Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

June 13 2024 - 8:35AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission file number: 001-39109

Fangdd

Network Group Ltd.

Room 4106, Building 12B1

Shenzhen Bay Ecological Technology Park

Nanshan District, Shenzhen, 518063

People’s Republic of China

Phone: +86 755 2699 8968

(Address and Telephone Number of Principal Executive

Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Transfer of Listing to Nasdaq Capital Market

and

Extension of Compliance Period for Minimum Bid

Price Requirement

As previously disclosed in a current report on

Form 6-K on December 15, 2023, Fangdd Network Group Ltd. (the “Company”) received a notification letter from The Nasdaq Stock

Market LLC (“Nasdaq”) dated December 13, 2023, notifying the Company that the bid price of the Company’s American depositary

shares (the “ADSs”) had closed below US$1.00 per ADS for a period of 30 consecutive business days, that it was not in

compliance with the minimum bid price requirement set forth in Nasdaq Listing Rule 5450(a)(1) (the “Minimum Bid Price Requirement”),

and that the Company had a grace period of 180 calendar days until June 10, 2024 to regain compliance with the Minimum Bid Price Requirement.

In response to the notification letter, the Company

submitted an application to Nasdaq to transfer the listing of its ADSs from The Nasdaq Global Market to The Nasdaq Capital Market. Nasdaq

approved the Company’s transfer application on June 11, 2024. The transfer will take effect at the opening of business on June 13,

2024. The transfer is not expected to have any immediate effect on trading of the Company’s ADSs, which will continue to trade uninterruptedly

under the symbol “DUO.” The Nasdaq Capital Market operates in substantially the same manner as The Nasdaq Global Market, and

companies on The Nasdaq Capital Market must meet certain financial and corporate governance requirements to qualify for continued listing.

In conjunction with such approval, Nasdaq also

granted the Company an extended period of 180 calendar days, or until December 9, 2024 (the “Extended Compliance Period”),

to regain compliance with the Nasdaq’s Minimum Bid Price Requirement. To regain compliance, the closing bid price of the Company’s

ADSs must meet or exceed US$1.00 per ADS for a minimum of 10 consecutive business days.

If the Company’s compliance with the Minimum

Bid Price Requirement is not satisfied by the end of the Extended Compliance Period, Nasdaq will notify the Company that its securities

will be delisted. At that time, the Company may appeal Nasdaq’s determination to a Hearings Panel.

There can be no assurance that the Company will

be able to regain compliance with the Minimum Bid Price Requirement or maintain its listing on The Nasdaq Capital Market. The Company

intends to continue actively monitoring the closing bid price of its ADSs and will consider other options to cure the deficiency and regain

compliance.

Incorporation by Reference

This report on Form 6-K is hereby incorporated

by reference in the registration statement of Fangdd Network Group Ltd. on Form F-3 (No. 333-267397) to the extent not superseded by

documents or reports subsequently filed.

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fangdd Network Group Ltd. |

| |

|

| |

By: |

/s/ Xi Zeng |

| |

|

Name: |

Xi Zeng |

| |

|

Title: |

Chief Executive Officer and

Chairman of the Board of Directors |

Date: June 13, 2024

2

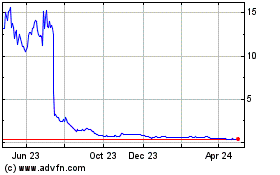

FangDD Network (NASDAQ:DUO)

Historical Stock Chart

From Nov 2024 to Dec 2024

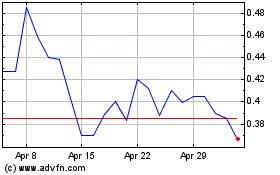

FangDD Network (NASDAQ:DUO)

Historical Stock Chart

From Dec 2023 to Dec 2024