Current Report Filing (8-k)

November 19 2015 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 19, 2015 (November 16, 2015)

HALLADOR ENERGY COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Colorado

|

001-3473

|

84-1014610

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

1660 Lincoln Street, Suite 2700, Denver Colorado

|

|

80264-2701

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: 303-839-5504

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

1

Item 8.01 – Other Events

See below.

Item 9.01 – Financial Statements and Exhibits

99.1See press release dated November 18, 2015, Hallador Revises Downward Contracted Coal Sales Position.

SIGNATURE

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HALLADOR ENERGY COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: November 19, 2015

|

|

/s/W. ANDERSON BISHOP

|

|

|

|

W. Anderson Bishop, CFO and CAO

|

EXHIBIT 99.1

Press Release

HALLADOR REVISES DOWNWARD CONTRACTED COAL SALES POSITION

DENVER, Colorado, November 18, 2015 (NASDAQ: HNRG) In May of this year, one of our customers asked to defer 571,000 tons from 2015 to 2016. As an incentive to modify our agreement with the customer, they offered to award us additional tons in 2016-2020. As such, we included the additional tons as agreed to in our second and third quarter filings. On November 16, our customer notified us that they wished to substantially modify the agreement. Negotiations are still ongoing. Until a contract is finalized, we feel it is prudent to revise our contracted sales position.

The table below includes 571,000 tons in 2016 that are currently contracted to ship in 2015.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minimum Tons To Be Sold

|

|

|

Maximum Tons To Be Sold

|

|

Average

|

|

|

|

|

Priced

|

|

(Unpriced)

|

|

Total

|

|

|

Priced

|

|

(Unpriced)

|

|

Total

|

|

Estimated

|

|

Year

|

|

Tons

|

|

Tons

|

|

Tons

|

|

|

Tons

|

|

Tons

|

|

Tons

|

|

Prices

|

|

|

2015 – Q4

|

|

|

1,528

|

|

|

|

|

|

1,528

|

|

|

|

1,528

|

|

|

|

|

|

1,528

|

|

$

|

45.29

|

|

|

2016(1)

|

|

|

5,518

|

|

|

|

|

|

5,518

|

|

|

|

5,874

|

|

|

|

|

|

5,874

|

|

|

43.55

|

|

|

2017(2)

|

|

|

2,820

|

|

|

389

|

|

|

3,209

|

|

|

|

4,620

|

|

|

581

|

|

|

5,201

|

|

|

42.86

|

|

|

2018

|

|

|

1,560

|

|

|

1,199

|

|

|

2,759

|

|

|

|

2,210

|

|

|

1,791

|

|

|

4,001

|

|

|

44.03

|

|

|

2019

|

|

|

1,000

|

|

|

2,009

|

|

|

3,009

|

|

|

|

1,250

|

|

|

3,001

|

|

|

4,251

|

|

|

45.76

|

|

|

2020

|

|

|

1,000

|

|

|

2,009

|

|

|

3,009

|

|

|

|

1,000

|

|

|

3,001

|

|

|

4,001

|

|

|

46.91

|

|

|

2021

|

|

|

|

|

|

2,009

|

|

|

2,009

|

|

|

|

|

|

|

3,001

|

|

|

3,001

|

|

|

|

|

|

2022

|

|

|

|

|

|

2,009

|

|

|

2,009

|

|

|

|

|

|

|

3,001

|

|

|

3,001

|

|

|

|

|

|

2023

|

|

|

|

|

|

1,620

|

|

|

1,620

|

|

|

|

|

|

|

2,420

|

|

|

2,420

|

|

|

|

|

|

2024

|

|

|

|

|

|

810

|

|

|

810

|

|

|

|

|

|

|

1,210

|

|

|

1,210

|

|

|

|

|

|

|

|

|

13,426

|

|

|

12,054

|

|

|

25,480

|

|

|

|

16,482

|

|

|

18,006

|

|

|

34,488

|

|

|

|

______________________________

|

|

|

|

(1)

|

For 2016, we estimate we will sell 6.5 million tons.

|

|

(2)

|

For 2017, we estimate we will sell 7.5 million tons.

|

AS PREVIOUSLY REPORTED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minimum Tons To Be Sold

|

|

|

Maximum Tons To Be Sold

|

|

Average

|

|

|

|

|

Priced

|

|

(Unpriced)

|

|

Total

|

|

|

Priced

|

|

(Unpriced)

|

|

Total

|

|

Estimated

|

|

Year

|

|

Tons

|

|

Tons

|

|

Tons

|

|

|

Tons

|

|

Tons

|

|

Tons

|

|

Prices

|

|

|

2015 – Q4

|

|

|

1,528

|

|

|

|

|

|

1,528

|

|

|

|

1,528

|

|

|

|

|

|

1,528

|

|

$

|

45.29

|

|

|

2016(1)

|

|

|

5,568

|

|

|

|

|

|

5,568

|

|

|

|

6,424

|

|

|

|

|

|

6,424

|

|

|

43.34

|

|

|

2017(2)

|

|

|

3,070

|

|

|

389

|

|

|

3,459

|

|

|

|

4,620

|

|

|

581

|

|

|

5,201

|

|

|

42.67

|

|

|

2018

|

|

|

2,685

|

|

|

1,199

|

|

|

3,884

|

|

|

|

4,410

|

|

|

1,791

|

|

|

6,201

|

|

|

41.67

|

|

|

2019

|

|

|

2,575

|

|

|

2,009

|

|

|

4,584

|

|

|

|

3,450

|

|

|

3,001

|

|

|

6,451

|

|

|

42.15

|

|

|

2020

|

|

|

2,350

|

|

|

2,009

|

|

|

4,359

|

|

|

|

3,200

|

|

|

3,001

|

|

|

6,201

|

|

|

43.77

|

|

|

2021

|

|

|

|

|

|

2,009

|

|

|

2,009

|

|

|

|

|

|

|

3,001

|

|

|

3,001

|

|

|

|

|

|

2022

|

|

|

|

|

|

2,009

|

|

|

2,009

|

|

|

|

|

|

|

3,001

|

|

|

3,001

|

|

|

|

|

|

2023

|

|

|

|

|

|

1,620

|

|

|

1,620

|

|

|

|

|

|

|

2,420

|

|

|

2,420

|

|

|

|

|

|

2024

|

|

|

|

|

|

810

|

|

|

810

|

|

|

|

|

|

|

1,210

|

|

|

1,210

|

|

|

|

|

|

|

|

|

17,776

|

|

|

12,054

|

|

|

29,830

|

|

|

|

23,632

|

|

|

18,006

|

|

|

41,638

|

|

|

|

______________________________

|

|

|

|

(1)

|

For 2016, we estimate we will sell 6.5 million tons.

|

|

(2)

|

For 2017, we estimate we will sell 7.5 million tons.

|

Committed unpriced tons are firm commitments, meaning we are required to ship and our customer is required to receive said tons through the duration of the contract. The contracts provide mechanisms for establishing a market-based price. As set forth in the table above, we have 12-18 million tons committed but unpriced through 2024.

Hallador is headquartered in Denver, Colorado and through its wholly owned subsidiary, Sunrise Coal, LLC, produces coal in the Illinois Basin for the electric power generation industry. To learn more about Hallador or Sunrise, visit our websites at www.halladorenergy.com or www.sunrisecoal.com.

Contact: Rebecca Palumbo

Phone: 303.839.5504 Ext. 316

E-mail: rpalumbo@halladorenergy.com

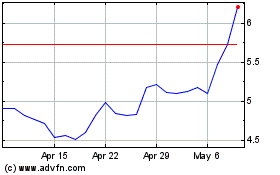

Hallador Energy (NASDAQ:HNRG)

Historical Stock Chart

From Jul 2024 to Aug 2024

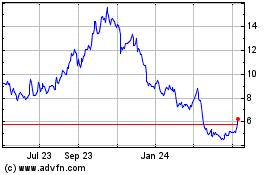

Hallador Energy (NASDAQ:HNRG)

Historical Stock Chart

From Aug 2023 to Aug 2024