Dollar General Focuses on Food as It Eyes Expansion

December 04 2018 - 4:35PM

Dow Jones News

By Aisha Al-Muslim

Dollar General Corp. is betting that more food options,

including fresh produce, will boost its revenue and traffic as it

looks to expand its presence in food deserts in rural and metro

areas.

In its fiscal 2019, which starts Feb. 2, the discount retailer

plans to open 975 new stores, remodel 1,000 stores and relocate 100

stores, the company said Tuesday. That is 75 more store openings

than expected in fiscal 2018.

Dollar General Chief Executive Todd Vasos said during a

conference call with analysts Tuesday that the company is eyeing

various setups as part of its expansion because customers' needs

vary.

"We intentionally develop these additional formats to be able to

move into certain demographics across the U.S. where a

one-size-fits-all mentality is really not the way to be productive

and to make the most of your real estate portfolio," he said.

For instance, Mr. Vasos said the company can "drive a tremendous

amount of traffic" by opening stores that offer refrigerated

products and produce in food deserts, areas where access to

affordable and healthier food options is limited.

The company expects to add produce to about 200 of these

remodeled stores. Currently, Dollar General has about 425 stores

that carry produce.

About half of the remodels will be in what the company describes

as its "traditional plus" format -- a traditional store in terms of

size, but with more cooler space.

Mr. Vasos added there is still an opportunity to add 12,000 to

13,000 stores in the continental U.S.

Out of the anticipated new stores, the company plans to open

about 10 locations that are about half the size of a traditional

Dollar General store and have a product selection that is "tailored

to vertical living customers" in more densely populated areas in

some key cities across the U.S., Mr. Vasos said. The company

currently has three of the smaller format stores.

The store growth outlook comes as Dollar General reported on

Tuesday a higher profit for its third quarter that were in line

with analysts' expectations. The company reported net sales rose

8.7% to $6.42 billion and same-store sales grew 2.8%, both beating

analysts' estimates.

Higher same-store sales during the third quarter were driven by

an increase in average transaction amount and sales in the

consumables, seasonal and home categories, partially offering sales

declines in the apparel category.

Overall, Dollar General's results were better than its

competitor Dollar Tree Inc. Last week, Dollar Tree Inc., which owns

both the Dollar Tree and Family Dollar chains, said sales rose 4.2%

to $5.54 billion in its latest quarter, but weaker sales at

existing Family Dollar stores dragged down the company's otherwise

strong performance.

Same-store sales rose 2.3% at Dollar Tree, but sales at stores

open at least a year under the Family Dollar banner fell 0.4%.

Since Dollar Tree bought Family Dollar more than three years

ago, Dollar Tree has been working to renovate Family Dollar stores.

The company plans to finish around 500 Family Dollar renovations

this fiscal year, at least 1,000 next year, and another 1,000 the

following year. The company also plans to close some Family Dollar

stores, but the number wasn't disclosed.

For fiscal 2018, Dollar General guided net sales of about 9%,

compared with its previous range of 9% to 9.3%. The company also

said it expects same-store sales growth to be in the middle of the

previous range of mid-to-high 2%. It also lowered its range

expectations for earnings per share to $5.85 to $6.05 for the

fiscal year, from its previous forecast of $5.95 to $6.15, to

reflect a 9-cent hit due to the weather events, ongoing

transportation cost pressures and year-to-date results.

The stock fell 6.9% to $104.04 in trading Tuesday. Shares are up

nearly 15% in the past 12 months.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

December 04, 2018 16:20 ET (21:20 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

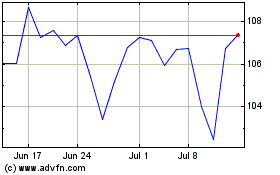

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024