Filed Pursuant to Rule 424(b)(3)

File No. 333-267983

PROSPECTUS

DRAGONFLY

ENERGY HOLDINGS CORP.

Up

to 21,512,027 Shares of Common Stock

This

prospectus relates to the potential offer and resale, from time to time, of up to 21,512,027 shares of our common stock, par value

$0.0001 per share (“common stock”), by the selling stockholder, Chardan Capital Markets LLC (“CCM”

or the “selling stockholder”).

The

shares of common stock to which this prospectus relates includes shares that have been or may be issued to CCM pursuant to a purchase

agreement between us and CCM, dated October 7, 2022 (the “Purchase Agreement”) establishing an equity facility (the

“ChEF Equity Facility”).

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of shares by the selling

stockholder. However, we may receive gross proceeds of up to $150 million from the sale of shares to CCM under the Purchase Agreement,

from time to time, in our discretion after the date of the registration statement of which this prospectus is a part is declared effective

and after satisfaction of other conditions in the Purchase Agreement.

CCM

is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, (the “Securities

Act”). See “ChEF Equity Facility” and “Plan of Distribution (Conflicts of Interest)”

for more information about how CCM may sell the shares of common stock being registered pursuant to this prospectus and for a description

of compensation payable to CCM.

CCM

may sell the shares of common stock described in this prospectus in a number of different ways and at varying prices. The price that

CCM will pay for the shares to be resold pursuant to this prospectus will depend upon the timing of sales and will fluctuate based on

the trading price of our common stock. While the number of shares of common stock that CCM is required to purchase is subject to certain

limitations under the Purchase Agreement, including the Beneficial Ownership Limitation, the number of shares of common stock that we

can sell to CCM under the Purchase Agreement could constitute a considerable percentage of our public float at the time of such sales.

As a result, the resale by CCM of shares of our common stock pursuant to this prospectus could have a significant negative impact on

the trading price of our common stock. See “ChEF Equity Facility” on page 104 for more information.

In

addition, we have filed separate registration statements registering the issuance to and resale by certain third parties of certain

shares of common stock and/or warrants issued prior to, or in connection with, the Business Combination. These third parties include

CNTQ’s Sponsor, members of our senior management and our Term Loan Lenders. Any sales of such shares into the public market by

such certain third parties could similarly have a significant negative impact on the trading price of our common stock.

We

have agreed to bear all of the expenses incurred in connection with the registration of the shares to which this prospectus relates.

CCM will pay or assume discounts, commissions, and fees of underwriters, selling brokers or dealer managers, if any, incurred in connection

with the sale of shares of our common stock.

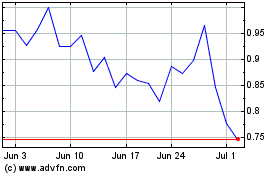

Our

common stock is currently listed on the Nasdaq Global Market (“Nasdaq”) under the symbol “DFLI”

and our public warrants are currently listed on the Nasdaq Capital Market under the symbol “DFLIW.” As of September 18, 2023,

the closing price of our common stock and warrants was $1.77 and $0.15, respectively.

We

are an “emerging growth company” under applicable federal securities laws and will be subject to reduced public company reporting

requirements.

INVESTING

IN OUR SECURITIES INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 9 OF THIS PROSPECTUS.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued

under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 27, 2023.

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus. No one has been authorized to provide you with information that is

different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not

assume that the information contained in this prospectus is accurate as of any date other than that date.

For

investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this

prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform

yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

INTRODUCTORY

NOTE

On

October 7, 2022 (the “Closing” and such date the “Closing Date”), Chardan NexTech Acquisition 2

Corp., a Delaware corporation (“CNTQ”), and Bronco Merger Sub, Inc., a Nevada corporation and newly formed wholly-owned

subsidiary of CNTQ (“Merger Sub”), consummated the previously announced Business Combination (as defined below) pursuant

to the terms of the Business Combination Agreement (as defined below).

On

the Closing Date, (i) CNTQ changed its name to “Dragonfly Energy Holdings Corp.” (“Dragonfly” or the “Company”);

(ii) Merger Sub merged with and into Dragonfly Energy Corp., a Nevada corporation (“Legacy Dragonfly”), with Legacy

Dragonfly surviving the Merger as a direct, wholly-owned subsidiary of the Company (the “Merger”); and (iii) the parties

to the Business Combination Agreement consummated the other transactions contemplated thereby. On March 31, 2023, Dragonfly was reincorporated

under the laws of the State of Nevada pursuant to a reincorporation by conversion.

FREQUENTLY

USED TERMS

Unless

the context otherwise requires, references in this prospectus to “Dragonfly,” the “Company,” “us,”

“we,” “our” and any related terms are intended to mean Dragonfly Energy Holdings Corp. and its consolidated subsidiaries.

“$10

Warrants” means warrants to initially acquire 1,600,000 shares of common stock at an initial $10.00 per share exercise price

issued at Closing in connection with the Term Loan.

“$10

Warrants Shares” means the 457,142 shares of common stock issued upon exercise of the $10 Warrants.

“Beneficial

Ownership Limitation” means the limitation by which CCM shall not be obligated to purchase or acquire, any shares of common

stock under the Purchase Agreement which, when aggregated with all other shares of common stock then beneficially owned by CCM and its

affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in the beneficial

ownership by CCM and its affiliates (on an aggregated basis) of more than 9.9% of the outstanding voting power or shares of common stock.

“Business

Combination” means the Merger and the other transactions contemplated by the Business Combination Agreement.

“Business

Combination Agreement” means that certain Agreement and Plan of Merger, dated May 15, 2022, as amended on July 12, 2022, by

and among CNTQ, Merger Sub and Dragonfly.

“CCM”

means Chardan Capital Markets LLC, a New York limited liability company.

“Charter”

means the articles of incorporation of Dragonfly, in effect as of the date of this prospectus.

“Closing”

means the closing of the Business Combination.

“CNTQ”

means Chardan NexTech Acquisition 2 Corp., a Delaware corporation, which was renamed “Dragonfly Energy Holdings Corp.” in

connection with the Closing.

“CNTQ

Common Stock” means, prior to consummation of the Business Combination, to CNTQ common stock, par value $0.0001 per share,

and, following consummation of the Business Combination, to the common stock, par value $0.001 per share, of Dragonfly.

“CNTQ

IPO” means the initial public offering by CNTQ, which closed on August 13, 2021.

“Dragonfly”

means Dragonfly Energy Holdings Corp., a Nevada corporation.

“Earnout

Shares” means up to an additional 40,000,000 shares of Company common stock that may be issued to the Legacy Dragonfly stockholders

at Closing if certain financial metrics or trading price metrics are achieved and other conditions are satisfied.

“Founder

Shares” means the shares of CNTQ common stock held by the Sponsor, CNTQ’s directors, and affiliates of CNTQ’s management

team.

“Legacy

Dragonfly” means Dragonfly Energy Corp., a Nevada corporation, and includes the surviving corporation after the Merger. References

herein to Dragonfly will include its subsidiaries, including Legacy Dragonfly, to the extent reasonably applicable.

“Merger”

means the merger of Merger Sub with and into Legacy Dragonfly, with Legacy Dragonfly continuing as the surviving corporation and as a

wholly-owned subsidiary of CNTQ (which changed its name to Dragonfly Energy Holdings Corp. upon the Closing), in accordance with the

terms of the Business Combination Agreement.

“Merger

Sub” means Bronco Merger Sub, Inc., a Nevada corporation.

“NRS”

means the Nevada Revised Statutes.

“Penny

Warrants” means warrants to initially acquire 2,593,056 shares of common stock at an exercise price of $0.01 per share issued

at Closing in connection with the Term Loan.

“Private

Warrants” means warrants to acquire shares of common stock at an $11.50 per share exercise price issued to an affiliate of

the Sponsor in a private placement simultaneously with the closing of the CNTQ IPO.

“Public

Warrants” means warrants to acquire shares of common stock at an $11.50 per share exercise price sold as part of the units

in the CNTQ IPO (whether they were purchased in the CNTQ IPO or thereafter in the open market).

“Sponsor”

means Chardan NexTech Investments 2 LLC, a Delaware limited liability company and an affiliate of CCM.

“Term

Loan” means the $75 million aggregate principal amount senior secured term loan facility entered into at Closing.

“Transactions”

means the Merger, and the other transactions contemplated by the Business Combination Agreement.

“Trust

Account” means the trust account of CNTQ that held the proceeds from the CNTQ IPO.

“Warrants”

means the Public Warrants, the Private Warrants and the Penny Warrants of Dragonfly.

“Warrant

Holdings” means Chardan NexTech 2 Warrant Holdings LLC, a Delaware limited liability company.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements contained in this prospectus may constitute “forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended. In addition,

any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying

assumptions, are forward-looking statements. Forward-looking statements may be identified by the use of words such as “estimate,”

“plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,”

“believe,” “seek,” “target,” “designed to” or other similar expressions that predict

or indicate future events or trends or that are not statements of historical matters. We caution readers of this prospectus that these

forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond

our control, that could cause the actual results to differ materially from the expected results. These forward-looking statements include,

but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity

and market share, potential benefits and the commercial attractiveness to our customers of our products and services, the potential success

of our marketing and expansion strategies, the potential for us to achieve design awards, and the potential benefits of the Business

Combination (including with respect to shareholder value). These statements are based on various assumptions, whether or not identified

in this prospectus, and on the current expectations of our management and are not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as,

a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult

or impossible to predict and will differ from assumptions. These forward-looking statements are subject to a number of risks and uncertainties,

including:

There

are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking

statement made by us. These factors include, but are not limited to:

| |

● |

our

ability to recognize the anticipated benefits of our recent Business Combination (as defined herein), which may be affected

by, among other things, the factors listed below; |

| |

● |

our

ability to successfully increase market penetration into target markets; |

| |

● |

the

addressable markets that we intend to target do not grow as expected; |

| |

● |

the

loss of any members of our senior management team or other key personnel; |

| |

● |

the

loss of any relationships with key suppliers, including suppliers in China; |

| |

● |

the

loss of any relationships with key customers; |

| |

● |

our

ability to protect our patents and other intellectual property; |

| |

● |

the

failure to successfully optimize solid-state cells or to produce commercially viable solid-state cells in a timely manner or at all,

or to scale to mass production; |

| |

● |

changes

in applicable laws or regulations; |

| |

● |

our

ability to maintain the listing of our common stock on the Nasdaq Global Market and Public Warrants (as defined herein) on the Nasdaq

Capital Market; |

| |

● |

the

possibility that we may be adversely affected by other economic, business and/or competitive factors (including an economic slowdown

or inflationary pressures); |

| |

● |

our

ability to sell the desired amounts of shares of common stock at desired prices under our equity facility; |

| |

● |

the

potential for events or circumstances that result in our failure to timely achieve the anticipated benefits of our customer arrangements

with THOR Industries and its affiliate brands (including Keystone RV Company (“Keystone”)), including Keystone’s decision in July 2023, that, due to weaker

demand for its products and their subsequent focus on reducing costs, it would no longer install our storage solutions as standard equipment,

but rather return to offering those solutions as an option to dealers and consumers; |

| |

● |

our

ability to raise additional capital to fund our operations; |

| |

● |

our

ability to generate revenue from future product sales and our ability to achieve and maintain profitability; |

| |

● |

the

accuracy of our projections and estimates regarding our expenses, capital requirements, cash utilization, and need for additional

financing; |

| |

● |

developments

relating to our competitors and our industry; |

| |

● |

our

ability to engage target customers and successfully retain these customers for future orders; |

| |

● |

the

reliance on two suppliers for our lithium iron phosphate cells and a single supplier for the manufacture of our battery management

system; and |

| |

● |

our

current dependence on a single manufacturing facility. |

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or

risk factors that we are faced with that may cause our actual results to differ from those anticipated in such forward-looking statements.

Please see “Risk Factors” for additional risks which could adversely impact our business and financial performance.

All

forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue

reliance on any forward-looking statements, which speak only as of the date of this Registration Statement. We have no obligation,

and expressly disclaim any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of

new information, future events or otherwise. We have expressed our expectations, beliefs and projections in good faith and believe

they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will result or be achieved

or accomplished.

SUMMARY

OF THE PROSPECTUS

This

summary highlights selected information from this prospectus and does not contain all of the information that is important to you in

making an investment decision. This summary is qualified in its entirety by the more detailed information included in this prospectus.

Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including the

information under “Risk Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” and the financial statements included elsewhere in this prospectus.

The

Company

We

are a manufacturer of non-toxic deep cycle lithium-ion

batteries that are designed to displace lead acid batteries in a number of different storage applications and end markets including

recreational vehicles (“RV”), marine vessel and off-grid residence industries, with disruptive solid-state cell technology currently under development. Our goal is to develop technology to deliver

environmentally impactful solutions for energy storage to everyone globally. We believe that the innovative design of our lithium-ion

batteries is ideally suited for the demands of modern customers who rely on consumer electronics, connected devices and smart appliances

that require continuous, reliable electricity, regardless of location.

Since

2020, we have sold over 266,000 batteries. We currently offer a line of batteries across our “Battle Born” (“Battle

Born”) and “Dragonfly Energy” (“Dragonfly Energy”) brands, each differentiated by size, power

and capacity, consisting of seven different models, four of which come with a heated option. We primarily sell “Battle Born” branded batteries directly to consumers (“DTC”) and

Dragonfly Energy branded batteries to original equipment manufacturers (“OEMs”).

We

currently source the lithium iron phosphate cells incorporated into our batteries from a limited number of carefully selected suppliers

that can meet our demanding quality standards and with whom we have developed long-term relationships.

To

supplement our battery offerings, we also offer our line of proprietary Wakespeed Offshore brand (“Wakespeed”)

alternator regulation products which are necessary to ensure that the alternator does not get unduly stressed during the current delivery

to the batteries, and that the current delivery remains within the operating limits of the onboard battery bank. In addition to its own

accessories, we are also a reseller of accessories for battery systems. These include chargers, inverters, monitors, controllers, solar

panels and other system accessories from brands such as Victron Energy, Progressive Dynamics, REDARK, Rich Solar, and Sterling Power.

In

addition to our conventional lithium iron phosphate (“LFP”) batteries, we are currently developing the

next generation of LFP solid-state cells. Since our founding, we have been developing proprietary battery cell manufacturing processes

and solid-state battery cell technology for which we have issued patents and pending patent applications, where appropriate. Solid-state

lithium-ion technology eliminates the use of a liquid electrolyte, which addresses the residual heat and flammability issues arising

from lithium-ion batteries. The unique competitive advantage of our solid-state battery cell is highlighted by our dry deposition technology,

which completely displaces the need for toxic solvents in the manufacturing process and allows for the rapid and scalable production

of chemistry-agnostic cells. Additionally, our internal production of battery cells will streamline our supply chain, allowing us to

vertically integrate our cells into our batteries, thereby lowering our production costs.

The

mailing address of our principal executive office is 1190 Trademark Dr. #108, Reno, Nevada 89521, and our telephone number is (775) 622-3448.

For

more information about us, see the sections entitled “Business” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations.”

Emerging

Growth Company

We

are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business

Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various

reporting requirements that are applicable to other public companies that are not “emerging growth companies” including,

but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of

2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports

and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder

approval of any golden parachute payments not previously approved. If some investors find our securities less attractive as a result,

there may be a less active trading market for our securities and the prices of our securities may be more volatile.

We

will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) ending December 31, 2026, (b) in

which we have total annual gross revenue of at least $1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which

means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s

second fiscal quarter; and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year

period. References herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

Smaller

Reporting Company

Additionally,

we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take

advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements.

We will remain a smaller reporting company until the last day of the fiscal year in which (i) the market value of our common stock held

by non-affiliates exceeds $250 million as of the prior June 30, or (ii) our annual revenues exceeded $100 million during such completed

fiscal year and the market value of our common stock held by non-affiliates exceeds $700 million as of the prior June 30.

Risk

Factors Summary

You

should consider all the information contained in this prospectus before making a decision to invest in our common stock or warrants.

In particular, you should consider the risk factors described under “Risk Factors” beginning on page 9. Such

risks include, but are not limited to, the following risks:

Risks

Related to this Offering

| |

● |

It

is not possible to predict the actual number of shares of our common stock we will sell under the Purchase Agreement to CCM, or the

actual gross proceeds resulting from those sales. Further, we may not have access to the full amount available under the ChEF Equity

Facility. |

| |

● |

The

issuance and sale of shares of our common stock to CCM will cause dilution to other holders of shares of our common stock, and the

sale of the shares of our common stock acquired by CCM, or the perception that such sales may occur, could cause the price of the

shares of our common stock to fall. |

| |

● |

Investors

who buy common stock from CCM at different times will likely pay different prices. |

Risks

Related to Our Existing Lithium-Ion Battery Operations

| |

● |

Our

business and future growth depends on the needs and success of our customers. |

| |

● |

We

operate in a competitive industry. We expect that the level of competition will increase and the nature of our competitors will change

as we develop new LFP battery products for, and enter into, new markets, and as the competitive landscape evolves. |

| |

● |

We

may not succeed in our medium- and long-term strategy of entering into new end markets for LFP batteries and our success depends,

in part, on our ability to successfully develop and manufacture new products for, and acquire customers in, these new markets and

successfully grow our operations and production capabilities (including, in time, our ability to manufacture solid-state cells in-house). |

| |

● |

We

currently rely on two suppliers to provide our LFP cells and a single supplier for the manufacture of our battery management system.

Any disruption in the operations of these key suppliers could adversely affect our business and results of operations. |

| |

● |

We

are currently, and likely will continue to be, dependent on a single manufacturing facility. If our facility becomes inoperable for

any reason, or our automation and expansion plans do not yield the desired effects, our ability to produce our products could be

negatively impacted. |

Risks

Related to Our Solid-State Technology Development

| |

● |

We

face significant engineering challenges in our attempts to develop and manufacture solid-state battery cells and these efforts may

be delayed or fail which could negatively impact our business. |

| |

● |

We

expect to make significant investments in our continued research and development of solid-state battery technology development, and

we may be unable to adequately control the costs associated with manufacturing our solid-state battery cells. |

| |

● |

If

our solid-state batteries fail to perform as expected, our ability to further develop, market and sell our solid-state batteries

could be harmed. |

Risks

Related to Intellectual Property

| |

● |

We rely heavily upon our

intellectual property portfolio. If we are unable to protect our intellectual property rights, our business and competitive position

would be harmed. |

| |

● |

We

may need to defend ourselves against intellectual property infringement claims, which may be time-consuming and could cause us to

incur substantial costs. |

General

Risk Factors

| |

● |

The uncertainty in global

economic conditions, including the Russia-Ukraine conflict, could reduce consumer spending and disrupt our supply chain which could

negatively affect our results of operations. |

| |

● |

The

loss of one or more members of our senior management team, other key personnel or our failure to attract additional qualified personnel

may adversely affect our business and our ability to achieve our anticipated level of growth. |

| |

● |

If

we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of customer service,

or adequately address competitive challenges. |

Risks

Related to Our Financial Position and Capital Requirements

| |

● |

Our

business is capital intensive, and we may not be able to raise additional capital on attractive terms, if at all. Any further indebtedness

we incur may limit our operational flexibility in the future. |

| |

● |

Failure

to comply with the financial covenants in our loan agreement could allow our lenders to accelerate payment under our loan agreement,

which would have a material adverse effect on our results of obligations and financial position and raise substantial doubt about

our ability to continue as a going concern. |

| |

● |

Restrictions

imposed by our outstanding indebtedness and

any future indebtedness may limit our ability to operate our business and to finance our future operations or capital

needs or to engage in acquisitions or other business activities necessary to achieve growth. |

Risks

Related to Ownership of Our Common Stock

| |

● |

Future

issuances of debt securities and equity securities may adversely affect us and may be dilutive to existing stockholders. |

| |

● |

We

may issue additional shares of our common stock or other equity securities without your approval, which would dilute your ownership

interests and may depress the market price of your shares. |

THE

OFFERING

| Issuer |

Dragonfly Energy Holdings

Corp. |

| |

|

| Securities

offered by CCM as the selling stockholder |

Up

to 21,512,027 shares of common stock that we may sell to CCM, from time to time in

accordance with the Purchase Agreement. All sales under the Purchase Agreement are at our

sole discretion.

The

actual number of our common stock issued and sold to CCM under the ChEF Equity Facility will vary depending on the then current market

price of our common stock sold to CCM under the ChEF Equity Facility. As of September 18, 2023, 98,500 shares have been issued pursuant

to the Purchase Agreement with CCM for aggregate net proceeds to us of $670,593. |

| |

|

| Terms of the Offering |

CCM will determine when

and how it will dispose of any shares of common stock registered under this prospectus for resale. |

| |

|

| Use of proceeds |

We

will receive no proceeds from the sale of shares of common stock by CCM in this offering. We may receive up to $150 million in gross

proceeds from the sale of shares to CCM pursuant to the Purchase Agreement from time to time. However, the actual proceeds

we receive may be less than $150 million (before being reduced for the discount to CCM) depending on the number of shares of common

stock sold and the price at which the shares of common stock are sold. Any proceeds we receive from CCM, we intend to use for the repayment of all or a portion of our outstanding debt and

for working capital and general corporate purposes. Additionally, pending the uses described above, we plan to invest the net proceeds

from the sale of shares of common stock to CCM, if any, in short- and intermediate-term, interest-bearing obligations, investment-grade

instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government. See “Use of Proceeds”

for additional information. |

| |

|

| Conflicts of Interest |

CCM,

an affiliate of the Sponsor, is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and is

expected to act as an executing broker for the resale of common stock in this offering. CCM’s receipt of all the proceeds from

resales of common stock results in a “conflict of interest” under FINRA Rule 5121. Accordingly, resales by CCM will be

conducted in compliance with FINRA Rule 5121. To the extent that the common stock does not have a “bona fide public market,”

as defined in FINRA Rule 5121, a qualified independent underwriter will participate in the preparation of, and exercise the usual

standards of “due diligence” with respect to, the registration statement. LifeSci Capital, LLC has agreed to act as qualified

independent underwriter for this offering and will receive an upfront fee of $100,000 and, beginning one year after the date of the

Purchase Agreement until its termination, a quarterly fee of $25,000 for doing so, or up to $300,000 in the aggregate. Pursuant to

FINRA Rule 5121, CCM will not confirm resales of common stock to any account over which it exercises discretionary authority without

the prior written approval of the customer. See “Plan of Distribution (Conflicts of Interest) — Conflicts

of Interest.” |

| |

|

| Nasdaq ticker symbol |

Our common stock is currently

listed on Nasdaq under the symbol “DFLI”. |

| |

|

| Risk factors |

Any investment in the securities

offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk

Factors” and elsewhere in this prospectus. |

Unless

we specifically state otherwise or the context otherwise requires, the information above is as of September 18, 2023, does not give

effect to issuances of our common stock, warrants or options to purchase shares of our common stock, or the exercise of warrants or options

after such date, and excludes:

| |

● |

40,000,000

Earnout Shares; |

| |

● |

1,501,386

shares of common stock (the “Private Warrant Shares”) issuable upon exercise of the private placement warrants

that were originally issued in a private placement at the time of the CNTQ IPO; |

| |

● |

9,422,519

shares of common stock (the “Public Warrant Shares”) issuable upon exercise of the Public Warrants sold as part

of the units in the CNTQ IPO; |

| |

● |

593,056

shares of common stock (the “Penny Warrant Shares”) currently issuable upon exercise of the Penny Warrants issued

as part of the Term Loan; |

| |

● |

11,131,900 shares of common stock (the “Investor Warrant Shares”) currently issuable upon exercise

of the Investor Warrants issued as part of the June 2023 S-1 Offering; |

| |

● |

570,250 shares of common stock (the “Underwriters’

Warrant Shares”) currently issuable upon the exercise of the Underwriters’ Warrants (defined below) issued as part

of the June 2023 S-1 Offering; |

| |

● |

3,443,099

shares of common stock underlying outstanding options; and |

| |

● |

180,000 shares of common stock underlying outstanding restricted stock units

(“RSUs”). |

RISK

FACTORS

Investment

in our securities involves risk. You should carefully consider the following risk factors in addition to the other information included

in this prospectus, including matters addressed in the section entitled “Cautionary Note Regarding Forward-Looking Statement.”

Please see the section entitled “Where You Can Find More Information” in this prospectus. These risk factors

are not exhaustive, and investors are encouraged to perform their own investigation with respect to our business, financial condition

and prospects. We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial,

which may also impair our business or financial condition. The following discussion should be read in conjunction with the financial

statements and notes to the financial statements included herein.

Risks

Related to the ChEF

It

is not possible to predict the actual number of shares of our common stock, if any, we will sell under the Purchase Agreement to CCM,

or the actual gross proceeds resulting from those sales. Further, we may not have access to the full amount available under the ChEF

Equity Facility.

Under

the Purchase Agreement entered into in connection with the ChEF Equity Facility, we have the right from time to time at our option

to direct CCM to purchase up to a specified maximum amount of shares of our common stock, up to a maximum aggregate purchase price

of $150 million, over the term of the ChEF Equity Facility. See “ChEF Equity Facility” on page 104 for more

information regarding the Purchase Agreement and the ChEF Equity Facility. We generally have the right to control the timing and

amount of any common stock sales to CCM under the Purchase Agreement. The timing and amount of common stock sold by us to CCM under

the Purchase Agreement will be determined by us from time to time in our sole discretion and will depend on a variety of factors,

including market conditions and the terms, conditions and limitations set forth in the Purchase Agreement (including certain

limitations on CCM’s obligation to purchase shares including, among other things, daily trading volumes and the Beneficial

Ownership Limitation). We may ultimately decide to sell to CCM all, some or none of the common stock shares available for our sale

to CCM pursuant to the ChEF Equity Facility. Depending on market liquidity at the time, resales of those shares by CCM may cause the

public trading price of our common stock to decrease.

Because

the purchase price per share to be paid by CCM for shares of common stock that we may elect to sell to CCM under the ChEF Equity Facility,

if any, will fluctuate based on the volume weighted average price (“VWAP”) of our common stock during the applicable

period for each purchase made pursuant to the Purchase Agreement, it is not possible for us to predict, prior to any such sales, the

number of shares of common stock we will sell to CCM under the Purchase Agreement, the per share purchase price CCM will pay for such

shares, or the aggregate gross proceeds that we will receive from those purchases by CCM under the Purchase Agreement, if any.

As

a result of the fluctuation of the purchase price per share to be paid by CCM, we may need to issue and sell more than the number of

shares that we initially expect to issue to CCM under the Purchase Agreement to receive aggregate gross proceeds equal to the maximum

aggregate purchase price of $150 million under the Purchase Agreement, which could cause additional substantial dilution to holders of

our common stock. The number of shares of common stock ultimately offered for sale by CCM is dependent upon the number of shares of common

stock, if any, we ultimately sell to CCM under the ChEF Equity Facility.

Under

the Purchase Agreement we may not commence sales of our common stock to CCM until all the conditions to CCM’s obligations thereunder

have been satisfied, including effectiveness of this registration statement of which this prospectus is a part and required FINRA clearance.

CCM is not obligated to (but may, at its option, choose to) purchase an amount of shares of common stock to the extent such amount purchased

exceeds the amount of shares of common stock equal to the least of: (a) a number of shares that would result in beneficial ownership

(as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder) by CCM, together with its affiliates,

of more than 9.9% of the outstanding voting power or shares of common stock, (b) a number of shares that would cause the aggregate purchase

price on the applicable Purchase Date (as defined in the Purchase Agreement) for such purchase to exceed $3 million or (c) a number of

shares that would equal 20% of the total number of shares of common stock that would count towards VWAP on the applicable Purchase

Date of such purchase. Our inability to access a portion or the full amount available under the ChEF Equity Facility, in the absence

of any other financing sources, could have a material adverse effect on our business.

CCM

is an affiliate of CNTQ’s Sponsor. See “Selling Stockholder” on page 100 for more information about CCM

and its affiliates’ beneficial ownership of our shares of common stock. In light of the Beneficial Ownership Limitation set forth

above, the Sponsor has agreed that the Private Warrants may not be exercised to the extent the Sponsor and its affiliates are deemed

to beneficially own, or it would cause the Sponsor and such affiliates to be deemed to beneficially own, more than 7.5% of our common

stock.

The

issuance and sale of shares of our common stock to CCM will cause dilution to other holders of shares of our common stock, and the sale

of the shares of our common stock acquired by CCM, or the perception that such sales may occur, could cause the price of the shares our

common stock to fall.

The

purchase price for the shares that we may sell to CCM under the Purchase Agreement will fluctuate based on the price of our common stock.

Depending on market liquidity at the time, sales of such shares may cause the trading price of shares of our common stock to fall.

If

and when we do sell shares to CCM, after CCM has acquired the shares, CCM may resell all, some, or none of those shares at any time or

from time to time in its discretion, subject to the terms of the Purchase Agreement and compliance with securities laws. Therefore, the

sales of our common stock to CCM could result in substantial dilution to the interests of other holders of their shares of our common

stock. Additionally, the sale of a substantial number of shares of our common stock to CCM, or the anticipation of such sales, could

make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise

wish to effect sales.

We

are obligated to register for sale or resale certain shares of our common stock and/or warrants issued in conjunction with the Business

Combination, and the perception that such sales may occur may cause the trading price for our common stock to fall.

In

addition to the registration pursuant to this prospectus of the common stock to be issued and sold to CCM under the ChEF Equity

Facility, under various registration rights agreements, we are required to file and keep effective one or more separate registration

statements registering the issuance to and resale by certain third parties of certain shares of common stock and/or warrants issued

prior to, or in connection with, the Business Combination. These third parties include CNTQ’s Sponsor, members of our senior

management, other large historic Legacy Dragonfly shareholders and our Term Loan Lenders (as defined herein). The shares

being registered for resale into the public markets represent a substantial majority of our outstanding common stock as of September

18, 2023. Once such separate registration statements are effective, including this registration statement, the shareholders

selling pursuant to such separate registration statements will determine the timing, pricing and rate at which they sell such shares

into the public market and such sales could have a significant negative impact on the trading price of our common stock. Certain of

the investors/lenders who have resale rights under such separate registration statements may have an incentive to sell

because they purchased shares and/or warrants at prices below the CNTQ IPO offering price. As such, while sales by the shareholders

selling pursuant to such registration statements may experience a positive rate of return based on the trading price at the time

they sell their shares, public securityholders may not experience a similar rate of return on the securities they purchased due to

differences in the prices at which such public securityholders purchased their shares and the trading price. Given the substantial

number of shares of common stock being registered for potential resale by the shareholders selling pursuant to such registration

statements, the sale of shares by such shareholders, or the perception in the market that the shareholders of a large number of

shares intend to sell shares, may increase the volatility of the market price of our common stock, may prevent the trading price of

our securities from exceeding the CNTQ IPO offering price and may cause the trading prices of our securities to experience a further

decline. Further, the 21,512,027 shares that may be resold and/or issued into the public markets pursuant to this prospectus

represent approximately 37% of the shares of our common stock outstanding as of September 18, 2023. Any sales of

such shares into the public market could have a significant negative impact on the trading price of our common stock. This impact

may be heightened by the fact that sales to CCM will generally be at prices below the then current trading price of our common

stock. If the trading price of our common stock does not recover or experiences a further decline, sales of shares of common stock

to CCM pursuant to the Purchase Agreement may be a less attractive source of capital and/or may not allow us to raise capital at

rates that would be possible if the trading price of our common stock were higher. Our management team may invest or spend the

proceeds from sales of our common stock made pursuant to the Purchase Agreement in ways with which you may not agree or in ways

which may not yield a significant return.

Our

management will have broad discretion over the use of proceeds from the sale of shares to CCM pursuant to the Purchase Agreement, if

any. We intend to use the net proceeds from the sale of shares to CCM pursuant to the Purchase Agreement, if any, for working capital

and general corporate purposes. You will not have the opportunity, as part of your investment decision, to assess whether such proceeds

are being used appropriately. The proceeds from the sale of shares to CCM pursuant to the Purchase Agreement, if any, may be used for

corporate purposes that do not increase our operating results or enhance the value of our common stock.

Investors

who buy common stock from CCM at different times will likely pay different prices.

Pursuant

to the Purchase Agreement, the timing, price and number of shares sold to CCM will vary depending on when we choose to sell shares, if

any, to CCM. If and when we elect to sell common stock to CCM pursuant to the Purchase Agreement, after CCM has acquired such common

stock, CCM may resell all, some or none of such shares at any time or from time to time in its sole discretion and at different prices.

As a result, investors who purchase shares from CCM in this offering at different times will likely pay different prices for those shares.

Investors may experience a decline in the value of the shares they purchase from CCM in this offering as a result of future sales made

by us to CCM pursuant to the Purchase Agreement or for other reasons.

Risks

Related to Our Existing Lithium-Ion Battery Operations

Our

business and future growth depends on the needs and success of our OEM’s and similar customers.

The

demand for our products, including sales to OEMs, ultimately depends on consumers in our current end markets (primarily

owners of RVs, marine vessels and off-grid residences). The performance and growth of these markets is impacted by numerous factors,

including macro-economic conditions, consumer spending, travel restrictions, fuel costs and energy demands (including an increasing trend

towards the use of green energy). Increases or decreases in these variables may significantly impact the demand for our products. If

we fail to accurately predict demand, we may be unable to meet our customers’ needs, resulting in the loss of potential sales,

or we may produce excess products, resulting in increased inventory and overcapacity in our production facilities, increasing our unit

production cost and decreasing our operating margins.

An

increasing proportion of our revenue has been and is expected to continue to be derived from sales to RV OEMs. Our RV OEM sales have

been on a purchase order basis, without firm revenue commitments, and we expect that this will likely continue to be the case. For example,

under our Supply Agreement (as defined herein) with Keystone RV Company, the largest manufacturer of towable RVs in North

America, Keystone has agreed to offer our storage solutions as an option to dealers and consumers on certain of its products. However,

this arrangement may not deliver the anticipated benefits, as there are no firm purchase commitments, sales will continue to be made

on a purchase order basis, and this arrangement may not be renewed. In addition, in July 2022, we agreed to a strategic investment

by THOR Industries (“THOR”), which, among other things, contemplates a future, mutually agreed exclusive distribution

agreement with THOR in North America. Although we expect that THOR will be a be significant contributor to our projected growth in RV

OEM battery sales, this arrangement may not deliver the anticipated benefits and this distribution agreement may, in the future, preclude

us from dealing with other large RV OEMs and their associated brands in North America or otherwise could negatively impact our relationships

with those RV OEMs to whom we may be permitted to supply our batteries. In July 2023, we were notified by Keystone that, due to weaker

demand for its products and their subsequent focus on reducing costs, it would no longer install our storage solutions as standard equipment,

but rather return to offering those solutions as an option to dealers and consumers. While Keystone is not moving to a different solution

or competitor, we do expect this change in strategy to have a material limiting effect on our revenue throughout the remainder of 2023.

Increased overall RV OEM sales in the future may not materialize as expected or at all and we may fail to achieve our targeted

sales levels. Future RV OEM sales are subject to a number of risks and uncertainties, including the number of RVs that these OEMs manufacture

and sell (which can be impacted by a variety of events including those disrupting our OEM customers’ operations due to supply chain

disruptions or labor constraints); the degree to which our OEM customers incorporate/design-in our batteries into their RV product lines

and renew our supply arrangements; the extent to which RV owners, if applicable, opt to purchase our batteries upon initial purchase

of their RV or in the aftermarket; and our continued ability to successfully develop and introduce reliable and cost-effective batteries

meeting evolving industry standards and customer specifications and preferences. Our failure to adequately address any of these risks

may result in lost sales which could have a material adverse effect on our business, financial condition and results of operations.

In

addition, our near-term growth depends, in part, on the continued growth of the end markets in which we currently operate. Although the

total addressable market for RVs, marine vessels and off-grid residences is estimated to reach $12 billion by 2025, these markets may

not grow as expected or at all, and we may be unable to maintain existing customers and/or attract new customers in these markets. Our

failure to maintain or expand our share of these growing markets could have a material adverse effect on our business, financial condition

and results of operations.

We

may not be able to engage target customers successfully and convert these customers into meaningful orders in the future.

Our

success, and our ability to increase sales and operate profitably, depends on our ability to identify target customers and convert these

customers into meaningful orders, as well as our continued development of existing customer relationships. Although we have developed

a multi-pronged sales and marketing strategy to penetrate our end markets and reach a range of customers, this strategy may not continue

to be effective in reaching or converting target customers into orders, or as we expand into additional markets. Recently, we have also

dedicated more resources to developing relationships with certain key RV OEMs, which we aim to convert into collaborations on custom

designs and/or long-term contractual arrangements. However, in July 2023, we were notified by Keystone that, due to weaker demand

for its products and their subsequent focus on reducing costs, it would no longer install our storage solutions as standard equipment,

but rather return to offering those solutions as an option to dealers and consumers. While Keystone is not moving to a different solution

or competitor, we do expect this change in strategy to have a material limiting effect on our revenue throughout the remainder of 2023.

We may be unable to convert these relationships into meaningful orders or renew these arrangements going forward, which may require

us to expend additional cost and management resources to engage other target customers.

Our

sales to any future or current customers may decrease for reasons outside our control, including loss of market share by customers to

whom we supply products, reduced or delayed customer requirements, supply and/or manufacturing issues affecting production, reputational

harm or continued price reductions. Furthermore, in order to attract and convert customers we must continue to develop batteries that

address our current and future customers’ needs. Our failure to achieve any of the foregoing could have a material adverse effect

on our business, financial condition and results of operations.

We

operate in a competitive industry. We expect that the level of competition will increase and the nature of our competitors will change

as we develop new LFP battery products for, and enter into, new markets, and as the competitive landscape evolves. These competitive

and other factors could result in lost potential sales and lower average selling prices and profitability for our products.

We

compete with traditional lead-acid battery manufacturers and lithium-ion battery manufacturers, who primarily either import their products

or components or manufacture products under a private label. As we continue to expand into new markets, develop new products and move

towards production of our solid-state cells, we will experience competition with a wider range of companies. These include companies

focused on solid-state cell production, vertically integrated energy companies and other technology-focused energy storage companies.

We believe our main competitive advantage in displacing incumbent lead-acid batteries is that we produce a lighter, safer, higher performing,

cost-effective battery with a longer lifespan. We believe our go-to-market strategy, established brands, proven reliability and

relationships with OEMs and end consumers both (i) enable us to compete effectively against other battery manufacturers and (ii) position

us favorably to expand into new addressable markets. However, OEM sales typically result in lower average selling prices and related

margins, which could result in overall margin erosion, affect our growth or require us to raise our prices. As a result, we may be unable

to maintain this competitive advantage given the rapidly developing nature of the industry in which we operate.

Our

current competitors have, and future competitors may have, greater resources than we do. Our competitors may be able to devote greater

resources to the development of their current and future technologies. These competitors may also be able to devote greater resources

to sales and marketing efforts, affording them greater access to customers, and may be able to establish cooperative or strategic relationships

amongst themselves or with third parties that may further enhance their competitive positioning. In addition, foreign producers may be

able to employ labor at significantly lower costs than producers in the United States, expand their export capacity and increase their

marketing presence in our major end markets. We expect actual and potential competitors to continue their efforts to develop alternative

battery technologies and introduce new products with more desirable, attractive features. These new technologies and products may be

introduced sooner than our offerings and could gain greater market acceptance. Although we believe we are a leader in developing solid-state

battery technology (particularly for energy storage applications) new competitors may emerge, alternative approaches to solid-state

battery technology may be developed and competitors may seek to market solid-state battery technologies better suited for other applications

such as electric vehicle’s (“EV”) to our target markets.

Additional

competitive and other factors may result in lost sales opportunities and declines in average sales prices and overall product profitability.

These include rapidly evolving technologies, industry standards, economic conditions and end-customer preferences. Our failure to adapt

to or address these factors as they arise could have a material adverse effect on our business, financial condition and results of operations.

We

may not succeed in our medium- and long-term strategy of entering into new end markets for LFP batteries and our success depends, in

part, on our ability to successfully develop and manufacture new products for, and acquire customers in, these new markets and successfully

grow our operations and production capabilities (including, in time, our ability to manufacture solid-state cells in-house).

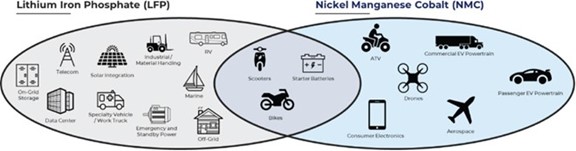

Our

future success depends, in part, upon our ability to expand into additional end markets identified by us as opportunities for our LFP

batteries. These markets include solar integration industrial, specialty and work vehicles, material handling, rail, and emergency and

standby power in the medium term, and data centers, telecom and distributed on-grid storage in the longer term. Our ability to expand

into these markets depends on a number of factors, including the continued growth of these markets, having sufficient capital to expand

our product offerings (including in the longer term batteries incorporating, once developed, our solid-state cells) and manufacturing

capacity, developing products adapted to customer needs and preferences in these markets, our successful expansion of our manufacturing

capabilities in order to meet customer demand, our ability to identify and convert potential customers within these markets and our ability

to attract and retain qualified personnel to assist in these efforts. Although we intend to devote resources and management time to understanding

these new markets, we may face difficulties in understanding and accurately predicting the demographics, preferences and purchasing habits

of customers and consumers in these markets. If we fail to execute on our growth strategies in accordance with our expectations, our

sales growth would be limited to the growth of existing products and existing end markets, and this could have a material adverse effect

on our business, financial condition and results of operations.

Further,

if we are unable to manage the growth of our operations effectively to match the growth in sales, we may incur unexpected expenses and

be unable to meet our customers’ requirements, which could materially adversely affect our business, financial condition and results

of operations. A key component of our growth strategy is the expansion and automation of our manufacturing sales capacity to address

expected growing product demand and to accommodate our production of solid-state cells at scale. We have experienced supply delays in

obtaining the necessary components to implement our automated adhesive application systems, as well as our pilot production line for

our solid-state cells, and we may continue to experience component shortages in the future, which may negatively impact our ability to

achieve these aspects of our growth strategy on time or at all. The costs of our expansion and automation efforts may be greater than

expected, and we may fail to achieve anticipated cost efficiencies, which could have a material adverse effect on our business, financial

condition and results of operations. We must also attract, train and retain a significant number of skilled employees, including engineers,

sales and marketing personnel, customer support personnel and management, and the availability of such personnel may be constrained.

Failure to effectively manage our growth could also lead us to over-invest or under-invest in development and operations; result in weaknesses

in our infrastructure, systems or controls; give rise to operational mistakes, financial losses, loss of productivity or business opportunities;

and result in loss of employees and reduced productivity of remaining employees, any of which could have a material adverse effect on

our business, financial condition and results of operations.

We

currently rely on two suppliers to provide our LFP cells and a single supplier for the manufacture of our battery management system.

Any disruption in the operations of these key suppliers could adversely affect our business and results of operations.

We

currently rely on two carefully selected cell manufacturers located in China, and a single supplier, also located in China, to manufacture

our proprietary battery management system, and we intend to continue to rely on these suppliers going forward.

Our

dependence on a limited number of key third-party suppliers exposes us to challenges and risks in ensuring that we maintain adequate

supplies required to produce our LFP batteries. Although we carefully manage our inventory and lead-times, we may experience a delay

or disruption in our supply chain and/or our current suppliers may not continue to provide us with LFP cells or our battery management

systems in our required quantities or to our required specifications and quality levels or at attractive prices. Our close working relationships

with our China-based LFP cell suppliers to-date, reflected in our ability to increase our purchase order volumes (qualifying us for related

volume-based discounts) and to order and receive delivery of cells in advance of required demand, has helped us moderate or offset increased

supply-related costs associated with inflation, currency fluctuations and tariffs imposed on our battery cell imports by the U.S. government

and avoid potential shipment delays. If we are unable to enter into or maintain commercial agreements with these suppliers on favorable

terms, or if any of these suppliers experience unanticipated delays, disruptions or shutdowns or other difficulties ramping up their

supply of products or materials to meet our requirements, our manufacturing operations and customer deliveries would be seriously impacted,

potentially resulting in liquidated damages and harm to our customer relationships. Although we believe we could locate alternative suppliers

to fulfill our needs, we may be unable to find a sufficient alternative supply in a reasonable time or on commercially reasonable terms.

Further,

our dependence on these third-party suppliers entails additional risks, including:

| |

● |

inability, failure or unwillingness

of third-party suppliers to comply with regulatory requirements; |

| |

|

|

| |

● |

breach

of supply agreements by the third-party suppliers; |

| |

|

|

| |

● |

misappropriation

or disclosure of our proprietary information, including our trade secrets and know-how; |

| |

|

|

| |

● |

relationships

that third-party suppliers may have with others, which may include our competitors, and failure of third-party suppliers to adequately

fulfill contractual duties, resulting in the need to enter into alternative arrangements, which may not be available, desirable or

cost-effective; and |

| |

|

|

| |

● |

termination

or nonrenewal of agreements by third-party suppliers at times that are costly or inconvenient for us. |

We

may not be able to accurately estimate future demand for our LFP batteries, and our failure to accurately predict our production requirements

could result in additional costs or delays.

We

seek to maintain an approximately nine-month supply of LFP cells and six-month supply of all other critical components by pre-ordering

components in advance of expected demand. However, our business and customer product demand is impacted by trends and factors that may

be outside our control. Therefore, our ability to predict our manufacturing requirements is subject to inherent uncertainty. Lead times

for materials and components that our suppliers order may vary significantly and depend on factors such as the specific supplier, contract

terms and demand for each component at a given time. If we fail to order sufficient quantities of product components in a timely manner,

the delivery of our batteries to our customers could be delayed, which would harm our business, financial condition and results of operations.

To

meet our delivery deadlines, we generally make significant decisions on our production level and timing, procurement, facility requirements,

personnel needs and other resources requirements based on our estimate of demand, our past dealings with such customers, economic conditions

and other relevant factors. Although we monitor our slow-moving inventory, if customer demand declines significantly, we may have excess

inventory which could result in unprofitable sales or write-offs. Expediting additional material to make up for any shortages

within a short time frame could result in increased costs and a delay in meeting orders, which would result in lower profits and negatively

impact our reputation. In either case, our results of operations would fluctuate from period to period.

In

addition, certain of our competitors may have long-standing relationships with suppliers, which may provide them with a competitive pricing

advantage for components and reduce their exposure to volatile raw material costs, including due to inflation. As a result, we may face

market-driven downward pricing pressures in the future, which may run counter to the cost of the components required to produce our products.

During 2022 in particular, we experienced rising materials costs due to inflation, which we partially mitigated through

increases in our product prices, where we thought it to be prudent. Our customers may not view this favorably and expect

us to cut our costs further and/or to lower the price of our products. We may be unable to increase our sales volumes to offset lower

prices (if we choose to implement lower prices), develop new or enhanced products with higher selling prices or margins, or reduce our

costs to levels enabling us to remain competitive. Our failure to accomplish any of the foregoing could have a negative impact on our

profitability and our business, financial condition and results of operations may ultimately be materially adversely affected.

We

are currently, and will likely continue to be, dependent on a single manufacturing facility. If our facility becomes inoperable for any

reason, or our automation and expansion plans do not yield the desired effects, our ability to produce our products could be negatively

impacted.

All

of our battery assembly currently takes place at our 99,000 square foot headquarters and manufacturing facility located in Reno, Nevada.

We currently operate three LFP battery production lines, which has been sufficient to meet customer demand. If one or both production

lines were to be inoperable for any period of time, we would face delays in meeting orders, which could prevent us from meeting demand

or require us to incur unplanned costs, including capital expenditures.

Our

facility may be harmed or rendered inoperable by natural or man-made disasters, including earthquakes, flooding, fire and power outages,

utility and transportation infrastructure disruptions, acts of war or terrorism, or by public health crises, which may render it difficult

or impossible for us to manufacture our products for an extended period of time. The inability to produce our products or the backlog

that could develop if our manufacturing facility is inoperable for even a short period of time may result in increased costs, harm to

our reputation, a loss of customers or a material adverse effect on our business, financial condition or results of operations. Although

we maintain property damage and business interruption insurance, this insurance may not be sufficient to cover all of our potential

losses and may not continue to be available to us on acceptable terms, if at all.

Over

the next several years we plan to automate additional aspects of existing LFP battery production lines, add additional LFP battery production

lines (as required) and construct and operate a pilot production line for our solid-state cells, all designed to maximize the capacity

of our manufacturing facility. Our plans for automation and expansion may experience delays, incur additional costs or cause disruption

to our existing production lines. For example, we have experienced supply delays in obtaining the necessary components to implement our

automated adhesive application systems, as well as our pilot production line for our solid-state cells, and we may continue to experience

component shortages in the future. The costs to successfully achieve our expansion and automation goals may be greater than we expect,

and we may fail to achieve our anticipated cost efficiencies, which could have a material adverse effect on our business, financial condition

and results of operations. Furthermore, while we are generally responsible for delivering products to the customer, we do not maintain

our own fleet of delivery vehicles and outsource this function to third parties. Any shortages in trucking capacity, any increase in

the cost thereof or any other disruption to the highway systems could limit our ability to deliver our products in a timely manner or

at all.

Lithium-ion

battery cells have been observed to catch fire or release smoke and flame, which may have a negative impact on our reputation and business.

Our

LFP batteries use LFP as the cathode material for lithium-ion cells. LFP is

intrinsically safer than other battery technologies due to its thermal and chemical stability and LFP batteries are less flammable than

lead-acid batteries or lithium-ion batteries using different chemistries. On rare occasions, however, lithium-ion cells can rapidly release

the energy they contain by releasing smoke and flames in a manner that can ignite nearby materials and other lithium-ion cells. This

faulty result could subject us to lawsuits, product recalls, or redesign efforts, all of which would be time consuming and expensive.

Further, negative public perceptions regarding the suitability or safety of lithium-ion cells or any future incident involving lithium-ion

cells, such as a vehicle or other fire, even if such incident does not involve our products, could seriously harm our business and reputation.

To

facilitate an uninterrupted supply of battery cells, we store a significant number of lithium-ion cells at our facility. While we have

implemented enhanced safety procedures related to the handling of the cells, any mishandling, other safety issue or fire related to the

cells could disrupt our operations. In addition, any accident, whether occurring at our manufacturing facility or from the use of our

batteries, may result in significant production interruption, delays or claims for substantial damages caused by personal injuries or

property damage. Such damage or injury could lead to adverse publicity and potentially a product recall, which could have a material

adverse effect on our brand, business, financial condition and results of operations.

We

may be subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully

defend or insure against such claims.

Product

liability claims, even those without merit or that do not involve our products, could result in adverse publicity or damage to our brand,

decreased partner and end-customer demand, and could have a material adverse effect on our business, financial condition and results

of operations. The occurrence of any defects in our products could make us liable for damages and legal claims. In addition, we could

incur significant costs to correct such issues, potentially including product recalls. We face an inherent risk of exposure to claims

in the event that our products do not perform or are claimed not to have performed as expected. We also face risk of exposure to claims

because our products may be installed on vehicles (including RVs and marine vessels) that may be involved in crashes or may not perform

as expected resulting in death, personal injury or property damage. Liability claims may result in litigation, the occurrence of which

could be costly, lengthy and distracting and could have a material adverse effect on our business, financial condition and results of

operations.

In

the future, we may voluntarily or involuntarily initiate a recall if any products prove to be defective or non-compliant with then-applicable

safety standards. Such recalls may involve significant expense and diversion of management attention and other resources, which could

damage our brand image in our target end markets, as well as have a material adverse effect on our business, financial condition and

results of operations.

A

successful product liability claim against us could require us to pay a substantial monetary award. While we maintain product liability

insurance, the insurance that we carry may not be sufficient or it may not apply to all situations. Moreover, a product liability claim

against us or our competitors could generate substantial negative publicity about our products and business and could have a material

adverse effect on our brand, business, financial condition and results of operations.

We

currently rely on software and hardware that is complex and technical, and we expect that our reliance will increase in the future with

the introduction of future products. If we are unable to manage the risks inherent in these complex technologies, or if we are unable

to address or mitigate technical limitations in our systems, our business could be adversely affected.

Each

of our batteries include our proprietary battery management system, which relies on software and hardware manufactured by third parties

that is complex and technical. In addition, Dragonfly IntelLigence, our battery communications system which we recently launched

in the first quarter of 2023, utilizes third-party software and hardware to store, retrieve, process and manage data.

The software and hardware utilized in these systems may contain errors, bugs, vulnerabilities or defects, which may be difficult to detect

and/or manage. Although we attempt to remedy any issues that we observe in our products as effectively and rapidly as possible, such

efforts may not be timely, may hamper production, or may not be to the satisfaction of our customers. If we are unable to prevent or

effectively remedy errors, bugs, vulnerabilities or defects in the software and hardware that we use, we may suffer damage to our brand,