SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2024

Commission

File Number 001-38490

HIGHWAY

HOLDINGS LIMITED

(Translation

of Registrant’s Name Into English)

Suite

1801, Level 18

Landmark

North

39

Lung Sum Avenue

Sheung

Shui

New

Territories, Hong Kong

(Address

of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

On October 11, 2024, the Company held its Annual

Meeting of Shareholders (the “Annual Shareholders Meeting”) at the offices of TroyGould PC, 1801 Century Park East, Suite

1600, Los Angeles, California U.S.A. At the Annual Shareholders Meeting, the Company’s shareholders voted on three proposals, each

of which is described in more detail in the Company’s Proxy Statement filed as Exhibit 99.1 on the Company’s Report

of Foreign Private Issuer on Form 6-K filed with the Securities and Exchange Commission on August 30, 2024 (the “Proxy Statement”).

At the Annual Shareholders Meeting, 2,388,882 common shares, or approximately 54.3% of common shares

outstanding at the record date of August 19, 2024 were present at the meeting in person or by proxy. The following is a brief description

of each matter voted upon and the certified results, including the number of votes cast for and against each matter.

| ● | Proposal 1: to elect Heiko Sonnekalb to the Company’s Board of Directors as Class II director for a three-year term expiring

at the 2027 Annual Meeting of Shareholders; |

| ● | Proposal 2: a proposal to ratify the selection by the Board of Directors of ARK Pro CPA & Co as the independent accountants

of the Company for the fiscal year ending March 31, 2025; and |

| ● | Proposal 3: a proposal to amend the 2020 Stock Option and Restricted Stock Plan to increase the number of shares authorized

for issuance by 500,000 shares. |

Voting Results

Proposal 1: Heiko Sonnekalb was elected

as director with 1,729,785 “FOR” votes and 40,160

“WITHHELD” votes.

Proposal 2: This proposal was approved with

2,175,153 “FOR” votes, 208,248 “AGAINST”

votes and 5,481 “ABSTAIN” votes.

Proposal 3: This proposal was approved with

1,9000,603 “FOR” votes, 265,391 “AGAINST”

votes and 222,888 “ABSTAIN” votes.

Exhibit Index.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

HIGHWAY HOLDINGS LIMITED |

| |

|

| Date: October 11, 2024 |

By |

/s/ ROLAND W. KOHL |

| |

|

Roland W. Kohl |

| |

|

Chief Executive Officer |

3

Exhibit 99.1

NEWS RELEASE

HIGHWAY HOLDINGS REPORTS SECOND QUARTER FISCAL

YEAR 2025 RESULTS

· 60.1% Year Over Year Increase in Second Quarter Revenue

· 117.8% Year Over Year Increase in Second Quarter Gross Profit

· Cash and Cash Equivalents of $1.28 Per Diluted Share

HONG KONG — October 10, 2024—

Highway Holdings Limited (Nasdaq: HIHO, “the Company” or “Highway Holdings”) today reported results for the second

quarter of fiscal year 2025 and the six months ended September 30, 2024, with second quarter of fiscal year 2025 revenue growth of 60.1%

and gross profit growth of 117.8% on a year over year basis.

Roland Kohl, chairman, president and chief executive

officer of Highway Holdings, noted, “While the positive results reflect an improving environment at our customers, we still have

a lot of ground to make up to return to our normalized pre-COVID business level. The rebound continues but has been slowed by the uncertain

macro environment, following the fallout of COVID, as orders for customer products have been adversely impacted by the Russia/Ukraine

war and the conflict in Mid-East. In addition, our business progress is not immediately reflected on a net income comparison, and we caution

investors this is not an accurate measure, because we benefitted in the year ago period from the reversal of previously taken bad debt

provisions. With that being said, we are encouraged with our progress and expect an improving business environment over the coming quarters

will help our business now that we have stopped the bleeding and can focus on expanding revenue growth, profitability and free cash flow.”

Mr. Kohl concluded, “We are cautiously optimistic

that we have come through the worst part of this low business cycle. Even with our existing products still experiencing below normal levels

of demand, we are coming online shortly with the new motor project we previously announced. Production is expected to start in the fiscal

third quarter of 2025 and should ramp up in the fiscal fourth quarter of 2025. As a result, if our core existing business remains stable

or improves slightly, the positive impact of the additional new business will help drive a further improvement in results. Our company

is financially very healthy with over $5.6 million in cash on hand and a net cash positive position. At the same time, as part of our

business growth strategy, we are evaluating numerous possible ventures, which could substantially improve the Company’s future.

We are fully committed to building value for the Company and all shareholders, as we continue to build on our track record of success

over the long-term.”

(more)

Highway Holdings Ltd.

2-2-2

Select Additional Financial Results:

Gross profit for the second quarter of fiscal year

2025 was $834,000 compared with $383,000 in the year ago period mainly due to the 60.1% increase in sales over the same period. Gross

profit as a percentage of sales for the second quarter of fiscal year 2025 was 39.4 percent, compared to 29.0 percent in the year ago

period. Gross profit for the first half of fiscal year 2025 was $1,495,000 compared with $760,000 in the year ago period. Gross profit

as a percentage of sales for the first half of fiscal year 2025 was 37.4 percent compared with 28.5 percent in the year ago period.

Selling, general and administrative expenses for

the second quarter of fiscal year 2025 increased to $724,000 from $272,000, primarily reflecting the above-noted bad debt provision reversal

in the year ago period.

Net income for the second quarter of fiscal year

2025 reflects a currency exchange gain of $58,000 compared to a $14,000 gain in the year ago period mainly due to a weakening of the Kyat.

The Company reported a currency exchange gain of $96,000 for the first half of fiscal year 2025, compared with a $31,000 gain in the year

ago period.

The Company had interest income of approximately

$58,000 for the second quarter of fiscal year 2025, and interest income of approximately $103,000 for the first half of fiscal year 2025

due to the increase in interest rates.

The Company’s balance sheet remains strong,

with total assets of $11.0 million dollar and cash and cash equivalents in excess of $5.6 million, or approximately $1.28 per diluted

share. The cash and cash equivalent amount exceeded all of its short- and long-term liabilities by approximately $1.4 million. Total shareholders’

equity at September 30, 2024, was $6.8 million, or $1.54 per diluted share.

About Highway Holdings Limited

Highway Holdings is an international manufacturer

of a wide variety of quality parts and products for blue chip equipment manufacturers based primarily in Germany. Highway Holdings’

administrative offices are located in Hong Kong and its manufacturing facilities are located in Yangon, Myanmar, and Shenzhen, China.

For more information visit website www.highwayholdings.com.

Except for the historical information contained

herein, the matters discussed in this press release are forward-looking statements which involve risks and uncertainties, including but

not limited to economic, competitive, governmental, political and technological factors affecting the company’s revenues, operations,

markets, products and prices, and other factors discussed in the company’s various filings with the Securities and Exchange Commission,

including without limitation, the company’s annual reports on Form 20-F.

(Financial Tables Follow)

# # #

Highway Holdings Ltd.

3-3-3

For further information, please contact:

Global IR Partners

David Pasquale

HIHO@globalirpartners.com

New York Office: +1-914-337-8801

HIGHWAY HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Statement of Income

(Dollars in thousands, except per share data)

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net sales | |

$ | 2,117 | | |

$ | 1,322 | | |

$ | 3,996 | | |

$ | 2,669 | |

| Cost of sales | |

| 1,283 | | |

| 939 | | |

| 2,501 | | |

| 1,909 | |

| Gross profit | |

| 834 | | |

| 383 | | |

| 1,495 | | |

| 760 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 724 | | |

| 272 | | |

| 1,382 | | |

| 1,049 | |

| Operating income/(loss) | |

| 110 | | |

| 111 | | |

| 113 | | |

| (289 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-operating items | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Exchange gain /(loss), net | |

| 58 | | |

| 14 | | |

| 96 | | |

| 31 | |

| Interest income | |

| 58 | | |

| 53 | | |

| 103 | | |

| 93 | |

| Gain/(Loss) on disposal of assets | |

| - | | |

| 13 | | |

| - | | |

| 13 | |

| Other income/(expenses) | |

| 5 | | |

| 6 | | |

| 12 | | |

| 6 | |

| Total non-operating income/ (expenses) | |

| 121 | | |

| 86 | | |

| 211 | | |

| 143 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income before income tax and non-controlling interests | |

| 231 | | |

| 197 | | |

| 324 | | |

| (146 | ) |

| Income taxes | |

| 0 | | |

| 3 | | |

| 0 | | |

| 6 | |

| Net income before non-controlling interests | |

| 231 | | |

| 200 | | |

| 324 | | |

| (140 | ) |

| Less: net gain attributable to non-controlling interests | |

| 0 | | |

| (13 | ) | |

| (5 | ) | |

| (15 | ) |

| Net income/(loss) attributable to Highway Holdings Limited’s shareholders | |

| 231 | | |

| 213 | | |

| 329 | | |

| (125 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Net Gain/ (loss) per share – Basic

| |

$ | 0.05 | | |

$ | 0.05 | | |

$ | 0.08 | | |

$ | (0.03 | ) |

| Net Gain/ (loss) per share - Diluted | |

$ | 0.05 | | |

$ | 0.05 | | |

$ | 0.08 | | |

$ | (0.03 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 4,402 | | |

| 4,219 | | |

| 4,379 | | |

| 4,345 | |

| Diluted | |

| 4,402 | | |

| 4,235 | | |

| 4,379 | | |

| 4,345 | |

Highway Holdings Ltd.

4-4-4

HIGHWAY HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Balance Sheet

(Dollars in thousands, except per share data)

| |

|

(unaudited)

Sept 30, |

|

|

(audited)

Mar 31, |

|

| |

|

2024 |

|

|

2024 |

|

| Current assets: |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

5,614 |

|

|

$ |

6,601 |

|

| Accounts receivable, net of doubtful accounts |

|

|

1,982 |

|

|

|

1,253 |

|

| Inventories |

|

|

1,785 |

|

|

|

1,566 |

|

| Prepaid expenses and other current assets |

|

|

156 |

|

|

|

226 |

|

| Total current assets |

|

|

9,537 |

|

|

|

9,646 |

|

| |

|

|

|

|

|

|

|

|

| Property, plant and equipment, (net) |

|

|

64 |

|

|

|

- |

|

| Operating lease right-of-use assets |

|

|

1,142 |

|

|

|

1,375 |

|

| Long-term deposits |

|

|

206 |

|

|

|

202 |

|

| Long-term loan receivable |

|

|

95 |

|

|

|

95 |

|

| Investments in equity method investees |

|

|

- |

|

|

|

- |

|

| Total assets |

|

$ |

11,044 |

|

|

$ |

11,318 |

|

| |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

1,021 |

|

|

$ |

935 |

|

| Operating lease liabilities, current |

|

|

621 |

|

|

|

588 |

|

| Other liabilities and accrued expenses |

|

|

1,559 |

|

|

|

1,789 |

|

| Income tax payable |

|

|

484 |

|

|

|

480 |

|

| Dividend payable |

|

|

45 |

|

|

|

45 |

|

| Total current liabilities |

|

|

3,730 |

|

|

|

3,837 |

|

| |

|

|

|

|

|

|

|

|

| Long term liabilities : |

|

|

|

|

|

|

|

|

| Operating lease liabilities, non-current |

|

|

507 |

|

|

|

803 |

|

| Long terms accrued expenses |

|

|

40 |

|

|

|

40 |

|

| Total liabilities |

|

|

4,277 |

|

|

|

4,680 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

| Preferred shares, $0.01 par value |

|

|

- |

|

|

|

- |

|

| Common shares, $0.01 par value |

|

|

44 |

|

|

|

44 |

|

| Additional paid-in capital |

|

|

12,159 |

|

|

|

12,117 |

|

| Accumulated deficit |

|

|

(4,908 |

) |

|

|

(5,015 |

) |

| Accumulated other comprehensive income/(loss) |

|

|

(516 |

) |

|

|

(501 |

) |

| Non-controlling interest |

|

|

(12 |

) |

|

|

(7 |

) |

| Total shareholders’ equity |

|

|

6,767 |

|

|

|

6,638 |

|

| Total liabilities and shareholders’ equity |

|

$ |

11,044 |

|

|

$ |

11,318 |

|

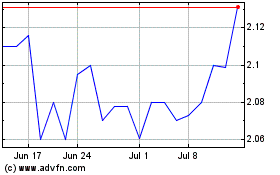

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Jan 2025 to Feb 2025

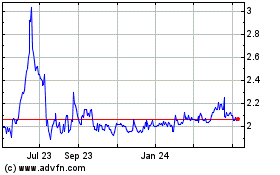

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Feb 2024 to Feb 2025