The Kraft Heinz Company (Nasdaq: KHC) (“Kraft Heinz” or the

“Company”) will present today at the 2024 Consumer Analyst Group of

New York (CAGNY) Conference. CEO Carlos Abrams-Rivera and Global

Chief Financial Officer Andre Maciel will discuss how the Company

plans to deliver on its goal to generate consistent top-tier

stockholder returns by being the leader in elevating and creating

food that makes you feel good.

The Company plans to deliver its long-term growth through its

three Growth Pillars: North America Retail, Global Away From Home,

and Emerging Markets. The Company expects to fuel its top-line

growth through its “Enablers of Growth,” which include investments

in marketing, research and development, and technology, increased

contribution from innovation, expanded collaboration with customers

through sales excellence, and deployment of its Brand Growth

System. The Brand Growth System is a global methodology, new to

Kraft Heinz, designed to enable the Company to measure, monitor and

build a superior brand proposition.

To fund these investments, the Company aims to continue driving

end-to-end efficiencies, through supply chain, revenue management,

working capital, and by expanding centralized services. Powering

these are the Company’s unique competitive advantages: tech-enabled

Agile@Scale methodologies, strategic partnerships, and an

ownership-centric culture.

Also, the Company has further refined its strategy by taking a

longer-term approach, looking out to a 10-year horizon across the

consumer demand landscape to predict trends and associated

opportunities. To capture identified opportunities, the Company

refined the role of portfolio categories based on a combination of

market attractiveness and its right to win.

As a result, the Company has realigned its portfolio around

three new platform roles – Accelerate, Protect, and Balance. It

expects the Accelerate platforms, which include Taste Elevation,

Easy Ready Meals, and Substantial Snacking, to drive outsized

growth and plans to prioritize investments in these platforms. The

Company will further describe these changes in today’s

presentation.

Long-Term Financial Profile

The Company will also detail its long-term growth algorithm. The

targets remain unchanged, with the exception of replacing the

previous Adjusted EBITDA(1) target with a target for Adjusted

Operating Income(1). This is a result of the Company’s work to

rewire the organization to drive a stronger connection to total

shareholder return and create an enhanced level of ownership

throughout the Company. The long-term algorithm consists of:

- Organic Net Sales(1) growth of 2% to 3%.

- Adjusted Operating Income(1) growth of 4% to 6%.

- Adjusted EPS(1) growth of 6% to 8%.

- Free Cash Flow Conversion(1) at approximately 100%.

2024 Outlook

As announced in its fourth quarter and full year 2023 earnings,

the Company reiterates its expectation to deliver:

- Organic Net Sales(1) growth of 0% to 2% versus the prior

year. The Company expects a positive contribution from price

throughout the year, with volumes inflecting positive in the second

half of the year.

- Adjusted Operating Income(1) growth of 2% to 4% versus

the prior year. Adjusted Gross Profit Margin(1) is expected to

expand modestly, in the range of 25 to 75 basis points versus the

prior year.

- Adjusted EPS(1) growth of 1% to 3% versus the prior

year, or in the range of $3.01 to $3.07. The Company expects an

effective tax rate on Adjusted EPS to be in the range of 20% to

22%. Additionally, the Company expects an unfavorable impact of

approximately $45 million within interest expense and other

expense/(income) versus the prior year, primarily driven by foreign

currency headwinds and debt refinancing that will come at a higher

rate. The outlook does not include the possibility of additional

share buyback in 2024.

End Notes

(1)

Organic Net Sales, Adjusted Gross Profit,

Adjusted Gross Profit Margin, Adjusted Operating Income, Adjusted

EBITDA, Adjusted EPS, Free Cash Flow, and Free Cash Flow Conversion

are non-GAAP financial measures. Please see discussion of non-GAAP

financial measures and the reconciliations at the end of this press

release for more information. Guidance for Organic Net Sales,

Adjusted Gross Profit Margin, Adjusted Operating Income, and

Adjusted EPS is provided on a non-GAAP basis only because certain

information necessary to calculate the most comparable GAAP measure

is unavailable due to the uncertainty and inherent difficulty of

predicting the occurrence and the future financial statement impact

of such items impacting comparability, including, but not limited

to, the impact of currency, acquisitions and divestitures,

divestiture-related license income, restructuring activities, deal

costs, unrealized losses/(gains) on commodity hedges, impairment

losses, certain non-ordinary course legal and regulatory matters,

equity award compensation expense, nonmonetary currency

devaluation, and debt prepayment and extinguishment

(benefit)/costs, among other items. Therefore, as a result of the

uncertainty and variability of the nature and amount of future

adjustments, which could be significant, the Company is unable to

provide a reconciliation of these measures without unreasonable

effort.

Webcast Information

A prepared presentation at the CAGNY conference will begin at 11

a.m. Eastern Standard Time today and will be available at

ir.kraftheinzcompany.com. A replay will also be accessible after

the event at ir.kraftheinzcompany.com.

ABOUT THE KRAFT HEINZ COMPANY

We are driving transformation at The Kraft Heinz Company

(Nasdaq: KHC), inspired by our Purpose, Let’s Make Life Delicious.

Consumers are at the center of everything we do. With 2023 net

sales of approximately $27 billion, we are committed to growing our

iconic and emerging food and beverage brands on a global scale. We

leverage our scale and agility to unleash the full power of Kraft

Heinz across a portfolio of six consumer-driven product platforms.

As global citizens, we’re dedicated to making a sustainable,

ethical impact while helping feed the world in healthy, responsible

ways. Learn more about our journey by visiting

www.kraftheinzcompany.com or following us on LinkedIn.

Forward-Looking Statements

This press release contains a number of forward-looking

statements. Words such as “aim,” “capture,” “deploy,” “expect,”

“increase,” “invest,” “plan,” “predict,” and “will,” and variations

of such words and similar future or conditional expressions are

intended to identify forward-looking statements. Examples of

forward-looking statements include, but are not limited to,

statements regarding the Company's plans, impacts of accounting

standards and guidance, growth, legal matters, taxes, costs and

cost savings, impairments, dividends, expectations, investments,

innovations, opportunities, capabilities, execution, initiatives,

and pipeline. These forward-looking statements reflect management's

current expectations and are not guarantees of future performance

and are subject to a number of risks and uncertainties, many of

which are difficult to predict and beyond the Company's

control.

Important factors that may affect the Company's business and

operations and that may cause actual results to differ materially

from those in the forward-looking statements include, but are not

limited to, operating in a highly competitive industry; the

Company’s ability to correctly predict, identify, and interpret

changes in consumer preferences and demand, to offer new products

to meet those changes, and to respond to competitive innovation;

changes in the retail landscape or the loss of key retail

customers; changes in the Company's relationships with significant

customers or suppliers, or in other business relationships; the

Company’s ability to maintain, extend, and expand its reputation

and brand image; the Company’s ability to leverage its brand value

to compete against private label products; the Company’s ability to

drive revenue growth in its key product categories or platforms,

increase its market share, or add products that are in

faster-growing and more profitable categories; product recalls or

other product liability claims; climate change and legal or

regulatory responses; the Company’s ability to identify, complete,

or realize the benefits from strategic acquisitions, divestitures,

alliances, joint ventures, or investments; the Company's ability to

successfully execute its strategic initiatives; the impacts of the

Company's international operations; the Company's ability to

protect intellectual property rights; the Company’s ability to

realize the anticipated benefits from prior or future streamlining

actions to reduce fixed costs, simplify or improve processes, and

improve its competitiveness; the influence of the Company’s largest

stockholder; the Company's level of indebtedness, as well as our

ability to comply with covenants under our debt instruments;

additional impairments of the carrying amounts of goodwill or other

indefinite-lived intangible assets; foreign exchange rate

fluctuations; volatility in commodity, energy, and other input

costs; volatility in the market value of all or a portion of the

commodity derivatives we use; compliance with laws and regulations

and related legal claims or regulatory enforcement actions; failure

to maintain an effective system of internal controls; a downgrade

in the Company's credit rating; the impact of sales of the

Company's common stock in the public market; the impact of our

share repurchases or any change in our share repurchase activity;

the Company’s ability to continue to pay a regular dividend and the

amounts of any such dividends; disruptions in the global economy

caused by geopolitical conflicts; unanticipated business

disruptions and natural events in the locations in which the

Company or the Company's customers, suppliers, distributors, or

regulators operate; economic and political conditions in the United

States and various other nations where the Company does business

(including inflationary pressures, instability in financial

institutions, general economic slowdown, recession, or a potential

U.S. federal government shutdown); changes in the Company's

management team or other key personnel and the Company's ability to

hire or retain key personnel or a highly skilled and diverse global

workforce; our dependence on information technology and systems,

including service interruptions, misappropriation of data, or

breaches of security; increased pension, labor, and people-related

expenses; changes in tax laws and interpretations and the final

determination of tax audits, including transfer pricing matters,

and any related litigation; volatility of capital markets and other

macroeconomic factors; and other factors. For additional

information on these and other factors that could affect the

Company's forward-looking statements, see the Company's risk

factors, as they may be amended from time to time, set forth in its

filings with the Securities and Exchange Commission (“SEC”). The

Company disclaims and does not undertake any obligation to update,

revise, or withdraw any forward-looking statement in this press

release, except as required by applicable law or regulation.

Non-GAAP Financial Measures

The non-GAAP financial measures provided in this press release

should be viewed in addition to, and not as an alternative for,

results prepared in accordance with accounting principles generally

accepted in the United States of America (“GAAP”) that are

presented in the Company’s filings with the SEC.

The Company has presented Organic Net Sales, Adjusted Gross

Profit, Adjusted Gross Profit Margin, Adjusted Operating Income,

Adjusted EBITDA, Adjusted EPS, Free Cash Flow, and Free Cash Flow

Conversion, which are considered non-GAAP financial measures. The

non-GAAP financial measures presented may differ from similarly

titled non-GAAP financial measures presented by other companies,

and other companies may not define these non-GAAP financial

measures in the same way. These measures are not substitutes for

their comparable GAAP financial measures, such as net sales, net

income/(loss), gross profit, diluted earnings per share (“EPS”),

net cash provided by/(used for) operating activities, or other

measures prescribed by GAAP, and there are limitations to using

non-GAAP financial measures.

Management uses these non-GAAP financial measures to assist in

comparing the Company’s performance on a consistent basis for

purposes of business decision making by removing the impact of

certain items that management believes do not directly reflect the

Company’s underlying operations. The Company believes:

- Organic Net Sales, Adjusted Gross Profit, Adjusted Gross Profit

Margin, Adjusted Operating Income, Adjusted EBITDA, and Adjusted

EPS provide important comparability of underlying operating

results, allowing investors and management to assess the Company’s

operating performance on a consistent basis; and

- Free Cash Flow and Free Cash Flow Conversion provide a measure

of the Company’s core operating performance, the cash-generating

capabilities of the Company’s business operations, and are factors

used in determining the Company’s borrowing capacity and the amount

of cash available for debt repayments, dividends, acquisitions,

share repurchases, and other corporate purposes.

Management believes that presenting the Company’s non-GAAP

financial measures is useful to investors because it (i) provides

investors with meaningful supplemental information regarding

financial performance by excluding certain items, (ii) permits

investors to view performance using the same tools that management

uses to budget, make operating and strategic decisions, and

evaluate historical performance, and (iii) otherwise provides

supplemental information that may be useful to investors in

evaluating the Company’s results. The Company believes that the

presentation of these non-GAAP financial measures, when considered

together with the corresponding GAAP financial measures and the

reconciliations to those measures, provides investors with

additional understanding of the factors and trends affecting the

Company’s business than could be obtained absent these

disclosures.

Definitions

Organic Net Sales is defined as net sales excluding, when

they occur, the impact of currency, acquisitions and divestitures,

and a 53rd week of shipments. The Company calculates the impact of

currency on net sales by holding exchange rates constant at the

previous year's exchange rate, with the exception of highly

inflationary subsidiaries, for which the Company calculates the

previous year's results using the current year's exchange rate.

Adjusted Operating Income is defined as net income/(loss)

from continuing operations before interest expense, other

expense/(income), and provision for/(benefit from) income taxes; in

addition to these adjustments, the Company excludes, when they

occur, the impacts of restructuring activities, deal costs,

unrealized losses/(gains) on commodity hedges, impairment losses,

and certain non-ordinary course legal and regulatory matters.

Adjusted EBITDA is defined as net income/(loss) from

continuing operations before interest expense, other

expense/(income), provision for/(benefit from) income taxes, and

depreciation and amortization (excluding restructuring activities);

in addition to these adjustments, the Company excludes, when they

occur, the impacts of divestiture-related license income,

restructuring activities, deal costs, unrealized losses/(gains) on

commodity hedges, impairment losses, certain non-ordinary course

legal and regulatory matters, and equity award compensation expense

(excluding restructuring activities).

Adjusted Gross Profit and Adjusted EPS are defined as

gross profit and diluted earnings per share excluding, when they

occur, the impacts of restructuring activities, deal costs,

unrealized losses/(gains) on commodity hedges, impairment losses,

certain non-ordinary course legal and regulatory matters,

losses/(gains) on the sale of a business, other losses/(gains)

related to acquisitions and divestitures (e.g., tax and hedging

impacts), nonmonetary currency devaluation (e.g., remeasurement

gains and losses), debt prepayment and extinguishment

(benefit)/costs, and certain significant discrete income tax items

(e.g., U.S. and non-U.S. tax reform), and including when they

occur, adjustments to reflect preferred stock dividend payments on

an accrual basis. Adjusted Gross Profit Margin is defined as

Adjusted Gross Profit divided by net sales.

Free Cash Flow is defined as net cash provided by/(used

for) operating activities less capital expenditures. The use of

this non-GAAP measure does not imply or represent the residual cash

flow for discretionary expenditures since the Company has certain

non-discretionary obligations such as debt service that are not

deducted from the measure. Free Cash Flow Conversion is

defined as Free Cash Flow divided by Adjusted Net

Income/(Loss).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221146866/en/

Alex Abraham (media) Alex.Abraham@kraftheinz.com

Anne-Marie Megela (investors)

Anne-Marie.Megela@kraftheinz.com

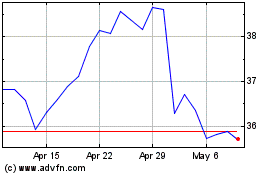

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Oct 2024 to Nov 2024

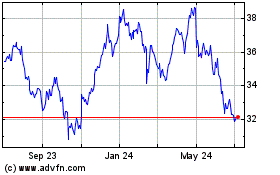

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Nov 2023 to Nov 2024