Investment Objective

The Fund’s investment objective is

long-term capital appreciation and current income.

Fees and Expenses of the Fund

This table describes the fees and

expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees

(fees paid directly from your investment)

|

|

|

|

|

|

|

|

|

Share class

|

|

|

|

|

AMR

|

|

|

Redemption fee (as a percentage of amount redeemed; applies to the proceeds of shares redeemed within 180 days of purchase)

|

|

|

2.00

|

%

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

|

|

Share class

|

|

|

|

|

AMR

|

|

|

Management fees

|

|

|

0.60

|

%

|

|

Distribution and/or service (12b-1) fees

|

|

|

0.00

|

%

|

|

Other expenses

|

|

|

0.23

|

%

|

|

Acquired Fund Fees and Expenses

|

|

|

0.01

|

%

|

|

|

|

|

|

|

|

Total annual fund operating expenses

1

|

|

|

0.84

|

%

|

|

|

|

|

|

|

|

1

|

The Total Annual Fund Operating Expenses do not correlate to the ratio of expenses to

average net assets provided in the Fund’s Financial Highlights table, which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

|

Example

This Example is intended to help

you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods.

The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share class

|

|

1 year

|

|

|

3 years

|

|

|

5 years

|

|

|

10 years

|

|

|

AMR

|

|

$

|

86

|

|

|

$

|

268

|

|

|

$

|

466

|

|

|

$

|

1,038

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs

and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the

Fund’s portfolio turnover rate was 107% of the average value of its portfolio.

Principal Investment Strategies

Under

normal circumstances, at least 80% of the Fund’s net assets (plus the amount of any borrowings for investment purposes) are invested in equity securities of middle market capitalization U.S. companies. These companies have market

capitalizations within the market capitalization range of the companies in the Russell Midcap

®

Index at the time

of investment. As of December 31, 2011 the market capitalizations of the companies in the Russell Midcap Index ranged from $36 million to $20.4 billion. The Fund’s investments may include common stocks, preferred stocks,

securities convertible into U.S. common stocks, real estate investment trusts (“REITs”), American Depositary Receipts (“ADRs”) and U.S. dollar-denominated foreign stocks trading on U.S. exchanges (collectively referred to as

“stocks”).

The Manager allocates the assets of the Fund among different sub-advisors. The Manager believes that this strategy may

help the Fund outperform other investment styles over the longer term while minimizing volatility and downside risk.

In general, the

sub-advisors select stocks that, in their opinion, have most or all of the following characteristics (relative to the Russell Midcap Index):

|

|

u

|

|

above-average earnings growth potential,

|

|

|

u

|

|

below-average price to earnings ratio,

|

|

|

u

|

|

below-average price to book value ratio, and

|

|

|

u

|

|

above-average dividend yields.

|

One sub-advisor invests in medium-sized companies with low price to earnings and price to book value ratios and high dividend yields in relation to the Russell Midcap Index. Through extensive research and

meetings with company management teams, the sub-advisor seeks to identify companies that not only possess these three characteristics, but that also exhibit high or improving profitability translating into earnings growth above that of the overall

Russell Midcap Index. The sub-advisor’s portfolio will generally consist of 35 to 45 stocks.

The second sub-advisor invests in

medium-sized companies and intends to maintain a concentrated portfolio of 30 to 40 stocks selected from the most undervalued or “deep” value portion of its investment universe. That sub-advisor looks for companies within that universe

that sell for a low price relative to normal earnings (with “normal earnings” defined as a 5 year estimate of what the company should earn in a normal environment based on research of the company’s history and the history of its

industry).

|

|

|

|

|

|

|

|

|

|

|

Summary Prospectus

|

|

|

|

February 29, 2012

|

|

1

|

|

American Beacon Mid-Cap Value Fund

|

The third sub-advisor utilizes a classic value-driven philosophy based on the belief that leading

businesses selling at a discount to fair value have the potential to generate excess returns. The strategy focuses on stocks that are temporarily out of favor in the market; specifically, companies with higher returns on capital, free cash flow

and strong balance sheets. These companies often dominate a particular industry niche, generally have significant barriers to entry and, as a result, are able to perpetuate a higher return on capital over time.

Each of the Fund’s sub-advisors determines the earnings growth prospects of companies based upon a combination of internal and external research

using fundamental analysis and considering changing economic trends. The decision to sell a security is typically based on the belief that the company is no longer considered undervalued or shows deteriorating fundamentals, or that better investment

opportunities exist in other stocks.

The Fund may invest cash balances in money market funds and may purchase and sell futures contracts to

gain market exposure on cash balances or reduce market exposure in anticipation of liquidity needs.

Principal Risks

There is no assurance that the Fund will achieve its

investment objective and you could lose part or all of your investment in the Fund. The Fund is not designed for investors who need an assured level of income and is intended to be a long-term investment. The Fund is not a complete investment

program and may not be appropriate for all investors. Investors should carefully consider their own investment goals and risk tolerance before investing in the Fund. The principal risks of investing in the Fund are:

Equity Securities Risk

Equity securities

generally are subject to market risk. The Fund’s investments in equity securities may include common stocks, preferred stocks, securities convertible into or exchangeable for common stocks, REITs, ADRs, and U.S. dollar denominated foreign

stocks trading on U.S. exchanges. Such investments may expose the Fund to additional risks.

Common stock generally is subordinate to preferred

stock upon the liquidation or bankruptcy of the issuing company. Preferred stocks and convertible securities are sensitive to movements in interest rates. In addition, convertible securities are subject to the risk that the credit standing of the

issuer may have an effect on the convertible securities’ investment value. Investments in ADRs and U.S. dollar denominated foreign stocks trading on U.S. exchanges are subject to certain of the risks associated with investing directly in

foreign securities. Investments in REITs are subject to the risks associated with investing in the real estate industry such as adverse developments affecting the real estate industry and real property values.

Foreign Exposure Risk

The Fund may

invest in securities issued by foreign companies through American ADRs and U.S. dollar-denominated foreign stocks traded on U.S. exchanges. These securities are subject to many of the risks inherent in investing in foreign securities, including, but

not limited to, currency fluctuations and political and financial instability in the home country of a particular ADR or foreign stock.

Futures Contract Risk

Futures contracts are a type of derivative investment. A derivative refers to any financial instrument whose value is derived, at least in part, from the price of another security or a specified index,

asset or rate. The use of derivatives presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. Gains or losses in a derivative may be magnified and may be much greater than the

derivatives original cost.

There may be an imperfect correlation between the changes in market value of the securities held by the Fund and

the prices of futures contracts. There may not be a liquid secondary market for the futures contract. When the Fund purchases or sells a futures contract, it is subject to daily variation margin calls that could be substantial in the event of

adverse price movements. If the Fund has insufficient cash to meet daily variation margin requirements, it might need to sell securities at a time when such sales are disadvantageous.

High Portfolio Turnover Risk

Portfolio turnover is a measure of a Fund’s trading

activity over a one year period. A portfolio turnover rate of 100% would indicate that a Fund sold and replaced the entire value of its securities holdings during the period. High portfolio turnover could increase a Fund’s transaction costs and

possibly have a negative impact on performance. Frequent trading by a Fund could also result in increased short term capital gain distributions to shareholders, which are taxable as ordinary income.

Investment Risk

An investment in the

Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. When you sell your shares of the Fund, they could be worth less than what you paid for them. Therefore, you

may lose money by investing in the Fund.

Market Events

Turbulence in financial markets and reduced liquidity in equity, credit and fixed-income markets may negatively affect many issuers worldwide which may have an adverse effect on the Fund.

Market Risk

Since this Fund invests most

of its assets in stocks, it is subject to stock market risk. Market risk involves the possibility that the value of the Fund’s investments in stocks will vary from day to day in response to the activities of individual companies, as well as

general market, regulatory, political and economic conditions. From time to time, certain investments held by the Fund may have limited marketability and may be difficult to sell at favorable times or prices. If the Fund is forced to sell holdings

to meet redemption requests or other cash needs, the Fund may have to sell them at a loss.

Mid-Capitalization Companies Risk

Investing in the securities of mid-capitalization companies involves greater risk and the possibility of greater price volatility than

investing in larger capitalization companies. Since smaller companies may have limited operating history, product lines and financial resources, the securities of these companies may lack sufficient market liquidity and can be sensitive to expected

changes in interest rates, borrowing costs and earnings.

|

|

|

|

|

|

|

|

|

|

|

Summary Prospectus

|

|

|

|

February 29, 2012

|

|

2

|

|

American Beacon Mid-Cap Value Fund

|

Securities Selection Risk

Securities selected by the Manager or a sub-advisor for the Fund may not perform to expectations. This could result in the Fund’s underperformance compared to other funds with similar investment

objectives.

Value Stocks Risk

Value stocks are subject to the risk that their intrinsic value may never be realized by the market or that their prices may go down. While the

Fund’s investments in value stocks may limit its downside risk over time, the Fund may produce more modest gains than riskier stock funds as a trade-off for this potentially lower risk. Different investment styles tend to shift in and out of

favor, depending on market conditions and investor sentiment. The Fund’s value style could cause the Fund to underperform funds that use a growth or non-value approach to investing or have a broader investment style.

Fund Performance

The bar chart and table below provide an indication of risk by showing how the Fund’s performance has varied from year to year. The table shows how

the Fund’s performance compares to a broad-based market index and the Lipper Mid-Cap Value Funds Index, a composite of mutual funds comparable to the Fund. You may obtain updated performance information on the Fund’s website at

www.americanbeaconfunds.com

.

Past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the

future.

Total Return for the Calendar Year Ended 12/31 of each Year

|

|

|

|

|

Highest Quarterly Return:

|

|

24.48%

|

|

(1/1/05 through 12/31/11)

|

|

(3rd Quarter 2009)

|

|

Lowest Quarterly Return:

|

|

-21.44%

|

|

(1/1/05 through 12/31/11)

|

|

(4th Quarter 2008)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

|

|

|

|

|

For the periods ended

December 31,

2011

|

|

|

AMR

|

|

1 Year

|

|

|

5 Years

|

|

|

Since

Inception

(6/30/2004)

|

|

|

Return Before Taxes

|

|

|

0.48

|

%

|

|

|

1.00

|

%

|

|

|

5.78

|

%

|

|

|

|

|

|

|

Indices

(reflects no deduction for fees,

expenses or taxes)

|

|

1 Year

|

|

|

5 Years

|

|

|

Since

Inception

(6/30/2004)

|

|

|

Russell Midcap Value Index

|

|

|

-1.38

|

%

|

|

|

0.04

|

%

|

|

|

6.16

|

%

|

|

Lipper

®

Mid-Cap Value Funds Index

|

|

|

-4.50

|

%

|

|

|

0.28

|

%

|

|

|

4.71

|

%

|

Management

The Manager

The Fund has retained American Beacon Advisors, Inc. to serve as its Manager.

Sub-Advisors

The Fund’s assets are currently allocated among the following investment

sub-advisors:

|

|

u

|

|

Barrow, Hanley, Mewhinney & Strauss, LLC

|

|

|

u

|

|

Lee Munder Capital Group, LLC

|

|

|

u

|

|

Pzena Investment Management, LLC

|

Portfolio Managers

|

|

|

|

|

American Beacon Advisors, Inc.

|

|

Gene L. Needles, Jr.

President & CEO

|

|

Since 2012

|

|

Wyatt L. Crumpler

Vice President, Asset Management

|

|

Since 2007

|

|

Adriana R. Posada

Senior Portfolio Manager

|

|

Since Fund Inception (2004)

|

|

|

|

Barrow, Hanley, Mewhinney & Strauss, LLC

|

|

James P. Barrow

Portfolio Manager/Executive Director

|

|

Since Fund Inception (2004)

|

|

Mark Giambrone

Portfolio Manager/Managing Director

|

|

Since Fund Inception (2004)

|

|

|

|

Lee Munder Capital Group, LLC

|

|

Donald Cleven

Portfolio Manager

|

|

Since 2011

|

|

|

|

Pzena Investment Management, LLC

|

|

Richard S. Pzena

Managing Principal, CEO, Co-Chief Investment Officer & Founder

|

|

Since Fund Inception (2004)

|

|

Manoj Tandon

Principal, Portfolio Manager

|

|

Since 2006

|

|

Eli Rabinowich

Principal, Portfolio Manager

|

|

Since 2012

|

|

|

|

|

|

|

|

|

|

|

|

Summary Prospectus

|

|

|

|

February 29, 2012

|

|

3

|

|

American Beacon Mid-Cap Value Fund

|

Purchase and Sale of Fund Shares

You

may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business through your retirement or benefit plan or by calling 1-800-658-5811, writing to the Fund at P.O. Box 219643,

Kansas City, MO 64121, or visiting

www.americanbeaconfunds.com

.

For

overnight delivery, please mail your request to American Beacon Funds, c/o BFDS, 330 West 9

th

Street, Kansas City, MO 64105. No minimums apply to subsequent investments and exchanges for Fund shares.

Tax Information

The qualified retirement and benefit plans of the Manager and AMR Corporation and its affiliates (“Plans”) pay no federal income tax. Individual

participants in the Plans should consult the Plans’ governing documents and their own tax advisors for information on the tax consequences associated with participating in the Plans.

|

|

|

|

|

|

|

|

|

|

|

Summary Prospectus

|

|

|

|

February 29, 2012

|

|

4

|

|

American Beacon Mid-Cap Value Fund

|

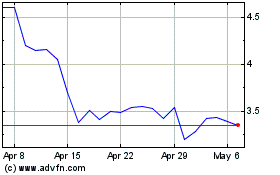

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jun 2024 to Jul 2024

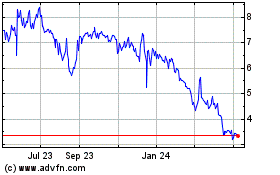

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jul 2023 to Jul 2024