As filed with the Securities and Exchange Commission on November 27, 2023

Registration Statement No. 333-275632

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-3

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

EXAGEN INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 8071 | | 20-0434866 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification Number) |

1261 Liberty Way

Vista, California 92081

(760) 560-1501

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John Aballi

President and Chief Executive Officer

Exagen Inc.

1261 Liberty Way

Vista, California 92081

(760) 560-1501

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Scott M. Stanton, Esq.

Melanie Ruthrauff Levy, Esq.

Jason Miller, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

San Diego, CA 92130

Tel: (858) 314-1500

Approximate Date of Commencement of Proposed Sale to the Public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

We currently have an existing shelf registration statement on Form S-3, File No. 333-250015, which initially became effective on November 19, 2020, or the Prior Registration Statement. In accordance with Rule 415(a)(6), the offering of securities on the Prior Registration Statement will be deemed terminated as of the date of effectiveness of this registration statement. One of the offerings registered under the Prior Registration Statement is the offering of our common stock under a sales agreement, dated as of September 15, 2022, as amended on November 17, 2023, or the Sales Agreement, we entered into with Cowen and Company, LLC, or TD Cowen, as sales agent. In accordance with the terms of the Sales Agreement, we may offer and sell our common stock having an aggregate offering price of up to $50.0 million from time to time through TD Cowen, acting as sales agent. As of the date of this prospectus, we had issued and sold no shares of common stock pursuant to the Sales Agreement under the Prior Registration Statement, which results in up to $50.0 million of shares of our common stock that may be sold under the Sales Agreement.

Accordingly, this registration statement contains:

•a base prospectus which covers the offering, issuance and sale by us of up to $150.0 million in the aggregate of the securities identified above from time to time in one or more offerings; and

•a sales agreement prospectus covering the offering, issuance and sale by us of up to a maximum aggregate offering price of $10.2 million of shares of our common stock that may be issued and sold from time to time under the Sales Agreement.

The base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus will be specified in a prospectus supplement to the base prospectus. The specific terms of the securities to be issued and sold under the Sales Agreement are specified in the sales agreement prospectus that immediately follows the base prospectus. The $10.2 million of shares of common stock that may be offered, issued and sold under the sales agreement prospectus is included in the $150.0 million of securities that may be offered, issued and sold by us under the base prospectus.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated November 27, 2023

PROSPECTUS

$150,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may offer and sell up to $150.0 million in the aggregate of the securities identified above from time to time in one or more offerings. This prospectus provides you with a general description of the securities.

This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement, together with the documents we incorporate by reference before you invest in any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

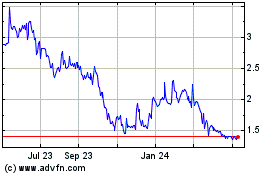

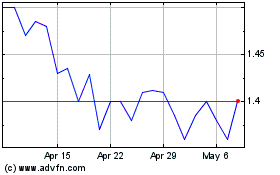

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 4 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES. Our common stock is listed on The Nasdaq Global Market under the symbol “XGN.” On November 24, 2023, the last reported sale price of our common stock on The Nasdaq Global Market was $1.55 per share. On March 20, 2023, the date we filed our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, our prospectus became subject to the offering limits in General Instruction I.B.6 of Form S-3. As of the date hereof, the aggregate market value of our common stock held by non-affiliates pursuant to General Instruction I.B.6 of Form S-3 is $30.7 million, which was calculated based on 12,832,888 shares of our common stock outstanding held by non-affiliates and a price of $2.39 per share, the closing price of our common stock on October 2, 2023. As of the date of this prospectus, we have not sold any securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to, and including, the date of this prospectus. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in public primary offerings on Form S-3 with a value exceeding more than one-third of our public float (as defined by General Instruction I.B.6) in any 12 calendar month period so long as our public float remains below $75 million.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf’ registration process. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings up to a total dollar amount of $150.0 million as described in this prospectus. Each time that we offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement (and any applicable free writing prospectuses), together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Documents by Reference.”

We have not authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. Although we are not aware of any misstatements regarding the market and industry data presented in this prospectus and the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

When we refer to “Exagen,” “we,” “our,” “us” and the “Company” in this prospectus, we mean Exagen Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

We use our trademarks in this prospectus as well as trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, certain trademarks and tradenames referred to in this prospectus appear without the ® and TM symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

PROSPECTUS SUMMARY

The following is a summary of what we believe to be the most important aspects of our business and the offering of our securities under this prospectus. We urge you to read this entire prospectus, including the more detailed consolidated financial statements, notes to the consolidated financial statements and other information incorporated by reference from our other filings with the SEC or included in any applicable prospectus supplement. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in any prospectus supplements and in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus and any prospectus supplements and the documents incorporated by reference herein or therein, before purchasing our securities. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

About Exagen Inc.

We exist to provide clarity in autoimmune disease decision making with the goal of improving patients' clinical outcomes. We have developed and are commercializing a portfolio of innovative testing products under our AVISE® brand which demonstrate excellent quality and performance. We believe our focus on and experience in the field of rheumatology, combined with our commitment to excellent customer service and support, position us very well to respond to the needs of rheumatologists and the patients they serve.

Marketed under our AVISE® brand, our testing products allow for the differential diagnosis, prognosis and monitoring of complex autoimmune and autoimmune-related diseases, including systemic lupus erythematosus (SLE) and rheumatoid arthritis (RA). We commercially launched our lead testing product, AVISE® CTD, in 2012. AVISE® CTD enables differential diagnosis for patients presenting with symptoms indicative of a wide variety of connective tissue diseases (CTDs) and other related diseases with overlapping symptoms. There is an unmet need for rheumatologists to add clarity in their CTD clinical evaluation, and we believe there is a significant opportunity for our tests that enable the differential diagnosis of these diseases, particularly for potentially life-threatening diseases such as SLE.

We perform all of our AVISE® tests in our approximately 13,000 square foot laboratory located in Vista, California, which is certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, and accredited by the College of American Pathologist. Our laboratory is certified for performance of high-complexity testing by the Centers for Medicare & Medicaid Services in accordance with CLIA and is licensed by all states requiring out-of-state licensure. Our clinical laboratory typically reports all AVISE® testing product results within five business days.

Additional Information

For additional information related to our business and operations, please refer to the reports incorporated herein by reference, as described under the caption “Incorporation of Documents by Reference” on page 33 of this prospectus. Our Corporate Information

We were incorporated under the laws of the state of New Mexico in 2002, under the name Exagen Corporation. In 2003, we changed our state of incorporation from New Mexico to Delaware by merging with and into Exagen Diagnostics, Inc., pursuant to which we changed our name to Exagen Diagnostics, Inc. In January 2019 we changed our name to Exagen Inc. In September 2019, we completed our initial public offering and in March 2021, we completed our secondary public offering. Our principal executive offices are located at 1261 Liberty Way, Vista, California 92081. Our telephone number is (760) 560-1501.

We maintain a website at http://www.exagen.com to which we regularly post copies of our press releases as well as additional information about us. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended are available free of charge through the investor relations page of our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

All brand names or trademarks appearing in this prospectus are the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners.

Offerings Under This Prospectus

Under this prospectus, we may offer shares of our common stock or preferred stock, various series of debt securities and/or warrants to purchase any of such securities, either individually or in units, with a total aggregate offering price of up to $150.0 million, from time to time at prices and on terms to be determined by market conditions at the time of the offering. This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities, including, to the extent applicable:

•designation or classification;

•aggregate principal amount or aggregate offering price;

•maturity, if applicable;

•rates and times of payment of interest or dividends, if any;

•redemption, conversion or sinking fund terms, if any;

•voting or other rights, if any; and

•conversion or exercise prices, if any.

The prospectus supplement also may add, update or change information contained in this prospectus or in documents we have incorporated by reference into this prospectus. However, no prospectus supplement will fundamentally change the terms that are set forth in this prospectus or offer a security that is not registered and described in this prospectus at the time of its effectiveness.

We may sell the securities directly to investors or to or through agents, underwriters or dealers. We, and our agents or underwriters, reserve the right to accept or reject all or part of any proposed purchase of securities. If we offer securities through agents or underwriters, we will include in the applicable prospectus supplement:

•the names of those agents or underwriters;

•applicable fees, discounts and commissions to be paid to them;

•details regarding over-allotment options, if any; and

•the net proceeds to us.

This prospectus may not be used to consummate a sale of any securities unless it is accompanied by a prospectus supplement.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves a high degree of risk. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement before acquiring any such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. Additional risks and uncertainties that we do not presently know or that we currently deem immaterial may also have a material adverse effect on our business.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including documents incorporated by reference herein and therein, and any free writing prospectus that we have authorized for use in connection with this offering, contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are statements other than historical facts and relate to future events or circumstances or our future performance, and they are based on our current assumptions, expectations and beliefs concerning future developments and their potential effect on our business. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect,” “possible,” “likely,” “probable,” and similar expressions that convey uncertainty of future events or outcomes identify forward-looking statements. These statements include, among other things, statements regarding:

•We have a history of losses, we expect to incur net losses in the future and we may not be able to generate sufficient revenue to achieve and maintain profitability;

•In the near-term, we expect that our financial results will depend primarily on sales of our testing products, and we will need to generate sufficient revenue from these testing products to grow our business;

•We may be unable to manage our ongoing growth effectively, which could make it difficult to execute our business strategy;

•Our commercial success depends on attaining and maintaining significant market acceptance of our testing products and promoted therapeutics among rheumatologists, patients, third-party payors and others in the medical community;

•We rely on sole suppliers for some of the reagents, equipment and other materials used in our testing products, and we may not be able to fund replacements or transition to alternative suppliers;

•If we are unable to support demand for our current testing products or any of our future testing products or solutions, our business could suffer;

•If third-party payors do not provide coverage and adequate reimbursement for our testing products, or they breach, rescind or modify their contracts or reimbursement policies or delay payments for our tests, or if we or our partners are unable to successfully negotiate payor contracts, gross margins and commercial success could be materially adversely affected;

•If we are unable to compete successfully, we may be unable to increase or sustain our revenue or achieve profitability;

•Developing new testing products involves a lengthy and complex process, and we may not be able to commercialize on a timely basis, or at all, other testing products we are developing;

•If our sole laboratory facility becomes damaged or inoperable, we are required to vacate our existing facility or we are unable to expand our existing facility as needed, we will be unable to perform our testing services and our business will be harmed and, in addition, we are in the process of converting warehouse space into additional laboratory facilities, but this may not be successful;

•We may require substantial additional capital to finance our planned operations, which may not be available to us on acceptable terms or at all. Our failure to obtain additional financing when needed on acceptable terms, or at all, could force us to delay, limit, reduce or eliminate our product development programs, commercialization efforts or other operations;

•We conduct business in a heavily regulated industry. Complying with the numerous statutes and regulations pertaining to our business is expensive and time-consuming, and any failure by us, our consultants or commercial partners to comply could result in substantial penalties;

•If we are unable to maintain intellectual property protection our competitive position could be harmed;

•If we fail to comply with our obligations in the agreements under which we license intellectual property rights from third parties or otherwise experience disruptions to our business relationships with our licensors, we could lose license rights that are important to our business;

•the impact of the above factors and other future events on the market price of our common stock; and

•the anticipated use of proceeds from this offering, if any.

Although forward-looking statements in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, and in any free writing prospectus that we have authorized for use in connection with this offering, reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risk Factors” contained in this prospectus supplement, the accompanying prospectus and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus, including our most recent annual report on Form 10-K and quarterly reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date made. We file reports with the SEC, and our electronic filings with the SEC (including our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and any amendments to these reports) are available free of charge on the SEC’s website at www.sec.gov.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this prospectus supplement, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this prospectus supplement, the accompanying prospectus and any related free writing prospectus, and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, which disclosures are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

USE OF PROCEEDS

We intend to use the net proceeds from the sale of the securities as set forth in the applicable prospectus supplement.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital stock. We intend to retain future earnings, if any, to finance the operation of our business and do not anticipate paying any cash dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments. In addition, our ability to pay cash dividends is currently prohibited by the terms of our loan and security agreement, as amended, with Innovatus Life Science Lending Fund I, LP.

DESCRIPTION OF CAPITAL STOCK

General

The following description summarizes some of the terms of capital stock. Because it is only a summary, it does not contain all the information that may be important to you and is subject to and qualified in its entirety by reference to our amended and restated certificate of incorporation, or the Certificate of Incorporation, and amended and restated bylaws, or the Bylaws, which are filed as exhibits to our most recent Annual Report on Form 10-K and are incorporated by reference herein. We encourage you to read our Certificate of Incorporation and our Bylaws for additional information.

Our authorized capital stock consists of 200,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, $0.001 par value per share.

Common Stock

As of September 30, 2023, there were 16,931,894 shares of our common stock issued and outstanding and held of record by 33 stockholders. Holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders, including the election of directors, and do not have cumulative voting rights. Accordingly, the holders of a majority of the outstanding shares of common stock entitled to vote in any election of directors can elect all of the directors standing for election, if they so choose, other than any directors that holders of any preferred stock we may issue may be entitled to elect. Subject to the supermajority votes for some matters, other matters shall be decided by the affirmative vote of our stockholders having a majority in voting power of the votes cast by the stockholders present or represented and voting on such matter. Our Certificate of Incorporation and Bylaws also provide that our directors may be removed only for cause and only by the affirmative vote of the holders of at least two-thirds in voting power of the outstanding shares of capital stock entitled to vote thereon. In addition, the affirmative vote of the holders of at least two-thirds in voting power of the outstanding shares of capital stock entitled to vote thereon is required to amend or repeal, or to adopt any provision inconsistent with, several of the provisions of our Certificate of Incorporation.

Subject to preferences that may be applicable to any then outstanding preferred stock, holders of common stock are entitled to receive ratably those dividends, if any, as may be declared by the board of directors out of legally available funds. In the event of our liquidation, dissolution or winding up, the holders of common stock will be entitled to share ratably in the assets legally available for distribution to stockholders after the payment of or provision for all of our debts and other liabilities, subject to the prior rights of any preferred stock then outstanding. Holders of common stock have no preemptive or conversion rights or other subscription rights and there are no redemption or sinking funds provisions applicable to the common stock. All outstanding shares of common stock are, and the common stock to be outstanding upon the closing of this offering will be, duly authorized, validly issued, fully paid and nonassessable. The rights, preferences and privileges of holders of common stock are subject to and may be adversely affected by the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A. The transfer agent and registrar’s address is 6200 S. Quebec St., Greenwood Village, CO 80111.

Stock Exchange Listing

Our common stock is listed for trading on Nasdaq under the symbol “XGN.”

Preferred Stock

As of September 30, 2023, there were no shares of our preferred stock outstanding. Under the terms of our Certificate of Incorporation, our board of directors has the authority, without further action by our stockholders, to issue up to 10,000,000 shares of preferred stock in one or more series, to establish from time to time the number of shares to be included in each such series, to fix the dividend, voting and other rights, preferences and privileges of

the shares of each wholly unissued series and any qualifications, limitations or restrictions thereon, and to increase or decrease the number of shares of any such series, but not below the number of shares of such series then outstanding.

Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in our control and may adversely affect the market price of the common stock and the voting and other rights of the holders of common stock. We have no current plans to issue any shares of preferred stock.

Prior to the issuance of shares of each series, the board of directors is required by the General Corporation Law of the State of Delaware, or the DGCL, and our Certificate of Incorporation to adopt resolutions and file a certificate of designation with the Secretary of State of the State of Delaware. The certificate of designation fixes for each class or series the designations, powers, preferences, rights, qualifications, limitations and restrictions, including dividend rights, conversion rights, redemption privileges and liquidation preferences.

All shares of preferred stock offered by this prospectus will, when issued, be fully paid and nonassessable and will not have any preemptive or similar rights. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in our control and may adversely affect the market price of the common stock and the voting and other rights of the holders of common stock.

We will describe in a prospectus supplement relating to the class or series of preferred stock being offered the following terms:

•the title and stated value of the preferred stock;

•the number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred stock;

•the dividend rate(s), period(s) or payment date(s) or method(s) of calculation applicable to the preferred stock;

•whether dividends are cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock will accumulate;

•the procedures for any auction and remarketing, if any, for the preferred stock;

•the provisions for a sinking fund, if any, for the preferred stock;

•the provision for redemption, if applicable, of the preferred stock;

•any listing of the preferred stock on any securities exchange;

•the terms and conditions, if applicable, upon which the preferred stock will be convertible into common stock, including the conversion price or manner of calculation and conversion period;

•voting rights, if any, of the preferred stock;

•a discussion of any material or special U.S. federal income tax considerations applicable to the preferred stock;

•the relative ranking and preferences of the preferred stock as to dividend rights and rights upon the liquidation, dissolution or winding up of our affairs;

•any limitations on issuance of any class or series of preferred stock ranking senior to or on a parity with the class or series of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of our affairs; and

•any other specific terms, preferences, rights, limitations or restrictions of the preferred stock.

Unless we specify otherwise in the applicable prospectus supplement, the preferred stock will rank, relating to dividends and upon our liquidation, dissolution or winding up:

•senior to all classes or series of our common stock and to all of our equity securities ranking junior to the preferred stock;

•on a parity with all of our equity securities the terms of which specifically provide that the equity securities rank on a parity with the preferred stock; and

•junior to all of our equity securities the terms of which specifically provide that the equity securities rank senior to the preferred stock.

The term equity securities does not include convertible debt securities.

Warrants

As of September 30, 2023, 1,214,059 shares of our common stock were issuable upon exercise of outstanding warrants to purchase common stock with a weighted average exercise price of $1.70 per share.

Each of the above warrants has a net exercise provision under which the holder may, in lieu of payment of the exercise price in cash, surrender the warrant and receive a net amount of shares of our common stock based on the fair market value of our common stock at the time of the net exercise of the warrant after deduction of the aggregate exercise price. These warrants also contain provisions for the adjustment of the exercise price and the aggregate number of shares issuable upon the exercise of the warrants in the event of stock dividends, stock splits, reorganizations and reclassifications and consolidations.

Registration Rights

We are party to an investors' rights agreement between certain common stockholders and holders of warrants to purchase shares of common stock, pursuant to which those holders are, as of the date of this prospectus, entitled to certain piggyback and demand registration rights with respect to the registration of such shares under the Securities Act. We filed a registration statement on Form S-3 with the SEC on November 10, 2020 in connection with these obligations. In connection with the registration rights, we are required to pay all expenses incurred by us related to any registration effected pursuant to the exercise of these registration rights. These expenses may include all registration and filing fees, printing expenses, fees and disbursements of our counsel, reasonable fees and disbursements of a counsel for the selling securityholders, blue sky fees and expenses and the expenses of any special audits incident to the registration.

Anti-Takeover Effects of Delaware Law and Our Certificate of Incorporation and Bylaws

Some provisions of Delaware law, our Certificate of Incorporation and our Bylaws contain provisions that could make the following transactions more difficult: an acquisition of us by means of a tender offer; an acquisition of us by means of a proxy contest or otherwise; or the removal of our incumbent officers and directors. It is possible that these provisions could make it more difficult to accomplish or could deter transactions that stockholders may otherwise consider to be in their best interest or in our best interests, including transactions which provide for payment of a premium over the market price for our shares.

These provisions, summarized below, are intended to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors. We believe that the benefits of the increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us outweigh the

disadvantages of discouraging these proposals because negotiation of these proposals could result in an improvement of their terms.

Undesignated Preferred Stock

The ability of our board of directors, without action by the stockholders, to issue up to 10,000,000 shares of undesignated preferred stock with voting or other rights or preferences as designated by our board of directors could impede the success of any attempt to change control of us. These and other provisions may have the effect of deferring hostile takeovers or delaying changes in control or management of our company.

Stockholder Meetings

Our Bylaws provide that a special meeting of stockholders may be called only by our chairman of the board, chief executive officer or president, or by a resolution adopted by a majority of our board of directors.

Requirements for Advance Notification of Stockholder Nominations and Proposals

Our Bylaws establish advance notice procedures with respect to stockholder proposals to be brought before a stockholder meeting and the nomination of candidates for election as directors, other than nominations made by or at the direction of the board of directors or a committee of the board of directors.

Elimination of Stockholder Action by Written Consent

Our Certificate of Incorporation and Bylaws eliminate the right of stockholders to act by written consent without a meeting.

Staggered Board

Our board of directors is divided into three classes. The directors in each class will serve for a three-year term, one class being elected each year by our stockholders. This system of electing and removing directors may tend to discourage a third party from making a tender offer or otherwise attempting to obtain control of us, because it generally makes it more difficult for stockholders to replace a majority of the directors.

Removal of Directors

Our Certificate of Incorporation provides that no member of our board of directors may be removed from office by our stockholders except for cause and, in addition to any other vote required by law, upon the approval of not less than two thirds of the total voting power of all of our outstanding voting stock then entitled to vote in the election of directors.

Stockholders Not Entitled to Cumulative Voting

Our Certificate of Incorporation does not permit stockholders to cumulate their votes in the election of directors. Accordingly, the holders of a majority of the outstanding shares of our common stock entitled to vote in any election of directors can elect all of the directors standing for election, if they choose, other than any directors that holders of our preferred stock may be entitled to elect.

Delaware Anti-Takeover Statute

We are subject to Section 203 of the Delaware General Corporation Law, which prohibits persons deemed to be “interested stockholders” from engaging in a “business combination” with a publicly held Delaware corporation for three years following the date these persons become interested stockholders unless the business combination is, or the transaction in which the person became an interested stockholder was, approved in a prescribed manner or another prescribed exception applies. Generally, an “interested stockholder” is a person who, together with affiliates and associates, owns, or within three years prior to the determination of interested stockholder status did own, 15% or more of a corporation’s voting stock. Generally, a “business combination” includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. The existence of this provision may have an anti-takeover effect with respect to transactions not approved in advance by the board of directors.

Choice of Forum

Our Certificate of Incorporation provides that, unless we consent in writing to the selection of an alternative form, the Court of Chancery of the State of Delaware will be the sole and exclusive forum for: (i) any derivative action or proceeding brought on our behalf; (ii) any action asserting a claim of breach of a fiduciary duty or other wrongdoing by any of our directors, officers, employees or agents to us or our stockholders, creditors or other constituents; (iii) any action asserting a claim against us arising pursuant to any provision of the General Corporation Law of the State of Delaware or our Certificate of Incorporation or Bylaws; (iv) any action to interpret, apply, enforce or determine the validity of our Certificate of Incorporation or Bylaws; or (v) any action asserting a claim governed by the internal affairs doctrine. This exclusive forum provision would not apply to suits brought to enforce any liability or duty created by the Securities Act or the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. Our Bylaws provide that, unless we consent in writing to the selection of an alternative forum, the federal district courts of the United States of America shall be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act. To the extent that any such claims may be based upon federal law claims, Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. The enforceability of similar choice of forum provisions in other companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that a court could find these types of provisions to be inapplicable or unenforceable. Our Certificate of Incorporation and Bylaws also provide that any person or entity purchasing or otherwise acquiring any interest in shares of our capital stock will be deemed to have notice of and to have consented to this choice of forum provision.

Amendment of Charter Provisions

The amendment of any of the above provisions, except for the provision making it possible for our board of directors to issue preferred stock, would require approval by holders of at least two thirds of the total voting power of all of our outstanding voting stock.

The provisions of Delaware law, our Certificate of Incorporation and our Bylaws could have the effect of discouraging others from attempting hostile takeovers and, as a consequence, they may also inhibit temporary fluctuations in the market price of our common stock that often result from actual or rumored hostile takeover attempts. These provisions may also have the effect of preventing changes in the composition of our board and management. It is possible that these provisions could make it more difficult to accomplish transactions that stockholders may otherwise deem to be in their best interests.

DESCRIPTION OF DEBT SECURITIES

The following description, together with the additional information we include in any applicable prospectus supplement or free writing prospectus, summarizes certain general terms and provisions of the debt securities that we may offer under this prospectus. When we offer to sell a particular series of debt securities, we will describe the specific terms of the series in a supplement to this prospectus. We will also indicate in the supplement to what extent the general terms and provisions described in this prospectus apply to a particular series of debt securities. To the extent the information contained in the prospectus supplement differs from this summary description, you should rely on the information in the prospectus supplement.

We may issue debt securities either separately, or together with, or upon the conversion or exercise of or in exchange for, other securities described in this prospectus. Debt securities may be our senior, senior subordinated or subordinated obligations and, unless otherwise specified in a supplement to this prospectus, the debt securities will be our direct, unsecured obligations and may be issued in one or more series.

The debt securities will be issued under an indenture between us and a trustee named in the prospectus supplement. We have summarized select portions of the indenture below. The summary is not complete. The form of the indenture has been filed as an exhibit to the registration statement and you should read the indenture for provisions that may be important to you. In the summary below, we have included references to the section numbers of the indenture so that you can easily locate these provisions. Capitalized terms used in the summary and not defined herein have the meanings specified in the indenture.

General

The terms of each series of debt securities will be established by or pursuant to a resolution of our board of directors and set forth or determined in the manner provided in a resolution of our board of directors, in an officer’s certificate or by a supplemental indenture. The particular terms of each series of debt securities will be described in a prospectus supplement relating to such series (including any pricing supplement or term sheet).

We can issue an unlimited amount of debt securities under the indenture that may be in one or more series with the same or various maturities, at par, at a premium, or at a discount. We will set forth in a prospectus supplement (including any pricing supplement or term sheet) relating to any series of debt securities being offered, the aggregate principal amount and the following terms of the debt securities, if applicable:

•the title and ranking of the debt securities (including the terms of any subordination provisions);

•the price or prices (expressed as a percentage of the principal amount) at which we will sell the debt securities;

•any limit on the aggregate principal amount of the debt securities;

•the date or dates on which the principal on a particular series of debt securities is payable;

•the rate or rates (which may be fixed or variable) per annum or the method used to determine the rate or rates (including any commodity, commodity index, stock exchange index or financial index) at which the debt securities will bear interest, the date or dates from which interest will accrue, the date or dates on which interest will commence and be payable and any regular record date for the interest payable on any interest payment date;

•the place or places where principal of, and interest, if any, on the debt securities will be payable (and the method of such payment), where the debt securities of such series may be surrendered for registration of transfer or exchange, and where notices and demands to us in respect of the debt securities may be delivered;

•the period or periods within which, the price or prices at which and the terms and conditions upon which we may redeem the debt securities;

•any obligation we have to redeem or purchase the debt securities pursuant to any sinking fund or analogous provisions or at the option of a holder of debt securities and the period or periods within which, the price or prices at which and the terms and conditions upon which the debt securities of a particular series shall be redeemed or purchased, in whole or in part, pursuant to such obligation;

•the dates on which and the price or prices at which we will repurchase debt securities at the option of the holders of debt securities and other detailed terms and provisions of these repurchase obligations;

•the denominations in which the debt securities will be issued, if other than denominations of $1,000 and any integral multiple thereof;

•whether the debt securities will be issued in the form of certificated debt securities or global debt securities;

•the portion of principal amount of the debt securities payable upon declaration of acceleration of the maturity date, if other than the principal amount;

•the currency of denomination of the debt securities, which may be U.S. dollars or any foreign currency, and if such currency of denomination is a composite currency, the agency or organization, if any, responsible for overseeing such composite currency;

•the designation of the currency, currencies or currency units in which payment of principal of, and premium and interest on, the debt securities will be made;

•if payments of principal of, or premium or interest on, the debt securities will be made in one or more currencies or currency units other than that or those in which the debt securities are denominated, the manner in which the exchange rate with respect to these payments will be determined;

•the manner in which the amounts of payment of principal of, and premium, if any, and interest on, the debt securities will be determined, if these amounts may be determined by reference to an index based on a currency or currencies or by reference to a commodity, commodity index, stock exchange index or financial index;

•any provisions relating to any security provided for the debt securities;

•any addition to, deletion of or change in the Events of Default described below or in the indenture with respect to the debt securities and any change in the acceleration provisions described in this prospectus or in the indenture with respect to the debt securities;

•any addition to, deletion of or change in the covenants described in this prospectus or in the indenture with respect to the debt securities;

•any depositaries, interest rate calculation agents, exchange rate calculation agents or other agents with respect to the debt securities;

•the provisions, if any, relating to conversion or exchange of any debt securities of such series, including if applicable, the conversion or exchange price and period, provisions as to whether conversion or exchange will be mandatory, the events requiring an adjustment of the conversion or exchange price and provisions affecting conversion or exchange;

•any other terms of the debt securities, which may supplement, modify or delete any provision of the indenture as it applies to that series, including any terms that may be required under applicable law or regulations or advisable in connection with the marketing of the securities; and

•whether any of our direct or indirect subsidiaries will guarantee the debt securities of that series, including the terms of subordination, if any, of such guarantees.

We may issue debt securities that provide for an amount less than their stated principal amount to be due and payable upon declaration of acceleration of their maturity pursuant to the terms of the indenture. We will provide

you with information on the federal income tax considerations and other special considerations applicable to any of these debt securities in the applicable prospectus supplement.

If we denominate the purchase price of any of the debt securities in a foreign currency or currencies or a foreign currency unit or units, or if the principal of, and premium, if any, and interest on, any series of debt securities is payable in a foreign currency or currencies or a foreign currency unit or units, we will provide you with information on the restrictions, elections, general tax considerations, specific terms and other information with respect to that issue of debt securities and such foreign currency or currencies or foreign currency unit or units in the applicable prospectus supplement.

Transfer and Exchange

Each debt security will be represented by either one or more global securities registered in the name of The Depository Trust Company, or the Depositary, or a nominee of the Depositary (we will refer to any debt security represented by a global debt security as a “book-entry debt security”), or a certificate issued in definitive registered form (we will refer to any debt security represented by a certificated security as a “certificated debt security”) as set forth in the applicable prospectus supplement.

Certificated Debt Securities. You may transfer or exchange certificated debt securities at any office we maintain for this purpose in accordance with the terms of the indenture. No service charge will be made for any transfer or exchange of certificated debt securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection with a transfer or exchange.

You may effect the transfer of certificated debt securities and the right to receive the principal of, premium and interest on certificated debt securities only by surrendering the certificate representing those certificated debt securities and either reissuance by us or the trustee of the certificate to the new holder or the issuance by us or the trustee of a new certificate to the new holder.

Global Debt Securities and Book-Entry System. Each global debt security representing book-entry debt securities will be deposited with, or on behalf of, the Depositary, and registered in the name of the Depositary or a nominee of the Depositary. Please see the section entitled “Global Securities” for more information.

Covenants

We will set forth in the applicable prospectus supplement any restrictive covenants applicable to any issue of debt securities.

No Protection in the Event of a Change of Control

Unless we state otherwise in the applicable prospectus supplement, the debt securities will not contain any provisions that may afford holders of the debt securities protection in the event we have a change in control or in the event of a highly leveraged transaction (whether or not such transaction results in a change in control) that could adversely affect holders of debt securities.

Consolidation, Merger and Sale of Assets

We may not consolidate with or merge with or into, or convey, transfer or lease all or substantially all of our properties and assets to, any person, or a successor person, unless:

•we are the surviving corporation or the successor person (if other than Exagen) is a corporation organized and validly existing under the laws of any U.S. domestic jurisdiction and expressly assumes our obligations on the debt securities and under the indenture;

•immediately after giving effect to the transaction, no Event of Default, shall have occurred and be continuing; and

•certain other conditions are met.

Notwithstanding the above, any of our subsidiaries may consolidate with, merge into or transfer all or part of its properties to us.

Events of Default

“Event of Default” means with respect to any series of debt securities, any of the following:

•default in the payment of any interest upon any debt security of that series when it becomes due and payable, and continuance of such default for a period of 30 days (unless the entire amount of the payment is deposited by us with the trustee or with a paying agent prior to the expiration of the 30-day period);

•default in the payment of principal of any debt security of that series at its maturity;

•default in the performance or breach of any other covenant or warranty by us in the indenture or any debt security (other than a covenant or warranty that has been included in the indenture solely for the benefit of a series of debt securities other than that series), which default continues uncured for a period of 60 days after we receive written notice from the trustee or Exagen and the trustee receive written notice from the holders of not less than 25% in principal amount of the outstanding debt securities of that series as provided in the indenture;

•certain voluntary or involuntary events of bankruptcy, insolvency or reorganization of Exagen; or

•any other Event of Default provided with respect to debt securities of that series that is described in the applicable prospectus supplement.

No Event of Default with respect to a particular series of debt securities (except as to certain events of bankruptcy, insolvency or reorganization) necessarily constitutes an Event of Default with respect to any other series of debt securities. The occurrence of certain Events of Default or an acceleration under the indenture may constitute an event of default under certain indebtedness of ours or our subsidiaries outstanding from time to time.

We will provide the trustee written notice of any Event of Default within 30 days of becoming aware of the occurrence of such Event of Default, which notice will describe in reasonable detail the status of such Event of Default and what action we are taking or propose to take in respect thereof.

If an Event of Default with respect to debt securities of any series at the time outstanding occurs and is continuing, then the trustee or the holders of not less than 25% in principal amount of the outstanding debt securities of that series may, by a notice in writing to us (and to the trustee if given by the holders), declare to be due and payable immediately the principal of (or, if the debt securities of that series are discount securities, that portion of the principal amount as may be specified in the terms of that series) and accrued and unpaid interest, if any, on all debt securities of that series. In the case of an Event of Default resulting from certain events of bankruptcy, insolvency or reorganization, the principal (or such specified amount) of and accrued and unpaid interest, if any, on all outstanding debt securities will become and be immediately due and payable without any declaration or other act on the part of the trustee or any holder of outstanding debt securities. At any time after a declaration of acceleration with respect to debt securities of any series has been made, but before a judgment or decree for payment of the money due has been obtained by the trustee, the holders of a majority in principal amount of the outstanding debt securities of that series may rescind and annul the acceleration if all Events of Default, other than the non-payment of accelerated principal and interest, if any, with respect to debt securities of that series, have been cured or waived as provided in the indenture. We refer you to the prospectus supplement relating to any series of debt securities that are discount securities for the particular provisions relating to acceleration of a portion of the principal amount of such discount securities upon the occurrence of an Event of Default.

The indenture provides that the trustee may refuse to perform any duty or exercise any of its rights or powers under the indenture, unless the trustee receives indemnity satisfactory to it against any cost, liability or expense that might be incurred by it in performing such duty or exercising such right or power. Subject to certain rights of the trustee, the holders of a majority in principal amount of the outstanding debt securities of any series will have the

right to direct the time, method and place of conducting any proceeding for any remedy available to the trustee or exercising any trust or power conferred on the trustee with respect to the debt securities of that series.

No holder of any debt security of any series will have any right to institute any proceeding, judicial or otherwise, with respect to the indenture or for the appointment of a receiver or trustee, or for any remedy under the indenture, unless:

•that holder has previously given to the trustee written notice of a continuing Event of Default with respect to debt securities of that series; and

•the holders of not less than 25% in principal amount of the outstanding debt securities of that series have made written request, and offered indemnity or security satisfactory to the trustee, to the trustee to institute the proceeding as trustee, and the trustee has not received from the holders of not less than a majority in principal amount of the outstanding debt securities of that series a direction inconsistent with that request and has failed to institute the proceeding within 60 days.

Notwithstanding any other provision in the indenture, the holder of any debt security will have an absolute and unconditional right to receive payment of the principal of, and premium and any interest on, that debt security on or after the due dates expressed in that debt security and to institute suit for the enforcement of payment.

The indenture requires us, within 120 days after the end of our fiscal year, to furnish to the trustee a statement as to compliance with the indenture. If an Event of Default occurs and is continuing with respect to the securities of any series and if it is known to a responsible officer of the trustee, the trustee shall mail to each holder of the securities of that series notice of an Event of Default within 90 days after it occurs or, if later, after a responsible officer of the trustee has knowledge of such Event of Default. The indenture provides that the trustee may withhold notice to the holders of debt securities of any series of any Event of Default (except in payment on any debt securities of that series) with respect to debt securities of that series if the trustee determines in good faith that withholding notice is in the interest of the holders of those debt securities.

Modification and Waiver

We and the trustee may modify, amend or supplement the indenture or the debt securities of any series without the consent of any holder of any debt security:

•to cure any ambiguity, defect or inconsistency;

•to comply with covenants in the indenture described above under the heading “Consolidation, Merger and Sale of Assets;”

•to provide for uncertificated securities in addition to or in place of certificated securities;

•to add guarantees with respect to debt securities of any series or secure debt securities of any series;

•to surrender any of our rights or powers under the indenture;

•to add covenants or Events of Default for the benefit of the holders of debt securities of any series;

•to comply with the applicable procedures of the applicable depositary;

•to make any change that does not adversely affect the rights of any holder of debt securities;

•to provide for the issuance of and establish the form and terms and conditions of debt securities of any series as permitted by the indenture;

•to effect the appointment of a successor trustee with respect to the debt securities of any series and to add to or change any of the provisions of the indenture to provide for or facilitate administration by more than one trustee; or

•to comply with requirements of the SEC in order to effect or maintain the qualification of the indenture under the Trust Indenture Act of 1939, as amended.

We may also modify and amend the indenture with the consent of the holders of at least a majority in principal amount of the outstanding debt securities of each series affected by the modifications or amendments. We may not make any modification or amendment without the consent of the holders of each affected debt security then outstanding if that amendment will:

•reduce the amount of debt securities whose holders must consent to an amendment, supplement or waiver;

•reduce the rate of or extend the time for payment of interest (including default interest) on any debt security;

•reduce the principal of or premium on or change the fixed maturity of any debt security or reduce the amount of, or postpone the date fixed for, the payment of any sinking fund or analogous obligation with respect to any series of debt securities;

•reduce the principal amount of discount securities payable upon acceleration of maturity;

•waive an Event of Default in the payment of the principal of, or premium or interest on, any debt security (except a rescission of acceleration of the debt securities of any series by the holders of at least a majority in aggregate principal amount of the then outstanding debt securities of that series and a waiver of the payment default that resulted from such acceleration);

•make the principal of, or premium or interest on, any debt security payable in currency other than that stated in the debt security;

•make any change to certain provisions of the indenture relating to, among other things, the right of holders of debt securities to receive payment of the principal of, and premium and interest on, those debt securities and to institute suit for the enforcement of any such payment and to waivers or amendments; or

•waive a redemption payment with respect to any debt security.

Except for certain specified provisions, the holders of at least a majority in principal amount of the outstanding debt securities of any series may on behalf of the holders of all debt securities of that series waive our compliance with provisions of the indenture. The holders of a majority in principal amount of the outstanding debt securities of any series may on behalf of the holders of all the debt securities of such series waive any past default under the indenture with respect to that series and its consequences, except a default in the payment of the principal of, premium or any interest on, any debt security of that series; provided, however, that the holders of a majority in principal amount of the outstanding debt securities of any series may rescind an acceleration and its consequences, including any related payment default that resulted from the acceleration.

Defeasance of Debt Securities and Certain Covenants in Certain Circumstances

Legal Defeasance. The indenture provides that, unless otherwise provided by the terms of the applicable series of debt securities, we may be discharged from any and all obligations in respect of the debt securities of any series (subject to certain exceptions). We will be so discharged upon the deposit with the trustee, in trust, of money and/or U.S. government obligations or, in the case of debt securities denominated in a single currency other than U.S. dollars, government obligations of the government that issued or caused to be issued such currency, that, through the payment of interest and principal in accordance with their terms, will provide money or U.S. government obligations in an amount sufficient in the opinion of a nationally recognized firm of independent public accountants or investment bank to pay and discharge each installment of principal of, premium and interest on, and any mandatory sinking fund payments in respect of, the debt securities of that series on the stated maturity of those payments in accordance with the terms of the indenture and those debt securities.

This discharge may occur only if, among other things, we have delivered to the trustee an opinion of counsel stating that we have received from, or there has been published by, the U.S. Internal Revenue Service a ruling or,

since the date of execution of the indenture, there has been a change in the applicable U.S. federal income tax law, in either case to the effect that, and based thereon such opinion shall confirm that, the holders of the debt securities of that series will not recognize income, gain or loss for U.S. federal income tax purposes as a result of the deposit, defeasance and discharge and will be subject to U.S. federal income tax on the same amounts and in the same manner and at the same times as would have been the case if the deposit, defeasance and discharge had not occurred.

Defeasance of Certain Covenants. The indenture provides that, unless otherwise provided by the terms of the applicable series of debt securities, upon compliance with certain conditions:

•we may omit to comply with the covenant described under the heading “Consolidation, Merger and Sale of Assets” and certain other covenants set forth in the indenture, as well as any additional covenants that may be set forth in the applicable prospectus supplement; and

•any omission to comply with those covenants will not constitute a Default or an Event of Default with respect to the debt securities of that series, or a covenant defeasance.

The conditions include:

•depositing with the trustee money and/or U.S. government obligations or, in the case of debt securities denominated in a single currency other than U.S. dollars, government obligations of the government that issued or caused to be issued such currency, that, through the payment of interest and principal in accordance with their terms, will provide money in an amount sufficient in the opinion of a nationally recognized firm of independent public accountants or investment bank to pay and discharge each installment of principal of, premium and interest on, and any mandatory sinking fund payments in respect of, the debt securities of that series on the stated maturity of those payments in accordance with the terms of the indenture and those debt securities; and

•delivering to the trustee an opinion of counsel to the effect that the holders of the debt securities of that series will not recognize income, gain or loss for U.S. federal income tax purposes as a result of the deposit and related covenant defeasance and will be subject to U.S. federal income tax on the same amounts and in the same manner and at the same times as would have been the case if the deposit and related covenant defeasance had not occurred.

No Personal Liability of Directors, Officers, Employees or Securityholders

None of our past, present or future directors, officers, employees or securityholders, as such, will have any liability for any of our obligations under the debt securities or the indenture or for any claim based on, or in respect or by reason of, such obligations or their creation. By accepting a debt security, each holder waives and releases all such liability. This waiver and release is part of the consideration for the issue of the debt securities. However, this waiver and release may not be effective to waive liabilities under U.S. federal securities laws, and it is the view of the SEC that such a waiver is against public policy.

Governing Law

The indenture and the debt securities, including any claim or controversy arising out of or relating to the indenture or the debt securities, will be governed by the laws of the State of New York.

The indenture will provide that we, the trustee and the holders of the debt securities (by their acceptance of the debt securities) irrevocably waive, to the fullest extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating to the indenture, the debt securities or the transactions contemplated thereby.

The indenture will provide that any legal suit, action or proceeding arising out of or based upon the indenture or the transactions contemplated thereby may be instituted in the federal courts of the United States of America located in the City of New York or the courts of the State of New York in each case located in the City of New York, and we, the trustee and the holder of the debt securities (by their acceptance of the debt securities) irrevocably submit to the non-exclusive jurisdiction of such courts in any such suit, action or proceeding. The indenture will further

provide that service of any process, summons, notice or document by mail (to the extent allowed under any applicable statute or rule of court) to such party’s address set forth in the indenture will be effective service of process for any suit, action or other proceeding brought in any such court. The indenture will further provide that we, the trustee and the holders of the debt securities (by their acceptance of the debt securities) irrevocably and unconditionally waive any objection to the laying of venue of any suit, action or other proceeding in the courts specified above and irrevocably and unconditionally waive and agree not to plead or claim any such suit, action or other proceeding has been brought in an inconvenient forum.

DESCRIPTION OF WARRANTS