0001822492false00018224922024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

Hillman Solutions Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39609 | | 85-2096734 |

| (State or other jurisdiction | | (Commission File No.) | | (I.R.S. Employer |

| of incorporation) | | | | Identification No.) |

1280 Kemper Meadows Drive

Cincinnati, Ohio 45240

(Address of principal executive offices)

Registrant’s telephone number, including area code: (513) 851-4900

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | HLMN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, Hillman Solutions Corp. (the “Company”) issued a press release, furnished as Exhibit 99.1 and incorporated herein by reference, announcing the Company's selected summary financial results for its thirteen and twenty-six weeks ended June 29, 2024.

The information provided pursuant to Item 2.02, including the exhibit attached hereto, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 1, 2024, the Board of Directors of Hillman Solutions Corp. (the “Company’) appointed Jon Michael Adinolfi to the position of Chief Executive Officer (“CEO”) and President of the Company, effective January 1, 2025. As CEO and President, Mr. Adinolfi will serve as the principal executive officer of the Company and will report to the Board of Directors.

Current Chairman, CEO, and President Douglas J. Cahill, age 64, will step down from the CEO and President position, effective January 1, 2025, and remain as Chair of the Board of Directors serving under the new position of Executive Chairman.

Mr. Adinolfi, age 48, has served as the Company’s Chief Operating Officer since June 2023, overseeing our Hardware and Protective Solutions businesses and Canadian operations. Mr. Adinolfi previously served as the Company’s Divisional President, Hillman US, since July 2019. Prior to joining Hillman, Mr. Adinolfi served as President of US Retail for Stanley Black & Decker from November 2016 to July 2019. Prior to that, he served as President of Hand Tools for Stanley Black & Decker from October 2013 to December 2016. From June 2011 to September 2013, he served as the CFO — North America, CDIY for Stanley Black & Decker.

The independent members of the Board of Directors, upon the recommendation of the Compensation Committee of the Board of Directors, approved the compensation for Mr. Adinolfi and Mr. Cahill in their new roles, all to take effect as of January 1, 2025.

Mr. Adinolfi’s new annual base salary will be $700,000, and his new target bonus opportunity will be 100% of base salary. Mr. Adinolfi’s new annual target equity award grant will be $2,000,000.

Mr. Cahill’s new annual base salary will be $800,000 and his new target bonus opportunity will be 100% of base salary. Mr. Cahill’s new annual target equity award grant will be $1,400,000. As Executive Chairman, Mr. Cahill will serve as the Chair of the Board of Directors will report to the independent members of the Board of Directors.

The independent members of the Board of Directors, upon the recommendation of the Compensation Committee of the Board of Directors, also approved increases to the participation levels of Mr. Adinolfi and decreases to the participation level of Mr. Cahill under the Company’s Executive Severance Plan, dated November 2, 2023 (the "Severance Plan"). Mr. Adinolfi and Mr. Cahill are each currently participants in the Severance Plan, and their new participation levels are described below (each a participating “Executive” under the Severance Plan).

Under the Severance Plan, in the event of a termination by the Company without Cause or by the Executive for Good Reason prior to a Change in Control or more than 24 months following a Change in Control, the updated severance benefits for Mr. Adinolfi and Mr. Cahill shall generally consist of the following:

•Lump sum payment of the Executive's earned but unpaid bonus for a performance period ending prior to the Executive's termination (if any);

•Continuation of the Executive's base salary for a period specified in the applicable Executive's participation notice, which is (i) eighteen months in the case of Mr. Adinolfi; and (ii) twelve months in the case of Mr. Cahill.

•In the case of Mr. Adinolfi only, and not in the case of Mr. Cahill, an amount equal to 150% of his performance based bonus at target achievement level, payable over eighteen months in equal installments on the Company's regular payroll dates.

•Payment by the Company of COBRA medical, dental and/or vision insurance premiums, based on the Executive’s benefits plan elections in effect at the time of termination for a period specified in the applicable Executive's participation notice, which is (i) eighteen months in the case of Mr. Adinolfi; and (ii) twelve months in the case Mr. Cahill.

•Payment of the Executive's performance based bonus for the year in which the termination occurred, pro-rated for the Executive's service up to and including the date of termination and based on actual performance for the year, payable concurrently with bonus payments to other employees under the bonus plan.

Under the Severance Plan, in the event of a termination by the Company without Cause or by the Executive for Good Reason within the 24 months following a Change in Control, the severance benefits for the Executive shall generally consist of the following:

•Lump sum payment of the Executive's earned but unpaid bonus for a performance period ending prior to the Executive's termination (if any);

•Continuation of the Executive's base salary for a period specified in the applicable Executive's participation notice, which is (i) twenty-four months in the case of Mr. Adinolfi; and (ii) twelve months in the case of Mr. Cahill.

•In the case of Mr. Adinolfi only, and not Mr. Cahill, an amount equal to 200% of his performance based bonus at target achievement level, payable over twenty-four months in equal installments on the Company's regular payroll dates.

•In the case of Mr. Cahill, an amount equal to 100% of the Executive's performance based bonus at target achievement level, payable over twelve months in equal installments on the Company's regular payroll dates.

•Payment by the Company of COBRA medical, dental and/or vision insurance premiums, based on the Executive’s benefits plan elections in effect at the time of termination for a period specified in the applicable Executive's participation notice, which is (i) twenty-four months in the case of Mr. Adinolfi; and (ii) twelve months in the case of Mr. Cahill.

•Payment of the Executive's performance based bonus for the year in which the termination occurred, pro-rated for the Executive's service up to and including the date of termination and based on actual performance for the year, payable concurrently with bonus payments to other employees under the bonus plan.

The foregoing summary is qualified in its entirety by reference to the Severance Plan filed as Exhibit 10.1 to our Quarterly Report on Form 10-Q filed with the SEC on November 8, 2023 and incorporated herein by reference. A copy of the press release announcing these leadership changes is attached hereto as Exhibit 99.3.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Date: August 6, 2024 | Hillman Solutions Corp. | |

|

|

|

| By: | /s/ Robert O. Kraft |

| Name: | Robert O. Kraft |

| Title: | Chief Financial Officer |

Hillman Reports Second Quarter 2024 Results

CINCINNATI, August 6, 2024 -- Hillman Solutions Corp. (Nasdaq: HLMN) (the “Company” or “Hillman”), a leading provider of hardware products and merchandising solutions, reported financial results for the thirteen and twenty-six weeks ended June 29, 2024.

Second Quarter 2024 Highlights (Thirteen weeks ended June 29, 2024)

•Net sales decreased (0.2)% to $379.4 million compared to $380.0 million in the prior year quarter

•Net income totaled $12.5 million, or $0.06 per diluted share, compared to $4.5 million, or $0.02 per diluted share, in the prior year quarter

•Adjusted diluted EPS1 was $0.16 per diluted share compared to $0.13 per diluted share in the prior year quarter

•Adjusted EBITDA1 totaled $68.4 million compared to $58.0 million in the prior year quarter

Second Quarter YTD 2024 Highlights (Twenty-six weeks ended June 29, 2024)

•Net sales were $729.7 million, unchanged versus the prior year period

•Net income totaled $11.0 million, or $0.06 per diluted share, compared to net loss of $(4.6) million, or $(0.02) per diluted share, in the prior year period

•Adjusted diluted EPS1 was $0.25 per diluted share compared to $0.19 per diluted share in the prior year period

•Adjusted EBITDA1 totaled $120.7 million compared to $98.2 million in the prior year period

•Net cash provided by operating activities was $76.5 million compared to $115.0 million in the prior year period

•Free Cash Flow1 totaled $36.4 million compared to $78.0 million in the prior year period

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

1

Balance Sheet and Liquidity at June 29, 2024

•Gross debt was $759.4 million, compared to $760.9 million on December 30, 2023, and $851.5 million on July 1, 2023

•Net debt1 outstanding decreased to $705.3 million, compared to $722.4 million on December 30, 2023, and $813.8 million on July 1, 2023

•Liquidity available totaled approximately $305.3 million, consisting of $251.2 million of available borrowing under the revolving credit facility and $54.0 million of cash and equivalents

•Net debt1 to trailing twelve month Adjusted EBITDA improved to 2.9x from 3.3x on December 30, 2023, and 4.0x on July 1, 2023

Management Commentary

"During the second quarter we delivered outstanding bottom-line performance resulting from improved efficiencies and strong margins," commented Doug Cahill, Chairman, President, and Chief Executive Officer of Hillman. "We took great care of our customers during the quarter with exceptional fill rates of 95%, which ensures that our products are in stock and on the shelves of our retail partners. Although sales were impacted by prevailing market conditions, we continued to roll out new business wins and improve our financial position by strengthening our balance sheet."

"As we navigate the market, we remain steadfast in our commitment to adding value to our customers, associates and stakeholders. Our strategic focus remains 'controlling the controllables' and positioning Hillman for future growth. We look forward to building the foundation for continued success in the years to come."

Full Year 2024 Guidance - Updated

Based on year-to-date performance and improved visibility on the remainder of the year, management is updating its full year 2024 guidance originally provided on February 22, 2024 with Hillman's fourth quarter 2023 results.

| | | | | | | | |

| Original 2024 Guidance | Full year 2024 Guidance |

| Net Sales | $1.475 to $1.555 billion | $1.44 to $1.48 billion |

Adjusted EBITDA1 | $230 to $240 million | $240 to $250 million |

Free Cash Flow1 | $100 to $120 million | $100 to $120 million |

Rocky Kraft, Hillman's chief financial officer commented: "We are adjusting our guidance to better align with the current market landscape. Specifically, we are lowering our top-line revenue expectations while simultaneously increasing our bottom-line guidance, underscoring our confidence in our ability to drive profitability through operations and margin management. Our cash flow guidance remains unchanged, reflecting the net impact of our top and bottom line expectations."

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

2

Leadership Succession

In a separate press release issued this morning, Hillman announced the following planned transition effective January 1, 2025:

•Jon Michael Adinolfi will transition to the role of President and Chief Executive Officer

•Doug Cahill will transition to the role of Executive Chairman

This leadership succession ensures the continuity of Hillman’s current leadership and strategy.

Second Quarter 2024 Results Presentation

Hillman plans to host a conference call and webcast presentation today, August 6, 2024, at 8:30 a.m. Eastern Time to discuss its results. Chairman, President, and Chief Executive Officer Doug Cahill; Chief Operating Officer Jon Michael Adinolfi, and Chief Financial Officer Rocky Kraft will host the results presentation.

Date: Tuesday, August 6, 2024

Time: 8:30 a.m. Eastern Time

Listen-Only Webcast: https://edge.media-server.com/mmc/p/rc53kxup

A webcast replay will be available approximately one hour after the conclusion of the call using the link above.

Hillman’s quarterly presentation and Form 10-Q are expected to be filed with the SEC and posted to its Investor Relations website, https://ir.hillmangroup.com, prior to the webcast presentation.

About Hillman Solutions Corp.

Founded in 1964 and headquartered in Cincinnati, Ohio, Hillman Solutions Corp. (“Hillman”) and its subsidiaries are leading North American providers of complete hardware solutions, delivered with outstanding customer service to over 46,000 locations. Hillman is celebrating 60 years of service this year, a significant milestone achieved by maintaining strong company values, an innovative culture, and delivering a “small business” experience with “big business” efficiency. Hillman designs innovative product and merchandising solutions for complex categories that deliver an outstanding customer experience to home improvement centers, mass merchants, national and regional hardware stores, pet supply stores, and OEM & industrial customers. For more information on Hillman, visit www.hillman.com.

Forward Looking Statements

All statements made in this press release that are consider to be forward-looking are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”,

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

3

“goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) direct and indirect costs associated with the May 2023 ransomware attack, and our receipt of expected insurance receivables associated with that cyber security incident; (6) seasonality; (7) large customer concentration; (8) the ability to recruit and retain qualified employees; (9) the outcome of any legal proceedings that may be instituted against the Company; (10) adverse changes in currency exchange rates; or (11) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed on February 22, 2024. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements.

Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

Contact:

Michael Koehler

Vice President of Investor Relations & Treasury

513-826-5495

IR@hillmangroup.com

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

4

HILLMAN SOLUTIONS CORP.

Condensed Consolidated Statement of Net Income (Loss), GAAP Basis

(dollars in thousands) Unaudited

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended

June 29, 2024 | | Thirteen Weeks Ended

July 1, 2023 | | Twenty-six Weeks Ended

June 29, 2024 | | Twenty-six Weeks Ended

July 1, 2023 |

| Net sales | $ | 379,432 | | | $ | 380,019 | | | $ | 729,737 | | | $ | 729,726 | |

| Cost of sales (exclusive of depreciation and amortization shown separately below) | 194,672 | | | 216,499 | | | 378,106 | | | 421,008 | |

| Selling, warehouse, general and administrative expenses | 121,154 | | | 111,452 | | | 239,719 | | | 222,517 | |

| Depreciation | 16,297 | | | 13,800 | | | 32,635 | | | 30,505 | |

| Amortization | 15,249 | | | 15,578 | | | 30,503 | | | 31,150 | |

| Other expense | 474 | | | 1,893 | | | 884 | | | 2,660 | |

| Income from operations | 31,586 | | | 20,797 | | | 47,890 | | | 21,886 | |

| Interest expense, net | 13,937 | | | 18,075 | | | 29,208 | | | 36,152 | |

| Refinancing costs | — | | | — | | | 3,008 | | | — | |

| Income (loss) before income taxes | 17,649 | | | 2,722 | | | 15,674 | | | (14,266) | |

| Income tax expense (benefit) | 5,114 | | | (1,823) | | | 4,631 | | | (9,679) | |

| Net income (loss) | $ | 12,535 | | | $ | 4,545 | | | $ | 11,043 | | | $ | (4,587) | |

| | | | | | | |

| Basic income (loss) per share | $ | 0.06 | | | $ | 0.02 | | | $0.06 | | $ | (0.02) | |

| Weighted average basic shares outstanding | 196,075 | | | 194,644 | | | 195,721 | | | 194,596 | |

| | | | | | | |

| Diluted income (loss) per share | $ | 0.06 | | | $ | 0.02 | | | $0.06 | | $ | (0.02) | |

| Weighted average diluted shares outstanding | 198,420 | | | 195,528 | | | 198,037 | | | 194,596 | |

HILLMAN SOLUTIONS CORP.

Condensed Consolidated Balance Sheets

(dollars in thousands)

Unaudited

| | | | | | | | | | | |

| | June 29, 2024 | | December 30, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 54,016 | | | $ | 38,553 | |

Accounts receivable, net of allowances of 2,477 (2,770 - 2023) | 130,505 | | | 103,482 | |

| Inventories, net | 411,928 | | | 382,710 | |

| Other current assets | 21,324 | | | 23,235 | |

| Total current assets | 617,773 | | | 547,980 | |

Property and equipment, net of accumulated depreciation of 358,874 (333,875 - 2023) | 212,428 | | | 200,553 | |

| Goodwill | 827,400 | | | 825,042 | |

Other intangibles, net of accumulated amortization of 500,617 (470,791 - 2023) | 627,671 | | | 655,293 | |

| Operating lease right of use assets | 83,539 | | | 87,479 | |

| Other assets | 16,305 | | | 14,754 | |

| | | |

| Total assets | $ | 2,385,116 | | | $ | 2,331,101 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 170,548 | | | $ | 140,290 | |

| Current portion of debt and financing lease liabilities | 11,416 | | | 9,952 | |

| Current portion of operating lease liabilities | 15,459 | | | 14,407 | |

| Accrued expenses: | | | |

| Salaries and wages | 28,324 | | | 22,548 | |

| Pricing allowances | 6,287 | | | 8,145 | |

| Income and other taxes | 10,021 | | | 6,469 | |

| | | |

| Other accrued liabilities | 24,504 | | | 21,309 | |

| Total current liabilities | 266,559 | | | 223,120 | |

| Long-term debt | 732,097 | | | 731,708 | |

| Deferred tax liabilities | 129,748 | | | 131,552 | |

| Operating lease liabilities | 74,794 | | | 79,994 | |

| Other non-current liabilities | 7,476 | | | 10,198 | |

| Total liabilities | $ | 1,210,674 | | | $ | 1,176,572 | |

| Commitments and contingencies (Note 6) | | | |

| Stockholders' equity: | | | |

Common stock, 0.0001 par, 500,000,000 shares authorized, 196,156,159 issued and outstanding at June 29, 2024 and 194,913,124 issued and outstanding at December 30, 2023 | 20 | | | 20 | |

| Additional paid-in capital | 1,431,862 | | | 1,418,535 | |

| Accumulated deficit | (225,163) | | | (236,206) | |

| Accumulated other comprehensive loss | (32,277) | | | (27,820) | |

| Total stockholders' equity | 1,174,442 | | | 1,154,529 | |

| Total liabilities and stockholders' equity | $ | 2,385,116 | | | $ | 2,331,101 | |

HILLMAN SOLUTIONS CORP.

Condensed Consolidated Statement of Cash Flows

(dollars in thousands)

Unaudited

| | | | | | | | | | | |

| | Twenty-six Weeks Ended

June 29, 2024 | | Twenty-six Weeks Ended

July 1, 2023 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 11,043 | | | $ | (4,587) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 63,138 | | | 61,655 | |

| Deferred income taxes | (1,706) | | | (5,232) | |

| Deferred financing and original issue discount amortization | 2,551 | | | 2,663 | |

| Stock-based compensation expense | 6,484 | | | 6,044 | |

| Loss on debt restructuring | 3,008 | | | — | |

| Cash paid to third parties in connection with debt restructuring | (1,554) | | | — | |

| | | |

| | | |

| Loss on disposal of property and equipment | 56 | | | 123 | |

| Change in fair value of contingent consideration | 780 | | | 4,167 | |

| | | |

| Changes in operating items: | | | |

| Accounts receivable, net | (28,413) | | | (43,458) | |

| Inventories, net | (10,929) | | | 62,208 | |

| Other assets | (4,409) | | | (4,514) | |

| Accounts payable | 28,683 | | | 43,845 | |

| Other accrued liabilities | 7,744 | | | (7,868) | |

| | | |

| | | |

| Net cash provided by operating activities | 76,476 | | | 115,046 | |

| Net cash from investing activities | | | |

| Acquisition of business, net of cash received | (23,783) | | | (300) | |

| Capital expenditures | (40,078) | | | (37,029) | |

| | | |

| Other investing activities | (153) | | | (225) | |

| Net cash used for investing activities | (64,014) | | | (37,554) | |

| Cash flows from financing activities: | | | |

| Repayments of senior term loans | (4,255) | | | (4,255) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Financing fees | (33) | | | — | |

| Borrowings on revolving credit loans | 65,000 | | | 58,000 | |

| Repayments of revolving credit loans | (65,000) | | | (122,000) | |

| Principal payments under finance lease obligations | (1,758) | | | (1,039) | |

| Proceeds from exercise of stock options | 6,379 | | | 611 | |

| Payments of contingent consideration | (133) | | | (1,125) | |

| Other financing activities | 570 | | | (155) | |

| | | |

| Net cash provided by (used for) financing activities | 770 | | | (69,963) | |

| Effect of exchange rate changes on cash | 2,231 | | | (954) | |

| Net increase in cash and cash equivalents | 15,463 | | | 6,575 | |

| Cash and cash equivalents at beginning of period | 38,553 | | | 31,081 | |

| Cash and cash equivalents at end of period | $ | 54,016 | | | $ | 37,656 | |

Reconciliations of Non-GAAP Financial Measures to the Most Directly Comparable GAAP Financial Measures

The Company uses non-GAAP financial measures to analyze underlying business performance and trends. The Company believes that providing these non-GAAP financial measures enhances the Company’s and investors’ ability to compare the Company’s past financial performance with its current performance. These non-GAAP financial measures are provided as supplemental information to the financial measures presented in this press release that are calculated and presented in accordance with GAAP. Non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. The Company’s definitions of its non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. Because GAAP financial measures on a forward-looking basis are not accessible, and reconciling information is not available without unreasonable effort, reconciliations to GAAP financial measures are not provided for forward-looking non-GAAP measures. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

Non-GAAP financial measures such as consolidated adjusted EBITDA and Adjusted Diluted Earnings per Share (EPS) exclude from the relevant GAAP metrics items that neither relate to the ordinary course of the Company’s business, nor reflect the Company’s underlying business performance.

Reconciliation of Adjusted EBITDA (Unaudited)

(dollars in thousands)

Adjusted EBITDA is a non-GAAP financial measure and is the primary basis used to measure the operational strength and performance of our businesses as well as to assist in the evaluation of underlying trends in our businesses. This measure eliminates the significant level of noncash depreciation and amortization expense that results from the capital-intensive nature of our businesses and from intangible assets recognized in business combinations. It is also unaffected by our capital and tax structures, as our management excludes these results when evaluating our operating performance. Our management use this financial measure to evaluate our consolidated operating performance and the operating performance of our operating segments as well as to allocate resources and capital to our operating segments. Additionally, we believe that Adjusted EBITDA is useful to investors because it is one of the bases for comparing our operating performance with that of other companies in our industries, although our measure of Adjusted EBITDA may not be directly comparable to similar measures used by other companies.

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended

June 29, 2024 | | Thirteen Weeks Ended

July 1, 2023 | | Twenty-six Weeks Ended

June 29, 2024 | | Twenty-six Weeks Ended

July 1, 2023 |

| Net income (loss) | $ | 12,535 | | | $ | 4,545 | | | $ | 11,043 | | | $ | (4,587) | |

| Income tax expense (benefit) | 5,114 | | | (1,823) | | | 4,631 | | | (9,679) | |

| Interest expense, net | 13,937 | | | 18,075 | | | 29,208 | | | 36,152 | |

| | | | | | | |

| | | | | | | |

| Depreciation | 16,297 | | | 13,800 | | | 32,635 | | | 30,505 | |

| Amortization | 15,249 | | | 15,578 | | | 30,503 | | | 31,150 | |

| | | | | | | |

| EBITDA | $ | 63,132 | | | $ | 50,175 | | | $ | 108,020 | | | $ | 83,541 | |

| | | | | | | |

| Stock compensation expense | 3,656 | | | 3,405 | | | 6,485 | | | 6,042 | |

Restructuring and other (1) | 879 | | | 1,440 | | | 1,870 | | | 2,848 | |

Litigation expense (2) | — | | | — | | | — | | | 260 | |

Transaction and integration expense (3) | 242 | | | 510 | | | 516 | | | 1,310 | |

| Change in fair value of contingent consideration | 448 | | | 2,452 | | | 780 | | | 4,167 | |

Refinancing costs (4) | — | | | — | | | 3,008 | | | $ | — | |

| Total adjusting items | 5,225 | | | 7,807 | | | 12,659 | | | 14,627 | |

| Adjusted EBITDA | $ | 68,357 | | | $ | 57,982 | | | $ | 120,679 | | | $ | 98,168 | |

(1)Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities.

(2)Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC.

(3)Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc acquisition and the CCMP secondary offerings in 2023.

(4)In the first quarter of 2024, we entered into a Repricing Amendment (2024 Repricing Amendment) on our existing Senior Term Loan due July 14, 2028.

Reconciliation of Adjusted Diluted Earnings Per Share

(in thousands, except per share data)

Unaudited

We define Adjusted Diluted EPS as reported diluted EPS excluding the effect of one-time, non-recurring activity and volatility associated with our income tax expense. The Company believes that Adjusted Diluted EPS provides further insight and comparability in operating performance as it eliminates the effects of certain items that are not comparable from one period to the next. The following is a reconciliation of reported diluted EPS from continuing operations to Adjusted Diluted EPS from continuing operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended

June 29, 2024 | | Thirteen Weeks Ended

July 1, 2023 | | Twenty-six Weeks Ended

June 29, 2024 | | Twenty-six Weeks Ended

July 1, 2023 |

| Reconciliation to Adjusted Net Income | | | | | | | |

| Net income (loss) | $ | 12,535 | | | $ | 4,545 | | | $ | 11,043 | | | $ | (4,587) | |

Remove adjusting items (1) | 5,225 | | | 7,807 | | | 12,659 | | | 14,627 | |

| Remove amortization expense | 15,249 | | | 15,578 | | | 30,503 | | | 31,150 | |

Remove tax benefit on adjusting items and amortization expense (2) | (1,544) | | | (2,190) | | | (3,780) | | | (3,851) | |

| Adjusted Net Income | $ | 31,465 | | | $ | 25,740 | | | $ | 50,425 | | | $ | 37,339 | |

| | | | | | | |

| Reconciliation to Adjusted Diluted Earnings per Share | | | | | | | |

| Diluted Earnings per Share | $ | 0.06 | | | $ | 0.02 | | | $ | 0.06 | | | $ | (0.02) | |

Remove adjusting items (1) | 0.03 | | | 0.04 | | | 0.06 | | | 0.07 | |

| Remove amortization expense | 0.08 | | | 0.08 | | | 0.15 | | | 0.16 | |

Remove tax benefit on adjusting items and amortization expense (2) | (0.01) | | | (0.01) | | | (0.02) | | | (0.02) | |

| Adjusted Diluted Earnings per Share | $ | 0.16 | | | $ | 0.13 | | | $ | 0.25 | | | $ | 0.19 | |

| | | | | | | |

| Reconciliation to Adjusted Diluted Shares Outstanding | | | | | | | |

| Diluted Shares, as reported | 198,420 | | | 195,528 | | | 198,037 | | | 194,596 | |

| Non-GAAP dilution adjustments: | | | | | | | |

| Dilutive effect of stock options and awards | — | | | — | | | — | | | 865 | |

| Adjusted Diluted Shares | 198,420 | | | 195,528 | | | 198,037 | | | 195,461 | |

Note: Adjusted EPS may not add due to rounding.

(1)Please refer to "Reconciliation of Adjusted EBITDA" table above for additional information on adjusting items. See "Per share impact of Adjusting Items" table below for the per share impact of each adjustment.

(2)We have calculated the income tax effect of the non-GAAP adjustments shown above at the applicable statutory rate of 25.1% for the U.S. and 26.2% for Canada except for the following items:

a.The tax impact of stock compensation expense was calculated using the statutory rate of 25.1%, excluding certain awards that are non-deductible.

b.The tax impact of acquisition and integration expense was calculated using the statutory rate of 25.1%, excluding certain charges that were non-deductible.

c.Amortization expense for financial accounting purposes was offset by the tax benefit of deductible amortization expense using the statutory rate of 25.1%.

(3)Diluted shares on a GAAP basis for thirteen and twenty-six weeks ended June 29, 2024 include the dilutive impact of 2,345 and 2,316 options and awards, respectfully. Diluted shares on a GAAP basis for the thirteen weeks ended July 1, 2023 include the dilutive impact of 884 options and awards.

Per Share Impact of Adjusting Items

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended

June 29, 2024 | | Thirteen Weeks Ended

July 1, 2023 | | Twenty-six Weeks Ended

June 29, 2024 | | Twenty-six Weeks Ended

July 1, 2023 |

| Stock compensation expense | | $ | 0.02 | | | $ | 0.02 | | | $ | 0.03 | | | $ | 0.03 | |

| Restructuring and other costs | | 0.00 | | 0.01 | | 0.01 | | 0.01 | |

| Litigation expense | | — | | | — | | | — | | | 0.00 |

| Transaction and integration expense | | 0.00 | | 0.00 | | 0.00 | | 0.01 | |

| Change in fair value of contingent consideration | | 0.00 | | 0.01 | | 0.00 | | 0.02 | |

| Refinancing costs | | — | | | — | | | 0.02 | | | $ | — | |

| Total adjusting items | | $ | 0.03 | | | $ | 0.04 | | | $ | 0.06 | | | $ | 0.07 | |

Note: Adjusting items may not add due to rounding.

Reconciliation of Net Debt

We define Net Debt as reported gross debt less cash on hand. Net debt is not defined under U.S. GAAP and may not be computed the same as similarly titled measures used by other companies. The Company believes that Net Debt provides further insight and comparability into liquidity and capital structure. The following is the calculation of Net Debt:

| | | | | | | | | | | |

| June 29, 2024 | | December 30, 2023 |

| Revolving loans | $ | — | | | $ | — | |

| Senior term loan, due 2028 | 747,597 | | | 751,852 | |

| Finance leases and other obligations | 11,759 | | | 9,097 | |

| Gross debt | $ | 759,356 | | | $ | 760,949 | |

| Less cash | 54,016 | | | 38,553 | |

| Net debt | $ | 705,340 | | | $ | 722,396 | |

Reconciliation of Free Cash Flow

We calculate free cash flow as cash flows from operating activities less capital expenditures. Free cash flow is not defined under U.S. GAAP and may not be computed the same as similarly titled measures used by other companies. We believe free cash flow is an important indicator of how much cash is generated by our business operations and is a measure of incremental cash available to invest in our business and meet our debt obligations.

| | | | | | | | | | | |

| Twenty-six Weeks Ended

June 29, 2024 | | Twenty-six Weeks Ended

July 1, 2023 |

| Net cash provided by operating activities | $ | 76,476 | | | $ | 115,046 | |

| Capital expenditures | (40,078) | | | (37,029) | |

| Free cash flow | $ | 36,398 | | | $ | 78,017 | |

Source: Hillman Solutions Corp.

###

Quarterly Earnings Presentation Q2 2024 August 6, 2024

2Earnings Presentation Q2 2024 PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout All statements made in this presentation that are consider to be forward-looking are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) direct and indirect costs associated with the May 2023 ransomware attack, and our receipt of expected insurance receivables associated with that cyber security incident; (6) seasonality; (7) large customer concentration; (8) the ability to recruit and retain qualified employees; (9) the outcome of any legal proceedings that may be instituted against the Company; (10) adverse changes in currency exchange rates; or (11) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed on February 22, 2024. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. generally accepted accounting principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non- GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. Forward Looking Statements

3Earnings Presentation Q2 2024 • Net sales decreased (0.2)% to $379.4 million versus Q2 2023 ◦ Hardware Solutions increased +2.7% ◦ Protective Solution increased +7.7% ◦ Robotics and Digital Solutions ("RDS") decreased (8.0)% ◦ Canada decreased (10.1)% • GAAP net income totaled $12.5 million, or $0.06 per diluted share, compared to $4.5 million, or $0.02 per diluted share, in Q2 2023 • Adjusted Gross Margins improved to 48.7% compared to 43.0% in Q2 2023 • Adjusted EBITDA totaled $68.4 million compared to $58.0 million in Q2 2023 • Adjusted EBITDA margins were 18.0% compared to 15.3% in Q2 2023 • Net Debt / Adjusted EBITDA (ttm): 2.9x at quarter end, improved from 3.3x on December 30, 2023, and 4.0x on July 1, 2023 Q2 2024 Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 13 Weeks Ended June 29, 2024

4Earnings Presentation Q2 2024 Q2 2024 Operational Review Highlights for the 13 Weeks Ended June 29, 2024 • Continued taking great care of customers: ◦ Fill rates averaged 95% during Q2 2024 ◦ Fill rates averaged 94% for the year to date period • Secured $10 million new business with Koch in the newly acquired rope and chain category ◦ Will begin shipping in 2H 2024 and rollout over 2025 and 2026 • Continued pursuing accretive, low-risk, tuck-in M&A opportunities that leverage the Hillman moat • Updated full year 2024 guidance

5Earnings Presentation Q2 2024 • Net sales were comparable at $729.7 million versus $729.7 million in the first half of 2023 ◦ Hardware Solutions increased +3.6% ◦ Protective Solution decreased (0.1)% ◦ Robotics and Digital Solutions ("RDS") decreased (8.6)% ◦ Canada decreased (5.7)% • GAAP net income totaled $11.0 million, or $0.06 per diluted share, compared to GAAP net loss of $(4.6) million, or $(0.02) per diluted share in the first half of 2023 • Adjusted Gross Margins were 48.2% compared to 42.3% in the first half of 2023 • Adjusted EBITDA totaled $120.7 million compared to $98.2 million in the first half of 2023 • Adjusted EBITDA margins were 16.5% compared to 13.5% in the first half of 2023 • Free Cash Flow totaled $36.4 million compared to $78.0 million in the first half of 2023 Q2 2024 YTD Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 26 Weeks Ended June 29, 2024

6Earnings Presentation Q2 2024 Quarterly Financial Performance Adjusted EBITDA (millions $ and % of Net Sales) Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Adjusted Gross Margin in the Appendix of this presentation. Not to scale. Top & Bottom Line (vs Q2 2023) Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) $58.0 $68.4 Q2 2023 Q2 2024 18.0%15.3% $163.5 $184.8 Q2 2023 Q2 2024 $380.0 $379.4 Q2 2023 Q2 2024 48.7% 43.0%

7Earnings Presentation Q2 2024 Hardware & Protective Q2 2024 Q2 2023 Δ Thirteen Weeks Ended 6/29/2024 7/1/2023 Comments Revenues $278,130 $268,794 3.5% Driven by Koch acquisition and new business Adjusted EBITDA $43,635 $27,847 56.7% Margin expansion from price/cost dynamic Margin (Adj. EBITDA/Net Sales) 15.7% 10.4% 530 bps Robotics & Digital Q2 2024 Q2 2023 Δ Thirteen Weeks Ended 6/29/2024 7/1/2023 Comments Revenues $57,483 $62,456 (8.0)% Soft volumes across RDS Adjusted EBITDA $18,266 $22,518 (18.9)% Mix of product sales Margin (Adj. EBITDA/Net Sales) 31.8% 36.1% (430) bps Canada Q2 2024 Q2 2023 Δ Thirteen Weeks Ended 6/29/2024 7/1/2023 Comments Revenues $43,819 $48,769 (10.1)% Soft market and economy more than offset new wins Adjusted EBITDA $6,456 $7,617 (15.2)% Margin (Adj. EBITDA/Net Sales) 14.7% 15.6% (90) bps Consolidated Q2 2024 Q2 2023 Δ Thirteen Weeks Ended 6/29/2024 7/1/2023 Revenues $379,432 $380,019 (0.2)% Adjusted EBITDA $68,357 $57,982 17.9% Margin (Adj. EBITDA/Net Sales) 18.0% 15.3% 270 bps Performance by Segment (Q2) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted.

8Earnings Presentation Q2 2024 Hardware & Protective Q2 2024 Q2 2023 Δ Twenty-six weeks ended 6/29/2024 7/1/2023 Comments Revenues $538,004 $522,645 2.9% Driven by Koch acquisition and new business Adjusted EBITDA $75,901 $46,726 62.4% Margin expansion from price/cost dynamic Margin (Adj. EBITDA/Net Sales) 14.1% 8.9% 520 bps Robotics & Digital Q2 2024 Q2 2023 Δ Twenty-six weeks ended 6/29/2024 7/1/2023 Comments Revenues $112,955 $123,522 (8.6)% Soft volumes across RDS Adjusted EBITDA $35,279 $42,043 (16.1)% Mix of product sales Margin (Adj. EBITDA/Net Sales) 31.2% 34.0% (280) bps Canada Q2 2024 Q2 2023 Δ Twenty-six weeks ended 6/29/2024 7/1/2023 Comments Revenues $78,778 $83,559 (5.7)% Soft market and economy in Canada Adjusted EBITDA $9,499 $9,399 1.1% Margin expansion from operations Margin (Adj. EBITDA/Net Sales) 12.1% 11.2% 90 bps Consolidated Q2 2024 Q2 2023 Δ Twenty-six weeks ended 6/29/2024 7/1/2023 Revenues $729,737 $729,726 —% Adjusted EBITDA $120,679 $98,168 22.9% Margin (Adj. EBITDA/Net Sales) 16.5% 13.5% 300 bps Performance by Segment (Q2 YTD) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted.

9Earnings Presentation Q2 2024 Hardware & Protective Robotics & Digital Canada Total Revenue Thirteen Weeks Ended June 29, 2024 Fastening and Hardware $231,128 $— $40,603 $271,731 Personal Protective 47,002 — 1,195 48,197 Keys and Key Accessories — 45,164 2,008 47,172 Engraving and Resharp — 12,319 13 12,332 Total Revenue $278,130 $57,483 $43,819 $379,432 Revenue by Product Category (Q2) Hardware & Protective Robotics & Digital Canada Total Revenue Thirteen Weeks Ended July 1, 2023 Fastening and Hardware $225,139 $— $44,743 $269,882 Personal Protective 43,655 — 1,928 45,583 Keys and Key Accessories — 49,021 2,091 51,112 Engraving and Resharp — 13,435 7 13,442 Total Revenue $268,794 $62,456 $48,769 $380,019 Figures in Thousands of USD unless otherwise noted.

10Earnings Presentation Q2 2024 Hardware & Protective Robotics & Digital Canada Total Revenue Twenty-six weeks ended June 29, 2024 Fastening and Hardware $445,518 $— $72,192 $517,710 Personal Protective 92,486 — 2,603 95,089 Keys and Key Accessories — 88,801 3,960 92,761 Engraving and Resharp — 24,154 23 24,177 Total Revenue $538,004 $112,955 $78,778 $729,737 Revenue by Product Category (Q2 YTD) Hardware & Protective Robotics & Digital Canada Total Revenue Twenty-six weeks ended July 1, 2023 Fastening and Hardware $430,114 $— $75,965 $506,079 Personal Protective 92,531 — 3,541 96,072 Keys and Key Accessories — 97,568 4,033 101,601 Engraving and Resharp — 25,954 20 25,974 Total Revenue $522,645 $123,522 $83,559 $729,726 Figures in Thousands of USD unless otherwise noted.

11Earnings Presentation Q2 2024 Total Net Leverage (Net Debt / TTM Adj. EBITDA) Capital Structure June 29, 2024 ABL Revolver ($251.2 million capacity) $— Term Note $747.6 Finance Leases and Other Obligations $11.8 Total Debt $759.4 Cash $54.0 Net Debt $705.3 TTM Adjusted EBITDA $241.9 Net Debt/ TTM Adjusted EBITDA 2.9x Leverage Continues to Improve Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Net Debt in the Appendix of this presentation. Figures in Millions of USD unless otherwise noted. 4.0x 3.7x 3.3x 3.2x 2.9x 07 /0 1/2 02 3 09 /3 0/ 20 23 12 /3 0/ 20 23 03 /3 0/ 20 24 06 /2 9/ 20 24 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x

12Earnings Presentation Q2 2024 2024 Outlook & Guidance (in millions USD) Original FY 2024 Guidance Full Year 2024 Guidance Range FY 2024 Guidance Midpoint Revenues $1.475 to $1.555 billion $1.44 to $1.48 billion $1.46 billion Adjusted EBITDA $230 to $240 million $240 to $250 million $245 million Free Cash Flow $100 to $120 million $100 to $120 million $110 million Assumptions • Net Debt / Adj. EBITDA leverage ratio expected to be around 2.7x at the end of 2024 • Interest expense: $55-$65 million • Cash interest: $50-$60 million • Cash tax expense: $5-$15 million • Capital expenditures: $70-$80 million • Restructuring / Other: Approx. $10 million • Working Capital Benefit: $5 - $15 million • Fully diluted shares outstanding: ~199 million On August 6, 2024, Hillman provided an update to its full year guidance, originally provided on February 22, 2024. 2024 Full Year Guidance - Update Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Free Cash Flow in the Appendix of this presentation.

13Earnings Presentation Q2 2024 Key Takeaways Actively Executing M&A; Winning New Business; Strong Margin Profile Historical Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Historical Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Business has 60-year track record of success; proven to be resilient through multiple economic cycles • Repair, Remodel and Maintenance industry has meaningful long-term tailwinds; expected increase in future home spending as 90% of homes pass 20 years of age during 2024 and 2025.1 • 1,100-member distribution (sales and service) team and direct-to-store fulfillment continue to provide competitive advantages and strengthen competitive moat - drives new business wins • Cost of goods peaked in May 2023, margins have since expanded and are expected to remain strong • Now that leverage has come down, executing tuck-in M&A that leverage the Hillman moat in order to fuel long-term growth 1) Jefferies Research Services: July 10, 2023

14 Appendix

15Earnings Presentation Q2 2024 Investment Highlights Significant runway for incremental growth: Organic + M&A Management team with proven operational and M&A expertise Strong financial profile with 60-year track record Market and innovation leader across multiple categories Indispensable partner embedded with winning retailers Customers love us, trust us and rely on us Large, predictable, growing and resilient end markets

16Earnings Presentation Q2 2024 Hillman: Overview Who We Are *Management Estimates Adjusted EBITDA is a non-GAAP measure. Please see Appendix for a reconciliation of Adjusted EBITDA to Net loss ~20 billion Fasteners Sold ~245 million Pairs of Work Gloves Sold ~115+ million Keys Duplicated ~114,000 SKUs Managed ~46,000 Direct Shipping Locations ~31,000 Kiosks in Retail Locations #1 Position Across Core Categories* 8.0% Sales CAGR over past 10 years 60-Year Track record of success $1.5 billion 2023 Sales 9.4% CAGR 2018-2023 Adj. EBITDA Growth 14.9% 2023 Adj. EBITDA Margin 2023: By The Numbers • We are a leading North American provider of hardware products and solutions, including; ◦ Hardware and home improvement products ◦ Protective and job site gear – including work gloves and job site storage ◦ Robotic kiosk technologies (“RDS”): Key duplication, engraving & knife sharpening • Our differentiated service model provides direct to-store shipping, in-store service, and category management solutions • We have long-standing strategic partnerships with leading retailers across North America: ◦ Home Depot, Lowes, Walmart, Tractor Supply, and ACE Hardware • Founded in 1964; HQ in Cincinnati, Ohio

17Earnings Presentation Q2 2024 Primary Product Categories #1 in Segment#1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE Construction Fasteners Work Gear Picture Hanging Source: Third party industry report. Hardware Solutions Protective Solutions Robotics & Digital Solutions Hillman has been selling its top customers for 25 years on average

18Earnings Presentation Q2 2024 Thirteen weeks ended June 29, 2024 July 1, 2023 Net income $12,535 $4,545 Income tax expense (benefit) 5,114 (1,823) Interest expense, net 13,937 18,075 Depreciation 16,297 13,800 Amortization 15,249 15,578 EBITDA $63,132 $50,175 Stock compensation expense 3,656 3,405 Restructuring and other (1) 879 1,440 Transaction and integration expense (2) 242 510 Change in fair value of contingent consideration 448 2,452 Adjusted EBITDA $68,357 $57,982 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc acquisition and the CCMP secondary offerings in 2023.

19Earnings Presentation Q2 2024 Twenty-six weeks ended June 29, 2024 July 1, 2023 Net income (loss) $11,043 $(4,587) Income tax benefit 4,631 (9,679) Interest expense, net 29,208 36,152 Depreciation 32,635 30,505 Amortization 30,503 31,150 EBITDA $108,020 $83,541 Stock compensation expense 6,485 6,042 Restructuring and other (1) 1,870 2,848 Litigation expense (2) — 260 Transaction and integration expense (3) 516 1,310 Change in fair value of contingent consideration 780 4,167 Refinancing costs (4) 3,008 — Adjusted EBITDA $120,679 $98,168 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC 3. Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc acquisition and the CCMP secondary offerings in 2023. 4. In the first quarter of 2024, we entered into a Repricing Amendment on our existing Senior Term Loan due July 14, 2028.

20Earnings Presentation Q2 2024 Thirteen weeks ended June 29, 2024 July 1, 2023 Net Sales $379,432 $380,019 Cost of sales (exclusive of depreciation and amortization) 194,672 216,499 Gross margin exclusive of depreciation and amortization $184,760 $163,520 Gross margin exclusive of depreciation and amortization % 48.7 % 43.0 % Twenty-six weeks ended June 29, 2024 July 1, 2023 Net Sales $729,737 $729,726 Cost of sales (exclusive of depreciation and amortization) 378,106 421,008 Gross margin exclusive of depreciation and amortization $351,631 $308,718 Gross margin exclusive of depreciation and amortization % 48.2 % 42.3 % Adjusted Gross Margin Reconciliation

21Earnings Presentation Q2 2024 Thirteen weeks ended June 29, 2024 July 1, 2023 Selling, general and administrative expenses $121,154 $111,452 SG&A Adjusting Items (1): Stock compensation expense 3,656 3,405 Restructuring 879 1,440 Litigation expense — — Acquisition and integration expense 242 510 Adjusted SG&A $116,377 $106,097 Adjusted SG&A as a % of Net Sales 30.7 % 27.9 % Twenty-six weeks ended June 29, 2024 July 1, 2023 Selling, general and administrative expenses $239,719 $222,517 SG&A Adjusting Items (1): Stock compensation expense 6,485 6,042 Restructuring 1,870 2,848 Litigation expense — 260 Acquisition and integration expense 516 1,310 Adjusted SG&A $230,848 $212,057 Adjusted SG&A as a % of Net Sales 31.6 % 29.1 % Adjusted SG&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items

22Earnings Presentation Q2 2024 As of June 29, 2024 December 30, 2023 Revolving loans $0 $0 Senior term loan 747,597 751,852 Finance leases and other obligations 11,759 9,097 Gross debt $759,356 $760,949 Less cash 54,016 38,553 Net debt $705,340 $722,396 Net Debt & Free Cash Flow Reconciliations Twenty-six Weeks Ended June 29, 2024 July 1, 2023 Net cash provided by operating activities $76,476 $115,046 Capital expenditures (40,078) (37,029) Free cash flow $36,398 $78,017 Reconciliation of Net Debt Reconciliation of Free Cash Flow

23Earnings Presentation Q2 2024 Thirteen weeks ended June 29, 2024 HPS RDS Canada Consolidated Operating income $20,043 $7,310 $4,233 $31,586 Depreciation & amortization 20,244 10,066 1,236 31,546 Stock compensation expense 3,052 333 271 3,656 Restructuring and other 63 100 716 879 Transaction and integration expense 233 9 — 242 Change in fair value of contingent consideration — 448 — 448 Adjusted EBITDA $43,635 $18,266 $6,456 $68,357 Thirteen weeks ended July 1, 2023 HPS RDS Canada Consolidated Operating income $4,367 $10,374 $6,056 $20,797 Depreciation & amortization 19,028 9,110 1,240 29,378 Stock compensation expense 2,865 329 211 3,405 Restructuring 1,128 202 110 1,440 Transaction and integration expense 459 51 — 510 Change in fair value of contingent consideration — 2,452 — 2,452 Adjusted EBITDA $27,847 $22,518 $7,617 $57,982 Segment Adjusted EBITDA Reconciliations

24Earnings Presentation Q2 2024 Twenty-six weeks ended June 29, 2024 HPS RDS Canada Consolidated Operating income $29,291 $13,067 $5,532 $47,890 Depreciation & amortization 40,113 20,442 2,583 63,138 Stock compensation expense 5,389 613 483 6,485 Restructuring and other 612 357 901 1,870 Litigation expense — — — — Transaction and integration expense 496 20 — 516 Change in fair value of contingent consideration — 780 — 780 Adjusted EBITDA $75,901 $35,279 $9,499 $120,679 Twenty-six weeks ended July 1, 2023 HPS RDS Canada Consolidated Operating income $531 $14,836 $6,519 $21,886 Depreciation & amortization 37,571 21,675 2,409 61,655 Stock compensation expense 5,070 611 361 6,042 Restructuring 2,385 353 110 2,848 Litigation expense — 260 — 260 Transaction and integration expense 1,169 141 — 1,310 Change in fair value of contingent consideration — 4,167 — 4,167 Adjusted EBITDA $46,726 $42,043 $9,399 $98,168 Segment Adjusted EBITDA Reconciliations

Hillman Announces Leadership Succession Plans: COO Jon Michael Adinolfi to be Appointed as Next CEO; CEO Doug Cahill to Become Executive Chairman

CINCINNATI, August 6, 2024 -- Hillman Solutions Corp. (Nasdaq: HLMN) (the “Company” or “Hillman”), a leading provider of hardware products and merchandising solutions, announced that Jon Michael Adinolfi (“JMA”), Hillman’s current Chief Operating Officer, will transition to the role of President and Chief Executive Officer; and Doug Cahill, Hillman’s current Chairman, President, and Chief Executive Officer, will transition to the Role of Executive Chairman effective January 1, 2025. This planned leadership succession ensures the continuity of Hillman’s current leadership and strategy.

“Over the past 60 years, Hillman has provided its customers with unparalleled service, brought innovative products and creative solutions to market, and has grown to be a trusted partner for hardware stores and home improvement centers across North America,” stated Jon Michael Adinolfi. “We love our customers and as the next CEO, I look forward to continuing to build on Hillman’s legacy of service and growth as we seek to find new ways to serve and deepen our partnerships with them.”

“I am grateful for Doug’s mentorship and guidance having worked side-by-side with him since joining Hillman five years ago. Together, we helped the team successfully navigate COVID, supply chain volatility, and inflation while regularly winning new business, expanding our range of products, and improving our competitive moat. As I look to Hillman’s next chapter, we have our sights set on the goal of achieving $2 billion in net sales through organic growth and M&A. I am confident that we have the right team in place to achieve our goals while continuing to take great care of our customers.”

Mr. Adinolfi has a track record of success in the hardware and home improvement industry and has proven to be an effective, strategic and forward-thinking leader. Prior to JMA’s role as COO, he served as Divisional President, Hillman U.S. since joining the Company in 2019. Prior to that, he held leadership roles with ever-increasing responsibility at Stanley Black & Decker starting in 2011, culminating with his role of President of U.S. Retail. Prior to that, JMA served as President of Crown Bolt, when Crown Bolt was the fastener supplier for Home Depot.

Doug Cahill, Hillman’s chairman, president, and chief executive officer added: “Leading Hillman for the past ten years as Chairman and the past five as CEO, has been a remarkable highlight of my career. From expanding our product offerings to include power screws and builder’s hardware, to becoming public in 2021 and paying down over $900 million of debt – it has been a great experience working with the warriors at Hillman. Throughout my tenure, we have upheld our commitment to the Hillman family legacy – putting our customers first. As JMA takes the reins, I have the utmost confidence that he will further strengthen Hillman’s relationship with our customers and investors while driving Hillman forward with profitable growth.”

Cahill continued: “JMA is a great leader and has excellent rapport with the Hillman team and our customers. We hired JMA five years ago and felt strongly that he would be a perfect fit as

Hillman’s next leader, now becoming just the sixth CEO in Hillman’s 60-year history. I love this company and am very proud of this leadership handoff. Hillman is in excellent hands under his leadership, and I look forward to continuing to support JMA and the Hillman team as I step into the executive chairman role.”

Hillman’s Second Quarter 2024 Financial Results

Later today, Tuesday, August 6, 2024, at 8:30 am ET, Hillman’s management team will discuss its results for the thirteen and twenty-six weeks ended June 29, 2024, as well as its leadership succession plans.

About Hillman Solutions Corp.

Founded in 1964 and headquartered in Cincinnati, Ohio, Hillman Solutions Corp. (“Hillman”) and its subsidiaries are leading North American providers of complete hardware solutions, delivered with outstanding customer service to over 46,000 locations. Hillman is celebrating 60 years of service this year, a significant milestone achieved by maintaining strong company values, an innovative culture, and delivering a “small business” experience with “big business” efficiency. Hillman designs innovative product and merchandising solutions for complex categories that deliver an outstanding customer experience to home improvement centers, mass merchants, national and regional hardware stores, pet supply stores, and OEM & industrial customers. For more information on Hillman, visit www.hillman.com.

Forward Looking Statements

All statements made in this press release that are consider to be forward-looking are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) direct and indirect costs associated with the May 2023 ransomware attack, and our receipt of expected insurance receivables associated with that cyber security incident; (6) seasonality; (7) large customer concentration; (8) the ability to recruit and retain qualified employees; (9) the outcome of any legal proceedings that may be instituted against the Company; (10) adverse changes in currency exchange rates; or (11) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and

readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed on February 22, 2024. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements.

Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

Contact:

Michael Koehler

Vice President of Investor Relations & Treasury

513-826-5495

IR@hillmangroup.com

Source: Hillman Solutions Corp.

###

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

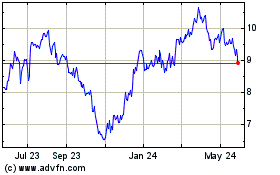

Hillman Solutions (NASDAQ:HLMN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hillman Solutions (NASDAQ:HLMN)

Historical Stock Chart

From Sep 2023 to Sep 2024