Dolphin Advocates $19-$21 JOUT Dutch Auction Tender; Stock Split and Quarterly Cash Dividends

September 29 2005 - 3:34PM

PR Newswire (US)

STAMFORD, Conn., Sept. 28 /PRNewswire/ -- On August 18, 2005

Dolphin Limited Partnership I, L.P. sent the following letter to

Ms. Helen Johnson-Leipold, Chairman and CEO of Johnson Outdoors

Inc. (NASDAQ:JOUT). Dolphin has now been informed that this letter

was recently forwarded to the entire board and the board "will be

discussing the proposals outlined in the letter at its upcoming

meeting." In its letter Dolphin advocates a one million share

$19-$21 per share Dutch Auction Tender offer that it believes would

be an accretive way to deploy JOUT's sizable amount of low yielding

cash. Dolphin also suggested the implementation of a 2:1 stock

split to enhance liquidity in the Class A common stock and the

initiation of an appropriate quarterly cash dividend. Dolphin

believes these steps in conjunction with appropriate accretive

acquisitions and more detailed public disclosure of the Company's

five year strategic plan would generate short and long-term value

for all shareholders. Dolphin awaits the results of the board's

deliberations on these matters. Dolphin Limited Partnership I, L.P.

Ninety-Six Cummings Point Road Stamford, Ct 06902 August 18, 2005

Via Facsimile and Federal Express Ms. Helen P. Johnson-Leipold

Chairman and Chief Executive Officer Johnson Outdoors Inc. 555 Main

Street Racine, WS 53403 Dear Helen: After so many months of not

being able to connect with you, it was a pleasure to finally speak

with you on JOUT's August 9, 2005 third quarter conference call. It

appears from the Company's strong third quarter results that JOUT's

inherent value is crystallizing for investors. We congratulate you

and your colleagues on taking good first steps to resolve some

outstanding operating challenges. You indicated on the call that

the company "doesn't talk about internal budget expectations", so

you would not indicate whether the 2005 nine month results exceeded

the Company's plan. Nevertheless, we observed the following: 1. As

of July 1, 2005, the Company's high cost debt had declined by $16.2

million. This debt carries an onerous prepayment penalty which, we

believe, meaningfully increased the cost of the going private

transaction and, we assume, correspondingly decreased the

consideration offered to minority shareholders. 2. Net debt

declined $15.6 million year over year to $11.2 million; however,

with the seasonal high in accounts receivable of $83.7 million at

July 1, 2005 (up from $49.7 million at Fiscal Year End, October 1,

2004), as we predicted in our letter of March 31, 2005, we suspect

JOUT is more likely now in an average net cash position. 3. JOUT's

shares are currently trading at approximately 1.0x book value and

1.2x tangible book value. 4. Consistent with the Company's 2004

10-K, the sizable EBITDA loss at Watercraft was reduced by $2.9

million for the 2005 nine months and, as indicated on the call, it

appears more progress is expected. 5. Without adjusting for the

anticipated drop in military tent sales and higher energy and raw

materials costs, it appears that adjusted EBITDA for the 2005 nine

months increased approximately 4%. As we were requesting on the

call for the Company to produce for all investors, below we have

"more finely broken out" this comparison: ($ Millions) Nine Months

Ended July 1, 2005 July 2, 2004 Net Sales $ 303.6 $ 279.7 Reported

Operating Profit $ 20.1 $ 23.7 Depreciation & Amortization $

7.1 $ 6.2 Non-Cash Equity Compensation .4 -- Watercraft Charge .7

Litigation Settlement Received -- (2.0) Diving Accrual Reversal

(.7) Merger Costs 2.5 1.4 Adjusted EBITDA* $ 29.8 $ 28.6 * After

corporate overhead (without merger costs) of $10.7 and $10.4,

respectively. Full Fiscal Year 2004 corporate overhead was $14.1

million. While the operating picture appears to be clarifying, this

has not translated into value for all shareholders. Given JOUT's

nine months operating results and its very favorable balance sheet

position, we encourage you and the board to proactively implement

steps to improve the price of JOUT's shares and their liquidity. In

this regard, we request the board to initiate a Dutch auction

tender offer for 1.0 million Class A shares at a price from $19 to

$21/share where all shareholders may participate pro rata. With

over $39.0 million of low yielding cash and a seasonally high

accounts receivable balance at July 1, 2005, the cash requirements

for this transaction appear modest when compared to JOUT's

financial capability. Accordingly, this would not detract from

JOUT's ability to make accretive acquisitions. If, for example, one

million shares were acquired at $21/share, we believe this would be

significantly accretive. We further suggest that these initiatives

be followed by a 2:1 stock split and the implementation of an

appropriate quarterly dividend. As you know, some investors can not

own shares in a company that does not pay a dividend. We believe

this program represents a compelling opportunity for the board to

deliver short-term and long-term value for all shareholders. We

look forward to discussing this with you in person at your earliest

convenience and will follow-up directly with you shortly. Very

truly yours, Donald T. Netter Senior Managing Director DATASOURCE:

Dolphin Limited Partnership I, L.P. CONTACT: L. Bolster,

+1-203-358-8000

Copyright

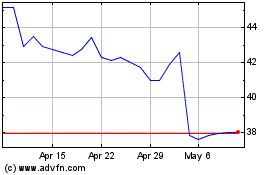

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Sep 2024 to Oct 2024

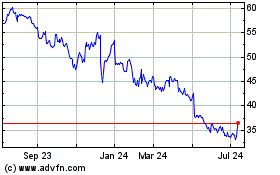

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Oct 2023 to Oct 2024