GUANGZHOU, China, May 19 /Xinhua-PRNewswire-FirstCall/ -- CNinsure

Inc., (NASDAQ:CISG), a leading independent insurance agency and

brokerage company operating in China, today announced its unaudited

financial results for the first quarter ended March 31, 2008.(1)

(1) This announcement contains translations of certain Renminbi

(RMB) amounts into U.S. dollars (US$) at specified rates solely for

the convenience of the reader. Unless otherwise noted, all

translations from RMB to U.S. dollars are made at a rate of

RMB7.0120 to US$1.00, the effective noon buying rate as of March

31, 2008 in The City of New York for cable transfers of RMB as

certified for customs purposes by the Federal Reserve Bank of New

York. Financial Highlights for First Quarter 2008 -- Total net

revenues: RMB136.6 million (US$19.5 million), representing a

decrease of 13.9% from the fourth quarter of 2007 and an increase

of 93.2% from the first quarter of 2007. -- Net income: RMB35.0

million (US$5.0 million), representing a decrease of 34.9% from the

fourth quarter of 2007 and an increase of 36.0% from the first

quarter of 2007. -- Basic and diluted net income per ADS: RMB0.768

(US$0.110), RMB0.768(US$0.110), respectively. Commenting on the

first quarter results, Yinan Hu, Chairman and CEO of CNinsure

stated: "We are pleased with the strong first quarter results,

especially the 93.2% growth in total net revenues over the

corresponding period in 2007, despite the snow storms that hit

large parts of China earlier this year. Of the total net revenues,

94.4% were contributed by existing operations, reflecting a strong

momentum for our organic growth. Meanwhile, life insurance business

has also played an important role in driving the growth of our top

line for this quarter. "Looking ahead to the remainder of 2008, we

believe that our business will be even stronger, primarily driven

by continued acquisitions and integration of the acquired

companies, increasing bargaining power with insurance companies,

further cooperation with insurance companies in the exclusive

distribution of customized products and addition of a nationwide

insurance claims adjusting service network. We expect that these

new initiatives, which we have already launched or aim to launch

before the end of this year, will improve our business structure

and diversify our revenue, adding new momentum to our growth not

only for this year but also in the long run.' Mr.Hu continued. "The

recent earthquake in Sichuan, China may adversely affect our

operations in Sichuan temporarily. However, we believe the

earthquake's impact on our overall business will be limited as our

distribution network spreads across many other provinces of China.

"We remain focused on our long term strategies, such as expanding

the distribution network through selective acquisitions, our

entrepreneurial agent program and franchising, further expanding

the life insurance business, seeking higher bargaining power with

insurance companies by expanding product and service offerings and

further improving our unified operating platform. I have great

faith in the ability of our management team to deliver these

strategic objectives and further enhance our leading position in

the insurance intermediary sector." Financial Results for the First

Quarter 2008 Total net revenues for the first quarter ended March

31, 2008 were RMB136.6 million (US$19.5 million), representing a

decrease of 13.9% from RMB158.7 million for the previous quarter,

and an increase of 93.2% from RMB70.7 million for the first quarter

in 2007. Net revenues from commissions and fees were RMB136.5

million (US$19.5 million) for the first quarter of 2008,

representing a decrease of 13.9% from RMB158.5 million for the

fourth quarter of 2007 and an increase of 93.3% from RMB70.6

million for the first quarter of 2007. The decrease as compared to

the fourth quarter of 2007 was primarily due to the seasonality of

our business. Historically, our net revenues from commissions and

fees for the first quarter of a year have generally been the lowest

among all four quarters. Business activities, including buying and

selling insurance, slow down during the Chinese New Year

festivities, which occur during the first quarter of each year. The

increase as compared to the first quarter of 2007 was primarily

attributable to an increase in commission rates, higher

productivity of sales agents in the distribution of life insurance

products, an increase in the number of sales agents and

contributions from newly acquired entities. Net revenues from other

service fees were RMB0.1 million (US$0.02 million) for the first

quarter of 2008. Total operating costs and expenses were RMB104.0

million (US$14.8 million) for the first quarter of 2008,

representing a decrease of 7.6% from RMB112.5 million for the

previous quarter and an increase of 123.5% from RMB46.5 million for

the first quarter of 2007. Commissions and fees expenses were

RMB71.1 million (US$10.1 million) for the first quarter of 2008,

representing a decrease of 14.6% from RMB83.2 million for the

previous quarter and an increase of 115.5% from RMB33.0 million for

the first quarter of 2007. The decrease as compared to the fourth

quarter of 2007 corresponded with the decrease in net revenues from

commissions and fees. The increase as compared to the first quarter

of 2007 corresponded with the increase in net revenues from

commissions and fees. The percentage increase of commissions and

fees expenses was higher than that of net revenues from commissions

and fees in the first quarter of 2007 primarily due to the

expiration of business tax exemptions for most of our affiliated

insurance intermediaries, which had a negative impact on the growth

rate of net revenues from commissions and fees, and increase in the

mix of life insurance sales, which generate lower gross margin than

the sales of property and casualty insurance products. Selling

expenses were RMB4.1 million (US$0.6 million) for the first quarter

of 2008, representing an increase of 45.4% from RMB2.8 million for

the previous quarter and an increase of 88.1% from RMB2.2 million

for the first quarter of 2007. The increases as compared to the

fourth quarter of 2007 and the first quarter of 2007 were primarily

due to selling expenses incurred by newly acquired entities in the

first quarter of 2008. General and administrative expenses were

RMB28.8 million (US$4.1 million) for the first quarter of 2008,

representing an increase of 8.8% from RMB26.4 million for the

previous quarter and an increase of 153.7% from RMB11.3 million for

the first quarter of 2007. The increase as compared to the fourth

quarter of 2007 was primarily due to an increase in share-based

compensation expenses. The increase as compared to the first

quarter of 2007 was primarily due to an increase in share-based

compensation expenses, salaries for administrative staff primarily

as a result of increased headcount, ongoing expenses for

professional services and Sarbanes-Oxley Act compliance-related

expenses. Income from operations were RMB32.7 million (US$4.7

million) for the first quarter of 2008, representing a decrease of

29.4% from RMB46.2 million for the previous quarter and an increase

of 34.9% from RMB24.2 million for the first quarter of 2007.

Operating margin was 23.9% for the first quarter of 2008 as

compared with 29.1% for the previous quarter and 34.2% for the

first quarter of 2007. Interest income for the first quarter of

2008 was RMB13.0 million (US$1.9 million), representing an increase

of 19.4% from RMB10.9 million for the previous quarter and an

increase of 1,169.2% from RMB1.0 million for the first quarter of

2007, primarily attributable to the proceeds generated by our

initial public offering in October 2007. Income tax expense for the

first quarter of 2008 was RMB11.2 million (US$1.6 million),

representing an increase of 245.6% from RMB3.2 million for the

previous quarter and an increase of 2,996.5% from RMB0.4 million

for the first quarter of 2007. Effective income tax rate was 24.5%

for the first quarter of 2008 compared to 5.7% for the previous

quarter and 1.4% for the first quarter of 2007. The increases in

income tax expense and effective income tax rate were primarily

attributable to the expiration of income tax exemptions. Net income

was RMB35.0 million (US$5.0 million) for the first quarter of 2008,

representing a decrease of 34.9% from RMB53.8 million for the

previous quarter, and an increase of 36.0% from RMB25.8 million for

the first quarter of 2007. Net margin was 25.6% for the first

quarter of 2008 as compared with 33.9% for the previous quarter and

36.4% for the first quarter of 2007. Fully diluted net income per

ADS was RMB0.768 (US$0.110) for the first quarter of 2008, compared

with RMB0.768 for the first quarter of 2007. As of March 31, 2008,

the Company had RMB1,575.4 million (US$224.7 million) in cash and

cash equivalents. Business Highlights CNinsure continued executing

its strategy of expanding its business, with the following

highlights for the first quarter ended March 31, 2008: Expanding

Distribution Network -- As of March 31, 2008, CNinsure's

distribution network has expanded to 11 provinces with a total of

17,137 sales professionals and 232 sales and service outlets, as

compared to 8 provinces, 13,830 sales professionals and 195 outlets

as of the end of 2007. Pursuing Expansion through Acquisitions

while Remaining Focused on Organic Growth Organic Growth --

CNinsure remained focused on organic growth. In the first quarter

of 2008, approximately 94.4% of our total net revenues were

contributed by existing operations. Acquisitions -- In the first

quarter of 2008, CNinsure completed acquisitions of majority

interests in six insurance intermediaries, including Guangdong

Fangzhong Insurance Surveyors & Loss Adjustors Co., Ltd., Hubei

East Century Insurance Agency Co, Ltd., Tianjin Fanhua Xianghe

Insurance Agency Co, Ltd., Changsha Lianyi Insurance Agency Co.,

Ltd., Jiangmen Fanhua Zhicheng Insurance Agency Co., Ltd., and

Hebei Lianda Insurance Agency Co., Ltd., expanding its market

presence into two new geographic markets, Tianjin and Hubei

Province. The acquired entities in aggregate contributed 5.6% of

our total net revenues in the first quarter of 2008. Acquisition

Integration -- CNinsure is in the process of replacing the existing

platforms of the newly acquired entities with CNinsure's

standardized operating platform which includes branding and

marketing strategy, operating procedures, finance and internal

control system and human resources management policies and

procedures. Further Expanding the Life Insurance Business --

Commissions and fees from life insurance have grown significantly.

Apart from increased resources devoted to life insurance business,

another primary reason behind this growth is higher commission

rates for life insurance policies we received from insurance

companies as a result of intensified competition among insurance

companies and our increasing bargaining power. Strengthening

Partnership with Insurance Companies -- CNinsure, which has

established business relationships with over 40 domestic and

foreign insurance companies, entered into strategic partnerships

with Ping An Life Insurance Company of China, Ltd. and Minsheng

Life Insurance Co., Ltd.. It also signed an agreement with Ping An

Life Insurance for the exclusive distribution of an insurance

product custom designed by Ping An Life Insurance for CNinsure.

Enhancing Leading Position in the Chinese Insurance Intermediary

Sector -- According to the Insurance Intermediary Market

Development Report published by the China Insurance Regulatory

Commission of the first quarter of 2008, seven of our affiliated

insurance agencies ranked Nos.2, 4, 6, 12, 13, 16 and 17,

respectively, among China's top 20 insurance agencies in terms of

revenue, one of our affiliated insurance brokerages ranked No. 16

among China's top 20 insurance brokerages for the same period,

while our affiliated insurance adjusting company ranked No.8 among

China's top 20 insurance claims adjusting companies in terms of

revenue. Business Outlook For the second quarter 2008, CNinsure

expects its total net revenues to be between RMB175.0 million

(US$25.0 million) and RMB180.0 million (US$25.7 million), which

reflects its current estimates of the potential impact of the

recent earthquake in Sichuan, China. This forecast reflects

CNinsure's current and preliminary view, which is subject to

change. Conference Call The Company will host a conference call to

discuss the First quarter of 2008 results at Time: 9:00 pm Eastern

Daylight Time on May 19, 2008 9:00 am Beijing/Hong Kong Time on May

20, 2008 The Toll Free dial-in number: US: 1866-549-1292 UK:

0808-234-6305 Canada: 1866-8691-825 Singapore: 800-852-3576 Taiwan:

0080-185-6004 Hong Kong: +852-3005-2050 China (Mainland):

800-701-1223; China (Mainland) local dial-in number: 400-681-6949

Password: 885507# A replay of the call will be available for three

days as follows: +852-3005-2020 (Hong Kong & International) PIN

number: 135111# Additionally, a live and archived web cast of this

call will be available at:

http://www.corpasia.net/us/CISG/irwebsite/index.php?mod=event About

CNinsure Inc. CNinsure is a leading independent insurance agency

and brokerage company operating in China. CNinsure's distribution

network reaches many of China's most economically developed regions

and affluent cities. The Company distributes a wide variety of

property and casualty and life insurance products underwritten by

domestic and foreign insurance companies operating in China, as

well as other insurance-related services. Forward-looking

Statements This press release contains statements of a

forward-looking nature. These statements are made under the "safe

harbor" provisions of the U.S. Private Securities Litigation Reform

Act of 1995. You can identify these forward- looking statements by

terminology such as "will," "expects," "believes," "anticipates,"

"intends," "estimates" and similar statements. Among other things,

the management's quotations and "Business Outlook" contain forward-

looking statements. These forward-looking statements involve known

and unknown risks and uncertainties and are based on current

expectations, assumptions, estimates and projections about CNinsure

and the industry. Potential risks and uncertainties include, but

are not limited to, those relating to CNinsure's limited operating

history, especially its limited experience in selling life

insurance products, its ability to attract and retain productive

agents, especially entrepreneurial agents, its ability to maintain

existing and develop new business relationships with insurance

companies, its ability to execute its growth strategy, its ability

to adapt to the evolving regulatory environment in Chinese

insurance industry, and its ability to compete effectively against

its competitors. All information provided in this press release is

as of May 19, 2008, and CNinsure undertakes no obligation to update

any forward looking statements to reflect subsequent occurring

events or circumstances, or to changes in its expectations, except

as may be required by law. Although CNinsure believes that the

expectations expressed in these forward looking statements are

reasonable, it cannot assure you that its expectations will turn

out to be correct, and investors are cautioned that actual results

may differ materially from the anticipated results. Further

information regarding risks and uncertainties faced by CNinsure is

included in CNinsure's filings with the U.S. Securities and

Exchange Commission, including its registration statement on Form

F-1. For more information, please contact: Phoebe Meng Investor

Relations Officer Email: Oasis Qiu Investor Relations Tel:

+86(20)6122-2777-850 Email: CNINSURE INC. Unaudited Condensed

Consolidated Balance Sheets As of As of As of December 31, March

31, March 31, 2007 2008 2008 RMB RMB USD (In thousands, except for

shares and per share data) ASSETS: Current assets Cash and cash

equivalents 1,545,501 1,575,395 224,671 Restricted cash 12,863

21,250 3,031 Accounts receivable 18,701 33,704 4,807 Insurance

premium receivable 655 275 39 Other receivables, net 30,510 32,797

4,677 Other current assets 6,136 375 53 Total current assets

1,614,366 1,663,796 237,278 Non-current assets Property, plant, and

equipment, net 11,117 13,552 1,933 Goodwill 9,329 10,515 1,500

Intangibles 4,271 12,090 1,724 Deferred tax assets 2,265 1,746 249

Other 500 8,528 1,216 Total assets 1,641,848 1,710,227 243,900

LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts

payables 10,122 32,549 4,642 Insurance premium payable 12,863

21,250 3,031 Other payables and accrued expenses 17,033 40,110

5,720 Accrued payroll 7,722 6,560 936 Income tax payable 1,966

12,036 1,716 Amounts due to related parties 369 369 53 Current

portion of long-term borrowings 103 113 16 Total current

liabilities 50,178 112,987 16,114 Non-current liabilities:

Long-term borrowings 57 84 12 Deferred tax liabilities 3,195 2,444

348 Total liabilities 53,430 115,515 16,474 Commitments and

contingencies Minority interests 18,248 21,706 3,096 Common stock

7,036 7,036 1,003 Additional paid-in capital 1,621,064 1,627,338

232,079 Accumulated deficit (38,458) (5,005) (714) Accumulated

other comprehensive Loss (19,472) (56,363) (8,038) Total

shareholders' equity 1,570,170 1,573,006 224,330 Total liabilities

and owners' equity 1,641,848 1,710,227 243,900 CNINSURE INC.

Unaudited Condensed Consolidated Statements of Operations For The

Three Months Ended March 31, 2007 2008 2008 RMB RMB USD (In

thousands, except for shares and per share data) Net revenues:

Commissions and fees 70,594 136,482 19,464 Other service fees 121

136 19 Total net revenues 70,715 136,618 19,483 Operating costs and

expenses: Commissions and fees (32,979) (71,069) (10,135) Selling

expenses (2,198) (4,135) (590) General and administrative expenses

(11,338) (28,764) (4,102) Total operating costs and expenses

(46,515) (103,968) (14,827) Income from operations 24,200 32,650

4,656 Other income (expense), net: Interest income 1,027 13,033

1,859 Interest expense (22) (7) (1) Others, net 11 1 0 Income

before income taxes 25,216 45,677 6,514 Income tax expense (362)

(11,205) (1,598) Net income before minority interest 24,854 34,472

4,916 Minority interest 914 560 80 Net income 25,768 35,032 4,996

Net Income per share: Basic 0.040 0.038 0.005 Diluted 0.038 0.038

0.005 Net Income per ADS: Basic 0.793 0.768 0.110 Diluted 0.768

0.768* 0.110 Shares used in calculating Net income per share Basic

650,000,000 912,497,726 912,497,726 Diluted 671,013,579 912,497,726

912,497,726 * There is no dilutive effect for the three months

ended March 31, 2008 as the stock options were anti-dilutive.

DATASOURCE: CNinsure Inc. CONTACT: Phoebe Meng, Investor Relations

Officer at ; or Oasis Qiu, Investor Relations at

+86(20)6122-2777-850 or

Copyright

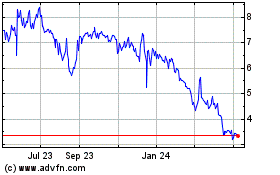

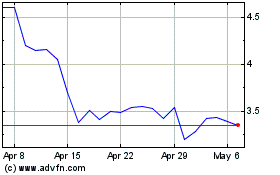

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jul 2023 to Jul 2024