Current Report Filing (8-k)

April 29 2022 - 5:44PM

Edgar (US Regulatory)

false

0000915779

0000915779

2022-04-29

2022-04-29

0000915779

dakt:CommonStockNoParValueCustomMember

2022-04-29

2022-04-29

0000915779

dakt:PreferredStockPurchaseRightsCustomMember

2022-04-29

2022-04-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 29, 2022

Daktronics, Inc.

(Exact Name of Registrant as Specified in Charter)

|

South Dakota

|

0-23246

|

46-0306862

|

|

(State or Other Jurisdiction of

|

(Commission

|

(I.R.S. Employer

|

|

Incorporation)

|

File Number)

|

Identification No.)

|

201 Daktronics Drive

Brookings, SD 57006

(Address of Principal Executive Offices, and Zip Code)

(605) 692-0200

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, No Par Value

|

DAKT

|

Nasdaq Global Select Market

|

|

Preferred Stock Purchase Rights

|

DAKT

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This Current Report on Form 8-K (the “Report”) of Daktronics, Inc. (the “Company,” “we”, “us” and “our”) contains both historical and forward-looking statements that involve risks, uncertainties and assumptions. The statements contained in this Report that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21B of the Securities Exchange Act of 1934, as amended, including statements regarding our expectations, beliefs, intentions and strategies for the future. These statements appear in a number of places in this Report and include all statements that are not historical statements of fact regarding the intent, belief or current expectations with respect to, among other things: (i.) our competition; (ii.) our financing plans; (iii.) trends affecting our financial condition or results of operations; (iv.) our growth and operating strategies; (v.) the declaration and payment of dividends; (vi.) the timing and magnitude of future contracts; (vii.) raw material shortages and lead times; (viii.) fluctuations in margins; (ix.) the seasonality of our business; (x.) the introduction of new products and technology; (xi.) the amount and frequency of warranty claims; (xii.) our ability to manage the impact that new or adjusted tariffs may have on the cost of raw materials and components and our ability to sell product internationally; (xiii.) the resolution of litigation contingencies; and (xiv.) the timing and magnitude of any acquisitions or dispositions. The words “may,” “would,” “could,” “should,” “will,” “expect,” “estimate,” “anticipate,” “believe,” “intend,” “plan” and similar expressions and variations thereof are intended to identify forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond our ability to control, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors discussed herein, including those discussed in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended May 1, 2021 in the section entitled “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations,” and those factors discussed in detail in our other filings with the Securities and Exchange Commission.

Section 1 – Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On April 29, 2022, we entered into a Fifth Amendment (the "Amendment") to the Credit Agreement dated as of November 16, 2016, as amended (the “Credit Facility”) with U.S. Bank National Association (the “Bank”). The Amendment extends the maturity date of the Credit Facility and the related Revolving Note dated as of November 16, 2016, as amended, with the Bank from November 15, 2022 to April 29, 2025 and modifies certain terms and financial covenants of the Credit Facility. The Amendment did not change the $35.0 million revolving amount of the Credit Facility, including up to $20.0 million for commercial and standby letters of credit, nor did the Amendment change the security interest held by the bank over certain assets.

As of April 29, 2022, there were no borrowings outstanding under the Credit Facility, and the balance of letters of credit outstanding was approximately $4.7 million.

The foregoing description of the Amendment is qualified in its entirety by reference to such document, a copy of which is filed as Exhibit 10.1 to this Report and incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is filed with this Report:

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

|

DAKTRONICS, INC.

|

| |

|

|

| |

|

By: /s/ Sheila M. Anderson

|

| |

|

Sheila M. Anderson, Chief Financial Officer

|

|

Date:

|

April 29, 2022

|

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

10.1

|

|

|

104

|

Cover page Interactive Data File (embedded within the Inline XBRL document) |

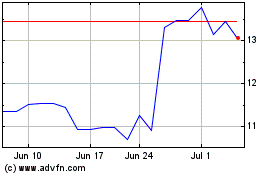

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Jun 2024 to Jul 2024

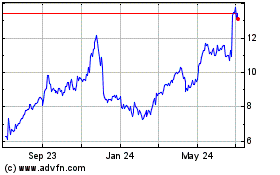

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Jul 2023 to Jul 2024