Filed by Hut 8 Corp.

Pursuant to Rule 425

Under the Securities Act of 1933, as amended

Subject Companies: U.S.

Data Mining Group, Inc. and Hut 8 Mining Corp.

S-4 Commission File No.: 333-269738

Bloomberg Crypto Full Show (February 14, 2023)

Bloomberg

Interviewer: I’m Matt Miller with Sonali Basak. Now Bitcoin

miners have made a comeback this year. But challenges remain as the SEC cracks down on digital assets. Bloomberg, David Pan joins us now

to talk more about this industry or this part of the industry, which is so fascinating. He covers it in depth for us here on Bloomberg

News. David, they've been struggling to stay afloat these miners with mounting debt since the crypto crash at the end of 21, beginning

of 22. How are they coping with it now?

David Pan: Right. So we started seeing a lot of troubled mining

companies selling assets, such as data centers, or mining machines at a discount, as well as their crypto hordes, right? Yeah, exactly.

Also, we're seeing a higher level of management turnover. So, they're swapping their existing executives with professionals that are well

versed in restructuring, or M&A.

Interviewer: So why now, what is the market rationale for these

two companies, Hut 8 and US Bitcoin, to merge? What does it do in a market that, as you say, after such struggle, is trying to come out

of this alive?

David Pan: Yeah, so Bitcoin mining actually is a very industrialized

sector. So, they want to achieve economies of scale to reduce costs, for example, they want to have enough cash deposits to secure power

purchase agreements. And they will want to reduce costs by laying off some of the people within the management. Also, at the same time,

they can reduce the risks by diversifying the locations of the mining sites just to prevent some of these natural disasters from costing

damages to the machines.

Interviewer: Do we, by the way, do we see an advantage here

to miners now that proof of stake is under attack? I mean, proof of work is I guess, the only other way left? Right.

David Pan: I think it's really interesting, because I've heard

some Ethereum miners they were saying, I told you so you know, you know, if Ethereum were still like staying with proof of work, and then

we wouldn't have a lot of the problems we're having right now.

Interviewer: Understood. David, thanks so much for your coverage.

Thanks so much for joining us. David Pan covers mining for us at Bloomberg News. Now joining us to talk more about this, Hut 8 Mining

CEO Jamie Leverton and US Bitcoin co-founder and CEO Mike Ho. You heard from David Pan just now a lot of miners saying I told you so.

I can understand that considering such a big to deal was made of proof of stake. Jamie, what do you think of this latest development in

that approach?

Jamie Leverton: I think it is what we expected to see, it's

unfortunate. We at Hut 8, we're a miner of Ethereum, and certainly would have liked to see it continue as a proof of work network.

Interviewer: Mike, what do you think of the SEC's deal with

Kraken and the idea that staking as a service they see as a security.

Mike Ho: Echo that sentiment, the proof of stake allows concentration

of larger finds just by simply deploying and having an influence over the network. Whereas proof of work is truly democratized. You have

a network of miners globally contributing to the network and securing how the platform performs.

Interviewer: I'd love to double down on that with you, Jamie,

because you just kind of mentioned this idea where you had mined Ethereum as well, you know, what's the path forward? It was interesting

to see Ethereum prices really rebound even with that looming threat of greater regulatory oversight, or crackdown, if you will. So what's

the road ahead for assets outside of Bitcoin?

Jamie Leverton: I think it's really difficult to say and certainly,

clarity is something that the industry desperately needs in order for it to chart a more solid path forward.

Interviewer: And you know, Michael, on that note, as well, too,

you know, what does it do now that both of your companies are put together and an industry that was so sorely bruised after last year,

you are seeing this kind of price increase this year? What is that price increase as Bitcoin itself mean for the merger of both of your

companies?

Mike Ho: We have a ton of synergies, we've always held the highest

regard and with Jamie at the helm, being able to be so disciplined throughout the bull markets, whereas the rest of the public peers were

bought into the hysteria and bought very expensive hardware. The companies that come out as true winners are built in the bear markets,

it's maintaining that balance sheet and knowing how to be agile and navigate that downturn.

Interviewer: What's your approach to Mike to the energy usage

debate? I know Jamie has long been a champion of greener mining at Hut 8. How do you approach this problem?

Mike Ho: Absolutely. It's shown within the sites that we operate

at in New York. We're right at Niagara Falls, we're over 90% hydro. In Texas, we have sites that are behind the meter directly on sites

of the energy generation, at the solar farms at the wind farms, we partner with the energy companies, renewable energy companies.

Interviewer: So Jamie, in terms of your business, you long benefited

from the fact that you're not in the United States of America. And we just heard from Michael Shalabh, saying he's worried that the kind

of regulation we're going to get posed to FTX is going to push businesses out. How do you view that in light of this combination?

Jamie Leverton: I think geographic diversity is really important.

We've long been exclusively in Canada, really looking for the right entry point into the US and we believe we found the perfect partner

in US Bitcoin to do that.

Interviewer: Jamie, do you think that after this merger, there

are more opportunities for consolidation? You know, a lot of the issues of last year was the unwillingness of capital markets to really

open up to the crypto sector, a lot of nervousness around the mining sector. But you did see very interesting deals pop up. You saw interesting

rescue financings. What did the capital markets and merger environments look like for you now as a bigger company?

Jamie Leverton: Yeah, I think we were expecting to see consolidation

in this space. It was a little bit late to come. But we have seen some really interesting deals in mining over the last few months. And

I think we're going to continue to see more M&A activity throughout the balance of 2023.

Interviewer: Well, what about for you? I mean, is there anything

that you could do to either raise more money or buy more assets as you've seen so many other companies struggle?

Jamie Leverton: I think our focus right now is entirely on getting

this deal closed and bringing the companies together, but certainly, I've been on a growth trajectory and I don't see that as something

that will change in New Hut post-closing of the deal.

Interviewer: All right, Jamie and Mike, great to get your take.

Thanks so much for joining us. Jamie Leverton of Hut 8 Mining and Mike Ho of US Bitcoin as the two combined.

Additional information about the transaction

and where to find it

In connection with the transaction, that,

if completed, would result in Hut 8 Corp. (“New Hut”) becoming a new public company, New Hut has filed a registration statement

on Form S-4 (the “Form S-4”) with the U.S. Securities Exchange Commission (the “SEC”). U.S. Data Mining

Group, Inc. (“USBTC”) and Hut 8 Mining Corp. (“Hut 8”) urge investors, shareholders, and other interested persons

to read the Form S-4, including any amendments thereto, the Hut 8 meeting circular, as well as other documents filed or to be filed

with the SEC and documents to be filed with Canadian securities regulatory authorities in connection with the transaction, as these materials

do and will contain important information about USBTC, Hut 8, New Hut and the transaction. New Hut also has, and will, file other documents

regarding the transaction with the SEC. This communication is not a substitute for the Form S-4 or any other documents that may be

sent to Hut 8’s shareholders or USBTC's stockholders in connection with the transaction. Investors and security holders are or will

be able to obtain free copies of the Form S-4 and all other relevant documents filed or that will be filed with the SEC by New Hut

through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department of Hut 8 at info@hut8.io and

of USBTC at info@usbitcoin.com.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”) or in a transaction

exempt from the registration requirements of the Securities Act.

Cautionary note regarding Forward–Looking Information

This communication includes “forward-looking

information” and “forward-looking statements” within the meaning of Canadian securities laws and United States securities

laws, respectively (collectively, “forward looking information”). All information, other than statements of historical facts,

included in this communication that address activities, events or developments that Hut 8 Mining Corp. (“Hut 8”) or U.S. Data

Mining Group, Inc. (“USBTC”) expects or anticipates will or may occur in the future, including such things as future business

strategy, competitive strengths, goals, expansion and growth of each company’s businesses, operations, plans and other such matters

is forward-looking information. Forward looking information is often identified by the words “may”, “would”, “could”,

“should”, “will”, “intend”, “plan”, “anticipate”, “allow”, “believe”,

“estimate”, “expect”, “predict”, “can”, “might”, “potential”,

“predict”, “is designed to”, “likely” or similar expressions. In addition, any statements in this

communication that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking

information and include, among others, statements with respect to: (i) the expected outcomes of the transaction, including Hut 8 Corp.’s

(“New Hut”) assets and financial position; (ii) the ability of Hut 8 and USBTC to complete the transaction on the terms described

herein, or at all, including, receipt of required regulatory approvals, shareholder approvals, court approvals, stock exchange approvals

and satisfaction of other closing customary conditions; (iii) the expected synergies related to the transaction in respect of strategy,

operations and other matters; (iv) projections related to expansion; (v) expectations related to New Hut’s hashrate and self-mining

capacity; (vi) acceleration of ESG efforts and commitments; and (vii) the ability of New Hut to execute on future opportunities, among

others.

Statements containing forward-looking information

are not historical facts, but instead represent management’s expectations, estimates and projections regarding future events based

on certain material factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 and USBTC as of the

date of this communication, such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that

may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied

by such forward-looking information, including but not limited to: the ability to obtain requisite shareholder approvals and the satisfaction

of other conditions to the consummation of the transaction on the proposed terms or at all; the ability to obtain necessary stock exchange,

regulatory, governmental or other approvals in the time assumed or at all; the anticipated timeline for the completion of the transaction;

the ability to realize the anticipated benefits of the transaction or implementing the business plan for New Hut, including as a result

of a delay in completing the transaction or difficulty in integrating the businesses of the companies involved (including the retention

of key employees); the ability to realize synergies and cost savings at the times, and to the extent, anticipated; the potential impact

on mining activities; the potential impact of the announcement or consummation of the transaction on relationships, including with regulatory

bodies, employees, suppliers, customers, competitors and other key stakeholders; the outcome of any litigation proceedings in respect

of USBTC's legal dispute with the City of Niagara Falls, New York; security and cybersecurity threats and hacks; malicious actors or botnet

obtaining control of processing power on the Bitcoin network; further development and acceptance of the Bitcoin network; changes to Bitcoin

mining difficulty; loss or destruction of private keys; increases in fees for recording transactions in the Blockchain; internet and power

disruptions; geopolitical events; uncertainty in the development of cryptographic and algorithmic protocols; uncertainty about the acceptance

or widespread use of digital assets; failure to anticipate technology innovations; the COVID-19 pandemic; climate change; currency risk;

lending risk and recovery of potential losses; litigation risk; business integration risk; changes in market demand; changes in network

and infrastructure; system interruption; changes in leasing arrangements; failure to achieve intended benefits of power purchase agreements;

potential for interrupted delivery, or suspension of the delivery, of energy to New Hut’s mining sites.

For further information:

Hut 8 investor contact:

Sue Ennis

sue@hut8.io

Hut 8 media contact:

Erin Dermer

erin.dermer@hut8.io

USBTC contact:

Matt Prusak

mprusak@usbitcoin.com

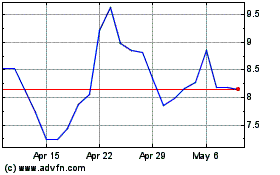

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

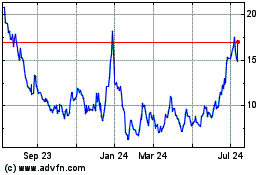

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jul 2023 to Jul 2024