Statement of Changes in Beneficial Ownership (4)

March 03 2021 - 3:10PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Watorek Jeffrey J. |

2. Issuer Name and Ticker or Trading Symbol

GIBRALTAR INDUSTRIES, INC.

[

ROCK

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

VP, Treasurer, Secretary |

|

(Last)

(First)

(Middle)

3556 LAKE SHORE ROAD, P.O. BOX 2028 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/1/2021 |

|

(Street)

BUFFALO, NY 14219-0228

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Performance Stock Unit (March 2021) (1) | 3/1/2021 | | A | | 1642 | A | $0 | 1642 | D | |

| Restricted Stock Unit (LTIP 3/1/2021) (2) | 3/1/2021 | | A | | 274 | A | $0 | 274 | D | |

| Discretionary RSU (March 2021) (3) | 3/1/2021 | | A | | 460 | A | $0 | 460 | D | |

| Common Stock (4) | 3/1/2021 | | A | | 3608 | A | $0 | 9772 | D | |

| Common Stock (5) | 3/1/2021 | | F | | 1574 | D | $88.06 | 8198 | D | |

| Performance Stock Units (March 2018) (6) | 3/1/2021 | | D | | 3608 | D | $0 | 0 | D | |

| Common Stock (7) | 3/1/2021 | | A | | 158 | A | $0 | 8356 | D | |

| Common Stock (8) | 3/1/2021 | | F | | 67 | D | $88.06 | 8289 | D | |

| Restricted Stock Units (LTIP 3/1/2018) (9) | 3/1/2021 | | D | | 158 | D | $0 | 158 | D | |

| Common Stock (7) | 3/1/2021 | | A | | 135 | A | $0 | 8424 | D | |

| Common Stock (8) | 3/1/2021 | | F | | 57 | D | $88.06 | 8367 | D | |

| Restricted Stock Unit (LTIP 3/1/2019) (10) | 3/1/2021 | | D | | 135 | D | $0 | 272 | D | |

| Common Stock (7) | 3/2/2021 | | A | | 111 | A | $0 | 8478 | D | |

| Common Stock (8) | 3/2/2021 | | F | | 47 | D | $84.10 | 8431 | D | |

| Restricted Stock Unit (LTIP 3/2/2020) (11) | 3/2/2021 | | D | | 111 | D | $0 | 333 | D | |

| Common Stock (401k) | | | | | | | | 333.905 | I | 401k |

| Performance Stock Unit (March 2019) | | | | | | | | 3775 | D | |

| Performance Stock Unit (March 2020) | | | | | | | | 2914 | D | |

| RSU (LTIP 4/3/2017) | | | | | | | | 127 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Unit (2018 MSPP Match) (12) | (13) | | | | | | | (13) | (13) | Common Stock | 138.45 | | 138.45 | D | |

| Explanation of Responses: |

| (1) | Represents Performance Units which will be awarded to Reporting Person under the Company's Equity Incentive Plan upon achievement of the targeted return on invested capital for 2021. The maximum number of Performance Units which may be earned is two hundred percent (200%) of the Performance Units awarded for target level performance and the minimum number of Performance Units which may be earned is zero (0) Performance Units. |

| (2) | Represents restricted stock units awarded as part of the Company's Long Term Incentive Plan. Twenty-five percent (25%) of the total units awarded vest and are payable solely in shares of common stock of the Company, on March 1st, 2022 and on each March 1st thereafter through March 1st, 2025. |

| (3) | Represents Discretionary Restricted Stock Units awarded to Reporting Person. Discretionary Restricted Stock Units vest and are payable, solely in shares of common stock of the Company, at the end of three (3) consecutive calendar year periods beginning on March 1st, 2021 ending on March 1st, 2024 or, if earlier, upon death or disability. Restricted Stock Units are forfeited if employment is terminated before March 1st, 2024, for reasons other than death or disability. |

| (4) | Represents the conversion of performance stock units to shares of common stock upon vesting. |

| (5) | Represents common stock retained by the Company upon conversion of Reporting Person's performance stock units into shares of common stock in satisfaction of Reporting Person's individual minimum statutory withholding obligation. |

| (6) | Represents Performance Units which were distributed to the Reporting Person under the Company 's Equity Incentive Plan upon achievement of the targeted return on invested capital for 2018. The maximum number of Performance Units which may be earned is two hundred percent (200%) of the Performance Units awarded for target level performance and the minimum number of Performance Units which may be earned is zero (0) Performance Units. |

| (7) | Represents the conversion of restricted stock units awarded as part of the Company 's Long Term Incentive Plan into common stock upon vesting. |

| (8) | Represents common stock retained by the Company upon conversion of Reporting Person's restricted stock units into shares of common stock in satisfaction of the Reporting Person's individual minimum statutory withholding obligation. |

| (9) | Represents restricted stock units awarded as part of the Company 's Long Term Incentive Plan. Twenty-five percent (25%) of the total units awarded vest and are payable, solely in shares of common stock of the Company, on March 1, 2019 and on each March 1st thereafter through March 1, 2022. |

| (10) | Represents restricted stock units awarded as part of the Company 's Long Term Incentive Plan. Twenty-five percent (25%) of the total units awarded vest and are payable, solely in shares of common stock of the Company, on March 1st, 2020 and on each March 1st thereafter through March 1st, 2023. |

| (11) | Represents restricted stock units awarded as part of the Company's Long Term Incentive Plan. Twenty-five percent (25%) of the total units awarded vest and are payable solely in shares of common stock of the Company, on March 2nd, 2021 and on each March 2nd thereafter through March 2nd, 2024. |

| (12) | Represents matching restricted stock units allocated to the Reporting Person with respect to the Reporting Person's deferral of a portion of their annual cash incentive compensation pursuant to the Company's 2018 Management Stock Purchase Plan. |

| (13) | Restricted stock units are forfeited if Reporting Person's service as an officer of the Company is terminated prior to the fifth (5th) anniversary of the Reporting Person's vesting commencement date. If service as an officer continues beyond the fifth (5th) anniversary of the Reporting Person's vesting commencement date, restricted stock units are payable solely in cash in one lump sum payment or in five (5) or ten (10) consecutive, substantially equal annual installments, whichever distribution form is elected by the Reporting Person, beginning six (6) months following termination of service. Each restricted stock unit is converted to cash in an amount equal to the fair market value of one share of the Company's common stock, as defined in the Company's 2018 Management Stock Purchase Plan, on the date of termination of the Reporting Person's service as an officer of the Company. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Watorek Jeffrey J.

3556 LAKE SHORE ROAD

P.O. BOX 2028

BUFFALO, NY 14219-0228 |

|

| VP, Treasurer, Secretary |

|

Signatures

|

| /s/ Lori A. Rizzo, Attorney-in-Fact for Jeffrey J. Watorek | | 3/3/2021 |

| **Signature of Reporting Person | Date |

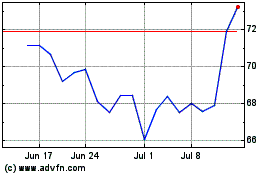

Gibraltar Industries (NASDAQ:ROCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gibraltar Industries (NASDAQ:ROCK)

Historical Stock Chart

From Apr 2023 to Apr 2024