false000115846300011584632024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 30, 2024

JETBLUE AIRWAYS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 000-49728 | 87-0617894 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

27-01 Queens Plaza North | Long Island City | New York | 11101 |

| (Address of principal executive offices) | (Zip Code) |

(718) 286-7900

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

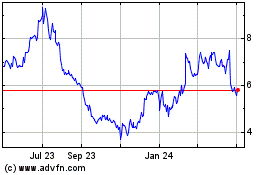

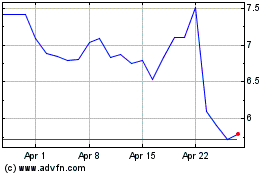

| Common Stock, $0.01 par value | JBLU | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 30, 2024 we issued a press release announcing our financial results for the fourth quarter ended December 31, 2023. A copy of the press release is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

The information included under Item 2.02 of this report (including the exhibits) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 7.01 Regulation FD Disclosure.

On January 30, 2024 we provided an update for investors presenting information relating to our financial outlook for the first quarter ending March 31, 2024 and full year 2024, and other information regarding our business. The update and materials to be used in conjunction with the presentation are furnished herewith as Exhibit 99.2 and Exhibit 99.3 and are incorporated herein by reference.

The information included under Item 7.01 of this report (including the exhibits) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| | Press Release dated January 30, 2024 of JetBlue Airways Corporation announcing financial results for the fourth quarter ended December 31, 2023. |

| | Investor Update dated January 30, 2024 of JetBlue Airways Corporation. |

| | Earnings Presentation dated January 30, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | JETBLUE AIRWAYS CORPORATION |

| | | (Registrant) |

| | | |

| Date: | January 30, 2024 | By: | /s/ Dawn Southerton |

| | | Dawn Southerton |

| | | Vice President, Controller |

| | | (Principal Accounting Officer) |

JETBLUE ANNOUNCES FOURTH QUARTER 2023 RESULTS

Fourth quarter revenue and costs beat expectations

Reached agreement to defer ~$2.5 billion of planned aircraft capital expenditures

Focused on restoring profitability through new revenue and cost initiatives in 2024

NEW YORK (January 30, 2024) - JetBlue Airways Corporation (NASDAQ: JBLU) today reported its financial results for the fourth quarter of 2023.

“We closed the year on a strong note thanks to the hard work and continued execution of our team as fourth quarter revenue and costs beat our expectations,” said Robin Hayes, JetBlue’s chief executive officer. “Looking ahead, I am confident that the next chapter of JetBlue, under Joanna’s leadership, will deliver a refreshed focus on our core customer, expanded opportunities for our crewmembers, and a return to JetBlue’s historical earnings power for our shareholders.”

“2024 is an important year of change for JetBlue and we are taking aggressive action, including launching $300 million of revenue initiatives, to return to profitability and deliver value for our shareholders. We are moving with renewed rigor and discipline as we refocus our energy and play to our strengths, further deepening our unique competitive positioning,” said Joanna Geraghty, JetBlue’s president and chief operating officer.

Fourth Quarter 2023 Financial Results

•Net loss for the fourth quarter of 2023 under Generally Accepted Accounting Principles ("GAAP") of $104 million or $(0.31) per share. Excluding special items, adjusted net loss for the fourth quarter of 2023 of $63 million (1) or $(0.19) per share.

•Fourth quarter of 2023 capacity increased by 3.3% year-over-year.

•Operating revenue of $2.3 billion for the fourth quarter of 2023, down 3.7% year-over-year.

•Operating expense per available seat mile ("CASM") for the fourth quarter of 2023 decreased 2.4% year-over-year.

•Operating expense per available seat mile, excluding fuel and related taxes, other non-airline operating expenses, and special items ("CASM ex-Fuel") (1) for the fourth quarter of 2023 increased 7.6% (1) year-over-year.

•Average fuel price in the fourth quarter of 2023 of $3.08 per gallon, including hedges.

Fourth Quarter 2023 Key Highlights

•Executed on Our Cost Initiatives

◦Achieved $70 million in cost savings under our structural cost program in 2023 keeping JetBlue on track to deliver run-rate savings of $175 million to $200 million by the end of 2024.

◦Realized $55 million in cumulative cost savings from our fleet modernization program, which is expected to deliver $75 million in cost savings through 2024 as we replace the Embraer E190s with the margin-accretive A220s.

•Provided Exceptional Service for Our Customers

◦Delivered excellent operational performance in the fourth quarter with a completion factor of 99.8%, JetBlue’s best fourth quarter completion factor since 2004.

◦Recognized by “The Points Guy” with an Editors’ Choice Award for Best Economy Class across U.S. airlines for the fourth time.

◦Launched new TrueBlue® loyalty program offering new perks and options to customers, which to date has generated exceptional growth and engagement, particularly from Mosaic customers.

•Initiated Strategic Network Changes

◦Redeployed assets to outperforming leisure and VFR routes and began the resizing of our presence at LaGuardia.

◦Expanded service to the Caribbean with new nonstop flights to St. Kitts and Nevis’s Robert Llewellyn Bradshaw International Airport from New York's John F. Kennedy International Airport (JFK), as well as new routes between the Dominican Republic and Orlando, Grenada and Boston Logan International Airport (BOS), the Bahamas and Los Angeles and Belize City and JFK.

◦Added new transatlantic destinations with daily service between JFK and Paris Charles de Gaulle, JFK and Amsterdam Schiphol Airport (AMS), and BOS and AMS, in addition to the announcement of two new seasonal routes to Dublin and Edinburgh, both launching in Spring 2024.

•Advanced Our Progress as a Sustainability Leader

◦Reduced our 2023 carbon emissions by 6% versus 2019 levels driven by fleet upgrades, a doubling of our use of sustainable aviation fuel versus 2022, and fuel optimization efforts.

◦Furthered efforts to diversify our talent pool and boost career accessibility in pilot and technician roles through our Gateways Program, with two-thirds of participants from underrepresented groups.

Balance Sheet and Liquidity

•Reached agreement to defer ~$2.5 billion of planned aircraft capital expenditures from 2024 – 2027 to 2028 and thereafter, providing a more consistent level of annual aircraft deliveries through the end of the decade.

•Ended the fourth quarter with $1.7 billion in unrestricted cash, cash equivalents, short-term investments, and long-term marketable securities (excluding our $600 million undrawn revolving credit facility).

Outlook

“As we look ahead in 2024, we are seeing positive momentum in our revenue growth. Demand during peak periods remains strong, and we continue to manage our capacity during off-peak periods to reflect evolving demand trends. We plan to continue to refine our network and product offering to better serve our leisure customers while diversifying revenues with margin-accretive initiatives,” continued Geraghty.

| | | | | | | | |

| First Quarter and Full Year 2024 Outlook | Estimated 1Q 2024 | Estimated FY 2024 |

| Available Seat Miles (ASMs) Year-Over-Year | (6.0%) - (3.0%) | Down low single digits |

| Revenue Year-Over-Year | (9.0%) - (5.0%) | ~Flat |

CASM Ex-Fuel (1) Year-Over-Year (2) | 9.0% - 11.0% | Up mid-to-high single digits |

Fuel Price per Gallon (3), (4) | $2.87 - $3.02 | - |

Adjusted Operating Margin (1) | - | Approaching breakeven |

| Capital Expenditures | ~$250 million | ~$1.6 billion |

“We remain intensely focused on restoring profitability, taking steps to ensure every dollar we invest is making an impact. As part of these efforts, we are carefully evaluating deeper cuts to our controllable costs beyond our ongoing fleet modernization and structural cost programs. Through these initiatives, coupled with the evolution of our network and product offering, I am confident in our ability to re-establish profitability and position JetBlue to restore historical earnings power,” said Ursula Hurley, JetBlue’s chief financial officer.

Earnings Call Details

JetBlue will conduct a conference call to discuss its quarterly earnings today, January 30, 2024 at 10:00 a.m. Eastern Time. A live broadcast of the conference call will also be available via the internet at http://investor.jetblue.com. The webcast replay and presentation materials will be archived on the company’s website.

For further details, see the fourth quarter 2023 Earnings Presentation available via the internet at http://investor.jetblue.com.

About JetBlue

JetBlue is New York's Hometown Airline®, and a leading carrier in Boston, Fort Lauderdale-Hollywood, Los Angeles, Orlando and San Juan. JetBlue, known for its low fares and great service, carries customers to more than 100 destinations throughout the United States, Latin America, the Caribbean, Canada and Europe. For more information and the best fares, visit jetblue.com.

Notes

(1)Non-GAAP financial measure; Note A provides a reconciliation of certain non-GAAP financial measures used in this release and explains the reasons management believes that presentation of these non-GAAP financial measures provides useful information to investors regarding JetBlue's financial condition and results of operations. In addition, refer to Note A for further details on non-GAAP forward-looking information.

(2)Includes the impact from the pilot union agreement of approximately two points for each the first quarter and full year 2024.

(3)Includes fuel taxes, hedges and other fuel fees.

(4)JetBlue utilizes the forward Brent crude curve and the forward Brent crude to jet crack spread to calculate the unhedged portion of its current quarter. Fuel price is based on forward curve as of January 19, 2024.

Forward-Looking Information

This Earnings Release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this Earnings Release may be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements contained in this Earnings Release include, without limitation, statements regarding our outlook and future results of operations and financial position, expectations with respect to headwinds, including the continued wind down of the Northeast Alliance (“NEA”) with American Airlines Group Inc. (“American Airlines”), the impact of air traffic control ("ATC") driven delays, shifts in post-COVID customer demand, and fluctuations in fuel prices, and our business strategy and plans for future operations, including our planned merger (the “Merger”) with Spirit Airlines Inc. (“Spirit”) and the associated impacts on our business. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the occurrence of any event, change or other circumstances, including outcomes of legal proceedings, that could give rise to the right of JetBlue or Spirit or both of them to terminate the Agreement and Plan of Merger dated as of July 28, 2022 (the “Merger Agreement”) and among Spirit and Sundown Acquisition Corp., a Delaware corporation and a direct wholly owned subsidiary of JetBlue; our extremely competitive industry; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to our NEA with American Airlines and our wind-down

of the NEA; failure to obtain certain governmental approvals necessary to consummate the Merger; the outcome of the lawsuit filed by the Department of Justice and certain state Attorneys General against us and Spirit related to the Merger; risks associated with failure to consummate the Merger in a timely manner or at all; risks associated with the pendency of the Merger and related business disruptions; indebtedness following consummation of the Merger and associated impacts on business flexibility, borrowing costs and credit ratings; the possibility that JetBlue may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all; challenges associated with successful integration of Spirit's operations; expenses related to the Merger and integration of Spirit; the potential for loss of management personnel and other key crewmembers as a result of the Merger; risks associated with effective management of the combined company following the Merger; risks associated with JetBlue being bound by all obligations and liabilities of the combined company following consummation of the Merger; risks associated with the integration of JetBlue and Spirit workforces, including with respect to negotiation of labor agreements and labor costs; the impact of the Merger on JetBlue’s earnings per share; risks associated with cybersecurity and privacy, including potential disruptions to our information technology systems or information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; our substantial indebtedness and impact on our ability to meet future financing needs; financial risks associated with credit card processors; restrictions as a result of our participation in governmental support programs under the CARES Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing attention to, and evolving expectations regarding, environmental, social and governance (“ESG”) matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Any outlook or forecasts in this document have been prepared without taking into account or consideration the Merger with Spirit.

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Earnings Release, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue's filings with the U.S. Securities and Exchange Commission (the “SEC”), including but not limited to in our Annual Report on Form 10-K for the year ended December 31, 2022, as updated by our other SEC filings, including our Annual Report on Form 10-K for the annual period ended December 31, 2023, to be filed with the SEC. In light of these risks and uncertainties, the forward-looking events discussed in this Earnings Release might not occur. Our forward-looking statements speak only as of the date of this Earnings Release. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| JETBLUE AIRWAYS CORPORATION |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (in millions, except per share amounts) |

| (unaudited) |

| | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | | | | |

| (percent changes based on unrounded numbers) | 2023 | | 2022 | | Percent Change | | 2023 | | 2022 | | Percent Change | | | | | | | |

| OPERATING REVENUES | | | | | | | | | | | | | | | | | | |

| Passenger | $ | 2,166 | | | $ | 2,267 | | | (4.5) | | | $ | 9,008 | | | $ | 8,586 | | | 4.9 | | | | | | | | |

| Other | 159 | | | 148 | | | 7.7 | | | 607 | | | 572 | | | 6.2 | | | | | | | | |

| Total operating revenues | 2,325 | | | 2,415 | | | (3.7) | | | 9,615 | | | 9,158 | | | 5.0 | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | | | | | | | | | | | |

| Aircraft fuel and related taxes | 677 | | | 800 | | | (15.2) | | | 2,720 | | | 3,105 | | | (12.4) | | | | | | | | |

| Salaries, wages and benefits | 751 | | | 689 | | | 9.0 | | | 3,055 | | | 2,747 | | | 11.2 | | | | | | | | |

| Landing fees and other rents | 158 | | | 132 | | | 19.3 | | | 657 | | | 544 | | | 20.7 | | | | | | | | |

| Depreciation and amortization | 159 | | | 150 | | | 5.9 | | | 621 | | | 585 | | | 6.1 | | | | | | | | |

| Aircraft rent | 28 | | | 31 | | | (11.3) | | | 126 | | | 114 | | | 10.4 | | | | | | | | |

| Sales and marketing | 78 | | | 73 | | | 7.3 | | | 316 | | | 289 | | | 9.2 | | | | | | | | |

| Maintenance, materials and repairs | 142 | | | 98 | | | 44.3 | | | 654 | | | 591 | | | 10.9 | | | | | | | | |

| Special items | 29 | | | 57 | | | (48.6) | | | 197 | | | 113 | | | 74.1 | | | | | | | | |

| Other operating expenses | 370 | | | 342 | | | 8.2 | | | 1,499 | | | 1,368 | | | 9.6 | | | | | | | | |

| Total operating expenses | 2,392 | | | 2,372 | | | 0.9 | | | 9,845 | | | 9,456 | | | 4.1 | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| OPERATING INCOME (LOSS) | (67) | | | 43 | | | NM (1) | | (230) | | | (298) | | | (22.9) | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Operating margin | (2.9) | % | | 1.8 | % | | (4.7) | | pts. | (2.4) | % | | (3.3) | % | | 0.9 | | pts. | | | | | | |

| | | | | | | | | | | | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | | | | | | | | | | | |

| Interest expense | (65) | | | (45) | | | 43.6 | | | (210) | | | (166) | | | 26.9 | | | | | | | | |

| Interest income | 25 | | | 15 | | | 65.4 | | | 89 | | | 39 | | | NM | | | | | | | |

| Gain (loss) on investments, net | 3 | | | (5) | | | NM | | 9 | | | (9) | | | NM | | | | | | | |

| Other | (6) | | | (1) | | | NM | | 8 | | | (3) | | | NM | | | | | | | |

| Total other expense | (43) | | | (36) | | | 18.4 | | | (104) | | | (139) | | | (24.6) | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) BEFORE INCOME TAXES | (110) | | | 7 | | | NM | | (334) | | | (437) | | | (23.4) | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Pre-tax margin | (4.7) | % | | 0.3 | % | | (5.0) | | pts. | (3.5) | % | | (4.8) | % | | 1.3 | | pts. | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Income tax benefit | 6 | | | 17 | | | (63.0) | | | 24 | | | 75 | | | (67.6) | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| NET INCOME (LOSS) | $ | (104) | | | $ | 24 | | | NM | | $ | (310) | | | $ | (362) | | | (14.3) | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| EARNINGS (LOSS) PER COMMON SHARE: | | | | | | | | | | | | | | | | | | |

| Basic | $ | (0.31) | | | $ | 0.07 | | | | | $ | (0.93) | | | $ | (1.12) | | | | | | | | | | |

| Diluted | $ | (0.31) | | | $ | 0.07 | | | | | $ | (0.93) | | | $ | (1.12) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| WEIGHTED AVERAGE SHARES OUTSTANDING: | | | | | | | | | | | | | | | | | |

| Basic | 337.8 | | | 326.4 | | | | | 332.9 | | | 323.6 | | | | | | | | | | |

| Diluted | 337.8 | | | 327.8 | | | | | 332.9 | | | 323.6 | | | | | | | | | | |

(1) Not meaningful or greater than 100% change.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| JETBLUE AIRWAYS CORPORATION |

| COMPARATIVE OPERATING STATISTICS |

| (unaudited) |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | |

| (percent changes based on unrounded numbers) | | | | | | | 2023 | | 2022 | | Percent Change | | 2023 | | 2022 | | Percent Change | |

| Revenue passengers (thousands) | | | | | | | 10,225 | | | 10,486 | | | (2.5) | | | 42,534 | | | 39,562 | | | 7.5 | | |

| Revenue passenger miles (RPMs) (millions) | | | | | | | 13,628 | | | 13,695 | | | (0.5) | | | 56,578 | | | 52,552 | | | 7.7 | | |

| Available seat miles (ASMs) (millions) | | | | | | | 17,013 | | | 16,470 | | | 3.3 | | | 68,497 | | | 64,475 | | | 6.2 | | |

| Load factor | | | | | | | 80.1 | % | | 83.2 | % | | (3.1) | | pts. | 82.6 | % | | 81.5 | % | | 1.1 | | pts. |

| Aircraft utilization (hours per day) | | | | | | | 10.5 | | | 10.2 | | | 2.5 | | | 10.9 | | | 10.1 | | | 7.9 | | |

| | | | | | | | | | | | | | | | | | |

| Average fare | | | | | | | $ | 211.83 | | | $ | 216.20 | | | (2.0) | | | $ | 211.79 | | | $ | 217.03 | | | (2.4) | | |

| Yield per passenger mile (cents) | | | | | | | 15.89 | | | 16.55 | | | (4.0) | | | 15.92 | | | 16.34 | | | (2.6) | | |

| Passenger revenue per ASM (cents) | | | | | | | 12.73 | | | 13.76 | | | (7.5) | | | 13.15 | | | 13.32 | | | (1.2) | | |

| Operating revenue per ASM (cents) | | | | | | | 13.67 | | | 14.66 | | | (6.8) | | | 14.04 | | | 14.20 | | | (1.2) | | |

| Operating expense per ASM (cents) | | | | | | | 14.06 | | | 14.40 | | | (2.4) | | | 14.37 | | | 14.67 | | | (2.0) | | |

Operating expense per ASM, excluding fuel (cents) (1) | | | | | | | 9.82 | | | 9.13 | | | 7.6 | | | 10.02 | | | 9.59 | | | 4.5 | | |

| | | | | | | | | | | | | | | | | | |

| Departures | | | | | | | 84,730 | | | 86,046 | | | (1.5) | | | 347,218 | | | 332,699 | | | 4.4 | | |

| Average stage length (miles) | | | | | | | 1,252 | | | 1,109 | | | 12.9 | | | 1,230 | | | 1,213 | | | 1.4 | | |

| Average number of operating aircraft during period | | | | | | | 284 | | | 288 | | | (1.5) | | | 282 | | | 285 | | | (1.1) | | |

| Average fuel cost per gallon, including fuel taxes | | | | | | | $ | 3.08 | | | $ | 3.70 | | | (16.8) | | | $ | 3.03 | | | $ | 3.69 | | | (17.9) | | |

| Fuel gallons consumed (millions) | | | | | | | 220 | | | 216 | | | 2.0 | | | 897 | | | 842 | | | 6.5 | | |

| Average number of full-time equivalent crewmembers | | | | | | | 20,411 | | | 20,016 | | | 2.0 | | | 20,632 | | | 20,075 | | | 2.8 | | |

| | | | | | | | | | | | | | | | | | |

(1) Refer to Note A at the end of our Earnings Release for more information on this non-GAAP financial measure. |

| | | | | | | | | | | |

| JETBLUE AIRWAYS CORPORATION |

| SELECTED CONSOLIDATED BALANCE SHEET DATA |

| (in millions) |

| December 31, 2023 | | December 31, 2022 |

| (unaudited) | | |

| Cash and cash equivalents | $ | 1,166 | | | $ | 1,042 | |

| Total investment securities | 564 | | | 522 | |

| Total assets | 13,853 | | | 13,045 | |

| Total debt | 4,716 | | | 3,647 | |

| Stockholders' equity | 3,337 | | | 3,563 | |

Note A - Non-GAAP Financial Measures

We report our financial results in accordance with GAAP; however, we present certain non-GAAP financial measures in this Earnings Release. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with GAAP. We present these non-GAAP financial measures because we believe they provide useful supplemental information that enables a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. The information below provides an explanation of each non-GAAP financial measure used in this Earnings Release and shows a reconciliation of certain non-GAAP financial measures used in this Earnings Release to the most directly comparable GAAP financial measures.

With respect to JetBlue’s CASM Ex-Fuel (1) and Adjusted Operating Margin Guidance (2), JetBlue is not able to provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measure cannot be calculated or predicted at this time without unreasonable efforts. In these cases, the reconciling information that is unavailable includes a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors beyond our control. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on our future GAAP financial results.

(1) CASM Ex-Fuel is a non-GAAP measure that excludes fuel, related taxes, hedges and other other non-airline operating expenses, and special items.

(2) Adjusted Operating Margin is a non-GAAP measure that excludes special items.

Operating expense per available seat mile, excluding fuel and related taxes, other non-airline operating expenses, and special items (“CASM ex-fuel”)

CASM is a common metric used in the airline industry. Our CASM for the relevant periods are summarized in the table below. We exclude aircraft fuel and related taxes, operating expenses related to other non-airline businesses, such as JetBlue Ventures and JetBlue Travel Products, and special items from total operating expenses to determine Operating expenses ex-fuel, which is a non-GAAP financial measure, and we exclude the same items from CASM to determine CASM ex-fuel, which is also a non-GAAP financial measure. We believe the impact of these special items distorts our overall trends and our metrics are more comparable with the presentation of our results excluding such impact.

Special items for 2023 include Spirit costs and union contract costs.

Special items for 2022 included Spirit costs, union contract costs and Embraer E190 fleet transition costs.

We believe Operating Expenses ex-fuel and CASM ex-fuel are useful for investors because they provide investors the ability to measure our financial performance excluding items that are beyond our control, such as fuel costs, which are subject to many economic and political factors, as well as items that are not related to the generation of an available seat mile, such as operating expense related to certain non-airline businesses and special items. We believe these non-GAAP measures are more indicative of our ability to manage airline costs and are more comparable to measures reported by other major airlines.

The table below provides a reconciliation of our total operating expenses (“GAAP measure”) to Operating Expenses ex-fuel, and our CASM to CASM ex-fuel for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NON-GAAP FINANCIAL MEASURE |

| RECONCILIATION OF OPERATING EXPENSE AND OPERATING EXPENSE PER ASM, EXCLUDING FUEL |

| ($ in millions, per ASM data in cents) |

| (unaudited) |

| | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 | | |

| $ | | per ASM | | $ | | per ASM | | $ | | per ASM | | $ | | per ASM | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total operating expenses | $ | 2,392 | | | 14.06 | | | $ | 2,372 | | | 14.40 | | | $ | 9,845 | | | 14.37 | | | $ | 9,456 | | | 14.67 | | | | | |

| Less: | | | | | | | | | | | | | | | | | | | |

| Aircraft fuel and related taxes | 677 | | | 3.98 | | | 800 | | | 4.86 | | | 2,720 | | | 3.97 | | | 3,105 | | | 4.82 | | | | | |

| Other non-airline expenses | 14 | | | 0.09 | | | 11 | | | 0.07 | | | 64 | | | 0.09 | | | 55 | | | 0.08 | | | | | |

| Special items | 29 | | | 0.17 | | | 57 | | | 0.34 | | | 197 | | | 0.29 | | | 113 | | | 0.18 | | | | | |

| Operating expenses, excluding fuel | $ | 1,672 | | | 9.82 | | | $ | 1,504 | | | 9.13 | | | $ | 6,864 | | | 10.02 | | | $ | 6,183 | | | 9.59 | | | | | |

| Percent change | | | 7.6 | % | | | | | | | | 4.5 | % | | | | | | | | |

Operating Expense, Operating Income (Loss), Adjusted Operating Margin, Pre-tax Income (Loss), Adjusted Pre-tax Margin, Net Income (Loss) and Earnings (Loss) per Share, excluding Special Items and Net Gain (Loss) on Investments

Our GAAP results in the applicable periods were impacted by credits and charges that were deemed special items.

Special items for 2023 include Spirit costs and union contract costs.

Special items for 2022 included Spirit costs, union contract costs and Embraer E190 fleet transition costs.

Certain gains and losses on our investments were also excluded from our 2023 and 2022 GAAP results.

We believe the impact of these items distort our overall trends and our metrics are more comparable with the presentation of our results excluding the impact of these items. The table below provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impact of these items for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | |

| NON-GAAP FINANCIAL MEASURE | |

| RECONCILIATION OF OPERATING EXPENSE, OPERATING INCOME (LOSS), ADJUSTED OPERATING MARGIN, PRE-TAX INCOME (LOSS), ADJUSTED PRE-TAX MARGIN, NET INCOME (LOSS), EARNINGS (LOSS) PER SHARE, EXCLUDING SPECIAL ITEMS AND NET GAIN (LOSS) ON INVESTMENTS |

| (unaudited, in millions) | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, | |

| 2023 | | 2022 | | 2023 | | 2022 | |

| Total operating revenues | $ | 2,325 | | | $ | 2,415 | | | $ | 9,615 | | | $ | 9,158 | | |

| | | | | | | | |

| RECONCILIATION OF OPERATING EXPENSE | | | | | | | | |

| Total operating expenses | $ | 2,392 | | | $ | 2,372 | | | $ | 9,845 | | | $ | 9,456 | | |

| Less: Special items | 29 | | | 57 | | | 197 | | | 113 | | |

| Total operating expenses excluding special items | $ | 2,363 | | | $ | 2,315 | | | $ | 9,648 | | | $ | 9,343 | | |

| | | | | | | | |

| RECONCILIATION OF OPERATING INCOME (LOSS) | | | | | | | |

| Operating income (loss) | $ | (67) | | | $ | 43 | | | $ | (230) | | | $ | (298) | | |

| Add back: Special items | 29 | | | 57 | | | 197 | | | 113 | | |

| Operating income (loss) excluding special items | $ | (38) | | | $ | 100 | | | $ | (33) | | | $ | (185) | | |

| | | | | | | | |

| RECONCILIATION OF ADJUSTED OPERATING MARGIN | | | | | | | |

| Operating margin | (2.9) | % | | 1.8 | % | | (2.4) | % | | (3.3) | % | |

| | | | | | | | |

| Operating income (loss) excluding special items | $ | (38) | | | $ | 100 | | | $ | (33) | | | $ | (185) | | |

| Total operating revenues | 2,325 | | | 2,415 | | | 9,615 | | | 9,158 | | |

| Adjusted operating margin | (1.6) | % | | 4.1 | % | | (0.3) | % | | (2.0) | % | |

| | | | | | | | |

| RECONCILIATION OF PRE-TAX INCOME (LOSS) | | | | | | | |

| Income (loss) before income taxes | $ | (110) | | | $ | 7 | | | $ | (334) | | | $ | (437) | | |

| Add back: Special items | 29 | | | 57 | | | 197 | | | 113 | | |

| Less: Net gain (loss) on investments | 3 | | | (5) | | | 9 | | | (9) | | |

| Income (loss) before income taxes excluding special items and net gain (loss) on investments | $ | (84) | | | $ | 69 | | | $ | (146) | | | $ | (315) | | |

| | | | | | | | |

| RECONCILIATION OF ADJUSTED PRE-TAX MARGIN | | | | | | | |

| Pre-tax margin | (4.7) | % | | 0.3 | % | | (3.5) | % | | (4.8) | % | |

| | | | | | | | |

| Income (loss) before income taxes excluding special items and net gain (loss) on investments | $ | (84) | | | $ | 69 | | | $ | (146) | | | $ | (315) | | |

| Total operating revenues | 2,325 | | | 2,415 | | | 9,615 | | | 9,158 | | |

| Adjusted pre-tax margin | (3.6) | % | | 2.8 | % | | (1.5) | % | | (3.4) | % | |

| | | | | | | | |

| RECONCILIATION OF NET INCOME (LOSS) | | | | | | | |

| Net loss | $ | (104) | | | $ | 24 | | | $ | (310) | | | $ | (362) | | |

| Add back: Special items | 29 | | | 57 | | | 197 | | | 113 | | |

| Less: Income tax benefit (expense) related to special items | (15) | | | 13 | | | 31 | | | 19 | | |

| Less: Net gain (loss) on investments | 3 | | | (5) | | | 9 | | | (9) | | |

| Less: Income tax benefit (expense) related to net gain (loss) on investments | — | | | 1 | | | (2) | | | 1 | | |

| Net loss excluding special items and net gain (loss) on investments | $ | (63) | | | $ | 72 | | | $ | (151) | | | $ | (260) | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| NON-GAAP FINANCIAL MEASURE | |

| RECONCILIATION OF OPERATING EXPENSE, OPERATING INCOME (LOSS), ADJUSTED OPERATING MARGIN, PRE-TAX INCOME (LOSS), ADJUSTED PRE-TAX MARGIN, NET INCOME (LOSS), EARNINGS (LOSS) PER SHARE, EXCLUDING SPECIAL ITEMS AND NET GAIN (LOSS) ON INVESTMENTS (CONTINUED) | |

| (unaudited) | |

| | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, | |

| CALCULATION OF EARNINGS (LOSS) PER SHARE | 2023 | | 2022 | | 2023 | | 2022 | |

| Earnings (loss) per common share | | | | | | | | |

| Basic | $ | (0.31) | | | $ | 0.07 | | | $ | (0.93) | | | $ | (1.12) | | |

| Add back: Special items | 0.09 | | | 0.17 | | | 0.59 | | | 0.35 | | |

| Less: Income tax benefit (expense) related to special items | (0.04) | | | 0.03 | | | 0.09 | | | 0.06 | | |

| Less: Net gain (loss) on investments | 0.01 | | | (0.01) | | | 0.03 | | | (0.03) | | |

| Less: Income tax benefit (expense) related to net gain (loss) on investments | — | | | — | | | (0.01) | | | — | | |

| Basic excluding special items and net gain (loss) on investments | $ | (0.19) | | | $ | 0.22 | | | $ | (0.45) | | | $ | (0.80) | | |

| | | | | | | | |

| Diluted | $ | (0.31) | | | $ | 0.07 | | | $ | (0.93) | | | $ | (1.12) | | |

| Add back: Special items | 0.09 | | | 0.17 | | | 0.59 | | | 0.35 | | |

| Less: Income tax benefit (expense) related to special items | (0.04) | | | 0.03 | | | 0.09 | | | 0.06 | | |

| Less: Net gain (loss) on investments | 0.01 | | | (0.01) | | | 0.03 | | | (0.03) | | |

| Less: Income tax benefit (expense) related to net gain (loss) on investments | — | | | — | | | (0.01) | | | — | | |

| Diluted excluding special items and net gain (loss) on investments | $ | (0.19) | | | $ | 0.22 | | | $ | (0.45) | | | $ | (0.80) | | |

CONTACTS

JetBlue Investor Relations

Tel: +1 718 709 2202

ir@jetblue.com

JetBlue Corporate Communications

Tel: +1 718 709 3089

corpcomm@jetblue.com

Investor Update

Investor Update

Investor Update: January 30, 2024

This update provides JetBlue’s investor guidance for the first quarter ending March 31, 2024 and full year 2024.

| | | | | | | | |

First Quarter and Full Year 2024 Outlook | Estimated 1Q 2024 | Estimated FY 2024 |

| | |

| Capacity and Revenue | | |

| Available Seat Miles (ASMs) Year-Over-Year | (6.0%) - (3.0%) | Down low single digits |

| Revenue Year-Over-Year | (9.0%) - (5.0%) | ~Flat |

| Expense | | |

CASM Ex-Fuel (1) Year-Over-Year (2) | 9.0% - 11.0% | Up mid-to-high single digits |

| | |

Fuel Price per Gallon (3), (4) | $2.87 - $3.02 | - |

| | |

Adjusted Operating Margin (1) | - | Approaching breakeven |

| Capital Expenditures | ~$250 million | ~$1.6 billion |

(1) Non-GAAP financial measure; refer to Note A for further details on non-GAAP forward looking information.

(2) Includes the impact from the new pilot union agreement of approximately two points for each the first quarter and full year 2024.

(3) Includes fuel taxes, hedges and other fuel fees.

(4) JetBlue utilizes the forward Brent crude curve and the forward Brent crude to jet crack spread to calculate the unhedged portion of its current quarter. Fuel price is based on forward curve as of January 19, 2024.

1

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

Investor Update

Investor Update

Fuel Hedges

As of January 30, 2024 JetBlue’s advanced fuel derivative contracts are as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Gallons | | Estimated Percentage of Consumption | | Price |

| | | |

1Q24 | | 63 million | | 30% | | USGC Jet bull call spreads at an average strike price of $2.65/gal x $2.90/gal |

2Q24 | | 35 million | | 16% | | USGC Jet bull call spreads at an average strike price of $2.63/gal x $2.88/gal |

3Q24 | | 6 million | | 3% | | USGC Jet bull call spreads at an average strike price of $2.55/gal x $2.80/gal |

4Q24 | | 11 million | | 5% | | USGC Jet bull call spreads at an average strike price of $2.67/gal x $2.92/gal |

FY24 | | 115 million | | 13% | | USGC Jet bull call spreads at an average strike price of $2.64/gal x $2.89/gal |

Order Book

As of December 31, 2023 JetBlue’s fleet was comprised of 130 Airbus A320 aircraft, 93 Airbus A321, 24 Airbus A220 and 53 Embraer E190 aircraft, for a total of 300 aircraft.

JetBlue’s aircraft delivery planning assumptions as of January 30, 2024:

| | | | | | | | | | | | |

| | |

| Year | A220 | A321NEO | TOTAL | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| 2024 | 20 | 7 | 27 | |

| 2025 | 20 | 5 | 25 | |

| 2026 | 20 | 4 | 24 | |

| 2027 | 5 | 9 | 14 | |

| | | | |

JetBlue’s contractual aircraft return schedule as of January 30, 2024:

| | | | | | | | | | | | |

| | |

| Year | A320 | E190 | TOTAL | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| 2024 | (8) | (16) | (24) | |

| 2025 | (7) | (7) | (14) | |

| | | | |

2

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

Investor Update

Investor Update

Forward Looking Information

This Investor Update contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this Investor Update may be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements contained in this Investor Update include, without limitation, statements regarding our outlook and future results of operations and financial position, and our order book and related assumptions. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the occurrence of any event, change or other circumstances, including outcomes of legal proceedings, that could give rise to the right of JetBlue or Spirit Airlines Inc. (“Spirit”) or both of them to terminate the Agreement and Plan of Merger dated as of July 28, 2022 (the “Merger Agreement”) and among Spirit and Sundown Acquisition Corp., a Delaware corporation and a direct wholly owned subsidiary of JetBlue; our extremely competitive industry; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to our Northeast Alliance with American Airlines Group Inc. and our planned wind-down of the Northeast Alliance; failure to obtain certain governmental approvals necessary to consummate the Merger with Spirit (the “Merger”); the outcome of the lawsuit filed by the Department of Justice and certain state Attorneys General against us and Spirit related to the Merger; risks associated with failure to consummate the Merger in a timely manner or at all; risks associated with the pendency of the Merger and related business disruptions; indebtedness following consummation of the Merger and associated impacts on business flexibility, borrowing costs and credit ratings; the possibility that JetBlue may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all; challenges associated with successful integration of Spirit's operations; expenses related to the Merger and integration of Spirit; the potential for loss of management personnel and other key crewmembers as a result of the Merger; risks associated with effective management of the combined company following the Merger; risks associated with JetBlue being bound by all obligations and liabilities of the combined company following consummation of the Merger; risks associated with the integration of JetBlue and Spirit workforces, including with respect to negotiation of labor agreements and labor costs; the impact of the Merger on JetBlue’s earnings per share; risks associated with cybersecurity and privacy, including potential disruptions to our information technology systems or information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; our substantial indebtedness and impact on our ability to meet future financing needs; financial risks associated with credit card processors; restrictions as a result of our participation in governmental support programs under the CARES Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing attention to, and evolving expectations regarding, environmental, social and governance matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Any outlook or forecasts in this document have been prepared without taking into account or consideration the Merger with Spirit.

3

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

Investor Update

Investor UpdateGiven the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Investor Update, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue's filings with the U.S. Securities and Exchange Commission (the “SEC”), including but not limited to in our Annual Report on Form 10-K for the year ended December 31, 2022, as updated by our other SEC filings, including our Annual Report on Form 10-K for the annual period ended December 31, 2023, to be filed with the SEC. In light of these risks and uncertainties, the forward-looking events discussed in this Investor Update might not occur. Our forward-looking statements speak only as of the date of this Investor Update. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Note A - Non-GAAP Financial Measures

We report our financial results in accordance with GAAP; however, we present certain non-GAAP financial measures in this Investor Update. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with GAAP. We present these non-GAAP financial measures because we believe they provide useful supplemental information that enables a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies.

With respect to JetBlue’s CASM Ex-Fuel (1) and Adjusted Operating Margin Guidance (2), we are not able to provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measures cannot be calculated or predicted at this time without unreasonable efforts. In these cases, the reconciling information that is unavailable includes a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors beyond our control. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on our future GAAP financial results.

(1) CASM Ex-Fuel is a non-GAAP measure that excludes fuel, related taxes, hedges and other fuel fees, other non-airline operating expenses, and special items.

(2) Adjusted Operating Margin is a non-GAAP measure that excludes special items.

4

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

1 4Q23 Earnings Presentation January 30, 2024

2 Safe Harbor This Presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this Presentation may be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” or the negat ive of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements contained in this Presentation include, without limitation, statements regarding our outlook and future results of operations and financial position, industry and market trends, expectations with respect to headwinds, including fleet modernization costs, engine issues, ATC delays and weather challenges, anticipated strategic growth in loyalty program and JetBlue Travel Products, our ability to achieve operational and financial targets, our business strategy and plans for future operations, including our revenue generation and cost savings initiatives (including our Structural Cost Program and fleet modernization program), and planned operational investments, and the associated impacts on our business. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the occurrence of any event, change or other circumstances, including outcomes of legal proceedings, that could give rise to the right of JetBlue or Spirit Airlines, Inc. (“Spirit”) or both of them to terminate the Agreement and Plan of Merger dated as of July 28, 2022 and among Spirit and Sundown Acquisition Corp., a Delaware corporation and a direct wholly owned subsidiary of JetBlue; our extremely competitive industry; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to our NEA with American Airlines and our wind-down of the NEA; failure to obtain certain governmental approvals necessary to consummate our merger with Spirit (the “Merger”); the outcome of the lawsuit filed by the Department of Justice and certain state Attorneys General against us and Spirit related to the Merger; risks associated with failure to consummate the Merger in a timely manner or at all; risks associated with the pendency of the Merger and related business disruptions; indebtedness following consummation of the Merger and associated impacts on business flexibility, borrowing costs and credit ratings; the possibility that JetBlue may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all; challenges associated with successful integration of Spirit's operations; expenses related to the Merger and integration of Spirit; the potential for loss of management personnel and other key crewmembers as a result of the Merger; risks associated with effective management of the combined company following the Merger; risks associated with JetBlue being bound by all obligations and liabilities of the combined company following consummation of the Merger; risks associated with the integration of JetBlue and Spirit workforces, including with respect to negotiation of labor agreements and labor costs; the impact of the Merger on JetBlue’s earnings per share; risks associated with cybersecurity and privacy, including potential disruptions to our information technology systems or information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; our substantial indebtedness and impact on our ability to meet future financing needs; financial risks associated with credit card processors; restrictions as a result of our participation in governmental support programs under the CARES Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing attention to, and evolving expectations regarding, environmental, social and governance (“ESG”) matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Any outlook or forecasts in this document have been prepared without taking into account or consideration the Merger with Spirit. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Earnings Release, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue's filings with the U.S. Securities and Exchange Commission (the “SEC”), including but not limited to in our Annual Report on Form 10-K for the year ended December 31, 2022, as updated by our other SEC filings, including our Annual Report on Form 10-K for the annual period ended December 31, 2023, to be filed with the SEC. In light of these risks and uncertainties, the forward-looking events discussed in this Earnings Release might not occur. Our forward-looking statements speak only as of the date of this Earnings Release. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

3 Commercial Update and Outlook Joanna Geraghty

4 Taking Measures to Restore Profitability by Strengthening Our Unique Competitive Positioning Reshaping cost structure in light of current operating environment Deferring ~$2.5B of planned capital expenditures from 2024-2027 to later in the decade Drive Cost and Capital Discipline Evolving our product offering and network to reflect customer trends, including a focus on premium leisure Actioning $300M of revenue initiatives in 2024 Focus on Core Customer Continue to Integrate Travel Brand Strategically growing loyalty and JetBlue Travel Products to drive earnings and cultivate sustainable customer engagement Operational Reliability is foundational to restoring profitability Fundamental Priorities

5 Strong Finish to 2023 is Setting the Stage for Progress Through 2024 2023 Key Highlights Renewed focus on operational reliability yielded early benefits • Completion factor in 4Q of 99.8% was JetBlue’s best 4Q performance since 2004, and at the top of the industry in 4Q23 • Full year on-time performance(1) improved by two points YoY, despite challenging 2Q • Initiated multi-year plan to structurally and sustainably improve reliability Operational Performance • Peak and off-peak period demand exceeded expectations in 4Q • Mint and Even More Space RASM growth outpaced Core YoY • Launched revamped TrueBlue program and saw 4Q performance exceed expectations • Strong sequential revenue growth in 4Q expected to continue into 2024 Revenue growth supported by leisure demand and loyalty Revenue Continued cost execution • Executed FY23 CASM ex- Fuel(2) within initial guidance range of 1.5%- 4.5%, despite unprecedented challenges • $70M of cumulative Structural Cost Program savings • Achieved $55M in cumulative cost savings through fleet modernization program Costs (1) A14 - Arrival within 14 minutes of scheduled arrival time (A14) (2) Operating expense per available seat mile, excluding fuel and related taxes, hedges, other non-airline operating expenses, and special items (“CASM ex-Fuel”); refer to reconciliations of non-GAAP financial measures in Appendix A

6 Revenue in 1H24 Cycling Against a Strong 1H23 • Encouraged by sequential RASM momentum and continued demand strength for peak period travel • Margin tailwinds in core NYC geography as LaGuardia transitions towards pre-Northeast Alliance footprint and post-COVID recovery continues Investments in Reliability Expected to Continue to Improve Completion Factor and On-Time Performance • Building on continued momentum from solid operational close to 2023 Deploying ~$300M of Revenue Initiatives Throughout 2024 • Aggressively reallocating underperforming capacity to proven premium leisure and visiting-friends-and-relatives markets • Refocusing our efforts to better serve and merchandise all leisure customers with a growing focus on premium leisure customers • Driving ancillary revenue per customer from mid to high $50s • Continued strategic growth in loyalty program and JetBlue Travel Products ASMs (3.7%) 3.3% Guidance (7.0%) to (4.0%) Guidance 2.0% to 3.0% 4Q23 vs. 4Q22 Actuals 1Q24 vs. 1Q23 (6.0%) to (3.0%) (9.0%) to (5.0%) Revenue Revenue ASMs Strong Demand Backdrop and Revenue Opportunities Support 2024 Top-Line Expectations

7 Financial Update and Outlook Ursula Hurley

8 (1) Operating expense per available seat mile, excluding fuel and related taxes, hedges, other non-airline operating expenses, and special items (“CASM ex-Fuel”); refer to reconciliations of non-GAAP financial measures in Appendix A Achieved FY23 Cost Guidance Despite Air Traffic Control and Weather Setbacks Cost Profile in FY24 Impeded by Temporary Challenges • Engine issues expected to drive significant aircraft ground time; currently seven aircraft out-of-service and expected to rise to ~13-15 by year-end Laser Focused on Delivering Competitive Cost Growth Despite Industry Cost Pressures and YoY Capacity Deceleration • Initiating deeper and targeted controllable fixed cost savings, driving roughly flat absolute CASM ex-Fuel(1) throughout 2024 • Structural Cost Program is at peak of expectations and expected to deliver $175-200M in run-rate cost reduction through year-end 2024 • Near-term pressures exist while transitioning to two fleet types, remain on track to deliver $75M savings via fleet modernization program by year-end 2024 Committed to Maintaining Our Competitive Cost Structure CASM Ex-Fuel(1) Year-over-Year Growth Guidance 8.5% to 10.5% 7.6% 4Q23 1Q24 FY24 Up Mid-to- High Single Digits 9.0% to 11.0% ASM Year-over-Year Growth 3.3% (6.0%) to (3.0%) Down low single digits

9 Plan to Defer ~$2.5B of Planned Capital Expenditures From 2024-2027 • Provides a more consistent level of firm aircraft deliveries and capital expenditures through the end of the decade • Continues to prioritize margin-accretive fleet modernization program and ongoing Embraer E190 retirement plan Maintaining a Total Financeable Asset Pool of $10B+ • Collateral pool includes TrueBlue loyalty program, JetBlue brand intellectual property, our slot portfolio, aircraft and engines Continuing to Actively Manage Risk to Protect Earnings • Hedged 30% of planned 1Q24 fuel consumption and 13% for FY24 Prioritizing Capital Discipline (1) Forecast as January 30, 2024 (2) Excludes options to purchase an additional 20 A220-300 aircraft. See Appendix C for more details Capital Expenditure Forecast(1) 2024-2027 $1.6B $1.5B $1.6B $1.4B $0.1B $0.8B $1.3B $0.3B 2024 2025 2026 2027 ~$2.5B of planned capex deferred Modified Delivery Planning Assumptions(2) 27 25 24 14 Deferred Capex Revised Capex Forecast

1 0 (1) See Appendix A for further details on Non-GAAP measures (2) Includes the impact from the pilot union agreement of approximately two points for each the first quarter and full year 2024 (3) Fuel hedged 30% for 1Q24; 13% for FY24 (4) Fuel price based on forward curve as of January 19, 2024. Includes fuel taxes, hedges, and other fuel fees Guidance Estimated 1Q 2024 Estimated FY 2024 Available Seat Miles (ASMs) Year-over-Year (6.0%) - (3.0%) Down low single digits Revenue Year-over-Year (9.0%) - (5.0%) ~Flat CASM ex-Fuel(1) Year-over-Year(2) 9.0% - 11.0% Up mid-to-high single digits Fuel Price per Gallon(3), (4) $2.87 - $3.02 - Adjusted Operating Margin(1) - Approaching breakeven Capital Expenditures ~$250 million ~$1.6 billion Outlook Summary

1 1 Leisure Focus with Increasing Exposure to Premium Segments • Refocusing our product and network efforts to better serve and merchandise all leisure customers with a growing focus on premium leisure customers • Long-term competitive advantage expected from sizable footprint in slot-constrained NYC market, which historically produces above system average margins Diversifying Revenues with Margin-Accretive Initiatives • Continuing to accelerate loyalty growth performance with ongoing evolution of TrueBlue and partnership programs • Strategically growing and tailoring our JetBlue Travel Products offering Continued Cost Execution and Capital Discipline • Deferring ~$2.5B of planned capex to prioritize capital discipline and smooth growth cadence through end of decade • Reshaping our cost structure to address cost convergence • Structural cost program continues to deliver significant benefits • Fleet modernization continues to drive efficiency Laying the Foundation to Re-Establish Profitability and Position JetBlue to Restore Historical Earnings Power

1 2 Non-GAAP Financial Measures We report our financial results in accordance with GAAP; however, we present certain non-GAAP financial measures in this Presentation. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with GAAP. We present these non-GAAP financial measures because we believe they provide useful supplemental information that enables a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. This Presentation includes an explanation of each non-GAAP financial measure presented in this Presentation and a reconciliation of certain non-GAAP financial measures used in this Presentation to the most directly comparable GAAP financial measures. We do not provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measure cannot be calculated or predicted at this time without unreasonable efforts. In those cases, the reconciling information that is unavailable would include a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors beyond our control. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on our future GAAP financial results. Appendix A

1 3 Operating expense per available seat mile, excluding fuel and related taxes, other non-airline operating expenses, and special items (“CASM Ex-Fuel”) Operating Expense per Available Seat Mile (“CASM”) is a common metric used in the airline industry. Our CASM for the relevant periods are summarized in the table below. We exclude aircraft fuel and related taxes, operating expenses related to other non-airline businesses, such as JetBlue Technology Ventures and JetBlue Travel Products, and special items from total operating expenses to determine Operating Expenses ex-fuel, which is a non-GAAP financial measure, and we exclude the same items from CASM to determine CASM ex-fuel, which is also a non-GAAP financial measure. We believe the impact of these special items distorts our overall trends and that our metrics are more comparable with the presentation of our results excluding such impact. For the three and twelve months ended December 31, 2023, special items included Spirit costs and union contract costs. Special items for 2022 included Spirit costs, union contract costs and Embraer E190 fleet transition costs. We believe that Operating Expenses ex-fuel and CASM ex-fuel are useful for investors because they provide investors the ability to measure our financial performance excluding items that are beyond our control, such as fuel costs, which are subject to many economic and political factors, as well as items that are not related to the generation of an available seat mile, such as operating expense related to certain non-airline businesses and special items. We believe these non-GAAP measures are more indicative of our ability to manage airline costs and are more comparable to measures reported by other major airlines. The table below provides a reconciliation of our total operating expenses (“GAAP measure”) to Operating Expenses ex-fuel, and our CASM to CASM ex-fuel for the periods presented. NON-GAAP FINANCIAL MEASURE RECONCILIATION OF OPERATING EXPENSE AND OPERATING EXPENSE PER ASM, EXCLUDING FUEL ($ in millions, per ASM data in cents) (unaudited) Three Months Ended December 31, Twelve Months Ended December 31, 2023 2022 2023 2022 $ per ASM $ per ASM $ per ASM $ per ASM Total operating expenses $ 2,392 $ 14.06 $ 2,372 $ 14.40 $ 9,845 $ 14.37 $ 9,456 $ 14.67 Less: Aircraft fuel and related taxes 677 3.98 800 4.86 2,720 3.97 3,105 4.82 Other non-airline expenses 14 0.09 11 0.07 64 0.09 55 0.08 Special items 29 0.17 57 0.34 197 0.29 113 0.18 Operating expenses, excluding fuel $ 1,672 $ 9.82 $ 1,504 $ 9.13 $ 6,864 $ 10.02 $ 6,183 $ 9.59 Percent change 7.6 % 4.5 %

1 4 Operating expense, operating income (loss), adjusted operating margin, pre-tax income (loss), adjusted pre-tax margin, net income (loss) and earnings (loss) per share, excluding special items and net gain (loss) on investments Our GAAP results in the applicable periods were impacted by credits and charges that were deemed special items. Special items for 2023 include Spirit costs and union contract costs. Special items for 2022 included Spirit costs, union contract costs and Embraer E190 fleet transition costs. Certain gains and losses on our investments were also excluded from our 2023 and 2022 GAAP results. We believe the impact of these items distort our overall trends and our metrics are more comparable with the presentation of our results excluding the impact of these items. The table provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impact of these items for the periods presented. Non-GAAP Financial Measure RECONCILIATION OF OPERATING EXPENSE, OPERATING INCOME (LOSS), ADJUSTED OPERATING MARGIN, PRE-TAX INCOME (LOSS), ADJUSTED PRE-TAX MARGIN, NET INCOME (LOSS), EARNINGS (LOSS) PER SHARE, EXCLUDING SPECIAL ITEMS AND NET GAIN (LOSS) ON INVESTMENTS (unaudited, in millions) Three Months Ended December 31, Twelve Months Ended December 31, 2023 2022 2023 2022 Total operating revenues $ 2,325 $ 2,415 $ 9,615 $ 9,158 RECONCILIATION OF OPERATING EXPENSE Total operating expenses $ 2,392 $ 2,372 $ 9,845 $ 9,456 Less: Special items 29 57 197 113 Total operating expenses excluding special items $ 2,363 $ 2,315 $ 9,648 $ 9,343 RECONCILIATION OF OPERATING INCOME (LOSS) Operating income (loss) $ (67) $ 43 $ (230) $ (298) Add back: Special items 29 57 197 113 Operating income (loss) excluding special items $ (38) $ 100 $ (33) $ (185) RECONCILIATION OF ADJUSTED OPERATING MARGIN Operating margin (2.9)% 1.8 % (2.4)% (3.3)% Operating income (loss) excluding special items $ (38) $ 100 $ (33) $ (185) Total operating revenues 2,325 2,415 9,615 9,158 Adjusted operating margin (1.6)% 4.1 % (0.3)% (2.0)% RECONCILIATION OF PRE-TAX INCOME (LOSS) Income (loss) before income taxes $ (110) $ 7 $ (334) $ (437) Add back: Special items 29 57 197 113 Less: Net gain (loss) on investments 3 (5) 9 (9) Income (loss) before income taxes excluding special items and net gain (loss) on investments $ (84) $ 69 $ (146) $ (315) RECONCILIATION OF ADJUSTED PRE-TAX MARGIN Pre-tax margin (4.7)% 0.3 % (3.5)% (4.8)% Income (loss) before income taxes excluding special items and net gain (loss) on investments $ (84) $ 69 $ (146) $ (315) Total operating revenues 2,325 2,415 9,615 9,158 Adjusted pre-tax margin (3.6)% 2.8 % (1.5)% (3.4)% RECONCILIATION OF NET INCOME (LOSS) Net loss $ (104) $ 24 $ (310) $ (362) Add back: Special items 29 57 197 113 Less: Income tax benefit (expense) related to special items (15) 13 31 19 Less: Net gain (loss) on investments 3 (5) 9 (9) Less: Income tax benefit (expense) related to net gain (loss) on investments — 1 (2) 1 Net loss excluding special items and net gain (loss) on investments $ (63) $ 72 $ (151) $ (260)