NasdaqFALSE000165194400016519442023-09-112023-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 11, 2023

DERMTECH, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38118 | 84-2870849 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

12340 El Camino Real

San Diego, CA 92130

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code (858) 450-4222

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.0001 per share | DMTK | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 11, 2023, DermTech, Inc. (the “Company”) announced that Mark Aguillard has accepted an offer to join the Company as its Chief Commercial Officer.

Mr. Aguillard is a proven commercial leader with over 20 years of experience driving growth through the development and commercialization of multiple, novel molecular diagnostics. Most recently, Mr. Aguillard served as Chief Commercial Officer of Epic Sciences, Inc. from July 2021 to September 2023, where he led the development and launch of a novel liquid biopsy, DefineMBC, designed to personalize treatment for patients with metastatic breast cancer. From November 2020 to June 2021, Mr. Aguillard served as Chief Commercial Officer at binx health Ltd. Prior to binx health Ltd., Mr. Aguillard held a series of executive positionsat Myriad Genetics Inc., from May 2016 to November 2020, including General Manager of its Women’s Health division, where he directed sales, marketing, medical affairs, customer success, and payer markets. Prior to Myriad Genetics Inc., Mr. Aguillard served in commercial leadership roles at OmniSeq Inc. and Eli Lilly and Company. Mr. Aguillard received his Bachelor’s degree in Business Administration with a major in Finance from Texas Tech University.

Mr. Aguillard does not have a family relationship with any director or executive officer of the Company or person nominated or chosen by the Company to become a director or executive officer, and there are no arrangements or understandings between Mr. Aguillard and any other person pursuant to which Mr. Aguillard was selected to serve as Chief Commercial Officer of the Company. There have been no transactions involving Mr. Aguillard that would require disclosure under Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended. In connection with Mr. Aguillard’s appointment, Mr. Aguillard and the Company will enter into an indemnification agreement in the form the Company has entered into with certain of its other executive officers (the “Indemnification Agreement”), which form is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on September 5, 2019. The Indemnification Agreement, among other things, will provide for indemnification of Mr. Aguillard for expenses, judgments, fines and settlement amounts incurred by him in any action or proceeding arising out of his services as an executive officer or at our request.

Pursuant to the Offer Letter, dated September 6, 2023, by and between the Company and Mr. Aguillard (the “Offer Letter”), Mr. Aguillard will report to Bret Christensen, CEO. Mr. Aguillard’s employment term will start on September 19, 2023 and will continue until terminated by either party. As set forth in the Offer Letter, Mr. Aguillard is entitled to an annual base salary of $400,000 and eligible to receive an annual target performance bonus of up to 50% of his then current base salary. In addition, Mr. Aguillard is eligible to participate in the Company’s Change in Control and Severance Plan (the “Severance Plan”) pursuant to its terms and the terms of the participation agreement to be executed by the Company and Mr. Aguillard upon Mr. Aguillard’s start date (the “Participation Agreement”).

Under the terms of the Participation Agreement, in the event of a Qualifying Termination (as defined in the Severance Plan) other than during a Change in Control Period (as defined in the Severance Plan), Mr. Aguillard would receive the following benefits: (i) nine months of his base salary in effect at the time of such Qualifying Termination, (ii) 50% of the pro-rata portion (based on days employed during the period) of his annual bonus determined to have been earned at the conclusion of the bonus performance period, (iii) nine months of COBRA benefits, (iv) six months of vesting acceleration for each of Mr. Aguillard’s then-outstanding equity awards at the time of such Qualifying Termination (except with respect to Performance Awards, the vesting of which will be determined by the terms of the applicable Performance Award agreement), and (v) an extension of the period during which Mr. Aguillard may exercise any of his stock options that are vested as of the time of such Qualifying Termination (after giving effect to the vesting acceleration described in clause (iv) above) to the earlier of (a) six months following such Qualifying Termination and (b) the expiration date of such stock options.

Mr. Aguillard’s participation agreement will provide further that in the event of a Qualifying Termination during a Change in Control Period, Mr. Aguillard would receive the following benefits: (i) 12 months of his base salary in effect at the time of such Qualifying Termination, (ii) 100% of the pro-rata portion (based on days employed during the period) of his annual bonus determined to have been earned at the conclusion of the bonus performance period, (iii) 12 months of COBRA benefits, (iv) the full acceleration of vesting of any of Mr. Aguillard’s then-outstanding equity awards (except with respect to Performance Awards, the vesting of which will be determined by the terms of the applicable Performance Award agreement), and (v) an extension of the period during which Mr. Aguillard may exercise any of his stock options that are vested as of the time of such Qualifying Termination (after giving effect to the vesting acceleration described in clause (iv) above) to the earlier of (a) six months following such Qualifying Termination and (b) the expiration date of such stock options.

In addition, pursuant to the Offer Letter, Mr. Aguillard will be entitled to a non-qualified stock option to purchase up to 90,000 shares (the “Options”) of the Company’s common stock, $0.0001 par value per share (“Common Stock”) and a

restricted stock unit award representing the contingent right to receive 90,000 shares (the “RSUs”) of Common Stock (together with the Options, the “Equity Award”), subject to approval by the Company’s Board of Directors (the “Board”), and the terms of the Second Amended and Restated Inducement Equity Incentive Plan and the applicable award agreements thereunder. Upon approval of the Equity Award, the Options shall vest over four (4) years with 25% of the shares subject to the Options vesting on the first anniversary of the date of grant, and the remaining 75% of the Options vesting in thirty-six equal monthly installments over the remaining three (3) years, subject to Mr. Aguillard’s continued employment. The RSUs shall vest over four (4) years with 25% of the RSUs vesting on the first anniversary of the grant date and the remaining 75% of the RSUs shall vest in twelve equal quarterly installments thereafter, subject to Mr. Aguillard’s continued employment. Mr. Aguillard is also eligible to participate in the Company’s health and welfare benefit plans, as may be maintained by the Company from time to time, on the same terms as other similarly situated senior executives of the Company. A copy of the Offer Letter is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing summary of the Offer Letter does not purport to be complete, and is qualified in its entirety by the terms of the Offer Letter.

Item 8.01. Other Events.

On September 11, 2023, the Company issued a press release announcing the executive appointment described above. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 10.1* | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

| * | | Management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| DERMTECH, INC. |

| | |

| Date: September 11, 2023 | By: | /s/ Kevin Sun |

| Name: | Kevin Sun |

| Title: | Chief Financial Officer |

September 5, 2023

Mark Aguillard

markaguillard@yahoo.com

RE: EMPLOYMENT OFFER

Dear Mark,

We are thrilled to offer you the role of Chief Commercial Officer at DermTech, Inc. (the “Company”).

At DermTech, we are on a mission to improve the lives of millions by providing non-invasive precision dermatology solutions that enable individualized care. We are so glad to have you join the team.

You will report directly to Bret Christensen, Chief Executive Officer, at the Company’s facilities in San Diego, California, subject to necessary business travel or telework. True to our company value of Agility, aspects

of your role may change due to various internal or external circumstances. We commit to communicating as those things come up.

Your annual salary will be $400,000 (your “Base Salary”), less payroll deductions and all required withholdings. You will be paid in accordance with the Company’s regular payroll schedule, which currently provides for semi-monthly payments and is subject to change. You will be eligible to participate in the Company’s bonus plan, with a target payout of 50% of your Base Salary, based upon the achievement of certain corporate and individual goals that will be determined by the Company’s Chief Executive Officer and/or board of directors, and subject to the provisions of the DermTech 2023 Corporate Bonus Plan. You must be actively employed by the Company at the time a bonus is paid in order to be eligible to receive such bonus.

In addition, the Company will offer a sign-on bonus in the amount of $55,000 payable immediately in the first pay period after your start date. This bonus is taxable and all regular payroll taxes will be withheld. The bonus is also contingent upon completing two years of employment and must be returned at a pro-rated basis if you voluntarily terminate your employment prior to September 19, 2025.

As a material inducement to you joining the Company, the Company has agreed to grant you equity in the form of restricted stock units (RSUs) and non-qualified stock options (together the “Equity Award”), subject to the approval of the Company’s board of directors and the commencement of your employment. This equity award will consist of 90,000 RSUs and 90,000 stock options. Twelve-forty-eighths (12/48) of the RSUs shall vest at one year from grant date and the remaining thirty-six forty-eighths (36/48) of the RSUs shall vest in twelve equal quarterly installments. RSUs for new hires are granted in March, June, September, and December of each year. Options shall have an exercise price equal to the fair market value of the Company’s common stock on the grant date and will vest over four (4) years with 25% of the shares subject to the Option vesting one (1) year after the date of grant, and the remaining 75% vesting in equal monthly installments over the remaining three (3) years, contingent upon your continued service to the Company on the vesting dates.

Notwithstanding anything to the contrary herein, the terms of the Equity Award, including but not limited to terms relating to vesting and forfeiture, are subject to provisions determined by the Board and included in the award agreement(s) to be executed by you upon issuance of such awards. The Equity Award is intended as an inducement grant under Nasdaq Rule 5635(c)(4).

| | |

12340 El Camino Real Del Mar, CA 92130 Direct: 858.450.4222 Fax: 858.200.3877 |

You will be eligible to participate in the various benefit programs maintained by the Company, including medical, dental, vision coverage, and Life Insurance, Accidental Death and Dismemberment (“AD&D”) Insurance, and both short- and long-term disability insurance. Your benefits will be effective on the first day of the month following the month of your start date. The Company currently pays the majority of the medical, dental and vision coverage premiums for employees and dependents. The Company also currently pays the full coverage premiums for the Life, AD&D and short- and long-term disability insurance for employees. The Company also offers a 401(k). You will also be eligible for flexible paid time off each year, managed in a way that minimizes disruption to the Company’s operations. The Company reserves the right to modify or terminate any of its benefit programs at any time.

Your employment is at-will, meaning either you or the Company can terminate your employment at any time, for any reason, with or without notice. This employment offer is contingent upon (i) the successful completion of a background and reference check, (ii) you providing satisfactory proof of your eligibility to work in the United States within three (3) days of your start date, and (iii) execution of the Company’s standard employee nondisclosure, arbitration and invention assignment agreement (“Employment Proprietary Information Agreement”). The Employee Proprietary Information Agreement that you must sign contains specific provisions concerning protection of the intellectual property of entities and persons other than Company, including Paragraph 2.C. which provides as follows: “I agree that I will not, during my employment with the Company, improperly use or disclose any proprietary information or trade secrets of any former or concurrent employer or other person or entity and that I will not bring onto the premises of the Company any unpublished document or proprietary information belonging to any such employer, person or entity unless consented to in writing by such employer, person or entity.”

Your start date is September 19, 2023. Please sign and date your acceptance of foregoing below and return to us by end of day on September 6, 2023. We are pleased to offer you the opportunity to join our team and look forward to working with you!

| | | | | |

| Sincerely, | Offer Accepted: |

Bret Christensen, Chief Executive Officer | /s/ Mark Aguillard Date 9/6/2023 |

| |

| | |

12340 El Camino Real Del Mar, CA 92130 Direct: 858.450.4222 Fax: 858.200.3877 |

DERMTECH APPOINTS MARK AGUILLARD AS CHIEF COMMERCIAL OFFICER

SAN DIEGO – September 11, 2023 – DermTech, Inc. (NASDAQ: DMTK) (DermTech or the Company), a leader in precision dermatology enabled by a non-invasive skin genomics technology, today announced the appointment of Mark Aguillard as chief commercial officer effective September 19, 2023. Mr. Aguillard will lead DermTech’s overall commercial strategy and execution.

Commenting on Mr. Aguillard’s appointment, Bret Christensen, DermTech’s CEO said, “I’d like to welcome Mark to the team. We are confident that his demonstrated success and wide breadth of commercial and payer access experience will serve us well during this transformational period as we focus on generating reimbursed tests to grow revenue. Mark’s leadership will be important as we strive to integrate the DermTech Melanoma Test (DMT) into the melanoma care pathway.”

Mr. Aguillard said, “I’m excited to be leading the commercialization efforts for the DMT. Patient access is critical as we deploy our technology to evaluate suspicious pigmented lesions and potentially save lives. I’m impressed by DermTech’s accomplishments and I look forward to partnering with the team to accelerate revenue growth and scale the business to reach more patients.”

Mr. Aguillard is a proven commercial leader with over 20 years of experience driving growth through the development and commercialization of multiple, novel molecular diagnostics. Prior to joining the Company, he served as the chief commercial officer of Epic Sciences, where he led the development and launch of a novel liquid biopsy, DefineMBC, designed to personalize treatment for patients with metastatic breast cancer. Prior to joining Epic, Mr. Aguillard served in commercial leadership roles with Myriad Genetics, binx health, OmniSeq and Eli Lilly & Company directing sales, marketing, medical affairs, customer success and market access teams across oncology and women’s health. Mr. Aguillard received his Bachelor’s in Business Administration with a major in Finance from Texas Tech University

About DermTech

DermTech is a leading genomics company in dermatology and is creating a new category of medicine, precision dermatology, enabled by its non-invasive skin genomics technology. DermTech’s mission is to improve the lives of millions by providing non-invasive precision dermatology solutions that enable individualized care. DermTech provides genomic analysis of skin samples collected non-invasively using our Smart StickersTM. DermTech develops and markets products that facilitate the assessment of melanoma. For additional information, please visit www.dermtech.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The expectations, estimates, and projections of DermTech may differ from its actual results and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” "outlook," “anticipate,” “intend,” “plan,” “strive," “may,” “will,” “could,” “should,” “believe,” “predict,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, expectations and evaluations with respect to: the performance, patient benefits, cost- effectiveness, commercialization and adoption of DermTech’s products and the market opportunity for these products; expectations regarding DermTech’s potential growth, scale, patient reach, financial outlook and future financial performance DermTech’s ability to increase its test volume, revenue and the proportion of reimbursed billable tests; and expectations regarding agreements with or reimbursement or cash collection patterns from government payers (including Medicare) or commercial payers and related billing practices or number of covered lives. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside of the control of DermTech and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the outcome of any legal proceedings that may be instituted against DermTech; (2) DermTech’s ability to obtain additional funding to develop and market its products; (3) the existence of favorable or unfavorable clinical guidelines for DermTech’s tests; (4) the reimbursement of DermTech’s tests by government payers (including Medicare) and commercial payers; (5) the ability of patients or healthcare providers to obtain coverage of or sufficient reimbursement for DermTech’s products; (6) DermTech’s ability to grow, manage growth and retain its key employees and maintain or improve its operating efficiency and reduce operating expenses; (7) changes in applicable laws or regulations; (8) the market adoption and demand for DermTech’s products and services together with the possibility that DermTech may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties included in the “Risk Factors” section of the most recent Annual Report on Form 10-K filed by DermTech with the Securities and Exchange Commission (the “SEC”), and other documents filed or to be filed by DermTech with the SEC, including subsequently filed reports. DermTech cautions that the foregoing list of factors is not exclusive. You should not place undue reliance upon any forward- looking statements, which speak only as of the date made. DermTech does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

Contact

Steve Kunszabo

DermTech

(858) 291-1647

steve.kunszabo@dermtech.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

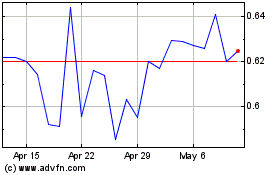

DermTech (NASDAQ:DMTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

DermTech (NASDAQ:DMTK)

Historical Stock Chart

From Apr 2023 to Apr 2024