Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

June 18 2024 - 4:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO

SECTION 13a-16 OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For

the month of June 2024

Commission

File Number: 001-39950

Evaxion

Biotech A/S

(Exact

Name of Registrant as Specified in Its Charter)

Dr.

Neergaards Vej 5f

DK-2970 Hoersholm

Denmark

(Address

of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

☒ Form 40-F

☐

INCORPORATION BY REFERENCE

This report on

Form 6-K shall be deemed to be incorporated by reference in Evaxion Biotech A/S’s registration statements on Form S-8 (File No.

333-255064), on Form F-3 (File No. 333-265132), on Form F-1, as amended (File No. 333-266050), Form F-1 (File No. 333-276505), and Form

F-1 (File No. 333-279153), including any prospectuses forming a part of such registration statements and to be a part thereof from the

date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

Notice of Extension to Comply with Continued Listing

Rule

As previously announced, on May 7, 2024, the Nasdaq

Stock Market LLC (“Nasdaq”) Listing Qualifications Department notified Evaxion Biotech A/S (the “Company”) that

it no longer complied with Nasdaq Listing Rule 5550(b)(1) (the “Rule”). Under the Rule, companies listed on Nasdaq must maintain

stockholders’ equity of at least $2,500,000 (the “Stockholders’ Equity Requirement”). The Company’s stockholders’

equity of $(4,729,000) for the period ended December 31, 2023 was below the Stockholders’ Equity Requirement for continued listing.

Additionally, the Company did not meet either of the alternative Nasdaq continued listing standards under the Nasdaq Listing Rules of

market value of listed securities or net income from continuing operations.

On May 31, 2024, the Company submitted a plan to

the staff at the Nasdaq Listing Qualifications Department (the “Staff”) to regain compliance with the Stockholders’

Equity Requirement (the “Compliance Plan”), and on June 13, 2024, the Staff notified the Company (the “Letter”)

that it would be granted an extension until November 4, 2024, to demonstrate compliance with Listing Rule 5550(b)(1) to meet the continued

listing requirements of Nasdaq, conditioned upon the Company evidencing compliance with the Rule.

The Company intends to regain compliance

with the applicable continued listing requirements of Nasdaq prior to the end of the compliance period set forth in the Letter. The Company

has determined that its deficiency in minimum stockholder’s equity was partly a result of the IFRS accounting treatment of its

investor warrants that are treated as a derivative liability, hence reducing equity. The Company has, as announced on May 24, already

amended outstanding investor warrants from the February public offering. The Company also intends to amend remaining outstanding investor

warrants and to take other steps in accordance with its Compliance Plan to ensure compliance with Nasdaq listing rules. However,

until Nasdaq has reached a final determination that the Company has regained compliance with all of the applicable continued listing

requirements, there can be no assurances regarding the continued listing of the Company’s common stock on Nasdaq.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Evaxion

Biotech A/S |

| |

|

| Date: June

18, 2024 |

By: |

/s/

Christian Kanstrup |

| |

|

Christian Kanstrup |

| |

|

Chief Executive Officer |

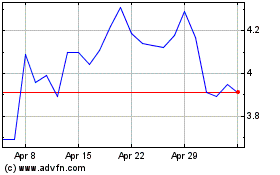

Evaxion Biotech AS (NASDAQ:EVAX)

Historical Stock Chart

From May 2024 to Jun 2024

Evaxion Biotech AS (NASDAQ:EVAX)

Historical Stock Chart

From Jun 2023 to Jun 2024