section 4.Voting. You will not have the right to vote, or direct the voting of, Shares until they are issued upon settlement of vested Awarded Performance RSUs.

Section 5.No Right to Continued Service. Nothing in this Award Agreement, or any action of the Board or Committee with respect to this Award Agreement, shall be held or construed to confer upon you any right to a continuation of Continuous Service. You may be dismissed or otherwise dealt with as though this Award Agreement had not been entered into.

Section 6.Taxes. Where you or any other person is entitled to receive the Shares to be issued upon settlement of vested Awarded Performance RSUs pursuant to this Award Agreement, the Company shall have the right to require you or such other person to pay to the Company the amount of any tax which the Company is required to withhold with respect to such Shares, or, in lieu thereof, to retain, or to sell without notice, a sufficient number of Shares to cover the amount required to be withheld. Section 9(e) of the Plan is incorporated by reference herein.

Section 7.Notices. Any communication required or permitted to be given under the Plan, including any notice, direction, designation, comment, instruction, objection or waiver, shall be in writing and shall be deemed to have been given at such time as it is delivered personally or when deposited in the United States mail, registered, postage prepaid, addressed to such party at the address listed below, or at such other address as one such party may by written notice specify to the other party:

If to the Participant, to the Participant’s address as shown in the Company’s records.

If to the Committee:

Kura Sushi USA, Inc.

17461 Derian Ave., Suite 200

Irvine, CA 92614

Attention: Committee and Company Secretary

Section 8.Restrictions on Transfer. The Awarded Performance RSUs granted hereunder shall not be subject in any manner to anticipation, alienation or assignment, nor shall such Award be liable for, or subject to, debts, contracts, liabilities, engagements or torts, nor shall it be transferable by the Participant other than by will or by the laws of descent and distribution or as otherwise permitted by the Plan.

Section 9.Successors and Assigns. This Award Agreement shall inure to the benefit of and shall be binding upon the Company and you and their respective heirs, successors and assigns.

Section 10.Construction of Language. Whenever appropriate in this Award Agreement, words used in the singular may be read in the plural, words used in the plural may be read in the singular, and words importing the masculine gender may be read as referring equally to the feminine or the neuter. Any reference to a section shall be a reference to a section of this Award Agreement, un�less the context clearly indicates otherwise. Capitalized terms not specifically defined herein shall have the meanings assigned to them under the Plan.

Section 11.Governing Law. This Award Agreement shall be construed, administered and enforced according to the laws of the State of Delaware without giving effect to the conflict of law principles thereof, except to the extent that such laws are preempted by federal law.

Section 12.Amendment. This Award Agreement may be amended, in whole or in part and in any manner not inconsistent with the provisions of the Plan, at any time and from time to time, by written agreement between the Company and you.

Section 13.Plan Provisions Control. This Award Agreement and the rights and obligations created hereunder shall be subject to all of the terms and conditions of the Plan. In the event of any conflict between

RSU-Performance and Service Vesting Page 3 of 6

the provisions of the Plan and the provisions of this Award Agreement, the terms of the Plan, which are incorporated herein by reference, shall control. By signing this Award Agreement, you acknowledge receipt of a copy of the Plan. You acknowledge that you may not and will not rely on any statement of account or other communication or document issued in connection with the Award other than the Plan, this Award Agreement, or any document signed by an authorized representative of the Company that is designated as an amendment of the Plan or this Award Agreement.

RSU-Performance and Service Vesting Page 4 of 6

Appendix A to Performance Restricted Stock Unit Award Notice and Award Agreement

|

|

Participant: |

___________ |

Award Number: |

___________ |

Award Date: |

___________ |

Awarded Performance RSUs (at Target Performance Level): |

___________ |

Vesting Date: |

___________ |

Performance Period: |

___________ |

Performance Goals: |

General & Administrative Expenses as a % of Sales (33 1/3% weight); Average Annual Restaurant Level Operating Profit Margin (33 1/3% weight); and Average Annual Same Store Sales Growth (33 1/3% weight) |

Section 1. Performance Goals. The Performance Goals applicable to the Awarded Performance RSUs with respect to the Performance Period are as follows:

a. G&A. The G&A as a % of Sales at the conclusion of the three-year Performance Period, must be no greater than ____% to earn any payout for that performance metric (the “G&A Minimum Performance Level”). If the G&A as a % of Sales at the conclusion of the three-year Performance Period is more than the G&A Minimum Performance Level percentage, then there shall be no payout with respect to the G&A Performance Goal. If the G&A as a % of Sales at the conclusion of the three-year Performance Period is less than the G&A Minimum Performance Level percentage, then the payout percentage with respect to the G&A Performance Goal shall be as follows, and shall be determined as of the end of the Performance Period:

|

|

|

|

|

|

|

G&A Minimum Performance Level |

G&A Target Performance Level |

G&A Maximum Performance Level |

Performance Goal |

Weight |

50% Payout |

100% Payout |

150% Payout |

G&A |

33 1/3% |

|

|

|

Linear interpolation shall be used to calculate payout percentages not specifically listed above, except that (i) for performance above the G&A Minimum Performance Level percentage, the payout percentage shall be 0%; and (ii) for performance below the G&A Maximum Performance Level percentage, the payout percentage shall be 150%.

b. Average Annual Restaurant Level Operating Profit Margin. The average annual restaurant level operating profit margin during the Performance Period (the “RLOP”), must be at least ____% (the “RLOP Minimum Performance Level”). If the RLOP is less than the RLOP Minimum Performance Level, then there shall be no payout with respect to the RLOP Performance Goal. If the RLOP is greater than the RLOP Minimum Performance Level, then the payout percentage with respect to the RLOP Performance Goal shall be as follows:

|

|

|

|

|

|

|

RLOP Minimum Performance Level |

RLOP Target Performance Level |

RLOP Maximum Performance Level |

Performance Goal |

Weight |

50% Payout |

100% Payout |

150% Payout |

RLOP |

33 1/3% |

|

|

|

RSU-Performance and Service Vesting Page 5 of 6

Linear interpolation shall be used to calculate payout percentages not specifically listed above, except that (i) for performance below the RLOP Minimum Performance Level, the payout percentage shall be 0%; and (ii) for performance above the RLOP Maximum Performance Level, the payout percentage shall be 150%.

c. Average Annual Same Store Sales Growth. The Average Annual Same Store Sales Growth during the Performance Period (the “AASSSG”) must be at least ____% (the “AASSSG Minimum Performance Level”). If the AASSSG during the Performance Period is less than the AASSSG Minimum Performance Level, then there shall be no payout with respect to the AASSSG Performance Goal. If the AASSSG during the Performance Period is greater than the AASSSG Minimum Performance Level, then the payout percentage with respect to the AASSSG Performance Goal shall be as follows:

|

|

|

|

|

|

|

AASSSG Minimum Performance Level |

AASSSG Target Performance Level |

AASSSG Maximum Performance Level |

Performance Goal |

Weight |

50% Payout |

100% Payout |

150% Payout |

AASSSG |

33 1/3% |

|

|

|

Linear interpolation shall be used to calculate payout percentages not specifically listed above, except that (i) for performance below the AASSSG Minimum Performance Level, the payout percentage shall be 0%; and (ii) for performance above the AASSSG Maximum Performance Level, the payout percentage shall be 150%.

d. Payout. The total payout percentage shall be determined as of the end of the Performance Period by the Committee after consideration of the actual performance of each established performance metric. This is calculated by taking the sum of the payout percentages applicable to each performance metric multiplied by the weighting applied to each Performance Goal: G&A, RLOP and AASSSG. Except as otherwise provided in Sections 2 and 3 of this Appendix A, such total payout percentage shall be applied to the number of Awarded Performance RSUs to determine the payout.

Section 2. Adjustments by Committee. The Committee may provide for inclusion or exclusion of the impact of an event or occurrence which the Committee determines should appropriately be included or excluded.

Section 3. General Committee Authority. The Committee has the authority to determine whether and to what extent the Performance Goals have been met as of the end of the Performance Period in accordance with the terms and conditions of the Plan and this Award Agreement, to determine the amount of the payout, if any, following the end of the Performance Period in accordance with the terms and conditions of the Plan and this Award Agreement, and to interpret the terms and conditions of the Plan and this Award Agreement. Any payout to be settled in Shares shall be rounded, up or down, to the nearest number of whole Shares.

RSU-Performance and Service Vesting Page 6 of 6

v3.24.4

Document And Entity Information

|

Jan. 23, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 23, 2025

|

| Entity Registrant Name |

KURA SUSHI USA, INC.

|

| Entity Central Index Key |

0001772177

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39012

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

26-3808434

|

| Entity Address, Address Line One |

17461 Derian Avenue, Suite 200

|

| Entity Address, City or Town |

Irvine

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92614

|

| City Area Code |

(657)

|

| Local Phone Number |

333-4100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.001 per share

|

| Trading Symbol |

KRUS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

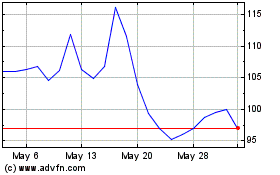

Kura Sushi USA (NASDAQ:KRUS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Kura Sushi USA (NASDAQ:KRUS)

Historical Stock Chart

From Mar 2024 to Mar 2025