Form 8-K - Current report

December 07 2023 - 4:42PM

Edgar (US Regulatory)

false

0001760903

0001760903

2023-12-05

2023-12-05

0001760903

us-gaap:CommonStockMember

2023-12-05

2023-12-05

0001760903

SHOT:WarrantsEachExercisableForOneShareOfCommonStockAt8.50PerShareMember

2023-12-05

2023-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 5, 2023

SAFETY

SHOT, INC.

(Exact

name of registrant as specified in charter)

| Delaware |

|

001-39569 |

|

83-2455880 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1061

E. Indiantown Rd., Ste. 110, Jupiter, FL 33477

(Address

of principal executive offices) (Zip Code)

(561)

244-7100

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

SHOT |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

| |

|

|

|

|

| Warrants,

each exercisable for one share of Common Stock at $8.50 per share |

|

SHOTW |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers

On

December 5, 2023, at the 2023 Annual Meeting of Stockholders (the “Meeting”) of Safety Shot, Inc. (the “Company”),

the shareholders voted against the re-election of Dr. Hector Alila. As a result, Dr. Alila was removed from his position as a member

of the board of directors (the “Board”), effective December 6, 2023.

On

December 6, 2023, the Board appointed Richard Pascucci as

a member of the Board to fill in the vacancy created by the removal of Mr. Alila. Mr. Pascucci,

age 48, has over 20 years of experience in beverage industry.

Since May 2018, Mr. Pascucci has

been working as the founder and owner of Black Apple Group, LLC, a consulting group specializing in strategy, brand marketing, business

intelligence, business insights and category development. Since May 2017, Mr. Pascucci

has been working as the Beverage Consultant at Pascucci

Enterprise, wherein he is responsible for the

company’s key strategic areas, while identifying and delivering key projects and priorities. Between May 2011 and May 2017, Mr.

Pascucci worked

as the Chief Growth Officer and the VP of Business Development at Pabst Brewing Company. Mr. Pascucci

has a bachelors in arts from St. Joseph’s

University, Philadelphia.

Mr.

Pascucci will

be paid an annual compensation of $25,000 along with options to purchase 20,000 shares of Company’s common stock. Mr. Pascucci

will be granted additional options to purchase

20,000 shares of Company’s common stock, for each additional year that he serves as the member of the Board. The options will be

vested upon grant and shall expire in 3 years from the issuance date.

There

are no arrangements or understandings between the Company and the newly appointed executive officer or director and any other person

or persons pursuant to which each executive officer or director was appointed and there is no family relationship between or among any

director or executive officer of the Company or any person nominated or chosen by the Company to become a director or executive officer.

There

are no transactions between the Company and any newly appointed executive officer or director that are reportable pursuant to Item 404(a)

of Regulation SK. The Company did not enter into or materially amend any material plan, contract or arrangement with any newly appointed

executive officer or director in connection with his or her appointment as a director or executive officer.

Item

5.07 Submission of Matters to a Vote of Security Holders.

At

the Meeting the Company’s stockholders voted on the matters described below.

| 1. |

The

Company’s stockholders elected seven directors, each to serve until his/her successor is duly elected and qualified at the

2023 Annual Meeting of Stockholders or until his/her earlier resignation or removal. The number of shares that (a) voted for the

election of each director, (b) voted against the election of each director, and (c) withheld authority to vote for each director

is summarized in the table below: |

| Director Nominee | |

Votes For | | |

Votes Against | | |

Votes Withheld | |

| | |

| | |

| | |

| |

| Brian S. John | |

| 13,348,298 | | |

| 253,339 | | |

| 116,744 | |

| Dr. Glynn Wilson | |

| 13,301,989 | | |

| 306,379 | | |

| 110,013 | |

| Dr. Skender Fani | |

| 13,536,204 | | |

| 160,964 | | |

| 21,213 | |

| Nancy Torres Kaufman | |

| 12,286,329 | | |

| 1,313,203 | | |

| 118,849 | |

| Christopher Melton | |

| 13,308,649 | | |

| 296,925 | | |

| 112,807 | |

| Jarrett Boon | |

| 4,674,398 | | |

| 8,933,208 | | |

| 110,775 | |

| Dr. Hector Alila | |

| 13,534,124 | | |

| 155,516 | | |

| 28,741 | |

| 4. |

Proxies

were solicited on behalf of the Board of Directors of the Company and a vote by ballot was taken for and against the ratification

of the appointment of M&K CPAS, PLLC (“M&K”) as the independent registered public accounting firm of the Company

for the fiscal year ending December 31, 2023. The number of shares that voted for, against, and withheld from voting for this proposal

is summarized in the table below: |

| Votes For | | |

Votes Against | | |

Votes Withheld | |

| | | |

| | |

| |

| | 22,836,925 | | |

| 106,737 | | |

| 35, 519 | |

| 6. |

Proxies

were solicited on behalf of the Board of Directors of the Company and a vote by ballot was taken for and against the ratification

of the 2023 Equity Incentive Plan, including the reservation of 7,000,000 shares of common stock. The number of shares that voted

for, against, and withheld from voting for this proposal is summarized in the table below: |

| Votes For | | |

Votes Against | | |

Votes Withheld | |

| | | |

| | |

| |

| | 11,614,569 | | |

| 1,929,120 | | |

| 174,692 | |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

December 7, 2023

| |

SAFETY

SHOT, INC. |

| |

|

| |

By: |

/s/

Brian John |

| |

|

Brian

John |

| |

|

Chief

Executive Officer |

v3.23.3

Cover

|

Dec. 05, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 05, 2023

|

| Entity File Number |

001-39569

|

| Entity Registrant Name |

SAFETY

SHOT, INC.

|

| Entity Central Index Key |

0001760903

|

| Entity Tax Identification Number |

83-2455880

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1061

E. Indiantown Rd.

|

| Entity Address, Address Line Two |

Ste. 110

|

| Entity Address, City or Town |

Jupiter

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33477

|

| City Area Code |

(561)

|

| Local Phone Number |

244-7100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock [Member] |

|

| Title of 12(b) Security |

Common

Stock

|

| Trading Symbol |

SHOT

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock at $8.50 per share |

|

| Title of 12(b) Security |

Warrants,

each exercisable for one share of Common Stock at $8.50 per share

|

| Trading Symbol |

SHOTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SHOT_WarrantsEachExercisableForOneShareOfCommonStockAt8.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

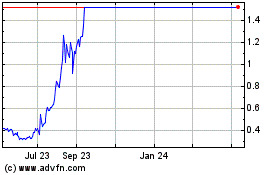

Jupiter Wellness (NASDAQ:JUPW)

Historical Stock Chart

From Apr 2024 to May 2024

Jupiter Wellness (NASDAQ:JUPW)

Historical Stock Chart

From May 2023 to May 2024