Form 8-K/A Item 7.01 Investor Presentation

true

0001035976

0001035976

2023-11-17

2023-11-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 17, 2023

FNCB Bancorp, Inc.

(Exact name of registrant as specified in its Charter)

|

Pennsylvania

|

|

001-38408

|

|

23-2900790

|

|

(State or other jurisdiction

|

|

(Commission file number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

102 E. Drinker St., Dunmore, PA, 18512

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: 570.346.7667

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $1.25 par value

|

|

FNCB

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicated by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Current Report on Form 8-K/A (this “Amendment”) is being filed as an amendment to the Current Report on Form 8-K filed on November 17, 2023 (the “Original 8-K”) by FNCB Bancorp, Inc. (“FNCB”). The sole purpose of this Amendment is to update certain disclaimers with respect to a proposed transaction between FNCB and Peoples Financial Services Corp., (“PFIS”) that were not included in the Original 8-K or investor presentation attached as Exhibit 99.1 thereto and to confirm that this Form 8-K is a written communications pursuant to Rule 425 under the Securities Act of 1933, as amended.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On November 17, 2023, FNCB Bancorp, Inc. ("FNCB") made available its investor presentation that will be posted on the investor relations page of its website located at investors.fncb.com.

The investor presentation is attached as Exhibit 99.1 to this Current Report and is incorporated herein by reference. The Current Report is being furnished pursuant to Regulation FD and no part shall be deemed "filed" for any purpose.

Forward-Looking Statements

FNCB may from time to time make written or oral “forward-looking statements,” including statements contained in its filings with the Securities and Exchange Commission (“SEC”), in its reports to shareholders, and in its other communications, which are made in good faith by us pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements include statements with respect to FNCB’s beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, including statements with respect to future changes in monetary policy or interest rates, or new product offerings and the anticipated merger between FNCB and Peoples Financial Services Corp., (“PFIS”) under the Agreement and Plan of Merger, dated September 27, 2023 (the “Merger Agreement”) pursuant to which FNCB will merge with and into PFIS, with PFIS as the surviving entity, along with the transaction occurring immediately after such merger, whereby FNCB’s wholly owned subsidiary, FNCB Bank (the “Bank”) will merge with and into Peoples Security Bank and Trust Company (“Peoples Bank”), with Peoples Bank as the surviving bank and a wholly-owned subsidiary of PFIS, that are subject to significant risks and uncertainties, and are subject to change based on various factors (some of which are beyond our control). The words “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “project,” “future” and similar expressions are intended to identify forward-looking statements. The following factors, among others, could cause FNCB’s financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements: government intervention in the U.S. financial system including the effects of recent legislative, tax, accounting and regulatory actions and reforms; political instability; acts of world terrorism; global unrest; the ability of FNCB to manage credit risk; weakness in the economic environment, in general, and within FNCB’s market area; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement between FNCB and PFIS; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate operations of FNCB and FNCB Bank and those of PFIS and Peoples Bank, its wholly-owned subsidiary, which may be more difficult, time consuming or costly than expected; diversion of management's attention from ongoing business operations and opportunities; effects of the announcement, pendency or completion of the proposed transaction on the ability of FNCB and PFIS to retain customers and retain and hire key personnel and maintain relationships with their vendors, and on their operating results and businesses generally; the deterioration of one or a few of the large balance commercial and/or commercial real estate loans contained in FNCB’s loan portfolio; greater risk of loan defaults and losses from concentration of loans held by FNCB, including those to insiders and related parties; if FNCB’s portfolio of loans to small and mid-sized community-based businesses increases its credit risk; if FNCB’s allowance for credit losses ("ACL") is not sufficient to absorb actual losses or if increases to the ACL were required; FNCB is subject to interest-rate risk and any changes in interest rates could negatively impact net interest income or the fair value of FNCB's financial assets; if management concludes that the decline in value of any of FNCB’s investment securities is caused by a credit-related event could result in FNCB recording an impairment loss; if FNCB’s risk management framework is ineffective in mitigating risks or losses to FNCB; if FNCB is unable to successfully compete with others for business; a loss of depositor confidence resulting from changes in either FNCB’s financial condition or in the general banking industry; if FNCB is unable to retain or grow its core deposit base; inability or insufficient dividends from its subsidiary, FNCB Bank; if FNCB loses access to wholesale funding sources; interruptions or security breaches of FNCB’s information systems; any systems failures or interruptions in information technology and telecommunications systems of third parties on which FNCB depends; security breaches; if FNCB’s information technology is unable to keep pace with growth or industry developments or if technological developments result in higher costs or less advantageous pricing; the loss of management and other key personnel; dependence on the use of data and modeling in both its management’s decision-making generally and in meeting regulatory expectations in particular; additional risk arising from new lines of business, products, product enhancements or services offered by FNCB; inaccuracy of appraisals and other valuation techniques FNCB uses in evaluating and monitoring loans secured by real property and other real estate owned; unsoundness of other financial institutions; damage to FNCB’s reputation; defending litigation and other actions; dependence on the accuracy and completeness of information about customers and counterparties; risks arising from future expansion or acquisition activity; environmental risks and associated costs on its foreclosed real estate assets; any remediation ordered, or adverse actions taken, by federal and state regulators, including requiring FNCB to act as a source of financial and managerial strength for the FNCB Bank in times of stress; costs arising from extensive government regulation, supervision and possible regulatory enforcement actions; new or changed legislation or regulation and regulatory initiatives; noncompliance and enforcement action with the Bank Secrecy Act and other anti-money laundering statutes and regulations; failure to comply with numerous "fair and responsible banking" laws; any violation of laws regarding privacy, information security and protection of personal information or another incident involving personal, confidential or proprietary information of individuals; any rulemaking changes implemented by the Consumer Financial Protection Bureau; inability to attract and retain its highest performing employees due to potential limitations on incentive compensation contained in proposed federal agency rulemaking; any future increases in FNCB Bank’s FDIC deposit insurance premiums and assessments; and the success of FNCB at managing the risks involved in the foregoing and other risks and uncertainties, including those detailed in FNCB’s filings with the SEC.

FNCB cautions that the foregoing list of important factors is not all inclusive. Readers are also cautioned not to place undue reliance on any forward-looking statements, which reflect management’s analysis only as of the date of this report, even if subsequently made available by FNCB on its website or otherwise. FNCB does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of FNCB to reflect events or circumstances occurring after the date of this report.

Readers should carefully review the risk factors described in the documents that FNCB periodically files with the SEC, including the 2022 Annual Report and Quarterly Reports on Form 10-Q for the periods ended March 31, 2023, June 30, 2023 and September 30, 2023.

Any references to FNCB's website, www.fncb.com or any variation thereof, shall not incorporate the contents of such website into this Report.

Additional Information and Where to Find It

In connection with the proposed transaction, PFIS will file a registration statement on Form S-4 with the SEC. The registration statement will include a joint proxy statement of Peoples and FNCB, which also constitutes a prospectus of PFIS, that will be sent to shareholders of PFIS and shareholders of FNCB seeking certain approvals related to the proposed transaction.

The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SHAREHOLDERS OF PFIS AND FNCB AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS TO BE INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PFIS, FNCB AND THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain a free copy of the registration statement, including the joint proxy statement/prospectus, as well as other relevant documents filed with the SEC containing information about PFIS and FNCB, without charge, at the SEC’s website www.sec.gov. Copies of documents filed with the SEC by PFIS will be made available free of charge in the “Investor Relations” section of PFIS’ website, www.psbt.com, under the heading “SEC Filings.” Copies of documents filed with the SEC by FNCB will be made available free of charge in the “About FNCB” section of FNCB’s website, www.fncb.com.

Participants in Solicitation

PFIS, FNCB, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding PFIS’ directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 5, 2023, and certain other documents filed by PFIS with the SEC. Information regarding FNCB's directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 10, 2023, and certain other documents filed by FNCB with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FNCB BANCORP, INC.

|

| |

|

| |

|

| |

By:

|

/s/ James M. Bone, Jr.

|

| |

|

James M. Bone, Jr., CPA

Executive Vice President and Chief Financial Officer

|

| |

|

|

| |

|

|

Dated: November 17, 2023

|

|

Exhibit 99.1

v3.23.3

Document And Entity Information

|

Nov. 17, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

FNCB Bancorp, Inc.

|

| Document, Type |

8-K/A

|

| Document, Period End Date |

Nov. 17, 2023

|

| Entity, Incorporation, State or Country Code |

PA

|

| Entity, File Number |

001-38408

|

| Entity, Tax Identification Number |

23-2900790

|

| Entity, Address, Address Line One |

102 E. Drinker St.

|

| Entity, Address, City or Town |

Dunmore

|

| Entity, Address, State or Province |

PA

|

| Entity, Address, Postal Zip Code |

18512

|

| City Area Code |

570

|

| Local Phone Number |

346.7667

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

FNCB

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Description |

Form 8-K/A Item 7.01 Investor Presentation

|

| Amendment Flag |

true

|

| Entity, Central Index Key |

0001035976

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

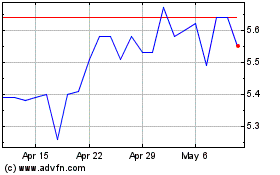

FNCB Bancorp (NASDAQ:FNCB)

Historical Stock Chart

From Apr 2024 to May 2024

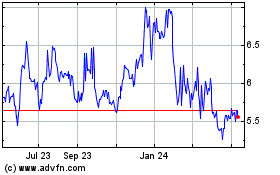

FNCB Bancorp (NASDAQ:FNCB)

Historical Stock Chart

From May 2023 to May 2024