false000088674400008867442024-01-082024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 08, 2024

GERON CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

000-20859 |

75-2287752 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

919 E. HILLSDALE BLVD., SUITE 250

FOSTER CITY, CALIFORNIA 94404

(Address of principal executive offices, including zip code)

(650) 473-7700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 par value |

GERN |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1

|

|

Item 2.02 |

Results of Operations and Financial Condition. |

Geron Corporation (the “Company” or “Geron”) will participate in various meetings with securities analysts and investors during the 42nd Annual J.P. Morgan Healthcare Conference the week of January 8, 2024, and will utilize a presentation handout during those meetings. Such presentation handout discloses that Geron expects to report that, as of December 31, 2023, it had cash, cash equivalents, restricted cash and current and non-current marketable securities of approximately $376.9 million. The aforementioned financial information is included on slide #30 of the presentation handout, as furnished in Exhibit 99.1 to this Current Report, and is incorporated herein by reference. The Company has not yet completed its financial close process for the quarter and year ended December 31, 2023. This estimate of the Company’s cash, cash equivalents, restricted cash and current and noncurrent marketable securities as of December 31, 2023, is preliminary, unaudited and is subject to change upon completion of the Company’s financial statement closing procedures and the audit of the Company’s consolidated financial statements.

|

|

Item 7.01 |

Regulation FD Disclosure. |

Geron will participate in various meetings with securities analysts and investors during the 42nd Annual J.P. Morgan Healthcare Conference the week of January 8, 2024, and will utilize a presentation handout during those meetings. The presentation handout, together with a slide setting forth certain cautionary language intended to qualify the forward-looking statements included in the presentation handout, is furnished as Exhibit 99.1 to this Current Report and is incorporated herein by reference. The presentation handout will also be made available in the Investors section of Geron’s website, located at www.geron.com.

The information contained in Items 2.02 and 7.01 and in the accompanying Exhibit 99.1 to this Current Report shall be deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act, and shall not be incorporated by reference into any filing made by the Company with the U.S. Securities and Exchange Commission under the Securities Act or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

GERON CORPORATION

|

|

|

|

|

Date: |

January 8, 2024 |

|

By: |

/s/ Scott A. Samuels |

|

|

|

Name: |

Scott A. Samuels |

|

|

|

Title: |

Executive Vice President, |

|

|

|

|

Chief Legal Officer and |

|

|

|

|

Corporate Secretary |

3

Company Logo Enhancing the Lives of Patients with Hematologic Malignancies Corporate Presentation January 2024

Forward-Looking Statements and Safe Harbor Except for the historical information contained herein, this presentation contains forward-looking statements made pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such statements, include, without limitation, those regarding: (i) that the Company is on target for successful transition to a commercial company in 2024; (ii) plans for approval and a potential launch of imetelstat in TD LR-MDS in the U.S. by the end of the first half of 2024 and for the MAA review to be completed by the end of 2024, with potential EU approval and launch in 2025; (iii) that imetelstat has showed unprecedented durability of transfusion independence across multiple MDS patient subgroups that are not addressed by currently available products, and is a differentiated first-in-class investigational telomerase inhibitor; (iv) that for the Phase 3 IMpactMF in R/R MF, Geron expects to conduct an interim analysis in the first half of 2025 and the final analysis in the first half of 2026, together with the assumptions used in making these estimates; (v) that the Company believes imetelstat has a potential total addressable market (TAM) in the US/EU of greater than $3.5B in TD LR-MDS and greater than $3.5B in R/R MF in 2031; (vi) the status, plans and expected timing of the Company’s clinical programs on its pipeline chart; (vii)that imetelstat has the potential to have disease-modifying activity in patients; (viii) the Company’s estimates and assumptions used in the calculations of percentages and numbers of patients in the treatment landscape for LR-MDS; (ix) that the Company expects imetelstat to be a highly differentiated product in the TD LR-MDS commercial marketplace; (x) that there are unmet needs in TD LR-MDS and R/R MF potentially addressed with imetelstat treatment; (xi) the Company’s market research used to obtain the views of practicing hematologists of the IMerge Phase 3 data and the opportunity in TD LR-MDS patients, including the characteristics of imetelstat and the Phase 3 data that support the expectation that imetelstat can become a compelling treatment option and standard of care with a significant market opportunity;(xii) that the Company is well-positioned for a successful launch of imetelstat, if approved, and the Company’s plans and expectations regarding launch preparations; (xiii) the Company’s assumptions and expectations regarding the expected opportunity for imetelstat in R/R MF; (xiv) the Company’s estimates of cash and marketable securities and operating expenses as of December 31, 2023; (xv) the Company’s projections and expectations regarding the sufficiency of its cash resources and expected available resources to fund its projected operating requirements into Q3 2025, and the assumptions underlying such projections and expectations; (xvi) the Company’s estimates and assumptions used in the calculations of total addressable market (TAM); and (xvii) other statements that are not historical facts, constitute forward-looking statements. These forward-looking statements involve risks and uncertainties that can cause actual results to differ materially from those in such forward-looking statements. These risks and uncertainties, include, without limitation, risks and uncertainties related to: (a) whether the FDA and EMA may have issues with the NDA or MAA for imetelstat for TD LR-MDS that delay or prevent approval and a potential commercial launch; (b) whether we will be able to continue to develop imetelstat or advance imetelstat to subsequent clinical trials, or that we will be able to receive regulatory approval for or successfully commercialize imetelstat, on a timely basis or at all; (c) whether imetelstat may cause, or have attributed to it, adverse events that could further delay or prevent the commencement and/or completion of clinical trials, delay or prevent its regulatory approval, or limit its commercial potential; (d) whether the IMpactMF Phase 3 trial for R/R MF has a positive outcome and demonstrates safety and effectiveness to the satisfaction of the FDA and international regulatory authorities, and whether our projected rates for enrollment and death events differ from actual rates, which may cause the interim and final analyses to occur later than anticipated; (e) whether we overcome all of the enrollment, clinical, safety, efficacy, technical, scientific, intellectual property, manufacturing and regulatory challenges in order to have the financial resources for, and to meet the expected timelines and planned milestones; (f) if imetelstat is approved for marketing and commercialization, whether we are able to establish and maintain effective sales, marketing and distribution capabilities, obtain adequate coverage and third-party payor reimbursement, and achieve adequate acceptance in the marketplace; (g) whether imetelstat actually demonstrates disease-modifying activity in patients; (h) whether there are failures in manufacturing or supplying sufficient quantities of imetelstat that would delay, or not permit, the anticipated commercial launch or not enable ongoing or planned clinical trials; (i) whether we are able to obtain and maintain the exclusivity terms and scopes provided by patent and patent term extensions, regulatory exclusivity, and have freedom to operate;(j) that we may be unable to successfully commercialize imetelstat due to competitive products, or otherwise; (k) that we may decide to partner and not to commercialize independently in the U.S. or in Europe and other international markets; (l) whether we have sufficient resources to satisfy our debt service obligations and to fund our planned operations; (m) that we may seek to raise substantial additional capital in order to complete the development and commercialization of imetelstat and to meet all of the expected timelines and planned milestones, and that we may have difficulty in or be unable to do so; and (n) the impact of general economic, industry or political climate in the U.S. or internationally and the effects of macroeconomic conditions on our business and business prospects, financial condition and results of operations. Additional information on the above risks and uncertainties and additional risks, uncertainties and factors that could cause actual results to differ materially from those in the forward-looking statements are contained under the heading “Risk Factors” or other similar headings found in documents Geron files from time to time with the Securities and Exchange Commission (the “SEC”), including the Company’s Report on Form 10-Q for the quarter ended September 30, 2023 and subsequent filings. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made, and the facts and assumptions underlying the forward-looking statements may change. Except as required by law, Geron disclaims any obligation to update these forward-looking statements to reflect future information, events or circumstances. Company Logo 2

Geron is On Target for a Successful Transition to Commercial Company in 2024 PDUFA date of June 16, 2024 for imetelstat in transfusion-dependent (TD) LR-MDS* MAA review completion expected by end-2024, with potential EU approval and launch in 2025 Imetelstat Ph3 data showed unprecedented durability of transfusion independence (TI) across multiple MDS patient subgroups not addressed by currently available products Additional Ph3 trial of imetelstat ongoing in relapsed/refractory myelofibrosis (R/R MF) with an interim analysis expected first half of 2025 Significant commercial opportunities with TD LR-MDS total addressable market (TAM) >$3.5B and R/R MF TAM >$3.5B in 2031 (U.S./EU)^ *Imetelstat is currently under regulatory review by FDA and EMA for the treatment of transfusion-dependent anemia in adult patients with low- to intermediate-1 risk myelodysplastic syndromes (LR- MDS) who have failed to respond or have lost response to or are ineligible for erythropoiesis-stimulating agents (ESAs). Platzbecker, Santini et al. The Lancet 2023 ^see slide 33 for more information on TAM and patient numbers Company Logo 3

Exploring the Broad Potential of Imetelstat and Telomerase Inhibition Indications Discovery Preclinical Phase 1 Phase 2 Phase 3 TD LR-MDS Single Agent R/R MF Single Agent Frontline MF Combination Therapy R/R AML & HR MDS Single Agent R/R AML Combination Therapy Lymphoid Malignancies Next Generation TI Program IMerge IMpactMF IMproveMF IMpress TELOMERE Ongoing; Investigator Led Planned; Investigator Led Ongoing; Company Sponsored Interim Analysis est.: 1H 2025 Final Analysis est.: 1H 2026 First patient dosed Jun. 2023 Experiments ongoing Leads identified; optimization ongoing Escalated to second dose cohort Oct. 2023 To follow single agent data from IMpress U.S. PDUFA: June 16, 2024 EU MAA under review TD LR-MDS: transfusion-dependent lower-risk myelodysplastic syndromes; R/R MF: relapsed/refractory myelofibrosis; MF: myelofibrosis; R/R AML: relapsed/refractory acute myeloid leukemia; HR MDS: higher risk myelodysplastic syndromes; TI: telomerase inhibitor; PDUFA: Prescription Drug User Fee Act; MAA: marketing authorization application Company Logo 4

Imetelstat is a First-in-Class Telomerase Inhibitor Based on Nobel-Prize Winning Science Potentially powerful mechanism for treating hematologic malignancies Evidence for potential disease modification Clinical efficacy: durable TI (TD LR- MDS Ph3); improved overall survival (R/R MF Ph2) Molecular data: reductions in variant allele frequency (VAF) and depletion of mutated abnormal cells associated with disease Imetelstat is designed to target malignant clones at their source and enable recovery of healthy blood cell production Malignant clones Upregulated telomerase Apoptotic malignant clones Telomerase is continually upregulated in malignant cells Imetelstat binds to telomerase, inhibiting its activity Apoptosis of malignant cells and recovery of effective hematopoiesis Inhibition of telomerase Murati et al, BMC Cancer 2012; Shih et al, Rev Cancer 2012; Ntziachristos et al, Adv Immunol 2013; Vardiman et al, Blood 2009; Kittur et al, Cancer 2007; Anastasi J Hematol Oncol Clin North Am. 2009; Hiyama et al, J Immunol 1995; Hiyama et al, Br J Cancer 2007; Bruedigam et al, Cell Stem Cell 2014;Mosoyan et al, Leukemia 2017; Wang et al, Blood Adv 2018; Steensma et al, JCO 2020; Platzbecker et al, ASH 2020; Mascarenhas et al, JCO 2021; Mascarenhas et al, ASH 2018 and 2020 and EHA 2021; Platzbecker, Santini et al, The Lancet 2023. Company Logo 5

Transfusion-Dependent Lower-Risk MDS PDUFA date of June 16, 2024* *Imetelstat is currently under regulatory review in the U.S. and EU for the treatment of transfusion-dependent anemia in adult patients with low- to intermediate- 1 risk myelodysplastic syndromes (MDS) who have failed to respond or have lost response to or are ineligible for erythropoiesis-stimulating agents (ESAs). Company Logo 6

Lower-Risk MDS Patient Experience Diagnosis Median age ~70 years Symptomatic Anemia Increasing Transfusion Dependence Lengthy Office Visits High-CostBurden Poor Quality of Life Shortened Survival Higher Risk of Progression to AML Symptomatic anemia and transfusion dependence are key drivers of patient burden and poor quality of life DRG MDS Landscape & Forecast 2022, Mangaonkar, et al., Blood Cancer Journal 2018; Giagounidis, et al. Clinical Cancer Research 2016; Incidence and Outcomes for Low Risk MDS, ASH 2012; Greenberg et al, Blood 2012; Feneaux et al, JCO 2017; Platzbecker et al, Blood 2019; Cogle et al, Curr Hematol Malig Rep 2015; Greenberg et al Blood 1997; Greenberg et al, Blood 1997.Company Logo 7

Treatment Landscape for LR-MDS Continuing unmet need presents significant opportunity for imetelstat; ~$3.5B TAM in 2031 (U.S./EU)^ Lower Risk MDS (~70%) HR MDS Symptomatic Anemia (~90%) Second line & later RS+/RS- RS+ (~25%) RS- (~75%) Luspatercept ESAs - preferred Luspatercept – other recommended NCCN Guidelines (updated Oct. 2023) sEPO (>500 mU/mL) (~10%) ESAs and luspatercept are among the agents approved in this first-line setting. Clinical trials preferred. Other options include HMAs and immunosuppressive drugs 1st line sEPO (>500 mU/mL) (~10%) Adapted from LR MDS NCCN Guidelines Oct 2023; Ring sider oblasts present in ~23%–33% of patients with MDS and are associated with anemia (references: 2. PapaemmanuilE, GerstungM, MalcovatiL, et al. Clinical and biological implications of driver mutations in myelodysplastic syndromes. Blood. 2013;122(22):3616-3627.3. MalcovatiL, CazzolaM. Recent advances in the understanding of myelodysplastic syndromes with ring sider oblasts. Br J Haematol. 2016;174(6):847-858. ^see slide 33 for more information on TAM and patient numbers Significant potential opportunity for imetelstat: Frontline ESA ineligible (~4k)^ ESA-failed, RS+ (~8k)^ ESA-failed, RS- (~24k)^ Complex presentations Company Logo

Differentiated Imetelstat Profile in IMerge Phase 3 Robust & Durable Response 1-year median TI duration 2.4 years median TI duration 1.3 years duration Broad Response Across MDS Subgroups RS+ and RS- High and very high transfusion burden sEPO level greater than or less than 500 mU/mL Low or intermediate-1 IPSS risk category the most common adverse events were thrombocytopenia and neutropenia that were manageable and of short duration Well Characterized Safety Profile 40% = 8-wk RBC-TI response rate; 3.6 g/dL median Hgb rise 18% = 1-yr RBC-TI response rate; 5.2 g/dL median Hgb rise 60% transfusion reduction by =4U/8 wks; 1.4 g/dL median Hgb rise 50% of imetelstat-treated patientsreported less fatigue (PRO data) =50% VAF reduction in commonly mutated MDS genes experienced by more imetelstat-treated patients vs placebo Additional Attributes Platzbecker, Santini et al. The Lancet 2023 Additional IMerge data including placebo comparisons included on slides 10-17 Company Logo 9

Durable Transfusion Independence and Significant Response Rates Observed with Imetelstat 17.8% 28.0% 39.8% 1.7% 3.3% 15.0% 0.05.010.015.020.025.030.035.040.045.050.0Percentageof patients (%) P<0.001P=0.002P<0.001 52 weeks median duration 80 weeks median duration 123 weeks median duration = 1-yearTI= 24-week TI= 8-week TI Imetelstat (n=118) Placebo (n=60) 8, 16, 24-weekdatacutoffwas October 2022;1-year represents 3 additional months of data(cut off January2023) P-value isbasedon Cochran Mantel Haenszel test stratified for prior RBC transfusion burden(=6unitsor >6unitsofRBCs/8weeks) and baseline IPSS risk score (Lowor Intermediate-1) 8-weekTI= proportion of patients without any RBC transfusion for at least eight consecutive weeks since entry to the trial; 16-weekTI =proportion of patients without any RBC transfusion for at least 16consecutiveweekssince entry to the trial; 24-weekTI= proportion of patients without any RBC transfusion for at least 24 consecutive weeks since entry to the trial; 1-yearTI =proportion of patients without any RBC transfusion forat least 52consecutive weeks since entry to the trial Platzbecker, Santiniet al. The Lancet 2023 Company Logo 10

Significant Hemoglobin Rises and Reduction in Transfusions Observed with Imetelstat 3.6 g/dL median Hgb rise in 8wk RBC-TI responders =4U/8 wks transfusion reduction in ~60% of imetelstat-treated patients P-value is based on a mixed model for repeated measures with change in RBC transfusion as the dependent variable, week, stratification factors, prior transfusion burden, and treatment arm as the independent variables with autoregressive moving average (ARMA(1,1) covariance structure. NOTE: graph starts at Week 1-8 with the number of the patients with transfusion follow-up data available at least eight weeks on study for imetelstat and placebo arms Number of patients Line Chart The mean changes from the minimum Hgb of the values that were after 14 days of transfusions in the eight weeks prior to the first. Data points that have fewer than four patients are not shown. P-value is based on a mixed model for repeated measures with Hgb change as the dependent variable, week, stratification factors, dose date, and treatment arm as the independent variables with autoregressive moving average (ARMA(1,1) covariance structure. Number of patients Platzbecker, Santini et al. The Lancet 2023 Company Logo 11

Consistent Responses Observed Across MDS Subgroups with Imetelstat (= 8-wk RBC-TI Responses) Imetelstat, n/N (%) Placebo, n/N (%) % Difference (95% CI) p-value Overall 47/118 (39·8) 9/60 (15·0) 24·8 (9·9–36·9) <0·001 WHO category^ RS+ 33/73 (45·2) 7/37 (18·9) 26·3 (5·9–42·2) 0·016 RS- 14/44 (31·8) 2/23 (8·7) 23·1 (-1·3 to 40·6) 0·038 Prior RBC transfusion burden per IWG 2006 4-6 U/8 wk 28/62 (45·2) 7/33 (21·2) 23·9 (1·9–41·4) 0·027 >6 U/8 wk 19/56 (33·9) 2/27 (7·4) 26·5 (4·7–41·8) 0·023 IPSS risk category Low 32/80 (40·0) 8/39 (20.5) 19·5 (-0·1 to 35·2) 0·034 Intermediate-1 15/38 (39·5) 1/21 (4·8) 34·7 (8·8–52·4) 0·004 Baseline sEPO =500 mU/mL 39/87 (44·8) 7/36 (19·4) 25·4 (5·27–40·70) 0·011 >500 mU/mL 7/26 (26·9) 2/22 (9·1) 17·8 (-8·17 to 40·25) 0·107 -20 -10 0 10 20 30 40 50 60 Favors Imetelstat Favors Placebo Cochran Mantel Haenszel test stratified for prior RBC transfusion burden (=6 units or >6 units of RBCs/8 weeks) and baseline IPSS risk score (Low or Intermediate-1) ^ One patient on imetelstat arm missing RS category Platzbecker, Santini et al. The Lancet 2023 Company Logo 12

Consistent Responses Observed Across MDS Subgroups with Imetelstat (≥ 24-wk RBC-TI Responses) IMERGE Imetelstat, n/N (%) Placebo, n/N (%) % Difference (95% CI) p-value Overall 33/118 (28⋅0) 2/60 (3⋅3) 24⋅6 (12⋅64–34⋅18) <0⋅001 WHO category^ RS+ 24/73 (32⋅9) 2/37 (5⋅4) 27⋅5 (10⋅0–40⋅37) 0⋅003 RS- 9/44 (20⋅5) 0/23 (0⋅0) 20⋅5 (-0⋅03 to 35⋅75) 0⋅019 Prior RBC transfusion burden per IWG 2006 4-6 U/8 wk 19/62 (30⋅6) 2/33 (6⋅1) 24⋅0 (5⋅68–38⋅66) 0⋅006 >6 U/8 wk 14/56 (25⋅0) 0/27 (0⋅0) 26⋅5 (6⋅44–38⋅65) 0⋅001 IPSS risk category Low 23/80 (28⋅8) 2/39 (5⋅1) 23⋅6 (7⋅23–35⋅75) 0⋅003 Intermediate-1 10/38 (26⋅3) 0/21 (0⋅0) 26⋅3 (3⋅46–43⋅9) 0⋅009 Baseline sEPO ≤500 mU/mL 29/87 (33⋅3) 2/36 (5⋅6) 27.8 (10.46–39.1) 0.002 >500 mU/mL 4/26 (15⋅4) 0/22 (0⋅0) 15.4 (-5.81 to 35.73) 0.050 Favors Placebo -20 -10 0 Favors Imetelstat 10 20 30 40 50 60 . Cochran Mantel Haenszel test stratified for prior RBC transfusion burden (≤6 units or >6 units of RBCs/8 weeks) and baseline IPSS risk score (Low or Intermediate-1) ^ One patient on imetelstat arm missing RS category Platzbecker, Santini et al. The Lancet 2023 Company Logo 13

Improvement in Patient-Reported Fatigue Associated with Clinical Responses with Imetelstat IMERGE Significant patient-reported fatigue improvements in 8 and 24-wk RBC-TI responders Sustained meaningful improvement in fatigue reported in imetelstat-treated patients Imetelstat Responders Imetelstat Nonresponders Placebo Responders Placebo Nonresponders 10 20 30 40 50 60 70 80 0 70.2 36.6 33.3 41.7 72.7 41.2 50.0 40.0 8-Week RBC-T1 24-Week RBC-T1 Patients,nN Responders 33/47 3/9 2433 1/2 Nonresponders 26/71 20/48 35/85 2255 Sustained Improvement in FACIT Fatigue,% Time to first sustained Improvement in the FACIT- Fatigue scorew, weeks Imetelstat Placebo Number at risk line chart Kaplan-Meier estimate of time to first sustained meaningful improvement in the FACIT Fatigue score. HR is from the Cox proportional hazard model, stratified by prior RBC transfusion burden (>4 to >vs>6 RBC units/8-weeks during a 16-week period prior to randomization) and baseline IPSS risk category (low vs intermediate- 1), with treatment as the only covariate. Imetelstat Placebo Sustained improvement for >2 cycles Patients,% line chart Company Logo14

Significant Reductions in Variant Allele Frequency (VAF) of Genes Frequently Mutated in MDS with Imetelstat IMERGE . Among patients with evaluable mutation data, the maximum reductions in VAF of the SF3B1, TET2, DNMT3A and ASXL1 genes were greater with imetelstat than placebo . VAF reduction correlated with longer RBC-TI duration and increases in hemoglobin levels in patients treated with imetelstat Note: Analyses included patients in the intent-to-treat population with a detectable mutant allele for the indicated gene (≥5%) prior to treatment and ≥1 postbaseline mutation assessment and had postbaseline Hgb assessment, excluding assessments within 14 days post-RBC transfusion. Fitted lines and P value based on linear regression with maximum increase in RBC-TI duration or maximum increase in Hgb from pretreatment as the dependent variable and the maximum percentage reduction from baseline in each gene VAF as independent variable. DNMT3A: DNA (cytosine-5)-methyltransferase 3A; RBC: red blood cell; Hgb: hemoglobin; TET2,: Tet methylcytosine dioxygenase 2; SF3B1: splicing factor 3b subunit 1. Platzbecker, Santini et al. The Lancet 2023 Maximum % Change in VAF in Blood line chart SF3B1 TET2 DNMT3A ASXL1 Imetelstat Placebo Company Logo15

The Most Common AEs were Manageable, Short-Lived Thrombocytopenia and Neutropenia IMERGE Consistent with prior clinical experience, the most common imetelstat AEs were hematologic Grade 3-4 cytopenias were generally of short duration and reversible Grade 3-4 thrombocytopenia and neutropenia most often reported during Cycles 1-3 • Non-hematologic AEs were generally low grade • No cases of Hy’s Law or drug-induced liver injury observed 80% of events were reversible to grade ≤ 2 within 4 weeks AEs(>10% of patients), n (%) Imetelstat (N=118) Placebo (N=59) Any Grade Grade3-4 Grade 3-4 Hematologic Thrombocytopenia Neutropenia Anemia Leukopenia line chart Grade 3-4 cytopenias Per Lab Value Imetelstat Placebo Thrombocytopenia Median duration, weeks (range) Resolved within 4 weeks,% Neutropenia Median duration, weeks (range) Resolved within 4 weeks,% Line Chart Geron Market Research, U.S./EU3 Jan 2023 Company Logo16

Grade 3-4 Cytopenias were Manageable with Low Incidence of Clinical Consequences IMERGE Clinical consequences of grade 3–4 infection and bleeding were low and similar for imetelstat and placebo Infections were not common in the setting of grade 3-4 neutropenia and were similar for imetelstat and placebo Imetelstat AEs were manageable with supportive care and dose modifications Most AEs leading to dose modifications were grade 3–4 neutropenia and thrombocytopenia <15% of patients discontinued treatment due to TEAEs 74% of patients treated with imetelstat had dose modifications due to AEs Imetelstat discontinuation due to TEAE generally occurred late in treatment (21.1 wks median time to treatment discontinuation; range, 2.3 to 44.0 weeks) 18% of imetelstat-treated patients received a median of 1 platelet transfusion per patient; 34% of imetelstat-treated patients received growth factor support Bleeding events were not reported in the setting of grade 3-4 thrombocytopenia Any infection AE within ± 7 days of Grade 3-4 neutropenia Grade 3-4 infection AE Febrile neutropenia Imetelstat N = 118 Placebo N = 59 line chart Any bleeding AE within ± 7 days of Grade 3-4 thrombocytopenia Imetelstat N = 118 Placebo N = 59 Grade 3-4 bleeding AE Geron Market Research, U.S./EU3 Jan 2023 Company Logo 17

IMerge Phase 3 Data Received Favorably by Surveyed Practicing Hematologists Across U.S./EU Key Markets Key attributes of imetelstat resonated strongly with community and academic hematologists Totality of Clinical Benefit Compelling TI rates across RS subgroups, sustained reduction of RBC units, and continuous rise of Hgb levels Meaningful Durability of Response 16- and 24-week TI data regarded as more robust than current standard of care SAFETY EFFICACY Predictable AE Profile, Manageable Cytopenias Given the familiar AE profile with transient cytopenias, physicians expect to use imetelstat in their LRMDS patients across both community and academic settings Geron Market Research, U.S./EU3 Jan 2023 Company Logo18

Hematologists’ Feedback Confirms Imetelstat Opportunity Across RS Subtypes and High Transfusion Burden Patients Imetelstat’s novel mechanism of action (MOA) is seen as a key driver for future market adoption Imetelstat is projected to be part of the standard of care across both RS- and RS+ patient subtypes In ESA R/R patient segment, durability of TI with imetelstat considered compelling Imetelstat is significantly differentiated in high transfusion burden patients Physicians view imetelstat’s novel/first-in-class MOA together with its durability of response as highly compelling, differentiating and as a foundation for imetelstat’s efficacy Physicians express a clear preference to use imetelstat first for their frontline RS-ESA-ineligible patients and across all luspatercept priortreated patients, given the significant efficacy shown by imetelstat and dissatisfaction with current treatments Physicians note that imetelstat demonstrated significant improvements in long-term response (24-week TI) over available options, especially in RSpopulation; additional clinical experience may increase comfort to prescribe before currently available options Physicians believe that in high transfusion burden patients, imetelstat may be a compelling option over currently approved therapies Geron Market Research, U.S./EU3 Jan 2023 Company Logo 19

Imetelstat Expected to Become New Standard-of-Care in Second-Line TD LR-MDS, ~32k patients by 2031 (U.S./EU) • Imetelstat is expected to be used in the second-line regardless of frontline use with either ESAs or luspatercept • Imetelstat is expected to be used in the frontline in the majority of patients who are ESA-ineligible (sEPO ≥500 U/L) Expected Second Line Usage Expected Front Line Usage ESA-experienced frontline patients luspatercept -experiencs ESA-ineligible patients (sEPO ≥500 U/L) line chart ESA Luspatercept Imetelstat HMA Other Based on U.S. market research with 50 practicing community and academic hematologists Geron Market Research with U.S. based practicing hematologists (N=50), May 2023; share estimates represent unadjusted physician preference shares across key patient segments and are directional. Utilization percentages were calculated using a weighted average of RS+ and RS- utilization estimates (1/3 RS+ and 2/3 RS- LR-MDS segmentations were assumed). Stimuli included Imetelstat Phase 2 data, Phase 3 topline results and publicly available data on other LR MDS therapies Company Logo 20

Imetelstat Expected to Become Important New Option in RS-Subgroup, Comprising 75% of LR-MDS Patients Expected Second Line Usage Expected Front Line Usage Imetelstat is expected to be used second line ESA-experienced luspatercept-experienced ESA-ineligible patients following ESAs in the majority of RS-patients frontline patients frontline patients(sEPO>=500 U/L) Imetelstat is expected to be used in the majority of second line patients following luspatercept regardless of RS status 11% 15% 28% 22% 16% 18% 53% 55% 41% 14% 13% 11% 1% 2% 14% 16% 26% 42% 14% 30% 35% 56% 32% 9% 14% 10% 2% RS+ve RS-ve RS+ve RS-ve RS+ve RS-ve ESA Luspatercept Imetelstat HMA Other Based on U.S. market research with 50 practicing community and academic hematologists Geron Market Research with U.S. based practicing hematologists (N=50), May 2023;share estimates represent unadjusted physician preference shares across key patient segments and are directional. Utilization percentages were calculated using a weighted average of RS+ and RS-utilization estimates (1/3 RS+and2/3 RS-LR-MDS segmentations were assumed). Stimuli included Imetelstat Phase 2 data, Phase3 top line results and publicly available data on other LR-MDS therapies 21 Company Logo

Well-Positioned for U.S. Launch Upon Potential Approval Prepare the Market Prepare Imetelstat Prepare Geron Experienced commercial and medical affairs teams fully-onboarded; field reimbursement and sales onboarding expected Q1-Q2 2024 Goal: Ensure broad access and reimbursement and deliver a seamless customer experience to all stakeholders Commercial and medical affairs leadership hired Sales force hiring on track for Q1-Q2 2024 Infrastructure development on track Commercial third-party logistics and specialty distribution network finalized Global trademark secured Value proposition messaging on target Comprehensive market access; payor and medical stakeholder engagement plan on target (majority of U.S. patients are treated under Medicare Part B) Concentrated prescriber base identified Pivotal Ph3 I Merge data published in The Lancet; additional publication planning on target HUB system finalized; patient access and affordability solutions on target 22 COMPANY LOGO

Imetelstat in Relapsed/Refractory MF Evaluating potential improved survival Company Logo 23

Expected MF Market Evolution and Imetelstat Opportunity Continuing unmet need in JAKi-treated patients presents significant opportunity for imetelstat; ~$3.5B TAM in 2031 (U.S./EU)^ We expect the future MF market to expand significantly with potential approvals of JAKi-based combination regimens and treatments that address anemia in MF patients. Agents in development today have primary endpoints focused on addressing spleen, symptoms and anemia Int-2/High Risk MF Patients Treated with JAK Inhibitors ~75% discontinuation rate after 5 years Potential Patient Population (2031): ~29,000 JAKi-treated MF patients Almost all JAKi-treated patients expected to become unresponsive to JAKis and eligible for imetelstat Unresponsive to JAK Inhibitors (JAKi) median OS ~14 – 16 months per literature reviews ^see slide 33 for more information on TAM and patient numbers 24 Company Logo

50% enrolled as of Nov 2023 First and Only Phase 3 Trial in MF with OS as Primary Endpoint Statistically well-powered trial Designed with >85% power to detect a 40% reduction in the risk of death in the imetelstat arm compared to best available therapy (BAT; hazard ratio=0.60; one-sided alpha=0.025) Conservative powering assumptions -Median OS: 14 mos for BAT vs 23 mos for imetelstat Planned analyses Interim Analysis expected in 1H 2025 when ~35% of the planned enrolled patients have died; alpha spend ~0.01 Final Analysis expected in 1H 2026 when >50% of the planned enrolled patients have died ClincialTrials.gov(NCT0457615) Actively enrolling global trial Sites across United States, South America, Europe, Australia and Asia Logo Primary Endpoint: Overall survival (OS) Key Secondary Endpoints: Symptom response Spleen response Patient Reported Outcomes (PROs) Company Logo 25

Improvement in overall survival (OS) observed for JAKi relapsed/refractory MF patients in IMbark Phase 2 14 – 16 mos median OS for historical controls for JAKi relapsed/refractory MF patients 29.9 mos median OS in imetelstat 9.4 mg/kg arm Mascarenhas et al, JCO 2021; Mascarenhas et al, ASH 2018 and 2020; Mascarenhas et al, EHA 2021 Median OS in IMbark Phase 2 Compares Favorably to Historical Controls 29.9 mos Imetelstat 9.4 mg/kg 26 Line Chart Survival probability Number at risk Imetelstat 9.4 MG/KG 59 53 46 42 29 7 Months From First Dose Administration Company Logo26

Kuykendall et al, Annals of Hematol2021 Acknowledging the limitations of such comparative analyses between RWD and clinical trial data, we believe the favorable overall survival (OS) of imetelstat treatment suggested by these comparative analyses in this very poor prognosis patient population warrants further evaluation. IMbark Phase 2 data compared to real world data (RWD) from a closely-matched cohort of patients at the Moffitt Cancer Center who had discontinued ruxolitinib and were subsequently treated with best available therapy (BAT) Survival Probability Evaluating imetelstat vs BAT in JAKi relapsed/refractory MF Improvement in overall survival and lower risk of death for imetelstat vs BAT in RWD study Imetelstat: 33.8 mos median OS BAT RWD: 12.0 mos median OS 65% lower risk of death with imetelstat compared to BAT from RWD OS improvement and lower risk of death for imetelstat vs BAT support IMpactMF Phase 3 trial design Same dose and schedule being used in IMpactMF Phase 3 trial Median OS More than Double vs BAT Treatment in RWD Study 33.8 mos 12.0 mos BAT Moffitt Imetelstat 9.4 mg/kg RWD BAT vs Imetelstat 9.4 mg/kg 27 Company Logo Line Chart

n (%) 9.4 mg/kg (n=59) All Grades Grade = 3 Hematologic (=10% in either arm)§ Thrombocytopenia 29 (49) 24 (41) Anemia 26 (44) 23 (39) Neutropenia 21 (36) 19 (32) Non-hematologic (=20% in either arm) Nausea 20 (34) 2 (3) Diarrhea 18 (31) 0 Fatigue 16 (27) 4 (7) Dyspnea 14 (24) 3 (5) Abdominal Pain 14 (24) 3 (5) Asthenia 14 (24) 6 (10) Pyrexia 13 (22) 3 (5) Edema peripheral 11 (19) 0 Mascarenhas et al, JCO 2021; Mascarenhas et al, ASH 2018 and 2020; Mascarenhas et al, EHA 2021 Manageable Imetelstat Safety Results in IMbark Phase 2 §Treatment emergent, per reported AEs (not laboratory values). Frequency of reported Grade 3/4 hematologic adverse events were consistent with cytopenias reported through lab values. *Reversible to Grade 2 or lower Limited clinical consequences of reversible, on target cytopenias Thrombocytopenia and neutropenia characterization: Short time to onset: Median 9 weeks (~3 cycles) Short duration: Median <2 weeks Reversible: >70% within 4 weeks* Manageable with dose hold and modifications Limited clinical consequences: 2% Grade 3 febrile neutropenia 5% Grade 3/4 hemorrhagic events 10% Grade 3/4 infections 28 Company Logo

Financials & Summary Company Logo 29

Financial resources expected to support projected level of operations into the third quarter 2025* Financial Resources to Support Potential US Commercial Launch of Imetelstat 30 * Based on the Company’s current operating plan and expectations regarding the timing of potential approval of imetelstat in the U.S., the Company expects that its existing cash, cash equivalents, and current and noncurrent marketable securities, together with projected revenues from U.S. sales of imetelstat, proceeds from the exercise of outstanding warrants, and funding under the Company’s loan facility, will be sufficient to fund projected operating requirements into the third quarter of 2025. ~$377M Up to ~$48M $210M Est. cash and marketable securities as of 12/31/23 2023 expected range of GAAP operating expenses Q3 2023 operating expenses $200M to $210M Company Logo

Geron Positioned for Successful Imetelstat Launch, If Approved Underserved TD LR-MDS and R/R MF markets with potential combined TAM >$7B in 2031 (U.S./EU)^ Differentiated first-in-class investigational telomerase inhibitor U.S. commercial preparations on track for expected June 2024 launch People and financial resources to support U.S.launch Imetelstat TD LR-MDS PDUFA Date of June 16, 2024*; MAA under review in same indication *Imetelstat is currently under regulatory review by FDA and EMA for the treatment of transfusion-dependent anemia in adult patients with low- to intermediate-1 risk myelodysplastic syndromes (LR-MDS) who have failed to respond or have lost response to or are ineligible for erythropoiesis-stimulating agents (ESAs). ^see slide 33 for more information on TAM and patient numbers 31 Company Logo

Thank you! Contact: Investor Relationsir@geron.com 32 Company Logo

Appendix: TAM (U.S./EU) LR-MDS Patient Numbers: Company projections in 2031, based on DRG MDS Landscape and Forecast syndicated data report 2021 and 2022 and YoY growth rate assumptions for eligible patient populations in LR-MDS in the US and EU. EU4/UK population as % of US population in 2031: ~93%; UN Population (2019) dataset used for total European population calculations. 60% patients treated for 12 months each year; 2nd line treated prevalence adjustments (~55%); LR-MDS: ~73% of all MDS; RS+ estimated as ~25%; first line ESA in-eligible estimates ~10% (Platzbecker, Treatment of MDS, Blood 2019). R/R MF Patient Numbers: Company projections US/EU (2031), based on DRG 2020 MF Niche & Rare Disease Landscape & Forecast and YoY growth rate assumptions for eligible Int-2/HR patient populations (excludes Int-1, patients with platelets <50K); Int-2/HR ~65%; platelets <50K ~14% (Al-Ali HK & Vannucchi AM, Ann Hematol 2017); JAKi treated ~90% (Geron Market Research); % with leukemic transformations (~10%, Vallapureddy et al. 2019); EU4/UK population as % of US population in 2031: ~93%; UN Population (2019) dataset used for total European population calculations. Total Addressable Market Price Assumptions: Includes annualized 12 months of treatment @ $25K/month; EU5: annualized 12 months of treatment @ $6K/month; Rest of Europe: annualized 12 months of treatment @ $3K/month Potential LR MDS Patient Population Potential R/R MF Patient Population ~4,000 ~8,000 ~24,000 ESA R/R RS+: ESA R/R RS-: ESA Ineligible (RS+/RS-): JAKi treated: ~29,000 >$7B by 2031 Become part of SOC in LR-MDS (~$3.5B TAM 2031) Expand as SOC in R/R MF (~$3.5B TAM 2031) 33 Company Logo

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

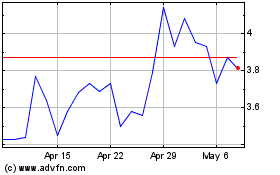

Geron (NASDAQ:GERN)

Historical Stock Chart

From Apr 2024 to May 2024

Geron (NASDAQ:GERN)

Historical Stock Chart

From May 2023 to May 2024