CardioNet, Inc. (NASDAQ:BEAT), a leading wireless medical

technology company with a current focus on the diagnosis and

monitoring of cardiac arrhythmias, today reported results for the

fourth quarter and full year-ended December 31, 2011.

2011 Highlights

- Achieved positive adjusted EBITDA for

the fourth quarter and full year 2011

- Reduced quarter-end DSO to 75 days

- Reached an agreement to settle

shareholder litigation

- Implemented over $7 million of

annualized cost reductions

- Launched next-generation MCOTTM

device

- Opened west coast monitoring

location

- Secured 52 new payor contracts covering

over 10 million lives

- Completed Biotel integration and

generated positive EBITDA contribution

- $46.5 million in cash and investments

as of December 31, 2011, with no outstanding debt

President and CEO Commentary

Joseph Capper, President and Chief Executive Officer of

CardioNet, commented: “During the fourth quarter, we continued to

successfully execute on our operational initiatives as evidenced by

the positive adjusted EBITDA generated for the quarter and full

year 2011. We launched our next-generation MCOTTM device,

implemented approximately $7.5 million of annualized cost

reductions, reached an agreement to settle the outstanding class

action litigation and opened the west coast monitoring facility. We

will ramp up our activity in this new facility over the next three

months and expect to be fully operational in the second quarter.

Given this significant progress, we are now in a far better

position to capitalize on a variety of growth opportunities.

“As an example, we recently announced the purchase of ECG

Scanning & Medical Services, Inc. (“ECG Scanning”), a $7

million cardiac monitoring company focused on event, Holter and

pacemaker monitoring. The acquisition is expected to be accretive

in the first year and improve the Company’s position in the cardiac

monitoring market by leveraging our infrastructure and ECG

Scanning’s customer relationships.

“Although results have improved, our stock price has clearly

been under pressure particularly since the announcement of the

civil investigative demand in August 2011. As a result, we were

required by accounting guidance to take a non-cash goodwill

impairment charge. This charge has no impact on the Company’s

business operations or cash flow.

“2011 presented a number of challenges for the Company and the

healthcare industry overall; however, we improved our

year-over-year operating results and are even more excited about

the future. With a number of operational improvements in place and

the full commercialization of our next-generation MCOTTM device, we

are confident that we can continue to enhance performance and

strategically leverage our balance sheet.”

Fourth Quarter Financial Results

Revenue for the fourth quarter 2011 was $26.8 million, a

decrease of 6.6% compared to $28.7 million in the fourth quarter

2010. Patient revenue decreased $3.9 million due to slightly lower

MCOTTM volume which correlates to the lower volumes being

experienced in physicians’ offices, partially offset by an increase

in event and Holter volumes. Largely offsetting the patient revenue

decline was the addition of Biotel, which generated revenue of $2.0

million. For the three months ended December 31, 2011, patient

revenue was comprised of 36% Medicare and 64% commercial, and

patient volume was comprised of 54% Medicare and 46%

commercial.

Gross profit for the fourth quarter 2011 decreased to $16.6

million, or 62.1% of revenue, compared to $16.7 million, or 58.3%

of revenue, in the fourth quarter 2010. The increase in gross

profit percentage was related to cost reduction initiatives

implemented during the quarter.

On a GAAP basis, operating expenses for the fourth quarter 2011

were $66.2 million, an increase of 210.7% compared to $21.3 million

in the fourth quarter 2010. This increase was driven by a goodwill

impairment charge of $46.0 million due to a suppressed market price

which the Company believes is primarily a result of market reaction

to the ongoing Department of Justice inquiry. Operating expenses on

an adjusted basis declined by 11.1% compared to the prior year

quarter, excluding $48.7 million in the fourth quarter 2011 and

$1.6 million in the fourth quarter 2010 related to restructuring

and other nonrecurring charges. The decrease in operating expenses

was driven partially by the implementation of cost reductions in

the quarter as well as a reduction in bad debt expense. These

reductions were partially offset by the addition of Biotel’s

operating expenditures in the quarter.

On a GAAP basis, net loss for the fourth quarter 2011 was $49.8

million, or a loss of $2.03 per diluted share, compared to a net

loss of $4.8 million, or a loss of $0.20 per diluted share, for the

fourth quarter 2010. Excluding expenses related to restructuring

and other nonrecurring charges, adjusted net loss for the fourth

quarter 2011 was $1.1 million, or a loss of $0.04 per diluted

share. This compares to an adjusted net loss of $3.2 million, or a

loss of $0.13 per diluted share, for the fourth quarter 2010, which

also excludes the impact of restructuring and other nonrecurring

charges.

Full Year 2011 Financial Results

Revenue for the twelve months ended December 31, 2011 was $119.0

million, a decrease of 0.8% compared to $119.9 million reported in

the prior year. Patient revenue decreased $13.1 million due to

slightly lower MCOTTM volume in the second half due to lower

patient census in physicians’ offices as well as lower

reimbursement rates, partially offset by an increase in event and

Holter volumes. Substantially offsetting the patient revenue

decline was the addition of Biotel, which generated revenue of

$12.2 million. For the twelve months ended December 31, 2011,

patient revenue was comprised of 36% Medicare and 64% commercial,

and patient volume was comprised of 51% Medicare and 49%

commercial.

Gross profit for the twelve months ended December 31, 2011

decreased to $69.9 million, or 58.8% of revenue, compared to $72.4

million, or 60.4% of revenue, in the prior year. The decline in

gross profit percentage was related to the addition of the lower

margin Biotel business.

On a GAAP basis, operating expenses for the twelve months ended

December 31, 2011 were $131.3 million, an increase of 42.5%

compared to $92.1 million in the prior year. This increase was

driven by a goodwill impairment charge of $46.0 million. Operating

expenses on an adjusted basis declined by 8.6% compared to the

prior year, excluding $53.5 million for the twelve months ended

December 31, 2011 and $7.1 million for the twelve months ended

December 31, 2010 related to restructuring and other nonrecurring

charges. The decrease in operating expenses was substantially

driven by a reduction in bad debt expense, as well as a reduction

in outside services and professional fees. These reductions were

partially offset by the addition of Biotel’s operating

expenditures.

On a GAAP basis, net loss for the twelve months ended December

31, 2011 was $61.4 million, or a loss of $2.51 per diluted share,

compared to a net loss of $19.9 million, or a loss of $0.82 per

diluted share, for the twelve months ended December 31, 2010.

Excluding expenses related to restructuring and other nonrecurring

charges, adjusted net loss for the twelve months ended December 31,

2011 was $7.9 million, or a loss of $0.32 per diluted share. This

compares to an adjusted net loss of $12.8 million, or a loss of

$0.53 per diluted share, for the twelve months ended December 31,

2010, which also excludes the impact of restructuring and other

nonrecurring charges.

Liquidity

As of December 31, 2011, the Company had total cash and

investments of $46.5 million compared to $45.5 million as of

December 31, 2010, an increase of $1.0 million. Benefits from

process improvements in the billing and collections areas resulted

in strong cash collections throughout the year, as well as a

significant decrease in bad debt expense. These factors created a

shorter collection cycle, thereby positively impacting DSO, which

decreased to 75 days.

Conference Call

CardioNet, Inc. will host an earnings conference call on

Wednesday, February 22, 2012, at 5:00 PM Eastern Time. The call

will be simultaneously webcast on the investor information page of

our website, www.cardionet.com. The call will be archived on our

website and will also be available for two weeks via phone at

888-286-8010, access code 35475486.

About CardioNet

CardioNet is a leading provider of ambulatory, continuous,

real-time outpatient management solutions for monitoring relevant

and timely clinical information regarding an individual’s health.

CardioNet’s initial efforts are focused on the diagnosis and

monitoring of cardiac arrhythmias, or heart rhythm disorders, with

a solution that it markets as Mobile Cardiac Outpatient TelemetryTM

(MCOTTM). More information can be found at

http://www.cardionet.com.

Forward-Looking Statements

This document includes certain forward-looking statements within

the meaning of the “Safe Harbor” provisions of the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, our growth prospects, the prospects for our products and

our confidence in the Company’s future. These statements may be

identified by words such as “expect,” “may,” “anticipate,”

“possible,” “estimate,” “potential,” “intend,” “plan,” “believe,”

“forecast,” “promises” and other words and terms of similar

meaning. Such forward-looking statements are based on current

expectations and involve inherent risks and uncertainties,

including important factors that could delay, divert, or change any

of them, and could cause actual outcomes and results to differ

materially from current expectations. These factors include, among

other things, the effect of the ECG Scanning and Biotel

acquisitions on our business operations and financial results,

effectiveness of our efforts to address operational initiatives,

including cost savings initiatives that affect our business,

changes to insurance coverage, relationships with our government

and commercial payors and reimbursement levels for our products,

the success of our sales and marketing initiatives, our ability to

attract and retain talented executive management and sales

personnel, our ability to identify acquisition candidates, acquire

them on attractive terms and integrate their operations into our

business, the commercialization of new products, market factors,

internal research and development initiatives, partnered research

and development initiatives, competitive product development,

changes in governmental regulations and legislation, the continued

consolidation of payors, acceptance of our new products and

services and patent protection, adverse regulatory action and

litigation success. For further details and a discussion of these

and other risks and uncertainties, please see our public filings

with the Securities and Exchange Commission, including our latest

periodic reports on Form 10-K and 10-Q. We undertake no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events, or

otherwise.

Three Months

Ended

Consolidated Statements of Operations

(unaudited) (In Thousands, Except Per Share Amounts)

December 31, December 31, 2011

2010 Revenue $ 26,784 $ 28,683 Cost of revenue

10,154 11,970 Gross profit 16,630 16,713 Gross profit %

62.1% 58.3% Operating expenses: Goodwill impairment charge

45,999 - General and administrative expense 7,697 7,715 Sales and

marketing expense 5,740 7,160 Bad debt expense 3,524 4,520 Research

and development expense 1,326 1,187 Integration, restructuring and

other charges 1,902 722 Total operating expenses

66,188 21,304 Loss from operations (49,558)

(4,591) Interest and other income, net 37 36 Loss

before income taxes (49,521) (4,555) Provision for income taxes

(240) (262) Net loss $ (49,761) $ (4,817)

Loss per Share:

Basic $ (2.03) $ (0.20) Diluted $ (2.03) $ (0.20) Weighted

Average Shares Outstanding: Basic 24,550 24,253 Diluted 24,550

24,253

Twelve Months

Ended

Consolidated Statements of Operations

(unaudited) (In Thousands, Except Per Share Amounts)

December 31, December 31, 2011

2010 Revenue $ 119,022 $ 119,924 Cost of revenue

49,076 47,492 Gross profit 69,946 72,432 Gross profit

% 58.8% 60.4% Operating expenses: Goodwill impairment charge

45,999 - General and administrative expense 35,011 34,657 Sales and

marketing expense 27,821 29,338 Bad debt expense 12,080 18,578

Research and development expense 5,698 4,897 Integration,

restructuring and other charges 4,659 4,654 Total

operating expenses 131,268 92,124 Loss from

operations (61,322) (19,692) Interest and other

income, net 144 94 Loss before income taxes (61,178)

(19,598) Provision for income taxes (244) (262) Net

loss $ (61,422) $ (19,860)

Loss per Share:

Basic $ (2.51) $ (0.82) Diluted $ (2.51) $ (0.82) Weighted

Average Shares Outstanding: Basic 24,425 24,109 Diluted 24,425

24,109

Summary Financial

Data (In Thousands) December 31,

December 31, 2011 2010 (unaudited)

Cash and investments $ 46,484 $ 45,484 Accounts receivable,

net 21,028 24,978 Other receivables, net 1,564 3,041 Days sales

outstanding 75 78 Working capital 57,177 60,634 Total assets 94,975

156,692 Total debt - - Total shareholders’ equity 77,997 134,928

Three Months

Ended

December 31, December 31, 2011

2010 (unaudited) Stock compensation expense $

709 $ 887

Twelve Months

Ended

December 31, December 31, 2011

2010 (unaudited) Stock compensation expense $

4,006 $ 3,945 Reconciliation of Non-GAAP Financial Measures

(In Thousands, Except Per Share Amounts) In accordance with

Regulation G of the Securities and Exchange Commission, the table

set forth below reconciles certain financial measures used in this

press release that were not calculated in accordance with generally

accepted accounting principles, or GAAP, with the most directly

comparable financial measure calculated in accordance with GAAP.

Three Months

Ended

(unaudited) December 31, December

31, 2011 2010 Operating loss – GAAP $ (49,558) $

(4,591) Nonrecurring charges (a) 48,675 1,599

Adjusted operating loss

$ (883) $ (2,992) Net loss – GAAP $

(49,761) $ (4,817) Nonrecurring charges (a) 48,675

1,599

Adjusted net loss $ (1,086) $

(3,218) Loss per diluted share – GAAP $ (2.03) $

(0.20) Nonrecurring charges per share (a) 1.99 0.07

Adjusted loss per diluted share $ (0.04)

$ (0.13) (a) In the fourth quarter of

2011, we incurred $46.0 million of goodwill impairment charges,

$1.3 million of legal fees related to litigation, $1.2 million

related to the integration of Biotel’s operations, restructuring

and other nonrecurring charges, as well as $0.2 million for the

forfeiture and acceleration of certain options. In the fourth

quarter of 2010, we incurred $0.7 million of severance and other

exit costs related to the restructuring of our sales and service

organizations, as well as $0.9 million of other nonrecurring

charges.

Three Months

Ended

(unaudited) December 31, December 31,

2011 2010 Cash provided by operating

activities $ 4,540 $ 14,191 Capital expenditures (1,140)

(1,575) Free cash flow 3,400 12,616

Three Months

Ended

(unaudited) December 31, December 31,

2011 2010 Operating loss – GAAP $ (49,558) $

(4,591) Nonrecurring charges 48,675 1,599 Depreciation and

amortization expense 2,163 3,346 Adjusted EBITDA

1,280 354 Reconciliation of Non-GAAP Financial

Measures (In Thousands, Except Per Share Amounts) In

accordance with Regulation G of the Securities and Exchange

Commission, the table set forth below reconciles certain financial

measures used in this press release that were not calculated in

accordance with generally accepted accounting principles, or GAAP,

with the most directly comparable financial measure calculated in

accordance with GAAP.

Twelve Months

Ended

(unaudited) December 31, December

31, 2011 2010 Operating loss – GAAP $ (61,322) $

(19,692) Nonrecurring charges (a) 53,527 7,104

Adjusted operating loss

$ (7,795) $ (12,588) Net loss – GAAP $

(61,422) $ (19,860) Nonrecurring charges (a) 53,527

7,104

Adjusted net loss $ (7,895) $

(12,756) Loss per diluted share – GAAP $ (2.51) $

(0.82) Nonrecurring charges per share (a) 2.19 0.29

Adjusted loss per diluted share $ (0.32)

$ (0.53) (a) For the twelve months

ended 2011, we incurred $46.0 million of goodwill impairment

charges, $4.3 million related to the integration of Biotel’s

operations, other strategic initiatives and other nonrecurring

charges, $2.2 million of legal fees related to litigation, as well

as $1.0 million for the forfeiture and acceleration of certain

options. For the twelve months ended 2010, we incurred $4.9 million

of severance and other exit costs related to the restructuring of

our sales and service organizations and management changes, $1.3

million for the forfeiture and acceleration of certain options, as

well as $0.9 million of other nonrecurring charges largely related

to our class action and Biotel law suits.

Twelve Months

Ended

(unaudited) December 31, December 31,

2011 2010 Cash provided by (used in) operating

activities $ 5,030 $ 10,362 Capital expenditures (3,954)

(5,247) Free cash flow 1,076 5,115

Twelve Months

Ended

(unaudited) December 31, December 31,

2011 2010 Operating loss – GAAP $ (61,322) $

(19,692) Nonrecurring charges 53,527 7,104 Depreciation and

amortization expense 11,432 12,878 Adjusted EBITDA

3,637 290

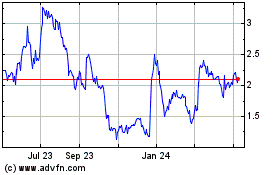

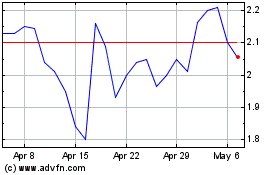

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024