Golub Capital BDC, Inc. Closes Merger With Golub Capital BDC 3, Inc., Declares Special Distributions Totaling $0.15 Per Share

June 03 2024 - 9:00AM

Business Wire

Golub Capital BDC, Inc. (“GBDC,” or the “Company”), a business

development company (Nasdaq: GBDC), announced today that it has

completed its previously announced merger with Golub Capital BDC 3,

Inc. (“GBDC 3”), with GBDC as the surviving company. With $8.8

billion of total assets at fair value and investments in 367

portfolio companies, on a pro forma basis as of March 31, 2024,

GBDC is the fifth-largest externally managed, publicly traded

business development company by assets.

David B. Golub, CEO of GBDC, said, “We would like to thank the

stockholders and independent directors of both GBDC and GBDC 3 for

their support throughout the merger process. GBDC’s focus on

traditional middle-market lending, its industry-leading fee

structure and its scale taken together position it to provide

market-leading returns across different economic and interest rate

environments.”

Upon closing of the merger, GBDC 3 stockholders received 0.9138

shares of GBDC common stock for each share of GBDC 3 common stock.

The transaction is estimated to be 2.1% accretive to GBDC’s net

asset value (“NAV”) per share as of March 31, 2024. The final NAV

accretion resulting from the merger will be disclosed when GBDC

reports its financial results for the period ended June 30,

2024.

In support of the proposed merger, the agreement by GBDC’s

investment adviser, GC Advisors LLC (“GC Advisors”), to reduce the

income incentive fee and capital gain incentive fee rate as well as

the incentive fee cap from 20.0% to 15.0% became permanent with the

merger close. GBDC’s cumulative incentive fee cap, since-inception

lookback period and income incentive fee hurdle rate of 8% per

annum have all remained in place.

On June 2, 2024, GBDC’s Board of Directors declared a series of

special distributions totaling $0.15 per share, to be distributed

in three consecutive quarterly payments of $0.05 per share per

quarter, based upon the following schedule:

- Special distribution #1 of $0.05 per share, payable on June 27,

2024, to stockholders of record as of June 13, 2024

- Special distribution #2 of $0.05 per share, payable on

September 13, 2024, to stockholders of record as of August 16,

2024

- Special distribution #3 of $0.05 per share, payable on December

13, 2024, to stockholders of record as of November 29, 2024

Morgan Stanley & Co. LLC served as financial advisor to the

special committee of the independent directors of GBDC. Keefe,

Bruyette & Woods, A Stifel Company, served as financial advisor

to the special committee of the independent directors of GBDC

3.

About Golub Capital BDC, Inc.

Golub Capital BDC Inc. (“Golub Capital BDC”) is an

externally-managed, non-diversified closed-end management

investment company that has elected to be regulated as a business

development company under the Investment Company Act of 1940. Golub

Capital BDC invests primarily in one stop and other senior secured

loans of U.S. middle-market companies that are often sponsored by

private equity investors. Golub Capital BDC’s investment activities

are managed by its investment adviser, GC Advisors LLC, an

affiliate of the Golub Capital group of companies (“Golub

Capital”).

About Golub Capital

Golub Capital is a market-leading, award-winning direct lender

and experienced credit asset manager. The firm specializes in

delivering reliable, creative and compelling financing solutions to

companies backed by private equity sponsors. Golub Capital’s

sponsor finance expertise also forms the foundation of its Broadly

Syndicated Loan and Credit Opportunities investment programs. Golub

Capital nurtures long-term, win-win partnerships that inspire

repeat business from private equity sponsors and investors.

As of April 1, 2024, Golub Capital had over 925 employees and

over $70 billion of capital under management, a gross measure of

invested capital including leverage. The firm has offices in North

America, Europe and Asia. For more information, please visit

golubcapital.com.

Forward-Looking Statements

This communication may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Statements other than statements of historical facts

included in this communication may constitute forward-looking

statements and are not guarantees of future performance or results

and involve a number of risks and uncertainties. Actual results may

differ materially from those expressed or implied in the

forward-looking statements as a result of a number of factors,

including those described from time to time in filings with the

Securities and Exchange Commission. GBDC undertakes no duty to

update any forward-looking statement made herein. All

forward-looking statements speak only as of the date of this

communication.

Some of the statements in this communication constitute

forward-looking statements, which relate to future events, future

performance or financial condition or the two-step merger of GBDC 3

with and into GBDC (collectively, the “Mergers”). The

forward-looking statements involve risks and uncertainties,

including statements as to: future operating results of GBDC;

business prospects of GBDC and the prospects of its portfolio

companies; and the impact of the investments that GBDC expects to

make. In addition, words such as “may,” “might,” “will,” “intend,”

“should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,”

“anticipate,” “predict,” “potential,” “plan” or similar words

indicate forward-looking statements, although not all

forward-looking statements include these words. The forward-looking

statements contained in this communication involve risks and

uncertainties. Certain factors could cause actual results and

conditions to differ materially from those projected, including the

uncertainties associated with (i) expected synergies and savings

associated with the Mergers; (ii) the ability to realize the

anticipated benefits of the Mergers, including the expected

elimination of certain expenses and costs due to the Mergers; (iii)

changes in the economy, financial markets and political

environment, including the impacts of inflation and rising interest

rates; (iv) risks associated with possible disruption in the

operations of GBDC or the economy generally, including those caused

by global health pandemics, such as the COVID-19 pandemic, or other

large scale events; (v) turmoil in Ukraine and Russia, including

sanctions related to such turmoil, and the potential for volatility

in energy prices and other supply chain issues and any impact on

the industries in which GBDC invests; (vi) future changes in laws

or regulations (including the interpretation of these laws and

regulations by regulatory authorities); (vii) changes in political,

economic or industry conditions, the interest rate environment or

conditions affecting the financial and capital markets that could

result in changes to the value of GBDC’s assets; (viii) elevating

levels of inflation, and its impact on GBDC, on its portfolio

companies and on the industries in which they invest; (ix) GBDC’s

plans, expectations, objectives and intentions, as a result of the

Mergers; (x) the future operating results and net investment income

projections of GBDC following the closing of the Mergers; (xi) the

ability of GC Advisors to locate suitable investments for GBDC and

to monitor and administer its investments; (xii) the ability of GC

Advisors or its affiliates to attract and retain highly talented

professionals; and (xiii) other considerations that may be

disclosed from time to time in GBDC’s publicly disseminated

documents and filings. GBDC has based the forward-looking

statements included in this press release on information available

to them on the date of this communication, and they assume no

obligation to update any such forward-looking statements. Although

GBDC undertakes no obligation to revise or update any

forward-looking statements, whether as a result of new information,

future events or otherwise, you are advised to consult any

additional disclosures that they may make directly to you or

through reports that GBDC in the future may file with the SEC,

including the registration statement on Form N-14, which includes

the joint proxy statement of GBDC and GBDC 3 and a prospectus of

GBDC, annual reports on Form 10-K, quarterly reports on Form 10-Q

and current reports on Form 8-K.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240603896435/en/

Christopher Ericson 312-212-4036 cericson@golubcapital.com

press@golubcapital.com

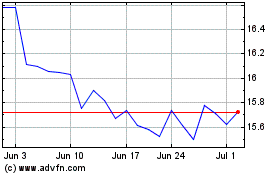

Golub Capital BDC (NASDAQ:GBDC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Golub Capital BDC (NASDAQ:GBDC)

Historical Stock Chart

From Jul 2023 to Jul 2024