| | | | | | | | |

| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| SCHEDULE 13D/A | |

Under the Securities Exchange Act of 1934

(Amendment No. 5)

IPG Photonics Corporation

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

44980X109

(CUSIP Number)

Angelo P. Lopresti

c/o IQ EQ Trust Company, U.S., LLC

3 Executive Park Drive, Suite 302

Bedford, NH 03110

(603) 219-0264

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

December 31, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

| | | | | | | | | | | | | | | | | |

| CUSIP No. 44980X109 |

1 | | NAME OF REPORTING PERSON The Valentin Gapontsev Trust I |

| 2 | | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) (b) |

| 3 | | SEC USE ONLY |

| 4 | | SOURCE OF FUNDS OO |

| 5 | | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

| 6 | | CITIZENSHIP OR PLACE OF ORGANIZATION New Hampshire |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | | 7 | | SOLE VOTING POWER 7,229,599 |

| | 8 | | SHARED VOTING POWER 0 |

| | 9 | | SOLE DISPOSITIVE POWER 7,229,599 |

| | 10 | | SHARED DISPOSITIVE POWER 0 |

| 11 | | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 7,229,599 |

| 12 | | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| 13 | | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 15.4% (1) |

14. | | TYPE OF REPORTING PERSON OO |

| | |

(1)Based on 46,922,454 shares of Common Stock outstanding as of October 30, 2023, as reported in the Issuer’s Form 10-Q for the three months ended September 30, 2023.

| | | | | | | | | | | | | | | | | |

| CUSIP No. 44980X109 |

1 | | NAME OF REPORTING PERSON Angelo P. Lopresti, individually and as trustee of The Valentin Gapontsev Trust I |

| 2 | | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) (b) |

| 3 | | SEC USE ONLY |

| 4 | | SOURCE OF FUNDS OO |

| 5 | | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

| 6 | | CITIZENSHIP OR PLACE OF ORGANIZATION United States |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | | 7 | | SOLE VOTING POWER 75,535(1) |

| | 8 | | SHARED VOTING POWER 9,064,378 |

| | 9 | | SOLE DISPOSITIVE POWER 75,535(1) |

| | 10 | | SHARED DISPOSITIVE POWER 9,064,378 |

| 11 | | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 9,139,913 |

| 12 | | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| 13 | | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 19.5% (2) |

14. | | TYPE OF REPORTING PERSON IN |

| | |

(1)Includes 32,032 shares of Common Stock issuable upon exercise of Issuer stock options that have vested and 4,990 shares of Common Stock issuable under restricted stock units and performance stock units with vesting dates within sixty days of the date hereof, subject to the conditions applicable to such awards.

(2)Based on 46,922,454 shares of Common Stock outstanding as of October 30, 2023, as reported in the Issuer’s Form 10-Q for the three months ended September 30, 2023.

| | | | | | | | | | | | | | | | | |

| CUSIP No. 44980X109 |

1 | | NAME OF REPORTING PERSON IQ EQ Trust Company, U.S., LLC, solely as trustee of The Valentin Gapontsev Trust I |

| 2 | | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) (b) |

| 3 | | SEC USE ONLY |

| 4 | | SOURCE OF FUNDS OO |

| 5 | | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

| 6 | | CITIZENSHIP OR PLACE OF ORGANIZATION New Hampshire |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | | 7 | | SOLE VOTING POWER 0 |

| | 8 | | SHARED VOTING POWER 8,765,740 |

| | 9 | | SOLE DISPOSITIVE POWER 0 |

| | 10 | | SHARED DISPOSITIVE POWER 8,765,740 |

| 11 | | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 8,765,740 |

| 12 | | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| 13 | | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 18.7% (1) |

14. | | TYPE OF REPORTING PERSON OO |

| | |

(1)Based on 46,922,454 shares of Common Stock outstanding as of October 30, 2023, as reported in the Issuer’s Form 10-Q for the three months ended September 30, 2023.

| | | | | | | | | | | | | | | | | |

| CUSIP No. 44980X109 |

1 | | NAME OF REPORTING PERSON Eugene Scherbakov, individually and as trustee of The Valentin Gapontsev Trust I |

| 2 | | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) (b) |

| 3 | | SEC USE ONLY |

| 4 | | SOURCE OF FUNDS OO |

| 5 | | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

| 6 | | CITIZENSHIP OR PLACE OF ORGANIZATION Russian Federation |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | | 7 | | SOLE VOTING POWER 7,032,542 (1) |

| | 8 | | SHARED VOTING POWER 8,765,740 |

| | 9 | | SOLE DISPOSITIVE POWER 7,032,542 (1) |

| | 10 | | SHARED DISPOSITIVE POWER 8,765,740 |

| 11 | | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 15,798,282 |

| 12 | | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| 13 | | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 33.7% (2) |

14. | | TYPE OF REPORTING PERSON IN |

| | |

(1)Includes 69,937 shares of Common Stock issuable upon exercise of Issuer stock options that have vested and 15,047 shares of Common Stock issuable under restricted stock units and performance stock units with vesting dates within sixty days of the date hereof, subject to the conditions applicable to such awards.

(2)Based on 46,922,454 shares of Common Stock outstanding as of October 30, 2023, as reported in the Issuer’s Form 10-Q for the three months ended September 30, 2023.

Introductory Note:

This Amendment to Schedule 13D is being filed to report that (i) Dr. Alexander Ovtchinnikov and Dr. Nikolai Platonov no longer serve as trustees of the Valentin Gapontsev Trust I and accordingly have been removed from this Schedule 13D and replaced by a new trustee, IQ EQ Trust Company, U.S., LLC; and (ii) Dr. Ovtchinnikov and Dr. Eugene Scherbakov no longer serve as trustee of the Gapontsev Trust (as

such term is used in the Reporting Persons' Amendment 4 to Schedule 13D filed on November 1, 2021). The Gapontsev Trust is a different trust than the Reporting Person, Valentin Gapontsev Trust I.

This Amendment No. 5 to Schedule 13D amends and supplements the Schedule 13D originally filed by certain of the Reporting Persons on December 21, 2010, as amended on January 24, 2011, May 23, 2011, December 17, 2012 and November 1, 2021 (as amended, the “Schedule 13D”). Except as expressly set forth herein, there have been no changes in the information set forth in Amendment No. 4 to Schedule 13D filed on November 1, 2021.

| | | | | | | | |

| ITEM 2. | IDENTITY AND BACKGROUND |

Item 2 of the Schedule 13D is amended and restated:

The Schedule 13D is being filed jointly by the Reporting Persons. The agreement among the Reporting Persons relating to the joint filing of the Schedule 13D is attached hereto as Exhibit 99.1. The name, business address, principal business or occupation and citizenship of each of the Reporting Persons is as follows:

| | | | | | | | |

| Name and Business Address | Principal Business or Occupation | Citizenship or place of organization |

The Valentin Gapontsev Trust I c/o IQ EQ Trust Company, U.S., LLC 3 Executive Park Drive, Suite 302 Bedford, NH 03110 | | A trust governed under the laws of New Hampshire |

Angelo P. Lopresti c/o IQ EQ Trust Company, U.S., LLC 3 Executive Park Drive, Suite 302 Bedford, NH 03110 | Executive Officer of IPG Photonics Corporation | United States |

Eugene Scherbakov c/o IQ EQ Trust Company, U.S., LLC 3 Executive Park Drive, Suite 302 Bedford, NH 03110 | Executive Officer of IPG Photonics Corporation | Russia |

IQ EQ Trust Company, U.S., LLC

3 Executive Park Drive, Suite 302

Bedford, NH 03110 | Providing trust fiduciary services | A limited liability company organized under the laws of South Dakota |

| | |

| | | | | | | | |

| ITEM 4. | PURPOSE OF THE TRANSACTION |

Item 4 of the Schedule 13D is supplemented as follows:

Dr. Alexander Ovtchinnikov and Dr. Nikolai Platonov no longer serve as trustees of the Valentin Gapontsev Trust I. IQ EQ Trust Company, U.S., LLC became a trustee of the Valentin Gapontsev Trust I as of 12/31/2023. Dr. Ovtchinnikov and Dr. Eugene Scherbakov are no longer trustees of the Gapontsev Trust.

| | | | | | | | |

| ITEM 5. | INTEREST IN SECURITIES OF THE ISSUER. |

(a)-(b) Incorporated by reference to Items (7) - (11) and (13) of the cover page relating to each Reporting Person. The individual Reporting Persons named in Item 2, above, by virtue of being trustees of any of the Gapontsev Trust, the Valentin Gapontsev Trust I, the Valentin Gapontsev Trust II and/or the Valentin Gapontsev Trust III may be deemed to have the power to direct the voting and disposition of the shares of the Issuer’s common stock owned by the respective Trust.

(c) The Reporting Persons effected the following transactions in shares of the Issuer’s Common Stock over the last 60 days:

On December 8, 2023, Reporting Person Valentin Gapontsev Trust I sold 8,250 shares of the Issuer’s common stock at an average price of $99.48 per share, in brokerage transactions pursuant to a 10b5-1 trading plan entered into on December 15, 2022.

On November 24, 2023, Reporting Person Valentin Gapontsev Trust I sold 8,250 shares of the Issuer’s common stock at an average price of $95.34 per share, in brokerage transactions pursuant to a 10b5-1 trading plan entered into on December 15, 2022.

On November 8, 2023, Reporting Person Valentin Gapontsev Trust I sold 8,250 shares of the Issuer’s common stock at an average price of $91.71 per share, in brokerage transactions pursuant to a 10b5-1 trading plan entered into on December 15, 2022.

(d) Not applicable.

(e) Not applicable.

| | | | | | | | |

| ITEM 6. | CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

Item 6 of the Schedule 13D is supplemented as follows:

Except for the arrangements described in Item 4 above and the documents attached as exhibits pursuant to Item 7 below, each of which is incorporated by reference herein and made a part hereof, to the best knowledge of the Reporting Persons, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between the Reporting Persons, and any other person, with respect to any securities of the Issuer, including, but not limited to, transfer or voting of any of the securities, finder's fees, joint ventures, loan or option agreements, puts or calls, guarantees of profits, divisions of profits or loss, or the giving or withholding of proxies.

| | | | | | | | |

| ITEM 7. | MATERIAL TO BE FILED AS EXHIBITS |

10.1 Promissory Note, dated December 17, 2019, by The Valentin Gapontsev Trust I

99.1 Joint Filing Agreement, dated December 31, 2023, by and among The Valentin Gapontsev Trust I, Angelo Lopresti, Eugene Scherbakov and IQ EQ Trust Company, U.S., LLC

SIGNATURES

After reasonable inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: January 2, 2024

THE VALENTIN GAPONTSEV TRUST I

By: /s/ Angelo P. Lopresti

Angelo P. Lopresti

Trustee

By: /s/ Eugene Scherbakov

Eugene Scherbakov

Trustee

IQ EQ Trust Company, U.S., LLC, as trustee

By: /s/ Christopher C. Martin

Christopher C. Marin

President

ANGELO P. LOPRESTI

/s/ Angelo P. Lopresti

EUGENE SCHERBAKOV

/s/ Eugene Scherbakov

IQ EQ TRUST COMPANY, U.S., LLC

By: /s/ Christopher C. Martin

Christopher C. Martin

President

EXHIBIT 10.1

PROMISSORY NOTE

$235,178,640.00 Oxford, Massachusetts December 17, 2019

FOR VALUE RECEIVED, Angelo P. Lopresti, Nikolai Platonov, Alex Ovtchinnikov and Eugene Scherbakov, solely as Trustees of THE VALENTIN GAPONTSEV TRUST I, a trust created by trust indenture dated December 17, 2010, and not individually or in any other capacity (the "Maker") hereby promise to pay to the order of Valentin P. Gapontsev, of Worcester, Massachusetts (the “Holder”) on the 9th anniversary of this Note the principal sum of Two Hundred Thirty-Five Million One Hundred Seventy-Eight Thousand Six Hundred Forty and 00/100 Dollars ($235,178,640.00) (or so much thereof as shall not have been prepaid) and to pay interest on the entire unpaid balance hereof on each anniversary of this Note at the rate of one and sixty-nine one hundredths percent (1.69%) per annum. Said principal and interest payments shall be paid, in cash, by wire transfer or by check, at such address or to such bank account as Holder shall designate in writing or in kind by shares of IPG Photonics Corporation.

This Note may be prepaid at any time and from time to time, in whole or in part, at the option of the undersigned, with interest accrued on the amount to be prepaid, without premium or penalty. Any amount of principal or interest not paid when due shall bear interest from the date when due until paid.

This Note shall become immediately due and payable without demand or notice if (1) any court of competent jurisdiction shall enter a decree or order not vacated or stayed within sixty (60) days from the date of entry (a) appointing a receiver of the Maker or (b) approving a petition for the adjudication of the Maker as a bankrupt or insolvent or (2) the Maker shall itself file any such petition or take or consent to any other action seeking any such judicial order or shall make an assignment for the benefit of its creditors or shall admit in writing its inability to pay its debts generally as they become due or (3) the Maker shall fail to pay any installment of interest within (30) days after receipt of notice of demand for payment. Any delay or failure to enforce any of these provisions shall not waive or change any of the Holder’s rights in enforcing the same.

In the event of the default in the payment of this Note, the Maker hereby promises to pay all costs, charges and expenses, including reasonable attorney’s fees, incurred by the Holder.

This Note shall be binding upon Maker and their legal representatives, successors and assigns, and shall inure to the benefit of Holder and his legal representatives, heirs and assigns. Notwithstanding the foregoing, the Maker is entering into this Note solely in their capacity as Trustees and not individually or in any other capacity and this Note is without recourse under any circumstances to the personal or corporate assets of any Trustee.

This Note shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts without giving effect to its principles of conflicts of law. The Maker hereby consents to service of process, and to be sued, in the Commonwealth of Massachusetts

and consents to the jurisdiction of the courts of the Commonwealth of Massachusetts and the United States District Court for the District of Massachusetts, for the purpose of any suit, action, or other proceeding arising hereunder, and expressly waives any and all objections they may have to venue in any such courts.

MAKER:

THE VALENTIN GAPONTSEV TRUST I

/s/ Angelo P. Lopresti

ANGELO P. LOPRESTI, as Trustee and not individually or in any other capacity

/s/ Nikolai Platonov

NIKOLAI PLATONOV, as Trustee and not individually or in any other capacity

/s/ Alex Ovtchinnikov

ALEX OVTCHINNIKOV, as Trustee and not individually or in any other capacity

/s/ Eugene Scherbakov

EUGENE SCHERAKOV, as Trustee and not individually or in any other capacity

EXHIBIT 99.1

Joint Filing Agreement

December 31, 2023

In accordance with Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, as amended, The Valentin Gapontsev Trust I, Angelo P. Lopresti, Eugene Scherbakov and IQ EQ Trust Company, U.S., LLC each hereby agree to the joint filing of this Statement on Schedule 13D (including any and all amendments hereto). In addition, each party to this Agreement expressly authorizes each other party to this Agreement to file on its behalf any and all amendments to such Statement on Schedule 13D. A copy of this Agreement shall be attached as an exhibit to the Statement on Schedule 13D filed on behalf of each of the parties hereto, to which this Agreement relates.

This Agreement may be executed in multiple counterparts, each of which shall constitute an original, one and the same instrument.

THE VALENTIN GAPONTSEV TRUST I

By: /s/ Angelo P. Lopresti

Angelo P. Lopresti

Trustee

By: /s/ Eugene Scherbakov

Eugene Scherbakov

Trustee

IQ EQ Trust Company, U.S., LLC, as trustee

By: /s/ Christopher C. Martin

Christopher C. Marin

President

ANGELO P. LOPRESTI

/s/ Angelo P. Lopresti

EUGENE SCHERBAKOV

/s/ Eugene Scherbakov

IQ EQ TRUST COMPANY, U.S., LLC

By: /s/ Christopher C. Martin

Christopher C. Martin

President

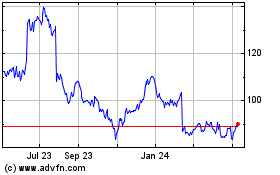

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Oct 2024 to Nov 2024

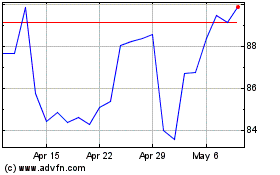

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Nov 2023 to Nov 2024