FILED BY HUT 8 MINING CORP.

COMMISSION FILE NO. 001-40487

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF

1933, AS AMENDED

SUBJECT COMPANY: U.S. DATA MINING GROUP, INC. AND

HUT 8 CORP.

The following is a partial transcript of an interview

made available by Hut 8 Mining Corp. on Youtube on August 23, 2023.

Energy Hedging | Sue Ennis (Hut 8) & Chris

Vickery (USBTC)

Sue Ennis: Okay. Okay. Hey, everybody. So as we talked about,

we're going to be talking to U.S. Bitcoin Core Corp's energy hedging team, a guy by the name of Chris. He's going to tell you a little

bit about what the energy hedging team is and what they do at U.S. Bitcoin Corp and why it's so significant for our business in a post-merger

world. So let's get into it. Okay. So, Chris, what is your name and what do you do at U.S. Bitcoin Corp.?

Chris Vickery: Yes. So my name is Chris Vickery. I'm a vice

president on our energy team. And broadly, our team's mandate is twofold. It's one, to manage the energy consumption and costs and revenues

associated with that energy consumption at our data centers and two, it’s to originate and find new sites to build additional data

centers at.

Sue Ennis: Very cool. Okay. So, Chris, what is energy hedging?

What does that even mean?

Chris Vickery: Yeah. So it's energy hedging is kind of like

hedging anything else, right? The idea is that you might be facing some sort of unknown future costs or volatile future costs. And for

a number of reasons, you may have interest in fixing that future cost. Right? So the idea is to try and manage volatility in your costs

going forward and stabilize the cash flows on the cost side of the ledger, you can do this on the revenue side of the ledger as well.

I mean, airlines do this to hedge their fuel costs. It's... The practice is fairly common, but in the energy space, it's particularly

related to the costs of electricity.

Sue Ennis: Awesome. And so why does this matter so much when

you're in the business of hosting Bitcoin infrastructure or Bitcoin mining or even potentially high performance computing? Like, why does

this matter?

Chris Vickery: Yeah. So it matters because a huge portion of

the operational expense of high density computing applications - whether that's mining or high performance computing - comes down to the

cost of electricity. It's just a huge portion of the cost. And because these types of facilities are so flexible in the way they operate,

in how quickly they can turn off and turn on and participate in the grid in a flexible manner, it opens up the options for how you procure

that major cost for you in a large variety of ways. So the sites are subject to costs, such as with just the electrons that the sites

consume, along with other kind of what are referred to as ancillary services that are costs associated with your participation within

the grid, along with capacity. And so for an industry type that has such a huge focus on the electricity costs, it's important because

you can, one, make sure that you aren't subject to scarcity events where costs become extremely high in short periods of time, and it

can also provide you a competitive advantage against your peers if you're able to lock in future pricing at attractive levels compared

to where prices go in the future.

Sue Ennis: Awesome. Okay, cool. And final question, how big

is the energy portfolio that you manage right now?

Chris Vickery: So you at US Bitcoin we manage. Right now, a

little over 700 megawatts of data centers. And those sites are distributed throughout the United States, in New York, in Nebraska and

Texas. And we manage the energy consumption for all of those megawatts.

…

Cautionary Note Regarding Forward–Looking

Information

This press release includes “forward-looking information”

and “forward-looking statements” within the meaning of Canadian securities laws and United States securities laws,

respectively (collectively, “forward-looking information”). All information, other than statements of historical facts, included

in this press release that address activities, events or developments that the Company expects or anticipates will or may occur in the

future, including such things as future business strategy, competitive strengths, goals, expansion and growth of the Company’s

businesses, operations, plans and other such matters is forward-looking information. Forward-looking information is often identified

by the words “may”, “would”, “could”, “should”, “will”, “intend”,

“plan”, “anticipate”, “allow”, “believe”, “estimate”, “expect”,

“predict”, “can”, “might”, “potential”, “predict”, “is designed to”,

“likely” or similar expressions. In addition, any statements in this press release that refer to expectations, projections

or other characterizations of future events or circumstances contain forward-looking information and include, among others, statements

regarding: (i) expectations related to New Hut's hashrate and self-mining capacity; (ii) the expected outcomes of the Transaction; (iii)

the ability of Hut 8 and USBTC to complete the Transaction on the terms described herein, or at all, including, receipt of required regulatory

approvals, shareholder approvals, court approvals, stock exchange approvals and satisfaction of other closing customary conditions; (iv)

the expected synergies related to the Transaction in respect of strategy, operations and other matters; (v) projections related to expansion;

(vi) acceleration of ESG efforts and commitments; (vii) the ability of USBTC to resume mining activities in Niagara Falls, New York,

and (viii) the ability of New Hut to execute on future opportunities, among others.

Statements containing forward-looking information are not historical

facts, but instead represent management’s expectations, estimates and projections regarding future events based on certain material

factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 as of the date of this press release,

such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results,

level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information,

including but not limited to: the ability to obtain requisite shareholder approvals and the satisfaction of other conditions to the consummation

of the Transaction on the proposed terms or at all; the ability to obtain necessary stock exchange, regulatory, governmental or other

approvals in the time assumed or at all; the anticipated timeline for the completion of the Transaction; the ability to realize the anticipated

benefits of the Transaction or implementing the business plan for New Hut, including as a result of a delay in completing the Transaction

or difficulty in integrating the businesses of the companies involved (including the retention of key employees); the ability to realize

synergies and cost savings at the times, and to the extent, anticipated; the potential impact on mining activities; the potential impact

of the announcement or consummation of the Transaction on relationships, including with regulatory bodies, employees, suppliers, customers,

competitors and other key stakeholders; security and cybersecurity threats and hacks; malicious actors or botnet obtaining control of

processing power on the Bitcoin network; further development and acceptance of the Bitcoin network; changes to Bitcoin mining difficulty;

loss or destruction of private keys; increases in fees for recording transactions in the Blockchain; internet and power disruptions;

geopolitical events; uncertainty in the development of cryptographic and algorithmic protocols; uncertainty about the acceptance or widespread

use of digital assets; failure to anticipate technology innovations; the COVID-19 pandemic; climate change; currency risk; lending risk

and recovery of potential losses; litigation risk; business integration risk; changes in market demand; changes in network and infrastructure;

system interruption; changes in leasing arrangements; failure to achieve intended benefits of power purchase agreements; potential for

interrupted delivery, or suspension of the delivery, of energy to New Hut’s mining sites. For a complete list of the factors that

could affect the Company, please see the “Risk Factors” section of the Company’s Annual Information Form dated March

9, 2023 and Hut 8’s other continuous disclosure documents which are available on the Company’s profile on the System for

Electronic Document Analysis and Retrieval at www.sedar.com and on the EDGAR section of the SEC’s website at www.sec.gov.

These risks are not intended to represent a complete

list of the factors that could affect Hut 8, USBTC, or New Hut; however, these factors should be considered carefully. There can be no

assurance that such estimates and assumptions will prove to be correct. Should one or more of these risks or uncertainties materialize,

or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described

in this press release as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted

and such forward-looking statements included in this press release should not be unduly relied upon. The impact of any one assumption,

risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent

and New Hut’s future decisions and actions will depend on management’s assessment of all information at the relevant time.

The forward-looking statements contained in this press release are made as of the date of this press release, and Hut 8 expressly disclaims

any obligation to update or alter statements containing any forward-looking information, or the factors or assumptions underlying them,

whether as a result of new information, future events or otherwise, except as required by law. Except where otherwise indicated herein,

the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and will

not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring

after the date of preparation.

Additional Information About the Transaction

and Where to Find It

In connection with the Transaction, that, if completed,

would result in New Hut becoming a new public company, Hut 8 Corp. ("New Hut”) has filed a registration statement on Form S-4

(the “Form S-4”) with the U.S. Securities and Exchange Commission (the “SEC”). USBTC and Hut 8 urge investors,

shareholders, and other interested persons to read the Form S-4, including any amendments thereto, the Hut meeting circular, as well as

other documents to be filed with the SEC and documents to be filed with Canadian securities regulatory authorities in connection with

the Transaction, as these materials will contain important information about USBTC, Hut 8, New Hut and the Transaction. New Hut also has,

and will, file other documents regarding the Transaction with the SEC. This communication is not a substitute for the Form S-4 or any

other documents that may be sent to Hut’s shareholders or USBTC's stockholders in connection with the Transaction. Investors and

security holders will be able to obtain free copies of the Form S-4 and all other relevant documents filed or that will be filed with

the SEC by New Hut through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department of Hut

8 at info@hut8.io and of USBTC at info@usbitcoin.com.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”) or in a transaction

exempt from the registration requirements of the Securities Act.

Hut 8 Investor Relations

Sue Ennis

sue@hut8.io

Hut 8 Media Relations

Erin Dermer

erin.dermer@hut8.io

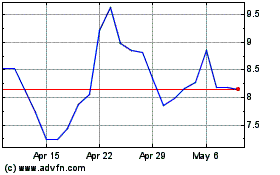

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

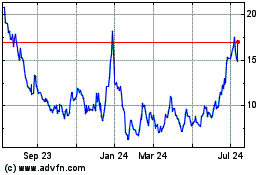

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jul 2023 to Jul 2024