0001743725FALSE00017437252024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2024

GRID DYNAMICS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38685 | | 83-0632724 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

5000 Executive Parkway, Suite 520

San Ramon, CA 94583

(Address of principal executive offices)

Registrant’s telephone number, including area code: (650) 523-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | GDYN | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On February 22, 2024, Grid Dynamics Holdings, Inc. issued a press release announcing its results for the quarter and full year ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K and the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by reference in such filing.

Item 9.01. Financial Statement and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Document |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: February 22, 2024 | GRID DYNAMICS HOLDINGS, INC. |

| | |

| By: | /s/ Anil Doradla |

| Name: | Anil Doradla |

| Title: | Chief Financial Officer |

Exhibit 99.1

Grid Dynamics Reports Fourth Quarter and Full Year 2023 Financial Results

Fourth Quarter Revenue of $78.1 million and Full Year Revenue of $312.9 million

San Ramon Calif. – February 22, 2024 – Grid Dynamics Holdings, Inc. (NASDAQ: GDYN) (“Grid Dynamics”, “the Company”), a leader in enterprise-level digital transformation, today announced results for its fourth quarter and full year ended December 31, 2023.

We are very pleased to report revenue of $78.1 million in the fourth quarter 2023 that was higher than our outlook range of $76 million to $78 million that we provided in November 2023. For the full year 2023, we achieved revenue of $312.9 million, up from $310.5 million in 2022. In the fourth quarter we continued to diversify our industry mix. Notable highlights included the following. Our Technology, Media and Telecom (“TMT”) vertical, at 31.0% of our fourth quarter revenue, rebounded and grew 1.9% on a sequential basis, driven by our large technology customers. Our Finance vertical, representing 10.6% of our fourth quarter revenue, grew 13.4% on a sequential basis. This was largely due to growth from our existing customers and new logos. And, Other vertical, including life sciences and pharmaceutical customers, representing 14.5% of our fourth quarter revenue grew 11.5% on a sequential basis. Also, our CPG and Manufacturing vertical, representing 12.4% of our fourth quarter revenue, remained unchanged on a sequential basis. As a result of our continued efforts of diversifying our business, our reliance on the Retail vertical diminished, representing 31.5% of our fourth quarter revenue, down from 34.3% on a sequential basis.

“I am pleased to report that the demand environment is improving and this should favorably support our business in 2024. There were many positives in this quarter. We added five new enterprise logos. Notable inclusions were a large insurance company and a healthcare company. AI is now infused across all of our industry practices, with many new customers embracing AI in their solutions. Customers recognize Grid Dynamics engineering quality in India leading to our growth in the region. As such, we are expanding our footprint beyond our two offices in Hyderabad and Chennai and opening a third office in Bengaluru.

The last twelve months have proven that the company is adept in navigating uncertainties as we executed across multiple areas of our business. In 2023 we added 33 enterprise customers, scaled our delivery locations across Poland, India, and Mexico, three areas strategic to a follow-the-sun model, enhanced our sales and R&D organizations with greater industry expertise, especially in supply-chain, manufacturing, financial services, and pharmaceutical. We were recognized by hyperscalers such as Google, Amazon, and Microsoft for our AI capabilities and other technical skills. In 2023, our partnership influenced business reached 13% of our total revenue. This is impressive given that we embarked on this strategy in 2021, and within a short period of two years we achieved these results. I am very proud of the Company’s achievements and I would like to thank all our employees for their contribution and perseverance.” said Leonard Livschitz, CEO.

Fourth Quarter of 2023 Financial Highlights

•Total revenue was $78.1 million, flat sequentially and decreased 3.1% year-over-year.

•GAAP gross profit was $28.1 million or 36.0% of revenue, compared to GAAP gross profit of $32.3 million or 40.1% of revenue in the fourth quarter of 2022. Non-GAAP gross profit was $28.6 million or 36.6% of revenue, compared to Non-GAAP gross profit of $32.7 million or 40.6% of revenue in the fourth quarter of 2022.

•GAAP net income attributable to common stockholders was $2.9 million, or $0.04 per share, based on 75.7 million weighted-average basic shares outstanding in fourth quarter of 2023, compared to GAAP net loss attributable to common stockholders of $6.7 million or $(0.09) per share based on 74.0 million weighted-average basic shares outstanding in the fourth quarter of 2022. GAAP diluted earnings per share during the fourth quarter of 2023 were $0.04 per share, based on 78.0 million weighted-average diluted shares outstanding, compared to $(0.09) per share based on 74.0 million weighted-average diluted shares outstanding in the fourth quarter of 2022. Non-GAAP net income was $5.7 million, or $0.07 per diluted share, based on 78.0 million weighted-average diluted shares outstanding in the fourth quarter of 2023, compared to Non-GAAP net income of $10.5 million or $0.14 per diluted share based on 76.5 million weighted-average diluted shares outstanding in the fourth quarter of 2022.

•Non-GAAP EBITDA (earnings before interest, taxes, depreciation, amortization, other income, fair value adjustments, stock-based compensation, and transaction and transformation-related costs as well as geographic reorganization

expenses), a Non-GAAP metric, was $10.7 million, compared with Non-GAAP EBITDA of $16.5 million in the fourth quarter of 2022.

2023 Full Year Financial Highlights

•Total revenue was $312.9 million, an increase of 0.8% year-over-year.

•GAAP gross profit was $113.1 million or 36.2% of revenue, compared to GAAP gross profit of $120.6 million or 38.8% of revenue in 2022. Non-GAAP gross profit was $115.1 million or 36.8% of revenue, compared to Non-GAAP gross profit of $121.9 million or 39.3% of revenue in 2022.

•GAAP net loss attributable to common stockholders was $1.8 million, or $(0.02) per share, based on 75.2 million weighted-average common shares outstanding, compared to GAAP net loss attributable to common stockholders of $29.2 million or $(0.42) per share based on 69.2 million weighted-average common shares outstanding in 2022. Non-GAAP net income was $25.1 million, or $0.32 per diluted share, based on 77.7 million weighted-average common shares outstanding, compared to Non-GAAP net income of $36.6 million or $0.51 per diluted share based on 72.2 million weighted-average common shares outstanding in 2022.

•Non-GAAP EBITDA (earnings before interest, taxes, depreciation, amortization, other income, fair value adjustments, stock-based compensation, and transaction and transformation-related costs as well as geographic reorganization expenses), a Non-GAAP metric, was $44.2 million, compared with Non-GAAP EBITDA of $58.2 million in 2022.

See “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Information” below for a discussion of our non-GAAP measures.

Cash Flow and Other Metrics

•Cash provided by operating activities was $41.1 million for the year ended December 31, 2023, compared to cash provided by operating activities of $31.7 million for the year ended December 31, 2022.

•Cash and cash equivalents totaled $257.2 million as of December 31, 2023, compared to $256.7 million as of December 31, 2022.

•Total headcount was 3,920 as of December 31, 2023, compared with 3,798 employees as of December 31, 2022.

Financial Outlook

•The Company expects revenue in the first quarter of 2024 to be in the range of $77 million to $79 million.

•Non-GAAP EBITDA in the first quarter of 2024 is expected to be between $9.5 million and $10.5 million.

•For the first quarter of 2024, we expect our basic share count to be in the 76.5-77.5 million range and diluted share count to be in the 78.5-79.5 million range.

Grid Dynamics is not able, at this time, to provide GAAP targets for net income for the first quarter of 2024 because of the difficulty of estimating certain items excluded from non-GAAP EBITDA that cannot be reasonably predicted, such as interest, taxes, other income, fair-value adjustments, geographic reorganization expenses, and charges related to stock-based compensation expense. The effect of these excluded items may be significant.

Conference Call and Webcast

Grid Dynamics will host a conference call at 4:30 p.m. ET on Thursday, February 22, 2024 to discuss its fourth quarter and full year 2023 financial results. Investors and other interested parties can access the call in the following ways: A webcast of the video conference call can be accessed on the Investor Relations section of the Company's website at https://ir.griddynamics.com/.

A replay will also be available after the call at https://ir.griddynamics.com/ with the passcode $Q4@2023.

About Grid Dynamics

Grid Dynamics (NASDAQ: GDYN) is a leading provider of technology consulting, platform and product engineering, and advanced analytics services. Fusing technical vision with business acumen, we enable positive business outcomes for enterprise companies undergoing business transformation by solving their most pressing technical challenges. A key differentiator for Grid Dynamics is our 7+ years of experience and leadership in enterprise AI, supported by profound expertise and ongoing investment in data, analytics, cloud & DevOps, application modernization, and customer experience. Founded in 2006, Grid Dynamics is headquartered in Silicon Valley with offices across the Americas, Europe, and India. Follow us on LinkedIn.

Non-GAAP Financial Measures

To supplement the financial measures presented in Grid Dynamics press release in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company also presents non-GAAP measures of financial performance.

A “non-GAAP financial measure” refers to a numerical measure of Grid Dynamics historical or future financial performance or financial position that is included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. Grid Dynamics provides certain non-GAAP measures as additional information relating to its operating results as a complement to results provided in accordance with GAAP. The non-GAAP financial information presented herein should be considered in conjunction with, and not as a substitute for or superior to, the financial information presented in accordance with GAAP and should not be considered a measure of liquidity and profitability.

Grid Dynamics has included these non-GAAP financial measures because they are financial measures used by Grid Dynamics’ management to evaluate Grid Dynamics’ core operating performance and trends, to make strategic decisions regarding the allocation of capital and new investments and are among the factors analyzed in making performance-based compensation decisions for key personnel.

Grid Dynamics believes the use of non-GAAP financial measures, as a supplement to GAAP measures, is useful to investors in that they eliminate items that are either not part of core operations or do not require a cash outlay, such as stock-based compensation expense. Grid Dynamics believes these non-GAAP measures provide investors and other users of its financial information consistency and comparability with its past financial performance and facilitate period to period comparisons of operations. Grid Dynamics believes these non-GAAP measures are useful in evaluating its operating performance compared to that of other companies in its industry, as they generally eliminate the effects of certain items that may vary for different companies for reasons unrelated to overall operating performance.

There are significant limitations associated with the use of non-GAAP financial measures. Further, these measures may differ from the non-GAAP information, even where similarly titled, used by other companies and therefore should not be used to compare our performance to that of other companies. Grid Dynamics compensates for these limitations by providing investors and other users of its financial information a reconciliation of non-GAAP measures to the related GAAP financial measures. Grid Dynamics encourages investors and others to review its financial information in its entirety, not to rely on any single financial measure, and to view its non-GAAP measures in conjunction with GAAP financial measures. Please see the reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures attached to this release.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are not historical facts, and involve risks and uncertainties that could cause actual results of Grid Dynamics to differ materially from those expected and projected. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continue,” or “should,” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include, without limitation, the quotations of management, the section titled “Financial Outlook,” and statements concerning Grid Dynamics’s expectations with respect to future performance, particularly in light of the macroeconomic environment and the Russian invasion of Ukraine, as well as its GigaCube strategy.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside Grid Dynamics’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (i) Grid Dynamics has a relatively short operating

history and operates in a rapidly evolving industry, which makes it difficult to evaluate future prospects and may increase the risk that it will not continue to be successful and may adversely impact our stock price; (ii) Grid Dynamics may be unable to effectively manage its growth or achieve anticipated growth, particularly as it expands into new geographies, which could place significant strain on Grid Dynamics’ management personnel, systems and resources; (iii) Grid Dynamics’ revenues are highly dependent on a limited number of clients and industries that are affected by seasonal trends, and any decrease in demand for outsourced services in these industries may reduce Grid Dynamics’ revenues and adversely affect Grid Dynamics’ business, financial condition and results of operations; (iv) macroeconomic conditions, inflationary pressures, and the geopolitical climate, including the Russian invasion of Ukraine, have and may continue to materially adversely affect our stock price, business operations, overall financial performance and growth prospects; (v) Grid Dynamics’ revenues are highly dependent on clients primarily located in the United States, and any economic downturn in the United States or in other parts of the world, including Europe or disruptions in the credit markets may have a material adverse effect on Grid Dynamics’ business, financial condition and results of operations; (vi) Grid Dynamics faces intense and increasing competition; (vii) Grid Dynamics’ failure to successfully attract, hire, develop, motivate and retain highly skilled personnel could materially adversely affect Grid Dynamics’ business, financial condition and results of operations; (viii) failure to adapt to rapidly changing technologies, methodologies and evolving industry standards may have a material adverse effect on Grid Dynamics’ business, financial condition and results of operations; (ix) failure to successfully deliver contracted services or causing disruptions to clients’ businesses may have a material adverse effect on Grid Dynamics’ reputation, business, financial condition and results of operations; (x) risks and costs related to acquiring and integrating other companies; and (xi) other risks and uncertainties indicated in Grid Dynamics filings with the SEC.

Grid Dynamics cautions that the foregoing list of factors is not exclusive. Grid Dynamics cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Grid Dynamics does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Further information about factors that could materially affect Grid Dynamics, including its results of operations and financial condition, is set forth under the “Risk Factors” section of the Company’s quarterly report on Form 10-Q filed November 2, 2023 and in other periodic filings Grid Dynamics makes with the SEC.

Contacts

Grid Dynamics Investor Relations:

investorrelations@griddynamics.com

Schedule 1:

GRID DYNAMICS HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME/(LOSS) AND

COMPREHENSIVE INCOME/(LOSS)

Unaudited

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 78,069 | | | $ | 80,576 | | | $ | 312,910 | | | $ | 310,482 | |

| Cost of revenue | 49,955 | | | 48,296 | | | 199,764 | | | 189,892 | |

| Gross profit | 28,114 | | | 32,280 | | | 113,146 | | | 120,590 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Engineering, research, and development | 3,863 | | | 4,697 | | | 14,741 | | | 15,772 | |

| Sales and marketing | 6,422 | | | 5,377 | | | 24,151 | | | 19,808 | |

| General and administrative | 18,894 | | | 27,818 | | | 79,834 | | | 106,018 | |

| Total operating expenses | 29,179 | | | 37,892 | | | 118,726 | | | 141,598 | |

| | | | | | | |

Loss from operations | (1,065) | | | (5,612) | | | (5,580) | | | (21,008) | |

| Other income/(expenses), net | 2,569 | | | 431 | | | 10,418 | | | 555 | |

Income/(loss) before income taxes | 1,504 | | | (5,181) | | | 4,838 | | | (20,453) | |

Provision for/(benefit from) income taxes | (1,398) | | | 1,521 | | | 6,603 | | | 8,761 | |

| Net income/(loss) | $ | 2,902 | | | $ | (6,702) | | | $ | (1,765) | | | $ | (29,214) | |

| | | | | | | |

Foreign currency translation adjustments | 785 | | | 1,215 | | | 2,122 | | | (722) | |

Comprehensive income/(loss) | $ | 3,687 | | | $ | (5,487) | | | $ | 357 | | | $ | (29,936) | |

| | | | | | | |

Income/(loss) per share | | | | | | | |

| Basic | $ | 0.04 | | | $ | (0.09) | | | $ | (0.02) | | | $ | (0.42) | |

| Diluted | $ | 0.04 | | | $ | (0.09) | | | $ | (0.02) | | | $ | (0.42) | |

| | | | | | | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 75,690 | | | 74,036 | | | 75,193 | | | 69,197 | |

| Diluted | 78,033 | | | 74,036 | | | 75,193 | | | 69,197 | |

Schedule 2:

GRID DYNAMICS HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

Unaudited

(In thousands, except share and per share data)

| | | | | | | | | | | |

| As of |

| December 31,

2023 | | December 31,

2022 |

Assets | | | |

Current assets | | | |

Cash and cash equivalents | $ | 257,227 | | | $ | 256,729 | |

Accounts receivable, net of allowance of $1,363 and $443 as of December 31, 2023 and December 31, 2022, respectively | 49,824 | | | 48,358 | |

| Unbilled receivables | 3,735 | | | 5,591 | |

Prepaid income taxes | 3,998 | | | 4,294 | |

Prepaid expenses and other current assets | 9,196 | | | 8,154 | |

Total current assets | 323,980 | | | 323,126 | |

| | | |

Property and equipment, net | 11,358 | | | 8,215 | |

| Operating lease right-of-use assets, net | 10,446 | | | 7,694 | |

Intangible assets, net | 26,546 | | | 20,375 | |

| Goodwill | 53,868 | | | 45,514 | |

| Deferred tax assets | 6,418 | | | 4,998 | |

Other noncurrent assets | 2,549 | | | 1,224 | |

Total assets | $ | 435,165 | | | $ | 411,146 | |

| | | |

Liabilities and equity | | | |

Current liabilities | | | |

Accounts payable | $ | 3,621 | | | $ | 3,897 | |

Accrued compensation and benefits | 19,263 | | | 13,065 | |

Accrued income taxes | 8,828 | | | 10,718 | |

| Operating lease liabilities, current | 4,235 | | | 2,505 | |

| Accrued expenses and other current liabilities | 6,276 | | | 8,525 | |

Total current liabilities | 42,223 | | | 38,710 | |

| | | |

Deferred tax liabilities | 3,274 | | | 3,756 | |

| Operating lease liabilities, noncurrent | 6,761 | | | 5,636 | |

Total liabilities | $ | 52,258 | | | $ | 48,102 | |

| | | |

Stockholders’ equity | | | |

Common stock, $0.0001 par value; 110,000,000 shares authorized; 75,887,475 and 74,156,458 issued and outstanding as of December 31, 2023 and December 31, 2022, respectively | $ | 8 | | | $ | 7 | |

Additional paid-in capital | 397,511 | | | 378,006 | |

Accumulated deficit | (15,886) | | | (14,121) | |

Accumulated other comprehensive income/(loss) | 1,274 | | | (848) | |

Total stockholders’ equity | 382,907 | | | 363,044 | |

Total liabilities and stockholders’ equity | $ | 435,165 | | | $ | 411,146 | |

Schedule 3:

GRID DYNAMICS HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Unaudited

(In thousands)

| | | | | | | | | | | |

| Twelve Months Ended

December 31, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net loss | $ | (1,765) | | | $ | (29,214) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 8,926 | | | 6,626 | |

| Operating lease right-of-use assets amortization expense | 3,192 | | | 3,021 | |

| Bad debt expense | 945 | | | 132 | |

| Deferred income taxes | (4,140) | | | (3,633) | |

Change in fair value of contingent consideration | (4,220) | | | — | |

| Stock-based compensation | 35,516 | | | 60,968 | |

Other expenses | 324 | | | 71 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (434) | | | (8,738) | |

| Unbilled receivables | 2,518 | | | (1,116) | |

| Prepaid income taxes | 435 | | | (3,450) | |

| Prepaid expenses and other assets | (511) | | | (3,371) | |

| Accounts payable | (538) | | | 1,729 | |

| Accrued compensation and benefits | 5,260 | | | 1,694 | |

| Operating lease liabilities | (3,135) | | | (2,574) | |

| Accrued income taxes | (2,271) | | | 8,525 | |

| Accrued expenses and other current liabilities | 991 | | | 982 | |

| Net cash provided by operating activities | 41,093 | | | 31,652 | |

| Cash flows from investing activities | | | |

| Purchase of property and equipment | (7,870) | | | (6,069) | |

| Purchase of investments | (250) | | | (1,000) | |

| Acquisition of business, net of cash acquired | (17,830) | | | (9,254) | |

| Net cash used in investing activities | (25,950) | | | (16,323) | |

| Cash flows from financing activities | | | |

| Payments of tax obligations resulted from net share settlement of vested stock awards | (16,831) | | | (5,755) | |

| Proceeds from exercises of stock options, net of shares withheld for taxes | 510 | | | 1,432 | |

| Proceeds from issuance of Common Stock from 2022 and 2021 Offerings | — | | | 109,537 | |

| Proceeds from debt | — | | | 5,000 | |

| Payment of contingent consideration related to previously acquired businesses | — | | | (6,933) | |

| Repayment of debt | — | | | (5,000) | |

| Debt issuance cost | — | | | (270) | |

| Equity issuance costs | — | | | (253) | |

Net cash (used in)/provided by financing activities | (16,321) | | | 97,758 | |

| Effect of exchange rate changes on cash and cash equivalents | 1,676 | | | (722) | |

| Net increase in cash and cash equivalents | 498 | | | 112,365 | |

| Cash and cash equivalents, beginning of period | 256,729 | | | 144,364 | |

| Cash and cash equivalents, end of period | $ | 257,227 | | | $ | 256,729 | |

Schedule 3:

GRID DYNAMICS HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Unaudited

(In thousands)

(Continued)

| | | | | | | | | | | |

| Twelve Months Ended

December 31, |

| 2023 | | 2022 |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for income taxes | $ | 12,365 | | | $ | 7,474 | |

| Supplemental disclosure of non-cash activities | | | |

| Acquisition fair value of contingent consideration issued for acquisition of business | $ | 932 | | | $ | 3,288 | |

Schedule 4:

GRID DYNAMICS HOLDINGS, INC.

RECONCILIATION OF NON-GAAP INFORMATION

Unaudited

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 78,069 | | | $ | 80,576 | | | $ | 312,910 | | | $ | 310,482 | |

| Cost of revenue | 49,955 | | | 48,296 | | | 199,764 | | | 189,892 | |

| GAAP gross profit | 28,114 | | | 32,280 | | | 113,146 | | | 120,590 | |

| Stock-based compensation | 477 | | | 446 | | | 1,959 | | | 1,334 | |

Non-GAAP gross profit | $ | 28,591 | | | $ | 32,726 | | | $ | 115,105 | | | $ | 121,924 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

GAAP net income/(loss) | $ | 2,902 | | | $ | (6,702) | | | $ | (1,765) | | | $ | (29,214) | |

| Adjusted for: | | | | | | | |

| Depreciation and amortization | 2,671 | | | 1,719 | | | 8,926 | | | 6,626 | |

Provision for/(benefit from) income taxes | (1,398) | | | 1,521 | | | 6,603 | | | 8,761 | |

| Stock-based compensation | 7,839 | | | 18,369 | | | 35,516 | | | 60,968 | |

Geographic reorganization (1) | 330 | | | 1,390 | | | 1,858 | | | 11,023 | |

Transaction and transformation-related costs (2) | 519 | | | 604 | | | 2,038 | | | 604 | |

Restructuring costs (3) | 402 | | | — | | | 1,488 | | | — | |

Other (income)/expenses, net (4) | (2,569) | | | (431) | | | (10,418) | | | (555) | |

| Non-GAAP EBITDA | $ | 10,696 | | | $ | 16,470 | | | $ | 44,246 | | | $ | 58,213 | |

__________________________(1)Geographic reorganization includes expenses connected with military actions of Russia against Ukraine and the exit plan announced by the Company and includes travel and relocation-related expenses of employees from the aforementioned countries, severance payments, allowances, as well as legal and professional fees related to geographic repositioning in various locations. These expenses are incremental to those expenses incurred prior to the crisis, clearly separable from normal operations, and not expected to recur once the crisis has subsided and operations return to normal.

(2)Transaction and transformation-related costs include, when applicable, external deal costs, transaction-related professional fees, transaction-related retention bonuses, which are allocated proportionally across cost of revenue, engineering, research and development, sales and marketing and general and administrative expenses as well as other transaction-related costs including integration expenses consisting of outside professional and consulting services.

(3)We implemented a restructuring plan during the first quarter of 2023. Our restructuring costs comprised of severance charges and respective taxes and are included in General and administrative expenses in the Company’s consolidated statement of income/(loss) and comprehensive income/(loss).

(4)Other (income)/expenses, net consist primarily of losses and gains on foreign currency transactions, fair value adjustments, and other miscellaneous non-operating expenses and other income consists primarily of interest on cash held at banks and returns on investments in money-market funds.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

GAAP net income/(loss) | $ | 2,902 | | | $ | (6,702) | | | $ | (1,765) | | | $ | (29,214) | |

| Adjusted for: | | | | | | | |

| Stock-based compensation | 7,839 | | | 18,369 | | | 35,516 | | | 60,968 | |

Geographic reorganization (1) | 330 | | | 1,390 | | | 1,858 | | | 11,023 | |

Transaction and transformation-related costs (2) | 519 | | | 604 | | | 2,038 | | | 604 | |

Restructuring costs (3) | 402 | | | — | | | 1,488 | | | — | |

Other (income)/expenses, net (4) | (2,569) | | | (431) | | | (10,418) | | | (555) | |

Tax impact of non-GAAP adjustments (5) | (3,726) | | | (2,757) | | | (3,640) | | | (6,199) | |

Non-GAAP net income | $ | 5,697 | | | $ | 10,473 | | | $ | 25,077 | | | $ | 36,627 | |

Number of shares used in the GAAP diluted EPS | 78,033 | | | 74,036 | | | 75,193 | | | 69,197 | |

GAAP diluted EPS | $ | 0.04 | | | $ | (0.09) | | | $ | (0.02) | | | $ | (0.42) | |

Number of shares used in the Non-GAAP diluted EPS | 78,033 | | | 76,543 | | | 77,651 | | | 72,223 | |

Non-GAAP diluted EPS | $ | 0.07 | | | $ | 0.14 | | | $ | 0.32 | | | $ | 0.51 | |

__________________________

(1)Geographic reorganization includes expenses connected with military actions of Russia against Ukraine and the exit plan announced by the Company and includes travel and relocation-related expenses of employees from the aforementioned countries, severance payments, allowances, as well as legal and professional fees related to geographic repositioning in various locations. These expenses are incremental to those expenses incurred prior to the crisis, clearly separable from normal operations, and not expected to recur once the crisis has subsided and operations return to normal.

(2)Transaction and transformation-related costs include, when applicable, external deal costs, transaction-related professional fees, transaction-related retention bonuses, which are allocated proportionally across cost of revenue, engineering, research and development, sales and marketing and general and administrative expenses as well as other transaction-related costs including integration expenses consisting of outside professional and consulting services.

(3)We implemented a restructuring plan during the first quarter of 2023. Our restructuring costs comprised of severance charges and respective taxes and are included in General and administrative expenses in the Company’s consolidated statement of income/(loss) and comprehensive income/(loss).

(4)Other (income)/expenses, net consist primarily of losses and gains on foreign currency transactions, fair value adjustments, and other miscellaneous non-operating expenses and other income consists primarily of interest on cash held at banks and returns on investments in money-market funds.

(5)Reflects the estimated tax impact of the non-GAAP adjustments presented in the table.

Schedule 5:

GRID DYNAMICS HOLDINGS, INC.

REVENUE BY VERTICALS

Unaudited

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | % of revenue | | 2022 | | % of revenue |

| Retail | $ | 24,579 | | | 31.5 | % | | $ | 25,662 | | | 31.8 | % |

| Technology, Media and Telecom | 24,191 | | | 31.0 | % | | 27,164 | | | 33.7 | % |

| CPG/Manufacturing | 9,675 | | | 12.4 | % | | 14,089 | | | 17.5 | % |

| Finance | 8,280 | | | 10.6 | % | | 6,244 | | | 7.7 | % |

| Other | 11,344 | | | 14.5 | % | | 7,417 | | | 9.3 | % |

| Total | $ | 78,069 | | | 100.0 | % | | $ | 80,576 | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2023 | | % of revenue | | 2022 | | % of revenue |

| Retail | | $ | 102,551 | | | 32.8 | % | | $ | 99,681 | | | 32.1 | % |

| Technology, Media and Telecom | | 98,830 | | | 31.6 | % | | 98,334 | | | 31.7 | % |

| CPG/Manufacturing | | 42,861 | | | 13.7 | % | | 61,216 | | | 19.7 | % |

| Finance | | 28,842 | | | 9.2 | % | | 21,893 | | | 7.1 | % |

| Other | | 39,826 | | | 12.7 | % | | 29,358 | | | 9.4 | % |

| Total | | $ | 312,910 | | | 100.0 | % | | $ | 310,482 | | | 100.0 | % |

Cover Page

|

Feb. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity Registrant Name |

GRID DYNAMICS HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38685

|

| Entity Tax Identification Number |

83-0632724

|

| Entity Address, Address Line One |

5000 Executive Parkway

|

| Entity Address, Address Line Two |

Suite 520

|

| Entity Address, City or Town |

San Ramon

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94583

|

| City Area Code |

650

|

| Local Phone Number |

523-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

GDYN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001743725

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

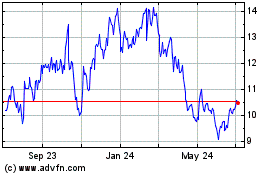

Grid Dynamics (NASDAQ:GDYN)

Historical Stock Chart

From Apr 2024 to May 2024

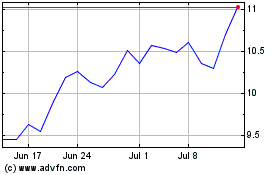

Grid Dynamics (NASDAQ:GDYN)

Historical Stock Chart

From May 2023 to May 2024