Amended Statement of Beneficial Ownership (sc 13d/a)

February 02 2023 - 4:44PM

Edgar (US Regulatory)

CUSIP No. 458751302

| |

UNITED

STATES |

|

| |

SECURITIES

AND EXCHANGE COMMISSION |

|

| |

Washington,

D.C. 20549 |

|

| |

|

|

| |

SCHEDULE

13D |

|

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

INTERLINK

ELECTRONICS, INC.

(Name of Issuer)

Common Stock,

$0.001 par value

(Title of Class of Securities)

458751302

(CUSIP Number)

Steven N. Bronson

SB4 Investments, LLC

BKF Capital Group, Inc.

BKF Asset Holdings, Inc.

10100 Santa Monica Boulevard

Suite 1400

Los Angeles, CA 90067

949.504.4442

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

January 26,

2023

(Date of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page.

The information required on the remainder of this cover

page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act")

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

CUSIP

No. 458751302

| |

1. |

Names

of Reporting Persons

Steven N. Bronson |

| |

| |

2. |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

|

| |

|

(b) |

o |

|

| |

| |

3. |

SEC

Use Only |

| |

| |

4. |

Source

of Funds (See Instructions)

PF; AF |

| |

| |

5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

| |

6. |

Citizenship

or Place of Organization

USA |

| |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole

Voting Power

4,249,040 (1) |

| |

| 8. |

Shared

Voting Power

993,658 (2) |

| |

| 9. |

Sole

Dispositive Power

4,249,040 (1) |

| |

| 10. |

Shared

Dispositive Power

993,658 (2) |

| |

| |

11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

5,242,698 (3) |

| |

| |

12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) x

Excludes 206,000 shares of common stock held by Mr. Bronson’s spouse. Mr. Bronson disclaims beneficial ownership

of such shares. |

| |

13. |

Percent

of Class Represented by Amount in Row (11)

79.38% |

| |

14. |

Type

of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

|

| (1) | This

includes (A) 4,022,140 shares previously held by Mr. Bronson and his spouse as joint tenants

that they contributed to SB4 Investments, LLC (“SB4”), which is owned by Mr.

Bronson and his spouse, and (B) 226,900 shares held directly by Mr. Bronson. As the Managing

Member and majority owner of SB4, Mr. Bronson may be deemed to be the beneficial owner of

the shares held by SB4. |

| (2) | These

shares are owned directly by BKF Asset Holdings, Inc. (“BKF Holdings”), which

is a wholly owned subsidiary of BKF Capital Group, Inc. (“BKF Capital”). Mr.

Bronson, as the Chairman, CEO and majority shareholder of BKF Capital, may be deemed to be

the beneficial owner of these shares. |

| (3) | This

includes the shares held directly by Mr. Bronson in addition to the shares owned by SB4 and

BKF Holdings. |

CUSIP

No. 458751302

| |

1. |

Names

of Reporting Persons

SB4 Investments, LLC

EIN 88-1598441 |

| |

| |

2. |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

|

| |

|

(b) |

o |

|

| |

| |

3. |

SEC

Use Only |

| |

| |

4. |

Source

of Funds (See Instructions)

OO; AF |

| |

| |

5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

| |

6. |

Citizenship

or Place of Organization

Nevada |

| |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole

Voting Power

4,022,140 (1) |

| |

| 8. |

Shared

Voting Power

0 |

| |

| 9. |

Sole

Dispositive Power

4,022,140 (1) |

| |

| 10. |

Shared

Dispositive Power

0 |

| |

| |

11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

4,022,140 (1) |

| |

| |

12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent

of Class Represented by Amount in Row (11)

60.9% |

| |

14. |

Type

of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

| (1) | Represents

shares previously held by Mr. Bronson and his spouse as joint tenants that they contributed

to SB4 Investments, LLC (“SB4”). As the Managing Member and majority owner of

SB4, Mr. Bronson may be deemed to be the beneficial owner of these shares. |

CUSIP

No. 458751302

| |

1. |

Names

of Reporting Persons

BKF Capital Group, Inc.

EIN 36-0767530 |

| |

| |

2. |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

|

| |

|

(b) |

o |

|

| |

| |

3. |

SEC

Use Only |

| |

| |

4. |

Source

of Funds (See Instructions)

OO; AF |

| |

| |

5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

| |

6. |

Citizenship

or Place of Organization

Delaware |

| |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole

Voting Power

0 |

| |

| 8. |

Shared

Voting Power

993,658 (1) |

| |

| 9. |

Sole

Dispositive Power

0 |

| |

| 10. |

Shared

Dispositive Power

993,658 (1) |

| |

| |

11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

993,658 |

| |

| |

12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent

of Class Represented by Amount in Row (11)

15.05% |

| |

14. |

Type

of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

| (1) | These

shares are owned directly by BKF Asset Holdings, Inc., which is a wholly owned subsidiary

of BKF Capital Group, Inc. |

CUSIP

No. 458751302

| |

1. |

Names

of Reporting Persons

BKF Asset Holdings, Inc.

EIN 90-0941288 |

| |

| |

2. |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

|

| |

|

(b) |

o |

|

| |

| |

3. |

SEC

Use Only |

| |

| |

4. |

Source

of Funds (See Instructions)

WC |

| |

| |

5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

| |

6. |

Citizenship

or Place of Organization

Delaware |

| |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole

Voting Power

0 |

| |

| 8. |

Shared

Voting Power

993,658 |

| |

| 9. |

Sole

Dispositive Power

|

| |

| 10. |

Shared

Dispositive Power

993,658 |

| |

| |

11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

993,658 |

| |

| |

12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) x |

| |

13. |

Percent

of Class Represented by Amount in Row (11)

15.05% |

| |

14. |

Type

of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

CUSIP

No. 458751302

| Item 1. |

Security and Issuer |

| |

This Schedule 13D Amendment is

filed on behalf of Steven N. Bronson (“Mr. Bronson”), SB4 Investments, LLC (“SB4”), BKF Capital Group, Inc.

(“BKF Capital”) and BKF Asset Holdings, Inc. (“BKF Holdings”) with respect to the shares of common stock,

par value $0.001 per share (the “Common Stock”), of Interlink Electronics, Inc., a Nevada corporation with its principal

offices located at 1 Jenner, Suite 200, Irvine, CA 92618 (the “Issuer” or “Interlink”). The Issuer

recently reported that as of November 10, 2022, there were 6,604,298 shares of Common Stock outstanding. |

| |

|

| Item 2. |

Identity and Background |

| |

(a) This schedule D is filed on behalf of Mr. Bronson, SB4, BKF Capital and BKF Holdings. BKF Holdings is a wholly owned subsidiary

of BKF Capital.

(b) The business address of Mr. Bronson, SB4, BKF Capital and BKF Holdings is 10100 Santa Monica Boulevard, Suite 1400, Los Angeles,

CA 90067.

(c)

Mr. Bronson is the Chairman, President and CEO of Interlink. He is also the Managing Member and majority owner of SB4 and

the Chairman, CEO and majority shareholder of BKF Capital, which is a publicly traded corporation.

(d)

During the last five years, none of Mr. Bronson, SB4, BKF Capital and BKF Holdings has been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors).

(e)

None of Mr. Bronson, SB4, BKF Capital and BKF Holdings, during the last five years, has been a party to a civil proceeding

of a judicial or adminstative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment,

decree or final order enjoining further violations of, or prohibiting or mandating activities subject to, the federal or state securities

laws or finding any violation with respect to such laws.

(f)

Mr. Bronson is a citizen of the Unites States of America. SB4 is a limited liability company organzed under the laws of the

State of Nevada. Each of BKF Capital and BKF Holdings is a corporation organized under the laws of the State of Delaware. |

| |

|

| Item 3. |

Source and Amount of Funds

or Other Consideration |

| |

The total cost for purchasing

the Common Stock reported as owned by the Reporting Persons in this Statement was approximately $6,284,814 The source

of funds was working capital of BKF Holdings and, for the shares held directly by Mr. Bronson, Mr. Bronson’s personal funds

(approximately $3,425,058). |

| |

|

| Item 4. |

Purpose of Transaction |

| |

The Reporting Persons acquired the Common Stock for investment

purposes and may make further purchases or sales of shares of Common Stock through open-market or privately negotiated transactions

or otherwise, on such terms and at such times as the Reporting Persons may deem advisable.

Except as set forth herein, none of the Reporting Persons has

any present plan or proposal that would result in any of the actions described in paragraphs (a) through (j) of Item 4 of Schedule

13D, except as may be proposed by Mr. Bronson in his capacity as a director of the Issuer or by the Board of Directors of the Issuer

with the participation of Mr. Bronson. Each of the Reporting Persons reserves the right in the future to formulate any such plans

or proposals and to take any actions with respect to its investments in the Issuer, including any or all of the actions specified

in paragraphs (a) through (j) of Item 4 of Schedule 13D. |

CUSIP

No. 458751302

| Item 5. |

Interest in Securities of the

Issuer |

| |

(a) SB4 beneficially owns an aggregate of 4,022,140 shares of Common Stock, all of which are held directly by SB4, representing

approximately 60.9% of the total outstanding shares of Common Stock. BKF Holdings beneficially owns an aggregate of 993,658 shares

of Common Stock, all of which are held directly by BKF Holdings, representing approximately 15.05% of the total outstanding shares

of Common Stock. BKF Capital beneficially owns an aggregate of 993,658 shares of Common Stock, all of which are held indirectly through

BKF Holdings, representing approximately 15.05% of the total outstanding shares of Common Stock.

Mr. Bronson is the Managing Member and majority owner

of SB4 and thus may be deemed to be the beneficial owner of the shares of Common Stock held by SB4. He is the Chairman, CEO and majority

shareholder of BKF Capital and thus may be deemed to be the beneficial owner of the shares of Common Stock held by BKF Capital. Mr.

Bronson personally owns an additional 226,900 shares of Common Stock, representing approximately 3.44% of the total outstanding shares

of Common Stock.

Accordingly, Mr. Bronson may be deemed to benefically

own an aggregate of 5,242,698 shares of Common Stock, representing approximately 79.38% of the total outstanding shares of Common

Stock.

Mr. Bronson’s wife personally owns an additional

206,000 shares of Common Stock, but Mr. Bronson disclaims beneficial ownership of such shares.

(b)

The information set forth in rows 7 through 10 of the cover pages attached hereto are incorporated herein by reference.

(c)

The following open market transactions were effected by Mr. Bronson, SB4, BKF Capital and BKF Holdings during the past sixty

(60) days: None

|

| |

(d) Not applicable.

(e) Not applicable. |

| |

|

| Item 6. |

Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer |

| |

Not applicable. |

| |

|

| Item 7. |

Material to be Filed as Exhibits |

| |

Not applicable |

CUSIP

No. 458751302

Signature

After reasonable inquiry and to the best of the undersigned’s

knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

Date: February 2, 2023

| |

Steven N. Bronson |

| |

|

| |

/s/

Steven N. Bronson |

| |

Steven N. Bronson |

| |

|

| |

SB4 Investments, LLC |

| |

|

| |

By: |

/s/

Steven N. Bronson |

| |

|

Steven N. Bronson |

| |

|

Managing Member |

| |

|

| |

BKF Capital Group, Inc. |

| |

|

| |

By: |

/s/ Steven N.

Bronson |

| |

|

Steven N. Bronson |

| |

|

President |

| |

|

| |

BKF Asset Holdings, Inc. |

| |

|

| |

By: |

/s/ Steven N.

Bronson |

| |

|

Steven N. Bronson |

| |

|

President |

| |

ATTENTION |

|

| Intentional

misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001). |

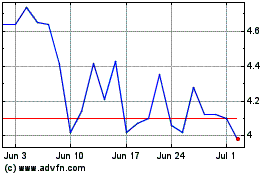

Interlink Electronics (NASDAQ:LINK)

Historical Stock Chart

From Aug 2024 to Sep 2024

Interlink Electronics (NASDAQ:LINK)

Historical Stock Chart

From Sep 2023 to Sep 2024