Current Report Filing (8-k)

January 12 2021 - 4:27PM

Edgar (US Regulatory)

0001385613false00013856132021-01-072021-01-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

January 7, 2021

Date of report (Date of earliest event reported)

GREENLIGHT CAPITAL RE, LTD.

(Exact name of registrant as specified in charter)

|

|

|

|

|

|

|

|

|

|

|

Cayman Islands

|

001-33493

|

N/A

|

|

(State or other jurisdiction of incorporation)

|

(Commission file number)

|

(IRS employer identification no.)

|

|

65 Market Street

|

|

|

|

Suite 1207, Jasmine Court

|

|

|

|

P.O. Box 31110

|

|

|

|

Camana Bay

|

|

|

|

Grand Cayman

|

|

|

|

Cayman Islands

|

|

KY1-1205

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

(345) 943-4573

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Ordinary Shares

|

GLRE

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Second Amended and Restated Exempted Limited Partnership Agreement

On January 7, 2021, Greenlight Reinsurance, Ltd. (“Greenlight Re”) and Greenlight Reinsurance Ireland, Designated Activity Company (“GRIL”), each a wholly owned subsidiary of Greenlight Capital Re, Ltd. (the “Registrant” and, together with Greenlight Re and GRIL, “GLRE”), the Registrant (for limited purposes) and DME Advisors II, LLC (together with GLRE, the “Parties”), general partner of Solasglas Investments, LP (“SILP”), executed that certain Second Amended and Restated Exempted Limited Partnership Agreement, effective as of January 1, 2021 (the “Second Restated Agreement”). Capitalized terms used herein and not otherwise defined have the meanings ascribed thereto in the Second Restated Agreement.

The Second Restated Agreement amends, restates, supersedes and incorporates all material terms of that certain Amended and Restated Exempted Limited Partnership of SILP, executed by the Parties on August 30, 2018 and effective as of September 1, 2018 (the “First Restated Agreement”), as amended by that certain Amendment No. 1, dated as of February 26, 2019, and the letter agreements dated as of June 18, 2019, December 27, 2019 and August 5, 2020 (collectively, the “Amendments”). The Second Restated Agreement also amends the definition of “Additional Investment Ratio” to mean a ratio where (x) the numerator is the product of (a) 0.50 (the “Investment Cap”) multiplied by (b) the GLRE Surplus, and (y) the denominator is the sum of the Capital Account of each of Greenlight Re and GRIL and amends each of the defined terms “Greenlight Re Surplus” and the “GRIL Surplus” so as to clarify that the each of the respectively referenced “financial statements” are “U.S. GAAP financial statements.” In addition, the Second Restated Agreement amends Section 4.1(c) to add the following as the final sentence to such section: “The Investment Portfolio of each Partner will not exceed the product of (a) such Partner’s surplus (Greenlight Re Surplus or GRIL Surplus, as the case may be) multiplied by (b) the Investment Cap, and the General Partner will designate any portion of a Partner’s Investment Portfolio as Designated Securities to effectuate such limit.” and amends each of Schedule 4.1(c)-1 (the Greenlight Re Guidelines) and Schedule 4.1(c)-2 (the GRIL Guidelines) to reflect the amended investment guidelines adopted by the board of directors of Greenlight Re and GRIL, respectively, effective as of January 1, 2021.

The foregoing summary of the Second Restated Agreement does not purport to be complete and is qualified in its entirety to the Second Restated Agreement, a copy of which is attached as Exhibit 10.1 and is incorporated herein by reference.

Item 8.01 Other Events

On January 12, 2021, the Registrant issued a press release announcing that it will hold its 2021 annual general meeting of shareholders (the “Annual Meeting”) on May 4, 2021. The time and location of the Annual Meeting will be set forth in the Registrant’s proxy materials.

Because the date of the Annual Meeting is more than 45 days from the anniversary of the Registrant’s 2020 annual general meeting of shareholders, the deadline for the submission of proposals by shareholders for inclusion in the Registrant’s proxy materials relating to the Annual Meeting in accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended, will be the close of business on February 11, 2021, which the Registrant believes is a reasonable time before it expects to begin to print and send its proxy materials. Any proposal received after such date will be considered untimely.

In accordance with the Registrant’s Third Amended and Restated Memorandum and Articles of Association, as revised (the “Articles”), shareholders who intend to nominate a person for election as a director or submit a proposal regarding any other matter of business at the Annual Meeting must deliver written notice of any proposed business or nomination to the Secretary of the Registrant at the Registrant’s registered office no later than the close of business on February 11, 2021. Any notice of proposed business or nomination must comply with the specific requirements set forth in the Articles in order to be considered at the Annual Meeting.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

|

|

|

|

|

|

|

10.1

|

|

Second Amended and Restated Exempted Limited Partnership Agreement of Solasglas Investments, LP, between DME Advisors II, LLC, as General Partner, Greenlight Reinsurance, Ltd., Greenlight Reinsurance Ireland, Designated Activity Company, Greenlight Capital Re, Ltd. and the initial limited partner, dated as of January 7, 2021.

|

|

99.1

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

GREENLIGHT CAPITAL RE, LTD.

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ Neil Greenspan

|

|

|

Name:

|

Neil Greenspan

|

|

|

Title:

|

Chief Financial Officer

|

|

|

Date:

|

January 12, 2021

|

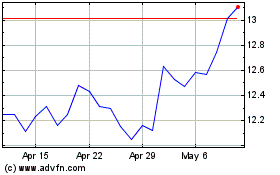

Greenlight Capital Re (NASDAQ:GLRE)

Historical Stock Chart

From Jun 2024 to Jul 2024

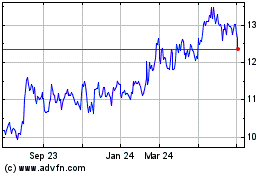

Greenlight Capital Re (NASDAQ:GLRE)

Historical Stock Chart

From Jul 2023 to Jul 2024