Jamf (NASDAQ: JAMF), the standard in managing and securing Apple at

work, today announced financial results for its first quarter ended

March 31, 2023.

“Jamf is pleased to report that our first

quarter of 2023 marks the 12th consecutive quarter where Jamf

outperformed expectations,” said Dean Hager, CEO. “This

performance, amid the backdrop of a difficult macroeconomic

environment, is a testament to Jamf’s strong business fundamentals

and exceptional execution by our team. Over the three years since

filing for our IPO, Jamf has added over $300 million of total ARR,

including $100 million from its new line of security solutions.

This market demand provides resiliency in a challenging economy and

tremendous opportunity when market conditions improve.”

First Quarter 2023 Financial

Highlights

-

ARR: ARR of $526.6 million as of

March 31, 2023, an increase of 21% year-over-year.

- Revenue: Total

revenue of $132.2 million, an increase of 22% year-over-year.

- Gross Profit: GAAP

gross profit of $102.5 million, or 78% of total revenue, compared

to $80.0 million in the first quarter of 2022. Non-GAAP gross

profit of $108.4 million, or 82% of total revenue, compared to

$87.5 million in the first quarter of 2022.

- Operating

Loss/Income: GAAP operating loss of $25.5 million, or

(19)% of total revenue, compared to $23.7 million in the first

quarter of 2022. Non-GAAP operating income of $6.1 million, or 5%

of total revenue, compared to $5.8 million in the first quarter of

2022.

- Cash Flow: Cash

flow provided by operations of $68.2 million for the TTM ended

March 31, 2023, or 14% of TTM total revenue, compared to $58.2

million for the TTM ended March 31, 2022. Unlevered free cash

flow of $72.8 million for the TTM ended March 31, 2023, or 14%

of TTM total revenue, compared to $61.9 million for the TTM ended

March 31, 2022.

A reconciliation between historical GAAP and

non-GAAP information is contained in the tables below and the

section titled “Non-GAAP Financial Measures” below contains

descriptions of these reconciliations.

Jamf Announces CEO Transition Plan,

Appoints John Strosahl as Chief Executive Officer

Jamf today also announced a CEO transition plan,

appointing John Strosahl as Chief Executive Officer to succeed

retiring Chief Executive Officer Dean Hager, effective September 2,

2023.

Mr. Strosahl, who currently serves as Jamf’s

President and Chief Operating Officer, has been with the company

since 2015. Mr. Strosahl first joined the company to lead Jamf’s

global revenue organization as Chief Revenue Officer and was

promoted to Jamf Chief Operating Officer in 2020 and President in

2022. Since joining Jamf, Mr. Strosahl has made an incredible

impact on the business, including driving Jamf’s shift from license

revenue to recurring revenue and expanding Jamf’s reach

globally.

Mr. Hager will remain a member of Jamf’s Board

of Directors following his retirement as Chief Executive Officer

and will work closely with Mr. Strosahl to facilitate a seamless

transition. Mr. Strosahl will also join Jamf’s Board of Directors,

effective concurrently with his promotion to Chief Executive

Officer.

Recent Business Highlights

- Ended the first

quarter serving more than 72,500 customers with 30.8 million

total devices on our platform.

- Showcased new ways Jamf is

empowering IT, simplifying access for users with ZTNA as part of

Jamf Connect, and protecting company resources with key conditional

access partnerships with Microsoft, AWS and Google during the

second annual Spring Event.

- Expanded strategic partnership with

Okta to deliver best-in-class identity security utilizing Apple’s

Platform Single Sign-on and Enrollment Single Sign-on.

- Joined the Microsoft Intelligent

Security Association (MISA), an ecosystem of software vendors and

managed security providers that have integrated their solutions

with Microsoft security technology to help customers better defend

themselves against increasingly sophisticated cyber threats.

- Launched Jamf Executive Threat

Protection, an advanced detection and response tool designed for

mobile devices that provides organizations with an efficient,

remote method to monitor devices and respond to advanced

attacks.

- Jamf Safe Internet, a best-in-class

web content filtering and threat protection solution for education,

launched support for Google Chromebook and announced it will become

available for Windows PCs starting this summer.

- Released Employee Badge with Jamf

Trust in partnership with SwiftConnect, bringing modernized access

to physical workspaces with digital employee badges.

- Earned Corporate Vision’s 2023

Security Award for the “Most Advanced Workplace Device Management

Solution,” reinforcing the importance of a strong device management

solution in an organization’s security posture.

Financial Outlook

For the second quarter of 2023, Jamf currently

expects:

- Total revenue of $133.5 to $135.5 million

- Non-GAAP operating income of $4.5 to $5.5 million

For the full year 2023, Jamf currently

expects:

- Total revenue of $559.0 to $563.0 million

- Non-GAAP operating income of $41.0 to $43.0 million

To assist with modeling, for the second quarter

of 2023 and full year 2023, amortization is expected to be

approximately $10.5 million and $42.0 million,

respectively. In addition, for the second quarter of 2023 and

full year 2023, stock-based compensation and related payroll taxes

are expected to be approximately $31.4 million and $107.4 million,

respectively.

Jamf is unable to provide a quantitative

reconciliation of forward-looking guidance of non-GAAP operating

income to GAAP operating income (loss) because certain items are

out of Jamf’s control or cannot be reasonably predicted.

Historically, these items have included, but are not limited to,

acquisition-related expenses and acquisition-related earn-out,

offering costs, amortization, and stock-based compensation and

related payroll taxes. Accordingly, a reconciliation for

forward-looking non-GAAP operating income is not available without

unreasonable effort. These items are uncertain, depend on various

factors, and could result in projected GAAP operating income (loss)

being materially less than is indicated by currently estimated

non-GAAP operating income.

These statements are forward-looking and actual

results may differ materially. Refer to the Forward-Looking

Statements safe harbor below for information on the factors that

could cause our actual results to differ materially from these

forward-looking statements.

Webcast and Conference Call

Information

Jamf will host a conference call and live

webcast for analysts and investors at 3:30 p.m. Central Time (4:30

p.m. Eastern Time) on May 4, 2023.

The conference call will be webcast live on

Jamf’s Investor Relations website at https://ir.jamf.com, along

with the earnings press release, financial tables, earnings

presentation, and investor presentation. Those parties interested

in participating via telephone may register on Jamf’s Investor

Relations website.

A replay of the call will be available on the

Investor Relations website beginning on May 4, 2023, at

approximately 6:00 p.m. Central Time (7:00 p.m. Eastern Time).

Please note that Jamf uses its

https://ir.jamf.com website as a means of disclosing material

non-public information, announcing upcoming investor conferences

and for complying with its disclosure obligations under Regulation

FD. Accordingly, you should monitor our investor relations website

in addition to following our press releases, SEC filings, and

public conference calls and webcasts.

Non-GAAP Financial Measures

In addition to our results determined in

accordance with generally accepted accounting principles in the

United States (“GAAP”), we believe the non-GAAP measures of

non-GAAP operating expenses, non-GAAP gross profit, non-GAAP gross

profit margin, non-GAAP operating income (loss), non-GAAP operating

income (loss) margin, non-GAAP income before income taxes, non-GAAP

provision for income taxes as it relates to the calculation of

non-GAAP net income, non-GAAP net income, free cash flow, free cash

flow margin, unlevered free cash flow, and unlevered free cash flow

margin are useful in evaluating our operating performance. Certain

of these non-GAAP measures exclude stock-based compensation,

amortization expense, acquisition-related expenses,

acquisition-related earnout, offering costs, foreign currency

transaction (gain) loss, payroll taxes related to stock-based

compensation, legal settlement, loss on extinguishment of debt,

amortization of debt issuance costs, and system transformation

costs. We believe that non-GAAP financial information, when

taken collectively, may be helpful to investors because it provides

consistency and comparability with past financial performance and

assists in comparisons with other companies, some of which use

similar non-GAAP information to supplement their GAAP results. The

non-GAAP financial information is presented for supplemental

informational purposes only, should not be considered a substitute

for financial information presented in accordance with GAAP, and

may be different from similarly-titled non-GAAP measures used by

other companies. The principal limitation of these non-GAAP

financial measures is that they exclude significant expenses that

are required by GAAP to be recorded in our financial statements. In

addition, they are subject to inherent limitations as they reflect

the exercise of judgment by our management about which expenses are

excluded or included in determining these non-GAAP financial

measures. Reconciliation tables of the most comparable GAAP

financial measures to the non-GAAP financial measures used in this

press release are included with the financial tables at the end of

this press release. We strongly encourage investors to review our

consolidated financial statements included in our publicly filed

reports in their entirety and not rely solely on any single

financial measurement or communication.

Forward-Looking Statements

This press release and the accompanying

conference call contain “forward-looking statements” within the

meaning of federal securities laws, which statements involve

substantial risks and uncertainties. Forward-looking statements

generally relate to future events or our future financial or

operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“may,” “can,” “will,” “would,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “forecasts,”

“potential” or “continue,” or other similar terms or expressions

that concern our expectations, strategy, plans, or intentions.

Forward-looking statements may involve known and unknown risks,

uncertainties, and other factors that may cause our actual results,

performance, or achievements to be materially different from those

expressed or implied by the forward-looking statements. These

statements include, but are not limited to, statements regarding

our future financial and operating performance (including our

outlook and guidance), the demand for our platform, anticipated

impacts of macroeconomic conditions on our business, our

expectations regarding business benefits and financial impacts from

our acquisitions, partnerships and investments, statements related

to our CEO transition, and our ability to deliver on our long-term

strategy.

The forward-looking statements contained in this

press release and the accompanying conference call are also subject

to additional risks, uncertainties, and factors, including those

more fully described in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2022. Additional information will

also be set forth in our Quarterly Report on Form 10-Q for the

fiscal quarter ended March 31, 2023, as well as the subsequent

periodic and current reports and other filings that we make with

the Securities and Exchange Commission from time to time. Moreover,

we operate in a very competitive and rapidly changing environment,

and new risks and uncertainties may emerge that could have an

impact on the forward-looking statements contained in this press

release and the accompanying conference call.

Given these factors, as well as other variables

that may affect our operating results, you should not rely on

forward-looking statements, assume that past financial performance

will be a reliable indicator of future performance, or use

historical trends to anticipate results or trends in future

periods. The forward-looking statements included in this press

release and the accompanying conference call relate only to events

as of the date hereof. We undertake no obligation to update or

revise any forward-looking statement as a result of new

information, future events or otherwise, except as otherwise

required by law.

About Jamf

Jamf’s purpose is to simplify work by helping

organizations manage and secure an Apple experience that end users

love and organizations trust. Jamf is the only company in the world

that provides a complete management and security solution for an

Apple-first environment designed to be enterprise secure, consumer

simple and protect personal privacy. To learn more, visit

www.jamf.com.

Investor ContactsJennifer

GaumondMichael Thomasir@jamf.com

Media ContactRachel

Nauenmedia@jamf.com

|

Jamf Holding Corp.Consolidated Balance

Sheets(in thousands)(unaudited) |

|

|

| |

March 31,2023 |

|

December 31,2022 |

|

Assets |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

200,340 |

|

|

$ |

224,338 |

|

|

Trade accounts receivable, net of allowances of $427 and $445 |

|

84,392 |

|

|

|

88,163 |

|

|

Income taxes receivable |

|

806 |

|

|

|

465 |

|

|

Deferred contract costs |

|

18,780 |

|

|

|

17,652 |

|

|

Prepaid expenses |

|

22,903 |

|

|

|

14,331 |

|

|

Other current assets |

|

6,535 |

|

|

|

6,097 |

|

|

Total current assets |

|

333,756 |

|

|

|

351,046 |

|

|

Equipment and leasehold improvements, net |

|

18,615 |

|

|

|

19,421 |

|

|

Goodwill |

|

862,747 |

|

|

|

856,925 |

|

| Other

intangible assets, net |

|

209,509 |

|

|

|

218,744 |

|

| Deferred

contract costs, non-current |

|

41,933 |

|

|

|

39,643 |

|

| Other

assets |

|

42,409 |

|

|

|

43,763 |

|

|

Total assets |

$ |

1,508,969 |

|

|

$ |

1,529,542 |

|

| |

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

$ |

14,982 |

|

|

$ |

15,393 |

|

|

Accrued liabilities |

|

48,993 |

|

|

|

67,051 |

|

|

Income taxes payable |

|

547 |

|

|

|

486 |

|

|

Deferred revenues |

|

278,407 |

|

|

|

278,038 |

|

|

Total current liabilities |

|

342,929 |

|

|

|

360,968 |

|

| Deferred

revenues, non-current |

|

62,435 |

|

|

|

68,112 |

|

| Deferred

tax liability, net |

|

5,539 |

|

|

|

5,505 |

|

|

Convertible senior notes, net |

|

365,127 |

|

|

|

364,505 |

|

| Other

liabilities |

|

27,480 |

|

|

|

29,114 |

|

|

Total liabilities |

|

803,510 |

|

|

|

828,204 |

|

|

Commitments and contingencies |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

124 |

|

|

|

123 |

|

|

Additional paid-in capital |

|

1,072,148 |

|

|

|

1,049,875 |

|

|

Accumulated other comprehensive loss |

|

(33,904 |

) |

|

|

(39,951 |

) |

|

Accumulated deficit |

|

(332,909 |

) |

|

|

(308,709 |

) |

|

Total stockholders’ equity |

|

705,459 |

|

|

|

701,338 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,508,969 |

|

|

$ |

1,529,542 |

|

|

|

|

Jamf Holding Corp.Consolidated Statements

of Operations(in thousands, except share and per share

amounts)(unaudited) |

|

|

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue: |

|

|

|

|

Subscription |

$ |

127,230 |

|

|

$ |

102,201 |

|

|

Services |

|

4,384 |

|

|

|

3,944 |

|

|

License |

|

598 |

|

|

|

2,113 |

|

|

Total revenue |

|

132,212 |

|

|

|

108,258 |

|

| Cost of revenue: |

|

|

|

|

Cost of subscription(1)(2)(3)(4) (exclusive of amortization expense

shown below) |

|

23,159 |

|

|

|

19,902 |

|

|

Cost of services(1)(3)(4) (exclusive of amortization expense shown

below) |

|

3,292 |

|

|

|

3,107 |

|

|

Amortization expense |

|

3,296 |

|

|

|

5,218 |

|

|

Total cost of revenue |

|

29,747 |

|

|

|

28,227 |

|

|

Gross profit |

|

102,465 |

|

|

|

80,031 |

|

| Operating expenses: |

|

|

|

|

Sales and marketing(1)(2)(3)(4) |

|

60,208 |

|

|

|

46,325 |

|

|

Research and development(1)(2)(3)(4) |

|

32,072 |

|

|

|

24,802 |

|

|

General and administrative(1)(2)(3)(4)(5) |

|

28,436 |

|

|

|

25,612 |

|

|

Amortization expense |

|

7,241 |

|

|

|

7,029 |

|

|

Total operating expenses |

|

127,957 |

|

|

|

103,768 |

|

|

Loss from operations |

|

(25,492 |

) |

|

|

(23,737 |

) |

| Interest income (expense),

net |

|

1,285 |

|

|

|

(859 |

) |

| Foreign currency transaction

gain (loss) |

|

604 |

|

|

|

(781 |

) |

|

Loss before income tax provision |

|

(23,603 |

) |

|

|

(25,377 |

) |

| Income tax provision |

|

(597 |

) |

|

|

(252 |

) |

|

Net loss |

$ |

(24,200 |

) |

|

$ |

(25,629 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.20 |

) |

|

$ |

(0.21 |

) |

| Weighted‑average shares used

to compute net loss per share, basic and diluted |

|

123,422,066 |

|

|

|

119,594,341 |

|

(1) Includes stock-based compensation as follows:

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

Subscription |

$ |

2,267 |

|

$ |

1,955 |

|

Services |

|

309 |

|

|

304 |

| Sales and marketing |

|

7,499 |

|

|

5,859 |

| Research and development |

|

5,033 |

|

|

3,859 |

| General and

administrative |

|

4,442 |

|

|

4,033 |

| |

$ |

19,550 |

|

$ |

16,010 |

(2) Includes payroll taxes related to stock-based compensation

as follows:

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

Subscription |

$ |

12 |

|

$ |

— |

| Sales and marketing |

|

104 |

|

|

12 |

| Research and development |

|

71 |

|

|

27 |

| General and

administrative |

|

76 |

|

|

97 |

| |

$ |

263 |

|

$ |

136 |

(3) Includes depreciation expense as follows:

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

Subscription |

$ |

315 |

|

$ |

320 |

|

Services |

|

39 |

|

|

45 |

| Sales and marketing |

|

805 |

|

|

684 |

| Research and development |

|

467 |

|

|

359 |

| General and

administrative |

|

261 |

|

|

238 |

| |

$ |

1,887 |

|

$ |

1,646 |

(4) Includes acquisition-related expense as follows:

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

Subscription |

$ |

— |

|

$ |

38 |

|

Services |

|

1 |

|

|

— |

| Sales and marketing |

|

— |

|

|

7 |

| Research and development |

|

51 |

|

|

263 |

| General and

administrative |

|

706 |

|

|

793 |

| |

$ |

758 |

|

$ |

1,101 |

(5) Includes system transformation costs as follows:

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| General and

administrative |

$ |

441 |

|

$ |

— |

General and administrative also includes acquisition-related

earnout of $0.1 million for the three months ended March 31,

2022. The acquisition-related earnout was an expense for the three

months ended March 31, 2022 reflecting the increase in fair

value of the Digita acquisition contingent liability due to growth

in sales of our Jamf Protect product.

|

|

|

Jamf Holding Corp.Consolidated Statements

of Cash Flows(in thousands)(unaudited) |

|

|

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating

activities |

|

|

|

|

Net loss |

$ |

(24,200 |

) |

|

$ |

(25,629 |

) |

|

Adjustments to reconcile net loss to cash used in operating

activities: |

|

|

|

|

Depreciation and amortization expense |

|

12,424 |

|

|

|

13,893 |

|

|

Amortization of deferred contract costs |

|

4,774 |

|

|

|

3,755 |

|

|

Amortization of debt issuance costs |

|

684 |

|

|

|

679 |

|

|

Non-cash lease expense |

|

1,493 |

|

|

|

1,291 |

|

|

Provision for credit losses and returns |

|

14 |

|

|

|

128 |

|

|

Share‑based compensation |

|

19,550 |

|

|

|

16,010 |

|

|

Deferred tax benefit |

|

(27 |

) |

|

|

(468 |

) |

|

Adjustment to contingent consideration |

|

— |

|

|

|

88 |

|

|

Other |

|

(677 |

) |

|

|

725 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Trade accounts receivable |

|

3,915 |

|

|

|

(2,190 |

) |

|

Income tax receivable/payable |

|

(273 |

) |

|

|

533 |

|

|

Prepaid expenses and other assets |

|

(8,598 |

) |

|

|

(3,668 |

) |

|

Deferred contract costs |

|

(8,145 |

) |

|

|

(6,952 |

) |

|

Accounts payable |

|

(575 |

) |

|

|

(413 |

) |

|

Accrued liabilities |

|

(19,765 |

) |

|

|

(11,250 |

) |

|

Deferred revenue |

|

(5,394 |

) |

|

|

10,478 |

|

|

Net cash used in operating activities |

|

(24,800 |

) |

|

|

(2,990 |

) |

| Investing

activities |

|

|

|

|

Acquisitions, net of cash acquired |

|

— |

|

|

|

(4,023 |

) |

|

Purchases of equipment and leasehold improvements |

|

(1,121 |

) |

|

|

(1,964 |

) |

|

Purchase of investments |

|

(750 |

) |

|

|

— |

|

|

Other |

|

14 |

|

|

|

8 |

|

|

Net cash used in investing activities |

|

(1,857 |

) |

|

|

(5,979 |

) |

| Financing

activities |

|

|

|

|

Debt issuance costs |

|

— |

|

|

|

(50 |

) |

|

Cash paid for contingent consideration |

|

(206 |

) |

|

|

(4,588 |

) |

|

Proceeds from the exercise of stock options |

|

2,723 |

|

|

|

1,197 |

|

|

Net cash provided by (used in) financing activities |

|

2,517 |

|

|

|

(3,441 |

) |

|

Effect of exchange rate changes on cash, cash equivalents, and

restricted cash |

|

42 |

|

|

|

(145 |

) |

|

Net decrease in cash, cash equivalents, and restricted cash |

|

(24,098 |

) |

|

|

(12,555 |

) |

| Cash, cash equivalents, and

restricted cash, beginning of period |

|

231,921 |

|

|

|

177,150 |

|

| Cash, cash equivalents, and

restricted cash, end of period |

$ |

207,823 |

|

|

$ |

164,595 |

|

| |

|

|

|

| Reconciliation of

cash, cash equivalents, and restricted cash within the consolidated

balance sheets to the amounts shown in the consolidated statements

of cash flows above: |

|

|

|

|

Cash and cash equivalents |

$ |

200,340 |

|

|

$ |

164,595 |

|

|

Restricted cash included in other current assets |

|

283 |

|

|

|

— |

|

|

Restricted cash included in other assets |

|

7,200 |

|

|

|

— |

|

| Total cash, cash equivalents,

and restricted cash |

$ |

207,823 |

|

|

$ |

164,595 |

|

|

|

|

Jamf Holding Corp.Supplemental Financial

InformationDisaggregated Revenues(in

thousands)(unaudited) |

|

|

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

2022 |

| SaaS subscription and support

and maintenance |

$ |

120,762 |

|

$ |

96,350 |

| On‑premise subscription |

|

6,468 |

|

|

5,851 |

|

Subscription revenue |

|

127,230 |

|

|

102,201 |

| Professional services |

|

4,384 |

|

|

3,944 |

| Perpetual licenses |

|

598 |

|

|

2,113 |

|

Non‑subscription revenue |

|

4,982 |

|

|

6,057 |

|

Total revenue |

$ |

132,212 |

|

$ |

108,258 |

|

|

|

Jamf Holding Corp.Supplemental

InformationKey Business Metrics(in

millions, except number of customers and

percentages)(unaudited) |

|

|

| |

|

March 31,2023 |

|

December 31,2022 |

|

September 30,2022 |

|

June 30,2022 |

|

March 31,2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

ARR |

|

$ |

526.6 |

|

|

$ |

512.5 |

|

|

$ |

490.5 |

|

|

$ |

466.0 |

|

|

$ |

436.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR from management solutions as a percent of total ARR |

|

|

80 |

% |

|

|

80 |

% |

|

|

82 |

% |

|

|

82 |

% |

|

|

83 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

ARR from security solutions as a percent of total ARR |

|

|

20 |

% |

|

|

20 |

% |

|

|

18 |

% |

|

|

18 |

% |

|

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR from commercial customers as a percent of total ARR |

|

|

72 |

% |

|

|

72 |

% |

|

|

71 |

% |

|

|

71 |

% |

|

|

70 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

ARR from education customers as a percent of total ARR |

|

|

28 |

% |

|

|

28 |

% |

|

|

29 |

% |

|

|

29 |

% |

|

|

30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dollar-based net retention rate (1) |

|

|

111 |

% |

|

|

113 |

% |

|

|

115 |

% |

|

|

117 |

% |

|

|

120 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Devices |

|

|

30.8 |

|

|

|

30.0 |

|

|

|

29.3 |

|

|

|

28.4 |

|

|

|

26.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Customers |

|

|

72,500 |

|

|

|

71,000 |

|

|

|

69,000 |

|

|

|

67,000 |

|

|

|

62,000 |

|

(1) The dollar-based net retention rate for March 31, 2022 was

based on our Jamf legacy business and does not include Wandera

since it had not been a part of our business for the full trailing

twelve months.

|

|

|

Jamf Holding Corp.Supplemental Financial

InformationReconciliation of GAAP to non-GAAP

Financial Data(in thousands, except share and per share

amounts)(unaudited) |

|

|

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

Operating expenses |

$ |

127,957 |

|

|

$ |

103,768 |

|

|

Amortization expense |

|

(7,241 |

) |

|

|

(7,029 |

) |

|

Stock-based compensation |

|

(16,974 |

) |

|

|

(13,751 |

) |

|

Acquisition-related expense |

|

(757 |

) |

|

|

(1,063 |

) |

|

Acquisition-related earnout |

|

— |

|

|

|

(88 |

) |

| Payroll

taxes related to stock-based compensation |

|

(251 |

) |

|

|

(136 |

) |

| System

transformation costs |

|

(441 |

) |

|

|

— |

|

| Non-GAAP

operating expenses |

$ |

102,293 |

|

|

$ |

81,701 |

|

| |

|

|

|

| |

Three Months Ended March 31, |

| |

|

2023 |

|

|

|

2022 |

|

| Gross profit |

$ |

102,465 |

|

|

$ |

80,031 |

|

| Amortization expense |

|

3,296 |

|

|

|

5,218 |

|

| Stock-based compensation |

|

2,576 |

|

|

|

2,259 |

|

| Acquisition-related

expense |

|

1 |

|

|

|

38 |

|

| Payroll taxes related to

stock-based compensation |

|

12 |

|

|

|

— |

|

| Non-GAAP gross profit |

$ |

108,350 |

|

|

$ |

87,546 |

|

| Gross profit margin |

|

78% |

|

|

|

74% |

|

| Non-GAAP gross profit

margin |

|

82% |

|

|

|

81% |

|

| |

|

|

|

| |

Three Months Ended March 31, |

| |

|

2023 |

|

|

|

2022 |

|

| Operating loss |

$ |

(25,492 |

) |

|

$ |

(23,737 |

) |

| Amortization expense |

|

10,537 |

|

|

|

12,247 |

|

| Stock-based compensation |

|

19,550 |

|

|

|

16,010 |

|

| Acquisition-related

expense |

|

758 |

|

|

|

1,101 |

|

| Acquisition-related

earnout |

|

— |

|

|

|

88 |

|

| Payroll taxes related to

stock-based compensation |

|

263 |

|

|

|

136 |

|

| System transformation

costs |

|

441 |

|

|

|

— |

|

| Non-GAAP operating income |

$ |

6,057 |

|

|

$ |

5,845 |

|

| Operating loss margin |

|

(19)% |

|

|

|

(22)% |

|

| Non-GAAP operating income

margin |

|

5% |

|

|

|

5% |

|

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Net loss |

$ |

(24,200 |

) |

|

$ |

(25,629 |

) |

|

Exclude: income tax provision |

|

(597 |

) |

|

|

(252 |

) |

| Loss

before income tax provision |

|

(23,603 |

) |

|

|

(25,377 |

) |

| Amortization expense |

|

10,537 |

|

|

|

12,247 |

|

| Stock-based compensation |

|

19,550 |

|

|

|

16,010 |

|

| Foreign currency transaction

(gain) loss |

|

(604 |

) |

|

|

781 |

|

| Amortization of debt issuance

costs |

|

684 |

|

|

|

679 |

|

| Acquisition-related

expense |

|

758 |

|

|

|

1,101 |

|

| Acquisition-related

earnout |

|

— |

|

|

|

88 |

|

| Payroll taxes related to

stock-based compensation |

|

263 |

|

|

|

136 |

|

| System transformation

costs |

|

441 |

|

|

|

— |

|

|

Non-GAAP income before income taxes |

|

8,026 |

|

|

|

5,665 |

|

| Non-GAAP provision for income

taxes (1) |

|

(1,926 |

) |

|

|

(1,360 |

) |

| Non-GAAP net income |

$ |

6,100 |

|

|

$ |

4,305 |

|

| Net loss

per share: |

|

|

|

|

Basic |

$ |

(0.20 |

) |

|

$ |

(0.21 |

) |

|

Diluted |

$ |

(0.20 |

) |

|

$ |

(0.21 |

) |

|

Weighted‑average shares used in computing net loss per share: |

|

|

|

|

Basic |

|

123,422,066 |

|

|

|

119,594,341 |

|

|

Diluted |

|

123,422,066 |

|

|

|

119,594,341 |

|

| Non-GAAP

net income per share: |

|

|

|

|

Basic |

$ |

0.05 |

|

|

$ |

0.04 |

|

|

Diluted |

$ |

0.05 |

|

|

$ |

0.03 |

|

| Weighted-average shares used

in computing non-GAAP net income per share: |

|

|

|

|

Basic |

|

123,422,066 |

|

|

|

119,594,341 |

|

|

Diluted |

|

133,959,253 |

|

|

|

129,620,460 |

|

(1) In accordance with the SEC’s Non-GAAP Financial Measures

Compliance and Disclosure Interpretation, the Company’s blended

U.S. statutory rate of 24% is used as an estimate for the current

and deferred income tax expense associated with our non-GAAP income

before income taxes.

| |

Three Months Ended March 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net cash

(used in) provided by operating activities |

$ |

(24,800 |

) |

|

$ |

(2,990 |

) |

|

$ |

4,023 |

|

|

$ |

90,005 |

|

|

$ |

65,165 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

Purchases of equipment and leasehold improvements |

|

(1,121 |

) |

|

|

(1,964 |

) |

|

|

(3,290 |

) |

|

|

(7,727 |

) |

|

|

(9,755 |

) |

| Free

cash flow |

|

(25,921 |

) |

|

|

(4,954 |

) |

|

|

733 |

|

|

|

82,278 |

|

|

|

55,410 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

313 |

|

|

|

293 |

|

|

|

3 |

|

|

|

763 |

|

|

|

967 |

|

|

Cash paid for acquisition-related expense |

|

403 |

|

|

|

960 |

|

|

|

61 |

|

|

|

4,480 |

|

|

|

5,039 |

|

|

Cash paid for system transformation costs |

|

773 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Cash paid for contingent consideration |

|

6,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Cash paid for legal settlement |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,000 |

|

|

Unlevered free cash flow |

$ |

(18,432 |

) |

|

$ |

(3,701 |

) |

|

$ |

797 |

|

|

$ |

87,521 |

|

|

$ |

66,416 |

|

| Total

revenue |

$ |

132,212 |

|

|

$ |

108,258 |

|

|

$ |

80,727 |

|

|

$ |

478,776 |

|

|

$ |

366,388 |

|

| Net cash

(used in) provided by operating activities as a percentage of total

revenue |

|

(19)% |

|

|

|

(3)% |

|

|

|

5% |

|

|

|

19% |

|

|

|

18% |

|

| Free

cash flow margin |

|

(20)% |

|

|

|

(5)% |

|

|

|

1% |

|

|

|

17% |

|

|

|

15% |

|

|

Unlevered free cash flow margin |

|

(14)% |

|

|

|

(3)% |

|

|

|

1% |

|

|

|

18% |

|

|

|

18% |

|

| |

Trailing Twelve Months Ended March

31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Net cash

provided by operating activities |

$ |

68,195 |

|

|

$ |

58,152 |

|

|

Less: |

|

|

|

|

Purchases of equipment and leasehold improvements |

|

(6,884 |

) |

|

|

(8,429 |

) |

| Free

cash flow |

|

61,311 |

|

|

|

49,723 |

|

|

Add: |

|

|

|

|

Cash paid for interest |

|

783 |

|

|

|

1,257 |

|

|

Cash paid for acquisition-related expense |

|

3,923 |

|

|

|

5,938 |

|

|

Cash paid for system transformation costs |

|

773 |

|

|

|

— |

|

|

Cash paid for contingent consideration |

|

6,000 |

|

|

|

— |

|

|

Cash paid for legal settlement |

|

— |

|

|

|

5,000 |

|

|

Unlevered free cash flow |

$ |

72,790 |

|

|

$ |

61,918 |

|

| Total

revenue |

$ |

502,730 |

|

|

$ |

393,919 |

|

| Net cash

provided by operating activities as a percentage of total

revenue |

|

14% |

|

|

|

15% |

|

| Free

cash flow margin |

|

12% |

|

|

|

13% |

|

|

Unlevered free cash flow margin |

|

14% |

|

|

|

16% |

|

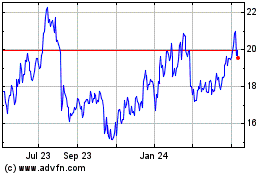

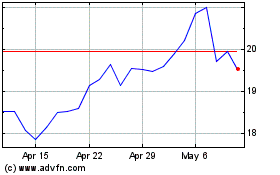

Jamf (NASDAQ:JAMF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jamf (NASDAQ:JAMF)

Historical Stock Chart

From Jul 2023 to Jul 2024