FALSE000165194400016519442023-08-032023-08-0300016519442022-11-032022-11-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2023

DERMTECH, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38118 | 84-2870849 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

12340 El Camino Real

San Diego, CA 92130

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code (858) 450-4222

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.0001 per share | DMTK | Nasdaq |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On August 3, 2023, the Company issued a press release announcing its financial results for the quarter ended June 30, 2023 and certain other information. This press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth under this Item 2.02 and in Exhibit 99.1 is not being filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that section. The information contained herein and in the accompanying exhibit is not to be incorporated by reference in any filing of the Company under the Exchange Act or the Securities Act of 1933, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| DERMTECH, INC. |

| | |

Date: August 3, 2023 | By: | /s/ Kevin Sun |

| Name: | Kevin Sun |

| Title: | Chief Financial Officer |

DERMTECH REPORTS SECOND-QUARTER 2023 FINANCIAL RESULTS

-Covered lives increased to 133 million

-Average selling price and test revenue grew sequentially

-Cash runway into the first quarter of 2025

SAN DIEGO – August 3, 2023 – DermTech, Inc. (NASDAQ: DMTK) (DermTech or the Company), a leader in precision dermatology enabled by a non-invasive skin genomics technology, today reported its second-quarter 2023 financial results.

“We’ve recently taken a few necessary steps to streamline operations and put all our energy into scaling the DermTech Melanoma Test (DMT) and prioritizing reimbursed billable samples to grow revenue,” said Bret Christensen, CEO, DermTech. “We’re pursuing a large addressable market where significant patient need exists, with approximately 200,000 new cases of melanoma reported every year in the U.S. resulting in $3.3 billion in annual treatment costs. My vision is for the DMT to be deployed universally as part of the melanoma care pathway and we have an excellent product to execute against this goal.”

Christensen continued, “We’ve made solid progress in the first half of 2023 entering into new payer agreements. Since the end of last year, we’ve expanded covered lives approximately 45 percent to 133 million and now work with seven of the top ten Blues plans and two large governmental payers. We must continue to actively engage with payers and reinforce our message around the clinical and health economic benefits of our test, as well as improve the onboarding process once we’ve completed agreements. We’ve also begun to adjust our commercial tactics to support our focus on reimbursed tests and maximizing revenue. Importantly, we’ve modified incentive compensation for our sales team to prioritize revenue over volume and dissolved or merged certain sales territories to focus on geographies where we have broad insurance coverage. We’re also targeting our spending more closely to sales team enablement rather than broad-based marketing efforts. We need to build DMT adoption at the ground level with clinicians and are confident this change in our approach will be beneficial.”

Christensen concluded, “We believe anchoring our effort around monetizing our already significant demand is the best way to reach a meaningful revenue inflection point while managing our cash runway. We plan for revenue to grow in 2023, and as result of our recent restructuring actions, anticipate that our cash runway will now take us into the first quarter of 2025.”

Second-Quarter 2023 Financial Results

•Billable sample volume declined 5 percent from the second quarter of 2022 to approximately 17,450.

•Test revenue was $3.6 million, down 14 percent from the second quarter of 2022, primarily due to changes in collection estimates for tests run in prior periods and lower billable sample volume.

•Total revenue was $4.0 million, a 6 percent decrease from the second quarter of 2022, driven by lower test revenue.

•Cost of test revenue was $3.9 million, a 21 percent increase from the second quarter of 2022, yielding a test gross margin of negative 10 percent, compared to 22 percent for the second quarter of 2022. Cost of test revenue increased primarily because of higher infrastructure costs related to the Company’s new facility and higher materials expense.

•Sales and marketing expenses were $13.0 million, a 13 percent decrease from the second quarter of 2022. The decrease was primarily attributable to lower marketing expenditures.

•Research and development expenses were $3.9 million, a 44 percent decrease from the second quarter of 2022, largely due to lower employee-related and clinical study costs.

•General and administrative expenses were $15.2 million, a $6.3 million or 71 percent increase from the second quarter of 2022. The increase was driven by approximately $2.9 million in additional non-cash stock-based compensation expense and $0.5 million in severance costs related to the former CEO’s departure, approximately $2.1 million of non-recurring restructuring costs and approximately $1.2 million of increased infrastructure costs related to the Company’s new facility.

•Net loss was $31.4 million, or ($0.99) per share, which included $7.5 million of non-cash stock-based compensation expense, as compared to $29.6 million, or ($0.99) per share, for the second quarter of 2022, which included $4.8 million of non-cash stock-based compensation expense.

•Cash, cash equivalents, restricted cash and short-term marketable securities were $89.7 million as of June 30, 2023. During the second quarter, the Company generated net proceeds of approximately $4.5 million from the issuance of 1,759,210 shares of common stock in at-the-market (ATM) offerings at a weighted average price of $2.62 per share. DermTech believes it has sufficient cash resources to fund its planned operations into the first quarter of 2025.

Conference Call Information

As previously announced, the Company will host a conference call to discuss its results at 5:00 p.m. ET on Thursday, August 3, 2023. For participants interested in asking questions during the teleconference, please register. After registering for the event, a confirmation e-mail will be sent with a meeting invitation and access information. Registration is open during the live teleconference, but advance registration is advised. For participants interested in listening only, please register for the webcast. For those unable to participate in the live call and webcast, a webcast replay will be available on the Company’s website shortly after the conclusion of the call.

About DermTech

DermTech is a leading genomics company in dermatology and is creating a new category of medicine, precision dermatology, enabled by its non-invasive skin genomics technology. DermTech’s mission is to improve the lives of millions by providing non-invasive precision dermatology solutions that enable individualized care. DermTech provides genomic analysis of skin samples collected non-invasively using our Smart StickersTM. DermTech markets and develops products that facilitate the early detection of skin cancers. For additional information, please visit www.dermtech.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The expectations, estimates, and projections of DermTech may differ from its actual results and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” "outlook," “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predict,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, expectations and evaluations with respect to: the performance, patient benefits, cost- effectiveness, commercialization and adoption of DermTech’s products and the market opportunity for these products, DermTech’s positioning and potential growth, financial outlook and future financial performance, ability to increase its proportion of reimbursed billable samples, ability to maintain or improve its operating efficiency and reduce operating expenses, the sufficiency of DermTech’s cash resources and runway and ability to access capital to fund its operating plan, the sufficiency of its cash resources to fund planned operations for the anticipated period, anticipated annual cash savings to be realized from the restructuring, implications and interpretations of any study results, and expectations regarding agreements with or reimbursement or cash collection patterns from government payers (including Medicare) or commercial payers and related billing practices or number of covered lives. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside of the control of DermTech and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the outcome of any legal proceedings that may be instituted against DermTech; (2) DermTech’s ability to obtain additional funding to develop and market its products; (3) the existence of favorable or unfavorable clinical guidelines for DermTech’s tests; (4) the reimbursement of DermTech’s tests by government payers (including Medicare) and commercial payers; (5) the ability of patients or healthcare providers to obtain coverage of or sufficient reimbursement for DermTech’s products; (6) DermTech’s ability to grow, manage growth and retain its key employees and maintain or improve its operating efficiency and reduce operating expenses; (7) changes in applicable laws or regulations; (8) the market adoption and demand for DermTech’s products and services together with the possibility that DermTech may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties included in the “Risk Factors” section of the most recent Annual Report on Form 10-K filed by DermTech with the Securities and Exchange Commission (the “SEC”), and other documents filed or to be filed by DermTech with the SEC, including subsequently filed reports. DermTech cautions that the foregoing list of factors is not exclusive. You should not place undue reliance upon any forward- looking statements, which speak only as of the date made. DermTech does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

Contact

Steve Kunszabo

DermTech

(858) 291-1647

steve.kunszabo@dermtech.com

DERMTECH, INC.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Test revenue | $ | 3,565 | | | $ | 4,147 | | | $ | 6,990 | | | $ | 7,665 | |

| Contract revenue | 415 | | | 86 | | | 467 | | | 286 | |

| Total revenues | 3,980 | | | 4,233 | | | 7,457 | | | 7,951 | |

| Cost of revenues: | | | | | | | |

| Cost of test revenue | 3,909 | | | 3,236 | | | 7,700 | | | 6,766 | |

| Cost of contract revenue | 63 | | | 37 | | | 93 | | | 61 | |

| Total cost of revenues | 3,972 | | | 3,273 | | | 7,793 | | | 6,827 | |

| Gross profit/(loss) | 8 | | | 960 | | | (336) | | | 1,124 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 13,033 | | | 15,001 | | | 28,450 | | | 30,444 | |

| Research and development | 3,887 | | | 6,915 | | | 8,296 | | | 13,253 | |

| General and administrative | 15,220 | | | 8,878 | | | 27,095 | | | 17,452 | |

| Total operating expenses | 32,140 | | | 30,794 | | | 63,841 | | | 61,149 | |

| Loss from operations | (32,132) | | | (29,834) | | | (64,177) | | | (60,025) | |

| Other income/(expense): | | | | | | | |

| Interest income, net | 763 | | | 149 | | | 1,545 | | | 215 | |

| Change in fair value of warrant liability | 6 | | | 105 | | | (1) | | | 122 | |

| Total other income | 769 | | | 254 | | | 1,544 | | | 337 | |

| Net loss | $ | (31,363) | | | $ | (29,580) | | | $ | (62,633) | | | $ | (59,688) | |

| Weighted average shares outstanding used in computing net loss per share, basic and diluted | 31,791,736 | | | 29,964,849 | | | 31,177,886 | | | 29,904,972 | |

| Net loss per share of common stock outstanding, basic and diluted | $ | (0.99) | | | $ | (0.99) | | | $ | (2.01) | | | $ | (2.00) | |

DERMTECH, INC.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 42,790 | | | $ | 77,757 | |

| Short-term marketable securities | 43,406 | | | 48,411 | |

| Accounts receivable | 3,865 | | | 4,172 | |

| Inventory | 1,352 | | | 1,757 | |

| Prepaid expenses and other current assets | 2,329 | | | 3,940 | |

| Total current assets | 93,742 | | | 136,037 | |

| Property and equipment, net | 6,074 | | | 6,375 | |

| Operating lease right-of-use assets | 53,791 | | | 56,007 | |

| Restricted cash | 3,467 | | | 3,488 | |

| Other assets | — | | | 168 | |

| Total assets | $ | 157,074 | | | $ | 202,075 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,324 | | | $ | 2,419 | |

| Accrued compensation | 7,387 | | | 7,894 | |

| Accrued liabilities | 3,695 | | | 3,464 | |

| Short-term deferred revenue | 295 | | | 109 | |

| Current portion of operating lease liabilities | 2,246 | | | 1,634 | |

| Current portion of finance lease obligations | 67 | | | 116 | |

| Total current liabilities | 16,014 | | | 15,636 | |

| Warrant liability | 6 | | | 5 | |

| | | |

| Long-term finance lease obligations, less current portion | 46 | | | 53 | |

| Operating lease liabilities, long-term | 52,931 | | | 54,028 | |

| Total liabilities | 68,997 | | | 69,722 | |

| Stockholders’ equity: | | | |

Common stock, $0.0001 par value per share; 100,000,000 shares authorized as of June 30, 2023 and December 31, 2022; 33,408,810 and 30,297,408 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | 3 | | | 3 | |

| Additional paid-in capital | 473,855 | | | 456,171 | |

| Accumulated other comprehensive loss | (101) | | | (774) | |

| Accumulated deficit | (385,680) | | | (323,047) | |

| Total stockholders’ equity | 88,077 | | | 132,353 | |

| Total liabilities and stockholders’ equity | $ | 157,074 | | | $ | 202,075 | |

v3.23.2

Cover Page

|

Aug. 03, 2023 |

Nov. 03, 2022 |

| Cover [Abstract] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Aug. 03, 2023

|

|

| Entity Registrant Name |

DERMTECH, INC.

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity File Number |

001-38118

|

|

| Entity Tax Identification Number |

84-2870849

|

|

| Entity Address, Address Line One |

12340 El Camino Real

|

|

| Entity Address, City or Town |

San Diego

|

|

| Entity Address, State or Province |

CA

|

|

| Entity Address, Postal Zip Code |

92130

|

|

| City Area Code |

858

|

|

| Local Phone Number |

450-4222

|

|

| Written Communications |

false

|

|

| Soliciting Material |

false

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Title of 12(b) Security |

Common Stock,par value $0.0001 per share

|

|

| Trading Symbol |

DMTK

|

|

| Security Exchange Name |

NASDAQ

|

|

| Entity Emerging Growth Company |

false

|

|

| Amendment Flag |

false

|

|

| Entity Central Index Key |

0001651944

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

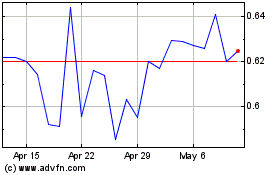

DermTech (NASDAQ:DMTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

DermTech (NASDAQ:DMTK)

Historical Stock Chart

From Apr 2023 to Apr 2024