- QBREXZA™ (glycopyrronium) cloth net product sales of $8.1M,

more than triple first quarter 2019 sales

- End-of-Phase 2 FDA meeting for lebrikizumab completed, Phase 3

initiation on schedule for later this year

- Company provides revenue guidance for the second half of

2019

Dermira, Inc. (NASDAQ: DERM), a biopharmaceutical company

dedicated to bringing biotech ingenuity to medical dermatology by

delivering differentiated, new therapies to the millions of

patients living with chronic skin conditions, today reported

financial results for the quarter ended June 30, 2019 and provided

a corporate update.

“We’ve set ambitious goals for ourselves and continue to

successfully deliver on them. For QBREXZA, our broad payer

coverage, the positive product experience and an improved

gross-to-net discount have established a strong foundation that we

are leveraging to drive patient activation and substantial revenue

growth,” said Tom Wiggans, chairman and chief executive officer of

Dermira. “For lebrikizumab, we completed a very productive

end-of-phase 2 meeting with the FDA and announced plans to move

forward with our partner Almirall to develop lebrikizumab in

Europe. As we look to the second half of the year, we are focused

on continuing to generate demand for QBREXZA and rapidly initiating

the lebrikizumab Phase 3 clinical development program by the end of

the year.”

Second Quarter 2019 Financial Results

- Revenue for the second quarter totaled $66.6 million, comprised

of $8.1 million in QBREXZA product sales and $58.6 million in

collaboration and license revenue associated with the Almirall S.A.

agreement, compared with $39.1 million in collaboration and license

revenue related to a prior collaboration for the comparable quarter

in 2018.

- Total costs and operating expenses for the quarter ended June

30, 2019 were $82.9 million compared to $60.3 million for the

second quarter of 2018.

- Cost of sales for the second quarter of 2019 was $1.3 million

related to QBREXZA.

- Research and development (R&D) expenses for the second

quarter of 2019 were $18.3 million compared to $19.5 million for

the comparable prior-year period. This decrease was primarily due

to reductions in clinical trial activities associated with the

company’s prior acne program and in personnel-related costs, which

were partially offset by increases in activities related to QBREXZA

and other R&D costs.

- Selling, general and administrative (SG&A) expenses for the

second quarter of 2019 were $63.3 million compared to $40.8 million

for the comparable prior-year period. This increase was primarily

driven by costs associated with the QBREXZA commercial launch,

particularly advertising and promotional expenses associated with

patient activation activities as well as higher personnel-related

costs. The second quarter 2019 results were consistent with the

company’s expectations and guidance that the period would represent

the peak SG&A expense quarter for the year.

- For the quarter ended June 30, 2019, Dermira reported a net

loss of $18.0 million compared with a net loss of $23.9 million for

the same period in 2018.

- As of June 30, 2019, Dermira had cash and investments of $327.2

million and 54.4 million common shares outstanding.

Key Operational Highlights

- Generated 28,609 prescriptions for QBREXZA as reported by

Symphony PHAST monthly data for the second quarter of 2019, an

increase of over 20 percent compared to the first quarter of 2019

despite a decrease in April prescriptions related to changes to the

co-pay savings card program.

- Drove a significant improvement in the QBREXZA gross-to-net

discount to 39 percent in the second quarter of 2019 from 76

percent in the first quarter.

- Secured QBREXZA coverage for approximately 85 percent of the

total U.S. commercial lives (calculated based on Dermira data on

file) as of August 1, 2019.

- Completed a successful end-of-Phase 2 meeting for lebrikizumab

with the U.S. Food and Drug Administration (FDA) in June 2019.

Management continues to expect to initiate the lebrikizumab Phase 3

clinical development program by the end of 2019.

- Announced in June 2019 that Almirall exercised its option to

license rights to develop lebrikizumab for the treatment or

prevention of dermatology indications, including but not limited to

atopic dermatitis, and commercialize lebrikizumab for the treatment

or prevention of all indications in Europe, pursuant to the option

and license agreement entered into in February 2019. As a result of

this option exercise, Dermira received $50 million in July and will

be eligible to receive additional payments upon the achievement of

certain milestones, including an aggregate of $30 million in

connection with the initiation of clinical studies related to the

lebrikizumab Phase 3 program.

Operational and Financial Expectations

- For QBREXZA, management expects net product sales for the full

year 2019 in the low-$30 million range, and the gross-to-net

discount for the second half of the year to remain at approximately

40 percent.

- Management expects collaboration and license revenue related to

the Almirall agreement of approximately $2 million for each of the

third and fourth quarters of 2019.

- Management maintains its previously issued guidance for cost of

sales and operating expenses. The company previously guided for

2019 R&D and SG&A expenses to be between $295 and $315

million, including estimated stock-based compensation expense of

approximately $35 million, plus an additional $20 million acquired

in-process research and development expense related to the

anticipated milestone payment due to Roche upon the initiation of

the lebrikizumab Phase 3 trials.

Conference Call Details

Dermira will host a conference call to discuss the second

quarter financial results today, August 7, 2019, beginning at 1:30

p.m. Pacific Time / 4:30 p.m. Eastern Time. The live call can be

accessed by phone by dialing 1-866-211-3117 from the U.S. and

Canada or +1-647-689-6606 internationally and using the passcode

3394726. The webcast can be accessed live on the Investor Relations

section of the Company's website at http://investors.dermira.com.

It will be archived for 30 days following the call.

About Hyperhidrosis

Hyperhidrosis is a condition of sweating beyond what is

physiologically required for normal thermal regulation and affects

an estimated 4.8 percent of the U.S. population, or approximately

15 million people. Of these, 65 percent, or nearly 10 million

people, suffer from sweating localized to the underarms (axillary

disease). Studies have demonstrated that excessive sweating often

impedes normal daily activities and can also result in

occupational, emotional, psychological, social and physical

impairment.

About QBREXZA™ (glycopyrronium) cloth

QBREXZA (pronounced kew brex’ zah) is an anticholinergic

indicated for topical treatment of primary axillary hyperhidrosis

in adult and pediatric patients 9 years of age and older. QBREXZA

is applied directly to the skin and is designed to block sweat

production by inhibiting sweat gland activation. For more

information visit www.QBREXZA.com.

Important Safety Information

CONTRAINDICATIONS

QBREXZA is contraindicated in patients with medical conditions

that can be exacerbated by the anticholinergic effect of

QBREXZA.

WARNINGS AND PRECAUTIONS

Worsening of Urinary Retention: Use with caution in patients

with a history or presence of documented urinary retention.

Control of Body Temperature: In the presence of high ambient

temperature, heat illness (hyperpyrexia and heat stroke due to

decreased sweating) can occur with the use of anticholinergic drugs

such as QBREXZA.

Operating Machinery or an Automobile: Transient blurred vision

may occur with use of QBREXZA. If blurred vision occurs, the

patient should discontinue use until symptoms resolve. Patients

should be warned not to engage in activities that require clear

vision such as operating a motor vehicle or other machinery, or

performing hazardous work until the symptoms have resolved.

ADVERSE REACTIONS

The most common adverse reactions seen in ≥2% of subjects

treated with QBREXZA were dry mouth (24.2%), mydriasis (6.8%),

oropharyngeal pain (5.7%), headache (5.0%), urinary hesitation

(3.5%), vision blurred (3.5%), nasal dryness (2.6%), dry throat

(2.6%), dry eye (2.4%), dry skin (2.2%) and constipation (2.0%).

Local skin reactions of erythema (17.0%), burning/stinging (14.1%)

and pruritus (8.1%) were also common.

It is important for patients to understand how to correctly

apply QBREXZA (see Patient Product Information). Instruct patients

to wash their hands with soap and water immediately after

discarding the used cloth.

Please see Full Prescribing Information

About Atopic Dermatitis

Atopic dermatitis is the most common and severe form of eczema,

a chronic inflammatory condition that can present as early as

childhood and continue into adulthood. A moderate-to-severe form of

the disease is characterized by rashes on the skin that often cover

much of the body and also includes redness, cracking, dryness and

intense, persistent itching. The skin condition can have a negative

impact on patients’ mental and physical functioning, limiting their

daily activities and health-related quality of life. Patients with

moderate-to-severe atopic dermatitis have reported a larger impact

on quality of life than patients with psoriasis.

About Lebrikizumab

Lebrikizumab is a novel, injectable, humanized monoclonal

antibody designed to bind IL-13 with very high affinity,

specifically preventing the formation of the IL-13Rα1/IL-4Rα

heterodimer complex and subsequent signaling, thereby inhibiting

the biological effects of IL-13 in a targeted and efficient

fashion. IL-13 is believed to be a central pathogenic mediator that

drives multiple aspects of the pathophysiology of atopic dermatitis

by promoting type 2 inflammation and mediating its effects on

tissue, resulting in skin barrier dysfunction, itch, skin

thickening and infection.

About Dermira

Dermira is a biopharmaceutical company dedicated to bringing

biotech ingenuity to medical dermatology by delivering

differentiated, new therapies to the millions of patients living

with chronic skin conditions. Dermira is committed to understanding

the needs of both patients and physicians and using its insight to

identify, develop and commercialize leading-edge medical

dermatology products. The company’s approved treatment, QBREXZA™

(glycopyrronium) cloth, is indicated for pediatric and adult

patients (ages 9 and older) with primary axillary hyperhidrosis

(excessive underarm sweating). Please see the QBREXZA prescribing

information. Dermira is evaluating lebrikizumab for the treatment

of moderate-to-severe atopic dermatitis (a severe form of eczema)

and plans to initiate a Phase 3 clinical development program by the

end of 2019. Dermira also has early-stage research and development

programs in other areas of dermatology. Dermira is headquartered in

Menlo Park, Calif. For more information, please visit

http://www.dermira.com. Follow Dermira on LinkedIn, Instagram and

Twitter.

In addition to filings with the Securities and Exchange

Commission (SEC), press releases, public conference calls and

webcasts, Dermira uses its website (www.dermira.com), LinkedIn page

(https://www.linkedin.com/company/dermira-inc-), corporate

Instagram account (https://www.instagram.com/dermira_inc/) and

corporate Twitter account (@DermiraInc) as channels of distribution

of information about its company, product candidates, planned

financial and other announcements, attendance at upcoming investor

and industry conferences and other matters. Such information may be

deemed material information and Dermira may use these channels to

comply with its disclosure obligations under Regulation FD.

Therefore, investors should monitor Dermira’s website, LinkedIn

page, Instagram and Twitter accounts in addition to following its

SEC filings, news releases, public conference calls and

webcasts.

Forward-Looking Statements

The information in this news release contains forward-looking

statements and information within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which are subject to

the “safe harbor” created by those sections. This news release

contains forward-looking statements that involve substantial risks

and uncertainties, including statements with respect to Dermira’s

goal of bringing biotech ingenuity to medical dermatology by

delivering differentiated, new therapies to the millions of

patients living with chronic skin conditions; Dermira’s plans to

generate demand for QBREXZA and to drive patient activation and

substantial revenue growth; Dermira’s plans to move forward with

its partner Almirall to develop lebrikizumab in Europe; the

anticipated timing of initiation of the Phase 3 clinical

development program for lebrikizumab by the end of the year;

guidance that the second quarter of 2019 represents the peak

SG&A expense quarter for the year; the anticipated receipt and

timing of payments from Almirall upon the achievement of certain

future milestones; expectations regarding net product sales for the

full year 2019 and the gross-to-net discount and collaboration and

license revenue for the second half of 2019; and estimated R&D,

SG&A, stock-based compensation expense and acquired in-process

research and development expense for 2019. These statements deal

with future events and involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance or achievements to be materially different from the

information expressed or implied by these forward-looking

statements. Factors that could cause actual results to differ

materially include risks and uncertainties such as those relating

to Dermira’s dependence on third-party clinical research

organizations, manufacturers, suppliers and distributors; the

design and implementation of Dermira’s clinical trials; the

outcomes of future meetings with regulatory agencies; Dermira’s

ability to attract and retain key employees; Dermira’s ability to

manage the growth and complexity of its organization; Dermira’s

ability to maintain, protect and enhance its intellectual property;

and Dermira’s ability to continue to stay in compliance with its

material contractual obligations, applicable laws and regulations.

You should refer to the section entitled “Risk Factors” set forth

in Dermira’s Annual Report on Form 10-K, Dermira’s Quarterly

Reports on Form 10-Q and other filings Dermira makes with the SEC

from time to time for a discussion of important factors that may

cause actual results to differ materially from those expressed or

implied by Dermira’s forward-looking statements. Furthermore, such

forward-looking statements speak only as of the date of this news

release. Dermira undertakes no obligation to publicly update any

forward-looking statements or reasons why actual results might

differ, whether as a result of new information, future events or

otherwise, except as required by law.

Dermira, Inc. Selected Consolidated Statement of

Operations Data (in thousands, except per share amounts)

Three Months Ended Six Months Ended

June 30, June 30,

2019

2018

2019

2018

Product sales

$

8,060

$

-

$

10,512

$

-

Collaboration and license revenue

58,585

39,080

58,585

39,379

Total revenue

66,645

39,080

69,097

39,379

Costs and operating expenses: Cost of sales (1)

1,335

-

2,261

-

Research and development (1)

18,285

19,545

33,854

45,136

Selling, general and administrative (1)

63,327

40,770

112,006

71,280

Impairment of intangible assets

-

-

-

1,126

Total costs and operating expenses

82,947

60,315

148,121

117,542

Loss from operations

(16,302

)

(21,235

)

(79,024

)

(78,163

)

Interest and other income, net

1,970

2,037

3,521

3,771

Interest expense

(3,630

)

(4,734

)

(7,291

)

(8,988

)

Loss before taxes

(17,962

)

(23,932

)

(82,794

)

(83,380

)

Benefit for income taxes

-

-

-

194

Net loss

$

(17,962

)

$

(23,932

)

$

(82,794

)

$

(83,186

)

Net loss per share, basic and diluted

$

(0.33

)

$

(0.57

)

$

(1.70

)

$

(1.99

)

Weighted-average common shares used to compute net loss per

share, basic and diluted

54,033

41,922

48,838

41,875

(1)

Amounts include stock-based compensation expense as follows:

Cost of sales

$

16

$

-

$

31

$

-

Research and development

2,371

2,408

4,831

5,261

Selling, general and administrative

5,123

4,898

10,629

9,559

Total stock-based compensation expense

$

7,510

$

7,306

$

15,491

$

14,820

Dermira, Inc. Selected Consolidated Balance Sheet

Data (in thousands)

June 30,

December 31,

2019

2018

Cash and investments

$

327,166

$

316,002

Working capital

377,597

296,853

Total assets

447,266

344,321

Term loan

32,731

32,566

Convertible notes, net

282,145

281,223

Accumulated deficit

(827,832

)

(745,038

)

Total stockholders' equity (deficit)

65,556

(9,039

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190807005668/en/

Media: Erica Jefferson Vice President, Corporate Communications

650-421-7216 media@dermira.com

Investors: Andrew Guggenhime Chief Financial Officer

650-421-7200 investor@dermira.com

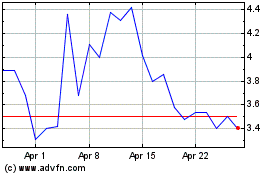

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Apr 2023 to Apr 2024