Honeywell Says Outlook Clouded by MAX Grounding, Coronavirus -- Update

January 31 2020 - 1:58PM

Dow Jones News

By Thomas Gryta and Dave Sebastian

Honeywell International Inc.'s fourth-quarter profit dropped 9%

on lower sales after spinning off two divisions last year.

The Charlotte, N.C., industrial conglomerate said Boeing Co.'s

production halt of the 737 MAX would dent its aerospace business

and expressed some caution in its full-year outlook because of

economic and other uncertainties. For the quarter, net income

dropped to $1.56 billion, or $2.16 a share, from $1.72 billion, or

$2.31 a share, last year.

"We're not going to promise things that we either don't have

visibility or can't do," Chief Executive Darius Adamczyk told

investors Friday. He added that there are "quite a few unknowns,"

including the impact of the coronavirus outbreak.

Honeywell shares were down $4.60, or 2.6%, to $173.74 amid a

steep drop in the broad market.

Adjusted earnings were $2.06 a share. Analysts polled by FactSet

were expecting adjusted earnings of $2.04 a share. Sales fell 2.4%

to $9.5 billion from the same period last year as it accounted for

the spinoffs of its homes and global-distribution businesses in

2018. Analysts were looking for $9.61 billion.

The company's organic sales, which exclude currency fluctuations

and the effect of deals, rose 2%. Sales in the company's aerospace

business rose 7% by the same measure.

The company expects earnings of $8.60 a share to $9 a share for

2020, up 5% to 10% on an adjusted basis. It sees sales of $36.7

billion to $37.8 billion for the full year, reflecting a growth of

flat to 3% on an organic basis.

Mr. Adamczyk said the wide range of projections reflects some

uncertainty around industrial sales cycles and other items,

including the coronavirus outbreak.

"The coronavirus right now as an example is something that's

very difficult for us to predict around the impact," he said. "What

if this continues to spread? What if it gets worse? That impact

could be substantially worse than what we're expecting."

Honeywell has limited travel to areas affected by the virus but

hasn't estimated a financial impact if the coronavirus outbreak

becomes more significant. It said the aviation industry is already

seeing some reduced flight hours, something that hurts companies

providing services to the airline industry.

Chief Financial Officer Greg Lewis said the outbreak "could also

have a broader negative impact on supply chains in the economy as

was experienced with the SARS outbreak."

The aerospace business, Honeywell's largest unit by sales,

generated $3.66 billion in sales in the quarter, compared with

$3.43 billion in the prior year. The company produces a range of

aerospace systems and technology, from electric power systems to

engine controls.

The company said that Boeing's production halt of the 737 MAX

would hurt the aerospace business, which accounted for about 40% of

revenue and almost 50% of total segment profit in 2019. Previously,

when the MAX was grounded but still being produced, Honeywell said

it wasn't significantly hurt by the situation and didn't expect any

effects for 2019.

Mr. Lewis said Friday that Honeywell is trying to mitigate the

MAX effects from higher aftermarket sales and by using improved

efficiency in its supply chain to increase production of

back-ordered products. Honeywell has aligned its expectation with

Boeing's communications that the plane will return to service in

the middle of the year.

Honeywell said the earnings reduction will be "somewhat muted"

and it expects Aerospace's organic sales to rise in the low to mid

single digits for 2020, down from the 9% increase in 2019.

"From a revenue perspective, it's not insignificant," Mr.

Adamczyk said in reference to the MAX halt.

Write to Thomas Gryta at thomas.gryta@wsj.com and Dave Sebastian

at dave.sebastian@wsj.com

(END) Dow Jones Newswires

January 31, 2020 13:43 ET (18:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

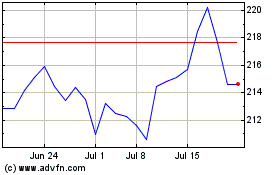

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Sep 2024 to Oct 2024

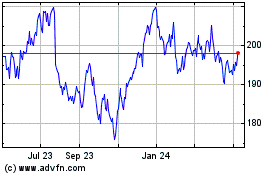

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Oct 2023 to Oct 2024