0001892322

true

FY

0001892322

2022-01-01

2022-12-31

0001892322

2022-06-30

0001892322

2023-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:JPY

iso4217:JPY

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

D.C. 20549

FORM

10-K/A

(Amendment

No. 1)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2022

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ______, 20 ____, to ______, 20_____.

Commission

File Number 001-41272

HeartCore

Enterprises, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

87-0913420 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

1-2-33,

Higashigotanda, Shinagawa-ku

Tokyo,

Japan |

| (Address

of principal executive offices) (Zip Code) |

(206)

385-0488, ext. 100

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HTCR |

|

The

Nasdaq Capital Market |

Securities

registered pursuant to section 12(g) of the Act:

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The

aggregate market value of the voting and non-voting common equity held by non-affiliates based upon the closing price of $2.37 per share

of common stock as of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter was

$11,899,377.

As

of March 31, 2023, there were 20,842,690 shares of common stock, par value $0.0001 per share, of the registrant issued and outstanding.

Documents

Incorporated by Reference

None

| Auditor Firm ID |

|

Auditor Name |

|

Auditor Location |

| 206 |

|

MaloneBailey, LLP |

|

Tokyo, Japan |

Explanatory

Note

On

March 31, 2023, HeartCore Enterprises, Inc. (the “Company”) filed its Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 (the “Original 2022 10-K”), with the Securities and Exchange Commission (“SEC”). This Amendment

No. 1 on Form 10-K/A (“Amendment No. 1”) is being filed to:

| (i) | Include

a description of the Company’s securities as Exhibit 4.1, as required by Item 601(b)(4)

of Regulation S-K; and |

| (ii) | Provide

current-dated certifications. |

Amendment

No. 1 speaks as of the filing date of the Original 2022 10-K, and does not reflect events that may have occurred subsequent to the filing

date of the Original 2022 10-K. Except as described above, no other changes have been made to the Original 2022 10-K, and Amendment No.

1 does not modify, amend or update the financial or other information contained in the Original 2022 10-K. Amendment No. 1 should be

read in conjunction with the Original 2022 10-K and the Company’s other filings with the SEC. The filing of this Amendment No.

1 is not an admission that the Original 2022 10-K, when filed, included any untrue statement of a material fact or omitted to state a

material fact necessary to make a statement not misleading.

PART

IV

ITEM

15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

| (a) |

The

following documents are filed as part of this annual report: |

See

Index to Financial Statements on page F-1 to the registrant’s annual report on Form 10-K filed with the Securities and Exchange

Commission on March 31, 2023 (the “Annual Report”).

| (2) |

Financial

Statements Schedules |

| |

|

| |

All

financial statements schedules are omitted because they are not applicable or the amounts are immaterial and not required, or the

required information is presented in the financial statements and notes thereto beginning on page F-1 of the Annual Report. |

| |

|

| (3) |

Exhibits |

| |

|

| |

We

hereby file as part of the Annual Report the exhibits listed in the Exhibit Index immediately before the signature page to the Annual

Report. Exhibits which are incorporated herein by reference can be inspected and copied at the public reference facilities maintained

by the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Copies of such material can also be obtained from the Public Reference

Section of the SEC, 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates or on the SEC website at www.sec.gov. |

EXHIBIT

INDEX

Exhibit

No. |

|

Exhibit |

| 3.1 |

|

Certificate of Incorporation of HeartCore Enterprises, Inc. (incorporated by reference to Exhibit 3.1 to the registrant’s Registration Statement on Form S-1 (File No. 333-261984) filed with the SEC on January 3, 2022). |

| 3.2 |

|

Bylaws of HeartCore Enterprises, Inc. (incorporated by reference to Exhibit 3.2 to the registrant’s Registration Statement on Form S-1 (File No. 333-261984) filed with the SEC on January 3, 2022). |

| 4.1* |

|

Description of the Registrant’s Securities. |

| 10.1 |

|

Memorandum to Share Exchange Agreement dated July 15, 2021, among HeartCore Co., Sumitaka. Yamamoto, and Information Services International-Dentsu Ltd. (incorporated by reference to Exhibit 10.1 to the registrant’s Registration Statement on Form S-1 (File No. 333-261984) filed with the SEC on January 3, 2022). |

| 10.2 |

|

Share Exchange Agreement dated July 16, 2021, among HeartCore Enterprises, Inc., all shareholders of HeartCore Co., Ltd., and Sumitaka Yamamoto as representative of the shareholders of HeartCore Co., Ltd. (incorporated by reference to Exhibit 10.2 to the registrant’s Registration Statement on Form S-1 (File No. 333-261984) filed with the SEC on January 3, 2022). |

| 10.3 |

|

Stock Purchase Agreement dated August 10, 2021, between HeartCore Enterprises, Inc. and Dentsu Digital Investment Limited (incorporated by reference to Exhibit 10.3 to the registrant’s Registration Statement on Form S-1 (File No. 333-261984) filed with the SEC on January 3, 2022). |

| 10.4† |

|

HeartCore Enterprises, Inc. 2021 Equity Incentive Plan (incorporated by reference to Exhibit 10.4 to the registrant’s Registration Statement on Form S-1 (File No. 333-261984) filed with the SEC on January 3, 2022). |

| 10.5† |

|

Employment Agreement, dated February 9, 2022, between the Company and Sumitaka Yamamoto (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on February 14, 2022). |

| 10.6† |

|

Employment Agreement, dated February 9, 2022, between the Company and Kimio Hosaka (incorporated by reference to Exhibit 10.3 to the registrant’s Current Report on Form 8-K filed with the SEC on February 14, 2022).). |

| 10.7† |

|

Employment Agreement, dated February 9, 2022, between the Company and Keisuke Kuno (incorporated by reference to Exhibit 10.5 to the registrant’s Current Report on Form 8-K filed with the SEC on February 14, 2022). |

| 10.8† |

|

Employment Agreement, dated February 9, 2022, between the Company and Qizhi Gao (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the SEC on February 14, 2022). |

| 10.9† |

|

Employment Agreement, dated February 9, 2022, between the Company and Hidekazu Miyata (incorporated by reference to Exhibit 10.4 to the registrant’s Current Report on Form 8-K filed with the SEC on February 14, 2022). |

| 10.10 |

|

Form of Independent Director Agreement between HeartCore Enterprises, Inc. and each independent director (incorporated by reference to Exhibit 10.10 to the registrant’s Registration Statement on Form S-1 (File No. 333-261984) filed with the SEC on January 3, 2022). |

| 10.11 |

|

Form of Indemnification Agreement between HeartCore Enterprises, Inc. and each independent director (incorporated by reference to Exhibit 10.11 to the registrant’s Registration Statement on Form S-1 (File No. 333-261984) filed with the SEC on January 3, 2022). |

| 10.12 |

|

Consulting and Services Agreement, dated as of March 31, 2022, by and between the registrant and Moveaction Co., Ltd. (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on April 6, 2022). |

| 10.13 |

|

Common Stock Purchase Warrant issued by Moveaction Co., Ltd. to the registrant. (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the SEC on April 6, 2022). |

| 10.14 |

|

Consulting and Services Agreement, dated as of April 13, 2022, by and between the registrant and A.L.I. Technologies Inc. (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on May 11, 2022). |

| 10.15 |

|

Common Stock Purchase Warrant issued by A.L.I. Technologies Inc. to the registrant (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the SEC on May 11, 2022). |

| 10.16 |

|

Consulting and Services Agreement, dated as of May 13, 2022, by and between the registrant and SYLA Holdings Co. Ltd. (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on May 25, 2022). |

| 10.17 |

|

Common Stock Purchase Warrant issued by SYLA Holdings Co. Ltd. to the registrant (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the SEC on May 25, 2022). |

| 10.18 |

|

Amendment No. 1 to Consulting and Services Agreement, dated as of August 17, 2022, by and between the registrant and Syla Technologies Co. Ltd. (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on August 18, 2022). |

| 10.19 |

|

Common Stock Purchase Warrant issued on August 17, 2022 by Syla Technologies Co. Ltd. to the registrant (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the SEC on August 18, 2022). |

| 10.20 |

|

Share Exchange and Purchase Agreement, dated as of September 6, 2022, by and among the registrant, Sigmaways, Inc. and Prakash Sadasivam (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on September 8, 2022). |

| 10.21 |

|

Consulting and Services Agreement, dated as of October 20, 2022, by and between HeartCore Enterprises, Inc. and Metros Development Co., Ltd. (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on October 26, 2022). |

| 10.22 |

|

Common Stock Purchase Warrant, issued on October 20, 2022, by Metros Development Co., Ltd. in favor of HeartCore Enterprises, Inc. (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the SEC on October 26, 2022). |

| 10.23 |

|

Consulting and Services Agreement, dated as of October 20, 2022, by and between HeartCore Inc. and Metros Development Co., Ltd. (incorporated by reference to Exhibit 10.3 to the registrant’s Current Report on Form 8-K filed with the SEC on October 26, 2022). |

| 10.24 |

|

Common Stock Purchase Warrant, issued on October 20, 2022, by Metros Development Co., Ltd. in favor of HeartCore Inc. (incorporated by reference to Exhibit 10.4 to the registrant’s Current Report on Form 8-K filed with the SEC on October 26, 2022). |

| 10.25 |

|

Termination of Consulting and Services Agreement and Warrant, dated as of October 26, 2022, by and between HeartCore Inc. and Metros Development Co., Ltd. (incorporated by reference to Exhibit 10.5 to the registrant’s Current Report on Form 8-K filed with the SEC on October 26, 2022). |

| 10.26 |

|

Amendment No. 1 to Consulting and Services Agreement, dated as of October 26, 2022, by and between HeartCore Enterprises, Inc. and Metros Development Co., Ltd. (incorporated by reference to Exhibit 10.6 to the registrant’s Current Report on Form 8-K filed with the SEC on October 26, 2022). |

| 10.27 |

|

Common Stock Purchase Warrant, issued on October 26, 2022, by Metros Development Co., Ltd. in favor of HeartCore Enterprises, Inc. (incorporated by reference to Exhibit 10.7 to the registrant’s Current Report on Form 8-K filed with the SEC on October 26, 2022). |

| 10.28 |

|

Amendment No. 1 to Executive Employment Agreement, dated as of October 28, 2022, by and between the registrant and Sumitaka Yamamoto (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on November 4, 2022). |

| 10.29 |

|

9th Stock Acquisition Rights Allotment Agreement, dated as of November 9, 2022, by and between the registrant and SYLA Technologies Co., Ltd. (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on November 23, 2022). |

| 10.30 |

|

Amendment No. 2 to Consulting and Services Agreement, dated as of November 15, 2022, by and between the registrant and SYLA Technologies Co., Ltd. (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the SEC on November 23, 2022). |

| 10.31 |

|

Consulting and Services Agreement, dated as of November 18, 2022, by and between the registrant and SBC Medical Group, Inc. (incorporated by reference to Exhibit 10.3 to the registrant’s Current Report on Form 8-K filed with the SEC on November 23, 2022). |

| 10.32 |

|

Common Stock Purchase Warrant, issued on November 18, 2022, by SBC Medical Group, Inc. in favor of the registrant (incorporated by reference to Exhibit 10.4 to the registrant’s Current Report on Form 8-K filed with the SEC on November 23, 2022). |

| 10.33 |

|

Consulting and Services Agreement, dated as of January 11, 2023, by and between the registrant and kk.BloomZ (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on January 17, 2023). |

| 10.34 |

|

Common Stock Purchase Warrant, issued on January 11, 2023, by kk.BloomZ in favor of the registrant (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on January 17, 2023). |

| 10.35 |

|

Amendment No. 2 to Share Exchange and Purchase Agreement, dated as of February 1, 2023, by and among the registrant, Sigmaways, Inc. and Prakash Sadasivam (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on February 6, 2023). |

| 10.36 |

|

Common Stock Purchase Warrant, dated February 1, 2023 (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the SEC on February 6, 2023). |

| 10.37† |

|

Employment Agreement, dated February 1, 2023, by and between the registrant and Prakash Sadasivam (incorporated by reference to Exhibit 10.3 to the registrant’s Current Report on Form 8-K filed with the SEC on February 6, 2023). |

| 10.38 |

|

Amended and Restated Common Stock Purchase Warrant, dated February 6, 2023 (incorporated by reference to Exhibit 10.4 to the registrant’s Current Report on Form 8-K/A (Amendment No. 1) filed with the SEC on February 9, 2023). |

| 10.39 |

|

Addendum to Share Exchange and Purchase Agreement, dated as of February 8, 2023, by and among the registrant, Sigmaways, Inc. and Prakash Sadasivam. (incorporated by reference to Exhibit 10.5 to the registrant’s Current Report on Form 8-K/A (Amendment No. 1) filed with the SEC on February 10, 2023). |

| 10.40 |

|

Consulting and Services Agreement, dated as of March 13, 2023, by and between the registrant and Libera Gaming Operations, Inc. (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the SEC on March 16, 2023). |

| 10.41 |

|

Common Stock Purchase Warrant, dated March 13, 2023, issued by Libera Gaming Operations, Inc. to the registrant (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the SEC on March 16, 2023). |

| 10.42 |

|

Consulting and Services Agreement, dated as of March 13, 2023, by and between the registrant and ICheck Co., Ltd. (incorporated by reference to Exhibit 10.3 to the registrant’s Current Report on Form 8-K filed with the SEC on March 16, 2023). |

| 10.43 |

|

Common Stock Purchase Warrant, dated March 13, 2023, issued by ICheck Co., Ltd. to the registrant (incorporated by reference to Exhibit 10.4 to the registrant’s Current Report on Form 8-K filed with the SEC on March 16, 2023). |

| 21.1*** |

|

List of Subsidiaries |

| 23.1*** |

|

Consent of independent registered public accounting firm |

| 24.1*** |

|

Power of Attorney |

| 31.1* |

|

Certification of Chief Executive Officer pursuant to Rule 13(a)-14(a) under the Securities Exchange Act of 1934, as amended. |

| 31.2* |

|

Certification of Chief Financial Officer pursuant to Rule 13(a)-14(a) under the Securities Exchange Act of 1934, as amended. |

| 32.1** |

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 101.INS* |

|

INLINE

XBRL INSTANCE DOCUMENT |

| 101.SCH* |

|

INLINE

XBRL TAXONOMY EXTENSION SCHEMA DOCUMENT |

| 101.CAL* |

|

INLINE

XBRL TAXONOMY EXTENSION CALCULATION LINKBASE DOCUMENT |

| 101.DEF* |

|

INLINE

XBRL TAXONOMY EXTENSION DEFINITION LINKBASE DOCUMENT |

| 101.LAB* |

|

INLINE

XBRL TAXONOMY EXTENSION LABEL LINKBASE DOCUMENT |

| 101.PRE* |

|

INLINE

XBRL TAXONOMY EXTENSION PRESENTATION LINKBASE DOCUMENT |

| 104* |

|

Cover

Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

*

Filed herewith.

**Furnished

herewith.

***Filed

previously.

†

Management contract, compensation plan or arrangement.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| |

HEARTCORE

ENTERPRISES, INC. |

| |

|

|

| Dated:

October 23, 2023 |

By: |

/s/

Sumitaka Yamamoto |

| |

|

Sumitaka

Yamamoto |

| |

|

Chief

Executive Officer and President |

Pursuant

to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the

registrant and in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Sumitaka Yamamoto |

|

Chairman

of Board, Chief Executive Officer and President |

|

October

23, 2023 |

| Sumitaka

Yamamoto |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Qizhi Gao |

|

Chief

Financial Officer (Principal Financial Officer and Principal Accounting Officer) |

|

October

23, 2023 |

| Qizhi

Gao |

|

|

|

|

| |

|

|

|

|

| /s/

Ferdinand Groenewald |

|

Director |

|

October

23, 2023 |

| Ferdinand

Groenewald |

|

|

|

|

| |

|

|

|

|

| /s/

Kimio Hosaka |

|

Director |

|

October

23, 2023 |

| Kimio

Hosaka |

|

|

|

|

| |

|

|

|

|

| /s/

Heather Neville |

|

Director |

|

October

23, 2023 |

| Heather

Neville |

|

|

|

|

| |

|

|

|

|

| /s/

Prakash Sadasivam |

|

Director |

|

October

23, 2023 |

| Prakash

Sadasivam |

|

|

|

|

| |

|

|

|

|

| /s/

Koji Sato |

|

Director |

|

October

23, 2023 |

| Koji

Sato |

|

|

|

|

| |

|

|

|

|

| /s/

Yoshitomo Yamano |

|

Director |

|

October

23, 2023 |

| Yoshitomo

Yamano |

|

|

|

|

Exhibit

4.1

DESCRIPTION

OF SECURITIES

The

following description of the capital stock of HeartCore Enterprises, Inc. (the “Company”) is based upon the Company’s

certificate of incorporation, the Company’s bylaws and applicable provisions of law, in each case as currently in effect. This

discussion does not purport to be complete and is qualified in its entirety by reference to the Company’s certificate of incorporation

and the Company’s bylaws, copies of which have been filed with the Securities and Exchange Commission.

Authorized

Capital Stock

The

Company is authorized to issue 200,000,000 shares of common stock, par value $0.0001 per share, and 20,000,000 shares of preferred stock,

par value $0.0001 per share.

As

of March 31, 2023, there were 20,842,690 shares of common stock issued and outstanding and no shares of preferred stock issued and outstanding.

As of such date, there were approximately 56 holders of record of the Company’s common stock and no holders of record of the Company’s

preferred stock.

Common

Stock

The

holders of the Company’s common stock are entitled to one vote for each share held on all matters to be voted on by the Company’s

stockholders. There shall be no cumulative voting.

Subject

to the rights of holders of preferred stock, the holders of shares of the Company’s common stock are entitled to dividends when

and as declared by the Company’s Board of Directors (the “Board”) from funds legally available therefor if, as and

when determined by the Board in its sole discretion, subject to provisions of law, and any provision of the Company’s certificate

of incorporation, as amended from time to time. In the event of any voluntary or involuntary liquidation, dissolution or winding up of

the Company’s affairs, the holders of the Company’s common stock will be entitled to share ratably in the net assets legally

available for distribution to stockholders after the payment of or provision for all of the Company’s debts and other liabilities.

There are no preemptive, conversion or redemption privileges, nor sinking fund provisions with respect to the common stock.

All

outstanding shares of common stock are duly authorized, validly issued, fully paid and non-assessable.

Preferred

Stock

The

Company’s certificate of incorporation authorizes the Board to issue up to 20,000,000 shares of preferred stock in one or more

series, to determine the designations and the powers, preferences and rights and the qualifications, limitations and restrictions thereof,

including the dividend rights, conversion or exchange rights, voting rights (including the number of votes per share), redemption rights

and terms, liquidation preferences, sinking fund provisions and the number of shares constituting the series. The Board could, without

stockholder approval, issue preferred stock with voting and other rights that could adversely affect the voting power and other rights

of the holders of common stock and which could have the effect of making it more difficult for a third party to acquire, or of discouraging

a third party from attempting to acquire, a majority of the Company’s outstanding voting stock.

2021

Equity Incentive Plan

The

Board and the Company’s stockholders approved the 2021 Equity Incentive Plan (the “2021 Plan”) on August 6, 2021. Under

the 2021 Plan, 2,400,000 shares of common stock were authorized for issuance to employees, directors and independent contractors (except

those performing services in connection with the offer or sale of the Company’s securities in a capital raising transaction, or

promoting or maintaining a market for the Company’s securities) of the Company or its subsidiary. The 2021 Plan authorizes equity-based

and cash-based incentives for participants.

There

were 6,330 and 777,680 shares available for award under the 2021 Plan as of March 30, 2023 and December 31, 2022, respectively. As of

March 30, 2023, the Company has granted (i) options to purchase a total of 1,651,000 shares of common stock under the 2021 Plan, and

(ii) an aggregate of 169,153 restricted stock units under the 2021 Plan.

Exclusive

Forum Provision

Section

21 of the Company’s certificate of incorporation and Section 7.4 of the Company’s bylaws provide that “[u]nless the

corporation consents in writing to the selection of an alternative forum, the sole and exclusive forum for (i) any derivative action

or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director,

officer or other employee of the Corporation to the Corporation or the Corporation’s stockholders, (iii) any action asserting a

claim arising pursuant to any provision of the DGCL, or (iv) any action asserting a claim governed by the internal affairs doctrine shall

be a state or federal court located in the county in which the principal office of the corporation in the State of Delaware is established,

in all cases subject to the court’s having personal jurisdiction over the indispensable parties named as defendants. Notwithstanding

the foregoing, the exclusive forum provision will not apply to suits brought to enforce any liability or duty created by the Exchange

of 1934, as amended, the Securities Act of 1933, as amended, or any claim for which the federal courts have exclusive or concurrent jurisdiction.”

This

choice of forum provision may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes

with the Company or its directors, officers or other employees, which may discourage such lawsuits against the Company and its directors,

officers and employees. Alternatively, a court could find these provisions of the Company’s certificate of incorporation and bylaws

to be inapplicable or unenforceable in respect of one or more of the specified types of actions or proceedings, which may require the

Company to incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect the Company’s

business and financial condition.

Fee

Shifting Provision

Section

7.4 of the Company’s bylaws provides that “[i]f any action is brought by any party against another party, relating to or

arising out of these Bylaws, or the enforcement hereof, the prevailing party shall be entitled to recover from the other party reasonable

attorneys’ fees, costs and expenses incurred in connection with the prosecution or defense of such action.”

The

bylaws provide that for this section, the term “attorneys’ fees” or “attorneys’ fees and costs” means

the fees and expenses of counsel to the Company and any other parties asserting a claim subject to Section 7.4 of the bylaws, which may

include printing, photocopying, duplicating and other expenses, air freight charges, and fees billed for law clerks, paralegals and other

persons not admitted to the bar but performing services under the supervision of an attorney, and the costs and fees incurred in connection

with the enforcement or collection of any judgment obtained in any such proceeding.

The

Company adopted the fee-shifting provision to eliminate or decrease nuisance and frivolous litigation. The Company intends to apply the

fee-shifting provision broadly to all actions except for claims brought under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and the Securities Act of 1933, as amended (the “Securities Act”).

There

is no set level of recovery required to be met by a plaintiff to avoid payment under this provision. Instead, whoever is the prevailing

party is entitled to recover the reasonable attorneys’ fees, costs and expenses incurred in connection with the prosecution or

defense of such action. Any party who brings an action, and the party against whom such action is brought under Section 7.4 of the Company’s

bylaws, which could include, but is not limited to former and current shareholders, Company directors, officers, affiliates, legal counsel,

expert witnesses, and other parties, are subject to this provision. Additionally, any party who brings an action, and the party against

whom such action is brought under Section 7.4 of the bylaws, which could include, but is not limited to former and current shareholders,

Company directors, officers, affiliates, legal counsel, expert witnesses, and other parties, would be able to recover fees under this

provision.

In

the event a claim is initiated or asserted against the Company, in accordance with the dispute resolution provisions contained in the

Company’s bylaws, and the plaintiff does not in a judgment prevail, the plaintiff will be obligated to reimburse the Company for

all reasonable costs and expenses incurred in connection with such claim, including, but not limited to, reasonable attorney’s

fees and expenses and costs of appeal, if any. Additionally, this provision in Section 7.4 of the bylaws could discourage shareholder

lawsuits that might otherwise benefit the Company and its shareholders.

THE

FEE SHIFTING PROVISION CONTAINED IN THE BYLAWS IS NOT INTENDED TO BE DEEMED A WAIVER BY ANY STOCKHOLDER OF THE COMPANY’S COMPLIANCE

WITH THE U.S. FEDERAL SECURITIES LAWS AND THE RULES AND REGULATIONS PROMULGATED THEREUNDER. THE FEE SHIFTING PROVISION CONTAINED IN THE

BYLAWS DOES NOT APPLY TO CLAIMS BROUGHT UNDER THE EXCHANGE ACT AND SECURITIES ACT.

Anti-Takeover

Effects of Certain Provisions of the Certificate of Incorporation and the Bylaws

Provisions

of the Company’s certificate of incorporation and bylaws could make it more difficult to acquire the Company by means of a merger,

tender offer, proxy contest, open market purchases, removal of incumbent directors and otherwise. These provisions, which are summarized

below, are expected to discourage types of coercive takeover practices and inadequate takeover bids and to encourage persons seeking

to acquire control of the Company to first negotiate with the Company. The Company believes that the benefits of increased protection

of the Company’s potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure

the Company outweigh the disadvantages of discouraging takeover or acquisition proposals because negotiation of these proposals could

result in an improvement of their terms.

Removal

of Directors. The certificate of incorporation and bylaws provide that directors may be removed prior to the expiration of their

terms by the affirmative vote of the holders of not less than two-thirds (2/3) of the voting power of the issued and outstanding stock

entitled to vote.

Vacancies.

The certificate of incorporation and bylaws provide the exclusive right of the Board to elect a director to fill a vacancy created by

the expansion of the Board or the resignation, death, or removal of a director, which prevents stockholders from being able to fill vacancies

on the Board.

Preferred

Stock. The certificate of incorporation authorizes the issuance of up to 20,000,000 shares of preferred stock with such rights and

preferences as may be determined from time to time by the Board in its sole discretion. The Board may, without stockholder approval,

issue series of preferred stock with dividends, liquidation, conversion, voting or other rights that could adversely affect the voting

power or other rights of the holders of the common stock.

Amendment

of Bylaws. The certificate of incorporation and bylaws provide that the bylaws may be altered, amended or repealed by the Board by

an affirmative vote of a majority of the Board of Directors at any regular meeting of the Board.

Limitation

of Liability. The certificate of incorporation provides for the limitation of liability of, and providing indemnification to, the

Company’s directors and officers.

Special

Stockholders Meeting. The certificate of incorporation provides that a special meeting of the stockholders may only be called by

a majority of the Board.

Nominations

of Directors. The bylaws provide for advance notice procedures that stockholders must comply with in order to nominate candidates

to the Board or to propose matters to be acted upon at a stockholders’ meeting, which may discourage or deter a potential acquirer

from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control

of the Company.

Transfer

Agent

The

transfer agent and registrar for the Company’s common stock is Transhare Corporation. The transfer agent and registrar’s

address is Bayside Center 1, 17755 US Highway 19 N, Suite 140, Clearwater, Florida 33764 and its telephone number is (303) 662-1112.

Exhibit

31.1

CERTIFICATIONS

I,

Sumitaka Yamamoto, certify that:

1.

I have reviewed this Amendment No. 1 to Annual Report on Form 10-K/A for the fiscal year ended December 31, 2022 of HeartCore Enterprises,

Inc.;

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the

period covered by this report;

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report;

4.

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act

Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant, including its consolidated subsidiary, is made known to us by others

within those entities, particularly during the period in which this report is being prepared; and

(b)

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under

our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles; and

(c)

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions

about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and

(d)

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

5.

The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over

financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons

performing the equivalent functions):

(a)

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are

reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information;

and

(b)

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s

internal control over financial reporting.

Date:

October 23, 2023

| /s/

Sumitaka Yamamoto |

|

| Sumitaka

Yamamoto |

|

Chief

Executive Officer and President

(Principal

Executive Officer) |

|

Exhibit

31.2

CERTIFICATIONS

I,

Qizhi Gao, certify that:

1.

I have reviewed this Amendment No. 1 to Annual Report on Form 10-K/A for the fiscal year ended December 31, 2022 of HeartCore Enterprises,

Inc.;

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the

period covered by this report;

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report;

4.

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act

Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant, including its consolidated subsidiary, is made known to us by others

within those entities, particularly during the period in which this report is being prepared; and

(b)

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under

our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles; and

(c)

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions

about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and

(d)

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

5.

The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over

financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons

performing the equivalent functions):

(a)

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are

reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information;

and

(b)

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s

internal control over financial reporting.

Date:

October 23, 2023

| /s/

Qizhi Gao |

|

| Qizhi

Gao |

|

Chief

Financial Officer

(Principal

Financial Officer) |

|

Exhibit

32.1

CERTIFICATION

PURSUANT

TO 18 U.S.C. SECTION 1350,

AS

ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In

connection with Amendment No. 1 to the Annual Report on Form 10-K/A of HeartCore Enterprises, Inc. (the “Company”) for the

fiscal year ended December 31, 2022 as filed with the Securities and Exchange Commission (the “Report”), I, Sumitaka Yamamoto,

Chief Executive Officer and President of the Company, and Qizhi Gao, Chief Financial Officer of the Company, certify, pursuant to 18

U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to the best of my knowledge:

1.

The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

2.

The information contained in the Report fairly presents, in all material respects, the financial condition and result of operations of

the Company.

| Date:

October 23, 2023 |

/s/

Sumitaka Yamamoto |

| |

Sumitaka

Yamamoto

Chief

Executive Officer and President

(Principal

Executive Officer) |

| |

|

| Date:

October 23, 2023 |

/s/

Qizhi Gao |

| |

Qizhi

Gao |

| |

Chief

Financial Officer

(Principal

Financial Officer) |

This

certification accompanies this Annual Report on Form 10-K pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and shall not, except

to the extent required by such Act, be deemed filed by the Company for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Such certification will not be deemed to be incorporated by reference into any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that the Company specifically incorporates it by reference.

v3.23.3

Cover - USD ($)

|

12 Months Ended |

|

|

Dec. 31, 2022 |

Mar. 31, 2023 |

Jun. 30, 2022 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Amendment Description |

Amendment

No. 1

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Document Period End Date |

Dec. 31, 2022

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Document Fiscal Year Focus |

2022

|

|

|

| Current Fiscal Year End Date |

--12-31

|

|

|

| Entity File Number |

001-41272

|

|

|

| Entity Registrant Name |

HeartCore

Enterprises, Inc.

|

|

|

| Entity Central Index Key |

0001892322

|

|

|

| Entity Tax Identification Number |

87-0913420

|

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

|

| Entity Address, Address Line One |

1-2-33

|

|

|

| Entity Address, Address Line Two |

Higashigotanda

|

|

|

| Entity Address, Address Line Three |

Shinagawa-ku

|

|

|

| Entity Address, City or Town |

Tokyo

|

|

|

| Entity Address, Country |

JP

|

|

|

| City Area Code |

206

|

|

|

| Local Phone Number |

385-0488

|

|

|

| Title of 12(b) Security |

Common

Stock

|

|

|

| Trading Symbol |

HTCR

|

|

|

| Security Exchange Name |

NASDAQ

|

|

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Current Reporting Status |

No

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

|

| Entity Small Business |

true

|

|

|

| Entity Emerging Growth Company |

true

|

|

|

| Elected Not To Use the Extended Transition Period |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Public Float |

|

|

$ 11,899,377

|

| Entity Common Stock, Shares Outstanding |

|

20,842,690

|

|

| ICFR Auditor Attestation Flag |

false

|

|

|

| Auditor Firm ID |

206

|

|

|

| Auditor Name |

MaloneBailey, LLP

|

|

|

| Auditor Location |

Tokyo, Japan

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

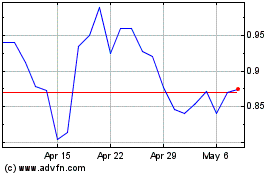

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Apr 2024 to May 2024

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From May 2023 to May 2024