FILED BY HUT 8 MINING CORP.

COMMISSION FILE NO. 001-40487

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF

1933, AS AMENDED

SUBJECT COMPANY: U.S. DATA MINING GROUP, INC.

AND HUT 8 CORP.

The following is a partial transcript of an interview

made available by Hut 8 Mining Corp. on X.com on August 31, 2023.

Check out our latest AMA on Hut 8’s proposed

merger with US Bitcoin Corp where we explain the 5:1 stock consolidation.

Sue Ennis: We are going

to do a little AMA today because a lot of you have questions about what is happening with our share consolidation. I’m recording

this from our office. Hold on. Let's go say hi to Jaime. Hi, Jaime!

Jaime Leverton: Hi Sue!

Sue Ennis: First of all,

the reason why any of this is going down the way that it is because we needed to make sure that for this to be an actual merger of equals,

that each company had the same amount of shares under ownership. So, US Bitcoin Corp had a certain amount and Hut, as we know, had a little

over 221 million shares outstanding. So that's not equal. Now, to get it equal, because this is a merger of equals, we multiplied each

outstanding share balance by an isolated factor so that we could get to an about 50/50 split between each company.

Now, Hut people, technically this means you're going to hold fewer

shares, but the value of each share is expected to be worth proportionately more. This is not a dilution event for you. It is a consolidation

event. You know, two very different concepts in corporate finance. So, share consolidation, which is what's, you know, happening as per

this proposed merger, divides the total amount of shares by a number of shares. In this case, it's 5.

So technically, the total amount of shares outstanding of a company,

yes, they will be less, but they should be worth proportionately more. If I own 5 Hut shares, in a post-merger world, those 5 shares would

then be worth 1 Hut share. But each of those 5 Hut shares, for example, as of yesterday's closed day, was worth $2.28 US. So now I have

to $2.28 times 5, and that's the one price of the share as an example, as of yesterday's close date. So, I hope this explains it.

My DMS are open @BigSuey or leave a comment below in the video.

Cautionary Note Regarding Forward–Looking

Information

This communication includes "forward-looking

information" and "forward-looking statements" within the meaning of Canadian securities laws and United States securities

laws, respectively (collectively, "forward-looking information"). All information, other than statements of historical facts,

included in this communication that address activities, events or developments that the Company expects or anticipates will or may occur

in the future, including such things as future business strategy, competitive strengths, goals, expansion and growth of the Company's

businesses, operations, plans and other such matters is forward-looking information. Forward-looking information is often identified by

the words "may", "would", "could", "should", "will", "intend", "plan",

"anticipate", "allow", "believe", "estimate", "expect", "predict", "can",

"might", "potential", "predict", "is designed to", "likely" or similar expressions.

In addition, any statements in this communication that refer to expectations, projections or other characterizations of future events

or circumstances contain forward-looking information and include, among others, statements with respect to the expected outcomes of the

Transaction, including the combined company's assets and financial position; the ability of Hut 8 and USBTC to complete the Transaction

on the terms described herein, or at all, including, receipt of required regulatory approvals, shareholder approvals, court approvals,

stock exchange approvals and satisfaction of other closing customary conditions.

Statements containing forward-looking information

are not historical facts, but instead represent management's expectations, estimates and projections regarding future events based on

certain material factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 as of the date of this

communication, such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the

actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking

information, including but not limited to, security and cybersecurity threats and hacks, malicious actors or botnet obtaining control

of processing power on the Bitcoin network, further development and acceptance of the Bitcoin network, changes to Bitcoin mining difficulty,

loss or destruction of private keys, increases in fees for recording transactions in the Blockchain, erroneous transactions, reliance

on a limited number of key employees, reliance on third party mining pool service providers, regulatory changes, classification and tax

changes, momentum pricing risk, fraud and failure related to digital asset exchanges, difficulty in obtaining banking services and financing,

difficulty in obtaining insurance, permits and licenses, internet and power disruptions, geopolitical events, uncertainty in the development

of cryptographic and algorithmic protocols, uncertainty about the acceptance or widespread use of digital assets, failure to anticipate

technology innovations, the COVID19 pandemic, climate change, currency risk, lending risk and recovery of potential losses, litigation

risk, business integration risk, changes in market demand, changes in network and infrastructure, system interruption, changes in leasing

arrangements, failure to achieve intended benefits of power purchase agreements, potential for interrupted delivery, or suspension of

the delivery, of energy to the Company's mining sites, and other risks related to the digital asset and data centre business. For a complete

list of the factors that could affect the Company, please see the "Risk Factors" section of the Company's Annual Information

Form dated March 9, 2023, and Hut 8's other continuous disclosure documents which are available on the Company's profile on

the System for Electronic Document Analysis and Retrieval at www.sedar.com and on the EDGAR section of the U.S. Securities and Exchange

Commission's website at www.sec.gov.

Additional Information About the Transaction

and Where to Find It

In connection with

the Transaction, that, if completed, would result in New Hut becoming a new public company, Hut 8 Corp. ("New Hut”) has filed

a registration statement on Form S-4 (the “Form S-4”) with the U.S. Securities and Exchange Commission (the “SEC”).

USBTC and Hut 8 urge investors, shareholders, and other interested persons to read the Form S-4, including any amendments thereto,

the Hut meeting circular, as well as other documents to be filed with the SEC and documents to be filed with Canadian securities regulatory

authorities in connection with the Transaction, as these materials will contain important information about USBTC, Hut 8, New Hut and

the Transaction. New Hut also has, and will, file other documents regarding the Transaction with the SEC. This communication is not a

substitute for the Form S-4 or any other documents that may be sent to Hut’s shareholders or USBTC's stockholders in connection

with the Transaction. Investors and security holders will be able to obtain free copies of the Form S-4 and all other relevant documents

filed or that will be filed with the SEC by New Hut through the website maintained by the SEC at www.sec.gov or by contacting the

investor relations department of Hut 8 at info@hut8.io and of USBTC at info@usbitcoin.com.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”) or in a transaction

exempt from the registration requirements of the Securities Act.

Hut 8 Investor Relations

Sue Ennis

sue@hut8.io

Hut 8 Media Relations

Erin Dermer

erin.dermer@hut8.io

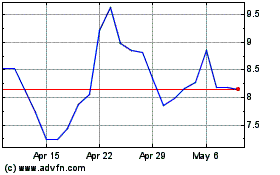

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

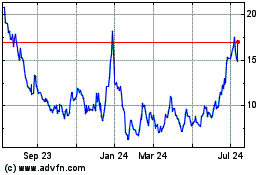

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jul 2023 to Jul 2024